Professional Documents

Culture Documents

Basic Aactng Terms: Profit and Loss Account

Uploaded by

Mark Johnson LeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basic Aactng Terms: Profit and Loss Account

Uploaded by

Mark Johnson LeeCopyright:

Available Formats

DO NOT SEND/EDIT

BASIC AACTNG TERMS

Cathleen Angelica L. Rubio

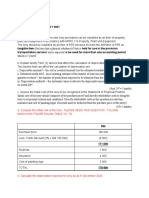

Profit and Loss account Cost of Sales

Þ Whereas the balance sheet shows a Cost of Sales are expenses that can

snapshot at a point in time of the net worth of be directly attributed to sales items,

such as purchases of stocks.

the business, the profit and loss account

shows the current financial year’s net

Expenses

operating profits, broken down into various

These are all other expenses (other

sales, cost of sales and expenses ledger than purchases of assets) which

accounts. cannot be attributed directly to sales

items, such as rent, electricity or

advertising.

Sales

Sales accounts show all sales made in the period, regardless

of whether or not money has been received yet, and are shown

as a credit in the Profit and Loss accounts. Where money has

not yet been received, the debit is not to cash (as per the CD FINANCIAL STATEMENTS

example above), but to a Debtors account (money owed from Financial statements are general purpose,

customer account). external financial statements prepared

according to generally accepted

Balance Sheet: reports the amounts of assets, liabilities, and accounting principles. Some terms that

stockholders’ equity at a specified moment, such as midnight apply to the financial statements include:

of December 31; also known as the statement of financial

position. Þ Statement Of Cash Flows:

reports the changes in cash and

cash equivalents during a period

Income Statement: reports revenues, expenses, gains, of time according to three

losses, and net income during the period of time stated in its activities: operating, investing,

heading; also known as the statement of operations and as the and financing.

profit and loss (P&L) statement.

FINANCIAL STATEMENTS

FINANCIAL STATEMENTS

Þ Statement Of Stockholders’ Equity: reports the

Þ Audited Financial Statements:

changes in the components of stockholders’ equity,

independent CPA firm gives

including net income, other comprehensive income,

assurance about reasonableness

dividends, exercise of stock options.

and compliance with accounting

principles.

Þ Interim Financial Statements: issued between the

annual financial statements, e.g. quarterly

Þ Financial Reporting: includes

financial statements, annual and

quarterly reports to SEC and

stockholders, press releases and

other financial reports.

You might also like

- Profit and Loss AccountDocument1 pageProfit and Loss AccountMark Johnson LeeNo ratings yet

- Module 1Document14 pagesModule 1Shayek tysonNo ratings yet

- 2022 Completion of The Accounting CycleDocument30 pages2022 Completion of The Accounting CycleCharlemagne Jared RobielosNo ratings yet

- 02.differences FA CostAcctDocument10 pages02.differences FA CostAcct5hw749rpmdNo ratings yet

- Topic 4rev (Students)Document36 pagesTopic 4rev (Students)Nemalai VitalNo ratings yet

- ACC Discussion 3Document2 pagesACC Discussion 3Kennedy BandaNo ratings yet

- NCIII ReviewerDocument3 pagesNCIII ReviewerEmellaine Arazo de Guzman90% (30)

- Bookkeeping NC Iii Coverage and Reviewer: Disbursements JournalDocument3 pagesBookkeeping NC Iii Coverage and Reviewer: Disbursements JournalHermin Austria0% (1)

- Topic 4rev (Students)Document30 pagesTopic 4rev (Students)RomziNo ratings yet

- Topic 4rev StudentsDocument31 pagesTopic 4rev StudentsNemalai VitalNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Analysis of IFRSDocument50 pagesAnalysis of IFRSjanckercfNo ratings yet

- 61809bos50279 cp7 U1Document61 pages61809bos50279 cp7 U1Sukhmeet Singh100% (1)

- 5 Financial StatementsDocument8 pages5 Financial StatementsMuhammad Muzammil100% (2)

- FMA (Financial Analysis Schedule 3) BritanniaDocument16 pagesFMA (Financial Analysis Schedule 3) BritanniaPowerPoint GoNo ratings yet

- DialogonenninglnnsnInformendenPresupuesto 656053795895abaDocument6 pagesDialogonenninglnnsnInformendenPresupuesto 656053795895abaCONSTRUPETROLNo ratings yet

- FABM2-Chapter 2Document31 pagesFABM2-Chapter 2Marjon GarabelNo ratings yet

- Entrepreneurship Na BusfinDocument7 pagesEntrepreneurship Na BusfinkiawaNo ratings yet

- 55008bosfndnov19 p1 Cp7u1Document62 pages55008bosfndnov19 p1 Cp7u1Jammigumpula Priyanka100% (1)

- Accounting Fundamentals: in This ChapterDocument37 pagesAccounting Fundamentals: in This ChapterSafi UllahNo ratings yet

- FS AnalysisDocument4 pagesFS Analysisserixa ewanNo ratings yet

- Entrepreneur Chapter 18Document6 pagesEntrepreneur Chapter 18CaladhielNo ratings yet

- Final Account: With AdjustmentDocument49 pagesFinal Account: With AdjustmentPandit Niraj Dilip Sharma100% (1)

- Sample DraftDocument51 pagesSample DraftFrances Monique AlburoNo ratings yet

- Ac 1Document39 pagesAc 1taajNo ratings yet

- Accounts TheoryDocument73 pagesAccounts Theoryaneupane465No ratings yet

- The Original Attachment: BasicsDocument32 pagesThe Original Attachment: BasicsVijayGogulaNo ratings yet

- 67178bos54090 Cp7u1Document59 pages67178bos54090 Cp7u1Hansika ChawlaNo ratings yet

- 67178bos54090 Cp7u1Document59 pages67178bos54090 Cp7u1ashifNo ratings yet

- Cee 5 PDFDocument38 pagesCee 5 PDFMUHAMMAD IRFAN MALIKNo ratings yet

- Topic Two (Poa) Ba-It 1 Principles of AccountingDocument10 pagesTopic Two (Poa) Ba-It 1 Principles of AccountingdaniloorestmarijaniNo ratings yet

- Chapter OneDocument24 pagesChapter OneffahddmmNo ratings yet

- Prepare Financial Report IbexDocument13 pagesPrepare Financial Report Ibexfentahun enyewNo ratings yet

- Financial StatementsDocument6 pagesFinancial Statementsnatasha dikolaNo ratings yet

- VU Accounting Lesson 29Document4 pagesVU Accounting Lesson 29ranawaseemNo ratings yet

- Acc124 Part1Document8 pagesAcc124 Part1Christine LigutomNo ratings yet

- Final Accounts of A Proprietary ConcernDocument14 pagesFinal Accounts of A Proprietary ConcernShivam MutkuleNo ratings yet

- Chapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRDocument14 pagesChapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRSaket_srv2100% (1)

- Statement of Financial PositionDocument8 pagesStatement of Financial PositionKaye LiwagNo ratings yet

- Account Unit3 MbaDocument27 pagesAccount Unit3 MbaAnantha KrishnaNo ratings yet

- Summary 1 60Document73 pagesSummary 1 60Karen Joy Jacinto Ello100% (1)

- Financial StatementsDocument6 pagesFinancial Statementsnabeel aliNo ratings yet

- Learning Topic 1Document29 pagesLearning Topic 1Muhammad Irfan NoorNo ratings yet

- Act2 TablazonDocument3 pagesAct2 Tablazon0044 TABLAZON, ABBY NICOLE B.ENo ratings yet

- A Lecture6 9 29 22Document46 pagesA Lecture6 9 29 22by ScribdNo ratings yet

- Accounting ProcessDocument5 pagesAccounting Process23unnimolNo ratings yet

- Final AcountsDocument20 pagesFinal Acountskarthikeyan01No ratings yet

- LESSON 07 - The Financial Aspect For EntrepreneursDocument28 pagesLESSON 07 - The Financial Aspect For Entrepreneurssalubrekimberly92No ratings yet

- Management Accounting: DR Hla Hla MonDocument77 pagesManagement Accounting: DR Hla Hla MonAnonymous jrIMYSz9No ratings yet

- Unit 11 Reconciliation of Cost Financial: AccountsDocument18 pagesUnit 11 Reconciliation of Cost Financial: AccountsDrJay DaveNo ratings yet

- Chapter 1 Advanced Financial Statement Analysis and ValuationDocument46 pagesChapter 1 Advanced Financial Statement Analysis and ValuationGigiNo ratings yet

- Financial Statements List of Types and How To Read ThemDocument18 pagesFinancial Statements List of Types and How To Read ThemLucas MgangaNo ratings yet

- Financial Plan: Maranatha University College: Entrepreneurship Remy Puoru LecturerDocument22 pagesFinancial Plan: Maranatha University College: Entrepreneurship Remy Puoru LecturerGodwin QuarcooNo ratings yet

- Chapter NineDocument5 pagesChapter NineAdefolajuwon ShoberuNo ratings yet

- B215 AC03 Ibiz Software Solutions - 6th Presentation - 30apr2009Document34 pagesB215 AC03 Ibiz Software Solutions - 6th Presentation - 30apr2009tohqinzhiNo ratings yet

- Financial AccountingDocument124 pagesFinancial AccountingShashi Ranjan100% (1)

- Accounting Cambridge O LevelDocument6 pagesAccounting Cambridge O LevelAgha Saeed AhmedNo ratings yet

- Tally Erp.9Document50 pagesTally Erp.9Jancy Sunish100% (1)

- jp02 Financial-Statements - BWDocument2 pagesjp02 Financial-Statements - BWJinwon KimNo ratings yet

- The Financial Statements: Chapter OutlineDocument15 pagesThe Financial Statements: Chapter OutlineBhagaban DasNo ratings yet

- An Introduction To Sampling Methods: Population Vs SampleDocument6 pagesAn Introduction To Sampling Methods: Population Vs SampleMark Johnson LeeNo ratings yet

- Statistics: Is A Scientific Method That Deals With Collection, Organizing, Summarizing, Presenting, and Analyzing DataDocument13 pagesStatistics: Is A Scientific Method That Deals With Collection, Organizing, Summarizing, Presenting, and Analyzing DataMark Johnson LeeNo ratings yet

- M6, M7 ArtsDocument11 pagesM6, M7 ArtsMark Johnson LeeNo ratings yet

- Arrange Those Visible Elements To Make Effective Compositions: These Include: Balance, Unity, Variety, Harmony, Movement, Rhythm and EmphasisDocument11 pagesArrange Those Visible Elements To Make Effective Compositions: These Include: Balance, Unity, Variety, Harmony, Movement, Rhythm and EmphasisMark Johnson LeeNo ratings yet

- ART Prelim Modules (Narative)Document10 pagesART Prelim Modules (Narative)Mark Johnson LeeNo ratings yet

- The Bank Reconciliation Provides Comfort That A Company's Accounting Records, and Balance Sheet Reflect The Proper Amount of CashDocument1 pageThe Bank Reconciliation Provides Comfort That A Company's Accounting Records, and Balance Sheet Reflect The Proper Amount of CashMark Johnson LeeNo ratings yet

- Balance SheetDocument1 pageBalance SheetMark Johnson LeeNo ratings yet

- What To See:: Asset Liabilities EquityDocument1 pageWhat To See:: Asset Liabilities EquityMark Johnson LeeNo ratings yet

- Allowance For Bad DebtsDocument2 pagesAllowance For Bad DebtsMark Johnson LeeNo ratings yet

- Adjusting Entries (Depreciation)Document2 pagesAdjusting Entries (Depreciation)Mark Johnson LeeNo ratings yet

- Bank Reconciliation: MeaningDocument1 pageBank Reconciliation: MeaningMark Johnson LeeNo ratings yet

- Adjusting Entries (Depreciation)Document2 pagesAdjusting Entries (Depreciation)Mark Johnson LeeNo ratings yet

- Assignment of Credits and Other Incorporeal RightsDocument3 pagesAssignment of Credits and Other Incorporeal RightsMark Johnson LeeNo ratings yet

- BAV Examination Pre-ReadDocument10 pagesBAV Examination Pre-ReadAninda DuttaNo ratings yet

- FINC512 Assignement QuestionsDocument37 pagesFINC512 Assignement QuestionsNaina Malhotra0% (1)

- Persistent Systems: Equity Research - ModelDocument9 pagesPersistent Systems: Equity Research - ModelNaman MalhotraNo ratings yet

- 3a Far210 Topic 3 - Discussion of Tutorial QuestionsDocument5 pages3a Far210 Topic 3 - Discussion of Tutorial QuestionsniklynNo ratings yet

- (11-9) Replacement AnalysisDocument3 pages(11-9) Replacement AnalysismUZANo ratings yet

- 3.1 - Investiment AppraisalDocument25 pages3.1 - Investiment AppraisalSamrawit DoyoNo ratings yet

- Usant Accounting 4 Castroverde Final Exam Problem 1: QuestionsDocument8 pagesUsant Accounting 4 Castroverde Final Exam Problem 1: QuestionsRica Catangui100% (1)

- Kay TravelDocument2 pagesKay TravelEllen Joy Peniero67% (3)

- Chapter - 2 Forms of Business Organisation: One Line QuestionsDocument2 pagesChapter - 2 Forms of Business Organisation: One Line QuestionstanishaNo ratings yet

- Chapter IIIDocument20 pagesChapter IIIVan MateoNo ratings yet

- Final Accounts of CompaniesDocument32 pagesFinal Accounts of CompaniesbE SpAciAlNo ratings yet

- Icpenney Operates A Chain of Retail Department Stores Selling ApparelDocument1 pageIcpenney Operates A Chain of Retail Department Stores Selling ApparelHassan JanNo ratings yet

- 2 Partnership FormationDocument2 pages2 Partnership FormationArmhel FangonNo ratings yet

- Financial Statement AnalysisDocument62 pagesFinancial Statement AnalysisCECILLE ALBAO100% (1)

- Delvi IJEETDocument4 pagesDelvi IJEETihda0farhatun0nisakNo ratings yet

- TOA QuizletDocument13 pagesTOA QuizletJehugem BayawaNo ratings yet

- BbaDocument5 pagesBbadevNo ratings yet

- Alternative Investments and EquityDocument613 pagesAlternative Investments and EquitySen RinaNo ratings yet

- GW9 SJQ HSXM9 Spus JDocument15 pagesGW9 SJQ HSXM9 Spus JPradnya KambleNo ratings yet

- English For Accounting: Lecturer: Rosdiana Mata, S.S, M.PDDocument3 pagesEnglish For Accounting: Lecturer: Rosdiana Mata, S.S, M.PDAngelThamariskaTrixieTallanNo ratings yet

- FAR Vol 2 Chapter 19 21Document13 pagesFAR Vol 2 Chapter 19 21Allen Fey De Jesus50% (4)

- XboxDocument6 pagesXboxvenipaz63No ratings yet

- Activity Module 2Document1 pageActivity Module 2JEANNE PAULINE OABELNo ratings yet

- Inventory Cases - Sessions 3 & 4Document23 pagesInventory Cases - Sessions 3 & 4akansha.associate.workNo ratings yet

- GameDev Friendly Investors List From ACHIEVERS HUBDocument7 pagesGameDev Friendly Investors List From ACHIEVERS HUBSarahNo ratings yet

- Synthesis - IFRSDocument37 pagesSynthesis - IFRSRoseJeanAbingosaPernito0% (1)

- Tax Free ExchangeDocument4 pagesTax Free ExchangeLara YuloNo ratings yet

- Latihan Harga Bond Muhammad Jihad Rusnanda Sya'bani - 1810116024Document3 pagesLatihan Harga Bond Muhammad Jihad Rusnanda Sya'bani - 1810116024Muhamad JihadNo ratings yet

- Venture Studios - The Future of Venture Capital and Startup CreationDocument21 pagesVenture Studios - The Future of Venture Capital and Startup CreationJazeer JamalNo ratings yet

- FS Analysis BobadillaDocument20 pagesFS Analysis BobadillaJEP WalwalNo ratings yet