Professional Documents

Culture Documents

Q-6. Enter The Following Transactions in The Cash Book With Cash and Bank

Uploaded by

krish mehta0 ratings0% found this document useful (0 votes)

61 views4 pagesOriginal Title

q-5 to 8

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

61 views4 pagesQ-6. Enter The Following Transactions in The Cash Book With Cash and Bank

Uploaded by

krish mehtaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

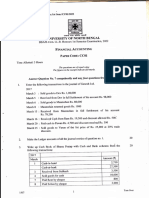

TWO COLUMN CASH BOOK

5. Prepare Two-column Cash Book of Bimal, Lucknow from the following

transactions:

2020 Rs.2018 Rs.

April Cash Balance 50,000April Drawn from Bank 25,000

1 21

April Bank Balance 1,00,00 April Paid rent 4,000

1 0 29

April Cash received from sale 10,000April Sold goods in cash for

5 of shares 30 Rs. 10,000 plus CGST

April Cheque received against and SGST @ 6% each

6 and banked the same

sale, paid into bank 1,00,00 April Paid Interest by cheque

0 30 including CGST

April Paid somesh by cheque 20,00 and SGST @ 6% each 2,240

7

Discount received 200April Paid into Bank 5,000

30

April Paid salaries in cash 2,000

9

April Received a cheque from 10,000

20 Akshay kumar and sent

it to bank

Q-6. Enter the following transactions in the Cash Book with Cash and Bank

Columns :—

2020 Rs.

Apr. 1 Cash-in-Hand 40,000

Cash at Bank 52,000

4 Sold goods for cash 10,000

5 Received from Rajan 2,000

6 Received a Cheque from Kashyap and immediately 6,000

deposited it into Bank

7 Rent paid by Cheque 1,000

10 Paid Vipin by Cheque 2,000

12 Paid for advertisement 1,000

15 Cash Purchases with IGST @12% 10,000

16 Cash deposited into Bank 5,000

20 Cash Sales with CGST & SGST @12% 25,000

Purchased Building and payment made by Cash 10,000

21 Paid for registration of above Building 1,00

22 Withdrew from Bank for office use 4,000

23 Received a Cheque from Bajaj and deposited it into Bank 4,000

27 Bajaj’s Cheque returned by Bank dishonoured

28 Purchased a LAptop and paid by Cheque 10,000

30 Paid Donation 500

31 Paid into Bank 7,000

Q-7. Enter the following transactions in the Double Column Cash Book of M/s.

Gupta Store:

2018 Rs.

July 1 Cash in Hand Rs. 2,000, Bank overdraft Rs. 9,000

July 5 Received a cheque from dinesh, discount allowed Rs. 200 4,800

July 8 Deposited the above cheque into Bank

July Cheque received from Sujal 1,200

12

July Dinesh's cheque returned dishonoured

22

July Sujal’s cheque was endorsed to Anuj

25

July Income tax paid by cheque 150

29 Withdrew Cash from Bank 2,000

July Purchased goods from Manya 40,000

30

Received repayment of Loan Rs 10,000 out of which Rs 6,000

July is deposited into Bank

31

July

31

Q-8 Prepare a cash book from the following transactions:

2020

January Rs.

1 Cash in hand 4,000

1 Cash in bank 13,000

1 Received from Bhavik 1,000

1 Cash sales@6% CGST & SGST each 20,000

5 Paid for travelling expenses 4,000

7 Cash purchases @6% CGST & SGST each 2,000

8 Paid to Anil sood by cheque 600

9 Stationery purchased 1,000

10 Goods sold for cash @12% IGST 5,000

11 Rent paid in cash 100

12 Withdrawn from bank for office 400

13 Paid S Chand by cheque 1,000

13 Received from Ram by cheque and sent it to bank 3,000

13 Cash sales@ 12% IGST 20,000

13 Paid to bank 5,000

13 Purchased a building and paid by cheque 5,000

14 Received a cheque from Lal ji 5,000

15 Cheque from Lal ji was deposited into Bank

You might also like

- Q-6. Enter The Following Transactions in The Cash Book With Cash and BankDocument4 pagesQ-6. Enter The Following Transactions in The Cash Book With Cash and Bankkrish mehtaNo ratings yet

- CASH BOOK TITLEDocument3 pagesCASH BOOK TITLEJaijeet SinghNo ratings yet

- Cash Book WorksheetDocument11 pagesCash Book WorksheetRaashiNo ratings yet

- Basu and Dutta Journal EntriesDocument7 pagesBasu and Dutta Journal EntriesAranya HaldarNo ratings yet

- CA FND M23 - Cash Book QuestionsDocument4 pagesCA FND M23 - Cash Book QuestionsRaaja YoganNo ratings yet

- Vijayam Junior College Commerce Exam QuestionsDocument2 pagesVijayam Junior College Commerce Exam QuestionsM JEEVARATHNAM NAIDUNo ratings yet

- Bba Bcom Ll.b-I-Fincncial Accounting CC01Document2 pagesBba Bcom Ll.b-I-Fincncial Accounting CC01vijay.s12usNo ratings yet

- Problems 123Document52 pagesProblems 123Dharani RiteshNo ratings yet

- Worksheet 3 (Recording Transactions Using The Accounting Equation and Journal Entries)Document3 pagesWorksheet 3 (Recording Transactions Using The Accounting Equation and Journal Entries)La MarNo ratings yet

- Journal Entries for Sole Traders and Business TransactionsDocument5 pagesJournal Entries for Sole Traders and Business TransactionsSonia Lakra100% (1)

- Xi Annual NewDocument5 pagesXi Annual NewPragadeshwar KarthikeyanNo ratings yet

- Class 11th Accounts Journal & LedgerDocument2 pagesClass 11th Accounts Journal & Ledgerjashan1079No ratings yet

- Principal of Accounting: Topic: Cash BookDocument6 pagesPrincipal of Accounting: Topic: Cash BooksajidNo ratings yet

- ZR Ics Oray WFF 4 o YVGRi 7Document46 pagesZR Ics Oray WFF 4 o YVGRi 7RahulNo ratings yet

- Two Column Cash BookDocument24 pagesTwo Column Cash BookDarshans dadNo ratings yet

- 5 Cash Book 08-2022 Regular 2023Document8 pages5 Cash Book 08-2022 Regular 2023jahnaviNo ratings yet

- Question 1Document3 pagesQuestion 1Mohammad Tariq AnsariNo ratings yet

- L2 - Journal PracticeDocument3 pagesL2 - Journal PracticeSaket RajNo ratings yet

- Course Id 23324 CourseTitle Principals of Accounting and Costing-LABDocument4 pagesCourse Id 23324 CourseTitle Principals of Accounting and Costing-LABICIS CollegeNo ratings yet

- Financial Accounting Past Paper BCom Part 1 PU 2019Document3 pagesFinancial Accounting Past Paper BCom Part 1 PU 2019Rana Hanzila TahirNo ratings yet

- Additional IllustrationsDocument4 pagesAdditional Illustrationsledaj19139No ratings yet

- AMITY XI ACCOUNTANCY EXAMDocument3 pagesAMITY XI ACCOUNTANCY EXAMAditiNo ratings yet

- 5.Cash-Bank Book (Three Column)Document6 pages5.Cash-Bank Book (Three Column)jangirvihan2No ratings yet

- Accounts PaperDocument2 pagesAccounts PaperRohan Ghadge-46No ratings yet

- Série 2 ENDocument8 pagesSérie 2 ENilyasosirajNo ratings yet

- Bba 1 Sem Business Accounting 21102401 Oct 2021Document4 pagesBba 1 Sem Business Accounting 21102401 Oct 2021lizabnamazliaNo ratings yet

- Accounting from Incomplete Records: Trading and Profit Loss StatementDocument21 pagesAccounting from Incomplete Records: Trading and Profit Loss StatementbinuNo ratings yet

- Journals, Ledgers, Trial Balance RecordsDocument9 pagesJournals, Ledgers, Trial Balance RecordsSoumendra RoyNo ratings yet

- THREE COLUMN CASH BOOKDocument5 pagesTHREE COLUMN CASH BOOKsubba1995333333No ratings yet

- Assignment 2023 For BPOI-102 (002) (DBPOFA Prog)Document2 pagesAssignment 2023 For BPOI-102 (002) (DBPOFA Prog)Pawar ComputerNo ratings yet

- 2 Chapters Inter 1ST YearDocument6 pages2 Chapters Inter 1ST YearM JEEVARATHNAM NAIDUNo ratings yet

- Revision Test FinalDocument4 pagesRevision Test FinalRitaNo ratings yet

- Accounting concepts, journal entries and financial statementsDocument3 pagesAccounting concepts, journal entries and financial statementsRNo ratings yet

- Question Bank-Accountancy 11thDocument26 pagesQuestion Bank-Accountancy 11thshaurya goyalNo ratings yet

- Accounts Class 11 SQPDocument7 pagesAccounts Class 11 SQPDSNo ratings yet

- Journal Entries Questions 123Document3 pagesJournal Entries Questions 123aparajita agarwalNo ratings yet

- Assignment JournalDocument4 pagesAssignment Journalaishasiddiq5784No ratings yet

- Accounting For Managers - Practical ProblemsDocument33 pagesAccounting For Managers - Practical ProblemsdeepeshmahajanNo ratings yet

- Accountancy Practice Paper - 1Document2 pagesAccountancy Practice Paper - 1Rinshi GuptaNo ratings yet

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- Commerce First YearDocument7 pagesCommerce First Yearravulapallysona93No ratings yet

- Zabala Auto Supply General JournalDocument3 pagesZabala Auto Supply General JournalDavid Bermudez0% (1)

- I. Answer Any TWO of The Following Questions. 2 X 5 10Document3 pagesI. Answer Any TWO of The Following Questions. 2 X 5 10M JEEVARATHNAM NAIDUNo ratings yet

- Accounting Send Up TestDocument3 pagesAccounting Send Up TestKashifNo ratings yet

- Tally Repor1Document74 pagesTally Repor1Ronak JainNo ratings yet

- Business Acoounting (2020)Document4 pagesBusiness Acoounting (2020)harshdeepgarg5No ratings yet

- M2 Jornal, Subsidiary, Leadger PracticalDocument7 pagesM2 Jornal, Subsidiary, Leadger Practicalsimran.patilNo ratings yet

- CH 9Document28 pagesCH 9scoutxrdxNo ratings yet

- 2 Journal Entry 08-2023Document7 pages2 Journal Entry 08-2023jahnaviNo ratings yet

- MPRDocument1 pageMPRCornelio SwaiNo ratings yet

- Notes by Accounts SirDocument11 pagesNotes by Accounts SirMuskan LohariwalNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 5 Journal PDFDocument46 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 5 Journal PDFQueen MNo ratings yet

- 1ST Sem P.Y. Acct PaperDocument30 pages1ST Sem P.Y. Acct PaperSuraj KumarNo ratings yet

- Subsidiary Books - DPP 03 - (Aarambh 2024)Document3 pagesSubsidiary Books - DPP 03 - (Aarambh 2024)Shubh KhandelwalNo ratings yet

- JR Mec Iii Term 06-12-18Document4 pagesJR Mec Iii Term 06-12-18M JEEVARATHNAM NAIDUNo ratings yet

- AACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Document4 pagesAACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Dawson Dela CruzNo ratings yet

- Problems On Journal, Ledger and Accounting EquationDocument11 pagesProblems On Journal, Ledger and Accounting EquationGopiNo ratings yet

- Bitcoin: Mastering And Profiting From Bitcoin Cryptocurrency Using Mining, Trading And Investing TechniquesFrom EverandBitcoin: Mastering And Profiting From Bitcoin Cryptocurrency Using Mining, Trading And Investing TechniquesNo ratings yet

- Bitcoin: 9 Shocking Facts About Bitcoin Money You Need to KnowFrom EverandBitcoin: 9 Shocking Facts About Bitcoin Money You Need to KnowNo ratings yet

- Q-10 Prepare Bank Reconciliation Statement As On 31Document2 pagesQ-10 Prepare Bank Reconciliation Statement As On 31krish mehtaNo ratings yet

- Assertion MCQ of Lit XiDocument7 pagesAssertion MCQ of Lit Xikrish mehtaNo ratings yet

- Assertion MCQ of Lit XiDocument7 pagesAssertion MCQ of Lit Xikrish mehtaNo ratings yet

- Q-10 Prepare Bank Reconciliation Statement As On 31Document2 pagesQ-10 Prepare Bank Reconciliation Statement As On 31krish mehtaNo ratings yet

- Law of Sines and Cosines ExplainedDocument44 pagesLaw of Sines and Cosines ExplainedTereseAnchetaNo ratings yet

- Case AnalysisDocument2 pagesCase AnalysisJasmine Kaur100% (1)

- Redacted InvoiceDocument8 pagesRedacted InvoiceUSA TODAY NetworkNo ratings yet

- Chapter 11 - The Triumphs and Travails of Jeffersonian RepublicDocument7 pagesChapter 11 - The Triumphs and Travails of Jeffersonian RepublicAndi MeyerNo ratings yet

- Itinerary - Atty. BanaDocument4 pagesItinerary - Atty. BanaJavicueNo ratings yet

- Street Survival SeminarDocument3 pagesStreet Survival Seminarjkudlak9281No ratings yet

- Comparison of Indian and American Pressure GroupsDocument3 pagesComparison of Indian and American Pressure GroupsHazelnut ButterNo ratings yet

- Tagle v. Equitable PCI BankDocument14 pagesTagle v. Equitable PCI BankAlvin Earl NuydaNo ratings yet

- BradleyDocument1 pageBradleyElward EL WardNo ratings yet

- Registration Dynamic PrintDocument1 pageRegistration Dynamic PrintakhilNo ratings yet

- Clif Mock CMC 500 Circulating SystemDocument10 pagesClif Mock CMC 500 Circulating SystemMrSebolliniNo ratings yet

- Youre The Voice Arr Kirby ShawDocument10 pagesYoure The Voice Arr Kirby Shawstudiotoni50% (4)

- Regala vs. Sandiganbayan GR. NO.105938Document3 pagesRegala vs. Sandiganbayan GR. NO.105938Jel AbogaNo ratings yet

- Revised Corporation Code Test Bank - CompressDocument25 pagesRevised Corporation Code Test Bank - CompressmayangedalynNo ratings yet

- Cambridge IGCSE: 0450/23 Business StudiesDocument12 pagesCambridge IGCSE: 0450/23 Business StudiesTamer AhmedNo ratings yet

- Legal Ethics Part 1Document70 pagesLegal Ethics Part 1Leoni Francis LagramaNo ratings yet

- Philippines Supreme Court Rules on Juvenile Exemption from Criminal LiabilityDocument8 pagesPhilippines Supreme Court Rules on Juvenile Exemption from Criminal Liabilityracel joyce gemotoNo ratings yet

- Social Security and Cess in Respect of Building and Other Construction WorkersDocument19 pagesSocial Security and Cess in Respect of Building and Other Construction WorkersAkhil DheliaNo ratings yet

- Tingley v. Ferguson 9CA DecisionDocument73 pagesTingley v. Ferguson 9CA DecisionGrant GebetsbergerNo ratings yet

- CFPB-2013-133 and 150 Response LetterDocument3 pagesCFPB-2013-133 and 150 Response LetterJudicial Watch, Inc.No ratings yet

- Option Payoff ChartsDocument6 pagesOption Payoff Chartsakhil doiphodeNo ratings yet

- SEC Rules and Regulations Regarding Whistle-BlowingDocument4 pagesSEC Rules and Regulations Regarding Whistle-BlowingLance Jazekmiel DOMINGONo ratings yet

- Municipal Ordinance No. 257 S. 2008Document2 pagesMunicipal Ordinance No. 257 S. 2008Gui Mo IIINo ratings yet

- Philippines Supreme Court Acquits Man of Drug Sale, Possession ChargesDocument2 pagesPhilippines Supreme Court Acquits Man of Drug Sale, Possession ChargesCamella AgatepNo ratings yet

- Risk assessment form templateDocument2 pagesRisk assessment form templateRajendraNo ratings yet

- Missoula Man Charged With Fatally Stabbing GirlfriendDocument5 pagesMissoula Man Charged With Fatally Stabbing GirlfriendWilliam MillerNo ratings yet

- Indemnity BondDocument3 pagesIndemnity Bondsimplyarnav90No ratings yet

- Technosoft OfferDocument4 pagesTechnosoft Offeryashwanth reddyNo ratings yet

- Navallo vs. SandiganbayanDocument1 pageNavallo vs. SandiganbayanDana Denisse RicaplazaNo ratings yet

- In The High Court of Judicature at MadrasDocument9 pagesIn The High Court of Judicature at MadrasBIRENDER SINGHNo ratings yet