Professional Documents

Culture Documents

Metlife To Pay $10M Over Internal Control Failures

Uploaded by

hey0 ratings0% found this document useful (0 votes)

69 views2 pagesOriginal Title

MetLIfe-Case

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

69 views2 pagesMetlife To Pay $10M Over Internal Control Failures

Uploaded by

heyCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

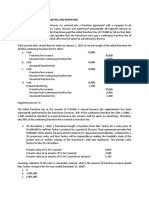

MetLife to pay $10M over internal control failures

Background of the corporation

MetLife, Inc is a leading global provider of insurance, annuities and employee

benefit programs.

With 152 years of experience, the MetLife companies are a leading innovator and

a recognized leader in protection planning and retirement and savings solutions

around the world.

Established a strong presence in more than 40 markets globally through organic

growth, acquisitions, joint ventures and other partnerships.

MetLife companies offer life, accident and health insurance, retirement and

savings products through agents, third-party distributors such as banks and

brokers, and direct marketing channels.

Trusted by tens of millions of customers worldwide, and we serve more than 90

of the top 100 FORTUNE 500® companies in the United States.

Facts and issues:

MetLife overstated its reserves by $896 million for a subsidiary MetLife

Reinsurance Company of Bermuda (MrB). This failure was due to conflicting

pieces of data that were received in a joint venture, and a failure to reconcile the

separate pieces of data.

MetLife’s internal controls unit of the MetLife’s finance department found that

there was no evidence to support the basis for accounting practice to release

reserves.

Further, it was unable to locate any record or documentation of the following:

The actual policy stating under what circumstances it was deemed

appropriate to release reserves or documentation of any kind describing

which department or what level leadership created the policy

Legal review or due diligence performed to approve the policy

Any record of reviews or testing performed on the policies or procedures as

technology advanced, assumptions changed, or shortcomings were identified

The company did not properly address issues or concerns that were identified

with the policy. As early as 2014, several employees had raised questions

related to the practices for releasing reserved funds for the unresponsive

individuals; however, the concerns were not escalated to the senior management

in a timely manner in order to perform substantive analysis. The concerns did not

reach the board of directors or audit committee until December 2017.

Violations committed by MetLife:

Securities and Exchange Commission (“SEC”) charge the company because it

violated the books and records and internal accounting controls provisions of the

federal securities laws.

The SEC’s order also finds that MetLife overstated reserves and understated

income relating to variable annuity guarantees assumed by a MetLife subsidiary.

MetLife disclosed that this error was caused by data mistakes, including a failure

to properly incorporate policyholder withdrawals into MetLife’s valuation model.

How could have these been avoided?

These violations could have been avoided if the management was able to properly

correct the operations of the internal control in a way that it complies the needs of the

client and governing agencies. The internal control should also comply with applicable

laws and regulations and have a reliable financial report that is transparent and

accurate. There is also a need for good communication and monitoring to ensure

effectiveness and efficiency for the operations.

Conclusion

In conclusion, MetLife is one of the most successful companies globally but due to its

internal control failure charged by the Securities and Exchange Commission, which cost

the company for $10 million to settle the violations. This issue shows that there is a

need for improvement in MetLife’s internal control in order to avoid these problem to

happen again.

You might also like

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Metlife Case StudyDocument2 pagesMetlife Case StudyheyNo ratings yet

- Module 1 Financial Accounting For MBAs - 6th EditionDocument15 pagesModule 1 Financial Accounting For MBAs - 6th EditionjoshNo ratings yet

- Auditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlFrom EverandAuditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlNo ratings yet

- BODY (Slide 2) : CindyDocument11 pagesBODY (Slide 2) : CindymichelleNo ratings yet

- Financial Intelligence: Mastering the Numbers for Business SuccessFrom EverandFinancial Intelligence: Mastering the Numbers for Business SuccessNo ratings yet

- Solution Manual For Intermediate Accounting 10th by SpicelandDocument37 pagesSolution Manual For Intermediate Accounting 10th by SpicelandDawn Steward100% (38)

- The Five Rules for Successful Stock Investing: Morningstar's Guide to Building Wealth and Winning in the MarketFrom EverandThe Five Rules for Successful Stock Investing: Morningstar's Guide to Building Wealth and Winning in the MarketRating: 4 out of 5 stars4/5 (1)

- Conflicting Auditor and ClientDocument5 pagesConflicting Auditor and ClientYousif ANo ratings yet

- Unlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditFrom EverandUnlocking Financial Opportunities: A Comprehensive Guide on How to Establish Business CreditNo ratings yet

- Ch. 1 HW Solutions-9eDocument19 pagesCh. 1 HW Solutions-9eNgNo ratings yet

- DocumentDocument7 pagesDocumenttafadzwagutusaNo ratings yet

- DocxDocument7 pagesDocxHeni OktaviantiNo ratings yet

- Solution Manual For Intermediate Accounting 10th by SpicelandDocument36 pagesSolution Manual For Intermediate Accounting 10th by SpicelandReginald Sanchez100% (38)

- Chapter 1 AuditDocument13 pagesChapter 1 AuditMisshtaC100% (1)

- ISP GovernanceDocument12 pagesISP GovernanceFrancis Leo Gunseilan100% (1)

- Solution Manual For Intermediate AccountDocument36 pagesSolution Manual For Intermediate AccountLe Nguyen Thu UyenNo ratings yet

- Actuarial AnalysisDocument12 pagesActuarial AnalysisNikita MalhotraNo ratings yet

- FRA Theoretical SolutionsDocument6 pagesFRA Theoretical SolutionsRebel X HamzaNo ratings yet

- Trust: The Unwritten Contract in Corporate GovernanceDocument6 pagesTrust: The Unwritten Contract in Corporate GovernanceBrian TayanNo ratings yet

- Thesis On Good Corporate GovernanceDocument7 pagesThesis On Good Corporate Governancevictorialeonlittlerock100% (2)

- 10-CSFs in MIS Planning-ShankDocument10 pages10-CSFs in MIS Planning-ShankShakti MishraNo ratings yet

- Treasury HandbookDocument137 pagesTreasury Handbookcarltawia100% (8)

- Case 25 NotesDocument5 pagesCase 25 NotesRohit AggarwalNo ratings yet

- COL Finance Sample ExamDocument7 pagesCOL Finance Sample ExammedicinenfookiNo ratings yet

- Intermediate - Accounting - Spiceland - Sepe - Nelson - 8th - Ed - CHPT - 01 - Exercises AnswerDocument27 pagesIntermediate - Accounting - Spiceland - Sepe - Nelson - 8th - Ed - CHPT - 01 - Exercises AnswerMelissaNo ratings yet

- Lecture Notes On Earnings Quality and ManagementDocument7 pagesLecture Notes On Earnings Quality and ManagementJanielle Nave100% (1)

- Ishelegwu A. VictoriaDocument41 pagesIshelegwu A. VictoriaShaguolo O. JosephNo ratings yet

- Strategic Financial Management Chapter IIDocument14 pagesStrategic Financial Management Chapter IIAnish MittalNo ratings yet

- Evaluating the Financial Health of Krispy KremeDocument4 pagesEvaluating the Financial Health of Krispy KremeUmair Mushtaq SyedNo ratings yet

- The Economic and Institutional Setting For Financial ReportingDocument48 pagesThe Economic and Institutional Setting For Financial Reportingcatelyne santosNo ratings yet

- CFO SVP Vice President Finance in ST Louis MO Resume Matt StrateDocument1 pageCFO SVP Vice President Finance in ST Louis MO Resume Matt StrateMattStrateNo ratings yet

- The Biggest Internal Audit Challenges in The Next Five YearsDocument3 pagesThe Biggest Internal Audit Challenges in The Next Five YearsBagusNo ratings yet

- Letter from Prison AnalysisDocument7 pagesLetter from Prison AnalysisFayeeeeNo ratings yet

- The Timing of Asset Sales and Earnings MDocument8 pagesThe Timing of Asset Sales and Earnings MRizqullazid MufiddinNo ratings yet

- FSA&V Case StudyDocument10 pagesFSA&V Case StudyAl Qur'anNo ratings yet

- EBC - Understand The Business TemplateDocument6 pagesEBC - Understand The Business TemplateBenjie AquinoNo ratings yet

- Assignment AccountingDocument11 pagesAssignment AccountingfatimamushaymNo ratings yet

- The Risk and Cost of Non-ComplianceDocument4 pagesThe Risk and Cost of Non-ComplianceSurmila Sen royNo ratings yet

- Understanding Financial StatementsDocument151 pagesUnderstanding Financial StatementsCj Lumoctos100% (1)

- Computer Written ReportDocument15 pagesComputer Written ReportVia Sacarine DariaNo ratings yet

- UntitledDocument3 pagesUntitledJhonatan Perez VillanuevaNo ratings yet

- CG CHP 15Document18 pagesCG CHP 15lani anggrainiNo ratings yet

- Users of Accounting InformationDocument37 pagesUsers of Accounting InformationAbby Rosales - Perez100% (3)

- Chapter (1) : Accounting Information Systems& Internal ControlDocument21 pagesChapter (1) : Accounting Information Systems& Internal ControlJou SharafNo ratings yet

- Ocean ManufacturingDocument5 pagesOcean ManufacturingАриунбаясгалан НоминтуулNo ratings yet

- 305Document34 pages305Kahfi Revi AlfatahNo ratings yet

- Case 7 2 EdvidDocument3 pagesCase 7 2 Edvidayin09No ratings yet

- Mercurio CoDocument3 pagesMercurio CoAdilah AzamNo ratings yet

- ACCT 504 MART Perfect EducationDocument68 pagesACCT 504 MART Perfect EducationdavidwarNo ratings yet

- Contracts ReviewerDocument123 pagesContracts Reviewertan2masNo ratings yet

- Us Fas Sanctions 5 Questions 052215Document2 pagesUs Fas Sanctions 5 Questions 052215boyohe3171No ratings yet

- Financial Reporting and Analysis Solutions The Economic and Institutional Setting For Financial Reporting ProblemsDocument28 pagesFinancial Reporting and Analysis Solutions The Economic and Institutional Setting For Financial Reporting Problemsdgunnarsson_4No ratings yet

- Assignment: Principles of AccountingDocument11 pagesAssignment: Principles of Accountingmudassar saeedNo ratings yet

- MetLife CaseDocument4 pagesMetLife Casekatee3847No ratings yet

- Fundamental Accounting Principles Chapter NDocument60 pagesFundamental Accounting Principles Chapter Nyejey53No ratings yet

- The Importance of Ethics in AccountingDocument3 pagesThe Importance of Ethics in AccountingShanta MathaiNo ratings yet

- REAL CHAPTER ONEDocument11 pagesREAL CHAPTER ONEdaniel.emmax123No ratings yet

- Corporate Governance Code & Business LawDocument52 pagesCorporate Governance Code & Business Lawmurarimishra17No ratings yet

- Understanding Chapter 14 Multiple Choice and ProblemsDocument15 pagesUnderstanding Chapter 14 Multiple Choice and Problemsmarycayton77% (13)

- Chapter 15 Multiple Choice Questions and ProblemsDocument14 pagesChapter 15 Multiple Choice Questions and Problemsmarycayton83% (6)

- Chapter 15 Multiple Choice Questions and ProblemsDocument14 pagesChapter 15 Multiple Choice Questions and Problemsmarycayton83% (6)

- Advanced financial reporting and accountingDocument18 pagesAdvanced financial reporting and accountingedrick LouiseNo ratings yet

- Multiple Choice QuestionsDocument25 pagesMultiple Choice QuestionsJohn Remar Lavina70% (20)

- This Study Resource Was Shared Via: ScoreDocument9 pagesThis Study Resource Was Shared Via: ScoreheyNo ratings yet

- Buscom Midterm PDF FreeDocument29 pagesBuscom Midterm PDF FreeheyNo ratings yet

- Chapter 12Document16 pagesChapter 12Darwin Competente LagranNo ratings yet

- PART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDocument7 pagesPART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDrew BanlutaNo ratings yet

- GLF Asia-Pac Oct'21 Student Info Flyer (Asia)Document2 pagesGLF Asia-Pac Oct'21 Student Info Flyer (Asia)heyNo ratings yet

- 14 Consolidated FS Pt1 PDFDocument2 pages14 Consolidated FS Pt1 PDFRiselle Ann Sanchez53% (15)

- Activity No. 1 Mind MappingDocument1 pageActivity No. 1 Mind MappingheyNo ratings yet

- Mid PS3Document8 pagesMid PS3heyNo ratings yet

- Renewed Province Plan 2021 2024 Promulgated 1Document13 pagesRenewed Province Plan 2021 2024 Promulgated 1heyNo ratings yet

- Title 1 ObligationsDocument3 pagesTitle 1 ObligationsheyNo ratings yet

- Obligations arising from loans and presumption of paymentDocument9 pagesObligations arising from loans and presumption of paymentheyNo ratings yet

- p2 - Guerrero Ch9Document49 pagesp2 - Guerrero Ch9JerichoPedragosa72% (36)

- Tutorial 4 - Audit of Purchases System Tutorial 4 - Audit of Purchases SystemDocument11 pagesTutorial 4 - Audit of Purchases System Tutorial 4 - Audit of Purchases SystemheyNo ratings yet

- This Study Resource Was: Audit Test 3 Study Guide HW 5 Cash ArDocument5 pagesThis Study Resource Was: Audit Test 3 Study Guide HW 5 Cash ArheyNo ratings yet

- Final ScriptDocument3 pagesFinal ScriptheyNo ratings yet

- Introduction To Law OutlineDocument1 pageIntroduction To Law OutlineheyNo ratings yet

- Graded Forum - 070921 Financial Statement ReportingDocument3 pagesGraded Forum - 070921 Financial Statement ReportingheyNo ratings yet

- Inventory Inclusion and ExclusionDocument11 pagesInventory Inclusion and ExclusionKimberly Claire AtienzaNo ratings yet

- Chapter 4 Extinguishment of ObligationsDocument8 pagesChapter 4 Extinguishment of Obligationshey100% (8)

- Activity No. 1 Cultural PracticesDocument1 pageActivity No. 1 Cultural PracticesheyNo ratings yet

- Associated RisksDocument1 pageAssociated RisksheyNo ratings yet

- Sarbanes-Oxley Act of 2002 and Its Impact On Corporate AmericaDocument27 pagesSarbanes-Oxley Act of 2002 and Its Impact On Corporate AmericawawanNo ratings yet

- Volkswagen Is A German CompanyDocument4 pagesVolkswagen Is A German CompanyheyNo ratings yet

- Graded Forum - 070921 Financial Statement ReportingDocument3 pagesGraded Forum - 070921 Financial Statement ReportingheyNo ratings yet

- Introduction To Law OutlineDocument1 pageIntroduction To Law OutlineheyNo ratings yet

- New Report AnujDocument37 pagesNew Report AnujSunil PandeyNo ratings yet

- Mission StatementDocument5 pagesMission StatementAsif SohailNo ratings yet

- Credit Analysis-Medlife: 1. Description of The LoanDocument20 pagesCredit Analysis-Medlife: 1. Description of The LoanAlexandraNo ratings yet

- Notice: Investment Company Act of 1940: Guardian Cash Fund, Inc., Et Al.Document4 pagesNotice: Investment Company Act of 1940: Guardian Cash Fund, Inc., Et Al.Justia.comNo ratings yet

- Medical Claim Reimbursement Form EnglishDocument2 pagesMedical Claim Reimbursement Form EnglishHananAhmedNo ratings yet

- Director VP Business Development in Indianapolis IN Resume William StaffordDocument2 pagesDirector VP Business Development in Indianapolis IN Resume William StaffordWilliamStafford2No ratings yet

- Letterhead MetlifeDocument8 pagesLetterhead Metlife87_kaminiNo ratings yet

- Consulting Case - Organizational BehaviourDocument96 pagesConsulting Case - Organizational BehaviourJerryJoshuaDiaz100% (1)

- Arlington ISD - MetLife - Legal Plans - Product OverviewDocument2 pagesArlington ISD - MetLife - Legal Plans - Product OverviewJordin TumlinsonNo ratings yet

- Executive SummaryDocument6 pagesExecutive SummaryMinhaz UddinNo ratings yet

- MetLife Smart Platinum Plus Brochure - 20 Nov Copy - tcm47-76489Document13 pagesMetLife Smart Platinum Plus Brochure - 20 Nov Copy - tcm47-76489sandeepNo ratings yet

- 80CDocument3 pages80CRajesh AdluriNo ratings yet

- Summer Internship Project ReportDocument55 pagesSummer Internship Project ReportRuchita SinghNo ratings yet

- Rajesh RelanDocument4 pagesRajesh Relanketan phoreNo ratings yet

- Mrs. Haniya Shahid Naseem: DirectorDocument15 pagesMrs. Haniya Shahid Naseem: DirectorAsim MalikNo ratings yet

- Met Life Scandalous Sales TacticsDocument21 pagesMet Life Scandalous Sales TacticsJosue E Melecio TrinidadNo ratings yet

- Foundations Nursing Community 4th Stanhope Test BankDocument8 pagesFoundations Nursing Community 4th Stanhope Test BankRaadqqqNo ratings yet

- Steven A. KandarianDocument2 pagesSteven A. KandarianMarina SeleznevaNo ratings yet

- Bharti Axa ProjectDocument59 pagesBharti Axa ProjectChirag NathaniNo ratings yet

- Project Report Metlife InsuranceDocument82 pagesProject Report Metlife InsuranceYaadrahulkumar Moharana100% (1)

- PNB MetLife presentation highlights key detailsDocument36 pagesPNB MetLife presentation highlights key detailsStuti SachdevaNo ratings yet

- Uas International Project ReportDocument68 pagesUas International Project Reportayushi biswas50% (2)

- Emkay Insurance Final ReportDocument73 pagesEmkay Insurance Final Reportrahulsogani123No ratings yet

- Investment in Life Insurance: A Study of Consumer BehaviourDocument40 pagesInvestment in Life Insurance: A Study of Consumer BehaviourKARISHMA RAJ100% (1)

- New Business Processing at Metlife Insurance Co...Document89 pagesNew Business Processing at Metlife Insurance Co...Abeena KhanNo ratings yet

- PNB MetLife Mera Term Plan Sales IllustrationDocument4 pagesPNB MetLife Mera Term Plan Sales IllustrationShreelekha PradeepNo ratings yet

- 08 - Chapter 1 KeshavDocument71 pages08 - Chapter 1 KeshavSAGARNo ratings yet

- Change Mangement and Recruitment System of Metlife (NASRIN SULTANA) 111 153 118 Final SubmissionDocument52 pagesChange Mangement and Recruitment System of Metlife (NASRIN SULTANA) 111 153 118 Final SubmissionSelim KhanNo ratings yet

- Insurance FinalDocument154 pagesInsurance FinalRashesh Doshi0% (1)

- As You LeaveDocument53 pagesAs You LeaveWeiniNo ratings yet

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- Bribery and Corruption Casebook: The View from Under the TableFrom EverandBribery and Corruption Casebook: The View from Under the TableNo ratings yet

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- GDPR for DevOp(Sec) - The laws, Controls and solutionsFrom EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsRating: 5 out of 5 stars5/5 (1)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- Electronic Health Records: An Audit and Internal Control GuideFrom EverandElectronic Health Records: An Audit and Internal Control GuideNo ratings yet

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsFrom EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsNo ratings yet

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksFrom EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksRating: 4 out of 5 stars4/5 (1)

- Audit and Assurance Essentials: For Professional Accountancy ExamsFrom EverandAudit and Assurance Essentials: For Professional Accountancy ExamsNo ratings yet

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceFrom EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceRating: 4 out of 5 stars4/5 (1)

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet