Professional Documents

Culture Documents

Rieter Consolidated Balance Sheet 2020 en

Uploaded by

Sachin ChourasiyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rieter Consolidated Balance Sheet 2020 en

Uploaded by

Sachin ChourasiyaCopyright:

Available Formats

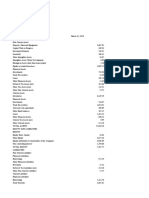

BALANCE SHEET

December 31,

CHF million 2020

Assets

Cash and cash equivalents 282.3

Marketable securities and time deposits 0.9

Trade receivables 50.4

Other current receivables1 26.1

Current income tax receivables1 3.5

Inventories 192.5

Current assets 555.7

Property, plant and equipment 210.6

Intangible assets and goodwill 89.5

Investments in associated companies 15.8

Defined benefit plan assets 62.7

Deferred income tax assets 22.1

Other non-current assets 7.1

Non-current assets 407.8

Assets 963.5

Liabilities and shareholders’ equity

Trade payables 47.7

Advance payments from customers 95.5

Other current liabilities 78.8

Current financial debt 151.4

Current income tax liabilities 24.9

Current provisions 30.0

Current liabilities 428.3

Non-current financial debt 90.5

Defined benefit plan liabilities 32.3

Deferred income tax liabilities 31.1

Other non-current liabilities 0.1

Non-current provisions 30.3

Non-current liabilities 184.3

Liabilities 612.6

Equity attributable to shareholders of Rieter Holding Ltd. 350.6

Equity attributable to non-controlling interests 0.3

Shareholders’ equity 350.9

Liabilities and shareholders’ equity 963.5

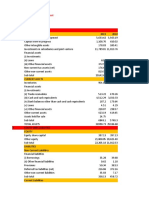

INCOME STATEMENT

CHF million 2020

Sales 573.0

Cost of sales - 439.2

Gross profit 133.8

Research and development expenses - 52.5

Selling, general and administrative expenses - 168.8

Other income1 15.2

Other expenses1 - 12.1

Operating result before interest and taxes (EBIT) - 84.4

Share in profit of associated companies - 0.3

Financial income 2.2

Financial expenses - 5.5

Profit before taxes - 88.0

Income taxes - 1.8

Net profit - 89.8

Attributable to shareholders of Rieter Holding Ltd. - 89.8

Attributable to non-controlling interests 0.0

Basic earnings per share (CHF) - 20.05

Diluted earnings per share (CHF) - 20.03

STATEMENT OF COMPREHENSIVE INCOME

CHF million 2020

Net profit - 89.8

Remeasurement of defined benefit plans 10.7

Income taxes on remeasurement of defined benefit plans - 0.7

Items that will not be reclassified to the income statement, net of taxes 10.0

Currency translation differences - 14.1

Income taxes on currency translation differences 0.3

Cash flow hedges 0.4

Income taxes on cash flow hedges - 0.1

Items that may be reclassified to the income statement, net of taxes - 13.5

Total other comprehensive income - 3.5

Total comprehensive income - 93.3

Attributable to shareholders of Rieter Holding Ltd. - 93.2

Attributable to non-controlling interests - 0.1

RatioAnalysis

Current Liability 428.3

Current Ratio 0.00

Gross Profit 133.8

Sales 573

Gross Profit Ratio 23.35%

Net Profit -89.8

Sales 573

Net Profit Ratio -15.67%

Assets 963.5

Sales 573

Asset Turnover Ratio 1.68

PBIT 133.8

Interest 5.5

Interest Coverage Ratio 24.33

P/E RATIO

Basic earnings per share -20.05

Diluted earnings per share -20.03

You might also like

- Dufry HY 2022 ReportDocument27 pagesDufry HY 2022 ReportHaden BraNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- 120 Financial Statements and Ratio Analysis PDFDocument20 pages120 Financial Statements and Ratio Analysis PDFMohit WaniNo ratings yet

- Kia Motors Chapter 3Document8 pagesKia Motors Chapter 3Craft Deal100% (1)

- Rieter Consolidated Balance Sheet 2020 enDocument1 pageRieter Consolidated Balance Sheet 2020 enMuhammadSiddiqNo ratings yet

- Marel q3 2019 Condensed Consolidated Interim Financial Statements ExcelDocument5 pagesMarel q3 2019 Condensed Consolidated Interim Financial Statements ExcelAndre Laine AndreNo ratings yet

- Honda Motors CH 3Document6 pagesHonda Motors CH 3Craft DealNo ratings yet

- ANNUAL REPORT ITC COMPANY Ltd.Document13 pagesANNUAL REPORT ITC COMPANY Ltd.KUNAL ANANDNo ratings yet

- Campari Model VFDocument97 pagesCampari Model VFJaime Vara De ReyNo ratings yet

- Campari Model VFDocument97 pagesCampari Model VFJaime Vara De ReyNo ratings yet

- Q3 2022 Quarterly Financial Statements VT Group AGDocument6 pagesQ3 2022 Quarterly Financial Statements VT Group AGAmr YehiaNo ratings yet

- Anexo 2: Selected Linear Financial Data in Millions of Dollars (Except Share Data), 1992-2003Document7 pagesAnexo 2: Selected Linear Financial Data in Millions of Dollars (Except Share Data), 1992-2003Milton Raul Rivas saballosNo ratings yet

- Standalone Statement of Cash Flows For The Year Ended March 31, 2021Document6 pagesStandalone Statement of Cash Flows For The Year Ended March 31, 2021Yash YellewarNo ratings yet

- Roll No-010,011,012,013 (Group No 3)Document7 pagesRoll No-010,011,012,013 (Group No 3)Ayush SatyamNo ratings yet

- Case Study - Campari - Model - VFDocument99 pagesCase Study - Campari - Model - VFPietro SantoroNo ratings yet

- Unaudited 3m Condensed Combined Financial StatementsDocument40 pagesUnaudited 3m Condensed Combined Financial StatementsValtteri ItärantaNo ratings yet

- Financial Management AssignmentDocument5 pagesFinancial Management AssignmentSREEJITH RNo ratings yet

- Long Hau LGH - Sonadezi Chau Duc SZC - Case Study Q7 ReviewDocument59 pagesLong Hau LGH - Sonadezi Chau Duc SZC - Case Study Q7 ReviewTrung Hung HoNo ratings yet

- National Aluminium Company LTD Balance Sheet: Non-Current AssetsDocument25 pagesNational Aluminium Company LTD Balance Sheet: Non-Current AssetsSmall Town BandaNo ratings yet

- Business Analysis and Valuation Asia Pacific 2nd Edition Palepu Solutions ManualDocument154 pagesBusiness Analysis and Valuation Asia Pacific 2nd Edition Palepu Solutions Manualtammyfrybiwfdqnmay100% (13)

- Ratio Analysis Berger Asian PaintsDocument11 pagesRatio Analysis Berger Asian PaintsHEM BANSALNo ratings yet

- Assignement No: 1 Submitting By: Maherban Haider Submitting To: Sir Shahab Aziz ENROLLMENT NO: 01-220182-010Document9 pagesAssignement No: 1 Submitting By: Maherban Haider Submitting To: Sir Shahab Aziz ENROLLMENT NO: 01-220182-010Maherban HaiderNo ratings yet

- WSP GL FS Q12023 enDocument20 pagesWSP GL FS Q12023 endennis72288No ratings yet

- AFM Project Report FinalDocument19 pagesAFM Project Report FinalRitu KumariNo ratings yet

- Accounts ProjectDocument20 pagesAccounts ProjectIman MazumderNo ratings yet

- Asian PaintsDocument6 pagesAsian PaintsDivyagarapatiNo ratings yet

- Asian Paints Ltd. (India) : SourceDocument6 pagesAsian Paints Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Group Project 30Document49 pagesGroup Project 30Omkar GadeNo ratings yet

- Britannia Industries Ltd. (India) : SourceDocument6 pagesBritannia Industries Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. Zenderrohin gargNo ratings yet

- Group 13 Bajaj AutoDocument6 pagesGroup 13 Bajaj AutoKshitij MaheshwaryNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. ZenderYudi Ahmad FaisalNo ratings yet

- Bajaj Finserv Ltd. (India) : SourceDocument5 pagesBajaj Finserv Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Consolidated Balance Sheet: Godrej Industries LimitedDocument6 pagesConsolidated Balance Sheet: Godrej Industries LimitedAjjay AmulNo ratings yet

- Pres Ratios DataDocument24 pagesPres Ratios Datasamarth chawlaNo ratings yet

- Adani Ports & Special Economic Zone Ltd. (India) : SourceDocument9 pagesAdani Ports & Special Economic Zone Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Ratios Report Ambuja CementDocument11 pagesRatios Report Ambuja CementSajal GoyalNo ratings yet

- Canada Packers - Exhibits + Valuation - FionaDocument63 pagesCanada Packers - Exhibits + Valuation - Fiona/jncjdncjdn100% (1)

- Burberry AR 2016-17 CleanDocument10 pagesBurberry AR 2016-17 Cleanqiaocheng2023No ratings yet

- Ermenegildo Zegna N.V. (ZGN)Document2 pagesErmenegildo Zegna N.V. (ZGN)Carlos Suárez MatosNo ratings yet

- Zomato Finaicial ModelDocument16 pagesZomato Finaicial ModelSaubhagya SuriNo ratings yet

- Full Download Business Analysis and Valuation Asia Pacific 2nd Edition Palepu Solutions ManualDocument22 pagesFull Download Business Analysis and Valuation Asia Pacific 2nd Edition Palepu Solutions Manualbaydayenory6100% (38)

- Financial Statements of Great Eastern Shipping: YearsDocument15 pagesFinancial Statements of Great Eastern Shipping: YearsPriyankaNo ratings yet

- Financial ModuleDocument7 pagesFinancial ModuleVarad VinherkarNo ratings yet

- Spring 2018, 2 Quarter Accounting and Financial Reporting Group 1E Instructor: Dr. Mohamed MoustafaDocument19 pagesSpring 2018, 2 Quarter Accounting and Financial Reporting Group 1E Instructor: Dr. Mohamed Moustafaremon mounirNo ratings yet

- Krsnaa Diagnostics PVT LTD - v2Document67 pagesKrsnaa Diagnostics PVT LTD - v2HariharanNo ratings yet

- ASN SOD Finacial AnalysisDocument6 pagesASN SOD Finacial Analysisjitendra tirthyaniNo ratings yet

- Vienna Insurance Group Key Financials 6M 2015: Year-To-DateDocument12 pagesVienna Insurance Group Key Financials 6M 2015: Year-To-DateTamara HorvatNo ratings yet

- 2021AnnualReport FINAL 39 43Document5 pages2021AnnualReport FINAL 39 43Wilson BastidasNo ratings yet

- ValuationDocument31 pagesValuationAman TaterNo ratings yet

- 2018-Annual-Report Selected PagesDocument11 pages2018-Annual-Report Selected PagesLuis David BriceñoNo ratings yet

- KGAR21 Financial StatementsDocument8 pagesKGAR21 Financial StatementsJhanvi JaiswalNo ratings yet

- Assets: Balance Sheet Particulars Note NoDocument5 pagesAssets: Balance Sheet Particulars Note NonidhidNo ratings yet

- Diagnosing Profitability, Risk, and Growth: Hawawini & Viallet 1Document29 pagesDiagnosing Profitability, Risk, and Growth: Hawawini & Viallet 1Imelda Gonzalez MedinaNo ratings yet

- WSP Financial Analysis V1.4Document68 pagesWSP Financial Analysis V1.4maruthimallepalliNo ratings yet

- Bajaj Auto Ltd. (India) : SourceDocument5 pagesBajaj Auto Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Long Hau LGH - Sonadezi Chau Duc SZC - Case Study Group17Document75 pagesLong Hau LGH - Sonadezi Chau Duc SZC - Case Study Group17Trung Hung HoNo ratings yet

- Bajaj AutoDocument5 pagesBajaj AutoDivyagarapatiNo ratings yet

- Public OfficerDocument12 pagesPublic OfficerCatNo ratings yet

- Module 4 Criminal Law 1Document7 pagesModule 4 Criminal Law 1Frans Raff LopezNo ratings yet

- ASME B16-48 - Edtn - 2005Document50 pagesASME B16-48 - Edtn - 2005eceavcmNo ratings yet

- Avantages Dis Advantages of Mutual FundsDocument3 pagesAvantages Dis Advantages of Mutual FundsJithendra Kumar MNo ratings yet

- Free Pattern Easy Animal CoasterDocument4 pagesFree Pattern Easy Animal CoasterAdrielly Otto100% (2)

- TM ApplicationDocument2 pagesTM Applicationlalitkaushik0317No ratings yet

- Scheulin Email Thread BRENT ROSEDocument3 pagesScheulin Email Thread BRENT ROSEtpepperman100% (1)

- All Weeks GlobalDocument70 pagesAll Weeks GlobalGalaxy S5No ratings yet

- Nysc Call Up LetterDocument1 pageNysc Call Up LetterVickthor ST77% (13)

- Apwh Wwi & Wwii WebquestDocument4 pagesApwh Wwi & Wwii WebquestNahom musieNo ratings yet

- Maharashtra Public Trust ActDocument72 pagesMaharashtra Public Trust ActCompostNo ratings yet

- Borromeo v. DescallarDocument2 pagesBorromeo v. Descallarbenjo2001No ratings yet

- Alumni Event ProposalDocument17 pagesAlumni Event ProposalClyte SoberanoNo ratings yet

- No Dues CertificateDocument2 pagesNo Dues CertificateSatyajit BanerjeeNo ratings yet

- Assignment - The Universal Declaration of Human RightsDocument5 pagesAssignment - The Universal Declaration of Human RightsMarina PavlovaNo ratings yet

- Ak. Jain Dukki Torts - PDF - Tort - DamagesDocument361 pagesAk. Jain Dukki Torts - PDF - Tort - Damagesdagarp08No ratings yet

- Orders, Decorations, and Medals of The Malaysian States and Federal Territories PDFDocument32 pagesOrders, Decorations, and Medals of The Malaysian States and Federal Territories PDFAlfred Jimmy UchaNo ratings yet

- 1854 - (Ennemoser) - The History of Magic Vol 1Document531 pages1854 - (Ennemoser) - The History of Magic Vol 1GreyHermitNo ratings yet

- Lessons of History (Abridgement)Document24 pagesLessons of History (Abridgement)infonomics100% (4)

- FCS Question Bank 2021-22Document4 pagesFCS Question Bank 2021-22Dhananjay SinghNo ratings yet

- Cortes Constitutional Foundations of Privacy in Emerging Trends in LawDocument3 pagesCortes Constitutional Foundations of Privacy in Emerging Trends in LawAce Reblora IINo ratings yet

- SECULAR Vs Islm ComparisonDocument2 pagesSECULAR Vs Islm ComparisonAsif SaeedNo ratings yet

- 2013 Annual ReportDocument100 pages2013 Annual ReportFederal Reserve Bank of St. LouisNo ratings yet

- Phase I - Price List (Towers JKLMNGH)Document1 pagePhase I - Price List (Towers JKLMNGH)Bharat ChatrathNo ratings yet

- Dukane TS200 Technical ManualDocument9 pagesDukane TS200 Technical ManualTom MaboetieNo ratings yet

- Giga FiberLinX IIDocument60 pagesGiga FiberLinX IIJuan PerezNo ratings yet

- Certificate of Conformity: No. CLSAN 080567 0058 Rev. 00Document2 pagesCertificate of Conformity: No. CLSAN 080567 0058 Rev. 00annamalaiNo ratings yet

- JurisDocument19 pagesJurisJee JeeNo ratings yet

- Idea Cellular Limited: NoticeDocument145 pagesIdea Cellular Limited: Noticeliron markmannNo ratings yet

- Green Delta Life Insurance at Power PointDocument12 pagesGreen Delta Life Insurance at Power Pointapi-3844412100% (2)