Professional Documents

Culture Documents

Income Tax On Individuals

Income Tax On Individuals

Uploaded by

Deanne Lorraine V. Guinto0 ratings0% found this document useful (0 votes)

5 views1 pageThe document details capital gains and losses from the sale of shares in three companies (D, Y, and W) by an individual. It also provides details of various sources of income (interest, royalties, dividends, business income, compensation, interest from lending) and capital gains for another individual. A final capital gain is listed from the sale of stocks directly to a buyer.

Original Description:

Original Title

INCOME TAX ON INDIVIDUALS (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document details capital gains and losses from the sale of shares in three companies (D, Y, and W) by an individual. It also provides details of various sources of income (interest, royalties, dividends, business income, compensation, interest from lending) and capital gains for another individual. A final capital gain is listed from the sale of stocks directly to a buyer.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageIncome Tax On Individuals

Income Tax On Individuals

Uploaded by

Deanne Lorraine V. GuintoThe document details capital gains and losses from the sale of shares in three companies (D, Y, and W) by an individual. It also provides details of various sources of income (interest, royalties, dividends, business income, compensation, interest from lending) and capital gains for another individual. A final capital gain is listed from the sale of stocks directly to a buyer.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

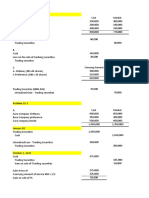

PROBLEM 1

(a) Selling price, D Company shares, not traded 250,000

Cost of Shares (120,000)

Capital Gains – subject to CGT 130,000

(b) Selling price, Y Company shares, traded 120,000

Cost of Shares (160,000)

Capital Loss – no CGT ( 40,000)

(c) Selling price, W Company shares, not traded 50,000

Cost of Shares ( 80,000)

Capital Loss – no CGT ( 30,000)

PROBLEM 2

Interest income from bank deposits 20,000

Royalty from literary works 100,000

Dividend income 50,000

170,000

Business Income 200,000

Compensation Income 300,000

Interest income from 5/6 lending to clients 100,000

Ordinary gain on sale of old furniture 10,000

Capital gain on sale of car 20,000

630,000

Capital gain on sale of stocks directly to a buyer 40,000 (3)

You might also like

- Use The Following Information For The Next Two (2) QuestionsDocument21 pagesUse The Following Information For The Next Two (2) QuestionsJennifer AdvientoNo ratings yet

- Test Bank 2 - Ia 3Document31 pagesTest Bank 2 - Ia 3Xiena100% (6)

- Vice CosmeticsDocument18 pagesVice CosmeticsDeanne Lorraine V. Guinto0% (3)

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- Sol. Man. - Chapter 4 - Nca Held For Sale & Discontinued Opns.Document10 pagesSol. Man. - Chapter 4 - Nca Held For Sale & Discontinued Opns.Crown Garcia50% (4)

- Statement of Comprehensive Income: Problem 1: True or FalseDocument17 pagesStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- 01-Principles of Taxation (Part 2)Document25 pages01-Principles of Taxation (Part 2)Deanne Lorraine V. GuintoNo ratings yet

- Export Packing, Marking and LabelingDocument3 pagesExport Packing, Marking and LabelingDeanne Lorraine V. Guinto100% (2)

- FAR First Preboard Batch 89 SolutionDocument6 pagesFAR First Preboard Batch 89 SolutionZiee00No ratings yet

- IA Chapter 15Document12 pagesIA Chapter 15Blue Sky100% (1)

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Midterms MADocument10 pagesMidterms MAJustz LimNo ratings yet

- Exchange Gain On DonationDocument11 pagesExchange Gain On DonationDinindu SahanNo ratings yet

- Answer-Key-Chapter-5-BC DeJesusDocument15 pagesAnswer-Key-Chapter-5-BC DeJesusMerel Rose FloresNo ratings yet

- Comprehensive Income & NcahsDocument6 pagesComprehensive Income & NcahsNuarin JJ67% (3)

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- Sir Mac Book SolmanDocument10 pagesSir Mac Book SolmanJAY AUBREY PINEDANo ratings yet

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- E5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryDocument9 pagesE5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryeryNo ratings yet

- AKL Kelompok 2Document11 pagesAKL Kelompok 2Wbok ZapztwvNo ratings yet

- Income Statement - ProblemsDocument4 pagesIncome Statement - ProblemsKatlene JoyNo ratings yet

- Proceeds of Property Insurance (BV 4,000,000)Document11 pagesProceeds of Property Insurance (BV 4,000,000)zeref dragneelNo ratings yet

- OSD and Regular Income Tax Rules IndvidualsDocument1 pageOSD and Regular Income Tax Rules IndvidualsMichael Angelo DeliniaNo ratings yet

- Multiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)Document4 pagesMultiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)anitaNo ratings yet

- Quiz 1.01 Financial Statements To Interim ReportingDocument22 pagesQuiz 1.01 Financial Statements To Interim ReportingJohn Lexter MacalberNo ratings yet

- Relevant CostingDocument3 pagesRelevant CostingPatrick SalvadorNo ratings yet

- ASSIGNMENT 2 Business CombinationDocument3 pagesASSIGNMENT 2 Business CombinationApril ManjaresNo ratings yet

- 95 AFAR Final Preboard SolutionsDocument10 pages95 AFAR Final Preboard Solutions20100723No ratings yet

- A. The Following Account Balances Were Presented On December 31, 2017Document3 pagesA. The Following Account Balances Were Presented On December 31, 2017Shiela Mae Pon AnNo ratings yet

- ExampleDocument8 pagesExampleAli Akand AsifNo ratings yet

- Installment Sales MethodDocument11 pagesInstallment Sales MethodJanella Umieh De UngriaNo ratings yet

- Chapter 2 Statement of Comprehensive IncomeDocument4 pagesChapter 2 Statement of Comprehensive IncomebwimeeeNo ratings yet

- Quiz 2Document2 pagesQuiz 2imagineimfNo ratings yet

- LCNRV - SolutionDocument3 pagesLCNRV - SolutionMagadia Mark JeffNo ratings yet

- Financial Accounting hw1Document5 pagesFinancial Accounting hw1Jermaine M. SantoyoNo ratings yet

- Polo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsDocument3 pagesPolo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsJunzen Ralph YapNo ratings yet

- HW On Equity Securities C Solutions and AnswersDocument6 pagesHW On Equity Securities C Solutions and AnswersAmjad Rian MangondatoNo ratings yet

- B CorporationDocument11 pagesB CorporationMelizze MejicoNo ratings yet

- Big Company LimitedDocument6 pagesBig Company LimitedFariha MaharinNo ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- Chapter 6-ExamplesDocument6 pagesChapter 6-ExamplesNguyen Tan AnhNo ratings yet

- 9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsDocument4 pages9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsRyan CartaNo ratings yet

- Ratio Analysis ActivityDocument3 pagesRatio Analysis ActivityKarlla ManalastasNo ratings yet

- Comparative and Common Size StatementsDocument10 pagesComparative and Common Size Statementsvanshikagoswami25No ratings yet

- Batch 95 FAR First Preboard SolutionDocument7 pagesBatch 95 FAR First Preboard Solutionssslll2No ratings yet

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- Net Cash Proceeds 915,000 Less: Carrying Amount of Non Cash Assets (1,300,000)Document4 pagesNet Cash Proceeds 915,000 Less: Carrying Amount of Non Cash Assets (1,300,000)Camila MolinaNo ratings yet

- Finalchapter 21Document9 pagesFinalchapter 21Jud Rossette ArcebesNo ratings yet

- P 5 - Assigned Tasks Afar302aDocument7 pagesP 5 - Assigned Tasks Afar302aLyn CosNo ratings yet

- Statement of Comprehensive Income Problems...Document2 pagesStatement of Comprehensive Income Problems...Darlyn Dalida San PedroNo ratings yet

- Problems On Sole PropritersDocument10 pagesProblems On Sole PropritersMouly ChopraNo ratings yet

- KHJNDocument2 pagesKHJNJanielah Catlyn FeronelNo ratings yet

- Trial Balance SampleDocument5 pagesTrial Balance SampleayeerahcaliNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- Cost-Volume-Profit Analysis: Solutions To Chapter 8 QuestionsDocument15 pagesCost-Volume-Profit Analysis: Solutions To Chapter 8 QuestionsGuinevereNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- 31 Chapter III Marketing AspectDocument33 pages31 Chapter III Marketing AspectDeanne Lorraine V. GuintoNo ratings yet

- Risk Reduction Management PlanDocument11 pagesRisk Reduction Management PlanDeanne Lorraine V. GuintoNo ratings yet

- International Supply Agreement Sample TemplateDocument6 pagesInternational Supply Agreement Sample TemplateDeanne Lorraine V. GuintoNo ratings yet

- Chapter 7 International Financial InstitutionsDocument36 pagesChapter 7 International Financial InstitutionsDeanne Lorraine V. GuintoNo ratings yet

- The Problem and Its BackgroundDocument32 pagesThe Problem and Its BackgroundDeanne Lorraine V. GuintoNo ratings yet

- Chapter 4 Bank Credit InstrumentsDocument17 pagesChapter 4 Bank Credit InstrumentsDeanne Lorraine V. GuintoNo ratings yet

- Investment ManagementDocument51 pagesInvestment ManagementDeanne Lorraine V. GuintoNo ratings yet

- Chapters 1-5Document139 pagesChapters 1-5Deanne Lorraine V. GuintoNo ratings yet

- Chapter 6 Bank OrganizationDocument22 pagesChapter 6 Bank OrganizationDeanne Lorraine V. GuintoNo ratings yet

- The Life, Works, & Writings of Jose RizalDocument39 pagesThe Life, Works, & Writings of Jose RizalDeanne Lorraine V. GuintoNo ratings yet

- Dr. Jose Rizal's LovelifeDocument20 pagesDr. Jose Rizal's LovelifeDeanne Lorraine V. GuintoNo ratings yet

- NST P-Cwts 1: Safety and Security Definition of TermsDocument3 pagesNST P-Cwts 1: Safety and Security Definition of TermsDeanne Lorraine V. GuintoNo ratings yet

- 01-Principles of Taxation (Part 3)Document21 pages01-Principles of Taxation (Part 3)Deanne Lorraine V. GuintoNo ratings yet

- Travels and Homecomings of RizalDocument50 pagesTravels and Homecomings of RizalDeanne Lorraine V. GuintoNo ratings yet