Professional Documents

Culture Documents

Bank Reconciliation: Meaning

Uploaded by

Mark Johnson LeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Reconciliation: Meaning

Uploaded by

Mark Johnson LeeCopyright:

Available Formats

DO NOT SEND

BANK RECONCILIATION

Cathleen angelica L. Rubio

Meaning: Terms associated with the “bank rec”

include:

The bank reconciliation provides

comfort that a company’s accounting

1. Outstanding Checks: check that

records, and balance sheet reflect the were written (and have been

proper amount of cash. recorded on the company’s books),

but have not cleared the bank

account.

2. Deposits In Transit: receipts that occurred but they

are not yet reported on the bank statement.

3. Adjusted Balance Per Bank: the balance on the

bank statement after deducting outstanding checks, 7. Bank Debit Memo: a deduction from

adding deposits in transit, and recording any bank a bank account made by the bank for

errors. a bank service charge, deposited

check that was returned, check

printing fee, etc.

4. Adjusted Balance Per Books: the balance in the

general ledger for the checking account after (1) 8. Demand Deposits: checking

deducting any bank fees or other deductions that are accounts

on the bank statement but are not yet recorded in the

9. Time Deposits: savings accounts

general ledger account and (2) adding any receipts on

and certificates of deposit.

the bank statement that are not yet recorded in the

general ledger account.

5. Journal Entries: entries to the company’s accounting 10. NSF Check: a check not paid by

records. Journal entries are required for bank the bank on which it was drawn

reconciliation adjustments to the balance per books. because the account’s balance was

less than the amount of the check.

6. Bank Credit Memo: an addition to a bank account

made by the bank for an adjustment to a deposit, 11. Float: usually the amount of

correction of a bank error, interest on bank balances, outstanding checks.

etc.

You might also like

- CHAPTER SIX - Doc Internal Control Over CashDocument7 pagesCHAPTER SIX - Doc Internal Control Over CashYared DemissieNo ratings yet

- Ace BankingDocument4 pagesAce Bankingshubham swaraj20% (10)

- Recent Sbi StatementDocument8 pagesRecent Sbi StatementMUTHYALA NEERAJANo ratings yet

- PDFDocument22 pagesPDFKarthik ShimogaNo ratings yet

- Assets and Liability ManagementDocument42 pagesAssets and Liability Managementssubha123100% (4)

- Audit of Cash and Cash EquivalentsDocument10 pagesAudit of Cash and Cash EquivalentsDebs FanogaNo ratings yet

- Instant Loans Uk Quickest Solution To Arrange MoneyDocument3 pagesInstant Loans Uk Quickest Solution To Arrange MoneyBennedsenAustin2No ratings yet

- 2nd QTR Week 8 Fabm 2 Bank ReconDocument9 pages2nd QTR Week 8 Fabm 2 Bank ReconHannah Grace ManagasNo ratings yet

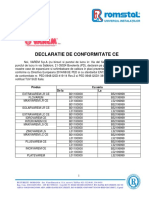

- Declaratie de Conformitate Ce: Cu Seria Produs de La LaDocument3 pagesDeclaratie de Conformitate Ce: Cu Seria Produs de La LaVasile Marian AdrianNo ratings yet

- SBI Mobile BankingDocument46 pagesSBI Mobile BankingAbhishek Tiwari100% (3)

- H TNB Ga Oy 2 KL I7 CSSDocument15 pagesH TNB Ga Oy 2 KL I7 CSSEVD18I019 NIMMAKAYALA SUMANTH GOURI MANJUNADHNo ratings yet

- Case Study 2 - ReportDocument10 pagesCase Study 2 - ReportTomás TavaresNo ratings yet

- Financial Accounting Chapter 8Document2 pagesFinancial Accounting Chapter 8Noel Guerra100% (2)

- Introduction To Open Banking in KSADocument33 pagesIntroduction To Open Banking in KSAShalabh100% (1)

- 5 Kyc Completed 26 April 2023Document37 pages5 Kyc Completed 26 April 2023sridhar sNo ratings yet

- The Bank Reconciliation Provides Comfort That A Company's Accounting Records, and Balance Sheet Reflect The Proper Amount of CashDocument1 pageThe Bank Reconciliation Provides Comfort That A Company's Accounting Records, and Balance Sheet Reflect The Proper Amount of CashMark Johnson LeeNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationGiyah UsiNo ratings yet

- 1.2 Bank Reconciliation and Proof of CashDocument6 pages1.2 Bank Reconciliation and Proof of CashShally Lao-unNo ratings yet

- ACCELE4Document3 pagesACCELE4Karylle AnneNo ratings yet

- ACC117 - Chapter 7 - Bank Reconciliation StatementDocument24 pagesACC117 - Chapter 7 - Bank Reconciliation StatementIrah NazirahNo ratings yet

- FABM2-MODULE 9 - With ActivitiesDocument7 pagesFABM2-MODULE 9 - With ActivitiesROWENA MARAMBANo ratings yet

- Chapter 2.bank ReconDocument26 pagesChapter 2.bank ReconLykie Mae ParedesNo ratings yet

- Key Terms and Chapter Summary-13Document2 pagesKey Terms and Chapter Summary-13onstudy015No ratings yet

- Lesson 8 - Bank Reconciliation StatementDocument5 pagesLesson 8 - Bank Reconciliation StatementUnknownymousNo ratings yet

- Bank Reconciliation Statement: ModuleDocument20 pagesBank Reconciliation Statement: ModuleTushar SainiNo ratings yet

- Bank Recon NotesDocument2 pagesBank Recon NotesFrancine PimentelNo ratings yet

- Bank Reconciliation (Millan, 2022)Document1 pageBank Reconciliation (Millan, 2022)didit.canonNo ratings yet

- Notes Chapter 6Document2 pagesNotes Chapter 6syafaNo ratings yet

- Bank ReconciliationDocument12 pagesBank ReconciliationJenny Pearl Dominguez CalizarNo ratings yet

- Bankasdasd Das AsdDocument9 pagesBankasdasd Das AsdRia AthirahNo ratings yet

- Unit 7. Cash 6.0 Aims & ObjectivesDocument10 pagesUnit 7. Cash 6.0 Aims & ObjectivesKaleab TesfayeNo ratings yet

- M10 TranscriptDocument3 pagesM10 TranscriptJanna RodriguezNo ratings yet

- Green Aesthetic Thesis Defense Presentation - 20240315 - 171147 - 0000Document49 pagesGreen Aesthetic Thesis Defense Presentation - 20240315 - 171147 - 0000joyce jabileNo ratings yet

- Lesson 5: Bank Reconciliation What Is A Bank Reconciliation?Document9 pagesLesson 5: Bank Reconciliation What Is A Bank Reconciliation?Reymark TalaveraNo ratings yet

- How To Prepare A Bank ReconciliationDocument6 pagesHow To Prepare A Bank ReconciliationMk Fisiha100% (1)

- Bank ReconciliationDocument24 pagesBank ReconciliationCyrelle MagpantayNo ratings yet

- Main IdeasDocument7 pagesMain IdeasIsabel Jost SouribioNo ratings yet

- Bank Reconciliation: AccountingtoolsDocument1 pageBank Reconciliation: AccountingtoolsQuenie De la CruzNo ratings yet

- Accounting For CashDocument6 pagesAccounting For CashAsnake YohanisNo ratings yet

- Final Chapter 6Document12 pagesFinal Chapter 6Nigussie BerhanuNo ratings yet

- Final Chapter 4Document8 pagesFinal Chapter 4Abraham RayaNo ratings yet

- Fabm2 QTR.2 Las 7.1Document10 pagesFabm2 QTR.2 Las 7.1Trunks KunNo ratings yet

- Introduction To Bank Reconciliation Statement: ReconcileDocument2 pagesIntroduction To Bank Reconciliation Statement: ReconcileJayesh RasalNo ratings yet

- Cash Chapter 5Document9 pagesCash Chapter 5yoantanNo ratings yet

- Bank Reconciliation 1Document4 pagesBank Reconciliation 1Ralph Renan NapalaNo ratings yet

- Bank Reconciliation PDFDocument17 pagesBank Reconciliation PDFJamaica IndacNo ratings yet

- Bank Reconciliation StatementDocument14 pagesBank Reconciliation StatementMarvie MendozaNo ratings yet

- Auditing Problems Ap.401 Audit of Cash and Cash Equivalents: Internal Control Measures For CashDocument9 pagesAuditing Problems Ap.401 Audit of Cash and Cash Equivalents: Internal Control Measures For CashMarjorie PonceNo ratings yet

- Final Chapter 6Document6 pagesFinal Chapter 6Hussen AbdulkadirNo ratings yet

- Audit of Cash and Cash Equivalents: Internal Control Measures For CashDocument7 pagesAudit of Cash and Cash Equivalents: Internal Control Measures For CashmoNo ratings yet

- AP.2904 - Cash and Cash EquivalentsDocument7 pagesAP.2904 - Cash and Cash EquivalentsRNo ratings yet

- What Is Bank Reconciliation.Document11 pagesWhat Is Bank Reconciliation.Sabrena FennaNo ratings yet

- BHT1333 Chapter 6Document6 pagesBHT1333 Chapter 6Weiqin ChanNo ratings yet

- FABM REVIEWER 2nd QUARTERDocument5 pagesFABM REVIEWER 2nd QUARTERMikaella Adriana GoNo ratings yet

- Bank Reconciliation and Steps in Bank ReconciliationDocument15 pagesBank Reconciliation and Steps in Bank ReconciliationGrace AncajasNo ratings yet

- FABM Notes 1 Bank ReconciliationDocument4 pagesFABM Notes 1 Bank ReconciliationnahatdoganNo ratings yet

- Bank ReconDocument23 pagesBank ReconAshley LumbaoNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsSarah CaballeroNo ratings yet

- AP.2904 - Cash and Cash Equivalents.Document7 pagesAP.2904 - Cash and Cash Equivalents.Eyes Saw0% (1)

- Chapter 5 - Bank Reconciliation StatementDocument23 pagesChapter 5 - Bank Reconciliation StatementNchumthung JamiNo ratings yet

- Financial Accounting Handout 2Document49 pagesFinancial Accounting Handout 2Rhoda Mbabazi ByogaNo ratings yet

- Chapter 2-Chapter 5Document17 pagesChapter 2-Chapter 5Jenn sayongNo ratings yet

- Chapter 2 Bank ReconciliationDocument15 pagesChapter 2 Bank Reconciliation2021315379No ratings yet

- AFS 2023 - Lecture 10 - CashDocument28 pagesAFS 2023 - Lecture 10 - CashKiều TrangNo ratings yet

- C6Document20 pagesC6AkkamaNo ratings yet

- Bank Reconciliation StatementDocument5 pagesBank Reconciliation StatementxxpinkywitchxxNo ratings yet

- Bank Reconciliation - For LectureDocument3 pagesBank Reconciliation - For LectureCharlene Jane EspinoNo ratings yet

- AE 111 Midterm Formative Assessment 2Document3 pagesAE 111 Midterm Formative Assessment 2Djunah ArellanoNo ratings yet

- Bank Reconciliation: There Are Three Kinds of Bank Deposits, NamelyDocument2 pagesBank Reconciliation: There Are Three Kinds of Bank Deposits, NamelyWimrod CanenciaNo ratings yet

- ACC 1100 Day 10 Cash and Bank AccountDocument17 pagesACC 1100 Day 10 Cash and Bank AccountMai Anh ĐàoNo ratings yet

- An Introduction To Sampling Methods: Population Vs SampleDocument6 pagesAn Introduction To Sampling Methods: Population Vs SampleMark Johnson LeeNo ratings yet

- M6, M7 ArtsDocument11 pagesM6, M7 ArtsMark Johnson LeeNo ratings yet

- ART Prelim Modules (Narative)Document10 pagesART Prelim Modules (Narative)Mark Johnson LeeNo ratings yet

- Statistics: Is A Scientific Method That Deals With Collection, Organizing, Summarizing, Presenting, and Analyzing DataDocument13 pagesStatistics: Is A Scientific Method That Deals With Collection, Organizing, Summarizing, Presenting, and Analyzing DataMark Johnson LeeNo ratings yet

- Arrange Those Visible Elements To Make Effective Compositions: These Include: Balance, Unity, Variety, Harmony, Movement, Rhythm and EmphasisDocument11 pagesArrange Those Visible Elements To Make Effective Compositions: These Include: Balance, Unity, Variety, Harmony, Movement, Rhythm and EmphasisMark Johnson LeeNo ratings yet

- Profit and Loss AccountDocument1 pageProfit and Loss AccountMark Johnson LeeNo ratings yet

- Balance SheetDocument1 pageBalance SheetMark Johnson LeeNo ratings yet

- What To See:: Asset Liabilities EquityDocument1 pageWhat To See:: Asset Liabilities EquityMark Johnson LeeNo ratings yet

- Allowance For Bad DebtsDocument2 pagesAllowance For Bad DebtsMark Johnson LeeNo ratings yet

- Adjusting Entries (Depreciation)Document2 pagesAdjusting Entries (Depreciation)Mark Johnson LeeNo ratings yet

- Adjusting Entries (Depreciation)Document2 pagesAdjusting Entries (Depreciation)Mark Johnson LeeNo ratings yet

- Assignment of Credits and Other Incorporeal RightsDocument3 pagesAssignment of Credits and Other Incorporeal RightsMark Johnson LeeNo ratings yet

- Hero Housing - Sanction - 09.09.2022 - MCDocument12 pagesHero Housing - Sanction - 09.09.2022 - MCvishwesheswaran1No ratings yet

- Challan FormDocument1 pageChallan FormAnonymous 0izsN2No ratings yet

- DownloadDocument3 pagesDownloadChristina SalliNo ratings yet

- ThesisDocument122 pagesThesissatyaNo ratings yet

- SBI PO Mains CA Exam PDF 1Document209 pagesSBI PO Mains CA Exam PDF 1Wasim AkramNo ratings yet

- TrainingDocument24 pagesTrainingturi kabetoNo ratings yet

- Corporate Social ResponsibilityDocument4 pagesCorporate Social Responsibilityaperez1105No ratings yet

- CP of Sbi BankDocument4 pagesCP of Sbi Bankharman singh0% (1)

- Kasb BankDocument17 pagesKasb BankUsman Chughtai0% (1)

- Liquidity Preference TheoryDocument5 pagesLiquidity Preference TheoryQute ClaudieNo ratings yet

- KM57070447 StatementDocument8 pagesKM57070447 Statementsanjay bindNo ratings yet

- HUNI - Account StatementDocument2 pagesHUNI - Account StatementShiela HuniNo ratings yet

- ReportDocument45 pagesReportAli FarhanNo ratings yet

- Nawiri Fund Group applicationDocument5 pagesNawiri Fund Group applicationCharles MwanikiNo ratings yet

- Matura 2015 Repetytorium PR Vocabulary 7Document2 pagesMatura 2015 Repetytorium PR Vocabulary 7Natalia ZdanowskaNo ratings yet

- Amity International School, Noida: Phone(s) : 4399000, 4399135 ReceiptDocument1 pageAmity International School, Noida: Phone(s) : 4399000, 4399135 ReceiptL.C. GOYALNo ratings yet

- 1.+FGV MCACapital Final BrasilDocument149 pages1.+FGV MCACapital Final BrasilBruno LimaNo ratings yet

- L9 Y6 SZ XCCQ GKV NCMDocument1 pageL9 Y6 SZ XCCQ GKV NCMShuvam SarkarNo ratings yet

- He Legal Status of Online Currencies ARE Itcoins The Future: Rhys Bollen 2013 1Document38 pagesHe Legal Status of Online Currencies ARE Itcoins The Future: Rhys Bollen 2013 1prabin ghimireNo ratings yet