Professional Documents

Culture Documents

PNB MetLife Mera Term Plan Sales Illustration

Uploaded by

Shreelekha PradeepOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PNB MetLife Mera Term Plan Sales Illustration

Uploaded by

Shreelekha PradeepCopyright:

Available Formats

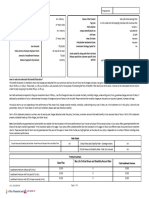

PNB MetLife India Insurance Company Limited

Sales Illustration – PNB MetLife Mera Term Plan UIN: 117N092V03

(Individual, Non-Linked, Non-Par, Pure Risk Premium, Life Insurance Plan)

This illustration will form part of the policy document.

Your Personal Details Spouse Details Your Proposal Details

Name of the Insured Mrs Shreelekha Pradeep Quote Number 519400284503

Age of the Insured 37 years Application

449698382

Number

Date of Birth of the

28-Mar-1982

Insured Application

27-Nov-2019

Date

Gender of the Insured Female

Goods &

Smoker Status Non-Smoker Services Tax 18%

rate

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy.

Lump Sum + Lump Sum +

Lump sum +

Lump Sum Monthly Increasing Monthly

Monthly Income till child ages 21

Death Benefit Option Income Income

Yes No No No

Premium Payment Frequency of Annualized

Sum Assured Policy Term

Term payment Premium

PNB MetLife Mera Term Plan

(Insured) Rs. 1,00,00,000 62 years 15,600

(UIN: 117N092V03)

PNB MetLife Mera Term Plan

(Spouse) - - -

(UIN: 117N092V03)

PNB MetLife Accidental Death

Benefit Rider Plus - - -

(UIN:117B020V03) 62 years Yearly

PNB MetLife Accidental Disability

Benefit Rider - - -

(UIN:117B022V02)

PNB MetLife Critical Illness Rider

- - -

(UIN:117B023V02)

PNB MetLife Serious Illness Rider

- - -

(UIN: 117B021V03)

Total 15,600

Your Premium Details

Total Annualized Premium without GST Rs. 15,600

GST on premium Rs. 2,808

Total Annualized Premium with GST Rs. 18,408

Modal Premium with GST Rs. 18,408

Note:

1. If you have chosen ‘Lump Sum plus Monthly Income’ as the death benefit option, the nominee will get 50% of the Sum Assured as lump sum and the

balance 50% of the Sum Assured will be paid over 120 months with level monthly income calculated as 0.58% of the Sum Assured.

2. If you have chosen ‘Lump Sum plus Increasing Monthly Income’ as death benefit option, the nominee will get 50% of the Sum Assured as lump sum and the

balance 50% of the Sum Assured over 120 months as Monthly Income. The First Year Monthly Income shall be 0.39% of the Sum Assured increasing @

12% simple p.a.

3. If you have chosen ‘Lump Sum plus Monthly Income till child ages 21’ as the death benefit option, the nominee will get 50% of the Sum Assured as lump

sum and the balance will be paid as level Monthly Income till the nominated child attains age of 21 years. Please refer the Sales Brochure to check the

applicable percentage of the Sum Assured.

Some benefits are guaranteed and some benefits are variable with returns based on future performance of PNB MetLife. If your policy offers guaranteed returns

then these will be clearly marked "guaranteed" in the illustration table. If your policy offers variable returns then the illustration on next page will show two different

rates of assumed future investment returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get

back, as the value of your policy is dependent on a number of factors including future investment performance.

Notes to the benefit illustration in the following pages:

1. Please read this benefit illustration in conjunction with the product brochure carefully to understand all Terms, Conditions and Exclusions before concluding

a sale. The detailed Terms and Conditions are contained in the Policy Document.

2. Neither the Company nor any of its Advisor / Financial Planning Consultants is authorized to offer any tax related advice. The tax benefits under various

sections shall be available as per the prevailing tax regulations.

3. This illustration explains the benefits and features of the proposed policy and is not a contract or a representation of any guarantee or warranty.

4. The values in the illustration have been rounded off to the nearest rupee wherever applicable.

5. There is no surrender value or paid-up value under any of the premium paying term options.

For 10 pay, we will pay the unexpired premium value upon:

• For inforce and fully paid policies: Policyholder voluntarily closing the policy during the policy term

• For lapsed policies: Earlier of-

o Death during revival period after date of lapse

o End of the revival period

o Policyholder voluntarily closing the policy during revival period

Age Guaranteed Guaranteed Guaranteed Guaranteed Guaranteed Guaranteed Guaranteed

Total

Policy of Death Death Accidental Accidental Critical Serious Joint Life

Annual

Year the Benefit Benefit Death Disability Illness Illness Death

Premium*

PI (Insured) (Spouse) Benefit Benefit Benefit Benefit Benefit

1 37 15,600 1,00,00,000

2 38 15,600 1,00,00,000

3 39 15,600 1,00,00,000

4 40 15,600 1,00,00,000

5 41 15,600 1,00,00,000

6 42 15,600 1,00,00,000

7 43 15,600 1,00,00,000

8 44 15,600 1,00,00,000

9 45 15,600 1,00,00,000

10 46 15,600 1,00,00,000

11 47 15,600 1,00,00,000

12 48 15,600 1,00,00,000

13 49 15,600 1,00,00,000

14 50 15,600 1,00,00,000

15 51 15,600 1,00,00,000

16 52 15,600 1,00,00,000

17 53 15,600 1,00,00,000

18 54 15,600 1,00,00,000

19 55 15,600 1,00,00,000

20 56 15,600 1,00,00,000

21 57 15,600 1,00,00,000

22 58 15,600 1,00,00,000

23 59 15,600 1,00,00,000

24 60 15,600 1,00,00,000

25 61 15,600 1,00,00,000

26 62 15,600 1,00,00,000

27 63 15,600 1,00,00,000

28 64 15,600 1,00,00,000

29 65 15,600 1,00,00,000

30 66 15,600 1,00,00,000

31 67 15,600 1,00,00,000

32 68 15,600 1,00,00,000

33 69 15,600 1,00,00,000

34 70 15,600 1,00,00,000

35 71 15,600 1,00,00,000

36 72 15,600 1,00,00,000

37 73 15,600 1,00,00,000

38 74 15,600 1,00,00,000

39 75 15,600 1,00,00,000

40 76 15,600 1,00,00,000

41 77 15,600 1,00,00,000

42 78 15,600 1,00,00,000

43 79 15,600 1,00,00,000

44 80 15,600 1,00,00,000

45 81 15,600 1,00,00,000

46 82 15,600 1,00,00,000

47 83 15,600 1,00,00,000

48 84 15,600 1,00,00,000

49 85 15,600 1,00,00,000

50 86 15,600 1,00,00,000

51 87 15,600 1,00,00,000

52 88 15,600 1,00,00,000

53 89 15,600 1,00,00,000

54 90 15,600 1,00,00,000

55 91 15,600 1,00,00,000

56 92 15,600 1,00,00,000

57 93 15,600 1,00,00,000

58 94 15,600 1,00,00,000

59 95 15,600 1,00,00,000

60 96 15,600 1,00,00,000

61 97 15,600 1,00,00,000

62 98 15,600 1,00,00,000

*The premium payable above excludes Goods & Services Tax. These taxes would be levied over and above the base premium payable as per the prevailing rates

from time to time.

You can also write to us at IndiaService@metlife.com or call us Toll free at 1-800-425-6969 (9am – 6pm)

Our Regd Office: PNB MetLife India Insurance Co. Ltd., Unit No. 701, 702 & 703, 7th Floor, West Wing, Raheja Towers, 26/27 M G Road, Bangalore -560001

IRDAI of India Registration Number. 117, Fax +91-80-26521970. Visit us at www.pnbmetlife.com

You might also like

- Monthly Income Plan BenefitsDocument3 pagesMonthly Income Plan Benefitsvivek0955158No ratings yet

- Illustration Qbbpi722hqyhtDocument3 pagesIllustration Qbbpi722hqyhtMaruti KambleNo ratings yet

- HDFC Life Click 2 Protect Life Benefit IllustrationDocument3 pagesHDFC Life Click 2 Protect Life Benefit IllustrationSoumen BeraNo ratings yet

- Illustration - 2022-08-31T155028.397Document3 pagesIllustration - 2022-08-31T155028.397Soumen BeraNo ratings yet

- Benefit Illustration: Of2 UIN: 104N076V11Document2 pagesBenefit Illustration: Of2 UIN: 104N076V11Vir ShahNo ratings yet

- Quotation Number Quotation DateDocument5 pagesQuotation Number Quotation DateMazhar SayedNo ratings yet

- Endowment Savings Plan Plus-Policy Document - tcm47-58256Document39 pagesEndowment Savings Plan Plus-Policy Document - tcm47-58256RedfalconNo ratings yet

- Illustration Qbbphn08e5mlqDocument4 pagesIllustration Qbbphn08e5mlqMaruti KambleNo ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- 255872_ILN_01KiB2jw7Document4 pages255872_ILN_01KiB2jw7abdulvajidparuthikkattilNo ratings yet

- Illustration - 2023-12-09T151835.539Document2 pagesIllustration - 2023-12-09T151835.539sebinsbstn93No ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- IllustrationDocument2 pagesIllustrationRajnandan shindeNo ratings yet

- IllustrationDocument2 pagesIllustrationseenasrinivas113No ratings yet

- IllustrationDocument2 pagesIllustrationseenasrinivas113No ratings yet

- Illustration How ToDocument2 pagesIllustration How Toakash agarwalNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- Benefit Illustration: UIN: 104N076V17 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N076V17 Page 1 of 3vipin jainNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- Illustration Qapkn8mbwyaa9Document3 pagesIllustration Qapkn8mbwyaa9AnithaNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3babunidoniNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- Illustration - 2022-08-31T122344.433Document3 pagesIllustration - 2022-08-31T122344.433Soumen BeraNo ratings yet

- Insured Benefits for PNB MetLife Century PlanDocument4 pagesInsured Benefits for PNB MetLife Century PlanManager Pnb LucknowNo ratings yet

- Bi 0655kgueDocument9 pagesBi 0655kguevanselimNo ratings yet

- Max Life Savings Advantage Plan proposal summaryDocument3 pagesMax Life Savings Advantage Plan proposal summaryvivek0955158No ratings yet

- E - SymbiosysFiles - Generated - OutputSIPDF - 09100000264060720Document2 pagesE - SymbiosysFiles - Generated - OutputSIPDF - 09100000264060720Sabarish T ENo ratings yet

- Illustration Qc0n50rclvfw0Document2 pagesIllustration Qc0n50rclvfw0Sumitt SinghNo ratings yet

- KFD New30012024195041118 I16Document3 pagesKFD New30012024195041118 I16Mayur NagdiveNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- Max Life Smart Wealth Plan benefit illustrationDocument3 pagesMax Life Smart Wealth Plan benefit illustrationparikshitNo ratings yet

- Zprmnotc 24501025 25787073Document1 pageZprmnotc 24501025 25787073user-289514No ratings yet

- Illustration - 2022-03-17T111744.362Document2 pagesIllustration - 2022-03-17T111744.362shubham gaundNo ratings yet

- Illustration - 2022-08-31T155906.546Document3 pagesIllustration - 2022-08-31T155906.546Soumen BeraNo ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001722290821Document5 pagesE SymbiosysFiles Generated OutputSIPDF 10200001722290821Sankalp SrivastavaNo ratings yet

- PNB MetLife Endowment Savings PlanDocument52 pagesPNB MetLife Endowment Savings PlanAmit GuptaNo ratings yet

- UIN: 104L115V01 Page 1 of 6Document6 pagesUIN: 104L115V01 Page 1 of 6Gobinda SinhaNo ratings yet

- IllustrationDocument2 pagesIllustrationadilamin08No ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- Benefit Illustration: UIN: 104N076V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N076V11 Page 1 of 2Vir ShahNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- Renewal Premium Notice: Mr. Ganesh Vasant Karalkar Insured Name: MR - Ganesh Vasant KaralkarDocument1 pageRenewal Premium Notice: Mr. Ganesh Vasant Karalkar Insured Name: MR - Ganesh Vasant KaralkarGanesh KaralkarNo ratings yet

- Benefit Illustration: UIN: 104N137V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N137V02 Page 1 of 4bhavnapal74No ratings yet

- Benefit Illustration: UIN: 104N120V01 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V01 Page 1 of 4Gobinda SinhaNo ratings yet

- 70014913388Document4 pages70014913388Manish YadavNo ratings yet

- Illustration PDFDocument2 pagesIllustration PDFArvind HarikrishnanNo ratings yet

- Max Life BIDocument8 pagesMax Life BIcambrittvNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- HDFC Life Sanchay Plus benefit illustrationDocument2 pagesHDFC Life Sanchay Plus benefit illustrationsarthakNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- Max Life UlipDocument4 pagesMax Life Ulipjagdevwasson761No ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionamarjeet456No ratings yet

- Benefit Illustration for HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration for HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- Illustration Qbhlvjke4x8v0Document2 pagesIllustration Qbhlvjke4x8v0Akshay ChaudhryNo ratings yet

- Benefit Illustration: Proposal No.Document6 pagesBenefit Illustration: Proposal No.VidhyaNo ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- Category 2Document10 pagesCategory 2Shreelekha PradeepNo ratings yet

- Chapter 6. Polygons, Circles, Stars and StuffDocument24 pagesChapter 6. Polygons, Circles, Stars and StuffSky SirNo ratings yet

- FR Smart BLPL PDFDocument32 pagesFR Smart BLPL PDFShreelekha PradeepNo ratings yet

- FDI Scenario in Indian Textiles Sector - A Study Report PDFDocument126 pagesFDI Scenario in Indian Textiles Sector - A Study Report PDFSachin AnguralNo ratings yet

- Ebony Heartwood's Intense Black Color and UsesDocument1 pageEbony Heartwood's Intense Black Color and UsesShreelekha PradeepNo ratings yet

- MSWord 2010Document21 pagesMSWord 2010Raquel RochiaNo ratings yet

- Chapter 6. Polygons, Circles, Stars and StuffDocument24 pagesChapter 6. Polygons, Circles, Stars and StuffSky SirNo ratings yet

- Category 2Document10 pagesCategory 2Shreelekha PradeepNo ratings yet

- Category 2Document10 pagesCategory 2Shreelekha PradeepNo ratings yet

- 1st PDFDocument8 pages1st PDFShreelekha PradeepNo ratings yet

- 1st PDFDocument8 pages1st PDFShreelekha PradeepNo ratings yet

- 1st PDFDocument8 pages1st PDFShreelekha PradeepNo ratings yet

- MTBC VS JMCDocument4 pagesMTBC VS JMCRichelle CartinNo ratings yet

- Business PlanDocument34 pagesBusiness Planjohn mwambuNo ratings yet

- ISO Contamination Control StandardsDocument8 pagesISO Contamination Control StandardsBernat Bertomeu BarralNo ratings yet

- Final Chapter 6 Financial PlanDocument26 pagesFinal Chapter 6 Financial Planangelo felizardoNo ratings yet

- Valuation Summary for Sin Chye Fatt FisheryDocument8 pagesValuation Summary for Sin Chye Fatt Fisheryshidah100% (1)

- Galvor CompanyDocument27 pagesGalvor CompanyAbbasgodhrawalaNo ratings yet

- Toaz - Info Partnership Qs PRDocument8 pagesToaz - Info Partnership Qs PRToni Rose Hernandez LualhatiNo ratings yet

- Women's Roles in Family BusinessesDocument29 pagesWomen's Roles in Family BusinessesRonald Samuel GozaliNo ratings yet

- Interface IP Holdings LLCDocument4 pagesInterface IP Holdings LLCPriorSmartNo ratings yet

- Land Titles and Deeds Survey List of Cases (AY2018-2019)Document10 pagesLand Titles and Deeds Survey List of Cases (AY2018-2019)lalynNo ratings yet

- ProcurementDocument47 pagesProcurementSalman Faris100% (1)

- AFA Animal Production 9 Quarter 4 Module 4Document13 pagesAFA Animal Production 9 Quarter 4 Module 4Claes TrinioNo ratings yet

- Resume Book GBC 2008Document121 pagesResume Book GBC 2008vtiwari182% (11)

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- CabalensDocument3 pagesCabalensHanah Abegail NavaltaNo ratings yet

- InstitutesDocument6 pagesInstitutesReema RatraNo ratings yet

- Dr Lal PathLabs Franchise Model for a Collection CentreDocument25 pagesDr Lal PathLabs Franchise Model for a Collection CentreDivyam SanghviNo ratings yet

- 8509Document8 pages8509Mudassar SaqiNo ratings yet

- Drivers Application Form For GuyanaDocument76 pagesDrivers Application Form For GuyanaRandy & BobNo ratings yet

- An Analysis of Workmen's Right To Strike Under Industrial Disputes Act, 1947Document8 pagesAn Analysis of Workmen's Right To Strike Under Industrial Disputes Act, 1947aridaman raghuvanshiNo ratings yet

- Case BumiDocument10 pagesCase BumiSigid PramNo ratings yet

- Summary of Significant CTA Decisions (February 2011)Document2 pagesSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNo ratings yet

- IFRS Chapter 1 SummaryDocument4 pagesIFRS Chapter 1 SummaryAsif AliNo ratings yet

- KFC Marketing Plan AnalysisDocument14 pagesKFC Marketing Plan AnalysisSialhaiNo ratings yet

- Предлоги Времени Английский Язык УпражненияDocument2 pagesПредлоги Времени Английский Язык УпражненияАлена ХитрукNo ratings yet

- Major Institutions That Foster Caribbean Integration ProcessDocument15 pagesMajor Institutions That Foster Caribbean Integration ProcessAcerkNo ratings yet

- Proceso de Construccion de Un PozoDocument16 pagesProceso de Construccion de Un PozoSusana CabreraNo ratings yet

- This Business Letter Format Illustrates The Specific Parts of A Business LetterDocument2 pagesThis Business Letter Format Illustrates The Specific Parts of A Business LetterDac Long NguyenNo ratings yet

- Revenue Recognition Policies of 4 Indian CompaniesDocument2 pagesRevenue Recognition Policies of 4 Indian CompaniesMohan BishtNo ratings yet

- PNB vs. Rodriguez G.R. No. 170325 September 26, 2008Document2 pagesPNB vs. Rodriguez G.R. No. 170325 September 26, 2008KF100% (3)