Professional Documents

Culture Documents

Washington Sycip Lecture

Uploaded by

Christian John PardoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Washington Sycip Lecture

Uploaded by

Christian John PardoCopyright:

Available Formats

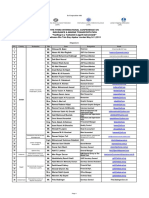

Washington Sycip Lecture

As part of the celebration of UST AMV-COA for its founding anniversary, it has been a tradition to

invite guests to do insightful talks that can give boost, understanding, knowledge, and perception to things

often not tackled within the four corners of our rooms. This year, the Washington Sycip lecture was

conducted online due to the restrictions set in place by the national government because of COVID-19.

Nonetheless, I can still say that the talk is still good even if there are some minor technical difficulties. The

lecture included a handful of successful professionals, having Atty. Dakila Elteen M. Napao as the main

lecturer, and Prof. Yew Kee Ho, Mr. Allan W. Ocho, Prof. Zubir Azhar, and Mr. Ace Ver C. Vargas as the

panel of reactors.

The main lecturer, Atty. Napao, the assistant secretary of the Department of Finance, gave a talk

about the policy measures during and post COVID-19 era which encircled around on three main points,

that is, immediate COVID-19 policy, recovery strategy of the government, and the vital role of accountants

on the path to economic recovery. Since the impact of the epidemic is too big, policies and certain laws

were created to combat such. According to Atty. Napao, the four-pillar strategy was created to aid the

country in going back to its state before the epidemic, this strategy mainly focuses on giving support to

vulnerable groups, front liners, and on recovery programs. The said strategy was under the Bayanihan as

One Act, and is done alongside small business strategy wage, which literally means what it says. Aside

from the Bayanihan act, the government also implemented the financial institutions’ strategic transfer or

FIST, mostly for giving out tax incentives to businesses in hopes that it will encourage both the private ang

public sector to recover their businesses. Aside from the FIST act that gives tax incentives to businesses,

the CREATE act or corporate recovery and tax incentive for enterprises act was also made for tax purposes,

specifically, on the reduction of corporate taxes, NOLCO deduction for five years, lessened MCIT, and other

more tax related aids. The said act was done to attract foreign investments, as the goal of this law is to

make Philippines look like a country that is great to invest in. With all of that, we can say that there are

various plans made by the government to combat the effects of the COVID-19 pandemic, to help the

government, getting investors, and generally the public at large. But, as Atty. Napao said, all of this will not

be possible without the help of the citizens of the country, and we current and future accountants, should

help guide businesses throughout this process of recovery with integrity.

Right after the talk of the main lecturer, the panel of reactors then followed. Prof. Yew Kee Ho as

the first one. He talked about the integration of technology to accounting and how it is being utilized both in

practice and in top universities in the western part of the world. But according to him, that us Filipinos have

a very specific and important asset, and that is the people or as he termed it as “human capital”. Because

humans form creativity, and that is the uniqueness about humanity, because with our creativity we can help

each other and the economy as well. It may be true that we are in a way reliant to technology since it now

helps us in our day to day, more specifically in surviving in this modern age, but according to Prof. Ho, “we

must never be slaves to technology because the greatest contribution an accountant could give should

always be our creativity”. The next reactor was Mr. Allan Ocho and there are a lot of things that he pointed

out, but it can all be summarized on how accountants can help revive the economy. Just like how

accountants can help distribute funds to beneficiaries, contribute to the management of liquidity in a

company, provide consultancy services, build foundational knowledge to students, and most specially in

providing reliable financial statements and preventing fraud. Mr. Allan Ocho ended his talk with eight tips

on how we in this profession can provide value, and that is to be, adaptable, brave and bold, customer-

centric, deliberate and disciplined, be focused our strengths, open to growth mindset, enhance human skills,

and innovative. The next lecturer, Prof. Azhar emphasized that the role of both the academe and

organizations in the step into entering the new accounting world that uses data processing systems that

aids in problem solving is essential ang most especially in helping employees and students add value to

the future of the profession. But the main thing that remained in my mind is when he said that we should

nurture our personal agency for this is something that everyone should have no matter where we are or

who we are. The last reactor was Mr. Vargas, he pointed out that we AMVians is that we should value our

learnings in school that we can relate into the test of knowledge, character, and most importantly the test

of faith. All of the speakers really did give us a sense of understanding, knowledge, and perception to things

that are not directly taught in school and am grateful for that. I just hope that there will be more talks like

this in the future at AMV not just to inspire me, but to the entire AMV community as well.

You might also like

- Narrative and Ref Group 6Document8 pagesNarrative and Ref Group 6johnaerongalang.bascNo ratings yet

- Academia de Santiago of Tarlac IncDocument6 pagesAcademia de Santiago of Tarlac IncryuseiNo ratings yet

- The 2015 ASEAN IntegrationDocument8 pagesThe 2015 ASEAN IntegrationEvans Buyco SansolisNo ratings yet

- Economic Problems in The Philippines ThesisDocument4 pagesEconomic Problems in The Philippines Thesisyvrpugvcf100% (1)

- Assignment 2Document7 pagesAssignment 2Kier Angelo MamaradloNo ratings yet

- Canlas - Economic ForumDocument2 pagesCanlas - Economic ForumErika Mae CastroNo ratings yet

- Applied Entrepreneurship: In Philippine Context for Senior High SchoolFrom EverandApplied Entrepreneurship: In Philippine Context for Senior High SchoolNo ratings yet

- Micro, Small and Medium EnterprisesDocument7 pagesMicro, Small and Medium EnterprisesJessica B. AsuncionNo ratings yet

- 10 Recommendations To Help Reduce Youth Unemployment Through EntrepreneurshipDocument32 pages10 Recommendations To Help Reduce Youth Unemployment Through EntrepreneurshipAprianusNo ratings yet

- Role of State in Fostering InnovationDocument3 pagesRole of State in Fostering InnovationReciel MaingatNo ratings yet

- Bicol University Lecture on Filipinnovation and Entrepreneurship EcosystemDocument2 pagesBicol University Lecture on Filipinnovation and Entrepreneurship EcosystemFu Fong PhenNo ratings yet

- Research Paper Philippine EconomyDocument4 pagesResearch Paper Philippine Economyfzkk43h9100% (1)

- 0000177Document4 pages0000177Aeron Rai RoqueNo ratings yet

- Bfa Issue 47Document96 pagesBfa Issue 47Renato WilsonNo ratings yet

- Education and Training for the Oil and Gas Industry: Building A Technically Competent WorkforceFrom EverandEducation and Training for the Oil and Gas Industry: Building A Technically Competent WorkforceNo ratings yet

- Government Policies For EntrepreneursDocument3 pagesGovernment Policies For EntrepreneursDylan50% (2)

- CountryDocument2 pagesCountryMeheraz hossain tanvirNo ratings yet

- Welcome Speech in EAC - SCDocument1 pageWelcome Speech in EAC - SCsajalgiriNo ratings yet

- Entrepreneurship: Role of Entrepreneurship To The Economic Development Why Entrepreneurship Is Important To The EconomyDocument9 pagesEntrepreneurship: Role of Entrepreneurship To The Economic Development Why Entrepreneurship Is Important To The EconomyShaina Mariz Serrano PanaliganNo ratings yet

- Entrepreneurship in ColombiaDocument14 pagesEntrepreneurship in ColombiaElizabeth SmithNo ratings yet

- Accounting, Auditing and Governance for Takaful OperationsFrom EverandAccounting, Auditing and Governance for Takaful OperationsNo ratings yet

- Bba Finance Thesis TopicsDocument4 pagesBba Finance Thesis TopicsFiona Phillips100% (2)

- Economic Thesis Topics in The PhilippinesDocument4 pagesEconomic Thesis Topics in The Philippinesangeladominguezaurora100% (1)

- Entrepreneurship Drives Economic GrowthDocument7 pagesEntrepreneurship Drives Economic GrowthMis El100% (1)

- Entrepreneur 01Document14 pagesEntrepreneur 01Icah Ramsej AnsingNo ratings yet

- Program Brochure: Towards Inclusive Regional Development in The PhilippinesDocument16 pagesProgram Brochure: Towards Inclusive Regional Development in The PhilippinesAngara Centre for Law and Economic PolicyNo ratings yet

- REBUTTALDocument3 pagesREBUTTALRoxanne GongobNo ratings yet

- Apec Summit 2015 SpeechDocument5 pagesApec Summit 2015 SpeechMugiwara No LuffyNo ratings yet

- Using Evidence to Inform Policy: Report of Impact and Policy Conference: Evidence in Governance, Financial Inclusion, and EntrepreneurshipFrom EverandUsing Evidence to Inform Policy: Report of Impact and Policy Conference: Evidence in Governance, Financial Inclusion, and EntrepreneurshipNo ratings yet

- Entrepreneurship Promotion ActivitiesDocument7 pagesEntrepreneurship Promotion ActivitiesAkki KwatraNo ratings yet

- Thesis On Batho Pele PrinciplesDocument7 pagesThesis On Batho Pele Principleshmnxivief100% (2)

- PUBLIC POLICIES ON WOMEN Preparatory Version To Meeting With G. Ott 16 - 10 - 2017 ViennaDocument7 pagesPUBLIC POLICIES ON WOMEN Preparatory Version To Meeting With G. Ott 16 - 10 - 2017 ViennalirribarNo ratings yet

- Philippine College of Science and TechnologyDocument7 pagesPhilippine College of Science and TechnologyHazel Jane MejiaNo ratings yet

- Module 1 Introduction To Enterprise Development Programs and PoliciesDocument16 pagesModule 1 Introduction To Enterprise Development Programs and PoliciesAxel Hagosojos100% (2)

- Literature Review On Public Sector ReformDocument4 pagesLiterature Review On Public Sector Reformgw1nm9nb100% (1)

- ASEAN Integration's Impact on Education, Skills & JobsDocument7 pagesASEAN Integration's Impact on Education, Skills & JobsEvans Buyco SansolisNo ratings yet

- Entrepreneurial Ecosystem in LebanonDocument10 pagesEntrepreneurial Ecosystem in LebanonTarek TomehNo ratings yet

- Blas EcodevDocument1 pageBlas EcodevAngelaNo ratings yet

- Importance of EntrepreneurshipDocument5 pagesImportance of EntrepreneurshipAnonymous 8SNpyX100% (3)

- Promoting An Entrepreneurial Culture in KenyaDocument9 pagesPromoting An Entrepreneurial Culture in KenyaVivek Raina100% (1)

- Abegail T. Valesco BS-Accountancy - IB Economic Development MWF (8:00-11:00)Document3 pagesAbegail T. Valesco BS-Accountancy - IB Economic Development MWF (8:00-11:00)Sweet MarimarNo ratings yet

- The PhilippinesDocument2 pagesThe Philippinesaccventure5No ratings yet

- Paper On EntrepreneurshipDocument7 pagesPaper On Entrepreneurshipvicky ocampoNo ratings yet

- Somaliland: Private Sector-Led Growth and Transformation StrategyFrom EverandSomaliland: Private Sector-Led Growth and Transformation StrategyNo ratings yet

- Key Note Speech of Jaime Augusto Zobel de AyalaDocument10 pagesKey Note Speech of Jaime Augusto Zobel de AyalaAsian Development Bank ConferencesNo ratings yet

- Creative Destruction As Essence of EntrepreneurshipDocument5 pagesCreative Destruction As Essence of EntrepreneurshipCriss JasonNo ratings yet

- The Road to Entrepreneurship: A Sure Way to Become Wealth at Individual, Business and State Levels.From EverandThe Road to Entrepreneurship: A Sure Way to Become Wealth at Individual, Business and State Levels.No ratings yet

- ENT202 - Importance of Entrepreneurship and Business Opportunities in NigeriaDocument5 pagesENT202 - Importance of Entrepreneurship and Business Opportunities in NigeriaAkinyemi IbrahimNo ratings yet

- Things To Improve With The Country PhilippinesDocument4 pagesThings To Improve With The Country Philippineskateangel elleso0% (1)

- Define Globalization Lecture Notes 1Document6 pagesDefine Globalization Lecture Notes 1Johairah YusophNo ratings yet

- Botswana National Business Conference Keynote on Economic DiversificationDocument15 pagesBotswana National Business Conference Keynote on Economic DiversificationBill ClintonNo ratings yet

- Entrepreneurship Can Be Described As A Process of Action AnDocument5 pagesEntrepreneurship Can Be Described As A Process of Action AnMirna KassarNo ratings yet

- Oniot, Erica B. Technopreneurship 50098Document5 pagesOniot, Erica B. Technopreneurship 50098Vanne CatalanNo ratings yet

- Good Economic Thesis TopicsDocument7 pagesGood Economic Thesis TopicsLisa Riley100% (1)

- 6 Reasons Why Entrepreneurship Is Important 341Document5 pages6 Reasons Why Entrepreneurship Is Important 341Muhammad BabarNo ratings yet

- Stand Up India - Start Up IndiaDocument28 pagesStand Up India - Start Up IndiaJo JaladdNo ratings yet

- Contact Sprint about your accountDocument2 pagesContact Sprint about your accountRajasekaran SubramaniNo ratings yet

- 1099-NEC Tax Form for Nonemployee Compensation under 40 CharactersDocument1 page1099-NEC Tax Form for Nonemployee Compensation under 40 Charactersmaria rodriguezNo ratings yet

- Chemicals Sector - FICCIDocument48 pagesChemicals Sector - FICCIP VinayakamNo ratings yet

- International Journal of Asian Social Science: Ebenezer Nana Yeboah Marfo AndrewDocument13 pagesInternational Journal of Asian Social Science: Ebenezer Nana Yeboah Marfo AndrewNana Aboagye DacostaNo ratings yet

- You Should Not Arrive in Oman Without Receiving The Visa Approval Notice. .Document1 pageYou Should Not Arrive in Oman Without Receiving The Visa Approval Notice. .shinaskhan088No ratings yet

- Supporting Document Application Requirements For Product Certification (Overseas)Document22 pagesSupporting Document Application Requirements For Product Certification (Overseas)Octo Adhi W PryhantoNo ratings yet

- Ride details and bill from 15 Jun 2022Document3 pagesRide details and bill from 15 Jun 2022Ayushi JaiswalNo ratings yet

- World Bank Auditors: World Financial Committee Delegation The Nigerian Desk Ikoyi LagosDocument1 pageWorld Bank Auditors: World Financial Committee Delegation The Nigerian Desk Ikoyi LagosMarkNo ratings yet

- Processing of Export OrderDocument20 pagesProcessing of Export Orderkaran singlaNo ratings yet

- Railroad's Preferential Routing Agreements Violate Sherman ActDocument1 pageRailroad's Preferential Routing Agreements Violate Sherman ActRonnieEnggingNo ratings yet

- Tender No. SH/014/2017-2019 For Supply of Seeds, Farm Inputs and ImplementsDocument39 pagesTender No. SH/014/2017-2019 For Supply of Seeds, Farm Inputs and ImplementsState House Kenya33% (3)

- 1941 CirDocument279 pages1941 CirAnandkumar PNo ratings yet

- At Your ServiceDocument50 pagesAt Your Serviceriver_wind228No ratings yet

- Battle of The Forms FlowchartDocument1 pageBattle of The Forms FlowchartIan GhristNo ratings yet

- Iso 377-2017Document27 pagesIso 377-2017EleanorNo ratings yet

- Practice Set - Alfresco Marketing WorksheetDocument4 pagesPractice Set - Alfresco Marketing WorksheetAdrian SaplalaNo ratings yet

- Competition Law in Regulating Mergers and Acquisitions Comparative Study of India Eu and UsDocument24 pagesCompetition Law in Regulating Mergers and Acquisitions Comparative Study of India Eu and Ushimanshi khivsara100% (1)

- F - LT E-Bill - Feb 2018Document2 pagesF - LT E-Bill - Feb 2018Sushil KhedekarNo ratings yet

- Insurance Conference Tackles Legal ChallengesDocument9 pagesInsurance Conference Tackles Legal ChallengesAnandhNo ratings yet

- Pyuol 24020511 858040Document2 pagesPyuol 24020511 858040Akash ChhabraNo ratings yet

- B11 Allied Banking Corporation V Lim Sio WanDocument3 pagesB11 Allied Banking Corporation V Lim Sio WanJ CaparasNo ratings yet

- 936-Jeevan Labh: Prepared byDocument5 pages936-Jeevan Labh: Prepared byGURSIMRAN SINGHNo ratings yet

- Procedure Declaration en AnglaisDocument7 pagesProcedure Declaration en AnglaisAlbkeyz WakilongoNo ratings yet

- Westin Spaces - Stamp Duty - 1-1Document1 pageWestin Spaces - Stamp Duty - 1-1Amit SinghNo ratings yet

- BNI Incoming SWIFT Message regarding LCZH2004310BJYYDocument4 pagesBNI Incoming SWIFT Message regarding LCZH2004310BJYYbaa group75% (4)

- Account StatementDocument10 pagesAccount StatementalotibyNo ratings yet

- Steppn-Stone Limited: (Supported Living Services)Document6 pagesSteppn-Stone Limited: (Supported Living Services)api-329925142No ratings yet

- Contingent Assets and Contingent LiabilitiesDocument5 pagesContingent Assets and Contingent LiabilitiesRonan Ferrer100% (1)

- Ogl 186051683101404946 PDFDocument5 pagesOgl 186051683101404946 PDFRajesh KumarNo ratings yet

- Rules for articleship at CA firmDocument1 pageRules for articleship at CA firmIshita shahNo ratings yet