Professional Documents

Culture Documents

TC LBT Checklist

Uploaded by

Carl John Paul FlemingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TC LBT Checklist

Uploaded by

Carl John Paul FlemingCopyright:

Available Formats

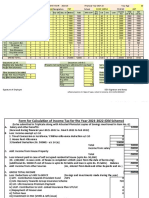

Tax Compliance Checklist for Local Business tax (LBT)

Company:

Channel Account:

TIN:

Period Covered:

Contact Person:

Title:

Contact No.:

OBJECTIVE:

The objective of the review is to determine if the Company is in compliance with the LBT laws and

regulations such that the risks and exposure of the Company on LBT related issues noted in the

examinations and when applicable, recommend corrective measures to address the issues.

INSTRUCTIONS:

This checklist is to be accomplished by the senior associate/ associate / in-charge of the engagement and

is to be reviewed by the senior associate / director / senior director and engagement partner. This checklist

should be accomplished for all tax audit engagements (e.g., Tax Compliance, Due Diligence, etc) and

shall form part of the tax audit working papers.

This must be completely accomplished in INK. When an item in the checklist has been performed, place

a (/) underneath the “Done” column and state the result of the action taken. If not, indicate “Not Done”

underneath the “Done” column and state the reasons for not having done the procedures called for. For

questions not applicable to the particular engagement, place the letters “NA” underneath the “Done”

column together with a brief explanation. The senior associate / in-charge may also refer to the pertinent

LBT provisions and regulations as aid in the performance of the examinations.

This checklist must be accompanied with working papers to support the procedures done in the review.

To easily identify issues noted in the examinations, the word “TRM” shall be indicated in red ink in the

pertinent working papers. A summary of findings noted shall also be attached to this checklist.

Prepared by:

TROG SA/A Initials Date

Reviewed by:

TROG SD/D/AD Initials Date

Approved by:

TROG Partner Initials Date

© SGV & Co. Tax Reporting and Operations Group

Tax Compliance Checklist for Local Business Tax (LBT)

Done Documentation W/P Ref. Or

Comments

GENERAL

1. Determine the nature of the Company’s business.

Based on the actual business activities conducted

by the Company, ascertain the local business taxes

(LBT) to which it is subject.

2. Secure from Company a listing and/or copies of

official receipts and mayor’s permits of all LBT

paid or accrued during the year showing such

details as nature, amount, date of payment, payee,

references, etc.

Ascertain whether LBT was paid within the first

20 days of January and for each subsequent

quarter in case of installment payments.

3. Obtain a listing of branches, sales outlets,

warehouse, plantation, factories, and/or service

establishments of the client.

Ascertain whether each of the offices maintained

by the Company qualifies as a taxable

establishment in a particular locality.

Under the Rules and Regulations implementing

the Local Government Code (LGC) of 1991,

branch or sales office, warehouse and factories are

defined as follows:

Branch or Sales Office — a fixed place in a

locality which conducts operations of the business

as an extension of the principal office. Offices

used only as display areas of the products where

no stocks or items are stored for sale, although

orders for the products may be received thereat,

are not branch or sales offices as herein

contemplated. A warehouse which accepts orders

and/or issues sales invoices independent of a

branch with sales office shall be considered as a

sales office

Warehouse — a building utilized for the storage

of products for sale and from which goods or

© SGV & Co. Tax Reporting and Operations Group

Tax Compliance Checklist for Local Business Tax (LBT)

Done Documentation W/P Ref. Or

Comments

merchandise is withdrawn for delivery to

customers or dealers, or by persons acting in

behalf of the business. A warehouse that does not

accept orders and/or issue sales invoices as

aforementioned shall not be considered a branch

or sales office.

Plantation- a tract of agricultural land planted to

trees or seedlings whether fruit bearing or not,

uniformly spaced or seeded by broadcast methods

or normally arranged to allow highest production.

4. Obtain from the Company updated copy(ies) of

applicable ordinance(s) governing the imposition

of LBT.

5. If the Company is registered with BOI, secure a

copy of the Company’s BOI Registration

Certificate and ascertain from the incentives

granted whether the Company is exempt from

LBT.

6. In case the Company is registered with PEZA and

is paying 5% preferential tax, check whether the

2% thereof (40% of the 5% preferential tax) was

paid in the municipality where the Company’s

principal place of office is located. (Section 24 of

RA No. 7916).

TAX BASE

7. Ascertain the tax base used:

a. gross sales of the preceding calendar year – if

Company is engaged in sale of goods;

b. gross receipts of the preceding calendar year

– if Company is engaged in sale of services.

(Section 143 of the LGC)

© SGV & Co. Tax Reporting and Operations Group

Tax Compliance Checklist for Local Business Tax (LBT)

Done Documentation W/P Ref. Or

Comments

Under Section 131 (n) of the LGC, “gross

sales or receipts” is defined to include the

total amount of money of its equivalent

representing the contract price, compensation

or service fee, including the amount charged

or materials supplied with the services and

deposits or advance payments actually or

constructively received during the taxable

quarter for the services performed or to be

performed for another person excluding

discounts if determinable at the time of sales,

returns, excise tax and value-added tax..

Ascertain whether gross sales or gross receipts

from other income have been included in the

LBT base.

Check whether passive income such as interest

income earned from banks which has been

subjected to final tax (7.5% or 20%) has not been

included in the tax base.

8. Reconcile the reported tax base against figures per

Financial Statements (FS).

9. Ascertain nature of deductions from the tax base.

Check propriety of these deductions.

Trace from relevant supporting documents the

discounts and returns deducted from the gross

sales or receipts.

Discounts may be deducted from the LBT base

provided it is indicated in the invoice at the time

of sale and the grant which does not depend on the

happening of the future event. Otherwise, the

same shall not be excluded from the tax base.

Sales returns and allowances in the month/quarter

which the refund or credit is made for sales

previously recorded as taxable sales; this should

be supported by credit memo.

10. If Company is engaged in two or more businesses

in the same locality mentioned under Section 143

of the Local Government Code (LGC) which are

subject to the same rate of tax, ascertain that the

© SGV & Co. Tax Reporting and Operations Group

Tax Compliance Checklist for Local Business Tax (LBT)

Done Documentation W/P Ref. Or

Comments

tax is based on the combined gross sales or

receipts of the related businesses. (Article 242 (b)

of the IRR)

TAX RATE

11. Ascertain the propriety of the tax rates used

against the ordinance of the city/municipality

where the principal office, factory or branch office

is located.

In case the ordinance(s) is(are) not available, use

the rates prescribed under LGC.

SITUS OF TAX

12. If a Company maintains or operates a branch or

sales offices elsewhere, all sales made in the

branch or sales office should be recorded therein

and the tax paid to the local government where the

said branch or sales office is located. ( BLGF

Opinion dated January 17, 2002)

On the other hand, if a Company has no such

branch or sales office in the locality where the

sale is made, the sale should be recorded in the

principal office along with the sales made by the

said principal office and the tax shall accrue to the

city or municipality where the principal office is

located. (BLGF Opinion dated January 29, 2002)

13. If a Company maintains a factory or plantation in

a locality other than where the principal office is

located, check the allocation of gross

sales/receipts for LBT purposes. It is proper to

make a diagram showing the allocation of

sales/receipts for each municipality where the

factory(ies) or/and plantation(s) is/are located.

Please take note of the following:

a. if a Company maintains a factory, project

office, plant or plantation in a locality other

than where the principal office is located,

© SGV & Co. Tax Reporting and Operations Group

Tax Compliance Checklist for Local Business Tax (LBT)

Done Documentation W/P Ref. Or

Comments

thirty percent (30%) of all sales recorded in

the principal office should be reported and

the tax due thereon paid to the local

government where the principal office is

located, while the remaining seventy percent

(70%) should be reported and the tax paid to

the local government where the factory,

project office, plant or plantation is located.

b. if a Company maintains a plantation located

at a place other than the place where the

factory is located, the seventy percent (70%)

above should be further subdivided; sixty

percent (60%) to the local government where

the factory is located and the remaining forty

percent (40%) to the local government where

the plantation is located.

c. if a Company has two or more factories

situated in different localities, the seventy

percent (70%) sales allocation mentioned in

paragraph (a) should be prorated among the

localities where the factories are situated in

proportion to their respective volumes of

production during the period in which the tax

is due.

d. if the Company is a manufacturer or

producer that engages the services of an

independent contractor to produce or

manufacture some of their products, the

factory or plant and warehouse of the

contractor utilized for the production and

storage of the manufacturers’ products shall

be considered as the factory or plant and

warehouse of the Company.

e. If the Company is a prime contractor, check

whether the payments to sub-contractors

have been deducted from the tax base.

Should the contractor, whose principal place

of business is located in the City of Makati is

duly licensed by or accredited by the

Philippine Contractors Association Board

(PCAB) and the City of Makati, undertake to

furnish the materials and labor in the

construction work, the cost of such materials

© SGV & Co. Tax Reporting and Operations Group

Tax Compliance Checklist for Local Business Tax (LBT)

Done Documentation W/P Ref. Or

Comments

and labor shall be deducted from his gross

receipts for the purpose of determining the

tax due from such cotractor.

14. If a Company has sales made by route trucks,

vans, or vehicles –

a. For route sales made in a locality where a

manufacturer, producer, wholesaler, retailer or

dealer has a branch or sales office or

warehouse, the sales recorded in the branch,

sales office or warehouse and tax due thereon

is paid to the LGU where such branch, sales

office or warehouse is located.

b. For route sales made in a locality where a

manufacturer, producer, wholesaler, retailer or

dealer has no branch, sales office or

warehouse, the sales are recorded in the

branch, sales office or warehouse from where

the route trucks withdraw their products for

sale, and the tax due on such sales is paid to the

LGU where such branch, sales office or

warehouse is located.

NEWLY STARTED BUSINESS

15. If the Company’s business is newly started in a

particular locality or transferred thereto, ascertain:

a. For the quarter in which the business starts to

operate – the initial tax to be paid is based on a

certain percentage of the capital investment as

provided by the applicable local ordinance.

b. For the succeeding quarters of the year:

Tax Rate – ¼ of the rate prescribed by the

applicable local ordinance.

Tax Base – Gross sales for the preceding

quarter should be used.

© SGV & Co. Tax Reporting and Operations Group

Tax Compliance Checklist for Local Business Tax (LBT)

Done Documentation W/P Ref. Or

Comments

TERMINATION OF BUSINESS

16. If the Company terminated its business in a

locality or transferred to another locality, ascertain

the following:

a. Whether the Company submitted a sworn

statement of its gross sales for the current year

to the city/municipal treasurer.

b. If the tax paid during the year was less than the

tax due on said current year gross sales,

whether the difference was paid before the

business was officially retired.

17. Determine if the Company has pending claims for

refund for erroneous payment or overpayment of

LBT. Ascertain that the claim has been duly filed

with the city or municipal treasurer within two (2)

years from the date of payment from the time the

taxpayer is entitled to such refund.

© SGV & Co. Tax Reporting and Operations Group

You might also like

- Individual Income Tax ReturnDocument2 pagesIndividual Income Tax ReturnMNCOOhioNo ratings yet

- BIR Ruling DA - VAT-021 121-10Document3 pagesBIR Ruling DA - VAT-021 121-10Jemila Paula Diala100% (1)

- Special Itemized Deductions, NOLCO & OSDDocument13 pagesSpecial Itemized Deductions, NOLCO & OSDdianne caballero100% (1)

- RR No. 12-2018: New Consolidated RR on Estate Tax and Donor's TaxDocument20 pagesRR No. 12-2018: New Consolidated RR on Estate Tax and Donor's Taxjune Alvarez100% (1)

- Awareness On Business Registration, Invoicing and BookkeepingDocument70 pagesAwareness On Business Registration, Invoicing and BookkeepingRonald Allan Valdez Miranda Jr.No ratings yet

- Tax Planning With Example, Compensation MGMTDocument40 pagesTax Planning With Example, Compensation MGMTrashmi_shantikumarNo ratings yet

- Account Receivable Team in Backoffice: Radio/Digital - Entry in WO and Monthly Upload in SAPDocument4 pagesAccount Receivable Team in Backoffice: Radio/Digital - Entry in WO and Monthly Upload in SAPDipesh Jain100% (1)

- 07) CIR V Seagate Tech PhilsDocument3 pages07) CIR V Seagate Tech PhilsAlfonso Miguel LopezNo ratings yet

- Deferred Tax IAS 12 by CPA Dr. Peter NjugunaDocument53 pagesDeferred Tax IAS 12 by CPA Dr. Peter Njugunafmsalehin9406No ratings yet

- BMBE SeminarDocument60 pagesBMBE SeminarBabyGiant LucasNo ratings yet

- Registration, Taxation & Accounting Compliance of Construction IndustryDocument52 pagesRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezNo ratings yet

- Materials For How To Handle BIR Audit Common Issues - 2021 Sept 21Document71 pagesMaterials For How To Handle BIR Audit Common Issues - 2021 Sept 21cool_peach100% (1)

- Revenue Recognition in SAP RARDocument5 pagesRevenue Recognition in SAP RARV S Krishna AchantaNo ratings yet

- VAT Compliance RequirementsDocument44 pagesVAT Compliance RequirementsAcademe100% (2)

- Chapt 11+Income+Tax+ +individuals2013fDocument13 pagesChapt 11+Income+Tax+ +individuals2013fiamjan_10180% (15)

- Secretary'S Certificate: (Authorized Filer For Securities and Exchange Commission)Document1 pageSecretary'S Certificate: (Authorized Filer For Securities and Exchange Commission)Gabriel Emerson100% (2)

- Income Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDDocument40 pagesIncome Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDSha Leen100% (2)

- Income Taxation Lecture Notes.5.Classifications of Individual TaxpayersDocument5 pagesIncome Taxation Lecture Notes.5.Classifications of Individual Taxpayerseinel dc100% (1)

- PFS For RECDocument93 pagesPFS For RECCarl John Paul FlemingNo ratings yet

- Sap GST Sample 26.02.2018Document26 pagesSap GST Sample 26.02.2018manas dasNo ratings yet

- Annex "D": Securities and Exchange CommissionDocument4 pagesAnnex "D": Securities and Exchange CommissionJESSICA RHEA CRUZ50% (2)

- AFP General Insurance v. CIRDocument19 pagesAFP General Insurance v. CIRUlyssesNo ratings yet

- Tax Audit Practical AspectDocument50 pagesTax Audit Practical AspectUMA INDUS GASNo ratings yet

- Clarification on allowable deductions for PEZA enterprisesDocument9 pagesClarification on allowable deductions for PEZA enterprisesKenneth Bryan Tegerero TegioNo ratings yet

- AMENDED REVENUE REGULATION ON PRIMARY REGISTRATION, UPDATES AND CANCELLATION (39 CHARACTERSDocument127 pagesAMENDED REVENUE REGULATION ON PRIMARY REGISTRATION, UPDATES AND CANCELLATION (39 CHARACTERSDa Yani ChristeeneNo ratings yet

- Tax Com Review Program - Administrative Requirements v.2018 082018Document4 pagesTax Com Review Program - Administrative Requirements v.2018 082018bulasa.jefferson16No ratings yet

- Chapter 4 To 6Document32 pagesChapter 4 To 6solomonaauNo ratings yet

- Chapter 4Document31 pagesChapter 4yebegashetNo ratings yet

- Firb Advisory Faqs (Firms, Atir, and Abr)Document10 pagesFirb Advisory Faqs (Firms, Atir, and Abr)Asam Marie FernandezNo ratings yet

- IAS 12 Income Taxes Technical SummaryDocument2 pagesIAS 12 Income Taxes Technical SummaryJCPAJONo ratings yet

- Interplay of Accounting and Taxation PrinciplesDocument20 pagesInterplay of Accounting and Taxation PrinciplesChelsea BorbonNo ratings yet

- Due Diligence-Tax Due Dil - FinalDocument6 pagesDue Diligence-Tax Due Dil - FinalEljoe VinluanNo ratings yet

- Pas 12 Income TaxesDocument9 pagesPas 12 Income TaxesAllegria AlamoNo ratings yet

- TDS in Tally.ERP 9Document2 pagesTDS in Tally.ERP 9Keyur ThakkarNo ratings yet

- Entrepreneur's World #2Document2 pagesEntrepreneur's World #2Lex ValoremNo ratings yet

- Recognizing Revenue: Understanding AS-9 and its ApplicabilityDocument3 pagesRecognizing Revenue: Understanding AS-9 and its Applicabilitygaurav069No ratings yet

- Due Diligence-Tax Due DilDocument4 pagesDue Diligence-Tax Due DilEljoe VinluanNo ratings yet

- GUIDELINESDocument2 pagesGUIDELINESpxcoreteamNo ratings yet

- Separate paid and unpaid deferred tax in FI-CADocument3 pagesSeparate paid and unpaid deferred tax in FI-CAAnand SharmaNo ratings yet

- BIR Ruling 133-13Document2 pagesBIR Ruling 133-13Kyra DiolaNo ratings yet

- How To Calculate Your Taxable Profits: Helpsheet 222Document14 pagesHow To Calculate Your Taxable Profits: Helpsheet 222subtle69No ratings yet

- 2.7 Intangible Assets (A) GoodwillDocument8 pages2.7 Intangible Assets (A) GoodwillLolita IsakhanyanNo ratings yet

- Tax Determination in Sales and Distribution: SymptomDocument8 pagesTax Determination in Sales and Distribution: SymptomRaviNo ratings yet

- As 22 Accounting For Taxes On IncomeDocument34 pagesAs 22 Accounting For Taxes On IncomeArun AroraNo ratings yet

- IFRS News: Beginners' Guide: Nine Steps To Income Tax AccountingDocument4 pagesIFRS News: Beginners' Guide: Nine Steps To Income Tax AccountingVincent Chow Soon KitNo ratings yet

- Percentage Tax in The PhilippinesDocument3 pagesPercentage Tax in The PhilippinesfrazieNo ratings yet

- IFRS 15 vs. IAS 18: Huge Change Is Here!: Ifrs Accounting Most Popular Revenue Recognition 305Document10 pagesIFRS 15 vs. IAS 18: Huge Change Is Here!: Ifrs Accounting Most Popular Revenue Recognition 305sharifNo ratings yet

- Income TaxDocument15 pagesIncome Taxkimuli FreddieNo ratings yet

- How to Compute VAT Payable in the PhilippinesDocument5 pagesHow to Compute VAT Payable in the PhilippinesTere Ypil100% (1)

- Guidance Note On Accounting For State-Level Value Added Tax: F F Y Y I IDocument8 pagesGuidance Note On Accounting For State-Level Value Added Tax: F F Y Y I Idark lord89No ratings yet

- Accounting Standard 22Document12 pagesAccounting Standard 22Rupesh MoreNo ratings yet

- Cof1-B 13102022Document18 pagesCof1-B 13102022wallavilesNo ratings yet

- Standards of AccountsDocument14 pagesStandards of Accountsaanu1234No ratings yet

- Common Tax Issues of PEZADocument25 pagesCommon Tax Issues of PEZALielet MatutinoNo ratings yet

- Accounting For Income TaxesDocument10 pagesAccounting For Income TaxesEunice WongNo ratings yet

- As 17 Segment ReportingDocument5 pagesAs 17 Segment ReportingcalvinroarNo ratings yet

- VAT RulesDocument11 pagesVAT RulesamrkiplNo ratings yet

- Value Added Tax-PDocument20 pagesValue Added Tax-PMa. Corazon CaramalesNo ratings yet

- The UAE Economic Substance Regulations Notification GuidanceDocument12 pagesThe UAE Economic Substance Regulations Notification Guidanceabdelrahman zyadaNo ratings yet

- Revenue Audit Memorandum Order No. 01-95: I. RationaleDocument3 pagesRevenue Audit Memorandum Order No. 01-95: I. RationalesaintkarriNo ratings yet

- Intermediate Accounting IIIDocument12 pagesIntermediate Accounting IIIAlma FigueroaNo ratings yet

- Analysis Group 4Document5 pagesAnalysis Group 4Clarise DatayloNo ratings yet

- PAS 10, 12, and 16 Events and TaxesDocument5 pagesPAS 10, 12, and 16 Events and TaxesMica DelaCruzNo ratings yet

- Characteristic of Vat-Business TaxationDocument8 pagesCharacteristic of Vat-Business TaxationAthena LouiseNo ratings yet

- VAT 404 - Guide For Vendors - External GuideDocument110 pagesVAT 404 - Guide For Vendors - External Guidesimphiwe8043No ratings yet

- Summary of Important Us Gaap:: Under US GAAP, The Financial Statements Include TheDocument28 pagesSummary of Important Us Gaap:: Under US GAAP, The Financial Statements Include TheSangram PandaNo ratings yet

- Pra 371Document3 pagesPra 371Nikesh SapkotaNo ratings yet

- Background: Manual Accounting Practice Set Disc-O-Tech, Australasian Edition 3Document5 pagesBackground: Manual Accounting Practice Set Disc-O-Tech, Australasian Edition 3muller1234No ratings yet

- Tax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeDocument7 pagesTax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeJouhara ObeñitaNo ratings yet

- IAS 18 - Revenue PDFDocument12 pagesIAS 18 - Revenue PDFJanelle SentinaNo ratings yet

- Tax Compliance Review Checklist For Fringe Benefits Tax (FBT)Document25 pagesTax Compliance Review Checklist For Fringe Benefits Tax (FBT)Carl John Paul FlemingNo ratings yet

- Corporation: WHEREAS, During The Special Meeting by The Board of Directors/Trustee of The (Corporation) Held LastDocument1 pageCorporation: WHEREAS, During The Special Meeting by The Board of Directors/Trustee of The (Corporation) Held LastGabriel EmersonNo ratings yet

- SGV Health Declaration Form Visitor Accomplished FormDocument2 pagesSGV Health Declaration Form Visitor Accomplished FormCarl John Paul FlemingNo ratings yet

- Ghdlkasohfd D 2014feb14 AssDocument53 pagesGhdlkasohfd D 2014feb14 AssCarl John Paul FlemingNo ratings yet

- Application For Treaty Purposes: (Relief From Philippine Income Tax On Dividends)Document2 pagesApplication For Treaty Purposes: (Relief From Philippine Income Tax On Dividends)Nepean Philippines IncNo ratings yet

- TAXNDocument22 pagesTAXNMonica MonicaNo ratings yet

- CIR vs. Lancaster Philippines, IncDocument19 pagesCIR vs. Lancaster Philippines, IncCharish DanaoNo ratings yet

- Click Here For English Version: AVDPK3530D 2021-22 400162530310821Document8 pagesClick Here For English Version: AVDPK3530D 2021-22 400162530310821Santoshi TanguduNo ratings yet

- TL106Document25 pagesTL106Elma VermeulenNo ratings yet

- 3260 PartsDocument12 pages3260 Partsplvg2009No ratings yet

- Tax Ch6 QuizDocument13 pagesTax Ch6 QuizJoshua Alan Braden0% (1)

- Thailand Corporate Income TaxDocument31 pagesThailand Corporate Income TaxPrincessJoyGinezFlorentinNo ratings yet

- Salary Statement Assessment for Financial Year 2021-22Document4 pagesSalary Statement Assessment for Financial Year 2021-22PriyanshuNo ratings yet

- CPAR Taxation PreweekDocument38 pagesCPAR Taxation PreweekAndrei Nicole RiveraNo ratings yet

- CTA Ruling on Estate Tax AssessmentDocument13 pagesCTA Ruling on Estate Tax AssessmentHershey GabiNo ratings yet

- C.T.A. CASE NO. 8935. August 18, 2017 PDFDocument15 pagesC.T.A. CASE NO. 8935. August 18, 2017 PDFnathalie velasquezNo ratings yet

- Commissioner v. Groetzinger, 480 U.S. 23 (1987)Document14 pagesCommissioner v. Groetzinger, 480 U.S. 23 (1987)Scribd Government DocsNo ratings yet

- CH 21 TBDocument18 pagesCH 21 TBJessica Garcia100% (1)

- Oregon Tax 40Document32 pagesOregon Tax 40Nat BrewNo ratings yet

- Gender Bias in Tax Systems:: The Example of GhanaDocument22 pagesGender Bias in Tax Systems:: The Example of GhanaDangyi GodSeesNo ratings yet

- F6 Midterm Test QuestionDocument11 pagesF6 Midterm Test QuestionChippu AnhNo ratings yet

- Completed 1040-FormDocument6 pagesCompleted 1040-Formapi-464285260No ratings yet

- Morton L. E. Chwalow and Esther L. Chwalow v. Commissioner of Internal Revenue, 470 F.2d 475, 3rd Cir. (1972)Document3 pagesMorton L. E. Chwalow and Esther L. Chwalow v. Commissioner of Internal Revenue, 470 F.2d 475, 3rd Cir. (1972)Scribd Government DocsNo ratings yet

- Scope of Total Income and Residential StatusDocument3 pagesScope of Total Income and Residential StatusSandeep SinghNo ratings yet

- Employers' GuideDocument44 pagesEmployers' GuideMary Ann AdrianoNo ratings yet

- Republic Act No. 10754Document4 pagesRepublic Act No. 10754MarissaNo ratings yet

- Introducing The Role of The Quantity Surveyor: Alistair Seel - Partner QS SquaredDocument21 pagesIntroducing The Role of The Quantity Surveyor: Alistair Seel - Partner QS SquaredMariz Ellaine BaltazarNo ratings yet

- Essentials of Federal Taxation 2018 Edition 9th Edition Spilker Solutions Manual 1Document49 pagesEssentials of Federal Taxation 2018 Edition 9th Edition Spilker Solutions Manual 1carrie100% (34)