Professional Documents

Culture Documents

Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part N)

Uploaded by

John Carlos Doringo0 ratings0% found this document useful (0 votes)

15 views1 pageP Company had inventory of P210,000 and S Company had P154,000 for a total of P364,000 between the two companies. Unrealized profit in ending inventory from intercompany transfers was P16,800. So the consolidated ending inventory was P347,200.

The consolidated cost of goods sold is calculated as P140,000 for Parent, P80,000 for Subsidiary, less P100,000 for the intercompany transfer, plus P12,000 in unrealized profit from the transfer in ending inventory, for a total of P132,000.

When Parent acquired Subsidiary (SZ), the consideration transferred was P260,000 and the non-cont

Original Description:

Original Title

Advanced Accounting - 2015 [Chapter 17] Multiple Choice Solution (Part N)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentP Company had inventory of P210,000 and S Company had P154,000 for a total of P364,000 between the two companies. Unrealized profit in ending inventory from intercompany transfers was P16,800. So the consolidated ending inventory was P347,200.

The consolidated cost of goods sold is calculated as P140,000 for Parent, P80,000 for Subsidiary, less P100,000 for the intercompany transfer, plus P12,000 in unrealized profit from the transfer in ending inventory, for a total of P132,000.

When Parent acquired Subsidiary (SZ), the consideration transferred was P260,000 and the non-cont

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part N)

Uploaded by

John Carlos DoringoP Company had inventory of P210,000 and S Company had P154,000 for a total of P364,000 between the two companies. Unrealized profit in ending inventory from intercompany transfers was P16,800. So the consolidated ending inventory was P347,200.

The consolidated cost of goods sold is calculated as P140,000 for Parent, P80,000 for Subsidiary, less P100,000 for the intercompany transfer, plus P12,000 in unrealized profit from the transfer in ending inventory, for a total of P132,000.

When Parent acquired Subsidiary (SZ), the consideration transferred was P260,000 and the non-cont

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Chapter 17

Multiple Choice Problems

76. d

Inventory

P Company 210,000

S Company 154,000

Total 364,000

Less: Unrealized profit in EI: [P140,000 x 60% = P84,000 x (140 - 112)/140] 16,800

Consolidated 347,200

77. d Add the two book values and remove P100,000 intercompany transfers.

78. c Intercompany gross profit (P100,000 - P80,000) .................................................................. P20,000

Inventory remaining at year's end ......................................................................................... 60%

Unrealized intercompany gross profit ................................................................................... P12,000

CONSOLIDATED COST OF GOODS SOLD

Parent balance ................................................................................................................ P140,000

Subsidiary balance ......................................................................................................... 80,000

Remove intercompany transfer ...................................................................................... (100,000)

Defer unrealized gross profit (above) ............................................................................ 12,000

Cost of goods sold ................................................................................................................. P132,000

79. c Consideration transferred .......................................................... P260,000

Non-controlling interest fair value.............................................. 65,000

SZ total fair value....................................................................... P325,000

Book value of net assets............................................................. (250,000)

Excess fair over book value P75,000

Annual Excess

Life Amortizations

Excess fair value assigned to undervalued assets:

Equipment............................................................................ 25,000

5 years......................................................................P5,000

Secret Formulas .................................................................. 50,000

20 years.................................................................... 2,500

Total ...................................................................................... P -0- P7,500

Consolidated Expenses = P37,500 (add the two book values and include current year amortization expense)

You might also like

- Premium, Inc. 2018 Tax Return - RRossDocument36 pagesPremium, Inc. 2018 Tax Return - RRossRaychael Ross100% (3)

- Module III. Business Combination - Subsequent To Date of AcquisitionDocument5 pagesModule III. Business Combination - Subsequent To Date of AcquisitionAldrin Zolina0% (4)

- SOAL LATIHAN INTER 1 - Chapter 4Document14 pagesSOAL LATIHAN INTER 1 - Chapter 4Florencia May67% (3)

- AIS Chapter 1 Question and Answer (Set B)Document2 pagesAIS Chapter 1 Question and Answer (Set B)John Carlos Doringo100% (2)

- Chapter 17 Advacc2 PDFDocument58 pagesChapter 17 Advacc2 PDFJoyce Anne Garduque0% (1)

- (Set D) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set D) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- Problems: Trial Balances For The Companies For The Year Ended December 31, 20x4 Are As FollowsDocument10 pagesProblems: Trial Balances For The Companies For The Year Ended December 31, 20x4 Are As FollowsBetty SantiagoNo ratings yet

- Buscom 8Document11 pagesBuscom 8dmangiginNo ratings yet

- Buscom 7Document9 pagesBuscom 7dmangiginNo ratings yet

- Solution Manual For Advanced Accounting 12th EditionDocument49 pagesSolution Manual For Advanced Accounting 12th EditionMariaPetersonewjkf100% (68)

- Reporting and Evaluation: Changes From The Eleventh EditionDocument13 pagesReporting and Evaluation: Changes From The Eleventh EditionAlka NarayanNo ratings yet

- Revenue Recognition: Optional Assignment Characteristics TableDocument10 pagesRevenue Recognition: Optional Assignment Characteristics TableAhmad HuzeinNo ratings yet

- DocxDocument17 pagesDocxVy Pham Nguyen KhanhNo ratings yet

- Chapter 11 & 12Document5 pagesChapter 11 & 12katie kateNo ratings yet

- 07 Fischer10e SM Ch07 Final PDFDocument57 pages07 Fischer10e SM Ch07 Final PDFvivi anggi0% (1)

- Cost and Equity MethodDocument11 pagesCost and Equity MethoddmangiginNo ratings yet

- Dividends - S Company: Cost ModelDocument10 pagesDividends - S Company: Cost ModelLove FreddyNo ratings yet

- Discussion Material For Partnership Dissolution1Document6 pagesDiscussion Material For Partnership Dissolution1Jaycee PascualNo ratings yet

- Requirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Document7 pagesRequirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Aira Jaimee GonzalesNo ratings yet

- Requirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Document6 pagesRequirement 1: Solutions To Seatwork #1 Strategic Cost Management Sisc Problem 1 (Close or Retain A Store)Aira Jaimee GonzalesNo ratings yet

- CH # 4 Financial StatementsDocument4 pagesCH # 4 Financial StatementsAbubakar AliNo ratings yet

- Consolidation Workpaper - Year of AcquisitionDocument78 pagesConsolidation Workpaper - Year of AcquisitionJames Erick LermaNo ratings yet

- 1.3.1 Responsibility Acccounting Sample ProblemsDocument4 pages1.3.1 Responsibility Acccounting Sample Problemsdanilynbrmdz0602No ratings yet

- Case About Break Even PointDocument27 pagesCase About Break Even Pointadeeba hassan100% (1)

- Advanced Financial AccountingDocument4 pagesAdvanced Financial AccountingchuaxinniNo ratings yet

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Questions On Chapter FourDocument2 pagesQuestions On Chapter Fourbrook butaNo ratings yet

- 03 Course Notes On Statement of Cash Flows-2 PDFDocument4 pages03 Course Notes On Statement of Cash Flows-2 PDFMaxin TanNo ratings yet

- Chapter 5 Tutorial ExerciseDocument5 pagesChapter 5 Tutorial ExerciseFarheen AkramNo ratings yet

- Case 1and2Document7 pagesCase 1and2Lema RevillameNo ratings yet

- Annual Report Analysis - The Account-AntsDocument14 pagesAnnual Report Analysis - The Account-AntsSonali Siddika OishiNo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)John Carlos DoringoNo ratings yet

- Hilton CH 7 Select SolutionsDocument25 pagesHilton CH 7 Select SolutionsParth ParthNo ratings yet

- Chapter 5 - AfaDocument6 pagesChapter 5 - AfaNguyễn Phương ThảoNo ratings yet

- 10.18 SamDocument1 page10.18 SamSAMUEL SILALAHI 200503147No ratings yet

- Partnership Formation ReviewDocument3 pagesPartnership Formation ReviewRafael Capunpon VallejosNo ratings yet

- Buscom - Module 3Document10 pagesBuscom - Module 3naddieNo ratings yet

- Problem 3,5,&8Document4 pagesProblem 3,5,&8Mark CalapatanNo ratings yet

- Equity Method: Amortization of Allocated ExcessDocument4 pagesEquity Method: Amortization of Allocated ExcesseiaNo ratings yet

- Balance of Payments - : R R R R R R RDocument2 pagesBalance of Payments - : R R R R R R RLambert SagnoNo ratings yet

- ACCT 3110 CH 4 Homework E 2 9 10 P 5 6Document7 pagesACCT 3110 CH 4 Homework E 2 9 10 P 5 6John JobNo ratings yet

- Excercise 19Document7 pagesExcercise 19raihan aqilNo ratings yet

- 6th Edition Module 2 Selected Homework AnswersDocument5 pages6th Edition Module 2 Selected Homework AnswersjoshNo ratings yet

- Chapter 15 JawabanDocument24 pagesChapter 15 JawabanDamelinaNo ratings yet

- Standard Costs, Variable Costing Systems, Quality Costs, and Joint CostsDocument18 pagesStandard Costs, Variable Costing Systems, Quality Costs, and Joint CostsAlka NarayanNo ratings yet

- Standard Costs, Variable Costing Systems, Quality Costs, and Joint CostsDocument21 pagesStandard Costs, Variable Costing Systems, Quality Costs, and Joint CostsGatorNo ratings yet

- Solutions To Exercises Exercise 18-1-15Document50 pagesSolutions To Exercises Exercise 18-1-15Aiziel OrenseNo ratings yet

- CHAPTER 3 - Partnership Dissolution - Changes in OwnershipDocument16 pagesCHAPTER 3 - Partnership Dissolution - Changes in OwnershipRominna Dela RuedaNo ratings yet

- More Cash Flow ExercisesDocument4 pagesMore Cash Flow ExercisesLorenzodeLunaNo ratings yet

- Cash Flow 1Document3 pagesCash Flow 1Percy JacksonNo ratings yet

- Financial Management, MBA511, Section: 01 Chapter 3: ProblemsDocument2 pagesFinancial Management, MBA511, Section: 01 Chapter 3: ProblemsShakilNo ratings yet

- Final Exam AnswerDocument5 pagesFinal Exam AnswerPham Ngoc AnhNo ratings yet

- Chapter 5 Assigned Question SOLUTIONS PDFDocument28 pagesChapter 5 Assigned Question SOLUTIONS PDFKeyur PatelNo ratings yet

- 06 Fischer10e SM Ch06 Final PDFDocument50 pages06 Fischer10e SM Ch06 Final PDFvivi anggiNo ratings yet

- PCOA007 - Exercise - Module 3 Part 2Document3 pagesPCOA007 - Exercise - Module 3 Part 2Eau Claire DomingoNo ratings yet

- Chapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachDocument3 pagesChapter 15 AFAR SOLMAN (DAYAG 2015ed) - PROB 8 Partial Goodwill ApproachMa Teresa B. CerezoNo ratings yet

- 10701 企一D 會計學小考解答 (一)Document3 pages10701 企一D 會計學小考解答 (一)張芷綾No ratings yet

- C.5 SOLUTIONS (Problems I - XV)Document59 pagesC.5 SOLUTIONS (Problems I - XV)Bianca AcoymoNo ratings yet

- South Africa’s Renewable Energy IPP Procurement ProgramFrom EverandSouth Africa’s Renewable Energy IPP Procurement ProgramNo ratings yet

- The Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepFrom EverandThe Boston Institute of Finance Mutual Fund Advisor Course: Series 6 and Series 63 Test PrepNo ratings yet

- The Pursuit of New Product Development: The Business Development ProcessFrom EverandThe Pursuit of New Product Development: The Business Development ProcessNo ratings yet

- Tax Loopholes for eBay Sellers: Pay Less Tax and Make More MoneyFrom EverandTax Loopholes for eBay Sellers: Pay Less Tax and Make More MoneyRating: 2.5 out of 5 stars2.5/5 (2)

- Beltran v. Samson, 53 Phil. 570Document5 pagesBeltran v. Samson, 53 Phil. 570John Carlos DoringoNo ratings yet

- Galman v. Pamaran, 138 SCRA 294Document72 pagesGalman v. Pamaran, 138 SCRA 294John Carlos DoringoNo ratings yet

- AIS Chapter 1 Question and Answer (Set E)Document3 pagesAIS Chapter 1 Question and Answer (Set E)John Carlos DoringoNo ratings yet

- AIS Chapter 1 Question and Answer (Set C)Document2 pagesAIS Chapter 1 Question and Answer (Set C)John Carlos Doringo100% (1)

- AIS Chapter 1 Question and Answer (Set D)Document4 pagesAIS Chapter 1 Question and Answer (Set D)John Carlos DoringoNo ratings yet

- AIS Multiple Choice Question and Answer (Chapter 2 - Set E)Document3 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set E)John Carlos DoringoNo ratings yet

- AIS Multiple Choice Question and Answer (Chapter 2 - Set D)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set D)John Carlos Doringo100% (1)

- AIS Multiple Choice Question and Answer (Chapter 2 - Set B)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set B)John Carlos Doringo67% (3)

- AIS Multiple Choice Question and Answer (Chapter 2 - Set F)Document2 pagesAIS Multiple Choice Question and Answer (Chapter 2 - Set F)John Carlos Doringo100% (1)

- Advanced Accounting - Dayag 2015 - Chapter 8 - Problems IXDocument2 pagesAdvanced Accounting - Dayag 2015 - Chapter 8 - Problems IXJohn Carlos DoringoNo ratings yet

- Set D (MC), Question and Answers Chapter 20 - BudgetingDocument4 pagesSet D (MC), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- Set E (MC), Question and Answers Chapter 20 - BudgetingDocument3 pagesSet E (MC), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- Set D (True or False), Question and Answers Chapter 20 - BudgetingDocument2 pagesSet D (True or False), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNo ratings yet

- Set B Multiple Choice, Chapter 24 - Capital Investment AnalysisDocument2 pagesSet B Multiple Choice, Chapter 24 - Capital Investment AnalysisJohn Carlos DoringoNo ratings yet

- (Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- (Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set E) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- (Set F) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument4 pages(Set F) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- GR 194201Document7 pagesGR 194201RajkumariNo ratings yet

- Ebix Singapore Private Limited and Ors Vs CommitteSC20211309211802221COM438457Document103 pagesEbix Singapore Private Limited and Ors Vs CommitteSC20211309211802221COM438457AYUSHI GOYAL 1750443No ratings yet

- Reflective Essay 3 - PDIC Truth in Lending Act & Secrecy of Bank DepositDocument2 pagesReflective Essay 3 - PDIC Truth in Lending Act & Secrecy of Bank DepositCha BuenaventuraNo ratings yet

- 12 Ida Dme Ibc Conf 2002Document29 pages12 Ida Dme Ibc Conf 2002danaosajoNo ratings yet

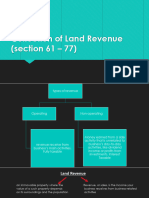

- Collection of Land RevenueDocument13 pagesCollection of Land Revenuemanuarora81No ratings yet

- Banking LawDocument16 pagesBanking LawmadhuNo ratings yet

- LNG Projects - Gravity Platforms Make Many Things Possible Exploration ProducDocument3 pagesLNG Projects - Gravity Platforms Make Many Things Possible Exploration ProducVijay K SinghNo ratings yet

- Bureau of Internal Revenue (Bir) BIR Is Under The Executive Supervision and Control of The Department of FinanceDocument1 pageBureau of Internal Revenue (Bir) BIR Is Under The Executive Supervision and Control of The Department of FinanceAlexandria DiegoNo ratings yet

- Guo 2020Document9 pagesGuo 2020gujjarashrafNo ratings yet

- India: SupplyDocument6 pagesIndia: SupplyHarish NathanNo ratings yet

- ED IFSB AAOIFI Revised Shariah Governance Framework enDocument88 pagesED IFSB AAOIFI Revised Shariah Governance Framework enMega Putri RachmaNo ratings yet

- Research Titles - Group 1Document12 pagesResearch Titles - Group 1Daynalou Gaille PeñeraNo ratings yet

- Food Products Manufacturing Using Microsoft Dynamics AX 2012Document84 pagesFood Products Manufacturing Using Microsoft Dynamics AX 2012Reshu SrivastavaNo ratings yet

- Lomc 1Document21 pagesLomc 1Mitha PramistyNo ratings yet

- Voluntary Inter-Industry Commerce StandardsDocument7 pagesVoluntary Inter-Industry Commerce StandardsnamithaNo ratings yet

- Reservation SectionDocument13 pagesReservation Sectionmikee albaNo ratings yet

- Accounting Principles - AllDocument104 pagesAccounting Principles - AllAHMED100% (1)

- F 48H - Appointment StrategyDocument22 pagesF 48H - Appointment StrategyAnastasia DragutanNo ratings yet

- Engineering Design Ch8Document8 pagesEngineering Design Ch8ansudasinghaNo ratings yet

- Lasu External Campus - Docx2Document5 pagesLasu External Campus - Docx2Bukola BukkyNo ratings yet

- Transcript: Transcript Downloaded From NGASCE Student PortalDocument2 pagesTranscript: Transcript Downloaded From NGASCE Student PortalPiyush GoyalNo ratings yet

- A Project Report On Artificial Intelligence in HRDocument109 pagesA Project Report On Artificial Intelligence in HRmd khaja100% (1)

- 2021 Mefa Lesson PlanDocument9 pages2021 Mefa Lesson PlanDileep TeruNo ratings yet

- Semi-Finals Managing ProjectsDocument41 pagesSemi-Finals Managing ProjectsChris PuelasNo ratings yet

- STR PresentationDocument49 pagesSTR PresentationApril ToweryNo ratings yet

- BT FinalDocument28 pagesBT Finalzala ujjwalNo ratings yet

- Application Form UniSea PDFDocument2 pagesApplication Form UniSea PDFJackNo ratings yet

- Finalise CV - LiveCareerDocument1 pageFinalise CV - LiveCareerAbdelali KhoujaNo ratings yet

- Method of Statement For R.C Piling WorkDocument10 pagesMethod of Statement For R.C Piling WorkMacgjoyner SaLauNo ratings yet

- VILLAREAL V. RAMIREZ, 406 SCRA 145 (2003) - FREE: July 22, 2021 Case ReportDocument13 pagesVILLAREAL V. RAMIREZ, 406 SCRA 145 (2003) - FREE: July 22, 2021 Case ReportybunNo ratings yet