Professional Documents

Culture Documents

Jai Indirect Tax

Uploaded by

Dr. LAKSHMANAN L Dept of Commerce0 ratings0% found this document useful (0 votes)

5 views3 pagess

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documents

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pagesJai Indirect Tax

Uploaded by

Dr. LAKSHMANAN L Dept of Commerces

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Indirect Taxation

Unit -I

1. What is the full form of GST?

A) Goods and Supply Tax,B) Goods and Services Tax,C) General Sales Tax,D) Government

Sales Tax

Answer: B

2. GST was implemented in India from

A) 1st January 2017,B) 1st April 2017,C) 1st March 2017,D) 1st July 2017

Answer: D

3. In India, the GST is a dual model of

A) UK,B) Canada,C) USA,D) Japan,E) China

Answer: B

4. GST is a consumption of goods and service tax based on

A) Development,B) Dividend,C) Destiny,D) Duration,E) Destination

Answer: E

5. India’s GST structure are based on how many structures?

A) 6,B) 4,C) 3,D) 5

Answer: B

6. The maximum rate for CGST is?

A) 28,B) 12,C) 18,D) 20

Answer: D

7. The maximum rate for SGST/UTGST is?

A) 28,B) 14,C) 20,D) 30

Answer: C

8. The maximum rate for SGST/UTGST is?

A) 28,B) 14,C) 20,D) 30

Answer: C

9. Which code is used to classify goods and services under GST?

A) HSN Code,B) SAC/HSN Code,C) GST Code,D) SAC Code

Answer: B

10. What does “I” in IGST stands stand for?

A) Internal,B) Integrated,C) Internal,D) Intra

Answer: B

11. As a result of constitution amendment for GST a Separate List --- has been inserted in the

constitution.

A) Article 246A B) Article 146B C) Article 122 C D) Article 101B

Answer: A

12. UTGST is applicable when

a) Sold from Union territory b) Goods are purchased by Central Government c) Sold from one

union territory to another union territory d) There is interstate supply

Answer: a) Sold from Union territory

13. Integrated Goods and Services Tax is applicable when –

a) Sold in Union territory b) Sold from one GST dealer to another GST dealer c) Sold within a

state d) There is interstate supply

14. SGST is applicable when

a) Goods are sold within a state b) Goods are sold from one GST dealer to a customer c) Goods

are sold by a GST dealer to another GST dealer d) Interstate supply

15. The tax which was not merged into GST

a) Counterveiling Duty b) Excise duty c) Basic Customs Duty d) Purchase tax

16. Goods and service tax is a – tax system

a) Single point tax b) Multipoint tax c) Regressive tax d) None of these

17. The council can take a decision only if there is

a) Three- fourth majority b) Two third Majority c) 60% majority d) Simple majority

18. What is the highest GST rate applicable now is ---

a) 100% b) 18% c) 28% d) 50%

19. Composite tax is applicable for dealer with turnover upto

a) Rs. 1 Crore b) Rs. 20 lakh c) Rs. 1.5 Crore d) Rs. 10 Crore

20. GST will be levied on………………..

(a) Manufacturers,(b) Retailers,(c) Consumers,(d) All of the above

21.Which of the following good will not be covered under the GST bill?

(a) Cooking gas,(b) Liquor,(c) Petrol,(d) All of the above Ans. d

22.

You might also like

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- D) Central Goods and Service TaxDocument3 pagesD) Central Goods and Service Taxvageesha namdeoNo ratings yet

- MCQ of GSTDocument23 pagesMCQ of GSTOnline tally guide100% (2)

- MCQ - GST Answer KeyDocument22 pagesMCQ - GST Answer KeyrupalNo ratings yet

- MCQ GST Answer KeyDocument23 pagesMCQ GST Answer KeyvineethkmenonNo ratings yet

- GST - MCQ by VGDocument18 pagesGST - MCQ by VGIS WING APNo ratings yet

- D) Igst: D) Supply of Services Whether The Job Work Is Carried Out With or WithoutDocument20 pagesD) Igst: D) Supply of Services Whether The Job Work Is Carried Out With or Withoutparesh shiralNo ratings yet

- MCQ On GSTDocument21 pagesMCQ On GSTSanket MhetreNo ratings yet

- Nirmala College of Commerce Malad (E) : T.Y.BCOM SEM-VI (Regular) Subject - Indirect Tax Question Bank-2020Document17 pagesNirmala College of Commerce Malad (E) : T.Y.BCOM SEM-VI (Regular) Subject - Indirect Tax Question Bank-2020Prathmesh KadamNo ratings yet

- Tybms Indirect Taxes Sem 6 Internals Sample QuestionsDocument6 pagesTybms Indirect Taxes Sem 6 Internals Sample QuestionsSarvesh MishraNo ratings yet

- Model Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsDocument25 pagesModel Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsShyam Prasad100% (1)

- GST Stands For: Answer & SolutionDocument36 pagesGST Stands For: Answer & SolutionMudasir LoneNo ratings yet

- VI Sem. - Income Tax and GST MCQDocument26 pagesVI Sem. - Income Tax and GST MCQsamreen fathimaNo ratings yet

- GST Important QuestionsDocument7 pagesGST Important QuestionsfcifapNo ratings yet

- Kon Banega GA Pati..aahhhaannnn Full Style SeDocument6 pagesKon Banega GA Pati..aahhhaannnn Full Style SeRaviKishorNo ratings yet

- Terminal Test March 2018Document6 pagesTerminal Test March 2018Laksh VermaniNo ratings yet

- Indirect Tax 4 Sem MbaDocument11 pagesIndirect Tax 4 Sem Mbakrushna vaidyaNo ratings yet

- 1 - PRELIMINARY-Q - As - AFTER SESSION 4Document6 pages1 - PRELIMINARY-Q - As - AFTER SESSION 4Mighty SinghNo ratings yet

- GST - IMP D.Tax (AKD) - 2Document15 pagesGST - IMP D.Tax (AKD) - 2algoscale techNo ratings yet

- Goods and Services Tax (MCQ) Grade 10: Answer: BDocument10 pagesGoods and Services Tax (MCQ) Grade 10: Answer: BsMNo ratings yet

- GST Question BankDocument6 pagesGST Question Bankrohithsarmanagaraju01No ratings yet

- Ii Pa GST Ques - BankDocument21 pagesIi Pa GST Ques - BankSARAVANAVEL VELNo ratings yet

- Ca Inter Indirect Tax MCQDocument85 pagesCa Inter Indirect Tax MCQVikramNo ratings yet

- Goods and Services Tax (Question Bank For Internal)Document14 pagesGoods and Services Tax (Question Bank For Internal)rupalNo ratings yet

- MCQ On GST Class 10 ICSEDocument27 pagesMCQ On GST Class 10 ICSEmanassaraf18No ratings yet

- CA Final IDT MCQ by Tharun Raj Sir-May 2019Document115 pagesCA Final IDT MCQ by Tharun Raj Sir-May 2019Karthik Srinivas Narapalle0% (1)

- Questionnaire... GST.Document1 pageQuestionnaire... GST.MUJEEB RAHIMAN KATTALINo ratings yet

- Most Imp MCQ ExciseDocument247 pagesMost Imp MCQ ExciseVasuNo ratings yet

- Cycle 3 Notes-3 Class 11 GSTDocument6 pagesCycle 3 Notes-3 Class 11 GSTtmoNo ratings yet

- GST TEST 1 by Vivek GabaDocument3 pagesGST TEST 1 by Vivek GabaAnkit KumarNo ratings yet

- Question Bank GSTDocument6 pagesQuestion Bank GSThimanshuNo ratings yet

- Indirect Tax 150Document17 pagesIndirect Tax 150Mangesh GuptaNo ratings yet

- Tally GST Module Question Set - 3Document3 pagesTally GST Module Question Set - 3Boni HalderNo ratings yet

- Important MCQ of GST: Igp-Cs GST Mcqs CA Vivek GabaDocument16 pagesImportant MCQ of GST: Igp-Cs GST Mcqs CA Vivek GabaammmajisNo ratings yet

- GST Revision of Mcqs 1Document21 pagesGST Revision of Mcqs 1forharshever9936No ratings yet

- Test 1 - 23328889 - 2024 - 02 - 05 - 14 - 59Document2 pagesTest 1 - 23328889 - 2024 - 02 - 05 - 14 - 59moonroseuniversityNo ratings yet

- IRS McqsDocument7 pagesIRS McqsIbrahimGorgageNo ratings yet

- Goods-And-Services-Tax-Mcq AnsDocument20 pagesGoods-And-Services-Tax-Mcq Ansanish narayanNo ratings yet

- Indirect Tax GST Tybcom 1Document13 pagesIndirect Tax GST Tybcom 1Vikas YadavNo ratings yet

- GST MCQDocument73 pagesGST MCQtongocharliNo ratings yet

- Goods and Services Tax: Multiple Choice QuestionsDocument20 pagesGoods and Services Tax: Multiple Choice QuestionsDhruti AthaNo ratings yet

- Advanced Tax QuestionsDocument6 pagesAdvanced Tax QuestionsEyob MogesNo ratings yet

- 3 Sem Core GOODS AND SERVICES TAX MCQDocument20 pages3 Sem Core GOODS AND SERVICES TAX MCQTax NatureNo ratings yet

- Goods-And-Services-Tax-Gst Solved MCQs (Set-2)Document8 pagesGoods-And-Services-Tax-Gst Solved MCQs (Set-2)Ayushi BhardwajNo ratings yet

- The Legal Bench Bar Economy-1Document10 pagesThe Legal Bench Bar Economy-1Adv Akanksha DubeyNo ratings yet

- GST Detailed Notes & Recently Asked QuestionsDocument6 pagesGST Detailed Notes & Recently Asked QuestionsDRISYANo ratings yet

- Sectors of The Indian Economy MCQDocument7 pagesSectors of The Indian Economy MCQDr. M Yaseen KhanNo ratings yet

- Important Mcqs On IirDocument13 pagesImportant Mcqs On IirKb AliNo ratings yet

- Chapter - 1 GSTDocument6 pagesChapter - 1 GSTbratati.dharNo ratings yet

- Insights Into Yojana: August 2017: Goods and Services Tax (GST)Document14 pagesInsights Into Yojana: August 2017: Goods and Services Tax (GST)Abhishek SinghNo ratings yet

- Frequently Asked Questions (Faqs) On Goods and Services Tax (GST)Document3 pagesFrequently Asked Questions (Faqs) On Goods and Services Tax (GST)IT'S MD CREATIONNo ratings yet

- National Income MCQDocument23 pagesNational Income MCQishaanrox64No ratings yet

- Module - 6 MBPFDocument10 pagesModule - 6 MBPFPRIYANKA MISHRANo ratings yet

- Multiple Choice Current AffairsDocument3 pagesMultiple Choice Current AffairsHoward R. MoirangchaNo ratings yet

- Model Exam Question Paper StatutoryDocument7 pagesModel Exam Question Paper Statutoryshibin cpNo ratings yet

- Taxguru - in-MCQs On GST For CACMACSDocument14 pagesTaxguru - in-MCQs On GST For CACMACSOm KambleNo ratings yet

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyFrom EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyRating: 5 out of 5 stars5/5 (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

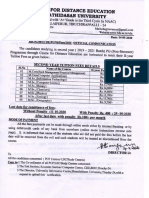

- Bdu 05.06.2020Document4 pagesBdu 05.06.2020Dr. LAKSHMANAN L Dept of CommerceNo ratings yet

- PG Tuition Fee Notification 2020Document3 pagesPG Tuition Fee Notification 2020Dr. LAKSHMANAN L Dept of CommerceNo ratings yet

- SUBJECT: Corporate Accounting - II SUBJECT: Corporate Accounting - IIDocument26 pagesSUBJECT: Corporate Accounting - II SUBJECT: Corporate Accounting - IIDr. LAKSHMANAN L Dept of CommerceNo ratings yet

- Income Tax Law and Practice: What Is Tax? What Are The Types of Tax? Why Commerce Student Should Study Tax?Document2 pagesIncome Tax Law and Practice: What Is Tax? What Are The Types of Tax? Why Commerce Student Should Study Tax?Dr. LAKSHMANAN L Dept of CommerceNo ratings yet

- School of Distance E Bharathiar University, Coimb Attendance Sheet For Reso Hindusthan College College O I Mba Claim - Jan 202Document20 pagesSchool of Distance E Bharathiar University, Coimb Attendance Sheet For Reso Hindusthan College College O I Mba Claim - Jan 202Dr. LAKSHMANAN L Dept of CommerceNo ratings yet

- Bdu 05.06.2020Document4 pagesBdu 05.06.2020Dr. LAKSHMANAN L Dept of CommerceNo ratings yet

- Breeding Corydoras MelanotaeniaDocument3 pagesBreeding Corydoras MelanotaeniayudispriyambodoNo ratings yet

- Experiment # 6 Heat of Solution Uy, Angelica A., Uson, Ma. Agatha Beatrice, Vargas, Louise ErikaDocument7 pagesExperiment # 6 Heat of Solution Uy, Angelica A., Uson, Ma. Agatha Beatrice, Vargas, Louise ErikaAngelica UyNo ratings yet

- Ac-Ppt On Crystal OscillatorDocument10 pagesAc-Ppt On Crystal OscillatorRitika SahuNo ratings yet

- Sales Marketing Director in Tampa FL Resume William RoelingDocument2 pagesSales Marketing Director in Tampa FL Resume William RoelingWilliamRoelingNo ratings yet

- 4 Komponen SDSSDocument9 pages4 Komponen SDSSRebecha Parsellya100% (1)

- Social Studies Lesson Plan 3Document4 pagesSocial Studies Lesson Plan 3api-260708940No ratings yet

- Zip 8-MBDocument9 pagesZip 8-MBThuan Van LeNo ratings yet

- FSED 1F Application Form FSEC For Building Permit Rev02Document2 pagesFSED 1F Application Form FSEC For Building Permit Rev02Angelito RegulacionNo ratings yet

- Taxation - Deduction - Quizzer - CPA Review - 2017Document6 pagesTaxation - Deduction - Quizzer - CPA Review - 2017Kenneth Bryan Tegerero Tegio100% (1)

- Inter 10 - Third ClassDocument96 pagesInter 10 - Third ClassRicardo Jackichan Barzola LopezNo ratings yet

- Cuadernillo de Ingles Grado 4 PrimariaDocument37 pagesCuadernillo de Ingles Grado 4 PrimariaMariaNo ratings yet

- Scheme and Syllabus of B.E. (Computer Science and Engineering) 3 TO8 Semester 2017-2018Document170 pagesScheme and Syllabus of B.E. (Computer Science and Engineering) 3 TO8 Semester 2017-2018pratik YadavNo ratings yet

- Wilkerson Case Study FinalDocument5 pagesWilkerson Case Study Finalmayer_oferNo ratings yet

- Leta 2022Document179 pagesLeta 2022Bigovic, MilosNo ratings yet

- Case Analysis: The Kimpton ExperienceDocument1 pageCase Analysis: The Kimpton ExperienceMaricel Ann BaccayNo ratings yet

- m5q3w2 Las 4Document5 pagesm5q3w2 Las 4ronaldNo ratings yet

- What Is System and Subsystem? What Is Its Relationship?Document6 pagesWhat Is System and Subsystem? What Is Its Relationship?Mulugeta kinde100% (1)

- World CurrenciesDocument7 pagesWorld Currenciespraiseonyinye3No ratings yet

- Probability Practice QuesDocument9 pagesProbability Practice QuesYamu HiadeenNo ratings yet

- Gr4 Reading InterventionDocument2 pagesGr4 Reading InterventionEvelyn Del RosarioNo ratings yet

- Procurement Policy For Bank Group Funded OperationsDocument28 pagesProcurement Policy For Bank Group Funded OperationsNiyi FunminiyiNo ratings yet

- Momo Nation Cafe ProfileDocument28 pagesMomo Nation Cafe ProfileMain AparchitNo ratings yet

- Oops MCQ (Unit-1)Document7 pagesOops MCQ (Unit-1)Jee Va Ps86% (14)

- Grade 6 - HEALTH - Q4 Module 1 - W1Document12 pagesGrade 6 - HEALTH - Q4 Module 1 - W1Love Lei67% (3)

- W01-Introduction To Materials Modeling and SimulationDocument30 pagesW01-Introduction To Materials Modeling and SimulationMuco İboNo ratings yet

- XDM-100 IOM SDH A00 4-5 enDocument334 pagesXDM-100 IOM SDH A00 4-5 endilipgulatiNo ratings yet

- Sample From Cambridge AssessmentDocument2 pagesSample From Cambridge AssessmentVinicius GomesNo ratings yet

- Competency Based Learning Materials: Housekeeping NciiDocument54 pagesCompetency Based Learning Materials: Housekeeping NciiNickolodian AsuncionNo ratings yet

- CMS-855B - 04052021Document49 pagesCMS-855B - 04052021Sheldon GunbyNo ratings yet

- AutoCad 2012 ReadmeDocument2 pagesAutoCad 2012 Readmema_basith50% (2)