Professional Documents

Culture Documents

Benefit Illustration: Proposal No.

Uploaded by

VidhyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benefit Illustration: Proposal No.

Uploaded by

VidhyaCopyright:

Available Formats

10 Nov 2020

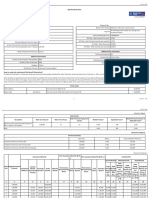

Benefit Illustration

Proposal No. :

Name of the Prospect/Policyholder : Ubaidur Rahman Name of the Product: Edelweiss Tokio Life- Active Income

Age (in Years) : 41 An Individual, Non-Linked, Par, Savings, Life

Tag Line: Insurance Product

Name of the Life Assured : Ubaidur Rahman

Unique Identification No.: 147N065V01

Age (in Years) : 41

GST Rate - Base Product (first year) : 4.50%

Policy Term (in Years) : 58

Premium Payment Term (in Years) : 12 GST Rate - Base Product (second year onwards) : 2.25%

GST Rate - Rider (first year): 18.00%

Amount of Instalment Premium (including Rider

Premiums and first year applicable taxes in Rupees) 1,04,500 GST Rate - Rider (second year onwards): 18.00 %

:

Mode of Payment of Premium : Annual Additional Plan Information

Family Income Benefit Yes

Additional Information Income Option Early Income

Gender of the Prospect / Policyholder : Male Guaranteed Income Type Level Guaranteed Income

Gender of the Life Assured : Male Maturity Age Till age 99

Category : Others

Distribution Channel : Direct Marketing

How to read and understand this benefit illustration?

This Benefit Illustration is intented to show year-wise premiums payable and benefits under the policy, at two assumed rates of interest i.e., 8% p.a. and 4% p.a.

Some benefits are guaranteed and some benefits are variable with returns based on the future performance of the Company. If your policy offers guaranteed benefits then these will be clearly marked "guaranteed"

in the illustration table on this page. If your policy offers variable benefits then the illustrations on this page will show two different rates of assumed future investment returns, of 8% p.a. and 4% p.a. These assumed

rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance.

Policy details

Policy Option - Sum Assured on Maturity Rs. 11,35,071

Bonus Type Cash Bonus Sum Assured on Death (at inception of the policy) Rs. 10,00,000

1 Vers ion : 1.07

10 Nov 2020

(Amounts in Rupees)

Premium Summary

Base Plan Riders Total Instalment Premium

Instalment Premium without GST 1,00,000 - 1,00,000

Instalment Premium with First Year GST 1,04,500 - 1,04,500

Instalment Premium with GST 2nd Year Onwards 1,02,250 - 1,02,250

(Amount in Rupees )

Non-Guaranteed Benefits @ 4% Non-Guaranteed Benefits @ 8%

Guaranteed Benefits p.a. p.a. Total Benefits

Survival Benefit

Maturity Benefit Death Benefit

Total Total

Maturity Maturity Total Total

Policy Single/Annualized Survival Total Total Death Death

Year Premium Reversionary Reversionary

Guaranteed Benefit Surrender Death Maturity Bonus/Terminal Cash Surrender Bonus/Terminal Cash Surrender Survival Survival Benefit, Benefit, Benefit, Benefit,

incl incl

Additions (Guaranteed Benefit # Benefit Benefit Bonus Benefit Bonus Benefit Benefit Benefit Terminal Terminal incl incl

Income) Bonus Bonus @4% @8% Terminal Terminal

p.a. p.a. Bonus Bonus Bonus, if Bonus, if

(TB), if any (TB), if any

(4+9) (4+12) @ 4% p.a. @ 8% p.a. any @ 4% any @ 8%

(7+8) (7+11) p.a. (6+8) p.a. (6+11)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19

1 1,00,000 - - - 10,00,000 - - - - - - - - - - - 10,00,000 10,00,000

2 1,00,000 - 17,026 60,000 10,02,370 - - - 79,455 - - 79,455 17,026 17,026 - - 10,02,370 10,02,370

3 1,00,000 - 17,026 1,05,000 10,04,739 - - - 1,39,046 - - 1,39,046 17,026 17,026 - - 10,04,739 10,04,739

4 1,00,000 - 17,026 2,00,000 10,07,109 - - - 2,09,988 - - 2,09,988 17,026 17,026 - - 10,07,109 10,07,109

5 1,00,000 - 17,026 2,55,000 10,09,479 - - - 2,86,605 - - 2,86,605 17,026 17,026 - - 10,09,479 10,09,479

6 1,00,000 - 17,026 3,12,000 10,11,848 - - - 3,80,249 - - 3,80,249 17,026 17,026 - - 10,11,848 10,11,848

7 1,00,000 - 17,026 3,64,000 10,14,218 - - - 4,80,513 - - 4,80,513 17,026 17,026 - - 10,14,218 10,14,218

8 1,00,000 - 17,026 4,24,000 10,16,588 - - - 5,92,129 - - 5,92,129 17,026 17,026 - - 10,16,588 10,16,588

9 1,00,000 - 17,026 4,86,000 10,18,957 - - - 7,23,608 - - 7,23,608 17,026 17,026 - - 10,18,957 10,18,957

10 1,00,000 - 17,026 5,50,000 10,50,000 - - - 8,68,329 - - 8,68,329 17,026 17,026 - - 10,50,000 10,50,000

11 1,00,000 - 17,026 6,05,000 11,55,000 - - - 10,26,293 - - 10,26,293 17,026 17,026 - - 11,55,000 11,55,000

12 1,00,000 - 17,026 6,72,000 12,60,000 - - - 11,97,500 - - 11,97,500 17,026 17,026 - - 12,60,000 12,60,000

2 Vers ion : 1.07

10 Nov 2020

(Amount in Rupees )

Guaranteed Benefits Non-Guaranteed Benefits @ 4% Non-Guaranteed Benefits @ 8% Total Benefits

p.a. p.a.

Survival Benefit

Maturity Benefit Death Benefit

Total Total Total Total

Maturity Maturity

Policy Single/Annualized Survival Total Total Death Death

Year Premium Reversionary Cash Surrender Reversionary Cash Surrender Survival Survival Benefit, Benefit,

Guaranteed Benefit Surrender Death Maturity Bonus/Terminal Benefit, Benefit,

Bonus/Terminal incl incl

Additions (Guaranteed Benefit # Benefit Benefit Bonus Bonus Benefit Bonus Bonus Benefit Benefit Benefit Terminal Terminal incl incl

Income) @4% @8% Bonus Bonus Terminal Terminal

p.a. p.a. (TB), if any (TB), if any Bonus, if Bonus, if

(4+9) (4+12) @ 4% p.a. @ 8% p.a. any @ 4% any @ 8%

p.a. (6+8) p.a. (6+11)

(7+8) (7+11)

13 - - 17,026 6,84,000 12,60,000 - - 6,810 12,38,362 - 45,403 12,76,955 23,836 62,429 - - 12,60,000 12,60,000

14 - - 17,026 6,96,000 12,60,000 - - 6,810 12,61,064 - 45,403 12,99,656 23,836 62,429 - - 12,60,000 12,60,000

15 - - 17,026 6,96,000 12,60,000 - - 6,810 12,83,765 - 45,403 13,22,358 23,836 62,429 - - 12,60,000 12,60,000

16 - - 17,026 7,08,000 12,60,000 - - 6,810 13,06,467 - 45,403 13,45,059 23,836 62,429 - - 12,60,000 12,60,000

17 - - 17,026 7,20,000 12,60,000 - - 6,810 13,29,168 - 45,403 13,67,760 23,836 62,429 - - 12,60,000 12,60,000

18 - - 17,026 7,32,000 12,60,000 - - 6,810 13,51,869 - 45,403 13,90,462 23,836 62,429 - - 12,60,000 12,60,000

19 - - 17,026 7,32,000 12,60,000 - - 6,810 13,74,571 - 45,403 14,13,163 23,836 62,429 - - 12,60,000 12,60,000

20 - - 17,026 7,44,000 12,60,000 - - 6,810 13,97,272 - 45,403 14,35,865 23,836 62,429 - - 12,60,000 12,60,000

21 - - 17,026 7,56,000 12,60,000 - - 6,810 14,31,324 - 45,403 14,69,917 23,836 62,429 - - 12,60,000 12,60,000

22 - - 17,026 7,68,000 12,60,000 - - 6,810 14,54,026 - 45,403 14,92,618 23,836 62,429 - - 12,60,000 12,60,000

23 - - 17,026 7,68,000 12,60,000 - - 6,810 14,88,078 - 45,403 15,26,670 23,836 62,429 - - 12,60,000 12,60,000

24 - - 17,026 7,80,000 12,60,000 - - 6,810 15,22,130 - 45,403 15,60,723 23,836 62,429 - - 12,60,000 12,60,000

25 - - 17,026 7,92,000 12,60,000 - - 6,810 14,19,974 3,40,521 45,403 18,77,407 23,836 62,429 - - 12,60,000 12,60,000

26 - - 17,026 8,04,000 12,60,000 - - 6,810 14,31,324 3,63,223 45,403 19,20,313 23,836 62,429 - - 12,60,000 12,60,000

27 - - 17,026 8,04,000 12,60,000 - - 6,810 14,54,026 3,85,924 45,403 19,78,883 23,836 62,429 - - 12,60,000 12,60,000

28 - - 17,026 8,16,000 12,60,000 - - 6,810 14,76,727 4,08,626 45,403 20,38,360 23,836 62,429 - - 12,60,000 12,60,000

29 - - 17,026 8,28,000 12,60,000 - - 6,810 14,99,429 4,42,678 45,403 21,13,502 23,836 62,429 - - 12,60,000 12,60,000

30 - - 17,026 8,40,000 12,60,000 - - 6,810 15,10,779 4,65,379 45,403 21,59,018 23,836 62,429 - - 12,60,000 12,60,000

31 - - 17,026 8,40,000 12,60,000 - - 6,810 15,33,481 4,99,431 45,403 22,36,317 23,836 62,429 - - 12,60,000 12,60,000

3 Vers ion : 1.07

10 Nov 2020

(Amount in Rupees )

Non-Guaranteed Benefits @ 4% Non-Guaranteed Benefits @ 8%

Guaranteed Benefits p.a. p.a. Total Benefits

Survival Benefit

Maturity Benefit Death Benefit

Total Total Total Total

Maturity Maturity

Policy Single/Annualized Survival Total Total Death Death

Year Premium Reversionary Cash Surrender Reversionary Cash Surrender Survival Survival Benefit, Benefit,

Guaranteed Benefit Surrender Death Maturity Bonus/Terminal Benefit, Benefit,

Bonus/Terminal incl incl

Additions (Guaranteed Benefit # Benefit Benefit Bonus Bonus Benefit Bonus Bonus Benefit Benefit Benefit Terminal Terminal incl incl

Income) @4% @8% Bonus Bonus Terminal Terminal

p.a. p.a. Bonus, if Bonus, if

(4+9) (4+12) @ 4% p.a. @ 8%ifp.a.

(TB), if any (TB), any any @ 4% any @ 8%

(7+8) (7+11) p.a. (6+8) p.a. (6+11)

32 - - 17,026 8,52,000 12,60,000 - - 6,810 15,56,182 5,33,483 45,403 23,14,977 23,836 62,429 - - 12,60,000 12,60,000

33 - - 17,026 8,64,000 12,60,000 - - 6,810 15,67,533 5,67,536 45,403 23,77,974 23,836 62,429 - - 12,60,000 12,60,000

34 - - 17,026 8,76,000 12,60,000 - - 6,810 15,90,234 6,01,588 45,403 24,59,018 23,836 62,429 - - 12,60,000 12,60,000

35 - - 17,026 8,76,000 12,60,000 - - 6,810 16,01,585 6,35,640 45,403 25,23,717 23,836 62,429 - - 12,60,000 12,60,000

36 - - 17,026 8,88,000 12,60,000 - - 6,810 16,12,936 6,81,043 45,403 26,04,988 23,836 62,429 - - 12,60,000 12,60,000

37 - - 17,026 9,00,000 12,60,000 - - 6,810 16,24,287 7,26,445 45,403 26,87,167 23,836 62,429 - - 12,60,000 12,60,000

38 - - 17,026 9,12,000 12,60,000 - - 6,810 16,35,637 7,71,848 45,403 27,70,254 23,836 62,429 - - 12,60,000 12,60,000

39 - - 17,026 9,12,000 12,60,000 - - 6,810 16,35,637 8,17,251 45,403 28,34,726 23,836 62,429 - - 12,60,000 12,60,000

40 - - 17,026 9,24,000 12,60,000 - - 6,810 16,35,637 8,74,005 45,403 29,15,316 23,836 62,429 - - 12,60,000 12,60,000

41 - - 17,026 9,36,000 12,60,000 - - 6,810 16,46,988 9,30,758 45,403 30,16,565 23,836 62,429 - - 12,60,000 12,60,000

42 - - 17,026 9,48,000 12,60,000 - - 6,810 16,46,988 9,87,512 45,403 30,97,722 23,836 62,429 - - 12,60,000 12,60,000

43 - - 17,026 9,48,000 12,60,000 - - 6,810 16,46,988 10,55,616 45,403 31,95,111 23,836 62,429 - - 12,60,000 12,60,000

44 - - 17,026 9,60,000 12,60,000 - - 6,810 16,35,637 11,12,370 45,403 32,53,794 23,836 62,429 - - 12,60,000 12,60,000

45 - - 17,026 9,72,000 12,60,000 - - 6,810 16,35,637 11,80,474 45,403 33,50,503 23,836 62,429 - - 12,60,000 12,60,000

46 - - 17,026 9,84,000 12,60,000 - - 6,810 16,12,936 12,59,929 45,403 34,15,429 23,836 62,429 - - 12,60,000 12,60,000

47 - - 17,026 9,84,000 12,60,000 - - 6,810 16,01,585 13,39,384 45,403 35,01,921 23,836 62,429 - - 12,60,000 12,60,000

48 - - 17,026 9,96,000 12,60,000 - - 6,810 15,67,533 14,18,839 45,403 35,35,746 23,836 62,429 - - 12,60,000 12,60,000

49 - - 17,026 10,08,000 12,60,000 - - 6,810 15,44,832 15,09,644 45,403 36,06,348 23,836 62,429 - - 12,60,000 12,60,000

50 - - 17,026 10,20,000 12,60,000 - - 6,810 14,99,429 16,00,450 45,403 36,18,606 23,836 62,429 - - 12,60,000 12,60,000

4 Vers ion : 1.07

10 Nov 2020

(Amount in Rupees )

Guaranteed Benefits Non-Guaranteed Benefits @ 4% Non-Guaranteed Benefits @ 8% Total Benefits

p.a. p.a.

Survival Benefit

Maturity Benefit Death Benefit

Total Total

Maturity Maturity Total Total

Policy Single/Annualized Survival Total Total Death Death

Benefit, Benefit,

Year Premium Guaranteed Benefit Surrender Death Maturity Reversionary Cash Surrender Reversionary Cash Surrender Survival Survival incl incl

Benefit, Benefit,

Bonus/Terminal Bonus/Terminal

Additions (Guaranteed Benefit # Benefit Benefit Bonus Bonus Benefit Bonus Bonus Benefit Benefit Benefit Terminal Terminal incl incl

Income) @4% @8% Terminal Terminal

p.a. p.a. Bonus Bonus Bonus, if Bonus, if

(TB), if any (TB), if any

(4+9) (4+12) @ 4% p.a. @ 8% p.a. any @ 4% any @ 8%

p.a. (6+8) p.a. (6+11)

(7+8) (7+11)

51 - - 17,026 10,20,000 12,60,000 - - 6,810 14,54,026 17,02,607 45,403 36,37,902 23,836 62,429 - - 12,60,000 12,60,000

52 - - 17,026 10,32,000 12,60,000 - - 6,810 13,97,272 18,16,114 45,403 36,33,362 23,836 62,429 - - 12,60,000 12,60,000

53 - - 17,026 10,44,000 12,60,000 - - 6,810 13,29,168 19,29,621 45,403 35,86,824 23,836 62,429 - - 12,60,000 12,60,000

54 - - 17,026 10,56,000 12,60,000 - - 6,810 13,17,817 20,43,128 45,403 36,85,575 23,836 62,429 - - 12,60,000 12,60,000

55 - - 17,026 10,56,000 12,60,000 - - 6,810 12,72,415 21,79,336 45,403 37,08,277 23,836 62,429 - - 12,60,000 12,60,000

56 - - 17,026 10,68,000 12,60,000 - - 6,810 12,27,012 23,15,545 45,403 37,20,082 23,836 62,429 - - 12,60,000 12,60,000

57 - - 17,026 10,80,000 12,60,000 - - 6,810 11,47,557 24,51,753 45,403 36,13,385 23,836 62,429 - - 12,60,000 12,60,000

58 - - 17,026 10,80,000 12,60,000 11,35,071 - 6,810 10,34,050 26,10,663 45,403 33,96,132 23,836 62,429 11,35,071 37,45,734 12,60,000 12,60,000

Notes : Annualized Premium excludes underwri ng extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods & Service Tax. Refer Sales Literature for explana on of

terms used in this illustration.

I, ___________________________ (name), have explained the premiums, and benefits under the I, Ubaidur Rahman , having received the informa on with respect to the above, have understood the

product fully to the prospect / policyholder. above statement before entering into the contract.

Place:

Date: Signature of Agent/ Intermediary/ Official Date: Signature of Prospect / Policyholder

Terms & Conditions

5 Vers ion : 1.07

10 Nov 2020

1) This document is for illustration purposes only. This illustration is based on the terms and conditions of the life insurance policy as on date of the illustration. The above information must be read in conjunction

with the sales literature & policy document.

2) The Premiums are to be paid in the beginning of the chosen mode of payment. For e.g. in case of Annual mode of payment, premiums are payable at the beginning of the respective policy year and in case of

Monthly mode of payment, premiums are payable at the beginning of the respective policy month. The amount shown in this column is the sum of all the premiums payable in the respective policy year, excluding

underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any and Goods & Service Tax.

3) Edelweiss Tokio Life - Active Income Plan is only the name of the policy and does not in any way indicate the quality of the policy, its future prospects or returns.

4) Applicable Taxes will be levied on the premium as per the prevailing Tax Laws and the same shall be borne by the policyholder.

5) Surrender value shall be higher of Guaranteed Surrender Value and Special Surrender Value and is payable at the end of the policy year. Special Surrender Value is not guaranteed. Before making a request for

Surrender, you may approach the company to know about the Special Surrender Value in respect of your Policy at that point in time.

6) # In case cash bonuses have been paid out, the same (along with Guaranteed survival benefit) shall be deducted from the Surrender Value indicated, at the time of pay out.

7) Survival Benefit under ‘Total Benefits’ includes Income Option (Guranteed Benefit) and Cash Bonus (Non-Guaranteed Benefit). Cash Bonus and Terminal Bonus would depend on the performance of the Par fund

of the Company.

8) Maturity Benefit shown under ‘Total Benefits’ includes Maturity Benefit shown under ‘Guaranteed Benefits’, and Terminal Bonus

9) If Additional Benefit, 'Family Income Benefit' is chosen, on the diagnosis of Critical Illness or death of the Life Assured (whichever is earlier) while the policy is in-force, no future Premiums are required to be

paid and the policy will continue as in-force policy.

The Survival Benefits till the policy term and Maturity Benefits on the date of maturity will be payable.

In addition, Sum Assured on Death will be paid.

10) In case the Life Insured is a minor, the risk cover will start from the date of commencement of the policy and on attainment of majority the ownership of Policy will automatically vest on the Life Insured. In case

of death of the Life Insured who is a minor, the death benefit will be paid to the Proposer in the policy.

6 Vers ion : 1.07

You might also like

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.From EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No ratings yet

- BABY SHARMA Active IncomeDocument8 pagesBABY SHARMA Active Incomeamitfeb19No ratings yet

- Benefit Illustration: Proposal No.Document4 pagesBenefit Illustration: Proposal No.MeenuNo ratings yet

- ABC ABC Guaranteed Income STARDocument5 pagesABC ABC Guaranteed Income STARArvin DabasNo ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlussarthakNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- Sanchay Par Advantage - Deferred IncomeDocument3 pagesSanchay Par Advantage - Deferred Incomesushant KumarNo ratings yet

- Illustration (17) - 2023-12-16T143445.154Document2 pagesIllustration (17) - 2023-12-16T143445.154shailendra.goswamiNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument2 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- 70014883867Document4 pages70014883867Manish YadavNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Illustration - 2022-11-03T115112.732Document3 pagesIllustration - 2022-11-03T115112.732BLOODY ASHHERNo ratings yet

- Illustration Qb22tohnmq5mjDocument3 pagesIllustration Qb22tohnmq5mjMotivational QuotesNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- PNBMetlife Gauranteed Future PlanDocument4 pagesPNBMetlife Gauranteed Future PlanManager Pnb LucknowNo ratings yet

- Illustration - 2022-10-11T115742.458Document3 pagesIllustration - 2022-10-11T115742.458BLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par Advantageraja reddyNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Document2 pagesHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekNo ratings yet

- Sandeep Pension PlanDocument3 pagesSandeep Pension PlanShruti SrivastavaNo ratings yet

- Vinoth - HDFC ParDocument3 pagesVinoth - HDFC ParVinodh VijayakumarNo ratings yet

- Life Time BenifitDocument3 pagesLife Time BenifitRajaNo ratings yet

- Illustration - 2022-07-30T133834.945Document3 pagesIllustration - 2022-07-30T133834.945Soumen BeraNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Illustration - 2022-08-30T164443.287Document2 pagesIllustration - 2022-08-30T164443.287Soumen BeraNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlusVamsi Krishna BNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageVamsi Krishna BNo ratings yet

- 70014913388Document4 pages70014913388Manish YadavNo ratings yet

- BenefitIllustrations 1Document2 pagesBenefitIllustrations 1vonamal985No ratings yet

- How To Read and Understand This Benefit Illustration?: Policy DetailsDocument3 pagesHow To Read and Understand This Benefit Illustration?: Policy DetailsBLOODY ASHHERNo ratings yet

- PNB MetLife PolicyDocument4 pagesPNB MetLife PolicyNeelNo ratings yet

- Illustration - 2022-07-30T141948.715Document3 pagesIllustration - 2022-07-30T141948.715Soumen BeraNo ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- NATRAJ Name Smart LifestyleDocument4 pagesNATRAJ Name Smart LifestylenataraNo ratings yet

- Illustration - 2024-01-04T213945.722Document2 pagesIllustration - 2024-01-04T213945.722Rishavdar ClassNo ratings yet

- Quotation Number Quotation DateDocument5 pagesQuotation Number Quotation DateMazhar SayedNo ratings yet

- Illustration Qc0n0t6y4j58fDocument3 pagesIllustration Qc0n0t6y4j58fNavneet PandeyNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationSharma RaviNo ratings yet

- IllustrationDocument2 pagesIllustrationRanjit PanigrahiNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- Illustration - 2022-11-04T161802.609Document3 pagesIllustration - 2022-11-04T161802.609BLOODY ASHHERNo ratings yet

- How To Read and Understand This Benefit Illustration?: Proposal NoDocument2 pagesHow To Read and Understand This Benefit Illustration?: Proposal NoDINESH JYOTHINo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- 70002886268Document4 pages70002886268acme financialNo ratings yet

- Illustration Qbxt9qkqiyoe8Document3 pagesIllustration Qbxt9qkqiyoe8mr copy xeroxNo ratings yet

- Benefit Illustration For HDFC Life Classicassure PlusDocument2 pagesBenefit Illustration For HDFC Life Classicassure PlusKrishna UpadhyayNo ratings yet

- Sanchay Par Immediete IncomeDocument3 pagesSanchay Par Immediete IncomeRavi KumarNo ratings yet

- IllustrationDocument2 pagesIllustrationShambhu RaulNo ratings yet

- IllustrationDocument3 pagesIllustrationsonuNo ratings yet

- DownloadDocument3 pagesDownloadKiran JohnNo ratings yet

- Benefit Illustration For HDFC Life Super Income PlanDocument2 pagesBenefit Illustration For HDFC Life Super Income PlanVamsi Krishna BNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- Toshiba CaseDocument14 pagesToshiba CaseCapNo ratings yet

- Review of Related LiteratureDocument5 pagesReview of Related LiteratureMae Tomelden100% (1)

- Highly Integrated Firms or Real Estate Developers in The Philippines:Housing Delivery Process in The PhilippinesDocument35 pagesHighly Integrated Firms or Real Estate Developers in The Philippines:Housing Delivery Process in The PhilippinesEditha BaniquedNo ratings yet

- Annual Report: ISO 9001:2015 "To Do It Right and Best From The Beginning"Document204 pagesAnnual Report: ISO 9001:2015 "To Do It Right and Best From The Beginning"Santhiya MogenNo ratings yet

- Lecture Notes Academic Year 2019-2020: General Principles of Political Science Fa1B 1-10 Dr. S. JeevaDocument73 pagesLecture Notes Academic Year 2019-2020: General Principles of Political Science Fa1B 1-10 Dr. S. JeevaSathish PNo ratings yet

- Member'S Data Form (MDF) : InstructionsDocument2 pagesMember'S Data Form (MDF) : InstructionsSamiracomputerstation Kuya MarvsNo ratings yet

- Law On Partnership MCQ QuestionsDocument28 pagesLaw On Partnership MCQ QuestionsasdfghjklNo ratings yet

- Newsletter Volume 14 Issue 19Document36 pagesNewsletter Volume 14 Issue 19AACONo ratings yet

- Evidentiary Value of FIRDocument12 pagesEvidentiary Value of FIRSiddharth soniNo ratings yet

- November 2019 Transactions: Date Account Titles and Explanations Debit CreditDocument5 pagesNovember 2019 Transactions: Date Account Titles and Explanations Debit CreditVirginia TownzenNo ratings yet

- District Selection Trial 2023 Part 2Document2 pagesDistrict Selection Trial 2023 Part 2sanurakshit007No ratings yet

- NCLT Verdict - Tata MistryDocument3 pagesNCLT Verdict - Tata MistryvaibhavNo ratings yet

- Acknowledgement ReceiptDocument8 pagesAcknowledgement ReceiptMary Ann MendozaNo ratings yet

- 3RD Quarter-G5Document32 pages3RD Quarter-G5Louie De PedroNo ratings yet

- CPC Memofrial 3rd YearDocument13 pagesCPC Memofrial 3rd YearSyed renobaNo ratings yet

- Brexit and The Border: An Overview of Possible Outcomes: Sinn Féin SDLPDocument20 pagesBrexit and The Border: An Overview of Possible Outcomes: Sinn Féin SDLPViktória SzalmaNo ratings yet

- Certificate of Assumed Name.Document4 pagesCertificate of Assumed Name.Chris LecceNo ratings yet

- Sexual Harassment at WorkplaceDocument12 pagesSexual Harassment at WorkplaceBaishali Bhattacharjee100% (1)

- Balaji Printing Solution ReportDocument10 pagesBalaji Printing Solution ReportYusuf AnsariNo ratings yet

- Crime QuamtoDocument125 pagesCrime QuamtoScribdTranslationsNo ratings yet

- Chapter 4 PDFDocument26 pagesChapter 4 PDFRishika SabharwalNo ratings yet

- Anti-Torture Act of 2009 RA 9745Document42 pagesAnti-Torture Act of 2009 RA 9745Lakan Bugtali100% (2)

- Isnt This Plate Indian - Sharmila Rege - 2009Document50 pagesIsnt This Plate Indian - Sharmila Rege - 2009Sri Ram KNo ratings yet

- VCS Project Description Template v4.0Document18 pagesVCS Project Description Template v4.0Gabriel de Moura MachadoNo ratings yet

- Seidlhofer, 2006 - English As A Lingua Franca in The Expanding CircleDocument11 pagesSeidlhofer, 2006 - English As A Lingua Franca in The Expanding CircleSamantha BasterfieldNo ratings yet

- Strategic Management: Author: Charles W. L. Hill Gareth R. JonesDocument48 pagesStrategic Management: Author: Charles W. L. Hill Gareth R. Joneslokesh_bhatiyaNo ratings yet

- An Act: Be It Enacted by The General Assembly of The State of OhioDocument11 pagesAn Act: Be It Enacted by The General Assembly of The State of OhioNevin SmithNo ratings yet

- Sample Contract To SellDocument2 pagesSample Contract To SellJM BermudoNo ratings yet

- Maryland American Water BillDocument1 pageMaryland American Water BillMasoud DastgerdiNo ratings yet

- Robbie - UprootedDocument12 pagesRobbie - UprootedIan ChauNo ratings yet