Professional Documents

Culture Documents

Crew Member'S Declaration NR A0000000: U.S. Customs and Border Protection

Uploaded by

KAREN VANESSA RODRIGUEZ MARQUEZOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Crew Member'S Declaration NR A0000000: U.S. Customs and Border Protection

Uploaded by

KAREN VANESSA RODRIGUEZ MARQUEZCopyright:

Available Formats

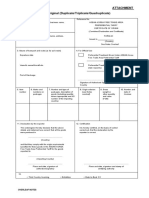

OMB Control Number:1651-0021; Expiration Date: 11/30/2020

U.S. Customs and Border Protection 1. Crew Member's Article No.

CREW MEMBER'S DECLARATION Nr A0000000

19 CFR 4.7, 4.7a, 4.81, 122.83, 122.84, 148.61-67

2. Carrier (Vessel Flag, Name) VH028 3. Date of Arrival 4 . Port of Arrival: MIA

06/08/2021

5 .Crew Member's Name Blair Romero Diaz 6 . Rank TCP 7.drfr

Date of Birth INSTRUCTIONS

04/06/1997 List all articles obtained abroad and prices paid or fair

value if not purchased. Include serial number with all

8 . Address: 11800 NW 101, Florida articles subject to registration such as cameras, radios,

etc.

9 . Answer Each Question :

List articles to remain on board separately from those

A. Are you carrying any fruits, B. Have you been on a C. Are you carrying over $10,000 in monetary articles to be landed in the United States.

plants, meats, other plant or farm or ranch outside instruments such as coin, currency, traveler's

animal products, birds, snails, the U.S.A. in the last checks, money orders, or negotiable List separately articles intended for sale, barter,

or other live organisms of any kind? 30 days? exchange, or carried by you as an accommodation for

instruments in bearer form? (If yes, you must

someone else.

file a report on FinCen 105)

Yes X No Yes X No Yes X No See additional instructions and information on reverse.

I. To be filled in by Crew Member II. For CBP Officer's Use

Cost or Value of

Quantity and Description of Goods Tariff Description Value Rate Duty

Gifts, etc.

I certify that the above statement is a just, true and c omplete account of all articles of foreign origin for which written

declaration and entry are required when landed in th e United States (defined on reverse side) and I also certify that this TOTAL

statement is a just, true, and complete declaration of all such articles which I am landing in the United States.

10 . CBP Officer Accepting Entry 11 . Signature of Crew Member 12 . Date 06/08/2021

BLAIR ROMERO D

RECEIPT FOR DUTY AND RELEASE SLIP Port Crew Member's Article No.

To be filled in by Crew Member

Name Carrier

Nr A0000000

Repeat List of Articles to Be Landed (include serial numbers when appropriate) For CBP Officer's Use

Date Duty $

Articles listed at left have been examined and passed

Pieces of Baggage Released:

of U.S. Customs and Border Protection

The CBP officer accepting the declaration and entry shall draw lines through unused spaces on receipt with ink.

Notice: Liquidation of amount of duties and taxes, if any, due on this entry is effective on date of payment of this amount (Section 159.10, C.R.) For

importer's right to protest or Government's right to re-determine this amount, see section 514 Tariff Act of 1930 as amended.

CBP Form 5129 (12/18) Page 1 of 2

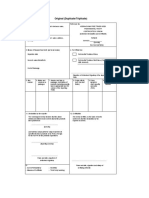

INSTRUCTIONS FOR USE

1. This declaration must be legibly prepared using pen, typewriter, or other permanent method. This declaration is required for all articles which are to be landed by a

crew member, including any person traveling on board a vessel, vehicle, or aircraft engaged in international traffic who is returning from a trip on which the person was

employed as a crew member.

2. Include serial number with all articles subject to registration, such as cameras, radios, etc. List articles to remain on board separately from those articles to be

landed in the United States. List separately articles intended for sale, barter, exchange, or carried by you as an accommodation for someone else.

3. All articles acquired abroad by the particular officer or crew member shall be declared on the declaration, with the exception of articles exclusively for use on the

voyage which include only necessary clothing, toiletries, and purely personal effects, and not to exceed 1 open (seal broken) liter container of alcoholic beverages, and 50

cigars, or

300 cigarettes, or 2 kilos of smoking tobacco, or a proportionate amount of each, and articles which have been previously cleared through Bureau of Customs and Border

Protection and described in a proper CBP receipt release form.

4. Articles in the possession of and exclusively for use by a crew member during the voyage, such as necessary clothing, toiletries, and purely personal effects, may be

brought ashore by the crew member on temporary shore or ground leave for use while in a port without a written declaration and entry and without payment of duty or

internal revenue tax ONLY if the Port Director of CBP for the port is satisfied that the articles so landed are necessary and appropriate for the crew member's

accommodation while on temporary shore or ground leave; that they will be devoted solely to the crew member's bona fide personal use; that the quantities are reasonable,

depending upon the circumstances of each particular case; and that, in the case of tobacco products and alcoholic beverages, the container shall have been opened and

the total quantity brought ashore while the vessel is in port shall not exceed 50 cigars, 300 cigarettes, or 2 kilos of smoking tobacco, or a proportionate amount of each, and

1 liter of alcoholic beverages. In the case of articles possessing substantial commercial value, such as cameras, watches, razors, and other articles not consumed through

use, the CBP officer concerned, before passing the articles free of duty, shall be assured beyond doubt that the article is brought ashore is for the actual bona fide personal

use of the crew member while on shore or ground leave and is to be returned to the vessel or aircraft.

5. In the column headed "Cost, Or Value of Gifts, Etc.", state in United States dollars the price actually paid for the articles, or fair value if not acquired by purchase, such as a

gift.

6. If additional space is needed to list all articles in column headed "Quantity and Description of Goods", include them in another declaration form obtained from purser. Do not

alter the preprinted serial number on the declaration. (If more than one form is needed by a crew member to list articles, all serial numbers of the forms used shall be noted

opposite the crew members name on the Crew's Effects Declaration, CBP Form 1304, or the Crew List, Customs and Immigration Form I-418).

7. If insufficient space on "Receipt for Duty and Release Slip" (lower perforated stub) to repeat the listing of all articles to be landed in the United States listed in the column

headed "Quantity and Description of Goods", continue on reverse side of stub.

8. This form may be printed by private parties (see footnote) as a 2-part or 3-part set for use as both a vessel's or aircraft's crew purchase manifest and the entry record for

articles landed in the United States, when the vessel or aircraft is to clear directly foreign from the first port of arrival.

WARNING-PENALTIES

The transportation of currency or monetary instruments, regardless of the amount, is legal, however, if you take out or bring into (or attempt to take out of or bring into)

X

the United States more than $10,000 (U.S. or foreign equivalent, or a combination of the two) in coin, currency, travelers checks or bearer instruments such as

money orders, checks, stocks or bonds, you are required by law to file a report on FinCEN Form 105 (formerly Customs Form 4790). If you have someone else

carry the currency or instruments for you, you must also file the report. FAILURE TO FILE THE REQUIRED REPORT OR FALSE STATEMENTS ON THE REPORT

MAY LEAD TO SEIZURE OF THE CURRENCY OR INSTRUMENTS AND TO CIVIL PENALTIES AND/OR CRIMINAL PROSECUTION.

AXclaim for exemption from duty on an article on the false ground that it is not intended for sale and acquired or carried by the declarant as an accommodation for

others will subject the articles to forfeiture.

Any

X article which is required to be manifested and which is not manifested is subject to forfeiture and the master of the vessel is subject to a penalty equal to the

forfeiture value (sec. 584, Tariff Act, 1930, as amended). If any article requiring a declaration and entry when brought into the United States is landed without

being covered by a release slip or other permit to unlade from the Port Director, Bureau of Customs and Border Protection, the article is subject to forfeiture, the vessel

master and any other person associated with the unauthorized removal are subject to penalties equal to the forfeiture value, and if valued at $500 or over, the vessel

itself is subject to forfeiture (sect. 453, Tariff Act, 1930).

This form may be printed by private parties, Blocks of serial numbers to be used on such forms will be furnished upon written request to the CBP,

Information Services Division, Forms Manager, Washington, DC 20229. Requests should state the quantity of serial numbers needed.

Paperwork Reduction Act Statement: An agency may not conduct or sponsor an information collection and a person is not required to respond to this

information unless it displays a current valid OMB control number and an expiration date. The control number for this collection is 1651-0021. The

estimated average time to complete this application is 10 minutes. If you have any comments regarding the burden estimate you can write to U.S.

Customs and Border Protection, Office of Regulations and Rulings, 799 9 th Street, NW., Washington DC 20229.

CBP Form 5129 (12/18) Page 2 of 2

You might also like

- Hollywood Dealmaking: Negotiating Talent Agreements for Film, TV and New MediaFrom EverandHollywood Dealmaking: Negotiating Talent Agreements for Film, TV and New MediaRating: 4.5 out of 5 stars4.5/5 (3)

- U.S. Customs Form: CBP Form 5129 - Crew Member's Declaration and InstructionsDocument2 pagesU.S. Customs Form: CBP Form 5129 - Crew Member's Declaration and InstructionsCustoms FormsNo ratings yet

- CBP Form 5129Document2 pagesCBP Form 5129BRANDON YESID SANA AVELLANo ratings yet

- U.S. Customs Form: CBP Form 7514 - Drawback Notice (Lading/FTZ Transfer)Document2 pagesU.S. Customs Form: CBP Form 7514 - Drawback Notice (Lading/FTZ Transfer)Customs FormsNo ratings yet

- Certificate of Free SaleDocument1 pageCertificate of Free SaleJhayd ManlapazNo ratings yet

- U.S. Customs Form: CBP Form 3171 - Application-Permit-Special License Unlading-Lading-Overtime ServicesDocument2 pagesU.S. Customs Form: CBP Form 3171 - Application-Permit-Special License Unlading-Lading-Overtime ServicesCustoms Forms0% (1)

- Att. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDocument2 pagesAtt. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDINI KUSUMAWATINo ratings yet

- Incoterms 2000: South CarolinaDocument58 pagesIncoterms 2000: South CarolinaDhanush KodiNo ratings yet

- ASEAN India OCP PDFDocument2 pagesASEAN India OCP PDFCha CahNo ratings yet

- COO SampleDocument1 pageCOO SampleAdolf NguyễnNo ratings yet

- Documentation and Finance: P (AceDocument11 pagesDocumentation and Finance: P (AceMillenia AdiniraNo ratings yet

- US Customs Docs Full SetDocument4 pagesUS Customs Docs Full SetleopardluigiNo ratings yet

- IowaPAC Hensley Contribution 04 16 2005Document1 pageIowaPAC Hensley Contribution 04 16 2005Zach EdwardsNo ratings yet

- House CustomsDocument1 pageHouse CustomsDavid BallotaNo ratings yet

- AVERY DENNISON CORPORATION 10-K (Annual Reports) 2009-02-25Document133 pagesAVERY DENNISON CORPORATION 10-K (Annual Reports) 2009-02-25http://secwatch.com100% (2)

- Bill of Lading Form - Printable TemplateDocument1 pageBill of Lading Form - Printable Templatecutieasiya102No ratings yet

- IncotermsDocument55 pagesIncotermsdheerajtiwari1No ratings yet

- NOT For Sale: 1. To The Board of Marine Engine OfficerDocument2 pagesNOT For Sale: 1. To The Board of Marine Engine OfficerMarco CalvaraNo ratings yet

- mtb18 60662 PDFDocument34 pagesmtb18 60662 PDFAnonymous JYxm0BhWNo ratings yet

- VMRR 001-2010Document1 pageVMRR 001-2010Mellissa ArriolaNo ratings yet

- 0993 HL AssociatesDocument5 pages0993 HL AssociatesYakshit JainNo ratings yet

- Chile Cert Origen ChinaDocument2 pagesChile Cert Origen ChinamiNo ratings yet

- Olsi-3 2016 UsDocument4 pagesOlsi-3 2016 UsOmar InNo ratings yet

- 1953 Flipbook PDFDocument1 page1953 Flipbook PDFMohamed RaafatNo ratings yet

- U.S. Customs Form: CBP Form 4315 - Application For Allowance in DutiesDocument2 pagesU.S. Customs Form: CBP Form 4315 - Application For Allowance in DutiesCustoms FormsNo ratings yet

- Rma Req t810211-g DubaiDocument2 pagesRma Req t810211-g DubaiUsman JabbarNo ratings yet

- CBP Form 1304 PDFDocument1 pageCBP Form 1304 PDFPavel ViktorNo ratings yet

- CHED MARINA CREW LIST and CSDocument3 pagesCHED MARINA CREW LIST and CSJohn Paulo LairdNo ratings yet

- Generalized System of Preferences For Goods Under Duty Free/ Quota Free For Least Developed Countries Certificate of Origin (Form DFQF)Document2 pagesGeneralized System of Preferences For Goods Under Duty Free/ Quota Free For Least Developed Countries Certificate of Origin (Form DFQF)Moges TolchaNo ratings yet

- U.S. Customs Form: CBP Form 1300 - Vessel Entrance or Clearance StatementDocument2 pagesU.S. Customs Form: CBP Form 1300 - Vessel Entrance or Clearance StatementCustoms FormsNo ratings yet

- Form 1300 CustomsDocument2 pagesForm 1300 Customsff88bvj4gvNo ratings yet

- Bill of LadingDocument1 pageBill of Ladingyesenia123433% (3)

- PRC Meo Form 5 / A Documentary Requirement For The STO and PRCDocument4 pagesPRC Meo Form 5 / A Documentary Requirement For The STO and PRCSto CuNo ratings yet

- Vantage Drilling CO 8-K (Events or Changes Between Quarterly Reports) 2009-02-20Document9 pagesVantage Drilling CO 8-K (Events or Changes Between Quarterly Reports) 2009-02-20http://secwatch.comNo ratings yet

- U.S. Customs Form: CBP Form 7512 - Transportation Entry and Manifest of Goods Subject To CBP Inspection and PermitDocument2 pagesU.S. Customs Form: CBP Form 7512 - Transportation Entry and Manifest of Goods Subject To CBP Inspection and PermitCustoms Forms100% (1)

- Crew'S Effects Declaration: U.S. Customs and Border ProtectionDocument1 pageCrew'S Effects Declaration: U.S. Customs and Border ProtectionAndreea CojocaruNo ratings yet

- 2excel TemplateDocument2 pages2excel Templateislah ksbNo ratings yet

- Cmo Forms 1Document3 pagesCmo Forms 1Alpha MirMNo ratings yet

- Jcmmc01.s2022-Annex H7-H8 Certificate of Sea Service and Crew ListDocument3 pagesJcmmc01.s2022-Annex H7-H8 Certificate of Sea Service and Crew Listmarvicmoral6197No ratings yet

- Form EDocument1 pageForm EHarenNo ratings yet

- Pp704-Sec-f08 Property Loss or Damage ReportDocument1 pagePp704-Sec-f08 Property Loss or Damage ReportMohamed MounerNo ratings yet

- U.S. Customs Form: CBP Form 3299 - Declaration For Free Entry of Unaccompanied ArticlesDocument2 pagesU.S. Customs Form: CBP Form 3299 - Declaration For Free Entry of Unaccompanied ArticlesCustoms FormsNo ratings yet

- Generalized System of Preferences Certificate of Origin (Combined Declaration and Certificate) Form ADocument1 pageGeneralized System of Preferences Certificate of Origin (Combined Declaration and Certificate) Form ALim DongseopNo ratings yet

- U.S. Customs Form: CBP Form 1302 - Inward Cargo DeclarationDocument1 pageU.S. Customs Form: CBP Form 1302 - Inward Cargo DeclarationCustoms FormsNo ratings yet

- Guayacan Ficha TecnicaDocument4 pagesGuayacan Ficha TecnicaCarlosBohmannNo ratings yet

- Bill of LadingDocument1 pageBill of LadingJaviera GarateNo ratings yet

- U.S. Customs Form: CBP Form 349 - Harbor Maintenance Fee Quarterly Summary ReportDocument2 pagesU.S. Customs Form: CBP Form 349 - Harbor Maintenance Fee Quarterly Summary ReportCustoms FormsNo ratings yet

- EIF The IMO Number Explained PDFDocument8 pagesEIF The IMO Number Explained PDFhelga perangin anginNo ratings yet

- Bol - 00000004 R&LDocument1 pageBol - 00000004 R&LJe-Ann Tabo-taboNo ratings yet

- Bill of Lading Form - Printable TemplateDocument1 pageBill of Lading Form - Printable TemplateFlorencia B. QuiñonesNo ratings yet

- China FJ fj3 enDocument7 pagesChina FJ fj3 enjverdugo272015No ratings yet

- SuppQuote - 3754-00748 - AFFFDocument2 pagesSuppQuote - 3754-00748 - AFFFmanolo floresNo ratings yet

- U.S. Customs Form: CBP Form 226 - Record of Vessel Foreign Repair or Equipment PurchaseDocument2 pagesU.S. Customs Form: CBP Form 226 - Record of Vessel Foreign Repair or Equipment PurchaseCustoms FormsNo ratings yet

- Mcafee LLC: Mercury World CargoDocument12 pagesMcafee LLC: Mercury World CargoDavidNo ratings yet

- BL FormatoDocument2 pagesBL FormatoBetsabeth LopezNo ratings yet

- I. Reason For ApplicationDocument4 pagesI. Reason For ApplicationMariyath Muraleedharan KiranNo ratings yet

- DHL Global Forwarding: La Chile AirlinesDocument12 pagesDHL Global Forwarding: La Chile AirlinesDavidNo ratings yet

- DHL Global Forwarding: La Chile AirlinesDocument12 pagesDHL Global Forwarding: La Chile AirlinesDavid Solorzano GuerraNo ratings yet

- Notas de CienciasDocument1 pageNotas de CienciasKAREN VANESSA RODRIGUEZ MARQUEZNo ratings yet

- Investigacion Love and ColeraDocument4 pagesInvestigacion Love and ColeraKAREN VANESSA RODRIGUEZ MARQUEZNo ratings yet

- CBP Form 6059B English (Sample Watermark)Document2 pagesCBP Form 6059B English (Sample Watermark)abhiNo ratings yet

- CBP Form 6059B English (Sample Watermark)Document2 pagesCBP Form 6059B English (Sample Watermark)abhiNo ratings yet

- The Art of Aeronautical Decision (ADM) FAADocument12 pagesThe Art of Aeronautical Decision (ADM) FAAHuaseongNo ratings yet

- IT-C-20-I YEAR - CompressedDocument148 pagesIT-C-20-I YEAR - Compressedsoma rajNo ratings yet

- Scotts Behavioral Interview: Scotts Program BI-Supplier 1Document2 pagesScotts Behavioral Interview: Scotts Program BI-Supplier 1SteveNo ratings yet

- Discussion Text 2Document5 pagesDiscussion Text 2Faustina KadjuNo ratings yet

- UTS-QP-024 Handling of Test ItemsDocument2 pagesUTS-QP-024 Handling of Test Itemsswapon kumar shillNo ratings yet

- Activity Completion Report: A Lampshade Making ProjectDocument7 pagesActivity Completion Report: A Lampshade Making ProjectciriloNo ratings yet

- Mil Mi 171 Flight Manual Book 1.stampedDocument465 pagesMil Mi 171 Flight Manual Book 1.stampedcharles_ac100% (15)

- LESSON 1 To 3 SCIENCEDocument51 pagesLESSON 1 To 3 SCIENCECasey Dela FuenteNo ratings yet

- History of RetailingDocument3 pagesHistory of RetailingANKIT SINGHNo ratings yet

- Pe 5Document5 pagesPe 5Ferb CruzadaNo ratings yet

- Wilkes University School of Nursing NSG 505 Policy Brief and Advocacy Letter AssignmentDocument3 pagesWilkes University School of Nursing NSG 505 Policy Brief and Advocacy Letter AssignmentSteveNo ratings yet

- Environmental Improvement of Urban SlumsDocument9 pagesEnvironmental Improvement of Urban SlumsSanatNo ratings yet

- Student Pro - Bono Work Card - ShubhitDocument2 pagesStudent Pro - Bono Work Card - ShubhitSME 865No ratings yet

- INCONTROL Company ProfileDocument11 pagesINCONTROL Company ProfileInControl Group InfoNo ratings yet

- Overview of Enterprise Resource Planning (Erp) System in Higher Education Institutions (Heis)Document21 pagesOverview of Enterprise Resource Planning (Erp) System in Higher Education Institutions (Heis)TashfeenNo ratings yet

- Rifts d20 Conversion Manual v34Document192 pagesRifts d20 Conversion Manual v34bossloki67% (3)

- Template For Clil Unit Plan For Teyl SensesDocument31 pagesTemplate For Clil Unit Plan For Teyl SensesSonia Felipe MartínezNo ratings yet

- DSD Jail Operations Audit ReportDocument84 pagesDSD Jail Operations Audit Report9newsNo ratings yet

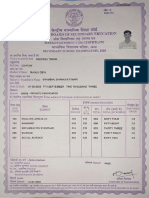

- Sehool 99999-PRIVATE CANDIDATES: Theory, Pr. Total Total (In Words) GDDocument1 pageSehool 99999-PRIVATE CANDIDATES: Theory, Pr. Total Total (In Words) GDDeepesh Tiwari100% (1)

- Tour Guide Syllabus: Quality Improvement For The Cross-Border Tourism in The Danube Delta (Romania, Ukraine and Moldova)Document11 pagesTour Guide Syllabus: Quality Improvement For The Cross-Border Tourism in The Danube Delta (Romania, Ukraine and Moldova)eltonNo ratings yet

- Zeeshan Sarwar Khan: Professional ExperienceDocument3 pagesZeeshan Sarwar Khan: Professional Experiencezeekhan898No ratings yet

- FSCJ Unofficial TranscriptsDocument2 pagesFSCJ Unofficial TranscriptsMegan AllenNo ratings yet

- Trends in Product Design and DevelopmentDocument611 pagesTrends in Product Design and Developmentdr psNo ratings yet

- Professional Development Plan DescriptionDocument33 pagesProfessional Development Plan DescriptionHessa MohammedNo ratings yet

- Mawar (Against Moneylenders) : Integrated Financial Inclusion Strategy in Sharia-Based Msme Finance in SemarangDocument20 pagesMawar (Against Moneylenders) : Integrated Financial Inclusion Strategy in Sharia-Based Msme Finance in SemarangDorothy Eugene NindyaNo ratings yet

- Client's Request Form (CRF English) - 09012018 With Address PDFDocument1 pageClient's Request Form (CRF English) - 09012018 With Address PDFAisha HamanNo ratings yet

- Philippine Health Insurance CorporationDocument2 pagesPhilippine Health Insurance CorporationJaikonnenNo ratings yet

- Mse Observation Field Performance Instrument 2020-2021 Candrews 3Document9 pagesMse Observation Field Performance Instrument 2020-2021 Candrews 3api-510185013No ratings yet

- Sign Language For BeginnersDocument34 pagesSign Language For BeginnersOnika Clarke-Gordon50% (2)

- Who Is This Person Writing My PHD?Document2 pagesWho Is This Person Writing My PHD?Toyin AdepojuNo ratings yet

- Governmentofkerala: Q Q (M ) NC? 2 QI F I! RI L:! 4 Ih L:! I!l:I!I!l:J: JHL L:PL:!! (L!!LDocument11 pagesGovernmentofkerala: Q Q (M ) NC? 2 QI F I! RI L:! 4 Ih L:! I!l:I!I!l:J: JHL L:PL:!! (L!!LSabitha N MNo ratings yet