Professional Documents

Culture Documents

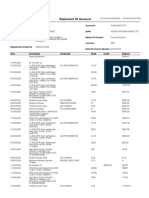

HUB Company Financiaal Report

Uploaded by

Sudazai Khan0 ratings0% found this document useful (0 votes)

20 views2 pagesOriginal Title

HUB company financiaal report

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views2 pagesHUB Company Financiaal Report

Uploaded by

Sudazai KhanCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Yellow

BUSINESS RECORDER KARACHI FRIDAY 25 MARCH 2011

Brief recordings

HUBCO has responded to the need for “future proof” planning in the power sector by initiating the

construction of two new power plants. The company is the first private company to go into hydroelectric

power generation and its 84 MW run of the river hydropower complex is projected to come online by

2013. The other project, a 214 MW power plant at Narowal expected to be operational by October 2010

will help the company move better on its policy path of achieving “Growth through energy”. FY 2010 has

brought in mixed results for the firm; where on one hand the ever rising financial difficulties of

HUBCO’s major client WAPDA have translated into soaring receivables of Rs 73 billion under the PPA,

the blockage of fund flow from this end has served to increase the loan owed to PSO in lieu of RFO

supply to Rs. 63 billion on the other. As far as the operational performance is concerned, the company

succeeded in achieving a record high load factor of 79.3%, symbolic of the ability of HUBCO to operate

at optimal efficiency levels. The turnover and operating costs simultaneously soared, due to a

combination of the various factors discussedin the analysis below. Finance costs have exhibited a

similarly dual phenomenon, whereby two trench loan repayment and issue of TFCs by GOP in HFY’10

helped to ease the burden to acertain extent but at the same time the existence of persistent and circular

debt owed to PSO helped offset the favorable impacts.

Recent results (1H11)

Turnover for the period was Rs. 49,202 million (2009: Rs. 46,168 million) and operating costs were Rs.

44,954 million (2009: Rs. 42,389 million) resulting in a gross profit of Rs. 4,248 million compared to Rs.

3,779 million in the corresponding period last year. Financial charges were considerably higher at Rs. 1.2

billion as compared to Rs. 0.78 billion in the same period last year. The Company earned a net profit of

Rs. 2,843 million during the period (earning per share of Rs. 2.46) compared to a net profit of Rs. 2,855

million and (earnings per share of Rs. 2.47) in the same period last year. Hub Plant operated at an average

load factor of 71% and an average complex availability (ACA) of 85%. Electricity sold to WAPDA was

3,746 GWh.

Operations

The operational performance for FY10 showed mixed results; as the chart below predicts both total

revenue and cost of goods sold registered an increase. The 20.42708% rise in turnover was but marginally

offset by a 19.97625% increase in the COGS. Also that the general administration expenses registered a

rise of 8.868768% yielding a positive EBIT change of 25% and 46.9% increase in the net profit (Figure

2). These movements have been a combined result of higher oil prices, an improvement in the indexation

factor and the favorable movement of the PCE. A devaluation of the rupee as registered during FY10

increased the indexation factor by 15% and together with the 31% or so rise in the PCE led to the positive

impact in turnover. Also that efficiency gains were more or less offset by the soaring repair and

maintenance costs in lieu of the modernization program under way. The 14% decline in financial costs, in

addition to the factors mentioned earlier was brought about due to a positive interest differential on

overdue receivables and payables. The financial crunch experienced by WAPDA however helped lower

the other income and gains figure and has thereby served to neutralize the positive results.

Profitability

The impact of the operational changes discussed above has been quite pronounced on the profit position

of the firm. Where on one hand the GP% has gone down perhaps due to the rising oil prices, the NP,

ROA and ROE have all soared due to the combined impact of the indexation and PCE effects stated

earlier. On a comparative level however, HUBCO has lagged behind KAPCO on all four fronts. One

possible explanation for this is the comparatively inefficient use of short and long-term assets by HUBCO

as opposed to KAPCO, the details of which have been presented in the next section.

Efficiency

As mentioned earlier, FY10 was a period of record breaking performance for the company. An analysis of

the firm’s utilization ratios as depicted in Fig 3a and 3b below reveals that compared to KAPCO, the firm

has a longer operating cycle and DSO but a substantially lower inventory turnover. The rising receivable

figure entrusted to WAPDA may be sufficient explanation for the cited disparity. However, the adverse

consequences that this might have on the liquidity position of HUBCO are yet to be examined. A

consideration of the company specific trend in this regard provides some reassuring information as we

can see in Fig 3b that a marked improvement in the operating cycle and DSO has been registered as

compared to FY09.

Liquidity and debt management

As highlighted by Fig 4, 2010 brought about a worsening of HUBCP’s debt position. The long-term debt

to equity position grew by 40 percentage points, whereas debt to equity percentage and debt to asset ratios

soared phenomenally as well. This was primarily a result of the increasing inability of the company to

channelize funds received by WAPDA towards retirement of debt taken from PSO on account of RFO

supply. However, the favorable profit position helped to register a rise in the TIE despite the rising

incidence of debt. The comparative debt standing with KAPCO registered similar movements. HUBCO’s

debt to asset percentage, debt to equity and long-term debt gearing ratios are substantially over those of

KAPCO; one possible explanation for such a position could be the debt taken up by HUBCO to finance

its pipeline power plants that are expected to become operational by late 2010 and 2013 respectively.

However, yet again we see that HUBCO’s TIE exceeds that of KAPCO thereby indicating that the firm is

taking advantage of its financial leverage. As far as the liquidity position is concerned, while KAPCO has

succeeded in maintaining a stable current ratio over the period FY09-FY10, HUBCO has experienced a

decline in its current ratio over the year. However, on a comparative level HUBCO has surpassed

KAPCO’s short-term financial position consistently as depicted in the chart below.

Investor ratios

Despite the financial crunch in the industry, HUBCO has experienced a positive growth in its EPS from

3.27 to 4.8 in FY10 from FY09. While this seems to be an indicator that could boost investor confidence

in the company, a comparative analysis wit KAPCO reveals that HUBCO has been consistently under-

performing its competition in this regard. Also that the increase in the EPS reflected positively on the

company’s stock price which rose to a level of 34.35 rupees, however, the P/E ratio plunged to 7.3. Hence

yet again the results for the company have been mixed on this front.

Future outlook

The future of the company seems secure as long as the positive profitability growth can be sustained; also

that the degree to which the firm is able to tap onto the benefits of its new power generation capacity as a

source of competitive advantage will determine the improvement or otherwise deterioration in the

comparative performance of the company relative to KAPCO in particular and other power generators

in general. Only time will tell if such breakthroughs bring forth more positives for HUBCO or if

worsening financial position of a client as significant as WAPDA serve to give a sour taste to the

company for keeping all its eggs in one basket.

You might also like

- AP U.S. HISTORY Brinkley Chapter 17 OutlinesDocument10 pagesAP U.S. HISTORY Brinkley Chapter 17 OutlinesLauren Bustillo100% (1)

- 'Account StatementDocument11 pages'Account StatementSikander Qazi100% (2)

- Star River Assignment-ReportDocument15 pagesStar River Assignment-ReportBlessing Simons33% (3)

- FFA535 - Strategic Finance and Value Creation Assignment 5 Acova RadiateursDocument4 pagesFFA535 - Strategic Finance and Value Creation Assignment 5 Acova RadiateursAnkit MishraNo ratings yet

- Financial Analysis of OGDCLDocument16 pagesFinancial Analysis of OGDCLsehrish_sadaqat7873100% (1)

- Grade A Steam Coal Soft Offer July 2010Document3 pagesGrade A Steam Coal Soft Offer July 2010dikluhNo ratings yet

- DMCIDocument4 pagesDMCIGlare RoseteNo ratings yet

- The Hub Power Holding LTDDocument1 pageThe Hub Power Holding LTDbinraziNo ratings yet

- AP A17Q Q2Jun2012 (02oct2012 Amended)Document41 pagesAP A17Q Q2Jun2012 (02oct2012 Amended)cuonghienNo ratings yet

- Analysis PsoDocument3 pagesAnalysis PsoTrend SetterNo ratings yet

- SharekhanTopPicks 030811Document7 pagesSharekhanTopPicks 030811ghachangfhuNo ratings yet

- Jep Ar 2010Document112 pagesJep Ar 2010Wee Seong SeowNo ratings yet

- Capm AnalysisDocument18 pagesCapm Analysisnadun sanjeewaNo ratings yet

- Hero Honda Motors Limited: ICRA Online Equity ResearchDocument8 pagesHero Honda Motors Limited: ICRA Online Equity ResearchAmit SoniNo ratings yet

- BHEL-4QFY14 Result Update-2 June 2014Document5 pagesBHEL-4QFY14 Result Update-2 June 2014Ravi ShekharNo ratings yet

- Vodafone Group PLC: GradeDocument5 pagesVodafone Group PLC: GradeTurcan Ciprian SebastianNo ratings yet

- Global Brass and Copper Holdings Research Note 1Document2 pagesGlobal Brass and Copper Holdings Research Note 1api-249461242No ratings yet

- Rosete, Gherlen Clare A. Manacct Prof. Lopez Comparative AnalysisDocument8 pagesRosete, Gherlen Clare A. Manacct Prof. Lopez Comparative AnalysisGlare RoseteNo ratings yet

- Punj Lloyd: Performance HighlightsDocument12 pagesPunj Lloyd: Performance HighlightsAngel BrokingNo ratings yet

- Star River - Sample ReportDocument15 pagesStar River - Sample ReportMD LeeNo ratings yet

- HDFC CenturionDocument4 pagesHDFC CenturionurmishusNo ratings yet

- Kohinoor Energy ReportDocument16 pagesKohinoor Energy ReportImama KhanNo ratings yet

- Financial AnalysisDocument5 pagesFinancial AnalysisAnalyn Joy TrinidadNo ratings yet

- Star RiverDocument8 pagesStar Riverjack stauberNo ratings yet

- Crompton Greaves LTD.: Investment RationaleDocument0 pagesCrompton Greaves LTD.: Investment Rationalespatel1972No ratings yet

- Dawood HercDocument1 pageDawood HercMohammad TallalNo ratings yet

- Star River Electronics.Document5 pagesStar River Electronics.Nguyen Hieu100% (3)

- Group 10 - Deliverable 3Document5 pagesGroup 10 - Deliverable 3Hamza AsifNo ratings yet

- Tenda 4T23Document33 pagesTenda 4T23Flavya PereiraNo ratings yet

- Interpretation FinalDocument6 pagesInterpretation FinalFarzana YasminNo ratings yet

- Financial Analysis of Novatex Customer Performance and ProjectionsDocument3 pagesFinancial Analysis of Novatex Customer Performance and Projectionstalha alamNo ratings yet

- Nagarjuna Construction: Performance HighlightsDocument12 pagesNagarjuna Construction: Performance HighlightsAngel BrokingNo ratings yet

- Final Quarterly Report 05 12 2023Document44 pagesFinal Quarterly Report 05 12 2023mazunmNo ratings yet

- Vladi FAF Financial ReportDocument4 pagesVladi FAF Financial ReportVladi DimitrovNo ratings yet

- 2011 Annual Report EngDocument143 pages2011 Annual Report Engsabs1234561080No ratings yet

- Financial Management and ControlDocument18 pagesFinancial Management and ControlcrystalNo ratings yet

- Port+Harcourt+DisCo+Rate+Case+Application July+2023Document3 pagesPort+Harcourt+DisCo+Rate+Case+Application July+2023Ibitola AbayomiNo ratings yet

- Reliance Communication: Performance HighlightsDocument10 pagesReliance Communication: Performance HighlightsAngel BrokingNo ratings yet

- PSO Financial Analysis Highlights LossesDocument14 pagesPSO Financial Analysis Highlights LossesDanish KhalidNo ratings yet

- Fin Statement Analysis - Atlas BatteryDocument34 pagesFin Statement Analysis - Atlas BatterytabinahassanNo ratings yet

- Empowering Partnerships: Meralco 2009 Annual ReportDocument150 pagesEmpowering Partnerships: Meralco 2009 Annual ReportPatrick GarciaNo ratings yet

- Hero Motocorp Limited: Icra Equity Research ServiceDocument7 pagesHero Motocorp Limited: Icra Equity Research ServiceArunkumar PalanisamyNo ratings yet

- Finolex Cables Poised for Growth on Derivative Losses CleanupDocument9 pagesFinolex Cables Poised for Growth on Derivative Losses CleanupsanjeevpandaNo ratings yet

- Power Grid Corporation of India LTD (Pgcil) (Pgcil) : AnalystDocument14 pagesPower Grid Corporation of India LTD (Pgcil) (Pgcil) : AnalystRajiv BharatiNo ratings yet

- Bajaj Electricals, 1Q FY 2014Document14 pagesBajaj Electricals, 1Q FY 2014Angel BrokingNo ratings yet

- Punj Lloyd Result UpdatedDocument10 pagesPunj Lloyd Result UpdatedAngel BrokingNo ratings yet

- NTPC Result UpdatedDocument11 pagesNTPC Result UpdatedAngel BrokingNo ratings yet

- SGT Vertical & Horizontal AnalysisDocument11 pagesSGT Vertical & Horizontal AnalysisHa LinhNo ratings yet

- Tata Motors Stock Update Maintains Buy With Revised Rs 430 TargetDocument9 pagesTata Motors Stock Update Maintains Buy With Revised Rs 430 TargetAniket DhanukaNo ratings yet

- Lighting Up': Sector: Mid CapsDocument12 pagesLighting Up': Sector: Mid Capsfriendajeet123No ratings yet

- PPL Corporation Financial AnalysisDocument16 pagesPPL Corporation Financial AnalysisMoses MachariaNo ratings yet

- Madhucon Projects: Performance HighlightsDocument13 pagesMadhucon Projects: Performance HighlightsAngel BrokingNo ratings yet

- Sun TV Equity Research ReportDocument7 pagesSun TV Equity Research ReportNitesh RulzNo ratings yet

- Coca Cola Financial AnalysisDocument8 pagesCoca Cola Financial AnalysisHoang0% (1)

- LNT AnalysisDocument7 pagesLNT AnalysisGagan KarwarNo ratings yet

- HSIE Results Daily - 12 Nov 22-202211120745240401459Document18 pagesHSIE Results Daily - 12 Nov 22-202211120745240401459N KhanNo ratings yet

- Q1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?Document6 pagesQ1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?sridhar607No ratings yet

- UK GDP decline and telecom sector recoveryDocument13 pagesUK GDP decline and telecom sector recoveryprahladtripathiNo ratings yet

- An Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipFrom EverandAn Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipNo ratings yet

- Performance of Private Equity-Backed IPOs. Evidence from the UK after the financial crisisFrom EverandPerformance of Private Equity-Backed IPOs. Evidence from the UK after the financial crisisNo ratings yet

- Procurement and Supply Chain Management: Emerging Concepts, Strategies and ChallengesFrom EverandProcurement and Supply Chain Management: Emerging Concepts, Strategies and ChallengesNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Promotion BBLDocument13 pagesPromotion BBLChalista RafaNo ratings yet

- IoBM Catalog 2021 2022Document205 pagesIoBM Catalog 2021 2022Yashal AlamNo ratings yet

- National Agricultural Extension Strategy GuideDocument66 pagesNational Agricultural Extension Strategy Guidenicholas ssebalamuNo ratings yet

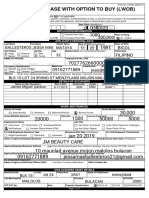

- Lwob - Application-Form Edited Edited EditedDocument2 pagesLwob - Application-Form Edited Edited Editedjessamaeballesteros21100% (1)

- John Maynard Keynes National Self-SufficiencyDocument27 pagesJohn Maynard Keynes National Self-SufficiencyreisbillNo ratings yet

- Financial Performance Analysis of Accor GroupDocument99 pagesFinancial Performance Analysis of Accor GroupsalmanNo ratings yet

- Pakistan's Ghost Kitchen Industry AnalysisDocument4 pagesPakistan's Ghost Kitchen Industry AnalysisHaiqa SheikhNo ratings yet

- Compiled Report On Avery Denisson 1 PDFDocument33 pagesCompiled Report On Avery Denisson 1 PDFTashfiqur Rahman Khan 1411446630No ratings yet

- Starbucks Corporation Ob Case StudyDocument5 pagesStarbucks Corporation Ob Case StudySyaie SyaiedaNo ratings yet

- Ducati, Case Analysis: Nitin Dangwal 13P094 Section BDocument4 pagesDucati, Case Analysis: Nitin Dangwal 13P094 Section BJames Kudrow100% (2)

- Logbook Gac022Document6 pagesLogbook Gac022PaulinaNo ratings yet

- Corporate Finance 10th Edition Ross Test Bank 1Document70 pagesCorporate Finance 10th Edition Ross Test Bank 1james100% (38)

- API IND DS2 en Excel v2 10081834Document462 pagesAPI IND DS2 en Excel v2 10081834Suvam PatelNo ratings yet

- Future of Finance:: 10 Trends To Watch NowDocument23 pagesFuture of Finance:: 10 Trends To Watch NowisudhNo ratings yet

- Projet: Telecom Africa Distrubition Expertise Security (Tades)Document8 pagesProjet: Telecom Africa Distrubition Expertise Security (Tades)Maimouna NdiayeNo ratings yet

- Accounting Information System at Sonali Bank LimitedDocument24 pagesAccounting Information System at Sonali Bank LimitedsaidulNo ratings yet

- Cooperatives and Rural MarketsDocument168 pagesCooperatives and Rural MarketsDhanraj WaghmareNo ratings yet

- Acct 5930 Quiz 1 Question 1Document26 pagesAcct 5930 Quiz 1 Question 1Mauhammad NajamNo ratings yet

- Derivative Report For 04 Jan - Mansukh Investment and Trading SolutionsDocument3 pagesDerivative Report For 04 Jan - Mansukh Investment and Trading SolutionsMansukh Investment & Trading SolutionsNo ratings yet

- 10k - Manpower Inc 2011Document115 pages10k - Manpower Inc 2011dayalratikNo ratings yet

- Ibm 130-Feasibility of International Trade QuizDocument2 pagesIbm 130-Feasibility of International Trade QuizmohitNo ratings yet

- Eco Projects Total List From JapanDocument498 pagesEco Projects Total List From JapanJain Sumeet100% (1)

- Assignment 2 ECON1194 2022A - NguyenHoangAnh - s3915023Document15 pagesAssignment 2 ECON1194 2022A - NguyenHoangAnh - s3915023Anh NguyenNo ratings yet

- Appointment Letter-New DraftDocument3 pagesAppointment Letter-New DraftNikita JaiswalNo ratings yet

- The Teaching Hub Class Xii Accountancy Chapter 2: The Fundamental of Partnership FirmDocument3 pagesThe Teaching Hub Class Xii Accountancy Chapter 2: The Fundamental of Partnership FirmAthArvA .TNo ratings yet

- NikeDocument47 pagesNikeRishabh AgarwalNo ratings yet

- Summary SIA Ch.13 - Expenditure CycleDocument3 pagesSummary SIA Ch.13 - Expenditure CycleAthiyya Nabila AyuNo ratings yet