Professional Documents

Culture Documents

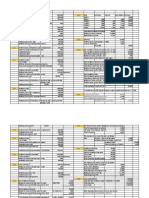

QUESTIONS Accounting For Government and Non Profit Organizations 2018

Uploaded by

Paupau0 ratings0% found this document useful (0 votes)

511 views80 pagesAccounting for government

Original Title

QUESTIONS Accounting for Government and Non Profit Organizations 2018 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting for government

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

511 views80 pagesQUESTIONS Accounting For Government and Non Profit Organizations 2018

Uploaded by

PaupauAccounting for government

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 80

bal al

GOVERNMENT

ACCOUNTING

&

Accounting for

Non-Profit Organizations

BASED ON

GOVERNMENT ACCOUNTING MANUAL FOR NATIONAL

GOVERNMENT AGENCIES (GAM for NGAs)

and

PHILIPPINE FINANCIAL REPORTING STANDARDS (PFRSs)

oui on

FEES). weionstorenostcean

16

Chapter 1 Summary:

‘Aside from providing informatio

demonstrate thé

entrusted to it.

The following are charged with government accounting

responsibility: COA, DBM, BTr and other government

agencies,

The GAM for NGAs pr

be applied in the financial reporting

was promulgated by the COA primarily to harmonize the

{des the principles and procedures to

government entities. It

government accounting standards _ with _ international

standards.

Basic principles: Compliance with PPSAS and other

aws, Accrual basis, Budget basis, Revised chart of accounts,

Double, entry, Financial statements based on accounting and

budgetary records, and Fund cluster acco

ual chara Understandabil

Materiality, Timeliness, Faithfu

Substance over fo Prudence, Completeness,

and Comparabil

‘An item is recognized as asset if all of the fo

are met:

eristics:

wing criteri

the item meets the definition of an asset;

2. probable inflow of future economic benefits; and

3, reliable measurement of cost or other value (e.g, fair

PROBLEMS:

PROBLEM 1-1: TRUE OR FALSE

1. Compared to

1g for business ent

s, government

ing places greater emphasis on the sources and

of government

overnment resources.

funds and the management's

stewardship over

Taxes are the main source of fund

1e government.

Other sources

f funds of the government include fees,

ements and

and grants from other go

Currently, report

based on NGAS. f

ig of government entities is

The p

entities are very hat

milar to tho:

inciples used in the financial report

ig of government

y a very few of these

that are applied to business

prine

The principles in the GAM

principles in the PFRSs.

1 NGAs are similar to the

The GAM

inder

autho

Constitution.

A unique financial report

ies is the use of fund

r NGAs is promulgated primarily to harmonize

US. GAAP.

19

10. An item is recognized as

set if it meets bi

benefits” and “reliable me

ia, regardless of whether the item is a resource

arising from past eve

al funds and managing and

s thereof.

rojects of the government.

future econo

NGAs, the basis of accounting to be

PROBLEM 1-2: MULTIPLE CHOICE

1, Which of the following is a unique requirement of governm

accounting that is not required in the accour

© Modified accrual basis

d. Any of these as a policy choice

jurces

ized and

i t0 PD. No,

renting this policy?

of

a. The use of double-entry recording sy

b. The use of single-entry recording system.

¢. The use of accrual basis of accounting,

> The presentation of budget in

statements.

Ww. Accord

prmation in the financial

2. What is the legal basis of the COA in promulgating the GAM

for NGAs? ;

@._P.D. No. 1445, State Audit

BL The Philippine Con:

©. R.A. 9298, The Philippine Accountancy Act of 2004

d.” Philippine Public Sector Accounting Standards (PPSAS)

Which of the following is tasked

keeping the general

accounts of the government, supporting vouchers, and other

documents?

a)COA ©. NGAs ian) to

b. DBM d. Congress

of a car as a birthday gift for

having her 18" birthd:

next

4. The Bureau of Treasury (BTR) is responsible for

a. promulgating accounting and auditing rules and

regulations

b. the formulation and implementation of the national

budget with the goal of attaining the nation’s. soci

economic ob

d._ Mr. A shall release the fund but requires Mr. B to p!

in writing, that the car shall be returned to the gove

is daughter's birthday:

overnment employee entrusted with the custody of

government funds, has lost the government funds entrusted 10

him in a force majeure. What should Mr. C do to felieve him

from liability?

a. Mr. C should immediately notify the Head of Agency after

30 days.

'p, /Mr. C should immediately notify the COA within 30 days.

© Mr. C should immediately notify the Bureau of Treasury

within 30 days.

Mr. C should keep the event a secret and

funds to arrive.

‘These refer to the attributes that make information useful to

a. Usefulness characteristics

b. Quantitative characteristics

€. Qualitative characteristics

4. Fundamental principl

Information los

reported on a timely basis,

4) Relevance

b. Reliability

c. Neutral

d. Materiality

. Which of the following qualitative characteristics does an

entity most likely would need to make some trade-offs?

a. Faithful representation and Substance over form

Materiality and Relevance

Relevance and Reliability

Understandability and Comparability

y Te

a property. Which of the

re ch stic being applied by

nce over form,

f the following is not one of the fund clusters of a

yment entity?

r Agency Fund

n Assisted Projects Fund

‘ash Fund

eve a proper balance between relevance and

werriding consideration is

w users’ needs are best satisfied

ce is always more important than reliability

ty is always more important than relevance

ter weight shall be given to relevance compared to

PROBLEM 1-3: FOR CLASSROOM DISCUSSION

differ from the accounting

ernment accounting places more emphasis on profit-

making,

Government accounting is very complex that only highly

tual individuals can understand it

Government accounting places greater emphasis on

sources and utilization of funds in accordance with the

law and management's stewardship over government

resources entrusted to the ent

2 Chapter 1

4. Government accounting is specialized in nature that the Which of the following is not

principles applicable to business ies. are_never for NGAS?

apt ‘a. to harmonize government accounting. standards

nternational standards,

2. Which of the following is not a source of revenue for b. to update the coding structure and accounts

government? cto update accounting books, registries, records, forms,

a. Taxes reports and

b. Fees collected by government agencies to update’ government accounting standards to be

c. Grants and donations from other governments consistent with the provisions of U.S. GAAP.

.)Contract price on government contracts awarded to

private companies. All of the following are requirements peculiar to a

government entity. Which is not?

3. Entity A (a government agency) is entrusted with government a. Presenting budget inform: ancial statements.

resources. According to P.D. 1445, who is directly responsible b

for the efficient and ef resources? © “Incorporating budgetary controls in the financial reporting

a. The government emp! istody over system.

resources. Accrual basis of accounting.

b.) The Head of Entity A.

© The COA staff stationed in Entity A 8. Which of the following qualitative characteristics is improved

d. The Foot of Entity A. when information is reported on a timely basis?

Relevance c. Understandability

4. Which of the following is not charged w ment aan

accounting responsibility under the GAM for NGAs?

a.COA c.NGAs 9. The best estimate for a loss is 100,000. However, the entity

b. DBM 4. House of Representatives deliberately overstated the loss to P200,000. Which of the

following qualitative characteristics is violated?

5. The Department of Budget and Management (DBM) is Si Patence! eae

b. Reliability d. Nothing is violated

a. promulgating accounting and auditing rules

regulations. Which of the following, financial statements is pec

‘by Yhe formulation and implementation of the national government entity?

budget with the goal of a

‘economic objectives.

ing, the nation’s socio- Balance Sheet

Statement of Cash Flows

nds and manay Statement of Comparison of Budget and Actual Amounts

ere. : of CHanges in Equity

1¢ projects of the government.

c. receiving and keeping national

controlling the disbursements

d. directly implementing

44

PROBLEMS:

PROBLEM 2-1: TRUE OR FALSE

a

‘The budget preparation in the Philippines uses a “bottom-up”

approach. Under this approach, the budget preparation starts

from the highest levels of the government down to the lowest

levels.

An entity prepares its budget by simply rolling-over the

budget in the previous year and adjusting each line item by

10% increment to reflect inflation. This process is described as

zero-based budgeting.

After the budget call from the DBM, the proposed budget of.

various agencies are submitted immediately to the Office of

the President for review.

An entity can incur obligations after receiving notice of its

appropriation but before receiving the allotment.

Budget deliberations in the Congress start in the House of

Senate

A government entity must first receive an allotment before it

can incur obligations.

A government entity can make disbursements even before it

receives a disbursement authority.

Appropriation is also called obligational authority.

The Notice of Cash Allocation (NCA) is an authority issued by

the DBM to central, regional and provincial offices and

operating units to cover their cash requirements

45

Responsi greatly enhances budget

accountability because managers are evaluated only in terms

of the costs or other variables that they control, and therefore,

budget deviations can be readily attributed to the managers

accountable therefor.

accounting

PROBLEM 2-2: MULTIPLE CHOICE

Which of the following does not properly describe the budget

process used in the Philippines?

a. Bottom-up budgeting

b. Top-down budgeting

<. Zero-based budgeting

d.) Non-incremental budgeting,

Arrange the following steps according to the sequence that

they appear in the budget cycle.

llotment

Bicameral deliberations

Budget accountability reports

President's enactment of the GAA.

Budget hearings with the DBM

V, IV, I Land IL

V, IL IV, Land I

cI, V, IL Land Hil

4. V, LL 1V and It

3. Arrarge the following steps according to the sequence that

they appear in the budget cycle.

Allotment

Disbursement authority

Disbursement

Appropriation

Incurrence of obligation

Chapier2

a. IV, 1,0, Vand It CIV, I, V, Hand IIL

b. IV,LV, land It d.1V, V, Land Il

This type of budget is prepared in such a way that estimated

revenues exceed estimated expenditures.

a, ) Balanced budget c. Obligations budget

B.. Excess budget d. Budget meal

This summarizes an agency's fiscal year plans and

performance targets. It shows the agency’s physical and

financial plan, monthly cash program, estimate of monthly:

income, and list of obligations that are not yet due and

demandable.

a. Budget Execution Documents (BEDs)

be Special Allotment Release Order

© Statement of Approved Budget, __Utilizations,

Disbursements and Balances

d. Aging of Due and Demandable Obligations

It is an authorization issued by the DBM to NGAs to incur

obligations. Itis also referred.to as Obligational Authority.

Appropriation ©. Budget call

d. Budget hearings

It refers to the amount contracted by a duly authorized

administrative officer for which the government is held

a. Appropriation Obligation

b. Allotment 4, Disbursement

Which of the following best describes the Notice of Cash

Allocation (NCA)?

a. It is a form of legislative authorization in the allocation of

funds for specified purposes.

b. It isa form of authorization to a government agency to

incur obligations on behalf of the government.

It is a form of authorization to a government agency to

make disbursements out of government funds.

et Process a7

d. It is a notice received from the Congress that cash is

located for the payment of planned expenditures.

9. Disbursements by government entities are most commonly

made through

a,” MDS Checks Petty Cash Fund

b. Cash Credit Card

Responsibility accounting requires all of the following except

a.) separate books of accounts to segregate controllable and

non-controllable costs

b, identification of responsibil

© distinction between controllable and non-controllable

costs

d. coding structure for responsi

PROBLEM 2.

Fact pattern:

A legislation approves the allocation of ®100B funds to support

\¢ operations of Entity A (a government agency) in the current

year. At the start of first quarter, Entity A receives authorization to

cur obligations for a maximum amount of P45B in that quarter.

ntity A extends half of that authorization to its lower operating

units. During the quarter, Entity A receives monthly authorization

disburse funds not to exceed P15B per month. Entity A extends

half af those monthly authorizations to its lower operating units.

At the end of the quarter, total obligations incurred amounted to

P40B while total disbursements amounted to ®35B.

MULTIPLE CHOICE

1. The allocation of the #100B funds to Entity A is referred to as

a, Allotment

by /Appropriation

‘The allocation of the P100B funds to Entity A is authorized by

a. Department of Budget and Management (DBM)

Chapter 2

b. Commission on Audit (COA)

©. Bureau of Treasury (BTr)

d. Congress

The P45B authorization is referred to as

a, Allotment c. Obligation

b. Appropriation d. Sub-allotment

The P45B authorization is received by Entity A from

a,/ DBM © BIr

b. COA d. Congress

The half of the P45B authorization extended by Entity A

(Central Office) to its lower operating units is referred to as

a. Allotment ©, Obligation

b. Appropriation 4. Sub-allotment

Which of the following best describes the P15B monthly

authorizations?

a. Allotment

b._ Obligation authority (e.g. Notice of Cash Allocation ‘NCA’)

©. Disbursement authority (e.g, Notice of Cash Allocation

NCA’)

4d. Disbursement authority (e.g., Notice of Transfer of Allocation

‘NTA’)

The P15B monthly authorizations are received by Entity A

from

a.) DBM c.BTr

b. COA d. Congress

The half of the 158 monthly authorizations extended by |

Entity A (Central Office) to its lower operating units is

referred to as

a. Cash Disbursement Ceiling

b. Non-Cash Availment Authority

Notice of Cash Allocation (NCA)

49

4d. Notice of Transfer of Allocation (NTA)

Appro

es, how much

is shown as “unreleased appr

a. P65B b. P60B

d. P45B

ss, how much

.PI5B

App

s, how much

©. PLOB aPisB

PROBLEM 2-4: FOR CLASSROOM DISCUSSION

All disbursements of government entities must be in

b, COA audit findings

oming year from

n the budget irrespective of

uded in the previous budget. This

An entity prepares its budg

scratch. It scrutinizes each

whether the item .was

proc d

a. zero budgeting

b. incremental budgs

¢. scratch budgeting

d. zero-based budgeting

Under this approach to budgeting, several parties participate

in the budget preparation - from the lowest levels of

government to the highest and sometimes even citizen

stakeholders participate in the budget preparation.

Chapter?

a. bottoms-up budgeting

b. zero-based budgeting

«. top-down budgeting

d. bottom-up budgeting

What is the correct sequence of the following steps in the

budget process?

L Budget Legislation

Il, Budget Accountability

Ill, Budget Preparation

IV. Budget Execution

a, ILL land IV «

b. I,11V andi 101, 1V, land It

5. After deliberations in both’ houses in the Congress are

finished, a committee is formed to harmonize any conflicts

between the Representatives and Senate versions of the

General Appropriations Bill. This committee is called the

‘Adjudication Conference Committee

Bicaramel Conference Committee

b,

c. Referee Conference Committee

@, Bicameral Conference Committee

It is the authorization made by a legislative body to all

funds for purposes specified by the legislative or similar

authority.

a) Appropriation

6, Allotment

. Obligation

4. Disbursement

These are the authorizations programmed annually or for

some other period prescribed by law, by virtue of outstanding

legislation which does not require periodic action by

Congress,

‘a) Automatic Appropri

b. New General Appropriations

¢. Continuing Appropriations

. Supplemental Appropriations

8, Entity A, a gover

Arrange the fol

Entity A can make

Allotment

Disbursement Authority

Appropriation

Incurrence of obligation

events in the correct sequence before

id disbursements.

, and IV

IV, and Il | and I

This is necessary before government entities can enter into

contracts that bind the government for the eventu

disbursement of government funds

a. "Disbursement auth c. Allotment

b. Notice of cash d. Incurrence of obligation’

Under responsibility aé€ounting, a manager's performance is

evaluated

based on all resources under his custody

b<) only in terms of the costs, or other variables, that he

controls.

on the basis of both

costs.

rollable and non-controllable

y at year-end.

100

PROBLEMS

PROBLEM 3-1: TRUE OR FALSE.

;, only the Journals and Ledgers are onsidered)

accounting records; the Registries are budget records.

Separate accounting records and budget registries are

maintained for each fund cluster.

Government entities and business entities use the term

“obligation” or the phrase “incurrence of obligation” similarly.

|. The various registries maintained by -government entities

primarily serve as internal control for controlling and

monitoring the conformance of actual results with the

approved budget. ‘

(A check disbursement-is normally recorded as a credit to the

“Cash-Modit

Disbursement System (MDS), Regular”

account. * :

Both the ORS and RAOD are updated each time an obligation

is incurred, a payable is recorded for the obligation incurred,

and disbursements are made to settle the recorded payables.

At the end of each year, an adjustment is made to revert any

unused NCA of a government entity.

‘The GAM for NGAs requires the Collecting Officer to issue an

official receipt to acknowledge the receipt of the Notice of

Cash Allocation.

The entry to record the reversion of unused NCA at the end of

the period is the exact opposite of the entry used to record the

receipt of NCA.

Process

10, The remittance of amounts withheld to the other government

agencies, such as the BIR, BOC, GSIS, PhilHealth, and Pag:

IBIG, is done through the TRA.

PROBLEM 3-2: MULTIPLE CHOICE

1. ‘The various registries maintained by government entities are

c. General Ledgers

‘b) Budget records d, Log books

Which of the following is recorded in-the Obligation Request

and Status (ORS)?

a. Receipt of notice of approp:

b. Receipt of allotment from the DBM

c.. Receipt of Notice of Cash Allocation from the DBM

4) Entering into employment contracts with employees

This type of expenditure pertains to all types of employee

benefits.

‘a. Personnel Services (PS)

b. Maintenance and Other Operating Expenses (MOOE)

c. Financial Expenses (FE)

4. Capital Outlays (CO)

Entity A, a government entity, made disbursements for the

travelling expenses of its personnel. These expenditures are

most likely classified as

‘a. Personnel Services (PS)

b. Maintenance and Other Operating Expenses (MOOE)

¢. Financial Expenses (FE)

d. Capital Outlays (CO)

Which of the following is charged with the responsibility of

Keeping the general accounts, and related documents, of the

Government?

102 Chapter 3

a.) COA .NGAs

. BIr d. DBM

PROBLEM 3-3: MULTIPLE CHOICE

‘The receipt of an allotment is recorded by a government entity

inthe i

a. RAOD © RAPAL

b. ORS Ga andc

6. A joumal entry with a credit to the “Cash-Modified

Disbursement System (MDS), Regular” account will most

likely be recorded in the

a. General Journal @ Cash Disbursements Journal

b. Special Journal . Check Disbursements Journal

2. The incurrence of an obligation for future delivery or

performance by: the o

gee is recorded by a government

Which of the following accounts is debited when a

lections to the National c RAPAL

d.aandb

government entity remits its c

Treasury?

a. Cash-Tax Remittance Advice

Cash-Modified Disbursement System (MDS), Regular

Cash-Treasury/Agency Deposit, Regular

Cash ~ Collecting Officers

The receipt of an appropriation is recorded by a government

s

) RAPAL

b. ORS daandb

8 Which of the following accounts is credited when a

government entity remits taxes withheld to the BIR?

a.) Cash-Tax Remittance Advi

b. Cash-Modified Disbursement System (MDS), Regular

c. Cash-Treasury/Agency Deposit, Regular

d. Cash — Collecting Officers

4. The entry to record the receipt of Notice of Cash Allocatio

(NCA) by a government entity is:

a, (Debit) Cash-Modified Disbursement System (MDS),

Regular; (Credit) Accumulated Surplus (Deficit)

b, (Debit) Cash-Modified Disbursement System (MDS),

Regular; (Credit) Subsidy from National Government

Cash-Collecting Officer; (Credit) Subsidy from

National Government i

4. No journal entry. The event is recorded only in the

Registries

9, Which of the following accounts is credited when al

government entity remits contributions to the GSIS)

PhilHealth and Pag-IBIG?

a, Cash-Tax Remittance Advice

’b, Cash-Modified Disbursement System (MDS), Regular

. Cash-Treasury/Agency Deposit, Regular

4. Cash — Collecting OF

According to the Revised Chart of Accounts (RCA) issued by

the COA, the “Subsidy from National Government” account is

10. Obligations recorded in the registries but not yet in the a(an)

accounting books are referred to as a. Asset account Revenue account

a.’ Not Yet Due and Demandable b. Liability account d. Equity account

b. Contingent liabilities

¢. Erroneous recording

d. Unpaid obligations

Which of the following is not one of the necessary closing

entries of a government entity? ‘

108

Closing of the “Cash-Treasury/Agency Deposit, Regular”

account to the “Accumulated Surplus/(Deficit)” account.

Closing of the “Subsidy from National Government”

account to the “Revenue and Expense Summary” account.

Closing of income and expense accounts to the “Revenue

and Expense Summary” account.

Closing of the net balance of “Revenue and Expense

Summary” account to the "Subsidy from National

Government” account.

A government entity pays an accounts payable. The entry to

record the payment will most likely include a

a. debit to the “Cash-Modified Disbursement System (MDS),

Regular” account.

b. credit to the “Due to BIR” account.

©, credit to the “Cash-Treasury/Agency Deposit, Regular”

account.

d/ None of these. The event is recorded only in the Registries

and the Obligation Request and Status,

In accordance with the GAM for NGAs and the Revised Chart

of Accounts, how does a government entity recognize the

uncollectability of accounts receivable?

By debiting the “Bad Debts Expense” account.

By debiting the “Impairment Loss-Loans and Receivables"

account.

©. By debiting the “Allowance for Impairment-Accounts

Receivab)

d. bande

The “Subsidy from Nat

when recording a

a. receipt of NCA

b, reversion of unused NCA.

© constructive remittance of customs duties or taxes

withheld through TRA

nal Government” account is credited

Chapter3,

PROBLEM 3-4: MULTIPLE CHOICE

Government A Process

4.

aandc

Expenditures to acquire

classified as

a. Personnel Services (PS)

b, Maintenance and Other Operating Expenses (MOOE)

long-term assets are most likely

4.

This is used to recognize the const tance of taxes

hheld to the BIR or customs duties withheld to the BOC.

a:) Tax Remittance Advice (TRA)

b. Notice of Tax Allocation (NTA)

¢. Tax and Customs Remittance Advice (TCRA)

d. Notice of Tax Remittance Advisory (NTRA)

Which of the following does not affect the amount of surplus

or deficit that is reported in the statement of financial

performance?

a. receipt of NCA.

b. constructive remittance of taxes withheld through TRA

c. losing of the “Cash-Treasury/Agency Deposit, Regular”

cour

d. adjustment of the “Cash-Modified Disbursement System

(MDS), Regular” account for the unused Notice of Cash

Allocation.

All of these affect surplus or defi

Entity A received Notice of Cash Allocation (NCA) amout

to 625,000 for the year. Unused NCA at the end of the period

amounted to 6,000. Entity A remitted taxes withheld to the

BIR amounting to 48,000 through Tax Remittance Advice

(TRA). How much is:the “Net ial Assistance/Subsidy”

to be reported in Entity A’s statement of financial

performance?

106

‘@) 667,000 571,000

619,000 4.0

4. Entity A, a government entity, had the following transactions

during the period:

+ Received Notice of Cash Allocation (NCA) amounting to

750,000.

© Earned total revenue of 290,000. from gs and)

collections of unbilled income.

* Incurred total expenses of 885,

+ Remitted total taxes withheld of 140,000 to the BIR

through Tax Remittance Advice (TRA)

+ The “Cash-Modified Disbursement System (MDS)

Regular” has an unused balance of 43,000 at the end of

the period,

How much is the surplus (deficit) for the period?

a. (595,000) «252,000

b. 135,000 112,000

5. The trial balances of Entity A, a government entity, show th

following amounts:

© Unadjusted Trial Balance - 2,753,000

* Adjusted Trial Balance - #2,765,000

+ Statement of Financial Position (Debit Column) - 1,880,000.

* Statement of Financial Performance (Credit) - 1,137,000

How much is the surplus (deficit) for the period?

‘a, ) 252,000 (252,000)

. 885,000 a. (743,000)

6. Which of the following expenditures is not shown in the

statement of financial performance

a. Personnel Services (PS)

b. Maintenance and Other Operating Expenses (MOOE)

© Capital Outlays (CO)

107

nancial Expenses (FE)

©. All of these expenditures are shown in the statement of

financial performance.

The entries to record the constructive remittance of taxes

withheld through Tax Remittance Advice include all of the

owing except

a. A debit to the “Cash-Tax Remittance Advice” account

b._A credit to the “Cash-Tax Remittance Advic

JA debit to the “Subsidy from National Government”

account

d. A debit to the “Due to BIR” account

e. Allof these are included.

"account

receipt of Notice of Cash Allocation is recorded in the

Books of accounts (Journal and Ledger)

b. Registry of Allotments and Notice of Cash Allocation

(RANCA)

© >aandb

d. None of these

Which of the following is not one of the special journals

prescribed by the GAM for NGAs?

a./ Sales Journal

b. Cash Disbursements Journal

©. Check Disbursements Journal

d. Cash'Receipts Journal

The 8-digit Revised Chart of Accounts (RCA) Code for

expenses starts with number

ad 5

wy ‘None of these

133,

& Chapter

> Not recognized as revenues

[Royalties

PROBLEMS

PROBLEM 4-1: TRUE OR FALSE

1. All revenues shall be remitted

Special Fund;~unless another

id or received is adjusted

tothe FV,

IF withoutcondition,

recognized immediately.

Ifwithvcondition, initially

recognized as liability until

included in

ally re

2. Payments to government entities in thi

allowed.

3. Revenues of a government entity arise from exchange

transactions only.

NGAs, revenue from exchange

cash received.

According to the GAM

transactions are measured at the amout

value and transaction price

| is recognized as revenue, if

| bs ___|___non-exchange transaction,

‘Subsidy from NG and other | > Recognized as revenue

NGAs from assistance and

subsid:

According to the GAM for NGA, the receipt of concessionary

loans by goverment entities may’ give rise to revenue

recognition

134

8: The taxable event for income tax is the passage of the ti

period for which the tax is levied.

10. The main source of revenue for the government is taxes.

PROBLEM 4-2: MULTIPLE CHOICE - THEORY

1, Which of the following is a non-exchange transaction?

Taxes are compulsory payments, imposed on persons)

properties or activities, intended to provide revenue to the

government. Taxes include fees, fines and penalties.

a.

v.

Entity A enters into a long-term contract to provide servi

‘The outcome of the transaction can be estimated

the progress on the contract can be measured wi

reliability. According to the PPSAS, how should Entity

recognize revenue from the contract?

a. Ona straight line basis over the céntract term.

b,) By reference to the stage of completion of the contract.

the reporting date.

¢. Full recognition of contract price upon completion of

contract.

d. Only to the extent of costs that are expected to

recovered,

According to the GAM for NGAs, interest revenue

recognized

a. on a time proportion basis using the effective inter

method

b. onastraight line basis.

¢. in accordance with the substance of the relevant I

agreement,

d. when the entity’s right to receive payment is established,

Chapter

Leasing ces

‘Collection of taxes

c. Rendering of legal ser

d. Collection of tuition fees

eliably at

fic

1s and Other Receipts 135,

The taxable event for Value added tax (VAT) is the

a.) undertaking ofa taxable activity,

b. earning of

axable income,

movement of dutiable goods or services across. the

customs boundary.

d. any of these

ch of the g would result to an increase or decrease

in the revenue reported by a goverment entity in

statement of financial performance?

a. Impairment loss on an amount already recognized, as

revenue.

b. Receipt of a pledge.

Receipt of donation in the form of services

~The repayment of a loan payable is forgiven.

kind.

It is a type of fund held by a government entity that is

designated for special purposes.

a, General fund . Trust fund

. )Special fund d, Fiduciary fund

The national government receives a foreign grant conditioned

on the construction of a public infrastructure, According to the

GAM for NGAs, when does the national government

recognize revenue from the grant (ie., credit to the ‘Income

from Grants and Donations in Cash’ account)?

a. Upon receipt of the grant

b. When the grant becomes receivable, provided there is

reasonable assurance that the attached condition will be

satisfied.

cc. When the condition is met.

d. When the related expenses for which the grant is

to compensate are incurred.

tended

The receipt of which of the following may not give rise to

revenue by a government entity?

136

10.

Chapter

Notice of Cash Allocation

Tax Remittance Advice

Subsidy from another government enti

Inter-agency fund transfer

ve

a\p

A government entity collects fees for the processing of certain

permits. The processing of a permit would take 4)

few minutes. The processing f scted upon issuance off

the permit. This government entity would normally recognize

reyenue from permit fees

‘a. ona straight line basis.

b._ by reference to the stage of comp!

upon collec

dd. when the signi

the customer.

n of the fee.

cant risks and rewards are

ferred to)

The receipt of a performance bond or a security deposit is

credited toa

cc. cash account

d.ajandc

PROBLEM 4-3: FOR CLASSROOM DISCUSSION

Which of the following is not one of the fundamental

principles for revenue under P.D. No. 1445?

a. Alll revenues shall be remitted to the BTr and included in

the General Fund, unless another law sp allows

otherwise.

b. Recording of revenue in other types of funds (e.g., Special |

Fund) shall be made only when authorized by law.

Collections of revenue shall be properly acknowledged

through pre-numbered Official Receipts.

d. All collections of revenue must be in the form of cash,

a. exchange transaction

Checks are not acceptable.

considered a(an)

137

b) non-exchange transaction _d. any of these

‘According to the GAM for NGAs, all of the following criteria

must be met before a government entity recognizes

from the sale of goods, except

a. Significant risks and rewards of ownership of the goods

are transferred to the buyer and the entity does not retain

control over those gi

b._Itis probable that ect

c. The am

measured reliably

d.) The stage of completion can be measured relia

ods.

mic benefits will flow to the entity.

lated

costs can be

ly.

According to th

contract. ca

GAM for NGAs, when the outcome of a

ot be estimated reliably, revenue is

on a straight line basis over the periods the services are

rendered.

b. by reference to the contract’s stage of completion at each

reporting date.

only to the extent of costs that are expected to be

recovered,

d. only upon the completion of the contract

th a list price of 100,000, on account.

s. The journal entry to recognize

of the following except?

al__A debit to accounts receivable for 72,000.

'b.) A credit to sales revenue for 972,000.

© A debit to sales discount for ®28,000."}

d. Allof these are included in the entry.

According to the GAM for NGAs, an exchange of goods or

of similar nature and value between entities

a. gives rise to revenue measured at the fair value of the

goods or services received, adjusted for any cash paid or

received on the exchange

oe cecil IA ah 2 Chapters

io.

b. gives rise to revenue measured at the fair value of

goods or services given up, adjusted for any cash paid

received on the exchange.

¢. aorb, whichever is more clearly determinable.

‘d> does not give rise to revenue.

Gifts, donations and goods in-kind with condition

a._ as revenue immediately upon the receipt thereof,

b. ) initially as liability and recognized as revenue only

the condition is satisfied.

as revenue measured at fair value only when actu:

received.

d. directly in eq

According to the GAM for NGAs, which of the following mi

never give rise to revenue for a government entity

a, Services in-kind . Concessionary loan

b. Debt forgiveness d. Grant with condition

When an amount already recognized as revenue becom

subsequently uncoll

a.) recognized as expense.

b. recognized as an adjustment to the revenue ori

recognized.

©. either a or bas an accounting policy choice

4. not recognized

h of the following receipts of a government entity

give rise to revenue recognition?

a. Receipt of excess cash advance

b. Receipt of refund for overpayment of expenses

©. Receipt of performance bond

>) Receipt of subsidy from the National Government or ot

National Government Agencies.

Disbursements 139

Learning Objectives

1

Chapter 5

Disbursements

State the main concepts in the disbursement of government

funds. .

Account for the different modes of disbursements.

Introduction

ursements constitute all payments in cash, in whatever manner

e, through cash, check, oF other means). Disbursements shall-be

supported =by"Disbursement=Vouchers (including Petty Cash

Vouchers) or Payroll.

Fundamental Principles for Disbursement of Public Funds

I government resources shall be wused.onlyin-accordance

withthe law and only for.public purposes.

‘Trustfunds shall be used only for theinspecifie purpose.

Fiscal responsibility shall be strictly shared by all those

exercising authority over a government agency.

‘The use of government resources shall be approved by proper

officials,

Claims against government funds. shall be supported with

‘complete documentation.

‘Alllaws*andsregulations applicable to financial transactions

shall-be-faithfully.adhered to, including generally accepted

principles and practices of accounting, management and fiscal

administratison, provided that they do not contravene existing

laws and regulations.

1465)

152 153

PROBLEMS Under the Advice to Del

disbursement, payments from a government e

PROBLEM 5-1: TRUE OR FALSE rectly credited to the bank accounts of the payees through

1. No additional cash advance shall be given to any official oF fund/bank transfers.

Account (ADA) mode of

y are

employee unless the previous cash advance given to him ig

first liquidated. The only valid modes of disbursement for a government entity

are throu gh cash or check,

2. All disbursements require prior certifications to establish their

PROBLEM 5-2: MULTIPLE CHOICE

jotment is required

3. Entity A acquires equipment from a supplier, on account. A before a disbursement of government funds is made.

lender settles the account of Entity A by directly paying thé ‘According to the GAM for NGAs, who shall issue this

supplier the proceeds of a loan payable that is recorded in the certification?

BIr's books. This transaction is called»Cash Disbursement a.) Budget Officer c. Head of Agency

Ceiling(CDQ), | * b. Chief Accountant 4. Requisitioning Individual

4, All disbursements shall be made through Disbursement ‘The Chief Accountant shall charge obligations incurred

Vouchers (DVs) or Payroll which are approved by the Head of | against available allotment to ensure that

the Requisitioning Unit. _ ||, the NCA is sufficient to meet the disbursement needs.

there are no unreleased appropriations.

5. Government entities are not allowed by law to, make no overdraft is incurred.

purchases using credit card no excess allotment exists.

6. The NonCash Availment Authority (NCAA) is @ ication on the availability of funds and completeness of

disbursement authority issued to government agencies with i documents is required before a disbursement of

foreign service posts. ¢ { government funds is made. According to the GAM for NGAs,

who shall issue this certification?

7, According to the GAM for NGAs, the Advice to Debit a. Budget Officer ¢. Head of Agency

‘Account (ADA) mode of disbursement can be used only if the .) Chief Accountant 4. Requisitioning Individual

payee maintains an account in the same bank where the

government entity maintains its account.

h of the following results to the recognition, in the books

of accounts, of expenses classified as Personnel Services?

8. Disbursements through the Cash Disbursement Ceiling (CDC) a._ Granting of cash advance for payroll

results to the recognition of a loan payable in the books of b_) Liquidation of payroll fund

accounts of the BTr, . Issuance of office supplies to end users

154

9,

Chapter

d. Set up of payable for payroll

According to the GAM for NGAs, disbursements for sala

and wages shall be supported by

a. Disbursement Vouchers

b,) Payroll

c. Petty Cash Vouchers

. Official Receipts

Which of the following results to the recognition of expense?’

a. Granting of cash advance for travel

wel

b:

€

d. Remittance of the refund for excess cash advance to

BIr

The entry in the books of a government agency with foreign

service post to record the receipt of disbursement authority

called the Cash Disbursement Ceiling (CDC) includes a

a. debit to Cash-Modified Disbursement System (MDS)

B.) credit to Subsidy from National Government

© credit to Cash-Constructive Income Remittance

. debit to Subsidy from National Government

This is used to recognize: (1) in the books of national

government agencies, the constructive remittance to BIR and)

BOC of taxes and customs’ withheld, and the

constructive receipt of NCA for those taxes and customs.

duties; 2) in the books of the BIR and BOC, the constructive

receipt of tax revenue and customs duties; and (3) in the books

of the BTr, the constructive receipt of the taxes and customs

duties remitted.

Notice of Cash Allocation (NCA)

) Tax Remittance Advice (TRA)

© Cash Disbursement Ceiling (CDC)

d. Non-Cash Availment Authority (NCAA)

duties

All of the following are considered valid cashless

disbursements, except

a. purchase of goods using an electronic card

CitiBank

b. payment of payables using a Non-Cash Availment

Authority.

remittance of taxes withheld to the BIR through Tax

Remittance Advice.

4. online payment through LBP’s eMDS.

©.) payment to a supplier through LBC padala.

Which of the following government agencies will most likely

be able to obtain a disbursement authority in the form of Cash

Disbursement Ceiling (CDC)?

a. BIR ©. DFA

b. DPWH d. NFA

PROBLEM 5-3: MULTIPLE CHOICE

Entity A disburses a check chargeable against the Treasury

Account. The journal entry to record the disbursement

involves a credit to which of the following accounts?

a. Cash-Treasury/Agency Deposit, Regular

Cash-Modified Disbursement System (MDS), Regular

Cash in Bank-Local Currency, Current Account

Cash-Collecting Officers

a 9\s)

Entity A sends an employee to an official travel and gives him

cash to cover his travelling expenses. Which of the following

most likel {try to record the cash disbursement?

the

‘Traveling Expenses x

Advances to Officers and Employees xx

Traveling Expenses vox

Cash ~ Modified Disbursement

System (MDS), Regular sexx

Advances to Officers and Employees x

‘Cash Modified Disbursement

System (MDS), Regular 0%

56

a.

3.

qd,

b.

4.

Advances to Officers and Employees 6.

Cash on Hand

Entity A purchases office supp!

merchant using an electronic card.

s from an authori

The entry to record

settlement of the transaction is

Inventory rox

Office Supplies Inventory xox

Cash ~ Modified Dis

System (MDS), Reg

No journal entry.

Entity A wants to make disbursements online. Which of

Apply for a PayPal account.

b. Obtain a debit card or credit catd that is either Visa

MasterCard from any bank.

©. Enrol with the MDS of the Land Bank of the Philippines.

d. Make a facebook account.

Entity A acquires an equipment on account and settles

account through Non-Cash Availment Authority (NCAA),

The entry to settle the account is

Accounts Payabl xox

ibsidy from National Government

Accounts Payable rox

Cash ~ Modified Disbursement

System (MDS), Regular

Accounts Payabl rx P.

tive Income

No journal entry.

{A receives authorization from the DBM allowing it to use the

lections of its foreign service post to pay for the necessary

perating expenses of the foreign service post. The entry

record the disbursemei

Cash in Bank-Foreign Currency

Account

owi

authority is

Cur

Cash-Collecting Officer

Cash-Constructive Income Remittance

Subsidy from NG

Accounts Payable

Cash-Constructive Income

Remittance

‘No journal entry.

rox

Which of the following modes of disburseme

similar to a check disbursement?

eMDS JADA

NCAA ‘4.NBA

s is most

a

b,

‘A government entity makes payment through Advice to Debit

Account (ADA). The entry most likely to be used in recording

the payment is

Accounts p:

Cash-Modified Disbursement

System (MDS), Regular

Accounts payable

Subsidy from National Government

Accounts pay‘

Cash-ADA

None. The transaction is recorded only in the Registries and

ORS.

A government entity makes constructive remittance of taxes

withheld to the BIR through Tax Remittance Advice (TRA).

The entry used i ig the transaction is

Cash-Tax Rem. \'2 Advice

158 Chapter5) E ighhn 159

Subsidy from National Government 20 necessary operating expenses of the foreign service post. This

b. Due to BIR 1x authorization is called

Cash-Tax Remittance Advice vox ‘Cash Disbursement Ceiling (CDC)

c aandb

d. None. The transaction is recorded only in the Registries ar

ors,

b. Non-Cash Availment Authority (NCAA)

Electronic Modified Disbursement System (

d. Advice to Debit Account (ADA)

DS)

10. Which of the following modes of disbursements would resull

Entity A disburses a check chargeable against its checking

to the recognition of a loan payable in books of the BT:? maintained: with Government Servicing Bank. The

a..CDC ©. ADA journal entry to record the disbursement involves a credit to

b. NCAA 4. UFC which of the following accounts?

a. Cash-Treasury/Agency Deposit, Regular

b._Cash-Modified Disbursement System (MDS), Regular

PROBLEM 5-4: FOR CLASSROOM DISCUSSION Cash in Bank-Local Currency, Current Account

1, Which of the following is not used in processi d. Cash-Collecting Officers

disbursements?

a. DVs c.PCVs

6. Which of the following entries would most likely constitute a

b. Payroll 4. ORs

cash disbursement, rather than a check disbursement?

a. Electricity Expenses 0%

2. Which of the following is not a form of disbursem ‘Cash Modified Disbursement

authority? System (MDS), Regular x

a. NCA NTA

b. TRA , Allotment expenses

p. Accounts Payable wx

3. It is an authority issued by the DBM to central, regional at

provincial offices and operating units to cover their bi

requirements. It specifies the maximum amount of cash +) iris Oe ea Ret a

can be withdrawn from a government servicing bank in Cea MR RDEG CLE

eee eeeaa System (MDS), Regular wx

a: Notice of Cash Allocation (NCA) To record grant ofesh advance for

b. Tax Remittance Advice (TRA) travel

© Cash Disbursement Ceiling (CDC) d. None. All of these are check disbursements.

d

Non-Cash Availment Authority (NCAA)

7. Which of the following would most likely constitute a

4. Entity A has a foreign service post. During the period, Entit disbursement through Advice to Debit Account (ADA)?

A receives authorization from the DBM allowing it to use

collections of its foreign service post to defray for

a

160

through

‘The disbursement is not recorded in the books of accounts,

qd

purchase is

Office Supplies Inventory

sh (iit ke Chapter

Electricity Expenses wx

Cash ~ Modified Disbursement

10x

wx

Advances to Officers and Employees wx

Cash - Modified Disbursement

System (MDS), Regular

To record gra

1

f these arc disbursements,

true regarding disbursements

tronic Modified Disbursement System (e¢MDS)?

the issuance of Mi

check,

‘The disbursement is made t

that is swiped in a card s

merchant.

‘ough the use of a credit card)

e machine of an authorized)

The disbursement is made through an online transaction,

horized

ig an electronic card. The entry to record

hases office supplies from an

xx

Accounts Payable

Accounts Payable

Cash ~ Modified Disbursement

‘System (MDS), Regular

Office Supplies Inventory

Cash - Modified Disbursement

System (MDS), Regular

mal entry,

Xxx

Disbursements 161

10. Entity A acquires an equipment on account and settles the

account by debiting Accounts Payable and crediting Subsidy

from National Government. The mode of disbursement used

by Entity A is most likely aan)

a. Credit Card transaction

b. Advice to Debit Account

c. Cash Disbursement Ceiling

d,) Non-Cash Availment Authority

180

Chapter 6 Summary:

Fi ‘asset is any asset that is: cash or right to receive cash.

or other financial asset, an equity instrument of another entity,

‘or contractual right to exchange financial instruments under

potentially favorable condition. Examples: cash and cash

equivalents, receivables, investments in debt and equity

securities, and derivative assets.

The Petty Cash Fund of a government entity is:

- _ maintained using the imprest system.

- _ sufficient to defray recurring petty expenses for 1 month.

- used for disbursements not exceeding 15,000 per

transaction.

- replenished as soon as disbursements reach at least 75'

or as needed.

government entity prepares monthly bank reconci

using the adjusted balance method.

+ Only debt instruments acquired 3 months or less before thei

scheduled maturity date can qualify.as cash equivalents.

+ Receivables are initially measured at fair value ph

transaction costs and subsequently measured at amortize

cost.

sequent measurement purposes, a government enti

its financial assets into the following categories: (

Financial asset at fair value through surplus or deficit; (b

Held-to-maturity investments; (c) Loans and receivables; and

(a) Available-for-sale financial assets.

Financial Assets

181

PROBLEMS

PROBLEM 6-1: TRUE OR FALSE

According to the GAM for NGAs, all financial assets are

initially measured at fair value

Accordirig to: the GAM for NGAs, government entities shall

Prepare bank reconciliations only at year-end or whenever

need arises,

Only debt instruments with remaining maturity of 3 months

or less can qualify as cash equivalents.

The PCF of a government entity is replenished when

disbursements reach at least 90%, or as needed.

No journal entry is prepared when a disbursement is made

‘out of the petty cash fund.

A government entity established a 30,000 petty cash fund.

‘The custodian must be bonded for at least 5,000,

ing to the GAM for NGAs, all financial assets shall be

‘measured at fair value plus transaction costs,

‘Transaction costs on financial assets classified under the held

to maturity category are expensed outright.

A derivative derives its value from the changes in value of a

specified rate, price, event or some other variable,

Risk management is the process of identifying the desired

level of risk, identifying the actual level of risk and altering the

latter to equal the former.

182

PROBLEM 6-2: MULTIPLE CHOICE

1

Which of the fol

a. Petty cash f

ig is not considered a financial asset?

id

b. Investment in debt sect

c. Accounts receivable

‘@> Prepaid assets

A cash shortage of a government entity is most likely record

asa

a. debit to a receivable account

b. debit to a cash shortage or overage account

¢. credit to miscellaneous income account

d. credit to a cash shortage or overage account

Dishonored checks are recorded by a government entity as

a. Notes receivable ¢. Accounts receivable

B. Other receivables d. Losses

‘The entry to record the replenishment of a petty cash fund of,

government entity is

Expense accounts x00

Cash-Modified Disbursement System

(MDS), Regular

Expense accounts xx

Petty Cash

Expense accounts wx

Cash-Collecting Officers

Expense accounts wax

Cash-Treasury/Agen:

osit, Regular

Under this method of bank reconciliation statem

preparation, the unadjusted book and bank balances

brought to an adjusted balance that is reported on

statement of financial position.

a. Bank to Book Method

b. Book to Bank Method

¢: Adjusted Balance Method

183

cial Assets

Which of the following may be paid through the petty cash

fund of a government entity?

a,_ Rent worth 12,000.

b. Pantry supplies worth 15,000.

©. Office supplies worth ®20,000.

d. None of these.

Entity A maintains a petty cash fund. At any given point of

time, the cash on hand and the petty cash vouchers must b

equal to the ledger balance of the petty cash fund. If these are

not equal, the difference is either shortage or overage. This

system of handling petty cash fund is called

a) Impress System Pretty Cash System

b. Fluctuating Balance System d. Imprest System

According to the GAM for NGAs, the establishment of a petty

cash fund

a.) requires the approval of the Head of Agency.

requires the approval of the Chief Accountant.

requires the approval of the President of the Philippines.

does not require any formal approval because petty cash

funds are likely to be immaterial.

aos

‘The “Loans Receivable” account is most likely to be used in

the books of accounts of which of the following government

agencies?

a. COA ¢. BTr

b. NIA All of these

Which of the following is not one of the characteristics of a

derivative?

a. )It requires no notional amount (or only a very minimal

notional amount),

b. Its value changes in response to the change

184 Chapter Assets x 185

‘ investment (or only a very a. 1,456,792 2. 1,582,711

b. 1,330,873 2,000,000

d. Itis settled at a future date.

5. The interest income in 20x is

a, 221,580 ¢, 186,322

PROBLEM 6-3: MULTIPLE CHOICE b. 203,951 4. 200,000

1. According to the GAM f

costs that are directly

NGAs, these refer

rributable to the acq

rent is classified as available for sale financial

disposal of a financial instrument. s fair value at year-end is 1,800,000, how much is

a, Costs to sell c. Financial costs the change infair value?

,) Transaction costs . Variable costs 195,709

238,869

is not one of the categories of financial

under the GAM for NGAs? If the investment is classified as available for sale financial

a. Held-to-maturity investments asset, how much is the interest income in 20x1?

b. Loans and receivables a 221,580 €. 186,322

. Available-for-sale financial assets b. 203,951 . 200,000

@, Financial asset through other comprehensive income

8. According to the GAM for NGAs, changes in fair value of

3, Entity A acquires an investment for 1,000,000. Transact

costs amount to 10,000. At year-end, jent has a fait

value of 900,000. If the investment is classified as financial

asset through surplus or deficit, how much is the loss from the

change in fair value?

(a) 100,000 «©.110,000

b. 90,000 4.0 9. Entity A acquires an investment for 100,000 and incurs

"i transaction costs of #10,000. At year-end, the fair value of the

Use the fo nformation for the next four q investment is 80,000. Entity A recognizes a ®30,000 loss from

On January 1, 20x1, Entity A acquires 10-year, 10%, 2,000,000 face the change in fair value. The investment would most likely to

amount bonds for 1,456,792 and classifies them as held-to- have been classified under which of the following categories

maturity investments. Transaction costs on the acquisition amount of financial assets?

to 125,919, The issuer pays annual interest every December 31 ‘,/ Available-for-sale financial assets

The effective interest rate is 14%, . Financial asset through surplus or deficit

. Held-to-maturity investments

4. The d. Loans and receivables

20x1 is

al carrying amount of the investment on January

186 Chay

10. Entity A acquires an investment for 100,000 and

transaction costs of 10,000. At year-end, the fair value of

investment is 120,000. However, the investment

appropriately reported in the year-end statement of finan¢

kely to have been clas

Wg categories of financial assets?

ble-for-sale financial assets

Held-to-maturity investments

Loans and receivables

|. Cannot be determined due to insufficie

ed under which of

information

PROBLEM 6-4: FOR CLASSROOM DISCUSSION

1. According to the GAM for NGAs, a government entity’s

comprises all of the following except

a. cash on hand . cash equivalents

b. cash in bank 4. cash treasury accounts

2. Which of the following is excluded from the amount of «

that is reported in the statement of financial position of

government entity’

@. unreleased checks drawn,

b. cancelled checks drawn

‘c, undeposited collections

d. post-dated checks receiv

3. An unexplained cash overage of a government entity

recorded as a

a. credit to a payable account

b, “debit to a cash shortage or overage account

©. -€redit to miscellaneous income account

4. credit to a cash shortage or overage account

4. All of the following are considered internal controls over ca:

except

a, Requiring a cash custodian to be properly bonded

amount of bond shall not be less than the c

accountability of the custodian.

Fis

Bopp

mncial Assets a

b. Preparing a bank recone for each bank account

maintained by a government entity.

Making estimates of recurring expenses _before

establishing an amount for a petty cash fund.

cash fund under a Fluctua

Balance System wherein the total cash on hand and p

cash vouchers may or may not be equal to a fixed amount

ash fund at any given point of time.

e wens Siskel ERLdete oe an bORy clone

making purchases.

The per transaction threshold for petty cash disbursements of

a government entity is.

a. 5,000

b. 10,000

A government agency sh

each bank account mai

prepared using the

a. Bank to Book Method

b. Book to Bank Method

‘¢/ Adjusted Balance Method

d. Any of these

If the adjusted balance of cash is less than the unadjusted

balance per books and there are no other reconciling items or

errors, the difference is most likely caused by :

a. Credit memo . Deposits in transit

b. Debit memo d. Outstanding checks

According to the GAM for NGAs, receivables are measured at

Initial Subsequent

Fair value Amortized cost

Amortized cost

Jue minus transaction costs. Amortized cost

Fair value Fair value

188 hapten Inetories oe

9. The subsequent changes in the fair value of an investment t Chapter 7

is classified as available for sale are recognized in + 7

a. surplus or deficit Inventories ~

b. net assets or equity

2) not recognized

d. any of these as an accounting policy choice

10. According to the GAM for NGAs, the very purpose

derivatives is

‘a. “risk management risk incurrence

b. speculation d.aorb

Learning Objectives

for inventories by a government entity.

and

we procedures in the r

inventories by agovernment entity...

Introduction

Inventories are assets:

a, Held=for-sale or ‘distribution in the ordinary course of

‘operations (Finished goods);

b. dnvthe-process.of production for sale or distribution (Work in

process); or ‘pia ‘

c. ithe form-of materials.or.supplies, to be-consumed in the

production process or distributed in the rendering of services

(Raw materials and supplies)

More specific

consists of the following:

_ Inventory Hild for Sale (eg, medicines fr sale in government

pharmacies)

b. dnventory Held for Distribution (e.g, rice and other welfare

goods held for distribution)

c. Inventory. Held for Manufacturing (e.g., raw materials, work-

in-process)

4. Inventory” Held for Consumption) (eg., office supplies

inventory)

e, Semi-Expendable Property ~.. consists of machinery,

equipment, furniture and fixtures and similar items that are

not-capitalizedas~PPE because their costs are sbelowethe

15,000 capitalization-threshold for PPE.

the inventories of a government entity

196

Chapter 7 Summary:

not used by government entities.

The inventories of government entities include the following!

d. Inventory Custodian Slip ~ prepared when issuing semie

expendable property.

Inventory Held for Sale, Inventory Held for Distribu

supplies), and Sei

below the P15,000 capitalization threshold for PPE).

Goods held for sale are subsequently measured at the Lower

Cost and NRV while goods held for distribution are subsequently

measured at the Lower of Cost and Current replacement cost.

The FIFO cost formula and the Periodic inventory system

PROBLEMS

PROBLEM 7-1; TRUE OR FALSE

According to the GAM for NGAs, inventories of government

entities are subsequently measured at net realizable value or

current replacement cost depending on whether the inventory

is classified as held for sale or held for distribution.

‘According to the GAM for NGAs, purchases

equipment, furniture and fixtures and si

10,000 capi threshol

inventories.

machinery

rems below the

for PPE are recorded as

Relief goods, office supplies, equipment and furniture and

fixture are items that may appropriately be recorded as

inventories by a government entity.

The GAM for NGAs allows government entities to use the

FIFO cost flow formula,

The GAM for NGAs allows government entities to use a

periodic inventory system.

The specific identification cost formula is not available for use

by government entities, according to the GAM for NGAs.

The Purchase Request (PR) form is prepared when end users

request for the issuance of items of inventory that are available

on stock,

If the beginning balance

and the cost

be P120.

inventory is P50, the net purchases

f goods sold is P30, the ending

are PI

inventory

198. Chapter:

Fact pattern

Entity A, a government enti

period,

carrying amount of P2.

(1) brown egg for P3 and one (1) blue egg for P4. Entity A sold

brown egg during the per

9. Under the Specific identification cost formula,

of sale is P2.

10. If the eggs are‘ordinarily interchangeable, Entity A’s

PROBLEM 7-2: MULTIPLE CHOICE

if

sells eggs. At the start of

ry consisted of one (1) red egg with

ing the period, Entity A acquired

ty A’s inv

is P25, assuming the sale occurred only after

purchases were made.

Entity A, a government , purchases inventories. To

record a purchase, Entity A would most likely debit the (an)

a) Inventory account c. Expense account

b. Purchases account daorb

Entity A, a government hospital, acquires medicines to be sold

record the medicines

acquired as

a. Semi-Expendable Property

b. Inventory Held for Consump

©. Inventory Held for Distribution

4.) Inventory Held for

Entity A, a government entity, purchases relief

are to be held on standby

calamity strikes. Entity A would most likely cla:

purchased as

a. Inventory Held

b) Inventory Held

© Purchases

d. None of these, only a note di

osure shall be made

Inventories 199

‘According to the GAM for NGAs, this shall be used for large

numbers of items of inventory that are ordinarily

Weighted average cost applied in a periodic inventory

system

sighted average cost applied in a perpetual inventory

these as a matter of accounting policy choice

This refers to the cost an entity wou!

the reporting date.

a. Net realizable value

b. Fair ve

\cur to acquire an asset

Current replacement cost

d. Present value

Which of the following inventories of a government entity

would be subsequently measured at the lower of cost and

current replacement cost?

a, Inventories of rice that are held for sale

b,_ Medicines being sold by a government-owned pharmacy

‘€) Books to be distributed to students in public schools

d._ Forest products held for sale

Which of the

to the recognition of

a. The inventory is written down.

b,, The inventory is distributed for free.

c.” The inventory is exchanged for dissimilar inventory.

@._ The inventory is consumed in the manufacturing process.

ing, events or transactions would not lead

e cost of inventory as expense?

on of a government entity uses this

or the movements and balances

inventories.

a._ Stock Card

%. \Stock Ledger Card

«Journal Entry

d. Special Journal

Chapter:

he following statements correctly differentiates

Stock Card from the Stock Ledger Card?

a. The Stock Ledger Card is maint

d by the Budget

b. The Stock Card is subject to audit by the COA while

Stock Ledger Card is not.

. The Stock Card shows quantities only while the St

Ledger Card shows monetary balances only.

. The Stock Card shows quantities only while the St

Ledger Card shows quantities

amounts.

10. This document is prepared when end users request for

issuance of inventories that are available on stock.

a. Purchase Requisition Form

Custodian Inventory Slip

Purchase Order

Requisition and Issue Slip

Ros

PROBLEM 7-3: MULTIPLE CHOICE

1. Entity A, a government entity, purchases inventory to be

for sale in the ordinary course of activities. Which of

following is the correct entry to record the purchase?

Inventory 30x

nts Payable

Xxx

Accounts Payable rx

© aorb depending on the accounting policy being used

d. none, a government entity cannot hold inventories

sale; only for consumption.

201

Entity A, a government entity, distributed welfare goods to

the intended recipients. The entry to recognize the event is.

a. Cost xx

ire Goods for Distribution xxx

b.) Welfare Goods Expense rox

Welfare Goods for Distribution rox

Distribution costs rox

Welfare Goods for Distribu

d. None. The expense is recognized at the end of the period

when a physical count is performed. The expense is closed

to the Income Summary account.

3. At year-end, Entity A, a government entity, determines the

wing information:

‘+ Carrying amount of goods held for distribution — 100,000

* Net realizable value~ 80,000.

* Current replacement cost ~ 90,000.

How much of the carrying amount of the inventory is

Tecognized as expense?

a 10,000

b. 20,000

90,000

d. None of these

the following information for the next two 4

Entity A, a government entity, determines the following

information regarding the inventory of Goods A, a non-

Units Unit ‘Total Cost

Cost

Balance at January 1, 20x1 3,000 P19.55, 58,650

Purchases:

wary 6, 20x1 10,200 21.50 219,300

Fy 26, 20x1 2,250 20.60 46,350

wary 7, 20x1 2,700

Fy 31, 2002 7,200

202 Chapter 203

4. _How-much is ending inventory? 4. Which of the following cost formulas is not available for use

Ca 116382 117,300 by government entities?

b. 116,495 d. Any of these a. Specific identification c. Weighted Average

by) FIFO d. All of these are available

5, How much is the cost of salé?

a, 207,805 207,000 5. The GAM for NGAs requires the use of which of the following

4. 207,918 d. Any of these. inventory systems?

a.) Perpetual inventory system caorb

b. Periodic inventory system d. none of these

PROBLEM 7-4: FOR CLASSROOM DISCUSSION

1. Entity A, a government entity, purchases furniture

fixtures amounting to P14,000. Entity A would most likel

record the purchase as

Property, Plant and Equipment

Inventory Held for Consumption

Inventory Held for Manufacturing

‘Semi-Expendable Property

6. Government entities record purchases of inventories

a} inan inventory account caorb

. in the Purchases account d. as expenses

7. Which of the following may be included as cost of inventory?

a) freight-in under a freight collect, FOB destination sale

term

b. trade discounts

. cost of insurance while the goods are in transit

d. advertisement cost that resulted to the resale of inventory

purchased

apoe

2. Accountable forms such as pre-printed forms used

government transactions are most likely to be classified by

government entity as

a._ Inventory Held for Consumption

b. Inventory Held for Sale

. Semi-Expendable Property

d. Not considered inventory, according to the GAM

NGAs

‘Arrange the following in the sequence they are used in the

requisition and receipt of inventories by a government entity

1. Inspection and Acceptance Report (IAR)

I, _ Disbursement Voucher (DV)

Purchase Request (PR)

IV. Journal entry

V. Purchase Order (PO).

VI. Stock Card (SC)

3. Inventories are initially measured at cost and subsequent

‘measured at

a. the Lower of Cost and Net realizable value for goods hel

for sale i

b. the Lower of Cost and Current replacement cost for g

held for distribut

© aandb

. cost

|, Vand IV

11, Viand IV

ac IML, V, 1, VI, IV and Il

b. IL, V, 1 IV, Vand IL

204 Agriculture 205,

9. This is maintained in the Property/Supply Division to ret Chapter 8

the movements of inventories.

a. Stock Card (SC) Agriculture

b, Property/Supply Card (PSC)

. Supplies Ledger Card (SLC)

d. Magic Card (MC)

| Learning Objectives

1. Differentiate between , the following: biol

agricultural produce and inventory.

2. State the initial and subsequent measurements of

assets and agricultural produce.

is is used to report wasted materials, such as destr

spare parts and other spoilages.

Wasted Stocks Card (WSC

Waste Materials Report

Report on the Physical Count of Inventories

Inventory Custodian Slip

aos

Introduction vein

A ire means farming or the process

sing livestock.) In this chay

principles used for assets,

resulting from agricultural activities.

producing crops at

, we will lear the accounting

ies, income and expenses

Agricultural Activity ~ ig the management by an entity of the

‘biological transformation and-harvest.of biological. assets for sale,

exchange or _mon-exchange transactions,

in into agricultural produce, or into addition:

Examples of agricultural . activities include:

tock, fore or perennial cropping, cultivi

chards and plantations, floriculture, and aquaculture

fish farming

The following are the common features of agricultural

activities:

a. Capability to change — living animals and plants are capable-of-

‘biological transformation;

b. Management of change. + management faci

transformation by enhancing, or at-least stabilizing, conditions

anecessary=for-the= process-to-take~place. Such management

214

PROBLEMS

PROBLEM 8-1: TRUE OR FALSE

1. Living animals and plants are always accounted for

biological assets,

ly and subsequently measured

3. Agricultural produce is measured at fair value less costs to

only at the point of harvest,

4, An essential element of agricultural acti

management of the biological transformation

assets.

5. Entity A’s dairy cattle gave birth to a calf. The fair value le

costs to sell of the new born calf is ®10,000. Entity A recogni:

‘a gain of 10,000 from the

6. A loss can arise from the initial measurement of a biologi

as

costs.

8. Entity A acquires a

gical asset for P100, equal to

value, and incurs transaction cost of P10 on the purchase |

the asset's costs to

20, Entity A will recognize a loss

of the purchased asset:

9. Entity A recognizes a gain of 100 from the change in F

of its biological assets during the period. If the change

FVLCS due to price change is #70, the change in FVLCS due!

physical change must be 40.

Agrhalure 215

10. If there are more than one active markets for a biological asset,

the entity shall use the price in the market expected to be used

when determining fair value,

PROBLEM 8-2: MULTIPLE CHOICE

1. According to the GAM for NGAs, a biol

a. an animator piant ‘a living animal or plant

b. anasset used in farming ~-d.a harvested product

ies include all of

The common features of agricultural acti

the following except

a. capability to change

b. management of change

measurement of change

‘wind of change

3. Which of the following is an agricultural produce?

a. carabao extra tice

b.) harvested palay 4. powdered milk