Professional Documents

Culture Documents

Yustika Adiningsih-F0319141-Mindmap SPM A Chapter 6 Dan 7

Uploaded by

yes iOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yustika Adiningsih-F0319141-Mindmap SPM A Chapter 6 Dan 7

Uploaded by

yes iCopyright:

Available Formats

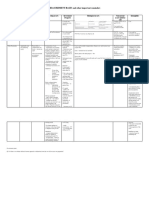

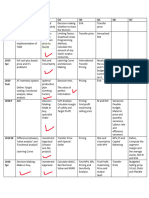

Effectiveness YUSTIKA ADININGSIH-

Calculating a Volume-Adjusted Volume-Adjusted Profit F0319141-MINDMAP

2 Measurements

Profit Plan (or Flexible Budget) Plan SPM A CHAPTER 6

Efficiency

favorable

Computing Profit Plan Variances

variance analysis

in Absolute and Relative Terms

unfavorable

Variable costs = Input volume x Operating Efficiencies : profit (loss) from competitive

Cost per unit of input Variable Costs effectiveness + profit (loss) from

operating efficiencies

Efficiency variance Strategic Profitability

Calculating Production Efficiency

and Cost Variances (If Applicable) Cash Wheel

Spending variance

Strategic Profitability Strategic Profitability

Spending variance = Analysis Wheel Analysis

(Planned cost - Actual cost)

Evaluating

Strategic Profit ROE Wheel

Committed Costs

Calculating Variances Operating Efficiencies : Performance

for Nonvariable Costs Nonvariable Costs

Market size variance = market size

Discretionary Expenses X planned market share X planned

average contribution margin

Competitive Effectiveness : Computing Market

Activity-Based Costs

Market Share Variances Share Variances

Market share variance = market

share X actual market size X planned

Searching for Explanations Interpreting Strategic

average contribution margin

and Initiating Action Plans Profitability Variances

increase (or decrease) in profit

due to changes in prices

increase (or decrease) in profit

due to changes in product mix

Strategic Learning Competitive Effectiveness : Computing Revenue

Revenue Variances Variances

price premium

Early Warning and Using Strategic

Corrective Action Profitability Analysis

Contribution margin

Performance Evaluation product mix

Product mix variance = average standard

product mix variance

contribution x actual unit volume

Set of formal routines and

procedures designed to process and

evaluate requests to acquire new assets

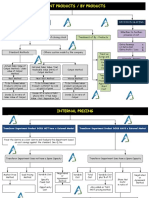

YUSTIKA ADININGSIH-

F0319141-MINDMAP

SPM A CH 7

Capital budget or capital investment plan

Senior managers must provide guidance

Limits on Asset Allocations to subordinates about what kind of

Evaluating Assets Acquired to Meet assets to acquire

Safety/Health/Regulatory Needs

The analyses

Asset Allocation

Payback Systems

Net Present Value (NPV)

Policies and Procedures The process

Discounted Cash Flow

Evaluating Assets to Enhance Operating

Weighted Average Cost of

Efficiency and/or Increase Revenue A time frame

Capital (WACC)

Hurdle Rate Internal Rate of Return Evaluating Asset Senior managers should

Acquisition Proposals communicate policies regarding who

Span of Accountability

Designing Asset has authority to approve the

Alignment of Proposal with Existing acquisition of assets

Allocation Systems

Strategy and/or Distinctive Capabilities

Spending Limits Limiting discretion

Risks in Acquiring the Asset

Assets to Meet Safety/Health/

Risk in Deciding Not to Regulatory Needs

Acquire the Asset

Evaluating Assets to be Acquired for

Competitive Effectiveness Sorting Asset by Assets to Enhance Operating

Quality of Information Category Efficiency and/or Increase Revenue

Supporting Proposal

Assets to Enhance Competitive

Track Record and Ability of Champion Effectiveness

Feasibility and Cost of

Reversing Decision

The Process of

Putting It All Together

Allocating Assets

You might also like

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Idle Capacity and Management: BE PresentationDocument15 pagesIdle Capacity and Management: BE PresentationBhawna GosainNo ratings yet

- Standard Costing: Chapter OverviewDocument19 pagesStandard Costing: Chapter OverviewJoy DharNo ratings yet

- Power Generation Financial ModelDocument56 pagesPower Generation Financial ModelArun Munjal20% (5)

- 1.3 CVP AnalysisDocument2 pages1.3 CVP AnalysisLea GerodiazNo ratings yet

- 9 Economics MMDocument42 pages9 Economics MMAishwarya BansalNo ratings yet

- Lecture 1 AMA - RevisionDocument9 pagesLecture 1 AMA - RevisionLưu Hồng Hạnh 4KT-20ACNNo ratings yet

- Cost Concepts and Analysis: Management Advisory ServicesDocument7 pagesCost Concepts and Analysis: Management Advisory ServicesAlexander QuemadaNo ratings yet

- HRM Lecture 4 Slides OnlyDocument16 pagesHRM Lecture 4 Slides Only晓冬亚军的二舅姥爷No ratings yet

- Arginal OstingDocument69 pagesArginal Ostingmoses jcNo ratings yet

- BUS254 - Variance Analysis - 4slidesper PageDocument14 pagesBUS254 - Variance Analysis - 4slidesper PageyuviNo ratings yet

- PM - PDF l5Document15 pagesPM - PDF l5THURGASHINI NAIR A/P RAGAWANNo ratings yet

- 2024 - Level 1 - Economics - SlideDocument42 pages2024 - Level 1 - Economics - Slidek60.2113340007No ratings yet

- Absorption and MarginalDocument7 pagesAbsorption and MarginalshafinasimanNo ratings yet

- MS05 - Cost-Volume-Profit (CVP) AnalysisDocument5 pagesMS05 - Cost-Volume-Profit (CVP) AnalysisElsie GenovaNo ratings yet

- Profitability Analysis PDFDocument47 pagesProfitability Analysis PDFitkishorkumar33% (3)

- Framework Profitability Smarthveer Sidana 1Document1 pageFramework Profitability Smarthveer Sidana 1adityaNo ratings yet

- MAS-02: Cost Behavior Regression Analysis: - T R S ADocument124 pagesMAS-02: Cost Behavior Regression Analysis: - T R S ADestiny LazarteNo ratings yet

- Materials From HBS and Text Book - Summary of Management AccountingDocument145 pagesMaterials From HBS and Text Book - Summary of Management AccountingMuhammad Helmi FaisalNo ratings yet

- CH 8Document16 pagesCH 8emanmamdouh596No ratings yet

- MS03 - Cost Behavior and Cost Classification PDFDocument12 pagesMS03 - Cost Behavior and Cost Classification PDFTina PascualNo ratings yet

- ManAcc S05 SlidesDocument88 pagesManAcc S05 SlidesNina Selin OZSEKERCINo ratings yet

- Flexible Budgets, Overhead Cost Variances, and Management ControlDocument14 pagesFlexible Budgets, Overhead Cost Variances, and Management ControlNoveliaNo ratings yet

- 02 CVP HandoutDocument23 pages02 CVP HandoutRishika RathiNo ratings yet

- ICAB Lecture 1 & 2 On Chapter 1 Fundamentals of Costing - RCKDocument10 pagesICAB Lecture 1 & 2 On Chapter 1 Fundamentals of Costing - RCKrajeshaisdu009No ratings yet

- #10 Production Planning & Control 2Document54 pages#10 Production Planning & Control 2Aidha AidilNo ratings yet

- Chapter 9 Standard Costing - SynopsisDocument8 pagesChapter 9 Standard Costing - SynopsissajedulNo ratings yet

- App 2 - Variance InvestigationDocument24 pagesApp 2 - Variance InvestigationAashikkhan100% (2)

- @PO Taken ATP Standard Costing N Variance Analysis - Pgs.40Document40 pages@PO Taken ATP Standard Costing N Variance Analysis - Pgs.40professional.ca728No ratings yet

- Toyota Motor Corporation: Target Costing SystemDocument8 pagesToyota Motor Corporation: Target Costing SystemdeekshaNo ratings yet

- 9003 CVP AnalysisDocument7 pages9003 CVP AnalysisSirNo ratings yet

- MEASUREMENT BASES and Other Important RemindersDocument2 pagesMEASUREMENT BASES and Other Important RemindersShaina Monique RangasanNo ratings yet

- STRATCOST Quiz 2 Reviewer by Diamla, Foronda, GanDocument15 pagesSTRATCOST Quiz 2 Reviewer by Diamla, Foronda, GanAhga MoonNo ratings yet

- Ms04 Cost Behavior and Cost ClassificationDocument7 pagesMs04 Cost Behavior and Cost ClassificationAshley BrevaNo ratings yet

- Sap-Copa SlidesDocument47 pagesSap-Copa SlidesWakeel QureshiNo ratings yet

- 2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFDocument1 page2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFIsna Fauziah Biljannah0% (1)

- 2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFDocument1 page2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFIsna Fauziah BiljannahNo ratings yet

- Chapter Cost Volume Profit and Break-Even AnalysisDocument20 pagesChapter Cost Volume Profit and Break-Even AnalysisINDIAN BEASTNo ratings yet

- Acctg 402Document9 pagesAcctg 402Marriah Izzabelle Suarez RamadaNo ratings yet

- Question PapersDocument3 pagesQuestion PapersAlii ArshadNo ratings yet

- Condensed Format 1Document10 pagesCondensed Format 1Mariz RapadaNo ratings yet

- Lecture-9.1 Variable & Absorption Costing PDFDocument24 pagesLecture-9.1 Variable & Absorption Costing PDFNazmul-Hassan Sumon100% (1)

- Marginal Costing TYBAFDocument13 pagesMarginal Costing TYBAFAkash BugadeNo ratings yet

- Mas Chapter 6 PDFDocument33 pagesMas Chapter 6 PDFJohanna Vidad100% (1)

- Management Accounting 2: MANG2005 Overhead Allocation & Income Effect of Costing SystemsDocument33 pagesManagement Accounting 2: MANG2005 Overhead Allocation & Income Effect of Costing Systems万博熠No ratings yet

- 03 CVP AnalysisDocument13 pages03 CVP AnalysisKenneth Marcial EgeNo ratings yet

- Flexible Budgets, Direct-Cost, Overhead Variances, and ManagementDocument30 pagesFlexible Budgets, Direct-Cost, Overhead Variances, and ManagementAmit DeyNo ratings yet

- Ms09 Standard Costing Variance AnalysisDocument7 pagesMs09 Standard Costing Variance AnalysisAshley BrevaNo ratings yet

- 9004 - HandoutsDocument7 pages9004 - HandoutsSirNo ratings yet

- Hms 05Document28 pagesHms 05JavierNo ratings yet

- The Costs of Production: End ShowDocument29 pagesThe Costs of Production: End ShowNick254No ratings yet

- Chapter 1Document11 pagesChapter 1kimberlyann ongNo ratings yet

- Standard Costing & Variance Analysis: Nur Anis Izzati BT Ismail !Document9 pagesStandard Costing & Variance Analysis: Nur Anis Izzati BT Ismail !anis izzatiNo ratings yet

- MAS 02 Cost Behavior With Regression AnalysisDocument6 pagesMAS 02 Cost Behavior With Regression AnalysisJericho G. BariringNo ratings yet

- Chapter 9 - IInd Sem 22-23Document124 pagesChapter 9 - IInd Sem 22-23krishparakh23No ratings yet

- Flexible Budgets, Overhead Cost Variances, and Management ControlDocument19 pagesFlexible Budgets, Overhead Cost Variances, and Management ControlSubha ManNo ratings yet

- STEcon 360 BMEToolDocument28 pagesSTEcon 360 BMEToolckalogNo ratings yet

- Joint Products / by Products: Accounting Decision MakingDocument16 pagesJoint Products / by Products: Accounting Decision MakingKaran KashyapNo ratings yet

- Ch-9 - Ist Sem 23-24Document120 pagesCh-9 - Ist Sem 23-24Hrishikesh KasatNo ratings yet

- MS 8904 - Standard Costing Variance AnalysisDocument7 pagesMS 8904 - Standard Costing Variance Analysisxara mizpahNo ratings yet

- Yustika Adiningsih - F0319141 - Mindmap Aik CH 7Document1 pageYustika Adiningsih - F0319141 - Mindmap Aik CH 7yes iNo ratings yet

- Yustika Adiningsih, AKL 1a 2021 E3-4Document1 pageYustika Adiningsih, AKL 1a 2021 E3-4yes iNo ratings yet

- Yustika Adiningsih-f0319141-Spm A-Mindmap CH 4 Dan 5Document2 pagesYustika Adiningsih-f0319141-Spm A-Mindmap CH 4 Dan 5yes iNo ratings yet

- Tryout Ukta Lapkeu 2Document62 pagesTryout Ukta Lapkeu 2yes iNo ratings yet

- Akl 1 E1-4Document2 pagesAkl 1 E1-4yes iNo ratings yet

- Validation of The Perceived Chinese Overparenting Scale in Emerging Adults in Hong KongDocument16 pagesValidation of The Perceived Chinese Overparenting Scale in Emerging Adults in Hong KongNeha JhingonNo ratings yet

- Educ 75 Activity 7Document3 pagesEduc 75 Activity 7Gliecy OletaNo ratings yet

- System Flyer PROSLIDE 32 B - V5.0 - 2020-03-09 PDFDocument10 pagesSystem Flyer PROSLIDE 32 B - V5.0 - 2020-03-09 PDFeduardoNo ratings yet

- 991282.JET - December - 2018 Web 29 40Document12 pages991282.JET - December - 2018 Web 29 40Camilo Rangel HolguinNo ratings yet

- Sainsbury 2010 PDFDocument13 pagesSainsbury 2010 PDFronaldNo ratings yet

- RedBrand Answers 1Document3 pagesRedBrand Answers 1Karthikeyan VelusamyNo ratings yet

- Importance of ForecastingDocument37 pagesImportance of ForecastingFaizan TafzilNo ratings yet

- Physics ProjectDocument11 pagesPhysics ProjectDimpySurya44% (25)

- Siesta TutorialDocument14 pagesSiesta TutorialCharles Marcotte GirardNo ratings yet

- Coal Lab Assignment 2 - v5 - f2019266302Document12 pagesCoal Lab Assignment 2 - v5 - f2019266302Talha ChoudaryNo ratings yet

- Kalviexpress'Xii Cs Full MaterialDocument136 pagesKalviexpress'Xii Cs Full MaterialMalathi RajaNo ratings yet

- Kenelm Digby On Quantity As Divisibility PDFDocument28 pagesKenelm Digby On Quantity As Divisibility PDFvalexandrescuNo ratings yet

- Changes Around Us Science - Class-ViDocument28 pagesChanges Around Us Science - Class-ViAmit SharmaNo ratings yet

- Strion Led HL - SupDocument2 pagesStrion Led HL - SupPatrickNo ratings yet

- 3tnv82a Bdsa2Document2 pages3tnv82a Bdsa2BaggerkingNo ratings yet

- Basics of Robotics 24.06.2020Document25 pagesBasics of Robotics 24.06.2020prabhaNo ratings yet

- Service Brake: Model FB (Air Over Hydraulic Brake)Document97 pagesService Brake: Model FB (Air Over Hydraulic Brake)Komatsu Perkins HitachiNo ratings yet

- Calin o An Informal Introduction To Stochastic Calculus WithDocument331 pagesCalin o An Informal Introduction To Stochastic Calculus Withjldelafuente100% (5)

- Alfred Sds ProjectDocument10 pagesAlfred Sds ProjectMr TuchelNo ratings yet

- Seatex DPS 132 User's ManualDocument96 pagesSeatex DPS 132 User's ManualilgarNo ratings yet

- 253 968 2 SPDocument16 pages253 968 2 SPAlvin MRNo ratings yet

- Pile CapDocument19 pagesPile Caprsdoost1345No ratings yet

- 2014oct FE PM QuestionDocument34 pages2014oct FE PM QuestionShwe Yee Win ThantNo ratings yet

- Additive Manufacturing 2Document24 pagesAdditive Manufacturing 2Classic PrintersNo ratings yet

- Power World Simulator 8 TutorialDocument8 pagesPower World Simulator 8 TutorialMauricio VargasNo ratings yet

- Structural SteelDocument17 pagesStructural SteelliNo ratings yet

- Fy CS Labbook 2019 20Document46 pagesFy CS Labbook 2019 20rajeshkanade121No ratings yet

- I2c To LCD InterfaceDocument1 pageI2c To LCD InterfaceTTM_SOBINo ratings yet

- Theoretical FrameworkDocument5 pagesTheoretical FrameworkPatziedawn GonzalvoNo ratings yet

- g12 Module CapacitorsDocument8 pagesg12 Module CapacitorsHarold Vernon MartinezNo ratings yet