Professional Documents

Culture Documents

Revenue Recognition: A 5-Step Model

Uploaded by

Vijaypal Singh RathoreOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revenue Recognition: A 5-Step Model

Uploaded by

Vijaypal Singh RathoreCopyright:

Available Formats

Ind AS 115

Revenue :

Income arising

in

ordinary

Course of business .

we

step model

the ② Identify FO ③ Determine TP ④ of TP to Pio

① Identify contract Allocation

Recognition of Revenue

'

.

⑤

.

tot

Contract to good

.

* Semite to

a) it is approved ⑨ Fixed Consideration * Based on Fv .

of such .

R internal admin I setup not PO Cassured

b) rights payment terms identified

are .

amount ) * If TPKEFV . then diff .

Period

Distinct if ⑤ variable Consideration C Discount ) allocated Poop

Over the At a

point

benefits directly from

in

c) Commercial substance

.

time time

Tus of of

penalty lconcessionl

tomes

d) Probable receipt of consideration

* Dish rebate ) of Fv

eg +

.

.

Such lated to

If Customer simultaneously

}

* Disc ①

goods

or

incentive / bonus

is r

any

Contingent

.

.

/

Contract Modification A Customer needs other

goodswhich

I

specific

P.o. adjust to such .

receives and consumes

Payment

,

as the benefits

to attain benefit

.

I service

.

# Part

are

easily available in market of TP .

② Entity work create or else .

Ferg

:

in

Deinregosepe If highly dependent then

indistinct

no " ed

In eggangusetoasmset.co

# I EV M

MLM

⑧ Specialized Gls without

recognize

options

.

felled -

standalone w .

A .

of more than 2 alternate use .

revenue when

Price with

Selling distinct non distinct

2 options ( option '

late revenue

recognition

control

transferred

is

goods

highest probability]

.

↳ goods

. .

contract

separate

* old

to

contract

to

Revise

If significant chances

of reversal

then

ends contract

not part of Revenue Licensing

.

* accounting

remaining goods

-

② Non -

cash Consideration

immediately if future

and yal using Recognize revenue no

-

ant .

receivable Cumulative ,

constitute new catch

up 1 I .

Performance by entity affects -

Customer

sights

-

with others

.

customer

.

basis

.

contract

.

the

.

µ a Recognize revenue over

period of time

if

of goods I

not revenue

a) Activities of entity effects I P to which

.

F V

.

. .

Contrast

.

service received

customer

has

rights

-

① Cost the activity to

1-

for obtaining

contract

Significant finance component b) Such Customer the ne

impact

⑨ expose

. .

② Gst incurred for the contract

to actnhes

from

.

trf customer such

c)

goods Isernia

No .

③ Cost not covered

by 2/16/38/401116 v

to

relation to the Same is not Goods delivered Ant read today

the

Capitalize

Cost until in

.

revenue

delivered

of recognition of today receipt goods upfront fees

.

recognized (

Amortize the period revenue or

Non refundable

.

over

after after 12M

-

12M

.

-

-

-

Impair if not expected to be recovered ) to ① Amt real

today

is ale -

as

-

Relates to specific Gls

inceptiontrf .

at → Allocate to such as -

① Revenue at time

of loan .

.

Else treat as Adv Payment

delivery being

-

.

Service Concession PV ② It wanted at

Arrangement e*p

.

is

of receivable at

£ BR C

not Implicit rate )

warranty

Incremental borrowing Csr to such loan -

by

-

rate C Not

Implicit rats transfer of

Fixed Consideration ④ At time of

Consideration Saleable

Variable

② Diff between Amt read .

guys

goods

.

Dr . loan Separately Not

separately

① Dnt Frame Cr Revenue C Service ) gold

Dr Receivable DI.IE?uemeg the period of and is

with int and

)°Ff¥mhE

①

.

over

Period ① Po

.

Revenue C assurance )

co

time

finance component if Considered as

separate

.

①

.

No

.

of )

.

( FV Gls

of

at such time at discretion customer

-

① considered

is

.

Dei ; Not

-

for ① very Revenue

.

② Amt receivable is adjusted ② over

Recognized

as

② Ep incurred ale Gnzra #Got

-

Performance Protection fo

as

②

. .

trf as

separate

finance element if Control

Period of warranty

- .

such

received future recognized

time

Iff of ③ Variable consideration

Revenue

in

receivable has ③ Am

② .ni

.

-

and nmr

of geog

.

expected

.

et

.

C ratio of cost

'

Consideration to customer

than 12in as revenue

② Payable

-

zed

.

more .

ay qzog

warranty )

,

such

,

④ ITA amortized over such Period

③ If any

ant receivable for other

Provision for

Amounts

of receipt ③ warranty esp

.

For

goods I service No

good No

.

③ Provision

when

service ( maintenance ) recognize service

made for

such rendered ① Revenue recognized at Gross such

warranty

service

Reduced from

.

es

adjusted

received future AGT

etat

?

in

④ Amr

to customer TP per 2nd AS 37

② ;o

paid

. .

,

such receivable

against

-

.

is ale as

expense

FUL Amt paid for Gls

If

.

① FV .

of such

goods service

expense d

② Revenue = TP . -

( Amt . Paid - FV )

You might also like

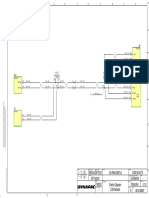

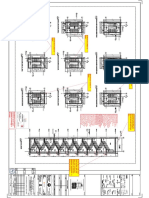

- AR MAM 004 Detail Drawing Mammo UpgradeDocument1 pageAR MAM 004 Detail Drawing Mammo UpgradeMABIN MATHEWNo ratings yet

- Step 1 Installation and Commissioning: Quick StartDocument2 pagesStep 1 Installation and Commissioning: Quick StartdachinicuNo ratings yet

- 360o of Omnichannel Commerce: CustomerDocument1 page360o of Omnichannel Commerce: CustomerLiliaNo ratings yet

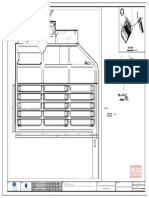

- Project Title Project Owner Note Scale: As Shown Sheet Contents Sheet NoDocument1 pageProject Title Project Owner Note Scale: As Shown Sheet Contents Sheet NoLorena TanNo ratings yet

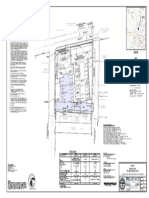

- C.plano de UbicacionDocument1 pageC.plano de UbicacionEdinson F. RomeroNo ratings yet

- Atys D Atys T: Installation and Commissioning Step 1Document1 pageAtys D Atys T: Installation and Commissioning Step 1Rurizwan Syahru WibisanaNo ratings yet

- Ilide - Info Caterpillar Gas Engine 3516 Schematic Diagram PRDocument2 pagesIlide - Info Caterpillar Gas Engine 3516 Schematic Diagram PRTamNo ratings yet

- The Abington Journal 04-06-2011Document28 pagesThe Abington Journal 04-06-2011The Times LeaderNo ratings yet

- fiDocument1 pagefifake19541998No ratings yet

- Edwards Aquifer SystemDocument1 pageEdwards Aquifer SystemIvan HerreraNo ratings yet

- Studying signals that vary over timeDocument7 pagesStudying signals that vary over timeselcervNo ratings yet

- Trading Income Tax BasicsDocument15 pagesTrading Income Tax BasicsJalees Ul HassanNo ratings yet

- Key Plan: Chancay Multipurpose Terminal New First Stage, Peru Detailed Engineering Layout Plan For Curb of ZOP AreaDocument1 pageKey Plan: Chancay Multipurpose Terminal New First Stage, Peru Detailed Engineering Layout Plan For Curb of ZOP AreaJoel MontoyaNo ratings yet

- ToneDocument1 pageToneNguyễn Quang TrânNo ratings yet

- Municipalidad Metropolitana de Lima: Instituto Metropolitano de PlanificacionDocument1 pageMunicipalidad Metropolitana de Lima: Instituto Metropolitano de Planificacionjuan pabloNo ratings yet

- D038 Evs Co000 1091 - 00Document1 pageD038 Evs Co000 1091 - 00Mussarat BabasahebNo ratings yet

- Locality Plan: Subject SiteDocument7 pagesLocality Plan: Subject SiteRavinesh SinghNo ratings yet

- Melbourne 3000Document1 pageMelbourne 3000risnandNo ratings yet

- Cable Track Sizing and Locations PDFDocument1 pageCable Track Sizing and Locations PDFiqbal husseinNo ratings yet

- Key To Oil Flow & Pressure: K High Dump (T E-42)Document1 pageKey To Oil Flow & Pressure: K High Dump (T E-42)NikNo ratings yet

- Downtown Durham: Fo Ste FultonDocument2 pagesDowntown Durham: Fo Ste FultonmishrahvNo ratings yet

- Cheat SheetDocument2 pagesCheat SheetRuth TheNo ratings yet

- PLMB 400Document20 pagesPLMB 400Khalid AlotaibiNo ratings yet

- Mapas Hidrogeologica RJDocument1 pageMapas Hidrogeologica RJChen Kuang HsiaoNo ratings yet

- Pahati ModelDocument1 pagePahati ModelKathleen YbañezNo ratings yet

- Brqva Sftleo 190923 CA-RAW-QSF3.8 Confidential CA25/30/35 T3 - 1 A SFT190537 13 ProductionDocument13 pagesBrqva Sftleo 190923 CA-RAW-QSF3.8 Confidential CA25/30/35 T3 - 1 A SFT190537 13 ProductionMauro PerezNo ratings yet

- Commercial building expansion joint installation guideDocument1 pageCommercial building expansion joint installation guideSudha ReddyNo ratings yet

- ML Coral0N IencantadoDocument3 pagesML Coral0N IencantadoGuilherme BarcikNo ratings yet

- ML Coral0N IencantadoDocument3 pagesML Coral0N IencantadoGuilherme BarcikNo ratings yet

- 220802DTDG09905 Exde00 01Document1 page220802DTDG09905 Exde00 01kepuren loroNo ratings yet

- 501 e Walnut 5.25.2022Document1 page501 e Walnut 5.25.2022sokil_danNo ratings yet

- Induction Motor Drive Using PI ControllerDocument15 pagesInduction Motor Drive Using PI ControllerMridul MishraNo ratings yet

- Wheeled Excavator Electrical System Magnetic Controller: Harness and Wire Electrical Schematic SymbolsDocument2 pagesWheeled Excavator Electrical System Magnetic Controller: Harness and Wire Electrical Schematic Symbolsمهدي شقرونNo ratings yet

- UOttawa CampusDocument1 pageUOttawa CampusAmrakpady UchNo ratings yet

- Orange Mug KeyDocument3 pagesOrange Mug Keyy1100520yNo ratings yet

- Od HangraoDocument1 pageOd HangraoPham Quan TamNo ratings yet

- CDHC DWG DD 125 MB02 Ar 4002 0Document1 pageCDHC DWG DD 125 MB02 Ar 4002 0HAITHAM ALINo ratings yet

- Production process flow chart for clothing manufacturerDocument3 pagesProduction process flow chart for clothing manufactureraichaNo ratings yet

- LWD-01a Phase 1 Road LvlsDocument1 pageLWD-01a Phase 1 Road LvlsSahil SharmaNo ratings yet

- 00099-Commissioners SubpoenaDocument2 pages00099-Commissioners SubpoenalegalmattersNo ratings yet

- PLS-CADD Drawing for Well ID 28298Document8 pagesPLS-CADD Drawing for Well ID 28298Parag Lalit SoniNo ratings yet

- Annur - Road - 2-2-2017Document1 pageAnnur - Road - 2-2-2017Geo Mapl InfraNo ratings yet

- Legend: BathymetryDocument1 pageLegend: BathymetryAnbu KumarNo ratings yet

- Instalasi Air Kotor, Air Bekas, Dan Oil Trap + (Posisi Biotech Opsi 1) - DitandatanganiDocument1 pageInstalasi Air Kotor, Air Bekas, Dan Oil Trap + (Posisi Biotech Opsi 1) - DitandatanganiOis HarefaNo ratings yet

- Mazowe DevelopmentDocument1 pageMazowe DevelopmentRodney ZephaniaNo ratings yet

- Mascagni/IntermezzoDocument3 pagesMascagni/Intermezzoshig_aokiNo ratings yet

- Key Plan: LegendDocument1 pageKey Plan: LegendJoel MontoyaNo ratings yet

- NC River BasinsDocument1 pageNC River Basinssimba momyNo ratings yet

- Outdoor Earthing SystemDocument5 pagesOutdoor Earthing SystemSebastián LagosNo ratings yet

- KTYM YARD HQ23-Sheet-2Document1 pageKTYM YARD HQ23-Sheet-2Anujith K BabuNo ratings yet

- Fuel System Schematic DiagramDocument1 pageFuel System Schematic DiagramAbhilash100% (1)

- Floor Plans.2Document1 pageFloor Plans.2maxNo ratings yet

- TopogDocument3 pagesTopogSally MichaelNo ratings yet

- TML Form MGT 7 2021-22Document15 pagesTML Form MGT 7 2021-22VINOTH kumarNo ratings yet

- All That Jazz: Q 130 Iq Q eDocument4 pagesAll That Jazz: Q 130 Iq Q eandreNo ratings yet

- 908 SCH 27 64 2021 SDWR 20220526 L1 Ter - SheetDocument1 page908 SCH 27 64 2021 SDWR 20220526 L1 Ter - SheetanaskahromikaNo ratings yet

- Base PlateDocument1 pageBase Platebacha01No ratings yet

- EPA Intranet Memo on Internal Testing ResultsDocument5 pagesEPA Intranet Memo on Internal Testing ResultsxdslNo ratings yet

- Mindmap Sustainable Supply ChainsDocument1 pageMindmap Sustainable Supply ChainsNgoc PhamNo ratings yet

- Instruction - Kit - Eform ADT-1Document11 pagesInstruction - Kit - Eform ADT-1RagzrNo ratings yet

- All AS 01-07-17Document779 pagesAll AS 01-07-17Hardik KalariaNo ratings yet

- All AS 01-07-17Document779 pagesAll AS 01-07-17Hardik KalariaNo ratings yet

- Form 5orkyachalDocument1 pageForm 5orkyachalVijaypal Singh RathoreNo ratings yet

- Instruction - Kit - Eform ADT-1Document11 pagesInstruction - Kit - Eform ADT-1RagzrNo ratings yet

- I (IPC) C: Ntermediate OurseDocument63 pagesI (IPC) C: Ntermediate OurseVijaypal Singh RathoreNo ratings yet

- Mun. 2011, 47, 3257-3259Document3 pagesMun. 2011, 47, 3257-3259Vijaypal Singh RathoreNo ratings yet

- Financial Reporting FinalDocument124 pagesFinancial Reporting FinalVijaypal Singh RathoreNo ratings yet

- I (IPC) C: Ntermediate OurseDocument63 pagesI (IPC) C: Ntermediate OurseVijaypal Singh RathoreNo ratings yet

- Supportive Information For PolymerDocument11 pagesSupportive Information For PolymerVijaypal Singh RathoreNo ratings yet

- Bariwal 2013Document21 pagesBariwal 2013Le Anh NhatNo ratings yet

- Coordination PolymerizationDocument14 pagesCoordination PolymerizationVijaypal Singh Rathore100% (1)

- 57498bos46599cp6 PDFDocument212 pages57498bos46599cp6 PDFManoj GNo ratings yet

- ATOM TRANSFER RADICAL POLYMERIZATION FROM MULTIFUNCTIONAL SUBSTRATESDocument47 pagesATOM TRANSFER RADICAL POLYMERIZATION FROM MULTIFUNCTIONAL SUBSTRATESVijaypal Singh RathoreNo ratings yet

- Input Tax Credit (TC)Document128 pagesInput Tax Credit (TC)Sidhant GoyalNo ratings yet

- GT Protection Type TestDocument24 pagesGT Protection Type Testashwani2101100% (1)

- Boiler Commissioning Procedure1Document62 pagesBoiler Commissioning Procedure1Okeyman100% (1)

- توصية - مستشار زيوت التشحيمDocument4 pagesتوصية - مستشار زيوت التشحيمhasm caadNo ratings yet

- Electrical design for proposed residential buildingDocument24 pagesElectrical design for proposed residential buildingMALABIKA MONDALNo ratings yet

- Microsoft v. TomTom ComplaintDocument10 pagesMicrosoft v. TomTom ComplaintcoderightsNo ratings yet

- Manual DishwashingDocument2 pagesManual Dishwashingkean redNo ratings yet

- ESG PresentationDocument16 pagesESG Presentationsumit100% (1)

- Ball ValveDocument12 pagesBall ValveIdabaNo ratings yet

- Project-Based Learning Lesson PlanDocument5 pagesProject-Based Learning Lesson Planapi-324732071100% (1)

- EI2 Public Benefit Organisation Written Undertaking External FormDocument1 pageEI2 Public Benefit Organisation Written Undertaking External Formshattar47No ratings yet

- Loan Agreement SummaryDocument13 pagesLoan Agreement SummaryKaran SharmaNo ratings yet

- Malware Analysis Project ClusteringDocument11 pagesMalware Analysis Project ClusteringGilian kipkosgeiNo ratings yet

- Prismatic Oil Level GaugeDocument2 pagesPrismatic Oil Level GaugevipulpanchotiyaNo ratings yet

- Home Work Chapter 1 To 12Document50 pagesHome Work Chapter 1 To 12Haha JohnNgNo ratings yet

- Information Requirements For Welding of Pressure Containing Equipment and PipingDocument20 pagesInformation Requirements For Welding of Pressure Containing Equipment and PipingPramod Athiyarathu100% (1)

- Seatwork 12 Analysis of Variance ANOVA Simple Linear RegressionDocument17 pagesSeatwork 12 Analysis of Variance ANOVA Simple Linear RegressionDanrey PasiliaoNo ratings yet

- Hidden Secrets of The Alpha CourseDocument344 pagesHidden Secrets of The Alpha CourseC&R Media75% (4)

- Loading Arms and Their Control Panels BrochureDocument5 pagesLoading Arms and Their Control Panels Brochureminah22No ratings yet

- Missing Dovetail RfiDocument1 pageMissing Dovetail RfiPurushotam TapariyaNo ratings yet

- ASME B16: Standardization of Valves, Flanges, Fittings, and Gaskets # Standard DesignationDocument6 pagesASME B16: Standardization of Valves, Flanges, Fittings, and Gaskets # Standard DesignationNicolás MerinoNo ratings yet

- Basic IT Tutorial 2 - No Answer, Candidates Are To Work Out The Answers ThemselveDocument3 pagesBasic IT Tutorial 2 - No Answer, Candidates Are To Work Out The Answers ThemselveTri Le MinhNo ratings yet

- Passive Fire Protection PDFDocument7 pagesPassive Fire Protection PDFVictor SampaNo ratings yet

- Study of Altman's Z ScoreDocument8 pagesStudy of Altman's Z ScoreKatarina JovanovićNo ratings yet

- Ethernet Networking EssentialsDocument5 pagesEthernet Networking Essentialsjmiguel000No ratings yet

- How To Write A Evaluation EssayDocument2 pagesHow To Write A Evaluation EssayurdpzinbfNo ratings yet

- Investingunplugged PDFDocument225 pagesInvestingunplugged PDFWilliam MercerNo ratings yet

- MSG 01084Document4 pagesMSG 01084testiandiniNo ratings yet

- Quiz ConsolidatedDocument131 pagesQuiz ConsolidatedSudhanshu GuptaNo ratings yet

- Blockchain For IBMers - Eng Model v2.01Document25 pagesBlockchain For IBMers - Eng Model v2.01ayanmukherjee1No ratings yet