Professional Documents

Culture Documents

Ratios Worksheet

Uploaded by

Sakshi Garg0 ratings0% found this document useful (0 votes)

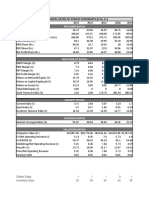

2 views8 pagesThe document provides financial information for company ABC Ltd. for the years 2018-19 through 2015-16. It includes line items for sales, profits, assets, liabilities, shareholder equity and ratios. Key figures given are sales of Rs. 542.38 crore in 2018-19, total assets of Rs. 122.98 crore, net profit of Rs. 3.01 crore, and equity of Rs. 30.55 crore. Various financial ratios are also presented such as current ratio, debt to equity, profit margins and asset turnover ratios.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial information for company ABC Ltd. for the years 2018-19 through 2015-16. It includes line items for sales, profits, assets, liabilities, shareholder equity and ratios. Key figures given are sales of Rs. 542.38 crore in 2018-19, total assets of Rs. 122.98 crore, net profit of Rs. 3.01 crore, and equity of Rs. 30.55 crore. Various financial ratios are also presented such as current ratio, debt to equity, profit margins and asset turnover ratios.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views8 pagesRatios Worksheet

Uploaded by

Sakshi GargThe document provides financial information for company ABC Ltd. for the years 2018-19 through 2015-16. It includes line items for sales, profits, assets, liabilities, shareholder equity and ratios. Key figures given are sales of Rs. 542.38 crore in 2018-19, total assets of Rs. 122.98 crore, net profit of Rs. 3.01 crore, and equity of Rs. 30.55 crore. Various financial ratios are also presented such as current ratio, debt to equity, profit margins and asset turnover ratios.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 8

Work Sheet

Company Name: ABC Ltd. Rs. In

S.No Particulars Abbre. 2018-19

1 Sales S 542.38

2 Other Income Profit (Loss) OI 0.07

3 Profit Before Dep., Interest and Tax PBDIT 12.53

4 Profit Before Interest and Tax PBIT 10.72

5 Profit Before Tax PBT 3.51

6 Profit After Tax PAT 3.01

7 Interest Payment INTP 7.21

8 Depreciation Provision for the Yr. DEP 1.81

9 Total Assets TA 122.98

10 Fixed Assets (net) FA 31.71

11 Current Assets CA 90.67

12 Current Liabilities CL 65.01

13 Share Capital SC 4.93

14 Reserve & Surplus RES 25.62

15 Long Term Loans DEBT 27.39

16 Working Capital (11-12) WC 25.66

17 Investment + Misc. Exp. INVST 0.6

18 Net Worth or Equity (13+14) NW 30.55

19 Capital Employed (10+16+17) or (15+18) CE 57.97

20 Dividends DIV 10

21 Inventories INV 36.35

22 Sundry Debtors DRS 42.21

23 Economic Value Added EVA 0

24 No. of outstanding Shares NoS 0.49

25 Mkt price per share as on date MPS 100

R

Crore Company Name :

2017-18 2016-17 2015-16 Ratios

511.02 342.33 256.15 LIQUIDITY

0.06 0.56 0.05 Current Ratio

13.85 11.67 7.66 Acid Test Ratio

12.21 10.4 6.47

3.92 3.42 2.12 SOLVENCY

2.61 2.01 1.3 Debt. : Equity

8.29 6.98 4.35 Interest Coverage in Times

1.64 1.27 1.19 Debt Service Coverage Ratio Times

127.81 122.98 72.92

27.14 19.97 14.34

100 102.96 58.53 PROFITABILITY

89.59 19.63 11.48 Profit Margin (%)

4.93 4.67 4.67 Profit on Share Capital

22.6 17.63 15.72 Profit on Net Worth

10.68 78.61 38.83 Return on Investment (ROI)

10.41 83.33 47.05 Book Value Per Share (Rs.)

0.66 0.05 0.05 EPS (Rs.)

27.53 22.3 20.39 DPS (Rs.)

38.21 103.35 61.44 P/E Ratio

12 12 13

53.72 71.31 31.18 OTHERS

34.8 24.56 20.65 Dividend Yield

### 0 0 Dividend Pay out Ratio

0.49 0.46 0.46 CE Turnover (Times)

120 130 125 Total Assets Turnover

Fixed Assets Turnover

Current Assets Turnover

W.C. Turnover

Inventory Turnover

Debtors Turnover

No. of Days Inventory Stock

No. of Day Debtors

(Assuming all sales is credit sales)

RATIOS ANALYSIS

Rs. In: Crore

Formula 2018-19 2017-18 2016-17 2015-16

CA/CL 1.39 1.12 5.25 5.10

(CA-INV)/CL 0.84 0.52 1.61 2.38

Debt/Equity 0.90 0.39 3.53 1.90

PBIT/INT 1.49 1.47 1.49 1.49

(PAT+DEP)/INT 0.67 0.51 0.47 0.57

PBIT/Sales *100 1.98 2.39 3.04 2.53

PAT/ Share Capital *100 61.05 52.94 43.04 27.84

PAT/NW * 100 9.85 9.48 9.01 6.38

PBIT/CE * 100 18.49 31.95 10.06 10.53

NW/No. of Shares 62.35 56.18 48.48 44.33

PAT/ No. of Shares 6.14 5.33 4.37 2.83

Div/No. of Shares 20.41 24.49 26.09 28.26

Mkt Price per share /EPS 16.28 22.53 29.75 44.23

(DPS/MPS)*100 20.408163 20.40816 20.06689 22.6087

DPS/EPS 3.3222591 4.597701 5.970149 10

S/CE 9.36 13.37 3.31 4.17

S/TA 4.41 4.00 2.78 3.51

S/FA 17.10 18.83 17.14 17.86

S/CA 5.98 5.11 3.32 4.38

S/WC 21.14 49.09 4.11 5.44

S/INV 14.92 9.51 4.80 8.22

S/DRS 12.85 14.68 13.94 12.40

365*INV/S 24.46 38.37 76.03 44.43

365*DRS/Credit Sales 28.41 24.86 26.19 29.43

Sys risk Alpha

Security Mean Return RI-RF Beta Unsys Risk (RI-RF)/BETA

tcs 23 18 1 50 18

B 24 19 1.5 40 12.666666667

C 13 8 1 20 8

D 14 9 2 10 4.5

E 15 10 1 40 10

F 23 18 0.8 16 22.5

G 6 1 0.6 6 1.6666666667

PORTFOLIO WEIGHTAGE

Security in port ZI ZI/SUMM ZI

TCS 0.24 0.34

REL POWER 0.24 0.35

KOTAK 0.09 0.13

ITC -0.33 -0.48

CIPLA 0.10 0.14

F 0.82 1.17

G -0.45 -0.65

SUM 0.70 100%

(RI-RF)*BETA/UNSYS RISK BETA^2/UNSYS RISK CUMM OF Cumm of Cut-off

0.36 0.0200 0.36 0.0200 2.482759

0.7125 0.0563 1.0725 0.0763 5.329193

0.4 0.0500 1.4725 0.1263 5.860697

1.8 0.4000 3.2725 0.5263 5.024952

0.25 0.0250 3.5225 0.5513 5.208872

0.9 0.0400 4.4225 0.5913 6.17452

0.1 0.0600 4.5225 0.6513 5.826087

Market variance 8 RF= RISK FREE RATE OF RETURN…RETURN YOU GO

RI = RETURN ON INVESTMENT

ETURN…RETURN YOU GOT AS INTEREST 5

You might also like

- Study Notes - SOR - BaptismDocument8 pagesStudy Notes - SOR - BaptismYousef Yohanna100% (1)

- Haal E Safar Az Farsh Ta Arsh or Read OnlineDocument174 pagesHaal E Safar Az Farsh Ta Arsh or Read OnlineHaal e Safar100% (4)

- 8 Extraordinary Qi VesselsDocument6 pages8 Extraordinary Qi VesselsRiccardo Lautizi100% (1)

- Echofish JRC Jfc-180bbDocument4 pagesEchofish JRC Jfc-180bbJERINsmileNo ratings yet

- CBLM Bartending Ncii # 1 & 4aDocument265 pagesCBLM Bartending Ncii # 1 & 4aQueenly Mendoza Aguilar81% (21)

- S6 E Working FinalDocument9 pagesS6 E Working FinalROHIT PANDEYNo ratings yet

- Prog Copywriting Exercise 10Document3 pagesProg Copywriting Exercise 10azertyNo ratings yet

- Color Symbolism and CultureDocument7 pagesColor Symbolism and CultureWAQAS SHARIFNo ratings yet

- Modern Life: Unit ContentsDocument13 pagesModern Life: Unit ContentsRodrigo Bastos FerreiraNo ratings yet

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 No. of Outstanding Shares Nos 25 MKT Price Per Share As On - MpsDocument10 pages1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 No. of Outstanding Shares Nos 25 MKT Price Per Share As On - MpsMaster FahimNo ratings yet

- Profit and Loss Account of Akzo NobelDocument15 pagesProfit and Loss Account of Akzo NobelKaizad DadrewallaNo ratings yet

- Sourses of Funds: Balance Sheet 2010 2009Document4 pagesSourses of Funds: Balance Sheet 2010 2009Deven PipaliaNo ratings yet

- Balance Sheet (In Crores) - MSN LABORATARIESDocument3 pagesBalance Sheet (In Crores) - MSN LABORATARIESnawazNo ratings yet

- Tata ChemicalsL LEVERAGEDocument2 pagesTata ChemicalsL LEVERAGEsarangdharNo ratings yet

- CCS G4Document14 pagesCCS G4Harshit AroraNo ratings yet

- Jamaica Broilers Group RatiosDocument93 pagesJamaica Broilers Group RatiosJasmine JacksonNo ratings yet

- Comparison - Ratios - Tyre - DistributionDocument15 pagesComparison - Ratios - Tyre - DistributionParehjuiNo ratings yet

- Solution To Mini Case (SAPM)Document8 pagesSolution To Mini Case (SAPM)Snigdha IndurtiNo ratings yet

- Antony Waste Handling Cell Ltd. Company OverviewDocument19 pagesAntony Waste Handling Cell Ltd. Company OverviewSarthak TinguriyaNo ratings yet

- AhujaDocument7 pagesAhujaShashikant Pandit RajnikantNo ratings yet

- ASN SOD Finacial AnalysisDocument6 pagesASN SOD Finacial Analysisjitendra tirthyaniNo ratings yet

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- DLF Announces Annual Results For FY10: HistoryDocument7 pagesDLF Announces Annual Results For FY10: HistoryShalinee SinghNo ratings yet

- Customised Dupont AnalysisDocument1 pageCustomised Dupont AnalysisbhuvaneshkmrsNo ratings yet

- Book 1Document18 pagesBook 1Ankit PichholiyaNo ratings yet

- Financial Ratios of Federal BankDocument35 pagesFinancial Ratios of Federal BankVivek RanjanNo ratings yet

- Balance Sheet of Empee DistilleriesDocument4 pagesBalance Sheet of Empee DistilleriesArun PandiyanNo ratings yet

- M/S. M/S. Sai Internet and ServicesDocument8 pagesM/S. M/S. Sai Internet and ServicesAkhil JamadarNo ratings yet

- India Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008Document6 pagesIndia Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008amitkr91No ratings yet

- Industry Segment of Bajaj CompanyDocument4 pagesIndustry Segment of Bajaj CompanysantunusorenNo ratings yet

- Cost of Debt Int (Exhibit 3a) /LT Liabili 0.063743662 Tax Rate Tax Rate 0.438833961 1-Tax Rate 0.561166039 Risk Free Rate April 98 in Exhibit 0.06Document9 pagesCost of Debt Int (Exhibit 3a) /LT Liabili 0.063743662 Tax Rate Tax Rate 0.438833961 1-Tax Rate 0.561166039 Risk Free Rate April 98 in Exhibit 0.06futyNo ratings yet

- (Billions) : Q2 2012 Data, Except Where NotedDocument17 pages(Billions) : Q2 2012 Data, Except Where Notedchatterjee rikNo ratings yet

- Finance Departrment 1Document5 pagesFinance Departrment 1Vansh RanaNo ratings yet

- Kavveri TelecomDocument1 pageKavveri TelecomrohitbhuraNo ratings yet

- Market View - 2023-06-18Document5 pagesMarket View - 2023-06-18Julian Brescia2No ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Ratio Analysis & Assesment of Working Capital Requirements Mrs. Basanti Bai MaavashkarDocument1 pageRatio Analysis & Assesment of Working Capital Requirements Mrs. Basanti Bai MaavashkarVijay HemwaniNo ratings yet

- 18 - Nacchhater - Tata MotorsDocument17 pages18 - Nacchhater - Tata Motorsrajat_singlaNo ratings yet

- Income Latest: Financials (Standalone)Document3 pagesIncome Latest: Financials (Standalone)Vishwavijay ThakurNo ratings yet

- Arunoday Lifestyle - Projections - 140120 - KarurDocument18 pagesArunoday Lifestyle - Projections - 140120 - KarurRakesh ChoudharyNo ratings yet

- Balance Sheet - in Rs. Cr.Document3 pagesBalance Sheet - in Rs. Cr.jelsiya100% (1)

- Annual Accounts 2021Document11 pagesAnnual Accounts 2021Shehzad QureshiNo ratings yet

- Peer GRP Compsn BankingDocument2 pagesPeer GRP Compsn Bankinganupnayak123No ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- SynopsisDocument1 pageSynopsisntkmistryNo ratings yet

- Key Financial Ratios of NTPC: - in Rs. Cr.Document3 pagesKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNo ratings yet

- Samsung FY17 Q1 PresentationDocument8 pagesSamsung FY17 Q1 PresentationJeevan ParameswaranNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- Three Statement Model (Beauty of Our FM - ADF) - CompletedDocument9 pagesThree Statement Model (Beauty of Our FM - ADF) - CompletedAnkit SharmaNo ratings yet

- 12 - Ishan Aggarwal - Shreyans Industries Ltd.Document11 pages12 - Ishan Aggarwal - Shreyans Industries Ltd.rajat_singlaNo ratings yet

- ProjectDocument5 pagesProjectHarshit ChiraniaNo ratings yet

- Project ReportDocument5 pagesProject ReportHarshit ChiraniaNo ratings yet

- Titan Co LTD (TTAN IN) - GrowthDocument6 pagesTitan Co LTD (TTAN IN) - GrowthSambit SarkarNo ratings yet

- Annexure III IVDocument9 pagesAnnexure III IVADVISE WISENo ratings yet

- Adlabs InfoDocument3 pagesAdlabs InfovineetjogalekarNo ratings yet

- Fundamental Sheet Bharat RasayanDocument28 pagesFundamental Sheet Bharat RasayanVishal WaghNo ratings yet

- Samsung FY16 Q3 PresentationDocument8 pagesSamsung FY16 Q3 PresentationJeevan ParameswaranNo ratings yet

- DABUR Easy Ratio AnalysisDocument4 pagesDABUR Easy Ratio AnalysisLakshay TakhtaniNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- Analysis of Annual Report 2009 of TTK Prestige LimitedDocument9 pagesAnalysis of Annual Report 2009 of TTK Prestige Limitedjainchetan2008No ratings yet

- MaricoDocument13 pagesMaricoRitesh KhobragadeNo ratings yet

- Source: Annual Report of Grasim (In Rs. Crores)Document1 pageSource: Annual Report of Grasim (In Rs. Crores)oasis kumarNo ratings yet

- Accounts AssignsmentDocument8 pagesAccounts Assignsmentadityatiwari8303No ratings yet

- Financial HighlightsDocument3 pagesFinancial HighlightsSalman SaeedNo ratings yet

- Predictive Analytics - Business Predictions Using Mutliple Linear RegressionDocument21 pagesPredictive Analytics - Business Predictions Using Mutliple Linear RegressionSakshi GargNo ratings yet

- BCM Anmol SakshiDocument19 pagesBCM Anmol SakshiSakshi GargNo ratings yet

- Ba Multiple Linear (Autosaved)Document30 pagesBa Multiple Linear (Autosaved)Sakshi GargNo ratings yet

- Career Objective:: Worked Under Finance Department and Managed Their Excel SheetsDocument2 pagesCareer Objective:: Worked Under Finance Department and Managed Their Excel SheetsSakshi GargNo ratings yet

- BSM Sakshi Garg FT 3 BDocument10 pagesBSM Sakshi Garg FT 3 BSakshi GargNo ratings yet

- Question Paper MarkedDocument25 pagesQuestion Paper MarkedSakshi GargNo ratings yet

- Sakshi Garg FT 3 BDocument1 pageSakshi Garg FT 3 BSakshi GargNo ratings yet

- Homework Organization ChartDocument5 pagesHomework Organization Chartafetbsaez100% (1)

- Week 1Document15 pagesWeek 1Jamaica AlejoNo ratings yet

- Cherrylene Cabitana: ObjectiveDocument2 pagesCherrylene Cabitana: ObjectiveMark Anthony Nieva RafalloNo ratings yet

- Syllabus Integrated Skill 3 - k63Document8 pagesSyllabus Integrated Skill 3 - k63Lê Hồng NhungNo ratings yet

- Presentation On Modal Auxiliary VerbsDocument18 pagesPresentation On Modal Auxiliary VerbsAbdelhafid ZaimNo ratings yet

- AOP Lecture Sheet 01Document7 pagesAOP Lecture Sheet 01Nakib Ibna BasharNo ratings yet

- PPP Projects at A Glance. Madhya PradeshDocument7 pagesPPP Projects at A Glance. Madhya PradeshPPPnewsNo ratings yet

- General Rules ICT Lab Rules PE & Gym RulesDocument1 pageGeneral Rules ICT Lab Rules PE & Gym Rulestyler_froome554No ratings yet

- Ece 250 Project PortfolioDocument7 pagesEce 250 Project Portfolioapi-511924847No ratings yet

- Tourism in India: Service Sector: Case StudyDocument16 pagesTourism in India: Service Sector: Case StudyManish Hemant DatarNo ratings yet

- APU CSLLT - 6 - Introduction To Assembly LanguageDocument23 pagesAPU CSLLT - 6 - Introduction To Assembly LanguageAli AtifNo ratings yet

- Marxist - Political Science IGNOUDocument15 pagesMarxist - Political Science IGNOUDesi Boy100% (2)

- Semantic Field Semantic Relation and SemDocument20 pagesSemantic Field Semantic Relation and SemLisa HidayantiNo ratings yet

- Normalization ExercisesDocument2 pagesNormalization ExercisesAnh DiệuNo ratings yet

- Forced Quenching Improves Three-Transistor FM Tuner: Lyle WilliamsDocument4 pagesForced Quenching Improves Three-Transistor FM Tuner: Lyle WilliamsbaymanNo ratings yet

- CDBFRDDocument88 pagesCDBFRDmarcol99No ratings yet

- Fundamentals of Software Engineering Course OutlineDocument4 pagesFundamentals of Software Engineering Course Outlinebetelhem yegzawNo ratings yet

- Rapes, Attacks, and Murders of Buddhists by MuslimsDocument11 pagesRapes, Attacks, and Murders of Buddhists by MuslimsPulp Ark100% (1)

- Nec Exhibition BrochureDocument4 pagesNec Exhibition BrochurejppullepuNo ratings yet

- Ayesha Ali: 2Nd Year Software Engineering StudentDocument1 pageAyesha Ali: 2Nd Year Software Engineering StudentShahbazAliRahujoNo ratings yet

- Vestel Alva B Na-127vb3 Na-147vb3 SMDocument40 pagesVestel Alva B Na-127vb3 Na-147vb3 SMjoseNo ratings yet

- Quantitative Reasearch KINDS OF RESEARCHDocument1 pageQuantitative Reasearch KINDS OF RESEARCHEivie SonioNo ratings yet