Professional Documents

Culture Documents

Grain Comments Highlight Lower Soybeans on US, Brazil Supply

Uploaded by

Lan HoàngOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Grain Comments Highlight Lower Soybeans on US, Brazil Supply

Uploaded by

Lan HoàngCopyright:

Available Formats

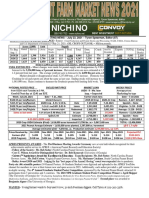

MORNING GRAIN COMMENTS

Matt Zeller | matt.zeller@stonex.com |Friday, June 11, 2021

CURRENT TREND: Lower REASON: Soybeans ease on increased U.S. carryout, strong South American output

CFTC REPORTS @ 2:30 PM

MORNING TRIVIA: On this day in 1962, Frank Morris, John Anglin, and Clarence Anglin became the only people to ever successfully flee ____...

MARKET HEADLINES NIGHT SESSION (to 7:00 AM): Grain Volume: 168,030

• Quick Editorial: soybeans are set to post a fourth straight lower high after Symbol High Low Last Chg Vol

Monday’s top, sinking into chart support and with the fundamental aid of CN1 703.00 686.25 687.50 -11.50 20,376

slightly-increased USDA carryouts and solid Brazilian production this season.

• South Korea’s MFG bought around 65k tonnes of optional-origin feed wheat CU1 641.50 621.75 623.50 -14.75 7,352

this morning at $313/tonne cost plus freight, for July or August shipment. CZ1 619.75 598.75 600.50 -16.00 27,126

• FranceAgriMer reported a one-point increase in French soft wheat ratings this WN1 688.00 676.25 677.00 -6.75 10,687

week, to 81% g/ex, up from 56% last year; corn was steady at 91% g/ex.

• The B.A. Exchange raised ‘20/21 Argentine corn production from 46 to 48 KWN1 642.75 630.75 631.25 -9.00 3,372

MMT due to better-than-expected late yields, with 38% of the crop harvested. SN1 1551.25 1527.75 1528.75 -15.25 16,368

• Mexico’s top farm lobby still has not received any guarantee that the coun- 1,621

try’s GMO corn ban will not apply to imported corn; the CNA lobby says the SU1 1473.50 1446.25 1446.75 -21.50

government is already holding up eight pending import permits for GMO SX1 1464.25 1435.75 1436.50 -23.00 11,787

corn, along with permits for other farm products including glyphosate. They

stated that it would be impossible to substitute current levels of GMO corn SMN1 383.90 379.20 379.50 -2.10 6,864

with non-GMO shipments or increased domestic output levels. The U.S. ex- BON1 70.60 68.25 68.28 -2.18 13,219

ports around 16 MMT of corn per year to Mexico, nearly all of it GMO.

• Brazil’s CONAB cut their official 2020/21 corn production estimate from CLN1 70.80 69.68 70.43 +0.14 100,584

106.4 to 96.4 MMT this month, with second-crop output down from 79.8 to DXY 90.31 89.96 90.31 +0.23 3,521

just under 70 MMT. Soybean output rose from 135.4 to 135.9 million tonnes, FUNDAMENTAL UPDATE

with wheat output seen at 6.9 MMT for 2021, up from 6.2 MMT last season. New-crop (2021/22) corn export sales basically slowed to a

• ‘20/21 Export Sales (000 tonnes): This Week / Estimates / Last Week crawl this week at just 26.4k tonnes, or just over a million

Corn: 189.6 / 100-500 / 531.1 Beans: 15.6 / -(100)-200 / 17.8 bushels. Cumulative new-crop sales still stand at more than

Meal: 136.3 / 100-300 / 217.7 Oil: 3.1 / -(10)-16 / 1.0 15 MMT (almost 600 mln bu), massively ahead of any oth-

• ‘21/22 Export Sales (000 tonnes): This Week / Estimates / Last Week er season’s pace at this point. China is obviously the top

Corn: 26.4 / 200-600 / 439.5 Beans: 105.0 / 100-400 / 180.3 destination at 10.744 MMT (423 mbu), with Mexico sec-

Wheat: 325.9 / 200-450 / 398.3 Meal: 3.9 / 0-50 / 0.5 ond at 1.87 MMT (73 mbu), “unknown” third at 885k

tonnes (35 mbu), and Japan fourth at 775k tonnes (30 mbu).

• ‘20/21 USDA Carryout (bln bu): June USDA / Avg Est / May USDA

Corn: 1.107 / 1.207 / 1.257 Beans: 0.135 / 0.122 / 0.120 New-Crop Corn Export Sales

Wheat: 0.852 / 0.869 / 0.872

18 708

• ‘21/22 USDA Carryout (bln bu): June USDA / Avg Est / May USDA Current

Corn: 1.357 / 1.423 / 1.507 Beans: 0.155 / 0.146 / 0.140

Wheat: 0.770 / 0.783 / 0.774 LY

16 630

• ‘20/21 World Carryout (MMT): June USDA / Avg Est / May USDA 19/20

Corn: 280.6 / 280.8 / 283.5 Beans: 88.00 / 87.14 / 86.55

Wheat: 293.5 / 294.4 / 294.7 18/19

14 551

• ‘21/22 World Carryout (MMT): June USDA / Avg Est / May USDA 17/18

Corn: 289.4 / 289.2 / 292.3 Beans: 92.55 / 91.22 / 91.10 16/17

Wheat: 296.8 / 294.5 / 295.0

WEATHER UPDATE 12 472

Million Bushels

• WCB rain chances arrive today but conditions remain dry otherwise; precip is

Million Tonnes

creeping in to east a bit later into the 11-15 day. Temps remain above-normal.

NWS 6-10 DAY OUTLOOK: TEMPS & PRECIP 10 394

8 315

6 236

CFTC MANAGED MONEY & RECORD (Since June 2006) POSITIONS:

4 157

Corn Beans Meal Oil Chi Wheat KC Wheat

Daily 10,000 -10,000 -6,000 -1,000 1,000 0 2 79

Est Net 337,600 139,421 7,355 92,029 -7,777 18,385

Rec + 498,177 260,433 132,126 125,722 66,351 72,845 0 0

O

N

S

F

M

A

M

A

J

J

J

Rec - -344,185 -171,141 -53,070 -110,846 -171,269 -59,759

This material should be construed as market commentary, merely observing economic, political and/or market conditions, and not intended to refer to any

particular trading strategy, promotional element or quality of service provided by the FCM Division of StoneX Financial Inc. (“SFI”) or StoneX Markets LLC

(“SXM”). SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this

material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from

Wor SXM for specific trading advice to meet your trading preferences. These materials represent the opinions and viewpoints of the author, and do not necessarily

SFI

reflect the viewpoints and trading strategies employed by SFI or SXM.

Answer: Alcatraz

You might also like

- 0 Method Statement-Trench Cutter FinalDocument36 pages0 Method Statement-Trench Cutter FinalGobinath GovindarajNo ratings yet

- Test Bank For Analysis For Financial Management 12th Edition Robert Higgins 2Document12 pagesTest Bank For Analysis For Financial Management 12th Edition Robert Higgins 2Osvaldo Laite100% (38)

- Property Law ProjectDocument11 pagesProperty Law ProjectNikhil Hans100% (1)

- Sea CB Vietnam Consumer Survey 2020 PDFDocument36 pagesSea CB Vietnam Consumer Survey 2020 PDFmtuấn_606116No ratings yet

- Theory of Production (Economics)Document13 pagesTheory of Production (Economics)Keshvi LakhaniNo ratings yet

- World Oil Outlook 2022-2045 PDFDocument332 pagesWorld Oil Outlook 2022-2045 PDFDajevNo ratings yet

- BlackbookDocument56 pagesBlackbookrashmishaikh68No ratings yet

- Grain and Feed Annual Report - Pretoria - Zimbabwe - 7!26!2017Document8 pagesGrain and Feed Annual Report - Pretoria - Zimbabwe - 7!26!2017Danisa NdhlovuNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau, and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument1 pageCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau, and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualBrittany EtheridgeNo ratings yet

- Development of Angola'S Agricultural Sector: Steven KyleDocument36 pagesDevelopment of Angola'S Agricultural Sector: Steven KyleMauroLopesNo ratings yet

- Presentation On Schemes of The Department of Food and Public DistributionDocument31 pagesPresentation On Schemes of The Department of Food and Public DistributionVinod Kumar MalikNo ratings yet

- USDA Supply & Demand Review Highlights May Corn & Soybean ReportsDocument4 pagesUSDA Supply & Demand Review Highlights May Corn & Soybean ReportsWillfrieds Nong WaingNo ratings yet

- PEANUT MARKETING NEWS - December 16, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 16, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- TrendhedgeclubDocument16 pagesTrendhedgeclubJavierNo ratings yet

- August 2021 Peanut Market ReportDocument5 pagesAugust 2021 Peanut Market ReportAhmedFatehyAbdelsalam100% (1)

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument1 pageCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualBrittany EtheridgeNo ratings yet

- Report On The Groundnuts Value Chain Analysis For ZambiaDocument17 pagesReport On The Groundnuts Value Chain Analysis For ZambiaFrançois Stepman100% (3)

- FINAL CLAFA 2 2023 Sharing 20 AprilDocument91 pagesFINAL CLAFA 2 2023 Sharing 20 AprilKennedy MabehlaNo ratings yet

- Corn Roadmap 2011-2017Document32 pagesCorn Roadmap 2011-2017philmaize100% (5)

- Cambodia Grain and Feed Annual Report 2018Document15 pagesCambodia Grain and Feed Annual Report 2018Faran MoonisNo ratings yet

- Ch#5 Agriculture Critical IssuesDocument31 pagesCh#5 Agriculture Critical Issuesڈاکٹرعدنان يوسفزئ100% (1)

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- SND CBT PDFDocument4 pagesSND CBT PDFSUPER INDUSTRIAL ONLINENo ratings yet

- PEANUT MARKETING NEWS - November 16, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - November 16, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Weekly CME 13 7 2020 1594543835Document7 pagesWeekly CME 13 7 2020 1594543835swapnidNo ratings yet

- PEANUT MARKETING NEWS - July 15, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - July 15, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- P#1 - ETHIOPIAN PULSE PRODUCTION MARKET ANALYSIS - November, 2018 (FINAL) (Mr. Kassahun Bekele)Document32 pagesP#1 - ETHIOPIAN PULSE PRODUCTION MARKET ANALYSIS - November, 2018 (FINAL) (Mr. Kassahun Bekele)RASNo ratings yet

- Grain and Feed Update - Rabat - Morocco - 09-27-2021Document4 pagesGrain and Feed Update - Rabat - Morocco - 09-27-2021SALAH NETNo ratings yet

- Alabama Crop Progress and Condition ReportDocument2 pagesAlabama Crop Progress and Condition ReportMorgan IngramNo ratings yet

- New England Crop Progress & ConditionDocument5 pagesNew England Crop Progress & ConditionGrowing AmericaNo ratings yet

- Corn Pricing Guide BreakdownDocument41 pagesCorn Pricing Guide BreakdownPapillion LutikNo ratings yet

- NFA 2010 Accomplishment ReportDocument59 pagesNFA 2010 Accomplishment Reportgmdumlao100% (1)

- Should We Believe The Sugar DaddiesDocument3 pagesShould We Believe The Sugar DaddiesindrajoshiNo ratings yet

- Diamond Flour Mill Project ReportDocument38 pagesDiamond Flour Mill Project ReportSanni Tajudeen OlugbengaNo ratings yet

- The Determinants of Low Wheat Productivity in KenyaDocument5 pagesThe Determinants of Low Wheat Productivity in KenyaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Grain and Feed Annual Brasilia Brazil 04-01-2021Document49 pagesGrain and Feed Annual Brasilia Brazil 04-01-2021gicorpbrasilNo ratings yet

- Livestock and Poultry Update - Manila - Philippines - RP2022-0014 PDFDocument17 pagesLivestock and Poultry Update - Manila - Philippines - RP2022-0014 PDFKathleen CornistaNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Brittany EtheridgeNo ratings yet

- Agricultural Performance and Productivity Targets in Eastern VisayasDocument10 pagesAgricultural Performance and Productivity Targets in Eastern VisayasLean PigaNo ratings yet

- Sri Roth 2000Document11 pagesSri Roth 2000ottoojuniiorNo ratings yet

- Karnatka PPT - 0Document22 pagesKarnatka PPT - 0basana patilNo ratings yet

- Market-Intelligence-Report-Soya-beans-Issue-4-of-2022Document28 pagesMarket-Intelligence-Report-Soya-beans-Issue-4-of-2022Oudano MomveNo ratings yet

- Zimbabwe's corn production and imports drop due to dry weatherDocument7 pagesZimbabwe's corn production and imports drop due to dry weatherDanisa NdhlovuNo ratings yet

- A Decade of Progress in Cowpea Genetic Improvement Using Mutation Breeding in Zimbabwe - Prince M. Matova1Document7 pagesA Decade of Progress in Cowpea Genetic Improvement Using Mutation Breeding in Zimbabwe - Prince M. Matova1Trevor ChimombeNo ratings yet

- PEANUT MARKETING NEWS - October 29, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - October 29, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Mississippi Crop Progress and Condition 092418Document2 pagesMississippi Crop Progress and Condition 092418Brittany EtheridgeNo ratings yet

- Mississippi Crop Progress and Condition ReportDocument2 pagesMississippi Crop Progress and Condition ReportBrittany EtheridgeNo ratings yet

- Louisiana Crop Progress and Condition ReportDocument2 pagesLouisiana Crop Progress and Condition ReportBrittany EtheridgeNo ratings yet

- Economic SectorDocument46 pagesEconomic SectorMadge FordNo ratings yet

- Boost Grains Facility EfficiencyDocument18 pagesBoost Grains Facility EfficiencyAgot Rosario0% (1)

- Ohio August 1 Crop ForecastDocument1 pageOhio August 1 Crop ForecastGrowing AmericaNo ratings yet

- Bangladesh Food Situation Report: January-March, 2019 Volume-116Document6 pagesBangladesh Food Situation Report: January-March, 2019 Volume-116Ashraf Uz ZamanNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Morgan IngramNo ratings yet

- IA Crop Progress 05-31-22Document2 pagesIA Crop Progress 05-31-22Matt GunnNo ratings yet

- Evaluation of Soybean Genotypes For Seed Longevity: Pallavi, M., Sandhya Kishore, N. and Praven Kumar, GDocument5 pagesEvaluation of Soybean Genotypes For Seed Longevity: Pallavi, M., Sandhya Kishore, N. and Praven Kumar, GJHANSIRANINo ratings yet

- Maharashtra Seeds InformationDocument18 pagesMaharashtra Seeds InformationjeevandohifodeNo ratings yet

- Weeklyagreport: SoybeanDocument2 pagesWeeklyagreport: Soybeanapi-164524372No ratings yet

- Shelled MKT Price Weekly Prices: Same As Last WeekDocument1 pageShelled MKT Price Weekly Prices: Same As Last WeekBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - October 15, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - October 15, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Economic Outlook - May 2020Document8 pagesEconomic Outlook - May 2020KaraNo ratings yet

- IA Crop Progress 08-15-22Document2 pagesIA Crop Progress 08-15-22Matt GunnNo ratings yet

- Mississippi Crop Progress and Condition ReportDocument2 pagesMississippi Crop Progress and Condition ReportBrittany EtheridgeNo ratings yet

- Agriculture's Future: World Foodgrain Production & Demand Projections to 2050Document1 pageAgriculture's Future: World Foodgrain Production & Demand Projections to 2050Hrishi GaykarNo ratings yet

- Weekly Recap Jan 15Document1 pageWeekly Recap Jan 15Daviduta IonutNo ratings yet

- Municipal Agriculture and Fisheries ProfileDocument10 pagesMunicipal Agriculture and Fisheries ProfilejaneNo ratings yet

- CME Group 2015Document134 pagesCME Group 2015BsgNo ratings yet

- CME Group 2017 Annual ReportDocument118 pagesCME Group 2017 Annual ReportLan HoàngNo ratings yet

- Cme Group Inc.: FORM 10-KDocument107 pagesCme Group Inc.: FORM 10-KLan HoàngNo ratings yet

- Section27 British Pound Call OptionsDocument5 pagesSection27 British Pound Call OptionsLan HoàngNo ratings yet

- Abn Amro The Circular Car ReportDocument28 pagesAbn Amro The Circular Car ReportLan HoàngNo ratings yet

- Preliminary: Interest Rate Futures PG09 Fri, Jun 11, 2021 PG09 Bulletin # 111@Document1 pagePreliminary: Interest Rate Futures PG09 Fri, Jun 11, 2021 PG09 Bulletin # 111@Lan HoàngNo ratings yet

- Preliminary: Currency Futures PG06 Fri, Jun 11, 2021 PG06 Bulletin # 111@Document1 pagePreliminary: Currency Futures PG06 Fri, Jun 11, 2021 PG06 Bulletin # 111@Lan HoàngNo ratings yet

- Section34 Japanese Yen Put OptionsDocument3 pagesSection34 Japanese Yen Put OptionsLan HoàngNo ratings yet

- USDA Hogs & Pigs Review Thursday, March 25, 2021: Report SummaryDocument2 pagesUSDA Hogs & Pigs Review Thursday, March 25, 2021: Report SummaryLan HoàngNo ratings yet

- Section62 Metals Futures ProductsDocument6 pagesSection62 Metals Futures ProductsLan HoàngNo ratings yet

- Commitments of Traders SummaryDocument1 pageCommitments of Traders SummaryLan HoàngNo ratings yet

- Agricultural Commodity Metric Conversion GuideDocument44 pagesAgricultural Commodity Metric Conversion GuideLan HoàngNo ratings yet

- Virtual Academy Economics QuizDocument11 pagesVirtual Academy Economics QuizIftekhar Ahmad IftekharNo ratings yet

- Tugas Analisis (Manajemen Keuangan) Mirna Puspita Rahayu 2051030227-DikonversiDocument3 pagesTugas Analisis (Manajemen Keuangan) Mirna Puspita Rahayu 2051030227-DikonversiFICKY ardhikaNo ratings yet

- Pestel Analysis NimraDocument23 pagesPestel Analysis NimraDaraz WorldNo ratings yet

- The Industry, The Company and Its Products 1.1 The IndustryDocument7 pagesThe Industry, The Company and Its Products 1.1 The IndustryRuthchell CiriacoNo ratings yet

- Cost Terminology and Classification ExplainedDocument8 pagesCost Terminology and Classification ExplainedKanbiro Orkaido100% (1)

- Subhadeep ChatterjeeDocument4 pagesSubhadeep ChatterjeeSubhadeep ChatterjeeNo ratings yet

- Narrative Report - Chapter 10Document4 pagesNarrative Report - Chapter 10Hazel BorboNo ratings yet

- (WNAzni) Edited IIMMDocument4 pages(WNAzni) Edited IIMMwanazniNo ratings yet

- Instrukcija Za Prilive Iz Inostranstva - 30092020Document1 pageInstrukcija Za Prilive Iz Inostranstva - 30092020Miloš LazarevićNo ratings yet

- Memo TaxDocument2 pagesMemo TaxKristine MagbojosNo ratings yet

- Jan Tinbergen's Statistical ContributionDocument17 pagesJan Tinbergen's Statistical ContributionF.N. HeinsiusNo ratings yet

- Ledger Fee Charges - Balance - Requirement, Turnover - Credit and Turnover - DebitDocument22 pagesLedger Fee Charges - Balance - Requirement, Turnover - Credit and Turnover - DebitCHARLES TUMWESIGYENo ratings yet

- Commerce Assignment... Suraj Singh... 253... FYBCOMDocument9 pagesCommerce Assignment... Suraj Singh... 253... FYBCOMVidhyashree YadavNo ratings yet

- Screenshot 2021-09-09 at 7.56.06 PMDocument1 pageScreenshot 2021-09-09 at 7.56.06 PMPraveen SinghNo ratings yet

- Living Faith Church Worldwide Intl.: Winners Chapel MaputoDocument7 pagesLiving Faith Church Worldwide Intl.: Winners Chapel MaputoAgostinho Carlos MatsinheNo ratings yet

- Mr. AnshulDocument2 pagesMr. AnshulAnshul SharmaNo ratings yet

- Practice Questions For EconomicsDocument6 pagesPractice Questions For EconomicsAlliah Mae Arbasto100% (1)

- Uspto 97197301Document2 pagesUspto 97197301Sebastian SinclairNo ratings yet

- Shipping & Billing Address: Neha Singh: Date: 23/02/2024Document2 pagesShipping & Billing Address: Neha Singh: Date: 23/02/2024tyrainternationalNo ratings yet

- Topic 1 - Introduction To InvestingDocument26 pagesTopic 1 - Introduction To InvestingLim Wei HanNo ratings yet

- Three Gap Model - Presentation - 01-1Document13 pagesThree Gap Model - Presentation - 01-1SANA ZAMANNo ratings yet

- Matemateik Managment 61606Document9 pagesMatemateik Managment 61606Noraini MiurahNo ratings yet

- Reading Comprehension Grade 10semester 2 20231206 193833Document27 pagesReading Comprehension Grade 10semester 2 20231206 193833aolefirNo ratings yet

- BUSM4561 - Assignment1 - Reflection On ReadingDocument9 pagesBUSM4561 - Assignment1 - Reflection On ReadingNgọc QuỳnhNo ratings yet