Professional Documents

Culture Documents

Flowchart LGU Taxes

Uploaded by

Hermay Banario0 ratings0% found this document useful (0 votes)

39 views1 page-

Original Title

flowchart-LGU-taxes

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document-

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

39 views1 pageFlowchart LGU Taxes

Uploaded by

Hermay Banario-

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

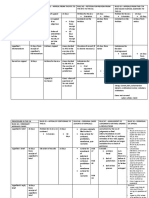

Process flow for Local Government Taxes

Notice of Assessment (Sec 171)

*Made by the local treasurer or

representative

*Assessed within the 5-yr prescriptive

period from the date they become due;

XPN: fraud or intent to evade payment of

tax - 10 yrs from discovery of fraud or intent

(Sec 194)

*States the nature and amount of tax (Sec

195)

Protest (Sec 195)

*Filed with the Local Treasury within 60

days from receipt of notice of assessment

*In case TP fails to file a protest,

Assessment become final and executory

Decision of Local Treasury

*within 60 days from the time of filing of

protest

A. Protest is Wholly or B. Assessment is Wholly or C. Local Treasury fails to

Partly Meritorious Partially Correct Decide within 60 days

*He shall issue a notice cancelling *He shall deny the protest wholly or partly *Protest is denied

wholly or partially the assessment with notice to the taxpayer

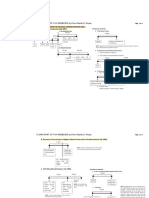

Appeal to Proper Court (Sec 195 LGC,

Sec 7 of RA 9282)

*Must be made within 30 days from receipt of denial or

from the lapse of the 60 day period

a. Less than 300k outside of NCR or 400K within NCR -

MTC;

b. More than 300K outside NCR or 400K within NCR but

less than 1 million - RTC (Original Jurisdiction)

c. More than 1 million - CTA in division (Original

Jurisdiction)

*Failure to file an appeal makes the decision final and

executory

*MTC Decision appealable to RTC (Appellate

Jurisdiction)

From RTC, Appeal to CTA Division

*Decisions of the RTC in its original jurisdiction (Sec 9 RA

9282)

*Appealled to CTA in division (Appellate Jurisdiction)

*Petition for review analogous to Rule 42 of ROC

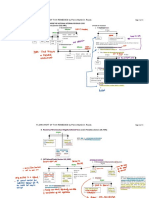

From CTA Division to en banc

*Decisions of CTA in division and decisions of RTC in its

Appellate Jurisdiction (Sec 11 RA 9282)

*There must first be an MR or MNT

* petition for review analogous to Rule 43 of ROC

From CTA En Banc to SC

Review by Certiorari Rule 45 of ROC (Sec 11 RA 9282)

You might also like

- Modes of Appeal TableDocument3 pagesModes of Appeal TablemarydalemNo ratings yet

- English Grammar BookDocument7 pagesEnglish Grammar BookTiaNắngNgọtNo ratings yet

- Equity of Redemption vs. Right of RedemptionDocument3 pagesEquity of Redemption vs. Right of RedemptionEmmagine E EyanaNo ratings yet

- Basic Concepts: CADASTRAL PROCEEDINGS (READ: PRDRL, Agcaoili, 2018 Ed., Pp. 350-368)Document14 pagesBasic Concepts: CADASTRAL PROCEEDINGS (READ: PRDRL, Agcaoili, 2018 Ed., Pp. 350-368)Hermay BanarioNo ratings yet

- Remedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimDocument14 pagesRemedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimCourt StenographerNo ratings yet

- CTA Appeals ProcessDocument7 pagesCTA Appeals ProcessClarisse ZaplanNo ratings yet

- Remedies and Prescriptive Periods: Prepared By: Dr. Jeannie P. LimDocument14 pagesRemedies and Prescriptive Periods: Prepared By: Dr. Jeannie P. LimMaria Emma Gille Mercado100% (1)

- NPC v. BenguetDocument2 pagesNPC v. BenguetAlexa Valaree SalugsuganNo ratings yet

- CTA jurisdiction over tax casesDocument16 pagesCTA jurisdiction over tax casesJoh SuhNo ratings yet

- Jurisdiction of the Court of Tax Appeals Over Tax DisputesDocument8 pagesJurisdiction of the Court of Tax Appeals Over Tax DisputesPJ SLSRNo ratings yet

- TAX Remedies (Jurisdiction of Courts, Prescription, Remedies Against Assessment Notice)Document11 pagesTAX Remedies (Jurisdiction of Courts, Prescription, Remedies Against Assessment Notice)KAREENA AMEENAH ACRAMAN BASMANNo ratings yet

- NIRC PROCEEDINGS SUMMARYDocument10 pagesNIRC PROCEEDINGS SUMMARYAkiko AbadNo ratings yet

- Studying 04 Flowchart of Tax Remedies 2019 Update TR (1) WithMarginNotesDocument11 pagesStudying 04 Flowchart of Tax Remedies 2019 Update TR (1) WithMarginNotesCelestino LawNo ratings yet

- Mindanao I Geothermal Partnership vs. Commissioner of Internal Revenue, 844 SCRA 386, November 08, 2017Document12 pagesMindanao I Geothermal Partnership vs. Commissioner of Internal Revenue, 844 SCRA 386, November 08, 2017Vida MarieNo ratings yet

- Summary of Tax Proceedings Under the NIRCDocument30 pagesSummary of Tax Proceedings Under the NIRCVenTenNo ratings yet

- Notes On Remedial LawDocument7 pagesNotes On Remedial LawRachel MarquezNo ratings yet

- Common Topics Quick RevisionDocument8 pagesCommon Topics Quick Revisionmaulesh bhattNo ratings yet

- Tax Remidies of The TaxpayerDocument6 pagesTax Remidies of The TaxpayerJustin Robert RoqueNo ratings yet

- LaMitipsJDY - Assessment, Remedies, Local TaxationDocument7 pagesLaMitipsJDY - Assessment, Remedies, Local TaxationJohn Dy FlautaNo ratings yet

- Allied Banking Corp - V - CIRDocument9 pagesAllied Banking Corp - V - CIRKatherine AlombroNo ratings yet

- Flowchart of Tax Remedies 2019 Update TRDocument11 pagesFlowchart of Tax Remedies 2019 Update TRBlackjack SharedNo ratings yet

- National Power Corporation vs. Municipal Government of NavotasDocument11 pagesNational Power Corporation vs. Municipal Government of NavotasEvelyn TocgongnaNo ratings yet

- Flowchart of Tax Remedies 2019 Update TRDocument11 pagesFlowchart of Tax Remedies 2019 Update TRAbraham Marco De GuzmanNo ratings yet

- TreeDocument1 pageTreeEricaNo ratings yet

- APPEAL RULES: A CONCISE COMPARISONDocument2 pagesAPPEAL RULES: A CONCISE COMPARISONmimayshudoNo ratings yet

- Local Government Tax PDFDocument9 pagesLocal Government Tax PDFNikko ParNo ratings yet

- RemediesDocument53 pagesRemediesjohnisflyNo ratings yet

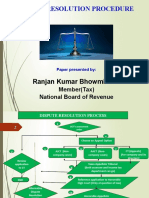

- DISPUTE RESOLUTION PROCEDURESDocument10 pagesDISPUTE RESOLUTION PROCEDURESmir makarim ahsanNo ratings yet

- Theory and Basis of TaxationDocument3 pagesTheory and Basis of TaxationBai Johara SinsuatNo ratings yet

- DIGEST - Sitel Philippines Corp. v. CIRDocument3 pagesDIGEST - Sitel Philippines Corp. v. CIRAgatha ApolinarioNo ratings yet

- DIGEST - Sitel Philippines Corp. v. CIRDocument3 pagesDIGEST - Sitel Philippines Corp. v. CIRAgatha ApolinarioNo ratings yet

- Two-year prescriptive period and 120+30 day rule for filing administrative and judicial claims for tax refunds or creditsDocument3 pagesTwo-year prescriptive period and 120+30 day rule for filing administrative and judicial claims for tax refunds or creditsBeryl Joyce BarbaNo ratings yet

- Quick guide to tax protest proceduresDocument5 pagesQuick guide to tax protest proceduresYasha Min HNo ratings yet

- SPECIAL CIVIL ACTIONS GUIDEDocument39 pagesSPECIAL CIVIL ACTIONS GUIDEAdriannaNo ratings yet

- TABLE 3: Procedure in Criminal CasesDocument1 pageTABLE 3: Procedure in Criminal CasesJP JimenezNo ratings yet

- Finals SCADocument26 pagesFinals SCAPJ HongNo ratings yet

- 2 Income TaxationDocument24 pages2 Income TaxationPablo EschovalNo ratings yet

- BIR Refund ProceduresDocument11 pagesBIR Refund ProceduresGelo MVNo ratings yet

- PM Reyes Flowchart of Tax Remedies (Feb 2023 Update)Document11 pagesPM Reyes Flowchart of Tax Remedies (Feb 2023 Update)Avril ZamudioNo ratings yet

- TAXATION LAW REVIEWER - KEY POINTS ON JURISDICTION OF BIR & CTADocument2 pagesTAXATION LAW REVIEWER - KEY POINTS ON JURISDICTION OF BIR & CTAGolden LightphNo ratings yet

- Tax Remedies ExplainedDocument8 pagesTax Remedies Explainedjohn vincentNo ratings yet

- CTA Jurisdiction Over RTC Decision on Real Property Tax CaseDocument2 pagesCTA Jurisdiction Over RTC Decision on Real Property Tax CaseJuno Geronimo100% (1)

- TAX REMEDIES AVAILABLE TO TAXPAYERSDocument53 pagesTAX REMEDIES AVAILABLE TO TAXPAYERSlynne tahilNo ratings yet

- Jurisdiction of The Supreme Court in Civil Cases TableDocument4 pagesJurisdiction of The Supreme Court in Civil Cases TableNea Tan100% (1)

- Flowchart of Tax Remedies 2017 Update PRDocument11 pagesFlowchart of Tax Remedies 2017 Update PRMarjorie Kate CresciniNo ratings yet

- Va. Jurisdiction - Venue - Remedies of SCA TableDocument3 pagesVa. Jurisdiction - Venue - Remedies of SCA TableIsabel Luchie GuimaryNo ratings yet

- FLOWCHART OF TAX REMEDIES by Pierre Martin D. ReyesDocument11 pagesFLOWCHART OF TAX REMEDIES by Pierre Martin D. ReyesKEMPNo ratings yet

- Flowchart of Tax Refund RemediesDocument8 pagesFlowchart of Tax Refund RemedieschenezNo ratings yet

- Tax Remedies: I. Remedies in GeneralDocument10 pagesTax Remedies: I. Remedies in GeneralSettee ZetteNo ratings yet

- LABOR DISPUTE RESOLUTION BODIESDocument3 pagesLABOR DISPUTE RESOLUTION BODIESMiguel QuevedoNo ratings yet

- Supreme CourtDocument34 pagesSupreme CourtClint Lou Matthew EstapiaNo ratings yet

- Outline of Procedure in The Court of Tax Appeals (Cta) Appeal To The CTA Division Appeal To The Supreme Court Appeal To The Cta en BancDocument1 pageOutline of Procedure in The Court of Tax Appeals (Cta) Appeal To The CTA Division Appeal To The Supreme Court Appeal To The Cta en BancRaymond RogacionNo ratings yet

- Special Civil ActionsDocument24 pagesSpecial Civil Actionsdaryl canozaNo ratings yet

- Special Civil Actions Overview: Doi Psalm 18:2Document3 pagesSpecial Civil Actions Overview: Doi Psalm 18:2JillandroNo ratings yet

- First Division: Court of Tax AppealsDocument23 pagesFirst Division: Court of Tax AppealsGeorge Mitchell S. GuerreroNo ratings yet

- ERDRAA PRIACRDocument5 pagesERDRAA PRIACRazuremangoNo ratings yet

- RA 1125 as amended: Jurisdiction and Procedures of the Court of Tax AppealsDocument66 pagesRA 1125 as amended: Jurisdiction and Procedures of the Court of Tax AppealsAgui S. T. PadNo ratings yet

- Tax Remidies of The TaxpayerDocument8 pagesTax Remidies of The TaxpayerNikki Coleen SantinNo ratings yet

- Table of Remedies by LumberaDocument10 pagesTable of Remedies by LumberaJodea Pearl AbalosNo ratings yet

- Issues On Remedies Under TCCDocument18 pagesIssues On Remedies Under TCCLheila MendozaNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- FlowChrt RPTDocument1 pageFlowChrt RPTHermay BanarioNo ratings yet

- Deficiency Interest Is Assessed On The Amount Still Due and CollectibleDocument1 pageDeficiency Interest Is Assessed On The Amount Still Due and CollectibleHermay BanarioNo ratings yet

- CreditsDocument3 pagesCreditsHermay BanarioNo ratings yet

- Power Sector Assets and Liabilities Management Corporation Commissioner of Internal RevenueDocument12 pagesPower Sector Assets and Liabilities Management Corporation Commissioner of Internal RevenueHermay BanarioNo ratings yet

- Lecture Notes - APRIL 23Document2 pagesLecture Notes - APRIL 23Hermay BanarioNo ratings yet

- LAWYERDocument11 pagesLAWYERHermay BanarioNo ratings yet

- Coffee May Reduce Heart Failure RiskDocument1 pageCoffee May Reduce Heart Failure RiskHermay BanarioNo ratings yet

- Philippine Bank of CommunicationsDocument1 pagePhilippine Bank of CommunicationsHermay BanarioNo ratings yet

- Lost ObjectsDocument1 pageLost ObjectsHermay BanarioNo ratings yet

- Electronic Evidence Act and The (Ii) The Child Witness LawDocument5 pagesElectronic Evidence Act and The (Ii) The Child Witness LawHermay BanarioNo ratings yet

- V. Presentation of Evidence: Axiom of Relevance: None But Facts Having Rational Probative Value Are AdmissibleDocument8 pagesV. Presentation of Evidence: Axiom of Relevance: None But Facts Having Rational Probative Value Are AdmissibleHermay BanarioNo ratings yet

- August 14Document7 pagesAugust 14Hermay BanarioNo ratings yet

- Americans Plan To Take Extra Vacation Days in 2021Document1 pageAmericans Plan To Take Extra Vacation Days in 2021Hermay BanarioNo ratings yet

- Amazon Announced That Jeff BezosDocument1 pageAmazon Announced That Jeff BezosHermay BanarioNo ratings yet

- Module 6Document16 pagesModule 6Hermay BanarioNo ratings yet

- ASSIGN 2 - 44 To 67Document8 pagesASSIGN 2 - 44 To 67Hermay BanarioNo ratings yet

- Module 2Document7 pagesModule 2Hermay BanarioNo ratings yet

- Nature of A Certificate of TitleDocument16 pagesNature of A Certificate of TitleHermay BanarioNo ratings yet

- EvidDocument1 pageEvidHermay BanarioNo ratings yet

- MODULE 4 With Included Digested CasesDocument10 pagesMODULE 4 With Included Digested CasesHermay BanarioNo ratings yet

- Basic Concepts: CADASTRAL PROCEEDINGS (READ: PRDRL, Agcaoili, 2018 Ed., Pp. 350-368)Document14 pagesBasic Concepts: CADASTRAL PROCEEDINGS (READ: PRDRL, Agcaoili, 2018 Ed., Pp. 350-368)Hermay BanarioNo ratings yet

- PD 1529: An OverviewDocument11 pagesPD 1529: An OverviewHermay BanarioNo ratings yet

- Module 6Document16 pagesModule 6Hermay BanarioNo ratings yet

- MODULE 4 With Included Digested CasesDocument10 pagesMODULE 4 With Included Digested CasesHermay BanarioNo ratings yet

- Module 1Document11 pagesModule 1Hermay BanarioNo ratings yet

- Malabanan vs. Republic, GR No. 179987, 29 April 2009 and The Resolution On The MR, 3 September 2013Document7 pagesMalabanan vs. Republic, GR No. 179987, 29 April 2009 and The Resolution On The MR, 3 September 2013Hermay BanarioNo ratings yet

- Nature and effects of a certificate of titleDocument16 pagesNature and effects of a certificate of titleHermay Banario100% (1)

- Ethical Issues in Business Thomas Donaldson and Patricia WerhaneDocument24 pagesEthical Issues in Business Thomas Donaldson and Patricia WerhaneM_RydeNo ratings yet

- Written Notes of ArgumentDocument5 pagesWritten Notes of ArgumentMohit ChugNo ratings yet

- Punjab Estacode GuidebookDocument1,043 pagesPunjab Estacode GuidebookAbubakar Zubair100% (4)

- Petitioner Vs Vs Respondents: First DivisionDocument8 pagesPetitioner Vs Vs Respondents: First DivisionMichaella Claire LayugNo ratings yet

- Negotiable Instruments - Definition and AnalysisDocument5 pagesNegotiable Instruments - Definition and Analysisrajagct100% (1)

- Laya, Jr. vs. Philippine Veterans Bank, 850 SCRA 315, January 10, 2018Document60 pagesLaya, Jr. vs. Philippine Veterans Bank, 850 SCRA 315, January 10, 2018Mark ReyesNo ratings yet

- Comparative Tables of The Articles of The Constitution of PakistanDocument10 pagesComparative Tables of The Articles of The Constitution of PakistanM Saeed MalikNo ratings yet

- GR 197849 Brodeth & Onal V People of The Philippines & VillegasDocument9 pagesGR 197849 Brodeth & Onal V People of The Philippines & VillegasXyriel RaeNo ratings yet

- Hannah Gallegos - Justice Monologue 1Document2 pagesHannah Gallegos - Justice Monologue 1api-439308454No ratings yet

- Velasco Vs Republic, G.R. No. L-14214, May 25, 1960Document2 pagesVelasco Vs Republic, G.R. No. L-14214, May 25, 1960Aldrin Tang50% (2)

- Wife and Child Maintenance CasesDocument4 pagesWife and Child Maintenance CasesNurul Azim FarhanahNo ratings yet

- Rachel Malley Benchmark - Building Trust in A Diverse Community Case Analysis and Rationale TemplateDocument5 pagesRachel Malley Benchmark - Building Trust in A Diverse Community Case Analysis and Rationale Templateapi-521877575No ratings yet

- Godinger Silver Art v. Hirschkorn - ComplaintDocument25 pagesGodinger Silver Art v. Hirschkorn - ComplaintSarah BursteinNo ratings yet

- 42 People's Industrial and Commercial Corp. vs. Court of AppealsDocument2 pages42 People's Industrial and Commercial Corp. vs. Court of AppealsJemNo ratings yet

- Man With A Child in His Eyes - Kate BushDocument4 pagesMan With A Child in His Eyes - Kate BushAmber RedmanNo ratings yet

- 04 GR 198162Document21 pages04 GR 198162Ronnie Garcia Del RosarioNo ratings yet

- Top GirlsDocument23 pagesTop Girlshussainzl826No ratings yet

- KGBV Society Gort758Document2 pagesKGBV Society Gort758Narasimha SastryNo ratings yet

- 1 29 20 Syllabus CONSTI2 Sec2Document72 pages1 29 20 Syllabus CONSTI2 Sec2James Patrick NarcissoNo ratings yet

- Lehfeldt, Max Rudolph 2017-02-03 Lawsuit MinutesDocument3 pagesLehfeldt, Max Rudolph 2017-02-03 Lawsuit Minutesjuly1962No ratings yet

- Calderon v. Roxas, G.R. No. 185595Document2 pagesCalderon v. Roxas, G.R. No. 185595laila ursabiaNo ratings yet

- Council of Europe Court Rules on Russian Detention CaseDocument35 pagesCouncil of Europe Court Rules on Russian Detention Casekapr1c0rnNo ratings yet

- Acain Vs Iac GRN 72706Document6 pagesAcain Vs Iac GRN 72706Brix IvanNo ratings yet

- People vs. Pugay, 167 SCRA 439 (1988) - G.R. No. L-74324 PDFDocument6 pagesPeople vs. Pugay, 167 SCRA 439 (1988) - G.R. No. L-74324 PDFAM CruzNo ratings yet

- Indecent Representation of Women Act 1986 (Kritika)Document9 pagesIndecent Representation of Women Act 1986 (Kritika)kritikaNo ratings yet

- Lianas Supermarket V NLRCDocument11 pagesLianas Supermarket V NLRCJobelle D. BarcellanoNo ratings yet

- 3-Vil-Rey Planners and Builders vs. Lexber, Inc.Document19 pages3-Vil-Rey Planners and Builders vs. Lexber, Inc.Angelie FloresNo ratings yet

- US vs Tamparong Supreme Court Validates Anti-Gambling OrdinanceDocument2 pagesUS vs Tamparong Supreme Court Validates Anti-Gambling OrdinanceThe Money FAQsNo ratings yet

- Ebro III V NLRCDocument7 pagesEbro III V NLRCMp CasNo ratings yet

- Special Reminders From Judge Singco PDFDocument22 pagesSpecial Reminders From Judge Singco PDFJeffrey FuentesNo ratings yet