Professional Documents

Culture Documents

8921 - Intercompany Transactions Fixed Assets

Uploaded by

Thalia BontigaoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8921 - Intercompany Transactions Fixed Assets

Uploaded by

Thalia BontigaoCopyright:

Available Formats

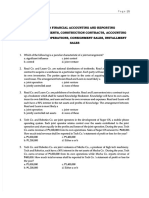

CPA REVIEW SCHOOL OF THE PHILIPPINES

Manila

ADVANCED FINANCIAL ACCOUNTING GERMAN/LIM/VALIX/K. DELA CRUZ/MARASIGAN

INTERCOMPANY SALE OF FIXED ASSETS

Part I: Theory of Accounts

1. Which of the following statements regarding the intercompany sale of fixed assets is TRUE?

a. If the intercompany sale of fixed assets is made at the beginning or any date before end of the

year, as a working paper procedure, any realize intercompany gain/loss affects the computation of

consolidated operating expense.

b. In the working paper, unrealized intercompany gain or loss on sale of fixed assets during the year

must be eliminated in full, regardless of the date of sale per books.

c. Credit Accumulated Depreciation in the working paper to recognize the realized gain on

intercompany sale of depreciable fixed assets.

d. Debit Loss on sale of equipment in the working paper, representing the realized loss on

intercompany sale of equipment based on the remaining useful life of the depreciable asset.

Part II: Problem Solving

Problem 1. On January 1, 2021, Entity ABC acquired 80% of outstanding ordinary shares of Entity

XYZ at a goodwill of P7,200,000. On January 1, 2021, there was an upstream sale of land with a cost of

P40,000,000 at a selling price of P44,000,000. The land was eventually sold by the buying affiliate to

Entity LMN the following year. On January 1, 2021, there was a downstream sale of equipment with a

cost of P8,000,000 and accumulated depreciation of P1,600,000 at a selling price of P7,200,000. The

equipment was already 4 years old at the date of sale.

On June 30, 2022, there was an upstream sale of machinery with a cost of P10,800,000 and accumulated

depreciation of P7,200,000 at a selling price of P2,400,000. The machinery was already 6 years old at the

date of sale. For the year ended December 31, 2022, Entity ABC reported net income of P32,000,000

while Entity XYZ reported net income of P20,000,000 and distributed dividends of P6,000,000. Entity

ABC accounted for its investment in Entity XYZ using cost method in its separate financial statements.

Compute for the following in the Consolidated Financial Statements in 2022:

1. Depreciation Expense

a. 1,600,000

b. 2,466,680

c. 2,200,000

d. 1,693,320

2. Carrying amount of the depreciable fixed assets

a. 9,000,000

b. 8,400,000

c. 8,000,000

d. 8,600,000

3. Non-controlling interest in profit

a. 4,160,000

b. 4,960,000

c. 5,000,000

d. 4,200,000

4. Net income attributable to controlling interest

a. 43,950,000

b. 47,250,000

c. 48,250,000

d. 53,050,000

8921

Page 2

Problem 2. A summary of the separate income statement of JKL Corporation and its 75% owned

subsidiary, QRS Company, for 2022 were as follows:

JKL QRS

Sales P18,000,000 P10,800,000

Gain on sale of equipment 360,000 ------------

Cost of goods sold (7,200,000) (4,680,000)

Depreciation expense (1,800,000) (1,080,000)

Other expenses (2,880,000) (1,440,000)

Income from operations P6,480,000 P3,600,000

QRS sold an equipment to JKL with a book value of P1,440,000 for P2,340,000 on January 2, 2020. At

the time of the intercompany sale, the equipment had a remaining useful life of five years. The buying

affiliate uses straight-line depreciation. JKL used the equipment until December 31, 2022, at which time

it was sold to TUV for P1,296,000.

Compute the amount of net profit attributable to non-controlling interests for 2022.

a. 1,125,000

b. 900,000

c. 1,035,000

d. 945,000

Problem 3. On July 1, 2021, DEF Company purchased 80% of the outstanding shares of NOP Company

at a cost of P64,000,000. On that date, the acquired company had P40,000,000 of ordinary shares and

P56,000,000 of retained earnings. For 2021, DEF had income of P22,400,000 from its separate

operations and paid dividends of P12,000,000. For 2021, the acquired company reported income of

P5,200,000 and paid dividends of P2,400,000. All the assets and liabilities of NOP have book values

equal to their respective fair market values. On October 1, 2021, NOP sold a machinery to DEF for

P8,000,000. The book value of the machinery on that date was P9,600,000. The machinery is expected to

have a useful life of 5 years from the date of sale.

In the December 31, 2021 Consolidated Statement of Comprehensive Income, compute the consolidated

net income attributable to controlling interest.

a. 37,856,000

b. 37,216,000

c. 25,696,000

d. 38,496,000

Problem 4. HIJ Corp. owns 80% of RST Corp.’s ordinary shares. On June 1, 2020, there was a

downstream sale for P1,350,000 delivery equipment with a carrying amount of P900,000. The buying

affiliate is to depreciate the acquired equipment over a five-year life by the straight-line method. On the

other hand, on September 30, 2021, there was an upstream sale of a slightly used computer for P255,000

with carrying value of P300,000 and remaining life of 3 years. On December 31, 2022, the buying

affiliate was able to sell the above delivery equipment to a non-affiliated company for P1,050,000. The

net adjustments to compute 2020, 2021 and 2022 consolidated income before income tax would be an

increase (decrease) of:

2020 2021 2022

a. (450,000) 438,750 150,000

b. (405,000) 382,500 292,500

c. (397,500) 131,250 75,000

d. (397,500) 131,250 292,500

-end of handouts-

8921

You might also like

- 8919 - Consolidation Subsequent To The Date of AcquisitionDocument4 pages8919 - Consolidation Subsequent To The Date of AcquisitionFayehAmantilloBingcangNo ratings yet

- 9019 - Consolidation Intercompany Sale of MerchandiseDocument3 pages9019 - Consolidation Intercompany Sale of MerchandisePRINCESS DE LUNANo ratings yet

- AFAR Self Test - 9005Document6 pagesAFAR Self Test - 9005King MercadoNo ratings yet

- ACCY 303 Midterm Exam ReviewDocument12 pagesACCY 303 Midterm Exam ReviewCORNADO, MERIJOY G.No ratings yet

- Chapter 13 - Property, Plant, and Equipment: Depreciation and DepletionDocument25 pagesChapter 13 - Property, Plant, and Equipment: Depreciation and Depletionnavie VNo ratings yet

- 94 - Final Preaboard AFAR - UnlockedDocument17 pages94 - Final Preaboard AFAR - UnlockedJessaNo ratings yet

- Rmbe Afar For PrintingDocument18 pagesRmbe Afar For PrintingjxnNo ratings yet

- MODAUD1 UNIT 4 Audit of Inventories PDFDocument9 pagesMODAUD1 UNIT 4 Audit of Inventories PDFJoey WassigNo ratings yet

- CH 13Document19 pagesCH 13pesoload100No ratings yet

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- Auditing Theory QuizDocument7 pagesAuditing Theory QuizKIM RAGANo ratings yet

- Abc Stock AcquisitionDocument13 pagesAbc Stock AcquisitionMary Joy AlbandiaNo ratings yet

- Acctg 10 - Final ExamDocument6 pagesAcctg 10 - Final ExamNANNo ratings yet

- Error Correction Problem 1: Lord Gen A. Rilloraza, CPADocument5 pagesError Correction Problem 1: Lord Gen A. Rilloraza, CPAMae-shane SagayoNo ratings yet

- Accounting For Business Combination - Practice ExamDocument6 pagesAccounting For Business Combination - Practice ExamZYRENE HERNANDEZNo ratings yet

- Use The Fact Pattern Below For The Next Three Independent CasesDocument5 pagesUse The Fact Pattern Below For The Next Three Independent CasesMichael Bongalonta0% (1)

- Afar 106 - Home Office and Branch Accounting PDFDocument3 pagesAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesNo ratings yet

- DrillDocument4 pagesDrillJEP WalwalNo ratings yet

- Compre 3Document7 pagesCompre 3casio3627No ratings yet

- Intercom PDocument20 pagesIntercom PLanze Micheal LadrillonoNo ratings yet

- Advanced Financial Accounting TopicsDocument16 pagesAdvanced Financial Accounting TopicsNhel AlvaroNo ratings yet

- Quiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDocument25 pagesQuiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDenise Jane RoqueNo ratings yet

- Advanced Accounting Home Office, Branch and Agency TransactionsDocument7 pagesAdvanced Accounting Home Office, Branch and Agency TransactionsMajoy Bantoc100% (1)

- Intacc2 - Assignment 4Document3 pagesIntacc2 - Assignment 4Gray JavierNo ratings yet

- Home Office and Branch Acccounting 2020Document3 pagesHome Office and Branch Acccounting 2020ReilpeterNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- Total Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Document8 pagesTotal Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Anonymous LC5kFdtcNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- Far TB2Document195 pagesFar TB2MarieJoiaNo ratings yet

- Investment AccountingDocument3 pagesInvestment AccountingMaxineNo ratings yet

- AP.2906 InvestmentsDocument6 pagesAP.2906 InvestmentsmoNo ratings yet

- Business Combination Problems Quiz 2Document7 pagesBusiness Combination Problems Quiz 2PrankyJellyNo ratings yet

- Partnership Liquidation Quiz AnswersDocument4 pagesPartnership Liquidation Quiz AnswersMikaella BengcoNo ratings yet

- Far - Pre BoardDocument17 pagesFar - Pre BoardClene DoconteNo ratings yet

- BAC 318 Final Examination With AnswersDocument10 pagesBAC 318 Final Examination With Answersjanus lopez100% (1)

- Solution Chapter 8 Rev FinalDocument20 pagesSolution Chapter 8 Rev FinalJonalyn SaloNo ratings yet

- Bornasal - Audit of InvestmentsDocument15 pagesBornasal - Audit of Investmentsnena cabañesNo ratings yet

- Accounting For Special Transactions:: Corporate LiquidationDocument28 pagesAccounting For Special Transactions:: Corporate LiquidationKim EllaNo ratings yet

- ch13 PDFDocument20 pagesch13 PDFJAY AUBREY PINEDANo ratings yet

- PNC Midterm Exam Valuation Ver 2Document55 pagesPNC Midterm Exam Valuation Ver 2Maybelle BernalNo ratings yet

- ICARE - MAS - PreWeek - Batch 4Document18 pagesICARE - MAS - PreWeek - Batch 4john paulNo ratings yet

- Audit Investments Chapter 6Document33 pagesAudit Investments Chapter 6Erica PortesNo ratings yet

- Special Transaction AssignmentDocument2 pagesSpecial Transaction Assignment수지No ratings yet

- 1 Afar - Preweek Summary 1 RehDocument16 pages1 Afar - Preweek Summary 1 RehCarlo AgravanteNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroNo ratings yet

- Afar Quiz 5 Probs Subsequent To Acqui DateDocument13 pagesAfar Quiz 5 Probs Subsequent To Acqui DatejajajaredredNo ratings yet

- Business Combinations ExplainedDocument8 pagesBusiness Combinations ExplainedLabLab ChattoNo ratings yet

- Audit of Cash Consolidated Valix ProblemsDocument7 pagesAudit of Cash Consolidated Valix ProblemsJulie Mae Caling MalitNo ratings yet

- NFJPIA - Mockboard 2011 - MAS PDFDocument7 pagesNFJPIA - Mockboard 2011 - MAS PDFSteven Mark MananguNo ratings yet

- Business Combination Comprehensive ExamDocument4 pagesBusiness Combination Comprehensive ExamRose VeeNo ratings yet

- Business Combination and Consolidated FS Part 1Document6 pagesBusiness Combination and Consolidated FS Part 1markNo ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Document35 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Mark Gelo WinchesterNo ratings yet

- Installment-Sales-Supplementary-Problems & NotesDocument3 pagesInstallment-Sales-Supplementary-Problems & NotesAlliah Mae ArbastoNo ratings yet

- NCHS Discontinued Operations ClassworkDocument5 pagesNCHS Discontinued Operations ClassworkKathleen Tabasa ManuelNo ratings yet

- Assignment 4 Intercompany Sale of PPEDocument2 pagesAssignment 4 Intercompany Sale of PPEAivan De LeonNo ratings yet

- 14 RevaluationDocument3 pages14 RevaluationAllegria AlamoNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaEsse ValdezNo ratings yet

- M36 - Quizzer 4Document5 pagesM36 - Quizzer 4Joshua DaarolNo ratings yet

- Ms 05 - Standard Costing Variance AnalysisDocument43 pagesMs 05 - Standard Costing Variance AnalysisThalia BontigaoNo ratings yet

- 5000 TOEFL Words PDFDocument36 pages5000 TOEFL Words PDFPrudhveeraj Chegu100% (2)

- Self-Test Partnership and Corporate LiquidationDocument6 pagesSelf-Test Partnership and Corporate Liquidationxara mizpahNo ratings yet

- 8923 - Foreign Currency HedgingDocument7 pages8923 - Foreign Currency HedgingThalia BontigaoNo ratings yet

- Acheiving Audience Involvement PGDocument2 pagesAcheiving Audience Involvement PGapi-550123704No ratings yet

- SC upholds estafa conviction but modifies penaltyDocument9 pagesSC upholds estafa conviction but modifies penaltyNixrabangNo ratings yet

- NACH FormDocument1 pageNACH FormPrem Singh Mehta75% (4)

- People v. Orita DigestDocument3 pagesPeople v. Orita Digestkathrynmaydeveza100% (3)

- Can Papiya Chakraborty (Extn)Document11 pagesCan Papiya Chakraborty (Extn)Debasish BandyopadhyayNo ratings yet

- Equatorial Realty v. Mayfair Theater ruling on ownership and fruitsDocument3 pagesEquatorial Realty v. Mayfair Theater ruling on ownership and fruitslinlin_17No ratings yet

- Functions of MoneyDocument15 pagesFunctions of MoneyRidhima MathurNo ratings yet

- Lecture Plan - CS801DDocument3 pagesLecture Plan - CS801DAvishek GhoshNo ratings yet

- The Art of Strategic Leadership Chapter 2 - The BusinessDocument6 pagesThe Art of Strategic Leadership Chapter 2 - The BusinessAnnabelle SmythNo ratings yet

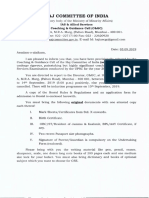

- Haj Committee of India: Tat Tory o Yoft e Ry I yDocument11 pagesHaj Committee of India: Tat Tory o Yoft e Ry I ysayyedarif51No ratings yet

- Bank of AmericaDocument113 pagesBank of AmericaMarketsWikiNo ratings yet

- The Core Beliefs and Practices of SikhismDocument26 pagesThe Core Beliefs and Practices of SikhismGVNo ratings yet

- Aqeelcv New For Print2Document6 pagesAqeelcv New For Print2Jawad KhawajaNo ratings yet

- Dax Tate Term PaperDocument5 pagesDax Tate Term Paperapi-301894375No ratings yet

- Response To Non Motion DocumentDocument5 pagesResponse To Non Motion DocumentLaw&CrimeNo ratings yet

- Slide Show On Kargil WarDocument35 pagesSlide Show On Kargil WarZamurrad Awan63% (8)

- BA 6th Sem INFLECTION AND DERIVATION NOTE PDFDocument2 pagesBA 6th Sem INFLECTION AND DERIVATION NOTE PDFRo Lu100% (1)

- Business Plan Highlights for Salon Beauty VenusDocument20 pagesBusiness Plan Highlights for Salon Beauty VenusEzike Tobe ChriszNo ratings yet

- Select The Correct Answer From The Five Choices Given!Document10 pagesSelect The Correct Answer From The Five Choices Given!Maulana Arif Budhiantoro maulanaarif.2017No ratings yet

- Quality Home AppliancesDocument3 pagesQuality Home AppliancesKevin WillisNo ratings yet

- Complete The Sentences Using Connectors of Sequence and The Past Form of The VerbDocument2 pagesComplete The Sentences Using Connectors of Sequence and The Past Form of The VerbLilibeth Aparicio MontesNo ratings yet

- Property Reviewer - Labitag OutlineDocument38 pagesProperty Reviewer - Labitag OutlineClarissa de VeraNo ratings yet

- Property rights in news, body parts, and wild animalsDocument22 pagesProperty rights in news, body parts, and wild animalskoreanmanNo ratings yet

- Securing Against The Most Common Vectors of Cyber AttacksDocument30 pagesSecuring Against The Most Common Vectors of Cyber AttacksCandra WidiatmokoNo ratings yet

- Computer Network Applications and UsesDocument31 pagesComputer Network Applications and Usessandhya bhujbalNo ratings yet

- CCC Letter To CPMGDocument3 pagesCCC Letter To CPMGAjay PandeyNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument6 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnSkarlz ZyNo ratings yet

- Spree Watch Marketing Plan Summary: Situation AnalysisDocument8 pagesSpree Watch Marketing Plan Summary: Situation AnalysisSreejib DebNo ratings yet

- Top IoT Authors and BlogsDocument3 pagesTop IoT Authors and Blogsmahesh gudimallaNo ratings yet

- GST/HST Credit Application For Individuals Who Become Residents of CanadaDocument4 pagesGST/HST Credit Application For Individuals Who Become Residents of CanadaAndrea Dr FanisNo ratings yet