Professional Documents

Culture Documents

Customised Dupont Analysis

Uploaded by

bhuvaneshkmrs0 ratings0% found this document useful (0 votes)

24 views1 pageCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views1 pageCustomised Dupont Analysis

Uploaded by

bhuvaneshkmrsCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

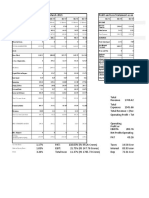

COMPANY/CUSTOMISED SCREENS/SCHEDULEFMTTS~SCHEDULEDETTS/175/Nestle India

Capital Market Publishers Pvt Ltd

Chembur

Nestle India Ltd

REGD OFFICE : M-5A, Connaught Circus, New D INDUSTRY : Food - Proc TEL : 91-11-23418891FAX : 91-11-23415130 WEB : http://www.ne

Dupont Analysis Balance Sheet

Year End 200812 200712 200612 Sourses of Funds 200812 200712 200612

a.OPM % 19 18 18 Equity Paid Up 96.42 96.42 96.42

b.EBIT Margin % 17 16 16 Preference Capital Paid Up 0 0 0

c.Turnover / Assets 9.43 8.66 7.27 Reserves Total 376.93 322.01 292.47

d.ROA % (d=b*c) 161 135 116 Secured loans 0.82 2.87 16.27

Unsecured loans 0 0 0

e.Interest Cost % 200 29.62 2.7 Total Liabilities 474.17 421.3 405.16

f.Debt / Assets 0 0.01 0.04 Application of Funds

g.Interest Dialution % (g=e*f) 0 0 0 Gross Block 1404.84 1179.77 1058.28

h.ROA after Interest %(h=d-g) 161 135 116 Less: Accumulated Depreciation 651.54 576.79 516.48

Net Block 753.3 602.98 541.8

i.Assets / Shareholder Funds 1 1.01 1.04 CWIP 109.17 73.7 38.24

j.ROE before other % (j=h*i) 161 135 121 Investments 34.9 94.4 77.77

k.Other Inc/Shareholders fund % 7 20 8 Working Capital -661.35 -604.38 -495

l.RONW after Other % (l=j+k) 168 156 129 Loans & Advances 123.76 145.39 127.04

Net Deffered tax -36.88 -28.7 -19.15

m.Tax Rate % 30 34 34 Miscellaneous Exp not Written Off 0 0 0

n.ROE after Tax% (n=l-(l*m/100) 118 104 85 Total Assets 474.17 421.3 405.16

o.Book Value 49.09 43.4 40.33

p.Earnings Per Share (p=n*o) 58.03 44.93 34.47 Contingent Liabilities 0 0 0

Equity Data Profit & Loss

BSE Code 500790 NSE Symbol NESTLE Income 200812 200712 200612

Latest Equity 96.42 Market Cap 24567.33 Sales 4471.06 3647.18 2944.2

Face Value 10 EPS 68.78 Excise Duty 143.39 146.53 125.04

Market Price 2547.95 PE Ratio 37.04 Net Sales 4327.67 3500.65 2819.16

52 Week High/Low 2739 /1377 EV/EBIDTA

Ownership Detail Expenditure

(Percentage) 200909 200906 200903 Raw materials-Stock Adjustment 1754.39 1402.78 1084.37

Indian Promoters 0 0 0 Employee Expenses 306.92 262.86 210.85

Foreign Promoters 61.85 61.85 61.85 Power & Fuel 159.76 123.94 115.56

Total Promoters 61.85 61.85 61.85 Other Expenses 1273.67 1091.35 891.99

Foreign Collaborators 0 0 0 Less:Preoperative Exp 0 0 0

Foreign Institutions 9.72 9.49 8

GDR \ ADR 0 0 0 Operating Profit before Other Inc 856.93 699.14 542.77

Mutual Funds 4.32 4.61 5.68 Depreciation 92.36 74.74 66.28

Domestic Institutions 5.89 5.79 6.18

All Institutions 19.93 19.89 19.86 EBIT before Other Income 764.57 624.4 476.49

Corportae Holders 1.66 1.61 1.67 Other Income 33.89 84.48 30.86

Public & Others 16.19 16.27 16.25

Total 100 100 100 EBT 764.57 624.4 476.49

Tax 230.49 210.59 161.39

Net Profit 534.08 413.81 315.1

Less:Extra Ordinary items -1.91 -13.44 -12.48

Adjusted Net Profit 535.99 427.25 327.58

You might also like

- The Acquirer's Multiple - How The Billionaire Contrarians of Deep Value Beat The Market PDFDocument149 pagesThe Acquirer's Multiple - How The Billionaire Contrarians of Deep Value Beat The Market PDFRamdisa100% (5)

- Airthread Excel SolutionDocument18 pagesAirthread Excel SolutionRiya ShahNo ratings yet

- Schaum's Outline of Basic Business Mathematics, 2edFrom EverandSchaum's Outline of Basic Business Mathematics, 2edRating: 5 out of 5 stars5/5 (1)

- Module 11 Financial PlanDocument47 pagesModule 11 Financial PlanAbdul Razak ChaqNo ratings yet

- Market Technician No38Document16 pagesMarket Technician No38ppfahdNo ratings yet

- Estimating Walmarts Cost of CapitalDocument6 pagesEstimating Walmarts Cost of CapitalPrashuk Sethi0% (1)

- E-Banking and Its Support ServicesDocument25 pagesE-Banking and Its Support ServicesbhuvaneshkmrsNo ratings yet

- ASTRAL RECORDS - EditedDocument11 pagesASTRAL RECORDS - EditedNarinderNo ratings yet

- Hero MotoCorp LTDDocument10 pagesHero MotoCorp LTDpranav sarawagiNo ratings yet

- Previous Papers PPSC Audit OfficerDocument30 pagesPrevious Papers PPSC Audit OfficerNaivy Sidhu100% (1)

- DDM Federal BankDocument15 pagesDDM Federal BankShubhangi 16BEI0028No ratings yet

- Performance of Mutual FundsDocument67 pagesPerformance of Mutual FundsbhagathnagarNo ratings yet

- Sourses of Funds: Balance Sheet 2010 2009Document4 pagesSourses of Funds: Balance Sheet 2010 2009Deven PipaliaNo ratings yet

- Industry Segment of Bajaj CompanyDocument4 pagesIndustry Segment of Bajaj CompanysantunusorenNo ratings yet

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- Particulars Mar'21 Mar'20 Mar'19 Mar'18 Mar'17 Mar'21 Mar'20 Mar'19 IncomeDocument4 pagesParticulars Mar'21 Mar'20 Mar'19 Mar'18 Mar'17 Mar'21 Mar'20 Mar'19 IncomeShruti SrivastavaNo ratings yet

- ASN SOD Finacial AnalysisDocument6 pagesASN SOD Finacial Analysisjitendra tirthyaniNo ratings yet

- Term Paper OF Accounting For Managers ON Ashoak Leyland: Lovely Professional UniversityDocument9 pagesTerm Paper OF Accounting For Managers ON Ashoak Leyland: Lovely Professional Universitymanpreet1415No ratings yet

- Three Statement ModelDocument9 pagesThree Statement ModelAnkit SharmaNo ratings yet

- Hero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17Document25 pagesHero Motocorp LTD Balance Sheet Common Size Particulars 17-18 16-17 Percentage of 17-18 Percentage of 16-17pranav sarawagiNo ratings yet

- JSW EnergyDocument15 pagesJSW EnergyShashank PullelaNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- Suzlon Energy Balance Sheet, P&L Statment, CashflowDocument10 pagesSuzlon Energy Balance Sheet, P&L Statment, CashflowBharat RajputNo ratings yet

- 1991 1990 EV/EBITDA Multiple Average EV/EBITDA Average 8.50 P/E Multiple Average PE Average 13.57Document15 pages1991 1990 EV/EBITDA Multiple Average EV/EBITDA Average 8.50 P/E Multiple Average PE Average 13.57tarun lahotiNo ratings yet

- Accm507 Shruti 12101804Document15 pagesAccm507 Shruti 12101804priyanshu kumariNo ratings yet

- Tvs Motor 2019 2018 2017 2016 2015Document108 pagesTvs Motor 2019 2018 2017 2016 2015Rima ParekhNo ratings yet

- Lovely Professional University Term Paper of Accounting For Managers TopicDocument25 pagesLovely Professional University Term Paper of Accounting For Managers TopicAshok KumarNo ratings yet

- Valuation: Beta and WACCDocument4 pagesValuation: Beta and WACCnityaNo ratings yet

- Company Finance Profit & Loss Nestle India LTDDocument16 pagesCompany Finance Profit & Loss Nestle India LTDKeshav MishraNo ratings yet

- SBI AbridgedProfitnLossDocument1 pageSBI AbridgedProfitnLossRohitt MutthooNo ratings yet

- Group 1 Adani PortsDocument12 pagesGroup 1 Adani PortsshreechaNo ratings yet

- BalaJi Amines LTDDocument7 pagesBalaJi Amines LTDchittorasNo ratings yet

- Titan Co Financial ModelDocument15 pagesTitan Co Financial ModelAtharva OrpeNo ratings yet

- Sun and Crocs ValuationDocument7 pagesSun and Crocs ValuationKshitishNo ratings yet

- PandL Account Presentation - FinalDocument21 pagesPandL Account Presentation - Finalapi-3712367No ratings yet

- Shree Cement Financial Model Projections BlankDocument10 pagesShree Cement Financial Model Projections Blankrakhi narulaNo ratings yet

- AirThread SecBC Group9Document4 pagesAirThread SecBC Group9Vishal BhanushaliNo ratings yet

- Annual Financial Results 2020Document9 pagesAnnual Financial Results 2020Yathish Us ThodaskarNo ratings yet

- Reliance FSA PrachiDocument16 pagesReliance FSA PrachiPrachi SrivastavaNo ratings yet

- T V S Motor Co. LTD.: Profits & Its Appropriation: Mar 2017 - Mar 2021: Non-Annualised: Rs. CroreDocument4 pagesT V S Motor Co. LTD.: Profits & Its Appropriation: Mar 2017 - Mar 2021: Non-Annualised: Rs. CroreRahul DesaiNo ratings yet

- Live Project Ratio Analysis On Castrol India Limited.Document8 pagesLive Project Ratio Analysis On Castrol India Limited.Rohit Maheshwari SomaniNo ratings yet

- Group Project - ACCDocument17 pagesGroup Project - ACCLovie GuptaNo ratings yet

- Hitung ProyeksiDocument3 pagesHitung ProyeksiDwinanda HarsaNo ratings yet

- Asian PaintsDocument40 pagesAsian PaintsHemendra GuptaNo ratings yet

- Exhibit 1Document28 pagesExhibit 1pre.meh21No ratings yet

- 17 - Manoj Batra - Hero Honda MotorsDocument13 pages17 - Manoj Batra - Hero Honda Motorsrajat_singlaNo ratings yet

- 34 - Neha Sabharwal - Panacea BiotechDocument10 pages34 - Neha Sabharwal - Panacea Biotechrajat_singlaNo ratings yet

- Balance Sheet (2009-2003) of TCS (US Format)Document15 pagesBalance Sheet (2009-2003) of TCS (US Format)Girish RamachandraNo ratings yet

- Financial Summary: Annual Report 2076/77Document1 pageFinancial Summary: Annual Report 2076/77Panchakanya SaccosNo ratings yet

- Dalmia Cement (Bharat) LTDDocument8 pagesDalmia Cement (Bharat) LTDRemonNo ratings yet

- CV Assignment - Agneesh DuttaDocument14 pagesCV Assignment - Agneesh DuttaAgneesh DuttaNo ratings yet

- The Magnificent-Equity ValuationDocument70 pagesThe Magnificent-Equity ValuationMohit TewaryNo ratings yet

- Accounts AssignsmentDocument8 pagesAccounts Assignsmentadityatiwari8303No ratings yet

- Company 1 Yr1 Yr2 EPS 10 11 Price 100 110Document38 pagesCompany 1 Yr1 Yr2 EPS 10 11 Price 100 110Bhaskar RawatNo ratings yet

- Dion Global Solutions Limited: SourceDocument15 pagesDion Global Solutions Limited: SourceAnish DalmiaNo ratings yet

- Accounts Assignement 21MBA0106Document4 pagesAccounts Assignement 21MBA0106TARVEEN DuraiNo ratings yet

- India Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008Document6 pagesIndia Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008amitkr91No ratings yet

- Ratio Analysis: Submitted To. Prof Lakshmi Chand Submitted By: Rahul Sebastian Submitted On: 10/01/2011Document6 pagesRatio Analysis: Submitted To. Prof Lakshmi Chand Submitted By: Rahul Sebastian Submitted On: 10/01/2011Thomas RajanNo ratings yet

- Business Valuation: Cia 1 Component 1Document7 pagesBusiness Valuation: Cia 1 Component 1Shubh SavaliaNo ratings yet

- Juhayna Food Industries: in Millions of EGP (Except For Per Share Items)Document11 pagesJuhayna Food Industries: in Millions of EGP (Except For Per Share Items)Shokry AminNo ratings yet

- Company Finance Profit & Loss (Rs in CRS.) : Company: ITC LTD Industry: CigarettesDocument16 pagesCompany Finance Profit & Loss (Rs in CRS.) : Company: ITC LTD Industry: CigarettesAnimesh GuptaNo ratings yet

- HUL FinancialsDocument5 pagesHUL FinancialstheNo ratings yet

- LIC Housing Finance Ltd. - Research Center: Balance SheetDocument3 pagesLIC Housing Finance Ltd. - Research Center: Balance Sheetpriyankaanu2345No ratings yet

- Balance Sheet of Cipla 1Document6 pagesBalance Sheet of Cipla 1anjalipawaskarNo ratings yet

- (Billions) : Q2 2012 Data, Except Where NotedDocument17 pages(Billions) : Q2 2012 Data, Except Where Notedchatterjee rikNo ratings yet

- Nerolec Balance Sheet: Sources of FundsDocument3 pagesNerolec Balance Sheet: Sources of Funds3989poojaNo ratings yet

- Jothikrishna AFD ProjectDocument32 pagesJothikrishna AFD ProjectDebayanNo ratings yet

- Jothikrishna AFD ProjectDocument34 pagesJothikrishna AFD ProjectDebayanNo ratings yet

- Industry MonitorDocument3 pagesIndustry MonitorbhuvaneshkmrsNo ratings yet

- Improvisation As A Way of Dealing With Ambiguity and ComplexityDocument8 pagesImprovisation As A Way of Dealing With Ambiguity and ComplexitybhuvaneshkmrsNo ratings yet

- Issues of Large Dams - Case StudyDocument33 pagesIssues of Large Dams - Case StudybhuvaneshkmrsNo ratings yet

- Looking To Increase Employee PerformanceDocument2 pagesLooking To Increase Employee PerformancebhuvaneshkmrsNo ratings yet

- IT SoftwareDocument12 pagesIT SoftwarebhuvaneshkmrsNo ratings yet

- Issues of Large Dams - Case StudyDocument35 pagesIssues of Large Dams - Case StudybhuvaneshkmrsNo ratings yet

- India Privatizes InsuranceDocument7 pagesIndia Privatizes InsurancebhuvaneshkmrsNo ratings yet

- How Change Mismanagement Created An IndustryDocument2 pagesHow Change Mismanagement Created An IndustrybhuvaneshkmrsNo ratings yet

- Hindalco LTDDocument11 pagesHindalco LTDbhuvaneshkmrsNo ratings yet

- Indian IT IndustryDocument22 pagesIndian IT IndustrybhuvaneshkmrsNo ratings yet

- Greed Is GoodDocument2 pagesGreed Is GoodbhuvaneshkmrsNo ratings yet

- For 45Document1 pageFor 45bhuvaneshkmrsNo ratings yet

- Glaxo SmithlineDocument3 pagesGlaxo SmithlinebhuvaneshkmrsNo ratings yet

- FSDocument14 pagesFSbhuvaneshkmrsNo ratings yet

- Green Marketing:: Better Late Than NeverDocument48 pagesGreen Marketing:: Better Late Than NeverbhuvaneshkmrsNo ratings yet

- HelpDocument58 pagesHelpbhuvaneshkmrsNo ratings yet

- Fortis HealthDocument2 pagesFortis HealthbhuvaneshkmrsNo ratings yet

- German RemediesDocument2 pagesGerman RemediesbhuvaneshkmrsNo ratings yet

- Executive CoachingDocument2 pagesExecutive CoachingbhuvaneshkmrsNo ratings yet

- Financial ServicesDocument2 pagesFinancial ServicesbhuvaneshkmrsNo ratings yet

- Forex AffectDocument21 pagesForex AffectbhuvaneshkmrsNo ratings yet

- Employee Performance ReviewsDocument2 pagesEmployee Performance ReviewsbhuvaneshkmrsNo ratings yet

- Evolving Indian Retail MarketDocument5 pagesEvolving Indian Retail MarketbhuvaneshkmrsNo ratings yet

- Creating and Sustaining An Ethical Workplace CultureDocument7 pagesCreating and Sustaining An Ethical Workplace CulturebhuvaneshkmrsNo ratings yet

- EmmDocument3 pagesEmmbhuvaneshkmrsNo ratings yet

- Coming To Grips With The New WorkplaceDocument3 pagesComing To Grips With The New WorkplacebhuvaneshkmrsNo ratings yet

- Controller of Examination - VMDocument1 pageController of Examination - VMbhuvaneshkmrsNo ratings yet

- Comparing Information Openness in China and IndiaDocument4 pagesComparing Information Openness in China and IndiabhuvaneshkmrsNo ratings yet

- Correlates of Multi Store Food ShoppingDocument1 pageCorrelates of Multi Store Food ShoppingbhuvaneshkmrsNo ratings yet

- This Study Resource WasDocument3 pagesThis Study Resource WasThanh XuânNo ratings yet

- Admission of A Partner With AnswersDocument20 pagesAdmission of A Partner With AnswersAaira IbrahimNo ratings yet

- Income From Capital GainDocument13 pagesIncome From Capital GainBhuvaneswari karuturiNo ratings yet

- BAFINMAX Working Capital Management InventoryDocument3 pagesBAFINMAX Working Capital Management InventoryLaiza AlforteNo ratings yet

- Examination About Investment 11Document3 pagesExamination About Investment 11BLACKPINKLisaRoseJisooJennieNo ratings yet

- 16 Investment Centers and Transfer PricingDocument2 pages16 Investment Centers and Transfer PricingRiselle Ann Sanchez100% (1)

- Feedback HPWDocument6 pagesFeedback HPWshavira nazliNo ratings yet

- Project Report RajDocument11 pagesProject Report RajRajkrishna ChowdhuryNo ratings yet

- Ing NV 2010 PDFDocument296 pagesIng NV 2010 PDFSergiu ToaderNo ratings yet

- PE Overview Priscila Rodrigues 07dez19 SaintPaulDocument16 pagesPE Overview Priscila Rodrigues 07dez19 SaintPaulGabriel SouzaNo ratings yet

- Alternative Sources of FinanceDocument8 pagesAlternative Sources of FinancediahNo ratings yet

- BCG MatrixDocument10 pagesBCG MatrixshoaibmirzaNo ratings yet

- Executive SummeryDocument18 pagesExecutive SummeryImtiaz RashidNo ratings yet

- Edu 2009 Spring Exam Mfe QaDocument154 pagesEdu 2009 Spring Exam Mfe QaYan David WangNo ratings yet

- Qatar Airways FS 31 March 2019 (En)Document62 pagesQatar Airways FS 31 March 2019 (En)HusSam Ud DinNo ratings yet

- Asset Classes and Financial Instruments: Bodie, Kane and Marcus 9 Global EditionDocument48 pagesAsset Classes and Financial Instruments: Bodie, Kane and Marcus 9 Global EditionDyan Palupi WidowatiNo ratings yet

- Lecture 1 SlidesDocument63 pagesLecture 1 Slidesnatasha carmichaelNo ratings yet

- Report 20231130172609Document7 pagesReport 20231130172609Rohit RajagopalNo ratings yet

- Arrowstreet Global Equity No.1 Fund 2018Document28 pagesArrowstreet Global Equity No.1 Fund 2018Ankur BhartiyaNo ratings yet

- FactSet Bank TrackerDocument9 pagesFactSet Bank TrackerBrianNo ratings yet

- LATEST Finalized - Report TIDDocument25 pagesLATEST Finalized - Report TIDIyLiaorohimaru SamaNo ratings yet

- Comprehensive Review QuestionsDocument5 pagesComprehensive Review QuestionsJane Ruby JennieferNo ratings yet

- Financial Analysis of ProjectsDocument61 pagesFinancial Analysis of ProjectsMohamed MustefaNo ratings yet