Professional Documents

Culture Documents

Commitments of Traders Summary

Commitments of Traders Summary

Uploaded by

Phương NguyễnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commitments of Traders Summary

Commitments of Traders Summary

Uploaded by

Phương NguyễnCopyright:

Available Formats

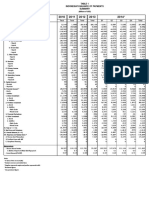

Commitments of Traders Summary

Friday, September 3, 2021

Futures & Options Summary - Data As Of: 8/31/2021

Commercial Non-Commercial Non-Reportable

Net Wk 52wk Net Wk 52wk Net Wk 52wk

Position Change Rank Position Change Rank Position Change Rank

Combinations

CBOT Grains -291,648 41,083 51 407,865 -38,361 4 -116,217 -2,722 2

Crude Oil Complex -571,730 2,543 50 505,283 -9,762 1 66,450 7,223 17

CBOT Grains and Soy Complex -396,342 63,457 52 488,469 -55,714 2 -92,126 -7,743 1

Non-Financial -1,972,318 42,027 52 1,884,461 -39,440 3 87,861 -2,582 4

Combined Precious Metals -306,013 -11,664 41 258,297 10,075 20 47,717 1,589 3

Combined Soy Complex -145,807 39,132 52 147,552 -30,929 1 -1,744 -8,203 1

Currencies

Canadian -7,153 9,775 40 -577 -7,988 16 7,730 -1,787 2

Dollar -26,181 -421 1 20,685 329 52 5,497 94 50

Euro -53,480 4,650 52 11,939 -13,107 1 41,541 8,457 8

Energies

Crude Oil -464,490 13,711 52 425,777 -17,827 1 38,714 4,118 15

Heating Oil -56,709 -3,874 1 38,310 4,083 52 18,400 -208 24

Natural Gas 109,192 -19,389 50 -144,585 21,391 3 35,393 -2,002 44

Gas (RBOB) -50,531 -7,294 47 41,196 3,982 8 9,336 3,313 19

Financials

Bonds 107,745 32,998 11 -101,636 -7,769 40 -6,109 -25,229 30

Dow Jones $5 -4,698 786 10 -2,577 -1,154 40 7,274 367 44

Nasdaq Mini 15,453 -3,401 29 -807 -2,595 33 -14,646 5,995 7

E-Mini S&P -77,546 35,933 20 -39,556 -48,064 7 117,102 12,132 48

T-Notes 221,106 190,638 47 4,874 -187,867 7 -225,980 -2,771 16

Grains

Canola Oil -29,954 -5,813 27 28,030 6,026 25 1,924 -213 47

Corn -236,624 20,878 46 317,678 -21,236 11 -81,054 358 2

KC Wheat -42,145 1,577 22 40,896 -297 31 1,249 -1,279 41

Minn Wheat -26,766 1,732 4 18,186 -601 46 8,579 -1,131 40

Rice 577 725 49 -755 -442 4 178 -283 3

Soybeans -41,113 16,758 52 66,948 -13,576 1 -25,835 -3,182 2

Soymeal -47,651 12,275 52 28,343 -9,763 1 19,309 -2,512 1

Soyoil -57,043 10,099 49 52,261 -7,590 4 4,782 -2,509 2

Wheat -13,911 3,447 30 23,239 -3,549 18 -9,328 102 48

Livestock

Feeder Cattle 1,491 -372 5 10,296 -1,132 50 -11,787 1,503 14

Hogs -77,152 -2,630 19 94,092 2,234 46 -16,941 395 2

Cattle -89,086 8,405 9 108,278 -11,272 46 -19,192 2,867 3

Metals

Copper -26,943 -13,745 47 22,032 13,909 11 4,912 -162 13

Gold -253,987 -8,819 29 228,975 8,469 27 25,012 350 3

Palladium 176 -116 51 -258 196 2 83 -79 1

Platinum -14,106 968 49 8,039 -853 3 6,067 -116 9

Silver -38,096 -3,697 50 21,541 2,263 3 16,555 1,434 14

Softs

Cocoa -24,100 5,570 37 21,483 -5,357 19 2,617 -213 4

Coffee -58,711 -4,101 14 53,063 3,129 37 5,647 971 23

Cotton -119,245 -2,118 2 108,567 2,222 52 10,678 -104 36

Lumber -414 -46 38 59 -26 4 354 70 22

Milk -395 -301 47 5,293 -345 1 -4,896 648 31

OJ -6,956 23 2 4,745 131 52 2,211 -153 46

Sugar -337,580 12,361 17 290,762 -7,583 42 46,818 -4,778 13

Green Cells = Extreme Long / Red Cells = Extreme Short

This report includes information from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made and we do not guarantee its accuracy or completeness.

Opinions expressed are subject to change without notice. Any information or recommendation contained herein: (i) is not based on, or tailored to, the commodity interest or cash market positions or other circumstances

or characterizations of particular investors or traders; (ii) is not customized or personalized for any such investor or trader; and (iii) does not take into consideration, among other things, risk tolerance, net worth, or

available risk capital. Any use or reliance upon the information or recommendations is at the sole discretion and election of the subscriber. The risk of loss in trading futures contracts or commodity options can be

substantial, and traders should carefully consider the inherent risks of such trading in light of their financial condition. Any reproduction or retransmission of this report without the express written consent of The

Hightower Report is strictly prohibited.

You might also like

- Natasha Kingery CaseDocument5 pagesNatasha Kingery CaseAlan BublathNo ratings yet

- Session 3 - Valuation Model - AirportsDocument105 pagesSession 3 - Valuation Model - AirportsPrathamesh GoreNo ratings yet

- Main Idea: Multiple ChoiceDocument1 pageMain Idea: Multiple ChoiceHartonoNo ratings yet

- 5.3.2 WTS Reserve Report As of 7-1-2023 (Yorktown - Dewitt)Document15 pages5.3.2 WTS Reserve Report As of 7-1-2023 (Yorktown - Dewitt)Ross ConwayNo ratings yet

- DSR SahidLippo 2022 V7Document142 pagesDSR SahidLippo 2022 V7Adivia DragunsonNo ratings yet

- (FM) AssignmentDocument7 pages(FM) Assignmentnuraini putriNo ratings yet

- I.4. Posisi Pinjaman Rupiah Dan Valas Yang Diberikan Bank Umum Dan BPR Menurut Kelompok Bank Dan Lapangan Usaha (Miliar RP)Document2 pagesI.4. Posisi Pinjaman Rupiah Dan Valas Yang Diberikan Bank Umum Dan BPR Menurut Kelompok Bank Dan Lapangan Usaha (Miliar RP)Izzuddin AbdurrahmanNo ratings yet

- Table 03 1 Aircraft MovementsDocument3 pagesTable 03 1 Aircraft MovementsAlberto Rivas CidNo ratings yet

- LACP Drilling Base Case WD 2022 Daily ProgressDocument99 pagesLACP Drilling Base Case WD 2022 Daily ProgressNicolas CostaNo ratings yet

- iMNS7jsuRvmEyLaZkLer - APS Balance SheetDocument3 pagesiMNS7jsuRvmEyLaZkLer - APS Balance SheetWajahat MazharNo ratings yet

- Annual Report 2022Document512 pagesAnnual Report 2022JohnNo ratings yet

- Praveen Subramanya: No. A 12, Kumar Guest House, KKGH Road, Bengaluru - 560001Document3 pagesPraveen Subramanya: No. A 12, Kumar Guest House, KKGH Road, Bengaluru - 560001kowsthubha 94No ratings yet

- Executive Cargo Report 2024 01Document1 pageExecutive Cargo Report 2024 01manthar.khan.001No ratings yet

- Final Project BSAF ADocument7 pagesFinal Project BSAF Aعصام المحمودNo ratings yet

- B. Model Ekonomi Teknis: Economic Model Annual SummaryDocument7 pagesB. Model Ekonomi Teknis: Economic Model Annual SummaryDheo AlviansyahNo ratings yet

- Fixed AssetsDocument33 pagesFixed AssetsmehboobalamNo ratings yet

- Serasa Experian Credit RatingDocument8 pagesSerasa Experian Credit Ratingsrmfilho123No ratings yet

- 2023 Plws MonitoringDocument4 pages2023 Plws MonitoringCris GapasNo ratings yet

- Festive Dan Loyalty Q1 AmbonDocument4 pagesFestive Dan Loyalty Q1 AmbonBernadheta. A.SermatanNo ratings yet

- Gaji Induk PNS Mei 2022 InhilDocument102 pagesGaji Induk PNS Mei 2022 Inhilfajri sabtiNo ratings yet

- MONTHLY TOP BONUS MASTER Sheet4Document4 pagesMONTHLY TOP BONUS MASTER Sheet4gailyNo ratings yet

- Historical Data BoeingDocument90 pagesHistorical Data BoeingRohit BhangaleNo ratings yet

- Consolidated Profit & Loss Statement (Monthly)Document1 pageConsolidated Profit & Loss Statement (Monthly)Ever AlcazarNo ratings yet

- UntitledDocument9 pagesUntitledvijajahNo ratings yet

- Certificate of Sales - February 2020Document1 pageCertificate of Sales - February 2020Precious Gail SantosNo ratings yet

- Opp Efficiency 2022-2023Document33 pagesOpp Efficiency 2022-2023Dasari VenkateshNo ratings yet

- Budget RH #09-2021-FRDocument13 pagesBudget RH #09-2021-FRKingo ZizoNo ratings yet

- SPE Basic Accting and Project Eval 11-2015 - RMartinezDocument40 pagesSPE Basic Accting and Project Eval 11-2015 - RMartinezjose naviaNo ratings yet

- Bahawalpur (Aslam Traders) Monthly Closing Sales 2020, 2021Document6 pagesBahawalpur (Aslam Traders) Monthly Closing Sales 2020, 2021Ali AsadNo ratings yet

- WorkingDocument5 pagesWorkingsugunec2013No ratings yet

- Sports Direct International PLC: Accounting Year: Peer Group Year Year Turnover TH GBPDocument3 pagesSports Direct International PLC: Accounting Year: Peer Group Year Year Turnover TH GBPCarmen MesescuNo ratings yet

- CAMEL Acqui Com Fev 2024 INASCODocument6 pagesCAMEL Acqui Com Fev 2024 INASCOnankenkmNo ratings yet

- Annual Project Report 2013-2014-2Document140 pagesAnnual Project Report 2013-2014-2umangcomputersNo ratings yet

- BS and CFDocument2 pagesBS and CFSachin SharmaNo ratings yet

- Kingston Educational Institute: Ratio AnalysisDocument1 pageKingston Educational Institute: Ratio Analysisdhimanbasu1975No ratings yet

- ProfilerDocument2 pagesProfilerTheDi CrwalingsNo ratings yet

- Sales Summary For 22-05-2021 NewDocument59 pagesSales Summary For 22-05-2021 NewilkhouwevNo ratings yet

- Daily Report 04 February 2011Document5 pagesDaily Report 04 February 2011abhijit_athalyeNo ratings yet

- 2017 Energy Designated StatisticsDocument1 page2017 Energy Designated StatisticsMarc Benedict TalamayanNo ratings yet

- FPI Data Analysis Latest UpdatedDocument7 pagesFPI Data Analysis Latest UpdatedSiddharth PandyaNo ratings yet

- Petroleum Planning & Analysis Cell: NotesDocument19 pagesPetroleum Planning & Analysis Cell: NotesVignesh Faque JockeeyNo ratings yet

- Sno. Sections Amount (Inr) Sep-21 Civil and Structural ADocument4 pagesSno. Sections Amount (Inr) Sep-21 Civil and Structural AJay UseitNo ratings yet

- Credit Note of MayDocument2 pagesCredit Note of MayKamran RasoolNo ratings yet

- 3.1.projected Balance SheetDocument1 page3.1.projected Balance Sheetdhimanbasu1975No ratings yet

- Financial Statement: Bajaj Auto LTDDocument20 pagesFinancial Statement: Bajaj Auto LTDrohanNo ratings yet

- Items 2010 2011 2012 2013 2014 : (Millions of USD)Document12 pagesItems 2010 2011 2012 2013 2014 : (Millions of USD)kongbengNo ratings yet

- Retention ViewDocument233 pagesRetention ViewSagar GuptaNo ratings yet

- Balance Sheet For Group and SegmentsDocument2 pagesBalance Sheet For Group and Segmentstry6y6hmhbNo ratings yet

- Aarondale P&LDocument8 pagesAarondale P&LAlviNo ratings yet

- Master Tabel Mro Juni 2023Document29 pagesMaster Tabel Mro Juni 2023inhu07No ratings yet

- UBL Annual Report 2018-129Document1 pageUBL Annual Report 2018-129IFRS LabNo ratings yet

- Financial DataDocument6 pagesFinancial DataCyd DuqueNo ratings yet

- Introduction To Business Finance Chemical Industry: Submitted To: Ma'Am Shakira FareedDocument69 pagesIntroduction To Business Finance Chemical Industry: Submitted To: Ma'Am Shakira Fareedmohtashim khalidNo ratings yet

- ICICI Form-Nl-7-Operating-Expenses-ScheduleDocument2 pagesICICI Form-Nl-7-Operating-Expenses-ScheduleSatyamSinghNo ratings yet

- FPIP. Cost Evaluation. S1 Admin Roof Replacement Repair .2024 02 21Document12 pagesFPIP. Cost Evaluation. S1 Admin Roof Replacement Repair .2024 02 21Lester CabungcalNo ratings yet

- Financials VTL FinalDocument19 pagesFinancials VTL Finalmuhammadasif961No ratings yet

- 8-Trade and PaymentDocument16 pages8-Trade and PaymentAhsan Ali MemonNo ratings yet

- Hyperion Master Sheet NL 2013 FinalDocument22 pagesHyperion Master Sheet NL 2013 Finalannemarie van zadelhoffNo ratings yet

- Driver Scorecard Report V2.1Document2 pagesDriver Scorecard Report V2.1TimothyNo ratings yet

- Planning Decision Support ModelDocument2,505 pagesPlanning Decision Support ModelwahajNo ratings yet

- Cme Group Inc.: FORM 10-KDocument107 pagesCme Group Inc.: FORM 10-KLan HoàngNo ratings yet

- Section27 British Pound Call OptionsDocument5 pagesSection27 British Pound Call OptionsLan HoàngNo ratings yet

- Preliminary: Interest Rate Futures PG09 Fri, Jun 11, 2021 PG09 Bulletin # 111@Document1 pagePreliminary: Interest Rate Futures PG09 Fri, Jun 11, 2021 PG09 Bulletin # 111@Lan HoàngNo ratings yet

- Section34 Japanese Yen Put OptionsDocument3 pagesSection34 Japanese Yen Put OptionsLan HoàngNo ratings yet

- USDA Hogs & Pigs Review Thursday, March 25, 2021: Report SummaryDocument2 pagesUSDA Hogs & Pigs Review Thursday, March 25, 2021: Report SummaryLan HoàngNo ratings yet

- Lower Soybeans Ease On Increased U.S. Carryout, Strong South American OutputDocument1 pageLower Soybeans Ease On Increased U.S. Carryout, Strong South American OutputLan HoàngNo ratings yet

- Marijuana LegalizationDocument10 pagesMarijuana Legalizationapi-253373502No ratings yet

- Guru Ravidas Ayurved University, Punjab, HoshiarpurDocument6 pagesGuru Ravidas Ayurved University, Punjab, HoshiarpurGursimranNo ratings yet

- Questions On "Hunting The Elements" Video (20 Marks)Document3 pagesQuestions On "Hunting The Elements" Video (20 Marks)Intan Ayuna FahriNo ratings yet

- DairyDocument9 pagesDairyvikrantNo ratings yet

- Sarnacol 2142S PDS Sika SarnafilDocument3 pagesSarnacol 2142S PDS Sika SarnafilKRISHNA PRASATH SNo ratings yet

- Gulf Stream Could Collapse As Early As 2025Document3 pagesGulf Stream Could Collapse As Early As 2025johnosborneNo ratings yet

- Aviation Meteorology - SPLDocument71 pagesAviation Meteorology - SPLGaurav NitnawareNo ratings yet

- West SyndromeDocument16 pagesWest Syndromeelma wiliandiniNo ratings yet

- Azolla ZS 68 MSDS PDFDocument5 pagesAzolla ZS 68 MSDS PDFMohamed ElnagdyNo ratings yet

- 2 Chemistry Exam ReviewDocument5 pages2 Chemistry Exam ReviewDA RATNo ratings yet

- Real Time Respiration Rate Measurement Using Temperature SensorDocument3 pagesReal Time Respiration Rate Measurement Using Temperature SensorEditor IJRITCCNo ratings yet

- Hubungan Tungau Debu Rumah Terhadap Angka Kejadian Rinitis Alergi Yang Berobat Di Poli THT Rsud Bangli TAHUN 2019Document12 pagesHubungan Tungau Debu Rumah Terhadap Angka Kejadian Rinitis Alergi Yang Berobat Di Poli THT Rsud Bangli TAHUN 2019RiskaaNo ratings yet

- Aptis G&V Old WB Tests 1,2,3 and AnswersDocument35 pagesAptis G&V Old WB Tests 1,2,3 and AnswersOlivia Marie McardleNo ratings yet

- IOT Based Accident Detection and PreventionDocument6 pagesIOT Based Accident Detection and PreventionShivani PatilNo ratings yet

- Atlas CopcoDocument9 pagesAtlas Copcojrsdve100% (1)

- Mil STD 883 4Document43 pagesMil STD 883 4Eduardo José TagleNo ratings yet

- 787 Walk 787-Walk 20120322 AllDocument91 pages787 Walk 787-Walk 20120322 Allapache9000No ratings yet

- Spe 129157 MsDocument16 pagesSpe 129157 MsFelipe BañosNo ratings yet

- Wedeco TAK55 UV DesinfectationDocument12 pagesWedeco TAK55 UV DesinfectationCarlos RamírezNo ratings yet

- 1408 Unit 3 Study Guide Campbell 8thDocument19 pages1408 Unit 3 Study Guide Campbell 8thFaith Palmer100% (1)

- IrrigationDocument19 pagesIrrigationpriya santosh nalamwarNo ratings yet

- Semester Spring 2020 Social Psychology (PSY403) Assignment No. 01Document4 pagesSemester Spring 2020 Social Psychology (PSY403) Assignment No. 01Hafsa YaseenNo ratings yet

- Instant Download Managerial Economics Theory Applications and Cases Eighth Edition 8th Edition Ebook PDF PDF FREEDocument33 pagesInstant Download Managerial Economics Theory Applications and Cases Eighth Edition 8th Edition Ebook PDF PDF FREEraymond.heras709100% (46)

- Yoga For DepressionDocument12 pagesYoga For DepressionSoulyogaNo ratings yet

- SAIC-A-2024 Rev 6 Leakness Tightness TestDocument3 pagesSAIC-A-2024 Rev 6 Leakness Tightness Testpookkoya thangalNo ratings yet

- Full Download Ebook Ebook PDF Marketing 4th Edition Australia by David Waller PDFDocument41 pagesFull Download Ebook Ebook PDF Marketing 4th Edition Australia by David Waller PDFbrenda.richardson73098% (46)

- National Economics University Advanced Educational Program: 3. Should Working Mums Be Given Special Privileges?Document4 pagesNational Economics University Advanced Educational Program: 3. Should Working Mums Be Given Special Privileges?Dương Nguyễn ThuỳNo ratings yet

- SF6 MSDSDocument6 pagesSF6 MSDSbejeweled87No ratings yet

- 1A - Discussion ForumDocument3 pages1A - Discussion ForumGionne Carlo GomezNo ratings yet