Professional Documents

Culture Documents

Direct and Indirect Tax Difference

Direct and Indirect Tax Difference

Uploaded by

Babita PremOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Direct and Indirect Tax Difference

Direct and Indirect Tax Difference

Uploaded by

Babita PremCopyright:

Available Formats

32 RRA Sith Semester (Businees faxation

Indirect

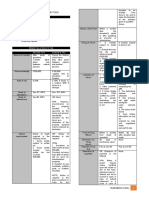

1.1.10. Difference between Direct and Indi

Taxes Indireet Taxes

is

Basis of Diferenc Direct Taxes indirect

taxes

The burden

of

1) Transfer of The burden of direct taxes is from

from the pe

the

person

transferred

Burden horne by the person on whom to another

person.

who pays it,

lev ied tax impact

In case of indirect

of direct tax the on the

the

2 Impact and In case

incidence are and

on

incidence

i ncidence

are

Incidence mpact and different persons.

the s a m e person

who pays the |

are not

tax. |Indirect

taxes

Direct taxes are progressive.

3 Progressive progressive.

are imposed on

on Indirect taxes

Direct taxes are imposed impersonal services.

4 Imposition goods and

Incomes, such as, wages, rent,

nterest, property, profits,

wealth, gifts etc.

Indirect taxes are

hidden in

in

Direct taxes are to be paid in | of

5) Burden Felt

prices and thus the burden

alump sum and hence their|

indirect taxes is not felt.

burden is felt.

Administrative cost of direct | The

administrative

administrative Cost

cost of

of

Adnministrative

6)

laxes is low

indirect taxes is quite high as

Cost to direct taxes.

compared

| Indirect taxes are generally n0t

7) Removal of Direct taxes are considered as

suitable from the point of view

Inequalities an important instrument of

inequalities of of removing inequalities of

removing

wealth.

income and wealth as they |income and

fall more heavily on the rich

than the poor.

Indirect taxes are uncertain.

8) Basis of Direct taxes are certain.

Certainty

on Indirect taxes are not based o

9) Taxable |Direct taxes are based

Capacity taxablecapacity, taxable capacity.

You might also like

- Chase Bank Statement BankStatements - Net JulyDocument4 pagesChase Bank Statement BankStatements - Net JulyJoe SF0% (1)

- Chase Statement 28032021Document4 pagesChase Statement 28032021yungler0% (2)

- 05 Cash Cash EquivalentsDocument54 pages05 Cash Cash EquivalentsFordan Antolino83% (12)

- PO Osna 4700002842Document2 pagesPO Osna 4700002842vijen33No ratings yet

- Ca Inter Nov 22 Marathon Revision Lecture Notes Indirect TaxDocument129 pagesCa Inter Nov 22 Marathon Revision Lecture Notes Indirect TaxMd AquibNo ratings yet

- H02 - Taxes, Tax Laws and Tax AdministrationDocument10 pagesH02 - Taxes, Tax Laws and Tax Administrationnona galido100% (1)

- JennylynreductocleofeDocument4 pagesJennylynreductocleofeLia Estrelle CleofeNo ratings yet

- AccountStatement 3286686240 Aug04 185310 PDFDocument2 pagesAccountStatement 3286686240 Aug04 185310 PDFAvijitSinharoyNo ratings yet

- Bank Al Jazira Statement - Usd PDFDocument3 pagesBank Al Jazira Statement - Usd PDFJoselito VargasNo ratings yet

- Taxation H01 - Fundamental Principles of TaxationDocument9 pagesTaxation H01 - Fundamental Principles of TaxationAnna TaylorNo ratings yet

- Import Export Manager Interview QuestionsDocument2 pagesImport Export Manager Interview Questionsgoswamimk100% (2)

- General Principles: Estate Tax Vs Donor's Tax Estate Tax Donor'S TaxDocument3 pagesGeneral Principles: Estate Tax Vs Donor's Tax Estate Tax Donor'S TaxKenneth Mataban100% (1)

- Chapter 9 Part 2 Input VatDocument24 pagesChapter 9 Part 2 Input VatChristian PelimcoNo ratings yet

- Topic 6 - Bank ReconciliationRev (Students)Document26 pagesTopic 6 - Bank ReconciliationRev (Students)Romzi100% (1)

- 2019 Tax LMTDocument26 pages2019 Tax LMTchristineNo ratings yet

- Chapter 12Document11 pagesChapter 12Kim Patrice NavarraNo ratings yet

- Tax 1 Midterm Reviewer BelloDocument64 pagesTax 1 Midterm Reviewer BelloJan Ceasar ClimacoNo ratings yet

- Chapter 1Document6 pagesChapter 1suhanivirdiNo ratings yet

- Scan 16-Nov-2020Document7 pagesScan 16-Nov-2020Sivakami SundaramNo ratings yet

- DR Umang Tandon 1Document19 pagesDR Umang Tandon 1Tanya dhawanNo ratings yet

- Withholding Tax Regime-PaksitanDocument2 pagesWithholding Tax Regime-Paksitanusmansss_606776863No ratings yet

- Introduction To GSTDocument16 pagesIntroduction To GSTkrishna vamsiNo ratings yet

- Indirect Taxation: The Institute of Cost Accountants of IndiaDocument6 pagesIndirect Taxation: The Institute of Cost Accountants of IndiaPapu SahooNo ratings yet

- TaxationDocument26 pagesTaxationAshfaqur RahmanNo ratings yet

- 2021 - 09 - 07 19 - 41 Office LensDocument4 pages2021 - 09 - 07 19 - 41 Office Lenssub6hamNo ratings yet

- Chapter 1 Introduction To Income Tax Act PDFDocument66 pagesChapter 1 Introduction To Income Tax Act PDFRISHI SHAHNo ratings yet

- Latest Chapter TwoDocument79 pagesLatest Chapter TwomickamhaaNo ratings yet

- Latest Chapter TwoDocument79 pagesLatest Chapter TwomickamhaaNo ratings yet

- GST Chapter 1Document21 pagesGST Chapter 1Dhriti UmmatNo ratings yet

- Chapter 14Document21 pagesChapter 14Kim Patrice NavarraNo ratings yet

- Unit-4 GOVT. BUDGETDocument1 pageUnit-4 GOVT. BUDGETAditya JhaNo ratings yet

- TAXXXXDocument2 pagesTAXXXXKeigrah Adelaine Gamban Pangilinan0% (1)

- I. General PrinciplesDocument3 pagesI. General PrinciplesMarian Gae MerinoNo ratings yet

- Tax 1 Session 1 Intro To Indonesian Tax 150224SNDocument105 pagesTax 1 Session 1 Intro To Indonesian Tax 150224SNhaikal.abiyu.w41No ratings yet

- Module 1 - Introduction To Business TaxesDocument14 pagesModule 1 - Introduction To Business TaxesfrecymaebaraoNo ratings yet

- 1 IntroductionDocument41 pages1 IntroductionKaminariNo ratings yet

- 02 Chap19 Gruber - Tax IncidenceDocument36 pages02 Chap19 Gruber - Tax IncidenceSagar ChowdhuryNo ratings yet

- Taxes-Direct and Indirect TaxDocument12 pagesTaxes-Direct and Indirect TaxLucky Verma- 3:33No ratings yet

- GST I - A I: IN Ndia N NtroductionDocument36 pagesGST I - A I: IN Ndia N NtroductionNagarjuna ReddyNo ratings yet

- The Equity Implications of Taxation: Tax IncidenceDocument36 pagesThe Equity Implications of Taxation: Tax IncidenceSatria Hadi LubisNo ratings yet

- Income TaxDocument74 pagesIncome Taxhemanshi07soniNo ratings yet

- EstateDocument75 pagesEstateApple AppleNo ratings yet

- Indirect TaxesDocument1 pageIndirect TaxescachallNo ratings yet

- GSSTDocument70 pagesGSSTmayankyadav.jhsNo ratings yet

- Adobe Scan Dec 01, 2023Document15 pagesAdobe Scan Dec 01, 2023ayushkorea52629No ratings yet

- Types of TaxesDocument2 pagesTypes of Taxesfreshe RelatoNo ratings yet

- What Is A Tax?Document38 pagesWhat Is A Tax?Yuvi SinghNo ratings yet

- Direct Tax Capital GainsDocument95 pagesDirect Tax Capital Gainskaran chawareNo ratings yet

- Lesson 2 PDFDocument7 pagesLesson 2 PDFErika ApitaNo ratings yet

- Tax Bar QuestionsDocument14 pagesTax Bar QuestionsPisto PalubosNo ratings yet

- Aggregate Turnover: New Composition SchemeDocument1 pageAggregate Turnover: New Composition SchemeAman SinghNo ratings yet

- DEDUCTIONSDocument21 pagesDEDUCTIONSlet me live in peaceNo ratings yet

- GST in India An Introduction PDFDocument30 pagesGST in India An Introduction PDFKrishna VamsiNo ratings yet

- Withholding-Taxes (ZRA)Document2 pagesWithholding-Taxes (ZRA)Noah MwansaNo ratings yet

- BES172 P1 Taxes Direct Indirect Ad ValoremDocument57 pagesBES172 P1 Taxes Direct Indirect Ad Valoremroy lexterNo ratings yet

- Indirect Taxes 1,2,3Document33 pagesIndirect Taxes 1,2,3Welcome 1995No ratings yet

- Tax and Taxation PDFDocument2 pagesTax and Taxation PDFwinky colinaNo ratings yet

- Demand & Recovery: Proceeding in Case WhereDocument1 pageDemand & Recovery: Proceeding in Case WhereKhader MohammedNo ratings yet

- Direct Taxes & Indirect Taxes: By: Sonam RehmaniDocument7 pagesDirect Taxes & Indirect Taxes: By: Sonam RehmaniAl MahmudNo ratings yet

- Directandindirecttaxes-180913164426 (1) 2Document7 pagesDirectandindirecttaxes-180913164426 (1) 2Al MahmudNo ratings yet

- Facilitation Guide: Withholding Tax Regime (Income Tax) Under The Income Tax Ordinance, 2001Document41 pagesFacilitation Guide: Withholding Tax Regime (Income Tax) Under The Income Tax Ordinance, 2001Raza312No ratings yet

- Scope of TaxDocument12 pagesScope of TaxHajra MalikNo ratings yet

- Adobe Scan Oct 11, 2023Document9 pagesAdobe Scan Oct 11, 2023Amir HamzaNo ratings yet

- Tax 1 Reviewer - Compress Vol 3Document4 pagesTax 1 Reviewer - Compress Vol 3bingoNo ratings yet

- Adobe Scan 11 Oct 2023Document23 pagesAdobe Scan 11 Oct 2023Ayesha ParweenNo ratings yet

- Tax Direct IndirectDocument2 pagesTax Direct IndirectSukram HembromNo ratings yet

- Screenshot 2023-10-29 at 9.17.46 PMDocument25 pagesScreenshot 2023-10-29 at 9.17.46 PMshubhanshiphogat062000No ratings yet

- Goods and Services Tax - Negative Liablity StatementDocument2 pagesGoods and Services Tax - Negative Liablity StatementANAND AND COMPANYNo ratings yet

- Transfer Tax: Marivic B. de Gracia Taxation 2Document1 pageTransfer Tax: Marivic B. de Gracia Taxation 2james reddNo ratings yet

- Exam - Taxation MSA 206Document4 pagesExam - Taxation MSA 206Juan FrivaldoNo ratings yet

- 2D46D407Document1 page2D46D407Dhyan MothukuriNo ratings yet

- Problem Ariana GrandeDocument24 pagesProblem Ariana GrandeMochammad YogaswaraNo ratings yet

- EFD Frequently Asked Questions PDFDocument2 pagesEFD Frequently Asked Questions PDFSimushi SimushiNo ratings yet

- Bus Karo Guidebook On Planning and OperationsDocument111 pagesBus Karo Guidebook On Planning and OperationsasikriNo ratings yet

- South Cargo, LLC. Tel: (305) 597-8730: InvoiceDocument1 pageSouth Cargo, LLC. Tel: (305) 597-8730: InvoiceChevyveronaNo ratings yet

- Oracle Applications Accounting Review Session: Beverly Baker-Harris Sr. Project Manager OracleDocument50 pagesOracle Applications Accounting Review Session: Beverly Baker-Harris Sr. Project Manager OracleBeverly Baker-HarrisNo ratings yet

- Easy Guide To HSBC Credit Card Fees and ChargesDocument2 pagesEasy Guide To HSBC Credit Card Fees and ChargesboboinksNo ratings yet

- Steps and Requirements For Registering With The BIRDocument2 pagesSteps and Requirements For Registering With The BIRDonita Maigue RocasNo ratings yet

- Pasig City Bayanihan Sa Daan Sustainable Transport ProgramDocument13 pagesPasig City Bayanihan Sa Daan Sustainable Transport ProgramLibrary MainNo ratings yet

- GEPCO - Gujranwala Electric Power CompanyDocument2 pagesGEPCO - Gujranwala Electric Power CompanyAli ButtNo ratings yet

- Internal TradeDocument28 pagesInternal TradeAsif ShaikhNo ratings yet

- Copy Invoice: (Asrama) 36100 Bagan Datoh Perak Darul Ridzuan Sekolah Menengah Sains Bagan DatohDocument1 pageCopy Invoice: (Asrama) 36100 Bagan Datoh Perak Darul Ridzuan Sekolah Menengah Sains Bagan DatohAfiq NaimNo ratings yet

- 1571200894498vXFbvpGvTzdbgeN8 PDFDocument3 pages1571200894498vXFbvpGvTzdbgeN8 PDFBazidpur GsssNo ratings yet

- Cá Ba SaDocument2 pagesCá Ba SaNguyen HoangNo ratings yet

- Travelling by Plane, Trains, Cars, Bikes and Public Transport-Exercises With KeyDocument8 pagesTravelling by Plane, Trains, Cars, Bikes and Public Transport-Exercises With KeyZsuzsa SzékelyNo ratings yet

- Platni Sistemi Participants ListDocument6 pagesPlatni Sistemi Participants ListKristijan PetrovskiNo ratings yet

- Specific Terms and Conditions For Ambank Bonuslink Visa CardDocument16 pagesSpecific Terms and Conditions For Ambank Bonuslink Visa Cardsmsd onlineNo ratings yet

- Iowa Highway Safety Programs: Wear Your Seat Belts! Story: Video: (Warning: Graphic Image)Document85 pagesIowa Highway Safety Programs: Wear Your Seat Belts! Story: Video: (Warning: Graphic Image)joe_b_32607No ratings yet

- Click Here For English Version: AMAPS2671K 2021-22 439514830050921Document8 pagesClick Here For English Version: AMAPS2671K 2021-22 439514830050921BabuHalderNo ratings yet