Professional Documents

Culture Documents

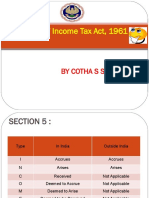

Scope of Total Income and Residential Status

Uploaded by

Sandeep SinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scope of Total Income and Residential Status

Uploaded by

Sandeep SinghCopyright:

Available Formats

Scope of Total Income and Residential Status

Definition of Income: Total income means total amount of income referred to

in Section 5, computed in the manner laid down in the Income Tax Act.

The Total Income is computed under the five heads of Income, namely:

1. Income from Salary

2. Income from House Property

3. Income from Business

4. Income from capital gains

5. Income from other sources

Income computed under each head is aggregated and the aggregate amount is

known as Gross Total Income. From Gross total Income certain deductions are

allowed under Section 80C to 80 U and the balance income after deduction is

known as Total Income.

Scope of Total Income/ Incidence of Tax [Section 5]

The Total Income of an assessee cannot be computed unless we now his

Residential Status in India during the previous year. According to the

residential status , the assessee can either be:

(i) Resident in India

(ii) Non Resident in India

However, an Individual and HUF cannot be simply called resident in India. If

Individual is a resident in India he will be either:

(a) Resident and Ordinarily Resident in India; or

(b) Resident but not ordinarily Resident in India

Other categories of persons shall ONLY be either Resident in India or Non

Resident in India.

Scope of Total Income according to Residential Status is as under:

In case of Resident and Ordinarily Resident in India [Individual or HUF]

[Section 5(1)]: The following incomes from whatever source derived form part

of Total Income in case of Resident and Ordinarily Resident In India:

a) Any income b) Any income c) Any income

which is received which accrues or which accrues or

or is deemed to arises or is arises outside

be received in deemed to accrue India during the

India in the or arise in India relevant previous

relevant previous during the year.

year by or on relevant previous

behalf of such year;

person

In case of Resident but not Ordinarily Resident in India [Individual or HUF]

[Section 5(1)]: The following incomes from whatever source derived form part

of Total Income in case of Resident but not Ordinarily Resident In India:

a) Any income b) Any income c) Any income

which is received which accrues or which accrues or

or is deemed to arises or is arises outside

be received in deemed to accrue India during the

India in the or arise in India relevant previous

relevant previous during the year if it is

year by or on relevant previous derived from a

behalf of such year; business

person controlled in or

profession set up

in India.

In case of Non Resident [Section 5(2)] : The Following Income from whatever

source derived form part of Total Income in case of Non Residents in India:

a) Any Income which is received b) Any income which accrues or

or is deemed to be received in arises or is deemed to accrue

India during the relevant or arise in India during the

previous year by or on behalf relevant previous year.

of such person

Please note the following things:

Incomes described in Items a) and b) in all the three cases above are to be

included in total income of all the three categories of the assesses in the same

manner.

1. The income described in item c) i.e income which accrue or arise outside

India is:

(i) Not includible in the total income at all in case the assessee is

non-resident in India.

(ii) Includible in the total income of Resident but not ordinarily

resident in India only when it is derived from a business controlled

in India or a profession set up in India.

Therefore, we can say that the incidence of tax is highest in case of resident

and ordinarily resident, a little less in case of resident but not ordinarily

resident, a least in case of non-resident in India, if the assessee has various

incomes both inside and outside India.

You might also like

- Nolo's Essential Retirement Tax GuideDocument436 pagesNolo's Essential Retirement Tax GuideabuaasiyahNo ratings yet

- Salary Structure CalculatorDocument7 pagesSalary Structure CalculatorMakesh Gopalakrishnan0% (1)

- Cir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Document2 pagesCir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Crisbon ApalisNo ratings yet

- Residential Status and Incidence of Tax On Income Under Income Tax ActDocument6 pagesResidential Status and Incidence of Tax On Income Under Income Tax ActhaseefaNo ratings yet

- Residential Status Under Income-Tax Act, 1961Document6 pagesResidential Status Under Income-Tax Act, 1961Bharat Tailor100% (1)

- Residential Status AssignmentDocument4 pagesResidential Status AssignmentSimran Kaur Khurana100% (1)

- GST Entries For Every Month SalesDocument3 pagesGST Entries For Every Month SalesGiri SukumarNo ratings yet

- Payslip 2022 2023 1 Aso8807 SOAGBALICDocument1 pagePayslip 2022 2023 1 Aso8807 SOAGBALICRamesh Kumar PrasadNo ratings yet

- Report of Law1 - Other Percentage TaxDocument16 pagesReport of Law1 - Other Percentage TaxJonalyn Maraña-ManuelNo ratings yet

- My Project Report On Icici Bank FinalDocument97 pagesMy Project Report On Icici Bank Finalgauravshuklapgdm71% (28)

- Prelim Examination Business TaxDocument16 pagesPrelim Examination Business Taxmikheal beyberNo ratings yet

- Section 5 of Income Tax ActDocument4 pagesSection 5 of Income Tax ActParth PandeyNo ratings yet

- Day4 Residential Status and Incidence of Tax (9 Oct)Document12 pagesDay4 Residential Status and Incidence of Tax (9 Oct)1986anuNo ratings yet

- Person (Section 2 (31) )Document1 pagePerson (Section 2 (31) )Tejas PandeyNo ratings yet

- Scope of Total IncomeDocument7 pagesScope of Total IncomeSatinderpal KaurNo ratings yet

- E Text Week 1 Module 1.5Document5 pagesE Text Week 1 Module 1.5bsc slpNo ratings yet

- Unit 3Document20 pagesUnit 3Ram KrishnaNo ratings yet

- Residential Status and Incidence of Tax - Study MaterialDocument6 pagesResidential Status and Incidence of Tax - Study MaterialEmeline SoroNo ratings yet

- Residential Status DC 2023-24Document11 pagesResidential Status DC 2023-24avinashhpv7785No ratings yet

- Corporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)Document10 pagesCorporate Tax Planning Unit-2 E-Text Module 5 & 6: Residential Status & Taxation of Companies Scope of Total Incidence of Tax (Section 5)imamNo ratings yet

- Residential Status and Tax IncidenceDocument3 pagesResidential Status and Tax Incidenceambarishan mrNo ratings yet

- Direct Tax Summary NotesDocument88 pagesDirect Tax Summary NotesAlisha LukeNo ratings yet

- Scope of Total Income U/S. 5: Presented To:-Prof. SeemaDocument17 pagesScope of Total Income U/S. 5: Presented To:-Prof. SeemaRaksha ShettyNo ratings yet

- Introduction To ResidenceDocument4 pagesIntroduction To ResidenceNiya Maria NixonNo ratings yet

- e Book PDF PDFDocument91 pagese Book PDF PDFGiri SukumarNo ratings yet

- R S T I: Esidence and Cope of Otal NcomeDocument5 pagesR S T I: Esidence and Cope of Otal NcomeMnk BhkNo ratings yet

- CTPM ProblemsDocument31 pagesCTPM ProblemsViraja GuruNo ratings yet

- Income Tax Law & PracticeDocument32 pagesIncome Tax Law & PracticeGautam TamtaNo ratings yet

- CHAPTER:-1 Definitions U/s - 2, Basis of Charge and Exclusions From Total IncomeDocument12 pagesCHAPTER:-1 Definitions U/s - 2, Basis of Charge and Exclusions From Total IncomeshyamiliNo ratings yet

- DTP 2nd ModuleDocument6 pagesDTP 2nd ModuleVeena GowdaNo ratings yet

- ch-11 Taxation of NRIsDocument25 pagesch-11 Taxation of NRIsdean.socNo ratings yet

- Semester V Direct Tax Residence & Scope of Total Income A/087/Divya KamaliyaDocument14 pagesSemester V Direct Tax Residence & Scope of Total Income A/087/Divya KamaliyaHarsh KamaliyaNo ratings yet

- Presentation On Residential Status & Its Incidence On Tax LiabilityDocument13 pagesPresentation On Residential Status & Its Incidence On Tax LiabilitypriyaniNo ratings yet

- 3.2 Incidence of TaxDocument5 pages3.2 Incidence of Taxswathi jaiganeshNo ratings yet

- MB FM 03 TAX PLANNING AND FINANCIAL REPORTING New-1Document70 pagesMB FM 03 TAX PLANNING AND FINANCIAL REPORTING New-1Khushboo SinghNo ratings yet

- Income Deemed To Arise in IndiaDocument7 pagesIncome Deemed To Arise in IndiaDebaNo ratings yet

- Caa0eresidential StatusDocument13 pagesCaa0eresidential StatusShashwat MishraNo ratings yet

- Residential Status and Tax IncidenceDocument46 pagesResidential Status and Tax IncidenceÄbhíñävJäíñNo ratings yet

- The Direct Taxes CodeDocument3 pagesThe Direct Taxes Codeanuj91No ratings yet

- Section 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The PersonDocument8 pagesSection 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The PersondipxxxNo ratings yet

- Taxation Final ProjectDocument12 pagesTaxation Final ProjectShreya KalyaniNo ratings yet

- 2 Residential StatusDocument30 pages2 Residential StatusVEDANT SAININo ratings yet

- TaxationDocument15 pagesTaxationharshithaaba8No ratings yet

- Sia - Itax-2018-19Document17 pagesSia - Itax-2018-19Abhay Pethani.No ratings yet

- UNIT 1 - CT - Part 1Document39 pagesUNIT 1 - CT - Part 1Amogh AroraNo ratings yet

- Resdential Status Questionsby Garun Kumar GDCM SrikakulamDocument9 pagesResdential Status Questionsby Garun Kumar GDCM Srikakulamgeddadaarun100% (1)

- Income Tax Act, 1961: Section - 5: Scope of Total IncomeDocument15 pagesIncome Tax Act, 1961: Section - 5: Scope of Total IncomeNisseem KrishnaNo ratings yet

- Income Tax Planning-1Document32 pagesIncome Tax Planning-1Ashutosh ShuklaNo ratings yet

- Residential StatusDocument11 pagesResidential StatusSaurav MedhiNo ratings yet

- Residential StatusDocument17 pagesResidential Statussaif aliNo ratings yet

- Residential StatusDocument9 pagesResidential Statussadhana20bbaNo ratings yet

- Incidence of TaxDocument53 pagesIncidence of TaxAnurag SindhalNo ratings yet

- Residential Status and Taxation For Individuals - Taxguru - inDocument2 pagesResidential Status and Taxation For Individuals - Taxguru - inSubhamNo ratings yet

- It - Lesson 3Document14 pagesIt - Lesson 3Sugandha AgarwalNo ratings yet

- Chapter-2 Residential StatusDocument5 pagesChapter-2 Residential StatusBrinda RNo ratings yet

- Income Tax ActDocument12 pagesIncome Tax ActSomnath GuptaNo ratings yet

- Income TaxDocument14 pagesIncome Taxankit srivastavaNo ratings yet

- Tax NotesDocument11 pagesTax NotesVishal DeshwalNo ratings yet

- 01 Section 9Document54 pages01 Section 9ABHIJEETNo ratings yet

- Income Tax Law & Practice: Unit 1Document30 pagesIncome Tax Law & Practice: Unit 1jaspreet kaurNo ratings yet

- Residential Status Cma IndaDocument10 pagesResidential Status Cma IndaKiran ChristyNo ratings yet

- Principle of TaxationDocument7 pagesPrinciple of TaxationAnas YawarNo ratings yet

- Income TaxDocument22 pagesIncome TaxUjjwal AnandNo ratings yet

- 1328866787Chp 2 - Residence and Scope of Total IncomeDocument5 pages1328866787Chp 2 - Residence and Scope of Total IncomeMohiNo ratings yet

- Model Answers Taxation 1. Residential Status of Assessee Under IT Act ?Document44 pagesModel Answers Taxation 1. Residential Status of Assessee Under IT Act ?Tejasvini KhemajiNo ratings yet

- Income Tax and Law UNIT-1 Part2Document26 pagesIncome Tax and Law UNIT-1 Part2rashmianand712No ratings yet

- Q1) (A) Person - Section 2Document5 pagesQ1) (A) Person - Section 2Minal GandhiNo ratings yet

- Tenses: Shivani M. (PDP Dept.)Document21 pagesTenses: Shivani M. (PDP Dept.)Sandeep SinghNo ratings yet

- New Doc 2020-09-14 14.58.08Document2 pagesNew Doc 2020-09-14 14.58.08Sandeep SinghNo ratings yet

- What Is Management AccountingDocument11 pagesWhat Is Management AccountingSandeep SinghNo ratings yet

- Questions On GDDocument8 pagesQuestions On GDSandeep SinghNo ratings yet

- Proverbs in English With Meanings and Example SentencesDocument9 pagesProverbs in English With Meanings and Example SentencesSandeep SinghNo ratings yet

- Active Passive VoiceDocument6 pagesActive Passive VoiceSandeep SinghNo ratings yet

- Personal Interviews: Prepared By: Ms. Shivani Arora Assistant Professor Graphic Era Hill UniversityDocument8 pagesPersonal Interviews: Prepared By: Ms. Shivani Arora Assistant Professor Graphic Era Hill UniversitySandeep SinghNo ratings yet

- Cover Letter Resume 101 FundamentalsDocument3 pagesCover Letter Resume 101 FundamentalsSandeep SinghNo ratings yet

- Resume Writing: Prepared By: Ms. Shivani Arora Assistant Professor Graphic Era Hill UniversityDocument6 pagesResume Writing: Prepared By: Ms. Shivani Arora Assistant Professor Graphic Era Hill UniversitySandeep SinghNo ratings yet

- Idiom / Phrase Meaning Example SentenceDocument4 pagesIdiom / Phrase Meaning Example SentenceSandeep SinghNo ratings yet

- Taxes - Types of TaxesDocument2 pagesTaxes - Types of TaxesZie BeaNo ratings yet

- Survey of Metro Manila RPT RatesDocument6 pagesSurvey of Metro Manila RPT RatesMarcus DoroteoNo ratings yet

- Laxmi Metal Press Ing Works Pvt. LTD.: Invoice Cum ChallanDocument5 pagesLaxmi Metal Press Ing Works Pvt. LTD.: Invoice Cum ChallanSujit Kumar SinghNo ratings yet

- EMAILDocument1 pageEMAILSmdryfruits IranianNo ratings yet

- 911 KCC Buildcon PVT LTD Packege - 5Document1 page911 KCC Buildcon PVT LTD Packege - 5Kcc AlwarNo ratings yet

- Description: Tags: 0708depverwkshtFINAL1218906Document2 pagesDescription: Tags: 0708depverwkshtFINAL1218906anon-562432No ratings yet

- Tax Invoice / Bill of SupplyDocument1 pageTax Invoice / Bill of SupplyabhimanyuNo ratings yet

- Pacific Airlines Operated Both An Airline and Several Rental CarDocument1 pagePacific Airlines Operated Both An Airline and Several Rental CarAmit PandeyNo ratings yet

- EP Trucking DocumentsDocument6 pagesEP Trucking DocumentsKatieNo ratings yet

- Quiz 7 - Transfer PricingDocument2 pagesQuiz 7 - Transfer PricingAlbert XuNo ratings yet

- Revised InvoiceDocument1 pageRevised InvoiceShaik NoorshaNo ratings yet

- Taxation, Types of Taxation, Main Objectives of TaxationDocument4 pagesTaxation, Types of Taxation, Main Objectives of TaxationKc Cassandra RosalNo ratings yet

- Form 16Document3 pagesForm 16Vikas PandyaNo ratings yet

- Hello SURESHA, Here's Your Tax Invoice: Original For RecipientDocument1 pageHello SURESHA, Here's Your Tax Invoice: Original For RecipientSuresh CANo ratings yet

- ICAEW - Tax - Mini Test 1 - STDDocument6 pagesICAEW - Tax - Mini Test 1 - STDlinhdinhphuong02No ratings yet

- FABM2121 Fundamentals of Accountancy Q2 Long Quiz 002Document6 pagesFABM2121 Fundamentals of Accountancy Q2 Long Quiz 002Christian Tero100% (2)

- There Is No Such Thing As 'SST'Document1 pageThere Is No Such Thing As 'SST'hfdghdhNo ratings yet

- Annexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedDocument5 pagesAnnexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedBiswajit MishraNo ratings yet

- SPIT. Abella SamplexDocument5 pagesSPIT. Abella SamplexEins BalagtasNo ratings yet

- Tax Invoice - Ezcash: Transaction DetailsDocument1 pageTax Invoice - Ezcash: Transaction DetailsShoaib AbbasiNo ratings yet

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDocument1 pageAhmedabad Municipal Corporation Mahanagar Sewa SadanJohn FernendiceNo ratings yet

- Invoice Template 1Document2 pagesInvoice Template 1PramodhNo ratings yet