Professional Documents

Culture Documents

19 03 29 KBC Read-Through From Xingdas Results

Uploaded by

ChanduSaiHemanthOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

19 03 29 KBC Read-Through From Xingdas Results

Uploaded by

ChanduSaiHemanthCopyright:

Available Formats

Morning Note

29 03 2019

This document has not been produced by KBC Securities USA, INC.

BEKAERT

Read-through from Xingda’s results

GENERAL INDUSTRIES CURRENT PRICE € 20.86 HOLD

BELGIUM TARGET PRICE € 23.00 RATING UNCHANGED

News: 109

Bekaert’s biggest Chinese competitor Xingda released its FY18 results. Xingda 36.0 101

grew its revenues by 9.7% to RMB 7,558m, with gross profit up 3.5% to RMB

1,322m (resulting in a 1.1 percentage point margin decline to 17.5%). The 32.0 94

figures compare to Bekaert’s 8.9% organic sales growth in 2018, with underlying 86

gross margin down from 17.2% to 13.6%. 28.0

79

24.0

Xingda’s sales volume for radial tire cord for trucks increased 5.7% to 440,100 71

tons. Sales of radial tire cord for passenger cars dropped in the domestic Chinese 20.0

64

market and were down by 4.4% to 226,500 tons. We computed this means an

overall volume decline of 2% (which compares to Bekaert reporting 2.2% overall 16.0 56

volume growth, across all product categories). M M J J A S O N D J F

Overall, Xingda’s sales volumes for radial tire cords in China dropped by 2.6% Price Rel. to index (RHS)

to 498,100 tons in 2018, while outside China sales volume grew by 18.8% to

168,500 tons. Source: Thomson Reuters Datastream

Bloomberg BEKB BB

At the end of last year, Xingda’s total production capacity of radial tire cords was

728,000 tons, with capacity of the Jiangsu plant 625,000 tons and the Shandong Reuters BEKB.BR

plant 103,000 tons. This means Xingda achieved a capacity utilization rate of www.bekaert.com

about 90%. The group is constructing a tire cord factory in Thailand which will

have 50,000 tons capacity in a first phase. Market Cap € 1,259.4m

Shares outst. 60.4m

In the press release, Xingda’s chairman commented he expects further industry

consolidation. Xingda claims to have abundant capital and aims to strengthen Volume (daily) € 2,779,391

its position. The road transportation industry is expected to benefit from the Free float 59.9%

flourishing e-commerce and logistics industries in China. Xingda commented to

Next corporate event

accelerate its globalization strategy of building factories overseas.

General Assembly 18: 8 May 2019

Our View:

Xingda’s volumes were slightly under pressure in 2018, while Bekaert benefited

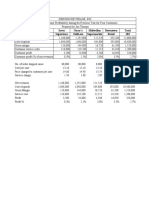

from capacity expansions. On the negative side, Xingda was able to sustain profit €m 2018 2019E 2020E

margins much better than Bekaert (gross margin down 1.1 percentage points vs

3.6 percentage points for Bekaert). Xingda is also targeting international Sales 4,305.3 4,439.7 4,597.8

expansion and is increasingly becoming a competitor for Bekaert outside its core REBITDA 426.0 479.8 530.4

Chinese market. We remind that Bekaert is currently trying to improve its cost

competitiveness, and has announced yesterday a large restructuring plan for its Net earnings 39.8 149.5 183.2

Belgian operations, which is expected to lead to 281 job cuts. Bekaert guided at Adj. EPS (€) 1.27 2.25 2.76

its FY18 results release to anticipates stable sales this year, while it did not give

a precise earnings guidance. The company commented furthermore to expect to P/E (x) 22.3 9.3 7.6

rebuild the underlying EBIT margin to above 7% over the medium term (from EV/REBITDA 7.2 5.3 4.6

4.9% in 2018). We currently bank on about 100bps improvement in the

FCF yield -0.1% 13.9% 11.7%

underlying EBIT margin to 5.9% for 2019, with Bekaert achieving the targeted

7% margin by 2022. The limited visibility prompts us to remain cautious on the Dividend yield 2.5% 3.8% 4.3%

underlying investment case, and we stick to our Hold rating and € 23 TP.

Wim Hoste

+32 2 429 37 13

wim.hoste@kbcsecurities.be

https://research.kbcsecurities.com 3

This document was provided for exclusive use of Christine Clarysse (christine.clarysse@bekaert.com)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- High Value Propylene Glycol From Low Value BiodiesDocument10 pagesHigh Value Propylene Glycol From Low Value BiodiesChanduSaiHemanthNo ratings yet

- Cefic PG Usp GuidelinesDocument46 pagesCefic PG Usp GuidelinesChanduSaiHemanthNo ratings yet

- Alkoxylates: Promoting Superior PerformanceDocument12 pagesAlkoxylates: Promoting Superior PerformanceChanduSaiHemanthNo ratings yet

- Market Insight: Winds of Change in The Polyurethane IndustryDocument4 pagesMarket Insight: Winds of Change in The Polyurethane IndustryChanduSaiHemanthNo ratings yet

- BASEAK Reports Competition Insight 2015Document24 pagesBASEAK Reports Competition Insight 2015ChanduSaiHemanthNo ratings yet

- JATMA Tyre Industry 2020Document32 pagesJATMA Tyre Industry 2020ChanduSaiHemanthNo ratings yet

- JATMA Tyre Industry 2019Document32 pagesJATMA Tyre Industry 2019ChanduSaiHemanth100% (1)

- SBR Cost Structure AnalysisDocument54 pagesSBR Cost Structure AnalysisChanduSaiHemanth100% (1)

- Lanxess Fact Book 2004Document140 pagesLanxess Fact Book 2004ChanduSaiHemanthNo ratings yet

- Indian Minerals Yearbook 2019: Kyanite, Sillimanite and AndalusiteDocument13 pagesIndian Minerals Yearbook 2019: Kyanite, Sillimanite and AndalusiteChanduSaiHemanthNo ratings yet

- 16 06 06-07 Capital Market Event RomaniaDocument79 pages16 06 06-07 Capital Market Event RomaniaChanduSaiHemanthNo ratings yet

- Showguide-2020 CompaniesDocument128 pagesShowguide-2020 CompaniesChanduSaiHemanthNo ratings yet

- Michelin PPT JPMorganDocument73 pagesMichelin PPT JPMorganChanduSaiHemanthNo ratings yet

- Sabanci - Industrialsday - Presentation - July2018 - KordsaDocument58 pagesSabanci - Industrialsday - Presentation - July2018 - KordsaChanduSaiHemanthNo ratings yet

- 2020 FTC Annual Report Formosa Taffeta Co., Ltd.Document356 pages2020 FTC Annual Report Formosa Taffeta Co., Ltd.ChanduSaiHemanthNo ratings yet

- SRF-interacts-with-Institutional-Investors-in-Mumbai (India Tyre Cord Fabrics)Document25 pagesSRF-interacts-with-Institutional-Investors-in-Mumbai (India Tyre Cord Fabrics)ChanduSaiHemanthNo ratings yet

- Century Enka Limited: BUY Industry: TextilesDocument5 pagesCentury Enka Limited: BUY Industry: TextilesChanduSaiHemanthNo ratings yet

- Document Incorporated by Reference BASF Financial Statements 2014 2016 09 12 PDFDocument76 pagesDocument Incorporated by Reference BASF Financial Statements 2014 2016 09 12 PDFChanduSaiHemanthNo ratings yet

- Century Enka Limited 2020 JanDocument2 pagesCentury Enka Limited 2020 JanChanduSaiHemanthNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ch09-Inventories-Additional Valuation IssuesDocument50 pagesch09-Inventories-Additional Valuation IssuesrenandanfNo ratings yet

- Sreepur Textile Mills Limited: Current RatioDocument11 pagesSreepur Textile Mills Limited: Current RatioZidan ZaifNo ratings yet

- 9D Research GroupDocument8 pages9D Research Groupapi-291828723No ratings yet

- Thrift Store Business Plan ExampleDocument33 pagesThrift Store Business Plan ExampleKim So-Hyun0% (2)

- d15 Hybrid F7 ADocument6 pagesd15 Hybrid F7 AAizatSafwanNo ratings yet

- Saver Oscar'S Midwellen Downtown Total Superstore Oddlots Supermarket Retail JbiDocument3 pagesSaver Oscar'S Midwellen Downtown Total Superstore Oddlots Supermarket Retail JbiVishalNo ratings yet

- Ch04 - Audit Evidence and Audit ProgramsDocument24 pagesCh04 - Audit Evidence and Audit Programsrain06021992No ratings yet

- Cornerstones 5e MA CH08 SM FINAL PDFDocument24 pagesCornerstones 5e MA CH08 SM FINAL PDFtarat0% (1)

- Chapter 3 Financial Statement AnalysisDocument61 pagesChapter 3 Financial Statement Analysisanwar jemalNo ratings yet

- Individual Sabre Quiz (MKTG 6010)Document8 pagesIndividual Sabre Quiz (MKTG 6010)Veerapong Patrawanichakarn0% (3)

- Entrepreneurship12q2 Mod8 Computation of Gross Profit v3Document22 pagesEntrepreneurship12q2 Mod8 Computation of Gross Profit v3Marc anthony Sibbaluca80% (10)

- Ch2.1 Cost Concepts and BehaviorsDocument42 pagesCh2.1 Cost Concepts and BehaviorsDouaa AbazeedNo ratings yet

- Centrum Private Credit Fund - Annual NewsLetterDocument17 pagesCentrum Private Credit Fund - Annual NewsLettersuraj211198No ratings yet

- Rosewood Hotels and ResortsDocument5 pagesRosewood Hotels and Resortskhushi kumari100% (1)

- All The Fields Are Mandatory For The Evaluation of The Answer Sheet Please Attach This Page As First Page of You Answer SheetDocument14 pagesAll The Fields Are Mandatory For The Evaluation of The Answer Sheet Please Attach This Page As First Page of You Answer SheetPrathamesh MokalNo ratings yet

- C05 Revenue Recognition - Percentage Completion AccountingDocument16 pagesC05 Revenue Recognition - Percentage Completion AccountingBrooke CarterNo ratings yet

- Fitih ProposalDocument21 pagesFitih ProposalMOTI100% (1)

- Boston Brewin Coffee Co. 5 PDFDocument62 pagesBoston Brewin Coffee Co. 5 PDFVishal DubeyNo ratings yet

- Hair and Beauty Salon Business Plan2019Document35 pagesHair and Beauty Salon Business Plan2019Simply BeautyNo ratings yet

- Hollydazzle.comDocument17 pagesHollydazzle.comShrutiGoyal100% (3)

- MSN Laboratories PVT Limited, Hyderabad: "A Study On Financial Performance"Document65 pagesMSN Laboratories PVT Limited, Hyderabad: "A Study On Financial Performance"Harish Kumar DaivamNo ratings yet

- Ferrari Case SudyDocument16 pagesFerrari Case Sudylalo salas100% (3)

- All Ears - Financial - Analysis For QualityDocument10 pagesAll Ears - Financial - Analysis For QualitysamebcNo ratings yet

- Hair Replacement and Salon Business PlanDocument32 pagesHair Replacement and Salon Business PlanAdeNo ratings yet

- MPKJDocument36 pagesMPKJJoshua Capa FrondaNo ratings yet

- Cma Practice Essay Type Questions Variable Absorption and Thorough CostingDocument9 pagesCma Practice Essay Type Questions Variable Absorption and Thorough CostingSwathi AshokNo ratings yet

- Tami Tyler Opened Tami's Creations, IncDocument11 pagesTami Tyler Opened Tami's Creations, Inclaale dijaanNo ratings yet

- Natureview Farm Case AnalysisDocument8 pagesNatureview Farm Case Analysiskks4h100% (2)

- Chapter 3 SolutionsDocument3 pagesChapter 3 SolutionsharleeniitrNo ratings yet

- Flower Shop Business Plan ExampleDocument31 pagesFlower Shop Business Plan ExampleSantos, JobelleNo ratings yet