Professional Documents

Culture Documents

CH09 Overhead Cost Variances

Uploaded by

Abdur RehmanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH09 Overhead Cost Variances

Uploaded by

Abdur RehmanCopyright:

Available Formats

CHAPTER 9

Flexible Budgets,

Overhead Cost Variances,

and

Management Control

© 2012 Pearson Prentice Hall. All rights reserved.

Planning and Overhead

•Variable overhead—as efficiently as

possible, plan only essential activities

•Fixed overhead—as efficiently as possible,

plan only essential activities, especially

because fixed costs are predetermined

well before the budget period begins

© 2012 Pearson Prentice Hall. All rights reserved.

Standard Costing

•Traces direct costs to output by multiplying the

standard prices or rate by the standard

quantities of inputs allowed for actual outputs

produced

•Allocates overhead costs on the basis of the

standard overhead-cost rates times the

standard quantities of the allocation bases

allowed for the actual outputs produced

© 2012 Pearson Prentice Hall. All rights reserved.

A Roadmap: Variable Overhead

Flexible Budget: Allocated:

Actual Costs

Budgeted Input Budgeted

Incurred: Actual Inputs

Allowed for Input Allowed for

Actual Input X

Actual Output Actual Output

X Budgeted Rate

X X

Actual Rate

Budgeted Rate Budgeted Rate

Spending Efficiency Never a

Variance Variance Variance

Flexible-Budget Never a

Variance Variance

Total Variable Overhead Variance

Over/Under Allocated Variable Overhead

© 2012 Pearson Prentice Hall. All rights reserved.

A Roadmap: Fixed Overhead

Same Budgeted Flexible Budget: Allocated:

Lump Sum Same Budgeted Budgeted

Actual Costs (as in Static Lump Sum (as in Input Allowed for

Incurred Budget) Static Budget) Actual Output

Regardless of Regardless of X

Output Level Output Level Budgeted Rate

Production-

Spending Never a Volume

Variance Variance Variance

Production-

Flexible-Budget

Volume

Variance

Variance

Total Fixed Overhead Variance

Over/Under Allocated Fixed Overhead

© 2012 Pearson Prentice Hall. All rights reserved.

Overhead Variances

•Overhead is the most difficult cost to

manage, and is the least understood.

•Overhead variances involve taking

differences between equations as the

analysis moves back and forth between

actual results and budgeted amounts.

© 2012 Pearson Prentice Hall. All rights reserved.

Developing Budgeted Variable

Overhead Cost Rates

1. Choose the period to be used for the budget.

2. Select the cost-allocation bases to use in allocating

variable overhead costs to output produced.

3. Identify the variable overhead costs associated

with each cost-allocation base.

4. Compute the rate per unit of each cost-allocation

base used to allocate variable overhead costs to

output produced.

© 2012 Pearson Prentice Hall. All rights reserved.

The Details: Variable OH Variances

• Variable overhead flexible-budget variance measures

the difference between actual variable overhead costs

incurred and flexible-budget variable overhead

amounts.

Variable Overhead Actual Costs Flexible-budget

flexible-budget variance = Incurred - amount

(c) 2012 Pearson Prentice Hall. All rights reserved.

The Details: Variable OH Variances

• Variable overhead efficiency variance is the difference

between actual quantity of the cost-allocation base

used and budgeted quantity of the cost per unit of the

cost-allocation base.

{ }X

Variable Actual quantity of Budgeted quantity of Budgeted variable

Overhead variable overhead variable overhead cost- overhead cost

Efficiency = cost-allocation base - allocation based allowed per unit of

Variance used for actual output for actual output cost-allocation base

(c) 2012 Pearson Prentice Hall. All rights reserved.

The Details: Variable OH Variances

• Variable overhead spending variance is the difference

between actual and budgeted variable overhead cost

per unit of the cost-allocation base, multiplied by actual

quantity of variable overhead cost-allocation base used

for actual output.

{ }X

Variable Actual variable Budgeted variable Actual quantity of

Overhead overhead cost overhead cost variable overhead

Spending = per unit of - per unit of cost-allocation base

Variance cost-allocation base cost-allocation base used for actual output

(c) 2012 Pearson Prentice Hall. All rights reserved.

Developing Budgeted Fixed Overhead

Cost Rates

1. Choose the period to be used for the budget.

2. Select the cost-allocation bases to use in allocating

fixed overhead costs to output produced.

3. Identify the fixed overhead costs associated with

each cost-allocation base.

4. Compute the rate per unit of each cost-allocation

base used to allocate fixed overhead costs to

output produced.

© 2012 Pearson Prentice Hall. All rights reserved.

The Details: Fixed OH Variances

• Fixed overhead flexible-budget variance is the

difference between actual fixed overhead costs and

fixed overhead costs in the flexible budget.

• This is the same amount for the fixed overhead

spending variance.

Fixed Overhead

flexible-budget variance = Actual Costs

Incurred - Flexible-budget

amount

(c) 2012 Pearson Prentice Hall. All rights reserved.

The Details: Fixed OH Variances

• Production-volume variance is the difference between budgeted fixed

overhead and fixed overhead allocated on the basis of actual output

produced.

• This variance is also known as the denominator-level variance or the

output-level overhead variance.

Production-Volume Budgeted Fixed Overhead allocated using

Variance = Fixed Overhead - budgeted input allowed for

actual output units produced

(c) 2012 Pearson Prentice Hall. All rights reserved.

Production-Volume Variance

• Interpretation of this variance is difficult due to the nature of

the costs involved and how they are budgeted.

• Fixed costs are by definition somewhat inflexible. While

market conditions may cause production to flex up or down,

the associated fixed costs remain the same.

• Fixed costs may be set years in advance, and may be difficult

to change quickly.

• Contradiction: Despite this, examination of the fixed

overhead budget formulae reveals that it is budgeted similar

to a variable cost.

© 2012 Pearson Prentice Hall. All rights reserved.

Variable Overhead

Variance Analysis Illustrated

© 2012 Pearson Prentice Hall. All rights reserved.

Fixed Overhead

Variance Analysis Illustrated

© 2012 Pearson Prentice Hall. All rights reserved.

Production-Volume Variance

© 2012 Pearson Prentice Hall. All rights reserved.

Integrated

Variance

Analysis

Illustrated

© 2012 Pearson Prentice Hall. All rights reserved.

© 2012 Pearson Prentice Hall. All rights reserved.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- IntroductionDocument120 pagesIntroductionAbdur RehmanNo ratings yet

- Assigment 1: Buck-Boost ConverterDocument4 pagesAssigment 1: Buck-Boost ConverterAbdur RehmanNo ratings yet

- SFE - Course OutlinesDocument9 pagesSFE - Course OutlinesAbdur RehmanNo ratings yet

- CSM Assignment No. 2Document9 pagesCSM Assignment No. 2Abdur RehmanNo ratings yet

- Capital University of Science and Technology: Department of Civil EngineeringDocument1 pageCapital University of Science and Technology: Department of Civil EngineeringAbdur RehmanNo ratings yet

- MS Civil Engineering Construction and Safety Management Assignment No. 1 MCE191010 Abdur RehmanDocument5 pagesMS Civil Engineering Construction and Safety Management Assignment No. 1 MCE191010 Abdur RehmanAbdur RehmanNo ratings yet

- CE-5833 Construction and Safety Management: Capital University of Science and Technology, IslamabadDocument29 pagesCE-5833 Construction and Safety Management: Capital University of Science and Technology, IslamabadAbdur RehmanNo ratings yet

- CE-5823 Advanced Project Management For Construction ProjectsDocument26 pagesCE-5823 Advanced Project Management For Construction ProjectsAbdur RehmanNo ratings yet

- CH02 Accounting CycleDocument53 pagesCH02 Accounting CycleAbdur RehmanNo ratings yet

- CH06 Activity-Based CostingDocument20 pagesCH06 Activity-Based CostingAbdur RehmanNo ratings yet

- CE-5823 Advanced Project Management For Construction ProjectsDocument35 pagesCE-5823 Advanced Project Management For Construction ProjectsAbdur RehmanNo ratings yet

- CE-5823 Advanced Project Management For Construction ProjectsDocument22 pagesCE-5823 Advanced Project Management For Construction ProjectsAbdur RehmanNo ratings yet

- CE-5823 Advanced Project Management For Construction ProjectsDocument18 pagesCE-5823 Advanced Project Management For Construction ProjectsAbdur RehmanNo ratings yet

- CE-5823 Advanced Project Management For Construction ProjectsDocument24 pagesCE-5823 Advanced Project Management For Construction ProjectsAbdur RehmanNo ratings yet

- CE-5823 Advanced Project Management For Construction ProjectsDocument28 pagesCE-5823 Advanced Project Management For Construction ProjectsAbdur RehmanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Solved, MF0015 AssignmentDocument3 pagesSolved, MF0015 AssignmentArvind KNo ratings yet

- Metodologi of NIEDocument21 pagesMetodologi of NIEStevanus Gabriel PierreNo ratings yet

- CAFC M21 CHP Wise Test Paper+hintsDocument2 pagesCAFC M21 CHP Wise Test Paper+hintsAkshay r GowdaNo ratings yet

- Chapter 6 Franchise QDocument20 pagesChapter 6 Franchise QNguyên Bùi100% (1)

- Applied Economics 2nd Periodic ExamDocument4 pagesApplied Economics 2nd Periodic ExamKrisha FernandezNo ratings yet

- Review Questions: Money in Continuous TimeDocument1 pageReview Questions: Money in Continuous Timeantoined11No ratings yet

- Mobile Banking in IndiaDocument9 pagesMobile Banking in IndiaNaveen DsouzaNo ratings yet

- Managerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreDocument38 pagesManagerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreNishatNo ratings yet

- Grade 12-FORTITUDE: Applied EconomicsDocument4 pagesGrade 12-FORTITUDE: Applied EconomicsReynald AntasoNo ratings yet

- Market Failure and The Case of Government InterventionDocument16 pagesMarket Failure and The Case of Government InterventionCristine ParedesNo ratings yet

- Mirco IIDocument87 pagesMirco IIChristine KaberaNo ratings yet

- Chapter 7 Summary - Economic GrowthDocument23 pagesChapter 7 Summary - Economic Growthtahnz22No ratings yet

- Test Bank For Economics Private and Public Choice 16th Edition William A MceachernDocument75 pagesTest Bank For Economics Private and Public Choice 16th Edition William A MceachernByron Holloway100% (39)

- Inventory List With Reorder HighlightingDocument1 pageInventory List With Reorder Highlightingacer paulNo ratings yet

- Assignments 3 & 4 Questions MEDocument10 pagesAssignments 3 & 4 Questions MEAjinkya BinwadeNo ratings yet

- CARREFOUR S.A. - Euro BondsDocument8 pagesCARREFOUR S.A. - Euro BondsSittipon'Seng'Samakkeenitch100% (4)

- Case Study Salem TelephoneDocument3 pagesCase Study Salem TelephoneahbahkNo ratings yet

- Ch-2-Investment Basics - PPSXDocument14 pagesCh-2-Investment Basics - PPSXRk BainsNo ratings yet

- Relevance of Keyensian Economics For Developing EconomicsDocument7 pagesRelevance of Keyensian Economics For Developing EconomicsParas GhaiNo ratings yet

- Group Assigment Eco560. 2021Document7 pagesGroup Assigment Eco560. 2021Hazim Tasnim09No ratings yet

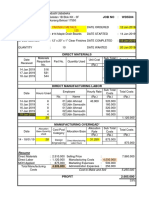

- COST SHEET Atau JOB COSTDocument1 pageCOST SHEET Atau JOB COSTWiraswasta MandiriNo ratings yet

- Sd16 Hybrid p4 QDocument12 pagesSd16 Hybrid p4 QQasim AliNo ratings yet

- The Basic Economic Problem: Section IDocument10 pagesThe Basic Economic Problem: Section IhbuzdarNo ratings yet

- Sarkozy Attacks Focus On Economic GrowthDocument1 pageSarkozy Attacks Focus On Economic GrowthCocindau MonicaNo ratings yet

- Mivumba in Kampala/Used Clothes TradeDocument49 pagesMivumba in Kampala/Used Clothes TradeMegan GarnerNo ratings yet

- International Business Chapter 10Document24 pagesInternational Business Chapter 10Rabiatul AndawiyahNo ratings yet

- CHAPTER 2 - Investment AppraisalDocument19 pagesCHAPTER 2 - Investment AppraisalMaleoaNo ratings yet

- The Structure of Financial System of BangladeshDocument8 pagesThe Structure of Financial System of Bangladeshmoaz_tareq1622No ratings yet

- Economics 1A and B Workbook PDFDocument90 pagesEconomics 1A and B Workbook PDFJOHN50% (4)

- D MDM QuestionsDocument4 pagesD MDM QuestionsAshwini AnandNo ratings yet