Professional Documents

Culture Documents

F2 Questions November 2010

Uploaded by

Robert MunyaradziCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

F2 Questions November 2010

Uploaded by

Robert MunyaradziCopyright:

Available Formats

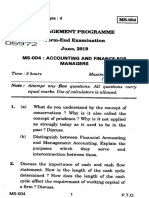

Financial Pillar

F2 – Financial Management

25 November 2010 – Thursday Afternoon Session

F2 – Financial Management

Instructions to candidates

You are allowed three hours to answer this question paper.

You are allowed 20 minutes reading time before the examination begins

during which you should read the question paper and, if you wish, highlight

and/or make notes on the question paper. However, you will not be allowed,

under any circumstances, to open the answer book and start writing or use

your calculator during this reading time.

You are strongly advised to carefully read ALL the question requirements

before attempting the question concerned (that is all parts and/or sub-

questions).

ALL answers must be written in the answer book. Answers written on the

question paper will not be submitted for marking.

You should show all workings as marks are available for the method you use.

ALL QUESTIONS ARE COMPULSORY.

Section A comprises 5 questions and is on pages 2 to 6.

Section B comprises 2 questions and is on pages 8 to 11.

Maths tables and formulae are provided on pages 13 to 15.

The list of verbs as published in the syllabus is given for reference on page

19.

Write your candidate number, the paper number and examination subject title

in the spaces provided on the front of the answer book. Also write your

contact ID and name in the space provided in the right hand margin and seal

to close.

Tick the appropriate boxes on the front of the answer book to indicate the

questions you have answered.

The Chartered Institute of Management Accountants 2010

SECTION A – 50 MARKS

[You are advised to spend no longer than 18 minutes on each question in this section.]

ANSWER ALL FIVE QUESTIONS IN THIS SECTION

Question One

LBP granted share options to its 600 employees on 1 October 2007. Each employee will

receive 500 share options provided they continue to work for LBP for four years from the

grant date. The fair value of each option at the grant date was $1.48.

The actual and expected staff movement over the 4 years to 30 September 2011 is given

below:

2008 20 employees left and another 50 were expected to leave over the next three years.

2009 A further 25 employees left and another 40 were expected to leave over the next two

years.

2010 A further 15 employees left and another 20 were expected to leave the following year.

2011 No actual figures are available to date.

The sales director of LBP has stated in the board minutes that he disagrees with the

treatment of the share options. No cash has been paid out to employees, therefore he fails to

understand why an expense is being charged against profits.

Required:

(a) Calculate the charge to the income statement for the year ended 30 September

2010 for LBP in respect of the share options and prepare the journal entry to

record this.

(6 marks)

(b) Explain the principles of recognition and measurement for share-based

payments as set out in IFRS 2 Share-based Payments so as to address the

concerns of the sales director.

(4 marks)

(Total for Question One = 10 marks)

November 2010 2 Financial Management

Question Two

A relative of yours has retired recently from the business world and has decided to invest

some of his money in the stock market. You have received an email from him asking for

advice:

“I have set aside some funds and wish to make some investments in the stock market. There

are a number of entities that have caught my attention and I have been comparing their

performance and financial position using their latest financial statements. The management

commentary and chairman’s statement for one entity in particular, mentions staff being a key

resource and a substantial asset.”

Required:

Discuss why the narrative elements of financial statements are likely to include

comments about staff resource being a key asset and the issues of recognition that

prevent such assets from being included in the statement of financial position.

(10 marks)

Section A continues on the next page

TURN OVER

November 2010 3 Financial Management

Question Three

The income statements for AB, CD and EF for the year ended 30 June 2010 are shown

below.

AB CD EF

$000 $000 $000

Revenue 2,000 1,500 800

Cost of sales (1,200) (1,000) (500)

Gross profit 800 500 300

Distribution costs (400) (120) (80)

Administrative expenses (240) (250) (100)

Other income 40 - -

Profit before tax 200 130 120

Income tax expense (50) (40) (20)

Profit for the year 150 90 100

Additional information

1. AB acquired 80% of the ordinary share capital of CD on 1 July 2008 for $4,100,000.

At the date of acquisition the fair value of the net assets of CD was $5,000,000.

The group policy is to value non-controlling interest at fair value and at the date of

acquisition the fair value of the non-controlling interest was $1,100,000. No

impairment of goodwill arose in the year ended 30 June 2009, however, an

impairment review conducted on 30 June 2010 showed goodwill had been impaired

by 15%. Impairment is charged to administrative expenses.

2. AB acquired 20% of the ordinary share capital of EF on 1 October 2009. The

interest acquired enables AB to exercise significant influence over the operating and

financial policies of EF.

3. During the year to 30 June 2010, AB and CD paid ordinary dividends of $100,000

and $50,000 respectively. Income from investments is shown in “Other income”.

4. Included in the fair value uplift on the acquisition of CD were depreciable assets with

a remaining useful life at the acquisition date of 12 years. The fair value of these

assets was found to be $240,000 higher than book value. The group policy is to

depreciate non-current assets on a straight line basis over their estimated economic

useful life. Depreciation is charged to administrative expenses.

5. EF sold goods to AB on 1 May 2010 with a sales value of $80,000. Half of these

goods remain in AB’s inventories at the year end. EF makes 25% profit margin on

all sales.

Required:

Prepare the consolidated income statement for the AB Group for the year ended 30 June

2010.

(Total for Question Three = 10 marks)

November 2010 4 Financial Management

Question Four

BCL entered into a forward contract on 31 July 2010 to purchase B$2 million at a contracted

rate of A$1: B$0.64 on 31 October 2010. The contract cost was nil. BCL prepares its

financial statements to 31 August 2010. At 31 August 2010 an equivalent contract for the

purchase of B$2 million could be acquired at a rate of A$1: B$0.70.

Required:

(a) Explain how this financial instrument should be classified and prepare the journal

entry required for its measurement as at 31 August 2010.

(6 marks)

(b) Assume now that the instrument described above was designated as a hedging

instrument in a cash flow hedge, and that the hedge was 100% effective.

(i) Explain how the gain or loss on the instrument for the year ended 31 August

2010 should now be recorded and why different treatment is necessary.

(ii) Prepare an extract of the statement of total comprehensive income for BCL

for the year ended 31 August 2010, assuming the profit for the year of BCL

was A$1 million, before accounting for the hedging instrument.

(4 marks)

(Total for Question Four = 10 marks)

Section A continues on the next page

TURN OVER

November 2010 5 Financial Management

Question Five

LOP operates in the construction industry and prepares its financial statements in accordance

with IFRS. It is listed on its local exchange. LOP is looking to expand its overseas operations

by acquiring a new subsidiary. Two geographical areas have been targeted, Frontland and

Sideland. Entity A operates in Frontland and entity B operates in Sideland. Both entities are

listed on their local exchanges.

The financial highlights for entities A, B and LOP are provided below for the last trading

period.

A B LOP

Revenue $160m $300m $500m

Gross profit margin 26% 17% 28%

Net profit 9% 11% 16%

Gearing 65% 30% 38%

Average rate of interest available in 5% 9% 8%

the respective markets

P/E ratio 11.6 15.9 16.3

Required:

(a) Analyse the information provided by the key financial indicators above and explain

the impact that each entity would have on the financial indicators of LOP.

(7 marks)

(b) Explain the limitations of using this type of analysis to decide on a potential

takeover target.

(3 marks)

(Total for Question Five = 10 marks)

(Total for Section A = 50 marks)

End of Section A

Section B starts on page 8

November 2010 6 Financial Management

This page is blank

TURN OVER

November 2010 7 Financial Management

SECTION B – 50 MARKS

[You are advised to spend no longer than 45 minutes on each question in this section.]

ANSWER BOTH QUESTIONS IN THIS SECTION – 25 MARKS EACH

Question Six

The statements of financial position for ROB and PER as at 30 September 2010 are provided

below:

ROB PER

ASSETS $000 $000

Non-current assets

Property, plant and equipment 22,000 5,000

Available for sale investment (note 1) 4,000 -

26,000 5,000

Current assets

Inventories 6,200 800

Receivables 6,600 1,900

Cash and cash equivalents 1,200 300

14,000 3,000

Total assets 40,000 8,000

EQUITY AND LIABILITIES

Equity

Share capital ($1 equity shares) 20,000 1,000

Retained earnings 7,500 5,000

Other components of equity 500 -

Total equity 28,000 6,000

Non-current liabilities

5% Bonds 2013 (note 2) 3,900 -

Current liabilities 8,100 2,000

Total liabilities 12,000 2,000

Total equity and liabilities 40,000 8,000

Additional information:

1. ROB acquired a 15% investment in PER on 1 May 2008 for $600,000. The investment

was classified as available for sale and the gains earned on it have been recorded within

other reserves in ROB’s individual financial statements. The fair value of the 15%

investment at 1 April 2010 was $800,000.

On 1 April 2010, ROB acquired an additional 60% of the equity share capital of PER at a

cost of $2,900,000. In its own financial statements, ROB has kept its investment in PER

as an available for sale asset recorded at its fair value of $4,000,000 as at 30 September

2010.

2. ROB issued 4 million $1 5% redeemable bonds on 1 October 2009 at par. The

associated costs of issue were $100,000 and the net proceeds of $3.9 million have been

recorded within non-current liabilities. The bonds are redeemable at $4.5 million on 30

September 2013 and the effective interest rate associated with them is approximately

8.5%. The interest on the bonds is payable annually in arrears and the amount due has

been paid in the year to 30 September 2010 and charged to the income statement.

November 2010 8 Financial Management

3. An impairment review was conducted at the year end and it was decided that the

goodwill on the acquisition of PER was impaired by 10%.

4. It is the group policy to value non-controlling interest at fair value at the date of

acquisition. The fair value of the non-controlling interest at 1 April 2010 was $1.25

million.

5. The profit for the year of PER was $3 million, and profits are assumed to accrue evenly

throughout the year.

6. PER sold goods to ROB for $400,000. Half of these goods remained in inventories at 30

September 2010. PER makes 20% margin on all sales.

7. No dividends were paid by either entity in the year to 30 September 2010.

Required:

(a) Explain how the investment in PER should be accounted for in the consolidated

financial statements of ROB, following the acquisition of the additional 60%

shareholding.

(5 marks)

(b) Prepare the consolidated statement of financial position as at 30 September 2010

for the ROB Group.

(20 marks)

(Total for Question Six = 25 marks)

Section B continues on the next page

TURN OVER

November 2010 9 Financial Management

Question Seven

GD is an entity that operates in the packaging industry across a number of different markets

and activities. GD has applied to the financial institution where you are employed, for a long

term loan of $150 million. Your immediate supervisor was working on the report and

recommendation in response to GD’s request, but has fallen ill and you have been asked to

complete the analysis and prepare the supporting documentation for the next management

meeting to discuss applications for lending.

Extracts from the consolidated financial statements of GD are provided below:

Statement of financial position as at 30 June 2010 2009

$m $m

Non-current assets

Property, plant and equipment 548 465

Goodwill 29 24

577 489

Current assets

Inventories 146 120

Receivables 115 125

Held for trading investments 31 18

Cash and cash equivalents - 41

292 304

Total assets 869 793

EQUITY AND LIABILITIES

Equity attributable to owners of the parent

Share capital ($1 shares) 120 120

Revaluation reserve 18 -

Retained earnings 293 183

431 303

Non-controlling interest 65 61

Total equity 496 364

Non-current liabilities

Long term loans 90 180

Current liabilities

Payables 185 160

Bank overdraft 50 -

Income tax payable 48 89

283 249

Total liabilities 373 429

Total equity and liabilities 869 793

November 2010 10 Financial Management

Statement of comprehensive income for the year

ended 30 June 2010 2009

$m $m

Revenue 1,200 1,400

Cost of sales (840) (930)

Gross profit 360 470

Distribution costs (40) (45)

Administrative expenses (130) (120)

Finance costs (11) (15)

Profit before tax 179 290

Income tax expense (50) (85)

PROFIT FOR THE YEAR 129 205

Other comprehensive income

Revaluation of property 18 -

Total comprehensive income (net of tax) 147 205

Profit for the year attributable to:

Owners of the parent 121 195

Non-controlling interest 8 10

129 205

Total comprehensive income attributable to:

Owners of the parent 139 195

Non-controlling interest 8 10

147 205

Additional information

1. In August 2009, a new competitor entered one of GD’s markets and pursued an

aggressive strategy of increasing market share by undercutting GD’s prices and

prioritising volume sales. The directors had not anticipated this as GD had been the

market leader in this area for the past few years.

2. The minutes from the most recent meeting of the Board of Directors state that the

directors believe they can implement a new strategy to regain GD’s market position in

this segment, providing long term funding can be secured. GD acquired a subsidiary

during the year as part of the new strategy and revenue is forecast to increase by the

second quarter of 2011.

3. A meeting is scheduled with GD’s main suppliers to discuss a reduction in costs for

bulk orders.

4. The existing long-term loan is due to be repaid on 1 August 2011.

5. Gains of $9 million generated by the held for trading investments have been offset

against administrative expenses.

Required:

(a) Analyse the financial performance and financial position of GD and recommend

whether or not GD’s application for borrowing should be considered further

Note: 8 marks are available for the calculation of relevant ratios.

(21 marks)

(b) Explain what further information might be useful in assessing the future

prospects of GD and its ability to service a new long term loan.

(4 marks)

(Total for Question Seven = 25 marks)

(Total for Section B = 50 marks)

End of Question Paper

Maths Tables and Formulae are on pages 13 to 15

November 2010 11 Financial Management

This page is blank

November 2010 12 Financial Management

MATHS TABLES AND FORMULAE

Present value table

-n

Present value of $1, that is (1 + r) where r = interest rate; n = number of periods until payment or

receipt.

Periods Interest rates (r)

(n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%

1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909

2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826

3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751

4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683

5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621

6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564

7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513

8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467

9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424

10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386

11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350

12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319

13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290

14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263

15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239

16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218

17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198

18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180

19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164

20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149

Periods Interest rates (r)

(n) 11% 12% 13% 14% 15% 16% 17% 18% 19% 20%

1 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833

2 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694

3 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579

4 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482

5 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402

6 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335

7 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279

8 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233

9 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194

10 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162

11 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135

12 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112

13 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093

14 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078

15 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.079 0.065

16 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054

17 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045

18 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038

19 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031

20 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026

November 2010 13 Financial Management

Cumulative present value of $1 per annum,

1− (1+ r ) − n

Receivable or Payable at the end of each year for n years r

Periods Interest rates (r)

(n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%

1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909

2 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736

3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487

4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170

5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791

6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355

7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868

8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335

9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759

10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145

11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495

12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814

13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103

14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367

15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606

16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824

17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022

18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201

19 17.226 15.679 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365

20 18.046 16.351 14.878 13.590 12.462 11.470 10.594 9.818 9.129 8.514

Periods Interest rates (r)

(n) 11% 12% 13% 14% 15% 16% 17% 18% 19% 20%

1 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833

2 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528

3 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106

4 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589

5 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991

6 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326

7 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605

8 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837

9 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031

10 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192

11 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327

12 6.492 6.194 5.918 5.660 5.421 5.197 4.988 7.793 4.611 4.439

13 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533

14 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611

15 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675

16 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730

17 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775

18 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812

19 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843

20 7.963 7.469 7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870

November 2010 14 Financial Management

FORMULAE

Annuity

Present value of an annuity of $1 per annum receivable or payable for n years, commencing

in one year, discounted at r% per annum:

1 1

PV = 1 −

r [1 + r ]n

Perpetuity

Present value of $1 per annum receivable or payable in perpetuity, commencing in one year,

discounted at r% per annum:

1

PV =

r

Growing Perpetuity

Present value of $1 per annum, receivable or payable, commencing in one year, growing in

perpetuity at a constant rate of g% per annum, discounted at r% per annum:

1

PV =

r −g

November 2010 15 Financial Management

This page is blank

November 2010 16 Financial Management

This page is blank

November 2010 17 Financial Management

This page is blank

November 2010 18 Financial Management

LIST OF VERBS USED IN THE QUESTION REQUIREMENTS

A list of the learning objectives and verbs that appear in the syllabus and in the question requirements for

each question in this paper.

It is important that you answer the question according to the definition of the verb.

LEARNING OBJECTIVE VERBS USED DEFINITION

Level 1 - KNOWLEDGE

What you are expected to know. List Make a list of

State Express, fully or clearly, the details/facts of

Define Give the exact meaning of

Level 2 - COMPREHENSION

What you are expected to understand. Describe Communicate the key features

Distinguish Highlight the differences between

Explain Make clear or intelligible/State the meaning or

purpose of

Identify Recognise, establish or select after

consideration

Illustrate Use an example to describe or explain

something

Level 3 - APPLICATION

How you are expected to apply your knowledge. Apply Put to practical use

Calculate Ascertain or reckon mathematically

Demonstrate Prove with certainty or to exhibit by

practical means

Prepare Make or get ready for use

Reconcile Make or prove consistent/compatible

Solve Find an answer to

Tabulate Arrange in a table

Level 4 - ANALYSIS

How are you expected to analyse the detail of Analyse Examine in detail the structure of

what you have learned. Categorise Place into a defined class or division

Compare and contrast Show the similarities and/or differences

between

Construct Build up or compile

Discuss Examine in detail by argument

Interpret Translate into intelligible or familiar terms

Prioritise Place in order of priority or sequence for action

Produce Create or bring into existence

Level 5 - EVALUATION

How are you expected to use your learning to Advise Counsel, inform or notify

evaluate, make decisions or recommendations. Evaluate Appraise or assess the value of

Recommend Advise on a course of action

November 2010 19 Financial Management

Financial Pillar

Management Level Paper

F2 – Financial Management

November 2010

Thursday Afternoon Session

November 2010 20 Financial Management

You might also like

- Guide to Management Accounting CCC (Cash Conversion Cycle) for ManagersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for ManagersNo ratings yet

- F2 March 2011Document20 pagesF2 March 2011Dhanushka SamNo ratings yet

- Guide to Management Accounting CCC for managers-Cash Conversion Cycle_2020 EditionFrom EverandGuide to Management Accounting CCC for managers-Cash Conversion Cycle_2020 EditionNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial Managementkarlr9No ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- HKICPA QP Exam (Module A) May2007 Question PaperDocument7 pagesHKICPA QP Exam (Module A) May2007 Question Papercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Feb2008 Question PaperDocument8 pagesHKICPA QP Exam (Module A) Feb2008 Question Papercynthia tsuiNo ratings yet

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsMarcin MichalakNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanNo ratings yet

- Mid-semester exam questions for business reporting and analysisDocument11 pagesMid-semester exam questions for business reporting and analysisb393208No ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsMuvin KoshtiNo ratings yet

- F1 May 2011Document20 pagesF1 May 2011Shamra KassimNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument56 pages© The Institute of Chartered Accountants of IndiaTejaNo ratings yet

- Financial Analyst P8nov09exampaperDocument20 pagesFinancial Analyst P8nov09exampaperNhlanhla2011No ratings yet

- F2 Sept 2014 QP Final Version For PrintDocument20 pagesF2 Sept 2014 QP Final Version For PrintFahadNo ratings yet

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- AFAR Exam Midterms 1Document4 pagesAFAR Exam Midterms 1CJ Hernandez BorretaNo ratings yet

- F1 May 2010 For Print. 23.3Document20 pagesF1 May 2010 For Print. 23.3mavkaziNo ratings yet

- ppb-M3Document23 pagesppb-M3Asad MuhammadNo ratings yet

- 2017 MJDocument4 pages2017 MJRasel AshrafulNo ratings yet

- AFR 2 End of Semester Examination 2022-2023Document10 pagesAFR 2 End of Semester Examination 2022-2023Sebastian MlingwaNo ratings yet

- National University of Science and TechnologyDocument8 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- Mcom AnnualDocument140 pagesMcom AnnualKiran TakaleNo ratings yet

- ACCA Dec 2011 F7 Mock PaperDocument10 pagesACCA Dec 2011 F7 Mock PaperCharles AdontengNo ratings yet

- BBA Semester 4 Financial Reporting AssignmentDocument2 pagesBBA Semester 4 Financial Reporting AssignmentSafa ShafiqNo ratings yet

- Financial Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesFinancial Accounting: The Institute of Chartered Accountants of PakistanShakeel IshaqNo ratings yet

- Management Control SystemDocument11 pagesManagement Control SystemomkarsawantNo ratings yet

- Quiz 2Document4 pagesQuiz 2Anonymous L3BfoT50% (2)

- Diploma in International Financial Reporting: Thursday 9 December 2010Document11 pagesDiploma in International Financial Reporting: Thursday 9 December 2010Zain Rehman100% (1)

- Financial Reporting & Financial Statement Analysis: Time - 3 Hours Group - ADocument6 pagesFinancial Reporting & Financial Statement Analysis: Time - 3 Hours Group - Atanmoy sardarNo ratings yet

- Institute of Financial Accountants January 2011 Examination P1. Financial Accounting and Ifrs For SmesDocument11 pagesInstitute of Financial Accountants January 2011 Examination P1. Financial Accounting and Ifrs For SmesColleen BosmanNo ratings yet

- Cma December-2018 Examination Management Level Subject: F2. Financial ManagementDocument11 pagesCma December-2018 Examination Management Level Subject: F2. Financial ManagementRashed AliNo ratings yet

- Ifrint 2012 Dec Q PDFDocument6 pagesIfrint 2012 Dec Q PDFPiyal HossainNo ratings yet

- Acct 550 Final ExamDocument4 pagesAcct 550 Final ExamAlexis AhiagbeNo ratings yet

- Preparing Financial StatementsDocument15 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Blondia Rocks Budget Project - Prathiba BodlaDocument33 pagesBlondia Rocks Budget Project - Prathiba BodlaRaam ThammiReddyNo ratings yet

- MBA-5107, Short QuestionsDocument2 pagesMBA-5107, Short QuestionsShajib GaziNo ratings yet

- Acct1511 Final VersionDocument33 pagesAcct1511 Final VersioncarolinetsangNo ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsIrfanNo ratings yet

- Practice Questions On Financial Planning and Corporate ValuationDocument6 pagesPractice Questions On Financial Planning and Corporate ValuationsimraNo ratings yet

- Section A - CASE QUESTIONS (Total: 50 Marks)Document9 pagesSection A - CASE QUESTIONS (Total: 50 Marks)Vong Yu Kwan EdwinNo ratings yet

- ACCT101 Sample Paper - With SolutionDocument24 pagesACCT101 Sample Paper - With SolutionBryan Seow100% (1)

- Corporate Reporting Past Question Papers (ICAB)Document55 pagesCorporate Reporting Past Question Papers (ICAB)Md. Zahidul Amin100% (1)

- Management Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersDocument4 pagesManagement Programme Term-End Examination June, 2019: Ms-004: Accounting and Finance For ManagersreliableplacementNo ratings yet

- Applied AuditingDocument3 pagesApplied AuditingJessicaNo ratings yet

- Tuition Mock D11 - F7 Questions FinalDocument11 pagesTuition Mock D11 - F7 Questions FinalRenato WilsonNo ratings yet

- HKICPA QP Exam (Module A) Sep2006 Question PaperDocument7 pagesHKICPA QP Exam (Module A) Sep2006 Question Papercynthia tsuiNo ratings yet

- Cash and Accrual Basis, Single Entry SystemDocument6 pagesCash and Accrual Basis, Single Entry SystemEuniceChung100% (1)

- Test Series - Test No. - 5. Advanced Accounting120413115441Document5 pagesTest Series - Test No. - 5. Advanced Accounting120413115441Kansal AbhishekNo ratings yet

- F2 Sept 2013 QPDocument20 pagesF2 Sept 2013 QPFahadNo ratings yet

- AssignmentsDocument5 pagesAssignmentsshikha mittalNo ratings yet

- F7-FINANCIAL REPORTING - ACCA (INT) 2011 JunDocument9 pagesF7-FINANCIAL REPORTING - ACCA (INT) 2011 JunIrfanNo ratings yet

- ICMAP Past PaperDocument4 pagesICMAP Past PaperNoman Qureshi100% (2)

- Acct1511 2013s2c2 Handout 2 PDFDocument19 pagesAcct1511 2013s2c2 Handout 2 PDFcelopurpleNo ratings yet

- CH18601 FM - II Model PaperDocument5 pagesCH18601 FM - II Model PaperKarthikNo ratings yet

- ACCT5001 S1 2010 Week 11 Self-Study SolutionsDocument4 pagesACCT5001 S1 2010 Week 11 Self-Study Solutionszhangsaen110No ratings yet

- Technician Pilot Papers PDFDocument133 pagesTechnician Pilot Papers PDFCasius Mubamba100% (4)

- Paper 2011 SumerDocument3 pagesPaper 2011 SumerMuhammad Ajmal GillNo ratings yet

- Consolidation Notes Complex Group StructuresDocument6 pagesConsolidation Notes Complex Group StructuresRobert MunyaradziNo ratings yet

- Complex Groups TutorialDocument9 pagesComplex Groups TutorialRobert MunyaradziNo ratings yet

- Value Added Tax Act Chapter 23 - 12 - Updated PDFDocument75 pagesValue Added Tax Act Chapter 23 - 12 - Updated PDFTinasheNo ratings yet

- Complex Group: Table of ContentDocument12 pagesComplex Group: Table of ContentRobert MunyaradziNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial ManagementRobert MunyaradziNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial ManagementRobert MunyaradziNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial ManagementRobert MunyaradziNo ratings yet

- F2 Questions November 2010Document20 pagesF2 Questions November 2010Robert MunyaradziNo ratings yet

- Earnings per share calculations for KJDocument20 pagesEarnings per share calculations for KJRobert MunyaradziNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial ManagementRobert MunyaradziNo ratings yet

- F 2 Nov 09 Specimen AnswersDocument9 pagesF 2 Nov 09 Specimen AnswersRobert MunyaradziNo ratings yet

- Tax.3105 - Capital Asset VS Ordinary Asset and CGTDocument10 pagesTax.3105 - Capital Asset VS Ordinary Asset and CGTZee QBNo ratings yet

- Te Ture Whenua Maori Act 1993Document294 pagesTe Ture Whenua Maori Act 1993:eric:1313No ratings yet

- Bdu-Jl Vol 7 No 1Document156 pagesBdu-Jl Vol 7 No 1Auto squadNo ratings yet

- Solved Compare The Efficiency of Perfectly Competitive Markets Monopoly Markets andDocument1 pageSolved Compare The Efficiency of Perfectly Competitive Markets Monopoly Markets andM Bilal SaleemNo ratings yet

- Event Policies Interim GuidelinesDocument3 pagesEvent Policies Interim Guidelinesniel doriftoNo ratings yet

- Dektak 150 ManualDocument349 pagesDektak 150 ManualSundar SkNo ratings yet

- Moa Junk Shop 2023Document3 pagesMoa Junk Shop 2023Calasag San Ildefonso71% (7)

- Oh DarlingDocument4 pagesOh DarlingLaurent BotzNo ratings yet

- Assignment Help Journal Ledger and MyodDocument9 pagesAssignment Help Journal Ledger and MyodrajeshNo ratings yet

- Create Windows 7 Bootable USB Drive From ISO File - SoftlayDocument9 pagesCreate Windows 7 Bootable USB Drive From ISO File - SoftlayAbu DaoudNo ratings yet

- Coca ColaDocument31 pagesCoca ColaAnmol JainNo ratings yet

- Bocconi Financial Reporting and Analysis CourseworkDocument7 pagesBocconi Financial Reporting and Analysis CourseworkLuigi NocitaNo ratings yet

- Minutes 1 SteagDocument3 pagesMinutes 1 SteagPalashXVNo ratings yet

- Chapter 2 - Accounting For Partnership Formation2 (NO ILLUS)Document65 pagesChapter 2 - Accounting For Partnership Formation2 (NO ILLUS)PatOcampo50% (2)

- Naxal WomenDocument2 pagesNaxal WomenRishabh SainiNo ratings yet

- RODRIGUEZ VS TAN HEIRS' RIGHT TO ADMINISTER ESTATEDocument2 pagesRODRIGUEZ VS TAN HEIRS' RIGHT TO ADMINISTER ESTATEtops videosNo ratings yet

- 2022 Purples Notes in Criminal LawDocument136 pages2022 Purples Notes in Criminal LawChristine Gel100% (2)

- 2012 Legal Ethics Bar Exam QDocument30 pages2012 Legal Ethics Bar Exam QClambeaux100% (1)

- G.R. No. 181021Document2 pagesG.R. No. 181021Jahbee Tecson Redillas100% (1)

- Causes of The French Revolution DBQDocument5 pagesCauses of The French Revolution DBQAndy RodriguezNo ratings yet

- Basic Concepts of A Business Concern-Corporate OrganizationDocument5 pagesBasic Concepts of A Business Concern-Corporate OrganizationMsw Ange100% (1)

- Jude Whole Study PDFDocument15 pagesJude Whole Study PDFStar RangerNo ratings yet

- Emphasis On Cloud: This Photo CC By-SaDocument33 pagesEmphasis On Cloud: This Photo CC By-SaDavid CowenNo ratings yet

- Investment Pattern of Salaried Persons in MumbaiDocument62 pagesInvestment Pattern of Salaried Persons in MumbaiyopoNo ratings yet

- The First Epistle of Paul To The CorinthiansDocument14 pagesThe First Epistle of Paul To The Corinthiansmaxi_mikeNo ratings yet

- Heirs of Spouses Teofilo M. Reterta and Elisa Reterta vs. Spouses Lorenzo Mores and Virginia Lopez, 655 SCRA 580, August 17, 2011Document20 pagesHeirs of Spouses Teofilo M. Reterta and Elisa Reterta vs. Spouses Lorenzo Mores and Virginia Lopez, 655 SCRA 580, August 17, 2011TNVTRLNo ratings yet

- ETSO-C127a CS-ETSO 0Document6 pagesETSO-C127a CS-ETSO 0Anurag MishraNo ratings yet

- Sample Paper of IBPDocument2 pagesSample Paper of IBPFarhan Razzaq75% (40)

- 375 1425035526891 PDFDocument404 pages375 1425035526891 PDFjmhdeveNo ratings yet

- Technical Specification For Fire ProtectionDocument3 pagesTechnical Specification For Fire ProtectionJoeven JagocoyNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet