Professional Documents

Culture Documents

2009-10 Cost Audit Report

2009-10 Cost Audit Report

Uploaded by

Irshad Hussain0 ratings0% found this document useful (0 votes)

5 views27 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views27 pages2009-10 Cost Audit Report

2009-10 Cost Audit Report

Uploaded by

Irshad HussainCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 27

RSM international

Hyder Liaquat Nauman

COST AUDITORS’ REPORT TO THE DIRECTORS

We Avais Hyder Liaquat Nauman, Chartered Accountants, having been appointed to

conduct an audit of cost accounts of D.G. Khan Cement Company Limited, have

examined the books of account and the statements prescribed under clause (e) of sub-

section (1) of section 230 of the Companies Ordinance, 1984 and other relevant record for

the year ended on June 30, 2010 and report that:

1. We have obtained all the information and explanations which to the best of our

knowledge and belief were necessary for the purpose of this audit.

2. In our opinion:

a) Proper cost accounting records as required by clause (e) of sub-section (1) of

section 230 of the Companies Ordinance, 1984 (XLVII of 1984), and as required by

Companies (Audit of Cost Accounts) Rules, 1998 (Rules), have been kept by the

Company;

b) Proper returns, statements and schedules for the purpose of the audit of cost

accounts have been received from branches not visited by us;

©) The said books and records give the information required by the Rules in the

manner so required; and

3. In our opinion and, subject to best of our information-

a) The annexed statement of capacity utilization and stock-in-trade are in agreement

with books of account of the company and exhibit true and fair view of the

company’s affairs; and

b) Cost accounting records have been properly kept so as to give a true and fair view

of the cost of production, processing, manufacturing and marketing of the under

mentioned products of the company, namely:-

i, Ordinary Portiand Cement

ji, Sulphate Resistant Cement

ssh foots We dee Lrageot Jamon

AVAIS HYDER LIAQUAT NAUMAN

CHARTERED ACCOUNTANTS:

Engagement Partner: Syed Naveed Abbas

Date: October 04, 2010

Place: Lahore

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

TABLE OF CONTENTS

e Brief history of company

e Report

Capacity

Cost Accounting System

Production

Raw Material

Wages & Salaries

Stores & Spares

Depreciation

Overheads

Royalty / Technical Aid Payments

Abnormal Non-Recurring Features

Cost of Production

Sales

Profitability

Cost Auditor’s Observations & Conclusions

eee e eer ee eres

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

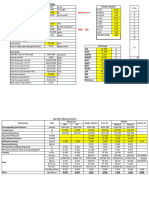

STATEMENT OF CAPACITY UTILIZATION

{Production 2010 2009

Installed Utilized Installed Utilized

Units | Capacity | Capacity | Capacity | Capacity

Clinker M.Tons 4,020,000 4,684,379 4,020,000 3,946,101,

Capacity Utilized 2010 2009

percentage

16.53% 98 %

Reason:

Installed capacity is based on 300 working days. Plants were operated more than 300 »

days to cater the increased cement demand. we

Pa A

Chief Executive Chief Accountant

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

STATEMENT OF STOCK IN TRADE

Raw Material

Lime Stone

Shale

Gypsum

Iron ore & Bauxite

Silica sand

Work-in-Process

Raw Meal

Clinker

Finished Goods

‘Cement (unpacked)

Cement (Packed)

Others

Packing Material (No. of bags)

Ral

Chief Executive

2010 2009 ]

Quantity | Cost Quantity | Cost

M.Tons | Rupees | M.Tons | Rupees

79,027 | 14,506,474] 85,309 {15,948,835

12,930 | 1,673,157| 12,600} —_ 1,390,446

81,570 | 48,843,626 | 86,338 | 45,804,682

70,776 | 58,819,894 | 86,034 | 56,384,663

14,698 | _3,913,149} 21,278 |_1,885,796

127,756,300 121,414,472

37,668 | 14,451,672] 37,806 { 13,722,759

239,667 | 523,087,558] 148,402 |_373,720,924

537,539,230_ 387,443,683

51,605 | 122,150,352] 59,535 [ 122,150,352

35,560 | 97,217,485 | 28,000 | _97,217,485

219,367,837 249,916,037

9,368,964 152,216,162 7,634,639 141,060,910

LA

Chief Accountant

ae?

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

Brief history of the company

D.G.Kan Cement Company Limited is a public limited company incorporated under

the Companies Ordinance 1984 and is listed on all stock exchanges in Pakistan. Its

main business activity is to manufacture and sell Ordinary Portland Cement and

Sulphate Resistant Cement. The plant commenced production on April 01, 1986.

Currently Company has three production lines, viz. two production lines at Dera

Ghazi Khan and one cement plant at Khairpur village Distt. Chakwal. Unit- I and

unit- II at Dera Ghazi Khan has production capacities of 2700 & 4000 tons per day

respectively. The plant at District Chakwal has production capacity of 6700 tons

per day.

KPMG Taseer Hadi and Company, Chartered Accountants is the statutory auditors

of the Company. The Company's financial statements have been audited up to

June 30, 2010. ws

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

1. CAPACITY

a) Licensed, Installed and utilized capacity

Installed Utilized Cn

capacity capacity capacity

4,020,000 4,684,379 116.53

Comments on Variance

Installed capacity is based on 300 working days. Increased production was achieved due

to better plant run to cater the increased cement demand.

b) Other Activiti

The Company is not engaged in any activity other than manufacturing of Ordinary

Portland Cement and Sulphate Resistant Cement,

ye

D G KHAN CEMENT C

MPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

2. COST ACCOUNTING SYSTEM

Brief comments on cost accounting system:

> — Quantitative data at each stage of the process is gathered and complied into a daily

production report. This report also covers month to date and year to date

quantitative data.

> The Company is using integrated Fox- Pro based accounting software in which cost

accounting functions and financial accounting functions are combined in one system

of ledger accounts. This enables the company to get information regarding cost

records.

> The system can generate various cost reports some of which are as follows:

Direct departmental cost (for each cost center).

Distribution of total production cost into raw material, gypsum and

manufacturing cost.

Distribution of common cost.

Summary of common cost distribution.

Detail of direct cost of Limestone.

Detail of total cost of Limestone.

Detail of direct cost of Shale.

Detail of total cost of Shale.

Stock valuation of raw materials.

Direct cost of Production departments,

Total cost of Production departments,

Stock valuation of Production departments.

Classification of Production costs into variable and fixed costs.

Detail of total cost before coal distribution.

Detail of Direct cost distributed.

Detail of total cost after coal distribution.

Detail of coal consumption in Plant 1 & 2.

Department wise coal summary.

‘Adequacy of Cost Accounting System to determine the cost of product

The system and procedures adopted by the company are adequate for determination of

cost of product. wes

DG KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

PRODUCTION

a) Production

Production

Clinker (Metric Tons)

2010 2009

Ordinary Portland [4,474,587] 3,811,488]

Sulphate Resistant

09,7!

84,3

b) Percentage of Production to Installed Capacity

% to total installed

capacity

Clinker 2010 2009

Ordinary Portland 4} 114.31 a

Sulphate Resistant 5.22

CC 116.53 98.16

©) Addition to Production Capacity

i. During the year

NIL

ii, Preceding two years

po

NIL

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

4. RAW MATERIALS

a) Cost of Major Raw Materials Consumed

2010 | 2009 _|

| Quantity | Value _[Rs./M. Quantity | Value Rs. /™|

(M.Tons)| Rs. Ton_| (M. Tons) Rs. Ton

Limestone/clay —6,305,964]1,157,544,851) 183.56 5,284,515] 992,370,326] 187.75]

Shale 599,958, 77,635,283, 129.40, 547,402] 60,407,363, 110.35]

‘Transportation charges for the year 2010 amounted to Rs. 290.32 million (2009 Rs.

219.45million)

b) Consumption of Major Raw Material Per Unit Of Production Compared With

The Standard Req

ments:

[ Consumption Per M. Ton of Clinker Production

2010 ___ 2009

; Actual Actual Actual Standard

Raw Material | consumption | Consumption | Consumption | Requirement

Limestone/clay 135, 1.34 1,32 1.18

Shale 0.13 0.14 0.15 7 |

c) Variance in Major Raw Materials Consumption

- ‘% Increase/ % Increase/

Raw Material | (Decrease) (Decrease)

material consumption compared with compared with

__| last two years. standard

| 2010 | 2009 | 2008 | 2009 | 2008 | Standard | Variance

Limestone/clay [1.35 | 1.34 | 1.32 |_.746 | 2.27 1.18 14.41

Shale (0.13 [0.14 [0.15 [ (7.14) | (3.33) 0.37 (64.86)_|

a

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

Explanation of Variances

The variance in material consumption per M. Ton is due to difference in chemical

composition of major raw materials used and change in production mix.

da)

Method of Accounting

Recelpts/purchase of raw materials

The company has six types of materials which are directly used in production

namely:

Limestone

Shale

Gypsum

Iron Ore

Bauxite

Silica Sand

oy sene

‘The company excavates Limestone and Shale from its quarries which have been

leased from the Government of Punjab and local residents, The other materials

Gypsum, Iron Ore, Bauxite and Silica Sand are purchased from outside and are

routed from stores accounting system.

Cost of purchase of raw materials includes royalties, duties, taxes, transport,

handling and other costs directly attributable to the acquisition of materials.

Stocks of limestone and shale are accounted for when they are received at raw

material yards and cost of service centers associated with raw materials incurred up

to that stage is divided in proportion of consumption pattern among them.

Issuance of materials to production

Monetary value of raw material issues and balances are booked on average cost

basis. vc,

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

5. SALARIES AND WAGES

a) Total Salaries and wages Paid

(Rupees in thousand)

Increase /—

2010 Decrease}

Rs. Rs. Rs.

Direct labour cost on production 187,604 174,176 13,428 8

ii, Indirect labour cost on production 508,135 467,232 40,903 9

iii, Employees’ cost on administration 91,633 73,858 17,775 24

iv. Employees’ cost on selling and

distribution 54,149 49,946 4,208 8

v. Bonus to workers and employees* 58,698 60,237__(1,539)

Total employees cost ( i to iv) 841521765212 __ 76,309

* It is included in items (i) to (iv) above

b) Salaries and Perquisites of Directors and Chief Executive

i. Chief Executive

(Rupees in thousand)

2010 2009 |_Increase / (Decrease)

| Rs.

Salaries & other benefits Rs. Rs, %

Managerial remuneration i 6,518] 5,668| 850] 1

Housing 270| __270| ec eeeeeeee0|

Medical Expenses 1,359) 385] 974

[Others [4,843] 4,238) 605

Total 12,990 10,561 2,429

wee

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

ii, Directors

(Rupees in thousand)

Salaries & other benefits [| 2010 2009 ‘| Increase / (Decrease)

Rs. Rs. Rs. %

Managerial remuneration ~~ 10,310 8,964) 1,346 ~_15]

Gratuity/Contribution to P. Fund 1,034] 896) «1385 35)

‘Housing, 683| 594 89) 15)

Leave passage 635) 697| (62) (9)

Medical Expenses a) 30 79 263]

(Others 2,045| 1,266] 779| "62

Total ___ 14,813 12,447 2366

¢) Total Man-Days of Direct Labour

Plant Maximum days | Normal working [Actual working

Available days days

Plant- 1 365 300 334

Plant II 365 300 334

Plant- Il 365 300 347

d) Average Number of Workers Employed

2010 2009 2008

988 952 936

e) Direct Labour Cost Per M. Ton

2010 2009 2008

Rs. Rs. Rs.

Direct labour cost per M. Ton 38.22 44,92 30.83

we

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

f) Explanation for Variance In Item (e)

The decrease in labour cost attributed to increased production.

g) Comments On Incentives Schemes

During the year company provided incentives as follows;

+ Production workers.

Management has not yet announced the rate of bonus for officers. however, provision

of 345 days basic pay plus 1 month cost of living allowance has been made in books

of accounts.

* Officers:

Management has not yet announced the rate of bonus for officers. However, following

provisions pay have been made in books of accounts:

87 days basic pay for D.G. Khan Plant

92 days basic pay for Khairpur Project

90 days basic Pay for officers in head office and marketing Officers.

D G KHAN CEMENT COMPANY LIMITE

COST AUDIT

For the year ended June 30, 2010

6. STORES AND SPARES

a) Expenditure per M. Ton of Output

[ 2010 [_ 2009

| Cost per M. Ton of output _ 226.90 |

b) System of Stores Accounting:

The company is maintaining an integrated Inventory System with other accounting

modules, A separate code has been allocated to each item in the system. The

system is maintained at the factory and updated at the Head Office. Each production

department is given a separate code and the stores and spares consumed are

charged department-wise on the basis of actual consumption

Store receipts are recorded on the basis of receiving reports, gate inward passes,

purchase orders, demand notes etc. Issues are made on the basis of issue

requisitions received from the relevant department.

Receipts of stores and spares

These are valued at cost comprising of purchase price, import duties, other taxes,

transportation, handling and other costs directly attributable to the acquisition of

stores and spares.

Issues and balance of stores and spares

Stores and spares are valued on moving average cost. Items in transit are valued at

cost comprising invoice values plus other charges paid thereon,

c) Slow Moving Items

Slow moving items amounted to Rs. 393,292,129 (2009: Rs. 360,690,036) that is

13.032% of closing inventory. pe

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

7. DEPRECIATION

a) Method of Depreciation

Assets Method of depreciation

All operating assets (except plant & machinery) Reducing balance method

Plant & machinery Straight line method

b) Basis of Allocation Of Depreciation

The depreciation of common assets is allocated to production departments on the

basis of proportion of services rendered to the respective departments.

ging Depreciation To Cost of Product

°) Basis of

Depreciation of assets in use of production and service departments is charged to

cost of production. we

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

8. OVERHEADS

a) Total amounts of the Overheads

(Rupees in thousand)

i a oo

Sr. # | 2008

9,022,747 |

_— 111,658

lling & distribution My 1,871,517 561,465,

Financial 1,902,760 2,606,358 1,749,837

_ 664,367 15,726,686 11,445,707

i) Break-up of items - Factory overheads

- _ _(Rupees in thousand)

Particulars 2010 2009 | 2008 | Increase/(Decrease) _|

Rs. Rs. Rs. | Compared to | Compared to

2009 2008

Indirect labor 508,135 467,232 348,434 40,903] __159,701)

Electricity and gas __1,991,243| 1,427,631, 1,644,759 563,612) _

[Furnace Oil/Coal __ 6,100,305] 6,603; 4,595,975| __(503,603)|_——,

‘Stores and spares 1,096,570, 879,772| 761,950, 216,798 334,620)

‘consumed a | a —

Repair and maintenance 165,951) 131,911 34,040, 67,469

[Insurance [52,727] 45,573) 7,154 9,645]

[Depreciatior 1,379,750) 1,354,851 24,899] 33,322]

‘Amortization — (80)! (3,331)

Royalty 185,052| 86,514] 98,538 101,321,

Excise duty 34,839) 4,816 8,877|

'Vehicle running 21,041 2,833} 5,557]

lexpenses ee

[Telephone and Postage | 4,829/ 4,188) 641 (554)

Printing and Stationery 4821] 8,149 (3,328) 1,350)

‘Legal and professional 2,079 2,856. (77) 603|

|charges | i

‘Travelling & Conveyance 8,652, 6,297 2,355 352|

Estate Development 12,514 10,285| 2,229) 2,875|

Rent, rates & taxes 492) 7,731 ~ 6,239) (5,490)

Freight charges 4,924 _ 5,600) (676) 8

‘Other Expenses 19,834 16,150 3,684)

(Total ___ 11,594,758 11,106,959 9,022,747 487,799) 2,572,011

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

ii) Break-up of items - Administration overheads

(Rupees in thousand)

Particulars 2010 2009 2008 Increase /

(Decrease)

Rs. Rs. Rs. | Compared |Compared|

— to 2009 | to 2008

‘Salaries, wages & others

benefits al 91633, 56,893; 17,775) 34,740)

Electricity 3,863} ___ 381. 878|

[Repair and mair 6,052! 1,614) (701)|___4,438)

‘Insurance 159% — 1,675] (411) (79),

[Depreciation a 11,538, 11,955, (4,150) (417)

Vehicle running __5,252| 4,259) 3,539) __ 993] 1,713

Postage, telephone & |

telegam 9,568) 3,353] 3,439) 6,215] 6,129

IPrinting & stationery 7 5,716 3,423) 2,206) 2,293) 3,510|

Legal & professional charge 6,978) 6,694) 1,740] 284] 5,238)

[Traveling &conveyance 4,983. 5,208) 6,765 (G06)| 4,762)

Rent, rates & taxes 1,480, 185, 170, 1,295] 1,310)

‘Auditor's remuneration 1,500, 1,320 1,723 180] (223)

Entertainment 1,492, 1441 1,132 51 360)

[School expenses 11,292! 9,790! 9,004! 1,502 2,288)

Fees and subscription —_ 4,948 | 3,818) 1,982| 1,130] 2,966!

Miscellaneous — 4,540) 3,792 | 4,836) 748) (296)

Total 172,431, 141,852|_114,658| __30,579| 60,773

we

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

iii) Break-up of items - Selling and distribution overheads

(Rupees in thousand)

Particulars 2010 2009 | 2008 | Increase/(Decrease)

Rs. Rs. Rs, | Compared | Compared to

to 2009 2008

Salaries, wages & others 4,203 18,78

36} 225]

191) 258)

[Insurance | (56)

Depreciation/Amortization | (59)

\Vehicle running ~ 322 803

Postage, telephone &

legram 1,468) 1,166)

Printing & stationary 66] 7

Rent, rates & taxes _ - 490) 82,

Legal & professional charge @a7y 16,

‘Traveling & conveyance (1,249), (1,641)

Entertainment 8} _3 _ 185) _ ____ 282!

Advertisement & sales

promotion _ 527 1657, 3,395, 3,614) 1,876|

Freight charges 917,045) 1,802,362) 505,133) (885,317) 411,912]

(Other expenses “1,213| 2,519 2,596 (1,306), (1,383)

Total _ 994,418) 1,871,517, 561,465, (877,099) 432,953

iv). Financial Charges

(Rupees in thousand)

[Particulars __ —| 2010 2009 2008

- Rupees Rupees Rupees

Financial charges | 1,902,760 | _2,606,358 [1,749,837

wee

D G KHAN CEMENT COMPANY LIMIT

COST AUDIT

For the year ended June 30, 2010

b) Reasons for significant variances

i. Factory overheads

+ Salaries increased due to yearly increments and increase in allowances and

other benefits.

‘© The increase in Electricity expenses is due to increased production and hike

in gas tariff and increase in fuel costs.

© The decrease in furnace oil/Coal is attributed to reduction in coal prices in

first half of the financial year.

© The increase in stores & spares is attributed to inflationary factor and

devaluation of Pak Rs. because most of the items used are imported.

* The increase in repair & maintenance cost is due to:

a) Devaluation of Pak Rupee because the payment of operation and

maintenance of power generation unit is made in foreign currency

© The increase in royalty and excise duty due to increased production.

ii, Administration expenses

* Salaries increased due to yearly increments and increase in allowances and

other benefits.

ili, Selling & Distribution expenses

* Salaries increased due to yearly increments and increase in allowances and

other benefits.

«The decrease in Freight expenses is due to decreased exports of cement and

clinker during year.

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

iv. Financial expenses

* The decrease in finance cost was due to repayment in of long term loans and

efficient management of funds.

Cc) Basis of allocation of overheads

‘* The cost of service department, including civil, electrical, mechanical, water supply

and quality control has been allocated on the basis of ratios worked out on actual

services rendered to production departments.

«The cost of general factory administration department is allocated on the basis of

number of employees of production departments.

d) Cost of Packing

(Rupees in thousand)

2009

Particulars: 2010

fo Rupees | Rupees

Cost of packing material ___1,560,509/ 1,268,999

[Other departmental cost 232,420 212,482

‘Total —_ 4,792,929 1,481,481

we

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

9. ROYALTY / TECHNICAL AID PAYMENTS

Royalty Pai

Royalty charges for the year 2010 amounted to Rs. 185,052,101 (2009 Rs. 86,514,350)

Average royalty chargeable to per unit of the product (Cement).

2010 2009 2008

Rs./M.Ton Rs,/M.Ton Rs./M.Ton

Royalty per unit [ 37.70 22.31 19.81

me

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

10. ABNORMAL NON-RECURRING FEATURES

a Features Affecting Production

There were no features like strikes, lockouts, major breakdowns in the plant,

substantial power cuts and serious accidents affecting production during the year.

b. Special Expenses

‘There were no special expenses incurred on the production during the year.

we

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

11, COST OF PRODUCTION

Cost Per Unit of Different Varieties

Co 2010 | _2009

Products Rupees/M. Ton | Rupees/M. |Rupees/M. Ton

a Ton |

(Ordinary Portland Cement - 207. (444.69)

'Sulphate Resistant Cement _ (3,164.48 | (366.22)

Total — __ 3,205.95 (441.62)

Comments on Variance

Decrease in per unit cost is due to;

‘+ Increased production during the year. Fixed cost of per unit decreased.

+ Decreased in fuel cost in international markets. On average coal price during the _

period has decreased by 21 % compared with last year.

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

12. SALES

a) Local Sales of Different Vari

Product Quantity Value ‘Avg. Sales

Realization

M.Ton Rupees/M.Ton

OPC 3,961,491.81 12,144,881 3,065.73

‘SRC 142,369.06 ___ 493,083 3,463.41

Clinker - = : _-

b) Export Sales:

[Product | Quantity Value ‘Avg, Sales Realization

M.Ton Rupees ‘000 Rupees/M.Ton

OPC 805,102 3,375,208 4,192.28

‘SRC = - = =

Clinker 71,041.42 262,182 3,690.55,

Profit or loss on export

Cement Rs. ‘000

Export sales 3,375,208

Cost of sales 2,201,060

Gross Profit on export 1,174,148

Clinker Rs. ‘000

Export sales 262,182

Cost of sales 155,052

Gross Profit on export 107,130

DG KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

13. PROFITABILITY

Gross Profit/(Loss) (Per M.Ton) Earned

Product 2009-2010 2008-2009

Rupees Rupees

Local

‘OPC — 302.98 1176.67

- SRC 665.16 1315.82

—__Glinker : -

Export

OPC 1,458.38 __1,859.25

SRC - 1,632.97

Glinker 1,507.99 (5.52)

Comments

Profitability declined due to stiff competition both in local as well international

markets.

we

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

14, COST AUDITOR'S OBSERVATIONS AND CONCLUSIONS

a. Matters which appear to us to be clearly wrong in principal or apparently

unjustifiable

NIL

b. Cases where the company funds have been used in a negligent or

inefficient manner

N/A

c, Factors which could have been controlled but have not been done

resulting in increase in the cost of production

N/A

i) The adequacy or otherwise of budgetary control system, if any, in

vogue in the company

The budgetary control system exists and operates adequately.

(ii) The scope and performance of Internal Audit, if Any

A full fledge internal audit department is functioning in the company. The audit

findings are regularly reported to the top management and corrective

measures are immediately adopted wherever necessary. we

D G KHAN CEMENT COMPANY LIMITED

COST AUDIT

For the year ended June 30, 2010

e. Suggestion for improvements in performance

i.

fi.

iti.

iw

Rectification of general imbalance in production facilities

Nit

Fuller utilization of installed capacity

Comments on areas offering scope for

a) Cost reduction

N/A

b) Increased productivity

NIL

¢) Key limiting factors causing production bottlenecks

NIL

d) Improved inventory pol

NIL

e) Energy conservancy

NIL

State of technology, whether modern or obsolete.

‘The project is based on modern dry process with energy efficient technology

and environment control system.

Plant, whether new or second hand when installed.

The Plants when installed were new.

haw!

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Coal comparisonDocument1 pageCoal comparisonIrshad HussainNo ratings yet

- yard clinker stregnth effectDocument3 pagesyard clinker stregnth effectIrshad HussainNo ratings yet

- Nya New PPR Like GCLDocument3 pagesNya New PPR Like GCLIrshad HussainNo ratings yet

- High VM Coal With 3% SulphurDocument1 pageHigh VM Coal With 3% SulphurIrshad HussainNo ratings yet

- PM - 900 Area WEIGH BRIDGEDocument1 pagePM - 900 Area WEIGH BRIDGEIrshad HussainNo ratings yet

- Coal SupplyDocument1 pageCoal SupplyIrshad HussainNo ratings yet

- Nya Cement Company Limited: Daily Production ReportDocument1 pageNya Cement Company Limited: Daily Production ReportIrshad HussainNo ratings yet

- Concrete Characteristics Design and ValuationDocument8 pagesConcrete Characteristics Design and ValuationIrshad HussainNo ratings yet

- VRM C SimulatorDocument19 pagesVRM C SimulatorIrshad HussainNo ratings yet

- Ball Mill SimulatorDocument4 pagesBall Mill SimulatorIrshad HussainNo ratings yet

- Mayor ShutdownDocument121 pagesMayor ShutdownIrshad HussainNo ratings yet

- Williams Mill Diagnostic and DesignDocument12 pagesWilliams Mill Diagnostic and DesignIrshad HussainNo ratings yet

- ANCHOREDocument2 pagesANCHOREIrshad HussainNo ratings yet

- Gharibwal Cement Production Department: Date Days Compressive StrengthDocument5 pagesGharibwal Cement Production Department: Date Days Compressive StrengthIrshad HussainNo ratings yet

- Ball Mill Inspection ProcedureDocument9 pagesBall Mill Inspection ProcedureIrshad HussainNo ratings yet

- مندرہ شاہ علی ؑDocument13 pagesمندرہ شاہ علی ؑIrshad HussainNo ratings yet

- Desi Elage: High Cholestrol Level in Blood (Khoon Main Cholesterol Ka Level Barh Jae)Document7 pagesDesi Elage: High Cholestrol Level in Blood (Khoon Main Cholesterol Ka Level Barh Jae)Irshad HussainNo ratings yet

- Dimensioning of POLFLAME VN: Basis DataDocument3 pagesDimensioning of POLFLAME VN: Basis DataIrshad HussainNo ratings yet

- Mobil (Mobilux) EP1 2 3Document2 pagesMobil (Mobilux) EP1 2 3Irshad HussainNo ratings yet

- Fuchs Lubritech-Lubricating GreasesDocument6 pagesFuchs Lubritech-Lubricating GreasesIrshad HussainNo ratings yet

- Pillard Burners and FlamesDocument21 pagesPillard Burners and FlamesIrshad HussainNo ratings yet

- Production Manager (Cement Clinker Production) : Your ResponsibilitiesDocument2 pagesProduction Manager (Cement Clinker Production) : Your ResponsibilitiesIrshad HussainNo ratings yet

- Heat BalanceDocument33 pagesHeat BalanceIrshad Hussain100% (2)

- Design Cal - Feed PreheaterDocument61 pagesDesign Cal - Feed PreheaterIrshad HussainNo ratings yet