Professional Documents

Culture Documents

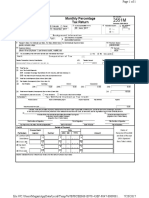

Tax Treaty Information: BIR Form No

Uploaded by

Nepean Philippines IncOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Treaty Information: BIR Form No

Uploaded by

Nepean Philippines IncCopyright:

Available Formats

Republika ng Pilipinas

Kagawaran ng Pananalapi

Tax Treaty Relief BIR Form No.

Kawanihan ng Rentas Internas Application for

Other Income Earnings

0901-O

Version 1.0 February 2010

Date of Application

Part I TAX TREATY INFORMATION

1

Fill in all applicable spaces. Mark all appropriate boxes with "NOT APPLICABLE" if no appropriate response.

2A Philippines Tax Convention with 2B Article Invoked

2C Preferential Tax Rate % 2D Exemption ___________________

Part II INCOME EARNER

3 Taxpayer's Taxpayer's Identification Number

Name 3A 3B

4 Foreign 4

Address

No. (Include Building Name) Street City Country Zip Code

5 Local 5

Address

No. (Include Building Name) Street District/Municipality City/Province Zip Code

6 Business 6A 6B 6C

Phone Number

Area/Access Code Fax Number

7 Local Representative in the Philippines, if any: Taxpayer's Identification Number

Name 7A 7B

0 0 0

8 Local 8A

Address

No. (Include Building Name) Street District/Municipality City/Province Zip Code

9 Business 9A 9B 9C

Phone Number

Area/Access Code Fax Number

10 Permanent Establishment / Fixed Base in the Philippines, if any: Taxpayer's Identification Number

Name 10A 10B

11 Local 11

Address

No. (Include Building Name) Street District/Municipality City/Province Zip Code

Part III PAYOR OF INCOME

13 Taxpayer's Taxpayer's Identification Number

Name 13A 13B

0 0 0

14 Local 14

Address

No. (Include Building Name) Street District/Municipality City/Province Zip Code

15 Registration with Board of Investments (BOI), if any:

15 Preferred Pioneer Others (Specify)

PART IV DETAILS OF TRANSACTION

Date of Transaction Terms Consideration Date of Payment

16

PART V PERJURY DECLARATION

I/We declare, under the penalties of perjury, that this application has been made in good faith, and Stamp of BIR Receiving Office and

that the representations incuding the accompanying documents have been verified by me/us and to the best Date of Receipt

of my/our knowledge, belief, and information are correct, complete and true account of the transaction/s

subject of this application.

(Signature of Applicant/Representative over printed name) Title/Position of Signatory

ITAD Filing Reference No.:

Part VI DOCUMENTARY REQUIREMENTS

GENERAL DOCUMENTS REMARKS

1 Proof of Residency

Original copy of consularized certification issued by the tax authority of the country of the income earner to

the effect that such income earner is a resident of such country for purposes of the tax treaty being invoked

in the tax year concerned.

2 Articles of Incorporation (For income earner other than an individual)

Photocopy of the Articles of Incorporation (AOI) (or equivalent Fact of

Establishment/Creation/Organization) of the income earner with the original copy of consularized

certification from the issuing agency, office or authority that the copy of Articles of Incorporation (AOI) (or

equivalent Fact of Establishment/Creation/Organization) is a faithful reproduction or photocopy.

3 Special Power of Attorney

A. If applicant/filer is the withholding agent of the income earner or the local representative in the

Philippines of the income earner -

i. Original copy of a consularized Special Power of Attorney (SPA) or a consularized written

authorization duly executed by the income earner authorizing its withholding agent or local

representative in the Philippines to file tax treaty relief application.

B. If applicant/filer is the local representative of the withholding agent of the income earner -

i. Original copy of a consularized Special Power of Attorney (SPA) or a consularized written

authorization duly executed by the income earner authorizing its withholding agent or local

representative in the Philippines to file tax treaty relief application; and

ii Original copy of Letter of Authorization from the withholding agent authorizing local representative

to file the tax treaty relief application

4 Certificate of Business Presence in the Philippines

a. For Corporation or Partnership - Original copy of certification from the Philippine Securities and

Exchange Commission that income recipient is/is not registered to engage in business in the

Philippines

b. For Individual - Original copy of a certification from the Department of Trade and Industry that the

income earner is not registered to engage in business in the Philippines

5 Certificate of No Pending Case

Original copy of a sworn statement providing information on whether the issue(s) or transaction involving

directly or indirectly the same taxpayer(s) which is/are the subject of the request for ruling is/are under

investigation; covered by an on-going audit, administrative protest, claim for refund or issuance of tax

credit certificate, collection proceedings, or subject of a judicial appeal

ADDITIONAL DOCUMENTS SPECIFIC TO OTHER INCOME

1. Letter

A letter request signed by the income earner or the duly authorized representative of the income earner is

required providing information on the subject transaction covered by tax treaty provision(s), the requested

tax treaty treatment for such transaction as well as the legal justification for the preferential tax treatment

2. Contract

Original or certified copy of the subject contract, or other document(s) (in its original or certified copies)

pertaining to the transaction.

3. Certification as to the duration of stay

Notarized certification by the Philippine contractor as to the duration of the service to be performed in the

Philippines by the concerned employee(s) of the income earner for the entire duration of the subject

contract.

BIR FORM NO. 0901 - O

Guidelines and Instructions

This form shall be duly accomplished in (3) three copies which must be signed by the applicant who may either be the income earner

or the duly authorized representative of the income earner. All fields must be mandatorily filled-up. If "NOT APPLICABLE" or "NONE"

is/are the appropriate response, the same has/have to be clearly indicated in the corresponding field.

This form together with all the necesary documents mentioned in Part VI shall be submitted only to and received by the International

Tax Affairs Division of the Bureau of Internal Revenue. Filing should always be made BEFORE the transaction. Transaction for

purposes of filing the Tax Treaty Relief Application (TTRA) shall mean before the occurrence of the first taxable event.

First taxable event shall mean the first or the only time when the income payor is required to withhold the income tax thereon or

should have withheld taxes thereon had the transaction been subjected to tax.

Failure to properly file the TTRA with ITAD within the period prescribed herein shall have the effect of disqualifying the TTRA

under this RMO.

You might also like

- 53135BIR Form No. 0901 O Other Income PDFDocument2 pages53135BIR Form No. 0901 O Other Income PDFBrigitte PocsolNo ratings yet

- Mama MoDocument2 pagesMama MoJan kenneth MalonesNo ratings yet

- 1901 PDocument2 pages1901 Pjef comendadorNo ratings yet

- Tax Treaty Forms 0901 SeriesDocument16 pagesTax Treaty Forms 0901 SeriesgoldagigiNo ratings yet

- Tax Treaty Information: BIR Form NoDocument2 pagesTax Treaty Information: BIR Form No071409No ratings yet

- 6J Store - WPDocument99 pages6J Store - WPAngelo LabiosNo ratings yet

- Application For Registration: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument1 pageApplication For Registration: Republic of The Philippines Department of Finance Bureau of Internal RevenueBRF Services IncNo ratings yet

- 2000ot - FigueroaDocument2 pages2000ot - Figueroadaryl canozaNo ratings yet

- Application For Registration: (To Be Filled Up by BIR) DLNDocument2 pagesApplication For Registration: (To Be Filled Up by BIR) DLNRhu BurauenNo ratings yet

- 20992NAP Payment Form ReDocument1 page20992NAP Payment Form ReTzuyu TchaikovskyNo ratings yet

- BIR Form 1903Document2 pagesBIR Form 1903rafael soriaoNo ratings yet

- Application For Registration: Republic of The Philippines Department of Finance Bureau of Internal Revenue BIR Form NoDocument4 pagesApplication For Registration: Republic of The Philippines Department of Finance Bureau of Internal Revenue BIR Form Nophoebemariealhambra1475No ratings yet

- Application For Registration: Republic of The Philippines BIR Form NoDocument6 pagesApplication For Registration: Republic of The Philippines BIR Form Nomarlon anzanoNo ratings yet

- 1905 FormDocument3 pages1905 FormFey FallerNo ratings yet

- 1905 January 2018 ENCS - CorrectedDocument14 pages1905 January 2018 ENCS - CorrectedKimberly MayNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasglydelNo ratings yet

- Application For Registration: Republic of The Philippines BIR Form No. Department of Finance Bureau of Internal RevenueDocument5 pagesApplication For Registration: Republic of The Philippines BIR Form No. Department of Finance Bureau of Internal RevenueSJC ITRNo ratings yet

- 1903 January 2018 ENCS FinalDocument4 pages1903 January 2018 ENCS FinalJames E. NogoyNo ratings yet

- Inbound 1611108369526332790Document5 pagesInbound 1611108369526332790Melvic PitorNo ratings yet

- Monthly Percentage Tax Return: 12 - December 06 - JuneDocument1 pageMonthly Percentage Tax Return: 12 - December 06 - JuneDana PardeNo ratings yet

- RMC No. 3-2020 Annex A - 1702Q 2018 PDFDocument3 pagesRMC No. 3-2020 Annex A - 1702Q 2018 PDFJemila Paula DialaNo ratings yet

- RMC No. 108-2020 Annex BDocument2 pagesRMC No. 108-2020 Annex BJoel SyNo ratings yet

- 0605Document2 pages0605Kath Rivera60% (42)

- 0605 PDFDocument2 pages0605 PDFeugene badere50% (2)

- Old Form 0605 PDFDocument2 pagesOld Form 0605 PDFeugene badere50% (2)

- Form 0605 PDFDocument2 pagesForm 0605 PDFeugene badereNo ratings yet

- Payment Form: 12 - DecemberDocument2 pagesPayment Form: 12 - DecemberElbert Natal100% (1)

- 0605 PDFDocument2 pages0605 PDFRob Villanueva100% (1)

- Quarterly Income Tax Return: Yes NoDocument3 pagesQuarterly Income Tax Return: Yes NoSusan P LauronNo ratings yet

- BIR Form 1702QDocument3 pagesBIR Form 1702QMique VillanuevaNo ratings yet

- Anned B & c-0605Document2 pagesAnned B & c-0605Rosmae BerrasNo ratings yet

- BIR Form 1902Document1 pageBIR Form 1902Digal AlfieNo ratings yet

- Anned B & c-0605Document2 pagesAnned B & c-0605da6795582No ratings yet

- 1 Taxpayer Identification Number (TIN) 2 RDO Code 3 Contact Number - 4 Registered NameDocument3 pages1 Taxpayer Identification Number (TIN) 2 RDO Code 3 Contact Number - 4 Registered NameRose O. DiscalzoNo ratings yet

- Bir 1701a FormDocument2 pagesBir 1701a FormChe CacatianNo ratings yet

- Annex A - 1701A Jan 2018Document2 pagesAnnex A - 1701A Jan 2018jeffrey josol100% (2)

- BIR Form 0605Document2 pagesBIR Form 0605Kathleen Anne CabreraNo ratings yet

- 0605 Version 1999Document3 pages0605 Version 1999Arlyn PisiaoNo ratings yet

- BIR Form NoDocument1 pageBIR Form NoAlden Christopher LumotNo ratings yet

- Annex A - 1701A Jan 2018481Document3 pagesAnnex A - 1701A Jan 2018481Rhon MarlNo ratings yet

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNo ratings yet

- 0605 Version 1999Document2 pages0605 Version 1999radzNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument2 pagesPayment Form: Kawanihan NG Rentas InternasFratz LaraNo ratings yet

- BIR-1905 Updated1Document3 pagesBIR-1905 Updated1Kevin CordovizNo ratings yet

- BIR Form No. 0622 - Rev - Guidelines2correctedDocument2 pagesBIR Form No. 0622 - Rev - Guidelines2correctedjomarNo ratings yet

- Monthly Percentage Tax Return: 12 - December 04 - AprilDocument1 pageMonthly Percentage Tax Return: 12 - December 04 - AprilTamara HamiltonNo ratings yet

- Bir Form 1905 New VersionDocument4 pagesBir Form 1905 New Versionchato law office100% (1)

- 2020 0605 Return MspaduaDocument1 page2020 0605 Return MspaduaEljoe VinluanNo ratings yet

- Income Taxation Bir FormDocument2 pagesIncome Taxation Bir FormVince AbabonNo ratings yet

- Capital Gains Tax Return: Yes NoDocument2 pagesCapital Gains Tax Return: Yes NoMaricor TambalNo ratings yet

- BIR Application For Registration FORM (1901)Document2 pagesBIR Application For Registration FORM (1901)Francis Nico PeñaNo ratings yet

- Income Tax Payment Challan: PSID #: 138637167Document1 pageIncome Tax Payment Challan: PSID #: 138637167naeem1990No ratings yet

- PH Bir 0605Document2 pagesPH Bir 0605Anonymous onBMYp9YNo ratings yet

- BIR Form No. 0605Document1 pageBIR Form No. 0605Troa BartonNo ratings yet

- Form A For 7E Certificate ExcelDocument1 pageForm A For 7E Certificate ExcelLabib ShahNo ratings yet

- Undertaking DTI 2023Document5 pagesUndertaking DTI 2023Cielo ChavezNo ratings yet

- DSTDocument2 pagesDSTRen A EleponioNo ratings yet

- Fsic - Bus - Makati - Ben - FsicDocument1 pageFsic - Bus - Makati - Ben - FsicNepean Philippines IncNo ratings yet

- Capital Markets: 2020 SEC Filing Deadlines and Financial Statement Staleness DatesDocument3 pagesCapital Markets: 2020 SEC Filing Deadlines and Financial Statement Staleness DatesNepean Philippines IncNo ratings yet

- Specimen Signature Form: InstructionsDocument1 pageSpecimen Signature Form: InstructionsCHRISTIAN MESA100% (1)

- Coon or Tax Appeals: Second DivisionDocument12 pagesCoon or Tax Appeals: Second DivisionNepean Philippines IncNo ratings yet

- Vil Certificate of R.A 2020Document1 pageVil Certificate of R.A 2020Nepean Philippines IncNo ratings yet

- Application For Treaty Purposes: (Relief From Philippine Income Tax On Dividends)Document2 pagesApplication For Treaty Purposes: (Relief From Philippine Income Tax On Dividends)Nepean Philippines IncNo ratings yet

- Procedures Results The Department of Foreign of Affairs (DFA) Will Require Immigrants To Have Residence PermitDocument3 pagesProcedures Results The Department of Foreign of Affairs (DFA) Will Require Immigrants To Have Residence PermitNepean Philippines IncNo ratings yet

- Enhanced Voluntary Assessment Program Payment Form: Kawanihan NG Rentas InternasDocument3 pagesEnhanced Voluntary Assessment Program Payment Form: Kawanihan NG Rentas InternasNepean Philippines IncNo ratings yet

- Voluntary Assessment Payment ProgramDocument2 pagesVoluntary Assessment Payment ProgramNepean Philippines IncNo ratings yet

- Annex A - RMC 55-2021 List of Major External FormsDocument3 pagesAnnex A - RMC 55-2021 List of Major External FormsNepean Philippines IncNo ratings yet

- Transfer Pricing - February 23, 2021Document63 pagesTransfer Pricing - February 23, 2021Nepean Philippines IncNo ratings yet

- United States v. Mundra, 4th Cir. (2003)Document3 pagesUnited States v. Mundra, 4th Cir. (2003)Scribd Government DocsNo ratings yet

- Eleclaw 6pageDocument23 pagesEleclaw 6pagePJ HongNo ratings yet

- Health LawDocument30 pagesHealth LawSana100% (1)

- Fundamental - Rights Chap5 - 8 - 24 PDFDocument152 pagesFundamental - Rights Chap5 - 8 - 24 PDFJassy BustamanteNo ratings yet

- G.R. No. 126713Document7 pagesG.R. No. 126713Mikko Gabrielle LangbidNo ratings yet

- Best Student Paper - Torts ExamDocument27 pagesBest Student Paper - Torts ExamGeorge Conk100% (2)

- MAHUSAYLAW211 REFLECTIVE ESSAY - Module 2Document4 pagesMAHUSAYLAW211 REFLECTIVE ESSAY - Module 2Jeth MahusayNo ratings yet

- A.M. No. 1637Document2 pagesA.M. No. 1637Samuel John CahimatNo ratings yet

- WONG CHU LAI v. WONG HO ENTERPRISE SDN BHD CLJ - 2020 - 4 - 120 - Cljkuim1 PDFDocument10 pagesWONG CHU LAI v. WONG HO ENTERPRISE SDN BHD CLJ - 2020 - 4 - 120 - Cljkuim1 PDFFitriah RabihahNo ratings yet

- Affidavit of TruthDocument12 pagesAffidavit of TruthAndre Lowe100% (22)

- 07-06-2016 ECF 1 9th Cir. - in Re Cliven Bundy - Petition For Writ of MandamusDocument154 pages07-06-2016 ECF 1 9th Cir. - in Re Cliven Bundy - Petition For Writ of MandamusJack Ryan100% (1)

- Instant Download Beginning and Intermediate Algebra 5th Edition Miller Solutions Manual PDF Full ChapterDocument32 pagesInstant Download Beginning and Intermediate Algebra 5th Edition Miller Solutions Manual PDF Full ChapterJohnBakeryoec100% (7)

- Future Business Leaders of America State of Louisiana BylawsDocument7 pagesFuture Business Leaders of America State of Louisiana BylawsTestNo ratings yet

- People v. Kottinger - Art 201Document3 pagesPeople v. Kottinger - Art 201Ethan KurbyNo ratings yet

- WWW Law Activity 13 & 14Document4 pagesWWW Law Activity 13 & 14Tan Toy100% (2)

- PP Vs ManhuyodDocument7 pagesPP Vs ManhuyodMariam PetillaNo ratings yet

- Law of Torts in KenyaDocument41 pagesLaw of Torts in KenyaMwaura Kamau93% (28)

- Ldersgate Ollege Ourse Udit Chool OF Usiness AND Ccountancy Odule Usiness AWDocument17 pagesLdersgate Ollege Ourse Udit Chool OF Usiness AND Ccountancy Odule Usiness AWcha11No ratings yet

- Video Making GuidelinesDocument3 pagesVideo Making GuidelinesAriza AlvarezNo ratings yet

- 5.. Confession and AdmissionDocument27 pages5.. Confession and AdmissionBaishnavi ShahNo ratings yet

- DOJ News Release 'Four St. Louis Police Officers Indicted For Civil Rights Violations and Obstruction of Justice'Document2 pagesDOJ News Release 'Four St. Louis Police Officers Indicted For Civil Rights Violations and Obstruction of Justice'WUSA9-TV100% (1)

- 516 Gawker Plan With Hogan & Other Settlement AgreementsDocument66 pages516 Gawker Plan With Hogan & Other Settlement AgreementsLaw&CrimeNo ratings yet

- Corporate Powers DigestDocument6 pagesCorporate Powers DigestLeo Garcia100% (1)

- The Trustee Under Indian Trusts ActDocument22 pagesThe Trustee Under Indian Trusts ActKuchuteddy92% (12)

- Speech The Rule of Law in The West Philippine Sea Dispute by Senior Associate Justice Antonio T. CarpioDocument12 pagesSpeech The Rule of Law in The West Philippine Sea Dispute by Senior Associate Justice Antonio T. CarpioHornbook Rule100% (1)

- Shinji Higaki (Editor), Yuji Nasu (Editor) - Hate Speech in Japan - The Possibility of A Non-Regulatory Approach-Cambridge University Press (2021)Document526 pagesShinji Higaki (Editor), Yuji Nasu (Editor) - Hate Speech in Japan - The Possibility of A Non-Regulatory Approach-Cambridge University Press (2021)Nicole HartNo ratings yet

- Answers 1) : The Objectives of Islamic Commercial Law AreDocument5 pagesAnswers 1) : The Objectives of Islamic Commercial Law AreMudug Primary and secondary schoolNo ratings yet

- AGATHA MSHOTE - It Is Settled Law That Parties Are Bound by Their Own Pleadings.Document29 pagesAGATHA MSHOTE - It Is Settled Law That Parties Are Bound by Their Own Pleadings.Fredy CalistNo ratings yet

- Dumo v. EspinasDocument1 pageDumo v. EspinasLex CabilteNo ratings yet

- 12-cr-00363-WYD: in The United States District Court For The District of ColoradoDocument7 pages12-cr-00363-WYD: in The United States District Court For The District of ColoradoMichael_Lee_RobertsNo ratings yet