Professional Documents

Culture Documents

Week 1 SIM

Week 1 SIM

Uploaded by

Kristine Joy EbradoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 1 SIM

Week 1 SIM

Uploaded by

Kristine Joy EbradoCopyright:

Available Formats

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

Course Outline: ACCBP 100 – Accounting Plus

Course Coordinator: April Kate F. Valisno

Email: aprilkatefernandez@umindanao.edu.ph

Student Consultation: Done online (LMS) or traditional contact

(calls, texts, emails)

Mobile: 09125002858

Phone : (082) 553-2914

Effectivity Date: August 2020

Mode of Delivery: Blended (On-Line with face to face or virtual

sessions)

Time Frame: 54 Hours

Student Workload: Expected Self-Directed Learning

Requisites: None

Credit: 3 units

Attendance Requirements: A minimum of 95% attendance is required at all

scheduled virtual or face to face sessions.

Course Outline Policy

Areas of Concern Details

Contact and Non-contact This 3-unit course self-instructional manual is

Hours designed for blended learning mode of

instructional delivery with scheduled face to face

or virtual sessions. The expected number of hours

will be 54 including the face to face or virtual

sessions. The face to face sessions shall include

the summative assessment tasks (exams) since

this course is crucial in the licensure examination

for accountants.

Assessment Task Submission Submission of assessment tasks shall be on 3rd,

5th, 7th and 9th week of the term. The assessment

paper shall be attached with a cover page

indicating the title of the assessment task (if the

task is performance), the name of the course

coordinator, date of submission and name of the

student. The document should be emailed to the

course coordinator. It is also expected that you

already paid your tuition and other fees before the

submission of the assessment task.

If the assessment task is done in real time through

the features in the Quipper Learning Management

System, the schedule shall be arranged ahead of

time by the course coordinator.

ACCBP 100 *Property of UMDC

Page 1 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

Since this course is included in the licensure

examination for accountants, you will be required

to take the Multiple-Choice Question exam inside

the University. This should be scheduled ahead of

time by your course coordinator. This is non-

negotiable for all licensure-based programs.

Turnitin Submission To ensure honesty and authenticity, all

(if necessary) assessment tasks are required to be submitted

through Turnitin with a maximum similarity index

of 30% allowed. This means that if your paper

goes beyond 30%, the students will either opt to

redo her/his paper or explain in writing addressed

to the course coordinator the reasons for the

similarity. In addition, if the paper has reached

more than 30% similarity index, the student may

be called for a disciplinary action in accordance

with the University’s OPM on Intellectual and

Academic Honesty.

Please note that academic dishonesty such as

cheating and commissioning other students or

people to complete the task for you have severe

punishments (reprimand, warning, expulsion).

Penalties for Late The score for an assessment item submitted after

Assignments/Assessments the designated time on the due date, without an

approved extension of time, will be reduced by 5%

of the possible maximum score for that

assessment item for each day or part day that the

assessment item is late.

However, if the late submission of assessment

paper has a valid reason, a letter of explanation

should be submitted and approved by the course

coordinator. If necessary, you will also be required

to present/attach evidences.

Return of Assignments/ Assessment tasks will be returned to you two (2)

Assessments weeks after the submission. This will be returned

by email or via Quipper portal.

For group assessment tasks, the course

coordinator will require some or few of the

students for online or virtual sessions to ask

clarificatory questions to validate the originality of

the assessment task submitted and to ensure that

all the group members are involved.

ACCBP 100 *Property of UMDC

Page 2 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

Assignment Resubmission You should request in writing addressed to the

course coordinator his/her intention to resubmit an

assessment task. The resubmission is premised

on the student’s failure to comply with the

similarity index and other reasonable grounds

such as academic literacy standards or other

reasonable circumstances e.g. illness, accidents

financial constraints.

Re-marking of Assessment You should request in writing addressed to the

Papers and Appeal program coordinator your intention to appeal or

contest the score given to an assessment task.

The letter should explicitly explain the

reasons/points to contest the grade. The program

coordinator shall communicate with the students

on the approval and disapproval of the request.

If disapproved by the course coordinator, you can

elevate your case to the program head or the dean

with the original letter of request. The final

decision will come from the dean of the college.

Grading System All culled from Quipper sessions and traditional

contact

Course discussions/exercises – 30%

1st formative assessment – 10%

2nd formative assessment – 10%

3rd formative assessment – 10%

All culled from on-campus/onsite sessions (TBA):

Final exam – 40%

Submission of the final grades shall follow the

usual University system and procedures.

Preferred Referencing Style Depends on the discipline; if uncertain or

inadequate, use the general practice of the APA

6th Edition.

Student Communication You are required to create an email account which

is a requirement to access the Quipper portal.

Then, the course coordinator shall enroll the

students to have access to the materials and

resources of the course. All communication

formats: chat, submission of assessment tasks,

requests etc. shall be through the portal and other

university recognized platforms.

You can also meet the course coordinator in

person through the scheduled face to face

sessions to raise your issues and concerns.

ACCBP 100 *Property of UMDC

Page 3 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

For students who have not created their student

email, please contact the course coordinator or

program head.

Contact Details of the Dean Eduard L. Pulvera, MSIS

Email: eduardpulvera@umdigoscollege.edu.ph

Phone: 09295288740

Contact Details of the Program Jeaneth P. Tormis, CPA, MBA

Head Email: tormis.jeaneth@yahoo.com

Phone: 09097231679

Students with Special Needs Students with special needs shall communicate

with the course coordinator about the nature of his

or her special needs. Depending on the nature of

the need, the course coordinator with the approval

of the program coordinator may provide

alternative assessment tasks or extension of the

deadline of submission of assessment tasks.

However, the alternative assessment tasks should

still be in the service of achieving the desired

course learning outcomes.

Course Information – see/download course syllabus in Quipper

CC’s Voice: Hello prospective accountant! Welcome to this course ACCBP

100: Accounting Plus. This course provides a reinforcement of basic

accounting, within the context of business and business decisions.

Students obtain additional knowledge of the principles and concepts of

accounting as well as their application that will enable them to appreciate

the production of accounting data.

CO In this course, the students are expected to understand the nature of

accounting and its practice. They are also expected to master the

accounting cycle and the financial reporting process of businesses. They

are to classify and record transactions, and prepare financial statements.

You will be studying the basics of bookkeeping in this course. Thus, you

are expected to read in advance the accounting cycle and basic

accounting.

Let us begin!

ACCBP 100 *Property of UMDC

Page 4 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

Big Picture

Week 1-3: Unit Learning Outcomes (ULO): At the end of the unit, you are expected to:

a. Learn the basic concepts in accounting and the accountancy profession; and

b. Summarize how the double-entry system follows the rules of the accounting

equation.

Big Picture in Focus: ULOa. Learn the basic concepts in accounting

and the accountancy profession

Metalanguage

To be able to understand more fully the terms in this section, the most essential

terms relevant to finance and to demonstrate ULOa will be defined to establish a

common frame of reference as to how the texts work in a business setting. You will

encounter these terms as we go through the study of financial management. Please

refer to these definitions in case you will encounter trouble in understanding

educational concepts.

1. Accounting. This simply is a process of keeping financial accounts. Accounting

has been defined by some organizations as follows:

1.1 Accounting is a service activity. Its function is to provide quantitative

information, primarily financial in nature, about economic entities that is

intended to be useful in making economic decisions (Statement of Financial

Accounting Standards No. 1)

1.2 Accounting is an information system that measures, processes and

communicates financial information about an economic entity (Statement of

Financial Accounting Concepts No. 1)

1.3 Accounting is the process of identifying, measuring and communicating

economic information to permit informed judgments and decisions by users

of the information (American Accounting Association)

1.4 Accounting is the art of recording, classifying and summarizing in a

significant manner and in terms of money, transactions and events which

are, in part at least, of a financial character, and interpreting the results

thereof (American Institute of Certified Public Accountants)

2. Bookkeeping. Literally means keeping records of books of financial transactions.

3. Double-entry bookkeeping. A way of recording financial transactions using

debits and credits.

4. Amatino Manucci. The inventor of double-entry bookkeeping. He also

constructed a comprehensive books of ledgers and gave importance to the aspect of

financial control.

5. Luca Pacioli. A Franciscan friar and mathematician who is regarded as the

“father of double-entry accounting” because of his published books describing the

practices of today’s use of double-entry bookkeeping. One of his books is called

“Summa” and is about essential things a merchant should know in bookkeeping.

ACCBP 100 *Property of UMDC

Page 5 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

6. Eugen Schmalenbach. German academic who published a book unifying the

financial data used in different companies called “The Model Chart of Accounts.”

7. Ethics. It is concerned with right and wrong and how conduct should be judged to

be good or bad.

7.1 Business ethics tells what is right or wrong in a business situation, while

professional ethics tells the same thing regarding a professions. Ethical

conflicts can rise, however, when what might be best for the company is

wrong morally or professionally.

8. Sarbanes-Oxley Act (SOX). Law enacted that requires all companies to report

periodic financial statements. This also provides provisions on integrity on audited

reports and role of auditors and management.

9. Memorandum. In Summa, it is a book prepared in chronological order where a

narrative description of the business economic events are recorded.

10. Journal. In Summa, the entries made here are one in currency, in chronological

order, and in narrative form.

11. Ledger. In Summa, it is an alphabetical listing of all the business’ accounts

along with the running balance of each particular accounts.

12. Generally accepted accounting principles (GAAP). Accounting practices

follow certain guidelines called GAAP. IT encompasses the conventions, rules and

procedures necessary to define accepted accounting principle at a particular time.

12.1 The general acceptance of an accounting principle usually depends on

how well it meets three criteria: relevance, objectivity and feasibility.

12.2 A principle has relevance to the extent that it results in information that is

meaningful and useful to those who need to know something about a certain

organization.

12.3 A principle has objectivity to the extent that the resulting information is

not influenced by the personal bias or judgment of those who furnish it.

Objectivity connotes reliability and trustworthiness. It also connotes

verifiability, which means that there is some way of finding out whether the

information is correct.

12.4 A principle has feasibility to the extent that it can be implemented without

undue complexity or cost. These criteria often conflict with one another. In

some cases, the most relevant solution may be the least objective and the

least feasible.

Essential Knowledge

Fundamental Business Model

The below figure illustrates how a business is structured to provide a customer

proposition. The business model is built on five activities:

1. First, the investors provide the required capital for the business. The cash

investment will then be held in a bank account.

2. The cash in the business can be:

converted into another type of asset that will be used in the business

(e.g. equipment) or sold (e.g. inventory); or

spent on operating costs such as salaries, rentals and utilities.

ACCBP 100 *Property of UMDC

Page 6 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

3. The combination of business resources provides the basis for producing the

products or services.

4. The sale of a product or service generates an asset called a receivable. This

asset once collected will produce a cash inflow for the business.

5. If there's an existing debt from banks, the cash inflow from collections will be

used to provide the debt providers with interest on their loans to the company.

The rest of the cash can be sent back to the cycle by being converted into

other assets or spent on operating costs (back to stage 2). In the normal

course of business, this whole process will earn profits on which tax will have

to be paid. Any profit after tax can continue to be reinvested in the cycle or

paid out to the owners as a "return" on their investments.

Forms of Business Organizations

1. Sole proprietorship. This business organization has a single owner called the

proprietor who generally is also the manager. Sole proprietorships tend to be

small service-type (e.g. physicians, lawyers and accountants) businesses and

retail establishments. The owner receives all profits, absorbs all losses and is

solely responsible for all debts of the business. From the accounting

viewpoint, the sole proprietorship is distinct from its proprietor. Thus, the

accounting records of the sole proprietorship do not include the proprietor's

personal financial records.

2. Partnership. A partnership is a business owned and operated by two or more

persons who bind themselves to contribute money, property, or industry to a

common fund, with the intention of dividing the profits among themselves.

Each partner is personally liable for any debt incurred by the partnership.

Accounting considers the partnership as a separate organization, distinct

from the personal affairs of each partner.

3. Corporation. A corporation is a business owned by its stockholders. It is an

artificial being created by operation of law, having the rights of succession

and the powers, attributes and properties expressly authorized by law or

ACCBP 100 *Property of UMDC

Page 7 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

incident to its existence. The Stockholders are not personally liable for the

corporation's debts. The corporation is a separate legal entity.

Activities in Business Organizations

Many types of decisions are made in business organizations. Accounting provides

important information to make these decisions. The three types of organizational

activities are as follows: financing, investing, and operating.

1. Financing Activities. Financing activities are the methods an organization

uses to obtain financial resources from financial markets and how it manages

these resources. Primary sources of financing for most businesses are

owners and creditors, such as banks and suppliers. Repaying the creditors

and paying a return to the owners are also financing activities.

2. Investing Activities. Investing activities involve the selection and management

including disposal and replacement of long-term resources that will be used

to develop, produce, and sell goods and services. Investing activities include

buying land, equipment, buildings and other resources that are needed in the

operation of the business, and selling these resources when they are no

longer needed.

3. Operating Activities. Operating activities involve the use of resources to

design, produce, distribute, and market goods and services. Operating

activities include research and development, design and engineering,

purchasing, human resources, production, distribution, marketing and selling,

and servicing.

Purpose and Phases of Accounting

Business transactions are the economic activities of a business. Recording

these historical events is a significant function of accounting. Accounts are produced

to aid management in planning, control and decision-making and to comply with

regulations.

Before the effects of transactions can be recorded, they must be measured.

In order that accounting information will be useful, it must be expressed in terms of

a common financial denominator—money. Money serves as both a medium of

exchange and measure of value.

To measure a business transaction, the accountant must decide when the

transaction occurred (recognition issue), what value to place on the transaction

(valuation issue) and how the components of the transaction should be classified

(classification issue).

By simply measuring and recording transactions, the resulting information will

be of limited use. To be useful in making decisions, the recorded data must be

classified and summarized. Classification reduces the effects of numerous

transactions into useful groups or categories. Summarization of financial data is

achieved through the preparation of financial statements. These summarize the

effects of all business transactions that occurred during some period.

ACCBP 100 *Property of UMDC

Page 8 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

After going through the preceding phases, it is imperative that the result of the

summarization phase be interpreted or analyzed to evaluate the liquidity, profitability

and solvency of the business organization. Accounting provides the decision-makers

with information to make reasoned choices among alternative uses of scarce

resources in the conduct of business and economic activities.

Fundamental Concepts

Several fundamental concepts underlie the accounting process. In recording

business transactions, accountants should consider the following:

1. Entity Concept. An accounting entity is an organization or a section of an

organization that stands apart from other organizations and individuals as a

separate economic unit. Simply put, the transactions of different entities

should not be accounted for together. Each entity should be evaluated

separately.

2. Periodicity Concept. An entity's life can be meaningfully subdivided into equal

time periods for reporting purposes. It will be aimless to wait for the actual last

day of operations to perfectly measure the entity's profit. This concept allows

the users to obtain timely information to serve as a basis on making decisions

about future activities. For the purpose of reporting to outsiders, one year is

the usual accounting period.

3. Stable Monetary Unit Concept. The Philippine peso is a reasonable unit of

measure and that its purchasing power is relatively stable. It allows

accountants to add and subtract peso amounts as though each peso has the

same purchasing power as any other peso at any time. This is the basis for

ignoring the effects of inflation in the accounting records.

Basic Principles

In order to generate information that is useful to the users of financial statements,

accountants rely upon the following principles:

Objectivity Principle. Accounting records and- statements are based on the

most reliable data available so that they will be as accurate and as useful as

possible. Reliable data are verifiable when they can be confirmed by

independent observers. Ideally, accounting records are based on

information that flows from activities documented by objective evidence.

Without this principle, accounting records would be based on whims and

opinions and is therefore subject to disputes.

Historical Cost. This principle states that acquired assets should be

recorded at their actual cost and not at what management thinks they are

worth as at reporting date.

Revenue Recognition Principle. Revenue is to be recognized in the

accounting period when goods are delivered or services are rendered or

performed.

ACCBP 100 *Property of UMDC

Page 9 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

Expense Recognition Principle. Expenses should be recognized in the

accounting period in which goods and services are used up to produce

revenue and not when the entity pays for those goods and services.

Adequate Disclosure. Requires that all relevant information that would affect

the user's understanding and assessment of the accounting entity be

disclosed in the financial statements.

Materiality. Financial reporting is only concerned with information that is

significant enough to affect evaluations and decisions. Materiality depends

on the size and nature of the item judged in the particular circumstances of

its omission. In deciding whether an item or an aggregate of items is

material, the nature and size of the item are evaluated together.

Consistency Principle. The firm should use the same accounting method

from period to period to achieve comparability over time.

Branches of Accounting

The main branches of accounting and their brief descriptions are discussed as

follows:

Auditing. Auditing is the accountancy profession's most significant service to the

public. An external audit is the independent examination that ensures the fairness

and reliability of the reports that management submits to users outside the business

entity. The result of the examinations is embodied in the independent auditor's

report. Once the required financial statements have been prepared by management,

they have to be evaluated in order to ensure that they do not present a distorted

picture.

Bookkeeping. Bookkeeping is a mechanical task involving the collection of basic

financial data. The data are first entered in the accounting records or the books of

accounts, and then extracted, classified and summarized in the form of income

statement, balance sheet and cash flows statement.

Cost Bookkeeping, Costing, and Cost Accounting. Cost bookkeeping is the

process that involves the recording of cost data in books of accounts. It is, therefore,

similar to bookkeeping except that data are recorded in very much greater detail.

Cost accounting makes use of those data once they have been extracted from the

cost books in providing information for managerial planning and control. Cost

accounting deals with the collection, allocation, and control of the cost of producing

specific goods and services. This accumulation and explanation of actual and

prospective cost data is important to control Current operations and to plan for the

future.

Financial Accounting. Financial accounting is focused on the recording of business

transactions and the periodic preparation of reports on financial position and results

ACCBP 100 *Property of UMDC

Page 10 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

of operations. Financial accounting is the more specific term applied to the

preparation and subsequent publication of highly summarized financial information.

Financial Management. Financial managers are responsible for setting financial

objectives, making plans based on those objectives, obtaining the finance needed

to achieve the plans, and generally safeguarding all the financial resources of the

entity. It should also be noted that the financial manager draws on a much wider

range of disciplines (such as economics and mathematics) and relies more

extensively on non-financial data than does the more traditional accountant.

Management Accounting. Management accounting incorporates cost accounting

data and adapts them for specific decisions which management may be called upon

to make. A management accounting system incorporates all types of financial and

non-financial information from a wide range of sources.

Taxation. Tax accounting includes the preparation of tax returns and the

consideration of the tax consequences of proposed business transactions or

alternative courses of action. As typically known, accountants involved in tax work

are responsible for computing the amount of tax payable by both business entities

and individuals.

Government Accounting. It is concerned with the identification of the sources and

uses of resources consistent with the provisions of city, municipal, provincial or

national laws. The government collects and spends huge amount of public funds

annually so it is necessary that there is proper custody and disposition of these

funds.

Self-Help: You can also refer to the sources below to help you further

understand the lesson:

Ballada, W. (2016). Basic Accounting 2016 issue (21st edition). DomDane Publishers

and Made Easy Books: Manila

BASIC ACCOUNTING: BASIC ACCOUNTING CONCEPTS, PRINCIPLES, AND

PROCEDURES, VOLUME 2, 2ND EDITION. (2018). Kirkus Reviews, Retrieved from

https://www.proquest.com/docview/1991915978?accountid=31259

Merino, D. N. (2016). Basic accounting and finance. 2nd edition; engineering

management handbook, 2nd edition, huntsville (2nd edition ed., pp. 199-223).

Huntsville: American Society for Engineering Management (ASEM). Retrieved from

https://www.proquest.com/docview/2173844129?accountid=31259

ACCBP 100 *Property of UMDC

Page 11 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

Let’s Check

Activity 1. Choose the best answer.

1. Which area of public accounting means the examination of financial statements

by a CPA for the purpose of expressing an opinion as to the fairness of the

statements?

a. External auditing

b. Internal auditing

c. Taxation

d. Management advisory services

2. Which of the following is true?

a. Partners are personally liable for the liabilities of the partnership if the

partnership is unable to pay.

b. Partners can normally transfer their partnership interests with ease.

c. Stockholders are personally liable for the liabilities of the corporation if the

company is unable to pay.

d. Normally, stockholders can only sell their ownership interests when the

corporation terminates.

3. The measurement accounting is accomplished by

a. storing data.

b. reporting to decision makers.

c. recording data.

d. processing data

4. The consistency concept means that

a. Firms in the same industry must account for similar items in the same way.

b. Firms may never change the way in which they prepare their accounts.

c. When preparing the accounts of a firm, one should normally account for

similar items in the same way from one accounting period to the next.

d. None of the above.

5. The financial statements should be stated in terms of a common denominator.

a. Stable monetary unit

b. Accrual

c. Time period

d. Going concern

6. Which of the following accounting concepts states that an accounting transaction

should be supported by sufficient evidence to allow two or more qualified individuals

to arrive at essentially similar conclusion?

a. Periodicity

b. matching

c. stable monetary unit

d. objectivity

ACCBP 100 *Property of UMDC

Page 12 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

7. The financial accounting process provides information about economic activities

of an enterprise for a specified accounting period that is shorter than the life of the

enterprise.

a. going concern

b. measurement in terms of money

c. time period

d. measurement of economic resources and obligations

8. They encompass the conventions, rules, and procedures necessary to define what

is accepted accounting practice.

a. Generally accepted accounting principles

b. Accounting assumptions

c. Conceptual frameworks

d. Accounting concepts

9. The main function is to establish and improve accounting standards that will be

generally accepted in the Philippines.

a. Philippine Institute of CPAs

b. Professional Regulation Commission

c. Board of Accountancy

d. Financial Reporting Standards Council

10. Accountants employed by a particular business firm or not-for-profit organization,

perhaps as chief accountant, controller, or financial vice president, are said to be

engaged in practice in

a. commerce and industry.

b. general accounting.

c. independent accounting.

d. public accounting.

11. This principle requires relevant information to form part of financial statements

for decision-making purposes.

a. accounting entity

b. adequate disclosure

c. materiality

d. objectivity

12. Proponents of historical costs maintain that in comparison with all other valuation

alternatives for general purpose financial reporting, statements prepared using

historical costs are more

a. indicative of the entity's purchasing power.

b. conservative.

c. objective.

d. relevant.

13. The principle of objectivity includes the concept of

a. summarization.

b. classification.

ACCBP 100 *Property of UMDC

Page 13 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

c. conservatism.

d. verifiability.

14. Which accounting process is the recognition or nonrecognition of business

activities as accountable events?

a. Recording

b. Identifying

c. Communicating

d. Measuring

15. Accounting is a service activity. Its function is to provide

a. Quantitative and qualitative information

b. Qualitative information

c. Quantitative information

d. None of the above

Let’s Analyze

Activity 1. Discuss the following statements below based on your own understanding.

1. Why is accounting often referred to as the language of business?

2. Research about the accountancy profession and write your thoughts below.

ACCBP 100 *Property of UMDC

Page 14 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

In a Nutshell

Activity 1. We have discussed in this unit the basic concepts in accounting and its

importance in your role as future accountants. In this part, you will be required to draw

conclusions, perspectives, arguments and ideas from the unit lesson. I will supply the

first item and you will continue the rest.

1. Accounting is part of our everyday life. We keep records of our daily transactions

and accounting can help us simplify it. Accounting is applicable to all whether you are

an individual or a business entity since we all have financial responsibilities to account

for.

Your Turn

2.

3.

ACCBP 100 *Property of UMDC

Page 15 of 126

UM Digos College

Department of Accounting Education

Roxas Extension, Digos City

4.

5.

6.

7.

8.

9.

10.

ACCBP 100 *Property of UMDC

Page 16 of 126

You might also like

- Cost Accounting and Control Handout 2205 Cost Accounting CycleDocument20 pagesCost Accounting and Control Handout 2205 Cost Accounting CycleJhenny Mae DeduyoNo ratings yet

- Statement of Comprehensive IncomeDocument11 pagesStatement of Comprehensive IncomeKhiezna PakamNo ratings yet

- Cost Accounting and Cost Management 1 Accounting For Factory OverheadDocument19 pagesCost Accounting and Cost Management 1 Accounting For Factory OverheadJamaica DavidNo ratings yet

- Nacua CAC Unit2 ActivityDocument13 pagesNacua CAC Unit2 ActivityJasper John NacuaNo ratings yet

- Uge 2 SimDocument66 pagesUge 2 SimKezzi Ervin UngayNo ratings yet

- CBA - Approved Module - Cost Accounting and Control v2021Document109 pagesCBA - Approved Module - Cost Accounting and Control v2021Mhekylha's AñepoNo ratings yet

- 03 Quiz 1 AubDocument3 pages03 Quiz 1 Aubken dahunanNo ratings yet

- BSA Curriculum 2022Document3 pagesBSA Curriculum 2022MhondsNo ratings yet

- MGMT 540: Managerial Economics Midterm Exam: Minutes To Complete The Exam (Including Formatting, Uploading, Etc.) - YouDocument9 pagesMGMT 540: Managerial Economics Midterm Exam: Minutes To Complete The Exam (Including Formatting, Uploading, Etc.) - Youliu anNo ratings yet

- BME 41 PrelimsDocument12 pagesBME 41 PrelimsFiles CompilationNo ratings yet

- Practical Research 2 Week 2 LT Midterm 2021-2022Document8 pagesPractical Research 2 Week 2 LT Midterm 2021-2022Nichole Balao-asNo ratings yet

- Module 2 Conceptual FrameworkDocument8 pagesModule 2 Conceptual FrameworkEloisa Joy MoredoNo ratings yet

- Module 1.a The Accountancy ProfessionDocument6 pagesModule 1.a The Accountancy ProfessionJonathanTipay0% (1)

- Chapter 1-INTRODUCTION: PresentsDocument100 pagesChapter 1-INTRODUCTION: PresentsWasherker KayerNo ratings yet

- Cost AccumulationDocument43 pagesCost AccumulationEmm Jey100% (1)

- I. Learning Activities: Sum of Weights (3+2+1) 6Document6 pagesI. Learning Activities: Sum of Weights (3+2+1) 6Valdez AlyssaNo ratings yet

- Simple and Compound Interest-Problem-Set-1Document2 pagesSimple and Compound Interest-Problem-Set-1John Vergel PensilgaNo ratings yet

- D AnalysisDocument1,241 pagesD AnalysisLuqmanhakim XavNo ratings yet

- Module 2 - Topic 4Document8 pagesModule 2 - Topic 4Moon LightNo ratings yet

- Ethical IssuesDocument24 pagesEthical IssuesJustin Earl GuevarraNo ratings yet

- Scanned With CamscannerDocument7 pagesScanned With CamscannerFlor Danielle QuerubinNo ratings yet

- Lumasag, Ac T. CODE 3056: Let's CheckDocument4 pagesLumasag, Ac T. CODE 3056: Let's CheckKayla Hingking ToraynoNo ratings yet

- Activity 4 Name: Course & Section: Assets Transaction Cash Supplies Equipment Accounts ReceivableDocument18 pagesActivity 4 Name: Course & Section: Assets Transaction Cash Supplies Equipment Accounts ReceivableJoshua Sta AnaNo ratings yet

- Adjusting Entries & Adjusted Trial Balance-1 - 94Document9 pagesAdjusting Entries & Adjusted Trial Balance-1 - 94Zubair Jutt100% (1)

- Activity #2: Case Analysis Involving Financial Statements: AnswerDocument2 pagesActivity #2: Case Analysis Involving Financial Statements: AnswerJeramie Sarita SumaotNo ratings yet

- Microeconomics Tutorial 2Document2 pagesMicroeconomics Tutorial 2zillxsNo ratings yet

- Group Activity 2.2 in Strategic ManagementDocument4 pagesGroup Activity 2.2 in Strategic ManagementLizcel CastillaNo ratings yet

- Bsa Lecture Discussion On AccrualsDocument8 pagesBsa Lecture Discussion On AccrualsGarp BarrocaNo ratings yet

- Bahr 212 SimDocument63 pagesBahr 212 SimLasti DirksawNo ratings yet

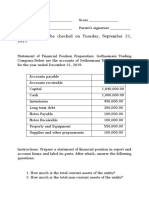

- Answer This To Be Checked On Tuesday, September 21, 2021Document2 pagesAnswer This To Be Checked On Tuesday, September 21, 2021Teresa Mae OrquiaNo ratings yet

- Financial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusDocument29 pagesFinancial Analysis and Planning: Cash Flow and Fund Flow Statement Are Not There in SyllabusHanabusa Kawaii IdouNo ratings yet

- Financial Planning and BudgetingDocument45 pagesFinancial Planning and BudgetingRafael BensigNo ratings yet

- Time Value of MoneyDocument8 pagesTime Value of MoneyLj SzeNo ratings yet

- Financial Management Week 2 AssignmentDocument2 pagesFinancial Management Week 2 AssignmentAndrea Monique AlejagaNo ratings yet

- Bachelor of Science in Accounting TechnologyDocument6 pagesBachelor of Science in Accounting TechnologyErme Fradejas DulceNo ratings yet

- (Do Not Distribute) SCM - Budgeting Part 1Document13 pages(Do Not Distribute) SCM - Budgeting Part 1James CantorneNo ratings yet

- Busmath ExamplesDocument18 pagesBusmath ExamplesChris Tin100% (2)

- Capital Budgeting Discounted Method - Discussion Problems - Part 1Document11 pagesCapital Budgeting Discounted Method - Discussion Problems - Part 1Deryl GalveNo ratings yet

- SolMan Chapt9Document65 pagesSolMan Chapt9Jesiel Claire MarasiganNo ratings yet

- Review Materials in Cost AccountingDocument10 pagesReview Materials in Cost AccountingCARMELITA CUETONo ratings yet

- OC & CCC Activity 1-4Document8 pagesOC & CCC Activity 1-4Maria Klaryce AguirreNo ratings yet

- MAC 406 Performance Management SystemsDocument38 pagesMAC 406 Performance Management SystemsRhodemar CuartoNo ratings yet

- Accounting in Our Daily LifeDocument3 pagesAccounting in Our Daily LifeJaeseupeo JHas VicenteNo ratings yet

- Ethics 3.1 1Document38 pagesEthics 3.1 1Nicole Tonog AretañoNo ratings yet

- Project Management 2Document62 pagesProject Management 2Abdul HaseebNo ratings yet

- Lesson 1 The Nature and Forms of Business OrganizationsDocument1 pageLesson 1 The Nature and Forms of Business OrganizationsYanko Yap BondocNo ratings yet

- FinMan Chapter 1Document3 pagesFinMan Chapter 1Cristine Tabaque GomobarNo ratings yet

- Senior High School Department: Quarter 3 - Module 1: Introduction To AccountingDocument9 pagesSenior High School Department: Quarter 3 - Module 1: Introduction To AccountingJaye RuantoNo ratings yet

- AC 4103 OBEdized SyllabusDocument21 pagesAC 4103 OBEdized SyllabusAyame KusuragiNo ratings yet

- Content 2 PDFDocument13 pagesContent 2 PDFSecurity Bank Personal LoansNo ratings yet

- Code of Ethics Part III and IV: Attempt HistoryDocument48 pagesCode of Ethics Part III and IV: Attempt HistoryLara FloresNo ratings yet

- The Following Unadjusted Trial Balance Is For Ace Construction CoDocument1 pageThe Following Unadjusted Trial Balance Is For Ace Construction Cotrilocksp SinghNo ratings yet

- Balanced ScorecardDocument14 pagesBalanced ScorecardLand DoranNo ratings yet

- Managementaccounting1 Relevant Costing Quiz 10187 1637883099Document4 pagesManagementaccounting1 Relevant Costing Quiz 10187 1637883099Olivia Chanco ManriqueNo ratings yet

- Quiz 6 Inventory ManagementDocument6 pagesQuiz 6 Inventory ManagementCindy Jane OmillioNo ratings yet

- Introduction About Enrolment Grading SystemDocument4 pagesIntroduction About Enrolment Grading SystemPauline Bogador MayordomoNo ratings yet

- Exercise 6-1 (Classification of Cost Drivers)Document18 pagesExercise 6-1 (Classification of Cost Drivers)Barrylou ManayanNo ratings yet

- Course Outline: ACP 313-Accounting For Government and Not-For - Profit OrganizationsDocument7 pagesCourse Outline: ACP 313-Accounting For Government and Not-For - Profit OrganizationsCharles D. FloresNo ratings yet

- Chap 1 & 2Document12 pagesChap 1 & 2Cristel ObraNo ratings yet

- Week 2 - ULOADocument15 pagesWeek 2 - ULOACristel ObraNo ratings yet

- Payment Plan ConfigurationDocument3 pagesPayment Plan Configurationraymart copiarNo ratings yet

- Nike Case StudyDocument5 pagesNike Case StudyNimisha PalawatNo ratings yet

- The Business Model Canvas: Customer Segments Value Propositions Key Activities Key Partners Customer RelationshipsDocument1 pageThe Business Model Canvas: Customer Segments Value Propositions Key Activities Key Partners Customer RelationshipsJAISHINI SIVARAM 2023259No ratings yet

- Agcaoili V GSISDocument3 pagesAgcaoili V GSISCamille Bugtas100% (2)

- Electronic Ticket Receipt 15FEB For GENA BEIVE BALISBISDocument2 pagesElectronic Ticket Receipt 15FEB For GENA BEIVE BALISBISGena Beive BalisbisNo ratings yet

- Sausage Production Plant Rs. 6.89 Million Feb-2021Document21 pagesSausage Production Plant Rs. 6.89 Million Feb-2021Zaighaum RanaNo ratings yet

- Delegate List - 10th IMRC With Contact Details - Removed (1) - RemovedDocument234 pagesDelegate List - 10th IMRC With Contact Details - Removed (1) - RemovedSharon SusmithaNo ratings yet

- Reasons Why Entrepreneurial Organizations Seek Opportunities For InnovationDocument5 pagesReasons Why Entrepreneurial Organizations Seek Opportunities For InnovationOliver AloyceNo ratings yet

- C1 Wordlist Unit 8Document6 pagesC1 Wordlist Unit 8Phạm Nguyễn Hồng LựcNo ratings yet

- Corporate Governance Scorecard For Mauritius 2021Document30 pagesCorporate Governance Scorecard For Mauritius 2021Rickesh NunkooNo ratings yet

- F.S Presentation (Aluminum Production Line)Document30 pagesF.S Presentation (Aluminum Production Line)Mohamed Fouad YounesNo ratings yet

- MTG 3000 VoIP Trunk Gateway User Manual v1.0Document94 pagesMTG 3000 VoIP Trunk Gateway User Manual v1.0ojmojnovNo ratings yet

- Billionfit Technology Redesigning HealthcareDocument26 pagesBillionfit Technology Redesigning HealthcareAnkitNo ratings yet

- Money LaunderingDocument38 pagesMoney LaunderingMuhammad Saiful IslamNo ratings yet

- Tenant App Form 2Document2 pagesTenant App Form 2api-26508830No ratings yet

- Cost Sheet: Meaning and Its ImportanceDocument15 pagesCost Sheet: Meaning and Its ImportanceDevanshi ShahNo ratings yet

- Operations & Welding ManagerDocument2 pagesOperations & Welding ManagerDemetrios HalastarasNo ratings yet

- Apparel Production Management and The Technical Package Illustrated Edition Full ChapterDocument38 pagesApparel Production Management and The Technical Package Illustrated Edition Full Chapterdaniel.caster195100% (25)

- S21 STEN-3930 (91) Course Outline - LEE - FinalDocument15 pagesS21 STEN-3930 (91) Course Outline - LEE - FinalGibran RiosNo ratings yet

- Cambridge IGCSE™: Enterprise 0454/11 May/June 2021Document24 pagesCambridge IGCSE™: Enterprise 0454/11 May/June 2021Sraboni ChowdhuryNo ratings yet

- D Management Overide of Controls HandoutDocument4 pagesD Management Overide of Controls Handoutys.yeetslNo ratings yet

- 7F Advanced Gas Path A Power Flexefficiency SolutionDocument2 pages7F Advanced Gas Path A Power Flexefficiency Solutiondm mNo ratings yet

- Weebly ResumeDocument2 pagesWeebly Resumeapi-502305472No ratings yet

- M.a.D's SWOT Analysis of Meezan Bank!Document10 pagesM.a.D's SWOT Analysis of Meezan Bank!Muhammad Ali DanishNo ratings yet

- C TSCM44 65Document2 pagesC TSCM44 65karamananNo ratings yet

- 122R1 - Aqua Refinery LTD - Ariel - Bangladesh-Rev-ARL-01Document8 pages122R1 - Aqua Refinery LTD - Ariel - Bangladesh-Rev-ARL-01Anwar SadatNo ratings yet

- Develop Business in Rural Areas With The Help of Digital PlatformsDocument30 pagesDevelop Business in Rural Areas With The Help of Digital PlatformsMd Tasnim FerdousNo ratings yet

- Uniqlo Social MediaDocument11 pagesUniqlo Social Mediarosallyn tanoyo100% (1)

- Top 50 Bad Hosts 201006Document27 pagesTop 50 Bad Hosts 201006jyrtNo ratings yet

- The Geography of Transport SystemsDocument10 pagesThe Geography of Transport SystemsFasumus FaisalNo ratings yet