Professional Documents

Culture Documents

Gam - Npo Quiz (Finals) Agency Books (Except Bir, Boc, BTR) Trial Balance - Beginning Balances Debit Credit

Uploaded by

Aprile Margareth HidalgoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gam - Npo Quiz (Finals) Agency Books (Except Bir, Boc, BTR) Trial Balance - Beginning Balances Debit Credit

Uploaded by

Aprile Margareth HidalgoCopyright:

Available Formats

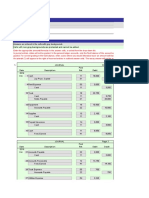

GAM - NPO Quiz (Finals)

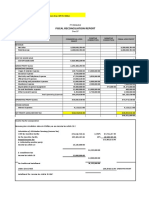

Agency Books (except BIR, BOC, BTr)

Trial Balance - Beginning Balances Debit Credit

Cash - Collecting Officer 19,875.00

Accounts Receivable 49,687.50

Office Equipment 159,000.00

Buildings 993,750.00

Due to BIR 8,446.88

Due to GSIS 2,534.06

Due to Pag-ibig 1,689.38

Due to PhilHealh 85.46

Accounts Payable 39,750.00

Accumulated Surplus (Deficit) 1,169,806.73

1,222,312.50 1,222,312.50

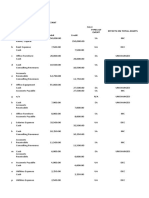

A. REVENUE

1. Billing of revenue/income for the following:

Rent/Lease Income 59,625.00

Waterworks System Fees 99,375.00

Power Supply System Fees 198,750.00

Seaport System Fees 89,437.50

Landing and Parking Fees 149,062.50

Total 596,250.00

2. Collection and remittance to BTr

a. Prior year's billed revenue:

1. Collection of Permit Fees, 19,875

2. Remittance

b. Current year's billed revenue:

1. Collections

Rent/Lease Income 49,687.50

Waterworks System Fees 59,625.00

Power Supply System Fees 149,062.50

Seaport System Fees 79,500.00

Landing and Parking Fees 19,875.00

Total 357,750.00

2. Remittance 321,975.00

c. Unbilled Tax Revenue

1. Collection thru Agency Collecting Officer

Travel Tax 39,750.00

Immigration Tax 496,875.00

Total 536,625.00

2. Remittance 536,625.00

3. Direct Deposit thru Authorized Agent Banks

Travel Tax 149,062.50

Immigration Tax 397,500.00

Total 546,562.50

d. Unbilled Service Income

1. Collection

Permit Fees 397,500.00

Registration Fees 149,062.50

Registration Plates, Tags and Sticker Fees 248,437.50

Clearance and Certification Fees 59,625.00

Franchising Fees 198,750.00

Licensing Fees 99,375.00

Supervision and Regulation Enforcement Fees 119,250.00

Spectrum Usage Fees 39,750.00

Legal Fees 49,687.50

Inspection Fees 9,937.50

Verification and Authentication Fees 39,750.00

Passport and Visa Fees 19,875.00

Processing Fees 49,687.50

Fines and Penalties Service Income 5,962.50

Other Service Income 3,975.00

Total 1,490,625.00

2. Remittance 1,192,500.00

e. Unbilled Business Income

1. Collection

Affiliation Fees 795.00

Examination Fees 993.75

Seminar/Training Fees 1,987.50

Guarantee Income 795.00

Fines and Penalties- Business Income 397.50

Other Business Income 993.75

Total 5,962.50

2. Remittance 5,962.50

B. APPROPRIATIONS, ALLOTMENT AND OBLIGATIONS

3. Receipt of GAA

PS 795,000.00

MOOE 662,500.00

CO 1,192,500.00

Total 2,650,000.00

4. Receipt of allotment from DBM

PS 768,500.00

MOOE 622,750.00

CO 1,126,250.00

Total 2,517,500.00

5. Incurrence of Obligation

PS 662,500.00

MOOE 132,500.00

CO 1,126,250.00

Total 1,921,250.00

6. Receipt of Notice of Cash Allocation from DBM (net of tax)

a. for current year's appropriation 2,385,000.00

b. For prior year's AP (not yet due and demandable 52,903.28

7. Delivery of office equipment and office supplies

(assumption, beginning of the year balance)

a. Prior Year's obligation

1. Receipt of delivery of office supplies 397.50

b. Current year's purchases and delivery

1. Receipt of delivery of office supplies

Office equipment 1,307,775.00

Office supplies inventory 27,427.50

Total 1,335,202.50

8. Payment of personnel benefits

a. Set up the amount Due to Officers and Employees upon approval of payroll

Salaries and wages 1,013,625.00

PERA 109,312.50

Gross Compensation 1,122,937.50

Withholding tax 101,362.50

GSIS 30,408.75

PAG-IBIG 20,272.50

PhilHealth 1,013.63

Total Deductions 153,057.38

Net payroll 969,880.13

b. Grant of cash advance for payroll 969,880.13

9. Liquidation of payroll funds

Liquidation of payroll funds 969,880.13

10. Payment of MOOE and Accounts Payable

a. Payment of Expense

Traveling Expenses -Local 8,776.80

Training Expenses 21,942.00

Water Expenses 3,291.30

Electricity Expenses 16,456.50

Telephone Expenses 3,291.30

Janitorial Services 2,194.20

Security Services 5,485.50

Rent/Lease Expenses 43,884.00

Total 105,321.60

Less: Withholding tax 4,289.03

Net 101,032.58

b. Payment of accounts payable

1. Current year's accounts payable for the purchase of:

Office equipment 1,046,220.00

Office supplies inventory 21,942.00

Total 1,068,162.00

Less: Withholding tax 57,222.11

Net 1,010,939.89

2. Prior year's accounts payable

MOOE

Total 39,750.00

Less: Withholding tax 2,484.38

Net 37,265.63

3. Prior year's obligation

MOOE

Total 397.50

Less: Withholding tax 21.86

Net 375.64

c. Grant of cash advance for travelling expense 3,975.00

d. Liquidation of cash advance for travelling expense - Foreign 3,776.25

e. Receipt (thru cash collecting officer) and deposit (to Cash- 198.75

treasury) of refund of excess cash advance for travelling

11. Remittance of taxes thru TRA

a. Constructive receipt of NCA for TRA consisting of:

PS 109,809.38

MOOE 7,969.88

CO 56,047.50

Total 173,826.75

b. Remittance of taxes thru TRA

Income Tax 120,611.44

Business Tax 53,215.31

Total 173,826.75

12. Remittance of the following deductions from payroll

GSIS 30,408.75

PAG-IBIG 20,272.50

PhilHealth 1,013.63

Total 51,694.88

13. Adjustments

a. Issuance of supplies and materials to end users 24,684.75

b. Adjustment for unused NCA

NCA Received xxx

Payments xxx

Net xxx

c. Depreciation of Office Equipment (annual) 278,687.25

d. Depreciation of building (annual) 37,762.50

e. Allowance for impairment of accounts receivables 238.50

You might also like

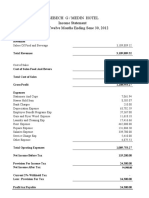

- Statement of Financial Performance 2020Document6 pagesStatement of Financial Performance 2020JCandz AmallaNo ratings yet

- Individual Income Tax ReturnDocument4 pagesIndividual Income Tax Returnnicole bancoroNo ratings yet

- Statement of Cash Flows for General FundDocument5 pagesStatement of Cash Flows for General FundJoergen Mae MicabaloNo ratings yet

- Statemnt of Cash Flows For The Period Ended June 30, 2013 General FundDocument6 pagesStatemnt of Cash Flows For The Period Ended June 30, 2013 General FundJoergen Mae MicabaloNo ratings yet

- XYZ Company Profit and Loss: All DatesDocument2 pagesXYZ Company Profit and Loss: All DatesMatt Kelvin ParaisoNo ratings yet

- D4 - 2a - Amp - Minggu6 - 205134024 - Putty Humaira NurgiaDocument6 pagesD4 - 2a - Amp - Minggu6 - 205134024 - Putty Humaira NurgiaNur LaelahNo ratings yet

- Profit & Loss: Xyz CompanyDocument1 pageProfit & Loss: Xyz CompanyMatt Kelvin ParaisoNo ratings yet

- MANCOM Report: June 7, 2021Document10 pagesMANCOM Report: June 7, 2021Pcup AccountingNo ratings yet

- Brgy 4 Perpetual Succor 2016 Financial ReportDocument2 pagesBrgy 4 Perpetual Succor 2016 Financial ReportCristina MelloriaNo ratings yet

- Profit & Loss (Standard) : Resa Harisma 195154024Document1 pageProfit & Loss (Standard) : Resa Harisma 195154024Bikin OrtubanggaNo ratings yet

- Firm Balance SheetDocument5 pagesFirm Balance SheetHimanshu YadavNo ratings yet

- PrelimsDocument4 pagesPrelimsRalph Carlo SumaculubNo ratings yet

- PT Jayatama - Dhiwa - Laba Rugi (Standar)Document1 pagePT Jayatama - Dhiwa - Laba Rugi (Standar)Dhiwa RafiantoNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 2 - Accounting Changes and ErrorsDocument5 pagesViray, Nhicole S. Asynchronous Quiz 2 - Accounting Changes and ErrorsZeeNo ratings yet

- Seven Heaven Corporation Adjusted Trial Balance For The Year Ended - December 31, 2019Document3 pagesSeven Heaven Corporation Adjusted Trial Balance For The Year Ended - December 31, 2019Judith DurensNo ratings yet

- Kashato-Shirts MerchandisingDocument3 pagesKashato-Shirts MerchandisingFred Wilson100% (1)

- Practice Exercise - Journalizing Government Accounting Transactions-NAVEDocument12 pagesPractice Exercise - Journalizing Government Accounting Transactions-NAVEJanielle NaveNo ratings yet

- Ae 117Document17 pagesAe 117Jlanie BalasNo ratings yet

- Abreham Bekele 2015 IntriemDocument4 pagesAbreham Bekele 2015 IntriemHaile KebedeNo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptDocument4 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptFred WilsonNo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleDocument12 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleFred WilsonNo ratings yet

- Receipt & PaymentDocument2 pagesReceipt & PaymentAZLANNo ratings yet

- UPIN DAN IPIN Corp. 2014 financial reportDocument6 pagesUPIN DAN IPIN Corp. 2014 financial reportMuhammad Fajar Al AminNo ratings yet

- FS AlfrescoDocument17 pagesFS AlfrescoAdrian Contillo100% (2)

- Terraceproforma 17Document17 pagesTerraceproforma 17api-354468897No ratings yet

- Maithri Shilpitha Sunflower Apartments Owners Association: Receipt Amount Payment AmountDocument2 pagesMaithri Shilpitha Sunflower Apartments Owners Association: Receipt Amount Payment AmountSourav AryaNo ratings yet

- 2010 July Finance Profit LossDocument2 pages2010 July Finance Profit LossblueriverdocNo ratings yet

- Evi4 104957Document2 pagesEvi4 104957Al QadriNo ratings yet

- Abebe Urge 2015 IntriemDocument6 pagesAbebe Urge 2015 IntriemHaile KebedeNo ratings yet

- Budget Expenditures and Sources of FinancingDocument5 pagesBudget Expenditures and Sources of FinancingkQy267BdTKNo ratings yet

- Variety Ply - 2014 - FInalDocument19 pagesVariety Ply - 2014 - FInalSridhar GandikotaNo ratings yet

- AK2 13 Kheisya Buku BesarDocument2 pagesAK2 13 Kheisya Buku BesarKheisya Siva Qolbi Kiss PutriXI AKL 2No ratings yet

- Financial Assumptions: RevenueDocument12 pagesFinancial Assumptions: RevenueKathleeneNo ratings yet

- Raval Bus CoDocument1 pageRaval Bus Coheynuhh gNo ratings yet

- SECUREX (PVT.) Limited: Statement of Comprehensive Income For The Year Ended 29 February 2016 2016 Notes TakaDocument4 pagesSECUREX (PVT.) Limited: Statement of Comprehensive Income For The Year Ended 29 February 2016 2016 Notes TakaBiplob K. SannyasiNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Subic Power Corp V CIR (CTA 6059, May 8 2003)Document16 pagesSubic Power Corp V CIR (CTA 6059, May 8 2003)Firenze PHNo ratings yet

- Subsidies: Remittance of Taxes Withheld Not Covered by Tra Remittance of Gsis/Pag-Ibig/PhilhealthDocument5 pagesSubsidies: Remittance of Taxes Withheld Not Covered by Tra Remittance of Gsis/Pag-Ibig/PhilhealthReginald ValenciaNo ratings yet

- April Income StatementDocument125 pagesApril Income StatementRowena Babagonio SarsuaNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceeaeNo ratings yet

- Operating Performance: Air Philippines Employees' CooperativeDocument4 pagesOperating Performance: Air Philippines Employees' CooperativeChristian LlanteroNo ratings yet

- Abebech G - Medin 2012 1Document19 pagesAbebech G - Medin 2012 1Deresegn NedaNo ratings yet

- Irma4 104904Document2 pagesIrma4 104904Al QadriNo ratings yet

- Unadjusted Bal. As of DEC. 31, 2019: Less: Accumulated Depreciation 7,886,099.60Document14 pagesUnadjusted Bal. As of DEC. 31, 2019: Less: Accumulated Depreciation 7,886,099.60Stephanie LouiseNo ratings yet

- Feasib Chapter 4Document9 pagesFeasib Chapter 4Red SecretarioNo ratings yet

- Profit & Loss Statement: Al Istethaa Elect Cont LLC Year End 2020Document1 pageProfit & Loss Statement: Al Istethaa Elect Cont LLC Year End 2020Asad RehmanNo ratings yet

- Darlami Hardware & Suppliers 3Document1 pageDarlami Hardware & Suppliers 3Manoj gurungNo ratings yet

- Income: Total A. Fees - GensanDocument4 pagesIncome: Total A. Fees - Gensanerick macompasNo ratings yet

- Management Wesb08 PunbDocument12 pagesManagement Wesb08 PunbRusilah KhalilNo ratings yet

- Show Financial Report by IdDocument1 pageShow Financial Report by IdpatrickstamesNo ratings yet

- Trial Balance Financial ReportDocument1 pageTrial Balance Financial Reportsaket agarwalNo ratings yet

- GUE GUL - Overheads 2023Document111 pagesGUE GUL - Overheads 2023John Bryan HernandoNo ratings yet

- Product Costing ExampleDocument6 pagesProduct Costing ExampleChethaka Lankara SilvaNo ratings yet

- Profit & Loss YTD Comparison: Town of Blue RiverDocument6 pagesProfit & Loss YTD Comparison: Town of Blue RiverblueriverdocNo ratings yet

- CHAPTER 4 Financial AspectDocument18 pagesCHAPTER 4 Financial AspectShan ShanNo ratings yet

- 1 PDFDocument1 page1 PDFjeffrey josolNo ratings yet

- Homework 1 - Statement of Financial PositionDocument2 pagesHomework 1 - Statement of Financial PositionBianca JovenNo ratings yet

- HOMEWORK 1. Statement of Financial PositionDocument2 pagesHOMEWORK 1. Statement of Financial PositionBianca JovenNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Local and Global Communication in Multi-Cultural Settings: Presented By: Jessieca, Irish, and AprileDocument15 pagesLocal and Global Communication in Multi-Cultural Settings: Presented By: Jessieca, Irish, and AprileAprile Margareth HidalgoNo ratings yet

- HEALTH (Injury)Document18 pagesHEALTH (Injury)Aprile Margareth HidalgoNo ratings yet

- Morality and Ethics Are Terms Often Used As If They Have The Same MeaningDocument3 pagesMorality and Ethics Are Terms Often Used As If They Have The Same MeaningAprile Margareth HidalgoNo ratings yet

- Forms of Classical MusicDocument23 pagesForms of Classical MusicAprile Margareth HidalgoNo ratings yet

- Group Two - PCDocument11 pagesGroup Two - PCAprile Margareth HidalgoNo ratings yet

- Universal / American Values: Presented By: Alondra Bantatua Aprile Margareth HidalgoDocument24 pagesUniversal / American Values: Presented By: Alondra Bantatua Aprile Margareth HidalgoAprile Margareth HidalgoNo ratings yet

- Presentation by Group 2Document39 pagesPresentation by Group 2Aprile Margareth HidalgoNo ratings yet

- Universal Values KemeDocument2 pagesUniversal Values KemeAprile Margareth HidalgoNo ratings yet

- Chap12 OLDocument34 pagesChap12 OLAprile Margareth HidalgoNo ratings yet

- MonopolyDocument15 pagesMonopolyAprile Margareth HidalgoNo ratings yet

- Chap11 MCDocument35 pagesChap11 MCAprile Margareth HidalgoNo ratings yet

- Firms in Competitive MarketsDocument15 pagesFirms in Competitive MarketsAprile Margareth HidalgoNo ratings yet

- Overview of The National Service Training ProgramDocument21 pagesOverview of The National Service Training ProgramAprile Margareth HidalgoNo ratings yet

- Universal / American Values: Presented By: Alondra Bantatua Aprile Margareth HidalgoDocument24 pagesUniversal / American Values: Presented By: Alondra Bantatua Aprile Margareth HidalgoAprile Margareth HidalgoNo ratings yet

- CASE STUDY 1 Global WarmingDocument4 pagesCASE STUDY 1 Global WarmingGennelyn Lairise RiveraNo ratings yet

- Chapter Twenty-Eight: Game TheoryDocument81 pagesChapter Twenty-Eight: Game TheoryBibin BabyNo ratings yet

- PreambleDocument1 pagePreambleAprile Margareth HidalgoNo ratings yet

- Demand Analysis Activity and Other ReadingsDocument3 pagesDemand Analysis Activity and Other ReadingsGennelyn Lairise RiveraNo ratings yet

- Advertising: Alvarado, Jonalyn Apura, Janine-AnDocument54 pagesAdvertising: Alvarado, Jonalyn Apura, Janine-AnAprile Margareth HidalgoNo ratings yet

- MANAGERIAL ECONOMICS Lesson 1Document7 pagesMANAGERIAL ECONOMICS Lesson 1Gennelyn Lairise RiveraNo ratings yet

- Sales Promotion IBMDocument34 pagesSales Promotion IBMAprile Margareth HidalgoNo ratings yet

- C. Castro Company-Cdc 2018Document42 pagesC. Castro Company-Cdc 2018Gennelyn Lairise Rivera100% (1)

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoNo ratings yet

- Lesson 3Document40 pagesLesson 3Aprile Margareth HidalgoNo ratings yet

- Operations Management: An IntroductionDocument35 pagesOperations Management: An IntroductionAprile Margareth Hidalgo100% (1)

- What Advice Would You Give To Monica?Document2 pagesWhat Advice Would You Give To Monica?Aprile Margareth HidalgoNo ratings yet

- Special Journals JessDocument13 pagesSpecial Journals JessAprile Margareth HidalgoNo ratings yet

- PDF Transfer PricingDocument10 pagesPDF Transfer PricingAprile Margareth HidalgoNo ratings yet

- MANAGEMENT ADVISORY SERVICES REVIEW: Break Even Analysis, Sensitivity Analysis and LeverageDocument15 pagesMANAGEMENT ADVISORY SERVICES REVIEW: Break Even Analysis, Sensitivity Analysis and LeverageAprile Margareth Hidalgo0% (1)

- Mas 8109 Decentralization - Performance - 20170623225858Document12 pagesMas 8109 Decentralization - Performance - 20170623225858Aprile Margareth HidalgoNo ratings yet

- Apti QuestionsDocument7 pagesApti QuestionsLisha sharma50% (8)

- Dhaka Bank Limited and Its Subsidiary Consolidated Balance SheetDocument8 pagesDhaka Bank Limited and Its Subsidiary Consolidated Balance Sheetshahid2opuNo ratings yet

- OverheadsDocument38 pagesOverheadsHebaNo ratings yet

- Investment Process and Valuation GuideDocument43 pagesInvestment Process and Valuation Guidegiorgiogarrido6No ratings yet

- Acct Project Question 2Document14 pagesAcct Project Question 2grace100% (1)

- Diploma in Ifrs 25th Edition BrochureDocument8 pagesDiploma in Ifrs 25th Edition BrochureamitNo ratings yet

- Jetblue Airways Case Study in FinanceDocument3 pagesJetblue Airways Case Study in FinanceAhmed El KhateebNo ratings yet

- I602 - 11 - Economics of The FirmDocument31 pagesI602 - 11 - Economics of The FirmRohan SinghNo ratings yet

- Accounting For PartnershipsDocument43 pagesAccounting For PartnershipsAqibNo ratings yet

- Guidebook On Mutual Funds KredentMoney 201911 PDFDocument80 pagesGuidebook On Mutual Funds KredentMoney 201911 PDFKirankumarNo ratings yet

- Capital Budgeting PPT 2Document32 pagesCapital Budgeting PPT 2Sakshi SharmaNo ratings yet

- VonRoll Geschaeftsbericht 2017 ENDocument116 pagesVonRoll Geschaeftsbericht 2017 ENraul_beronNo ratings yet

- The 75 KPIs Every Manager Needs To KnowDocument4 pagesThe 75 KPIs Every Manager Needs To KnowKaran Mehta100% (4)

- Allowable DeductionsDocument16 pagesAllowable DeductionsChyna Bee SasingNo ratings yet

- Chapter Two Financial Analysis and Planning Part One-Financial Analysis 2.1Document17 pagesChapter Two Financial Analysis and Planning Part One-Financial Analysis 2.1TIZITAW MASRESHA100% (2)

- Improve Dutch Lady with New Products, Lower PricesDocument3 pagesImprove Dutch Lady with New Products, Lower PricesMathias MikeNo ratings yet

- Power Tariff Determination - ThermalDocument74 pagesPower Tariff Determination - ThermalSourav DasNo ratings yet

- BAC103A-02a Income Tax For IndividualsDocument8 pagesBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- (VALIX) InterimDocument22 pages(VALIX) InterimMaeNo ratings yet

- Pertemuan Ke 5 Management StrategicDocument33 pagesPertemuan Ke 5 Management StrategicErica SPNo ratings yet

- Zimbabwe Tax SystemDocument396 pagesZimbabwe Tax SystemEugenie KupembonaNo ratings yet

- Cost Accounting Assignment #2Document5 pagesCost Accounting Assignment #2BRIANNIE ASRI VIVASNo ratings yet

- REFLECTION PAPER Momentum StrategiesDocument2 pagesREFLECTION PAPER Momentum StrategiesPrincess Shyne PeñaNo ratings yet

- 2019 ResultsDocument98 pages2019 ResultsJulieAnnPaguicanNo ratings yet

- UNIT 4. Operations ManagementDocument9 pagesUNIT 4. Operations ManagementSergio VázquezNo ratings yet

- StratCost Quiz 2Document6 pagesStratCost Quiz 2ElleNo ratings yet

- Notes - ACCTG 114 - 04 26 - 04 28 2022Document13 pagesNotes - ACCTG 114 - 04 26 - 04 28 2022Janna Mari FriasNo ratings yet

- Decision on Loan Based on Income StatementDocument3 pagesDecision on Loan Based on Income StatementLorelyn TriciaNo ratings yet

- PUMA 2019 Combined Management Report SummaryDocument166 pagesPUMA 2019 Combined Management Report SummaryChetanya100% (1)

- Problem 2-3B: Name: Section: ScoreDocument10 pagesProblem 2-3B: Name: Section: ScoreAlba LunaNo ratings yet