Professional Documents

Culture Documents

ACCOUNTING

Uploaded by

Hazel L. ansula0 ratings0% found this document useful (0 votes)

12 views4 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views4 pagesACCOUNTING

Uploaded by

Hazel L. ansulaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

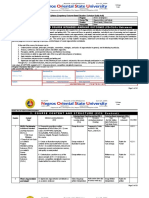

VIRTUAL CO.

COMPARATIVE BALANCE SHEET

DECEMBER 31

ASSETS 2018 2017

CASH 66,700 83,250

ACCOUNTS RECEIVABLE 55,400 54,220

PREPAID INSURANCE 2,400 3,600

NVESTMENTS 95,000 75,000

PLANT ASSETS 356,000 290,000

ACCUMULATED DEPRECIATION (65,700) (36,700)

TOTAL ASSETS 509, 800 469, 370

LIABILITIES AND EQUITY

LIABILITIES:

ACCOUNTS PAYABLE 48,100 43,700

NOTES PAYABLE 160,000 185,000

TOTAL LIABILITIES 208,100 232,300

EQUITY

COMMON STOCK 130,000 100,000

RETAINED EARNINGS 171,700 137,070

TOTAL EQUITY 306,700 237,070

TOTAL LIABILITIES & EQUITY 509,800 469,370

VITRTUAL CO.

INCOME STATEMENT

FOR THE YEAR ENDED DEC. 31, 2018

SALES REVENEW 433,000

COST OF GOODS SOLD 289,000

GROSS PROFIT 144,000

OPERATING EXPENSES:

DEPRECIATION EXPENSE 29,000

INSURANCE EXPENSES 14,400

OTHER OPERATING EXPENSES 57,200

TOTAL OPERATION EXPENSES 100,600

OPERATING INCOME 43,400

OTHER REVENUE & EXPENSES

GAIN ON SALEW OF LAND 17,500

TOTAL OTHER REVENUE & EXPENSES 17,500

INCOME BEFORE TAX 60,900

INCOME TAX EXPENSE 18,270

NET INCOME 42,630

VIRTUAL CO.

STATEMENT OF CASH FLOWS: INDIRECT METHOD

FOR THE YEAR ENDED DEC. 31, 2018

CASH FLOW FROM OPERATING ACTIVITIES:

NET INCOME 42,600

ADJUSTMENTS TO RECONCILE NET INCOME TO

NET CASH FLOW FROM OPERATING ACTIVITIES:

DEPRECIATION 29,000

GAIN ON SALE OF PLANT ASSETS (17,500)

ACCOUNTS RECEIVABLE DECREASE (1,180)

PREPAID INSURANCE DECREASES 1,200

ACCOUNTS PAYABLE INCREASE 800 12,320

NET CASH FLOW: OPERATING ACTIVITIES 54,920

CASH FLOW FROM INVESTING ACTIVITIES:

PROCEEDS FRPM SALE INVESTMENTS 47,500

COST OF INVESTMENTS PORCHASED (50,000)

COST OF NEW PLANT ASSETS (66,000)

NET CASH FLOW: INVESTING ACTIVITIES (68,500)

CASH FLOW FROM FINANCING ACTIVITIES:

PAYMENT OF NOTES PAYABLE (PRINCIPAL) (25,000)

ISSUANCE OF COMMON STOCK 30,000

PAYMENT OF DIVIDENDS (8,000)

(3,000)

TOTAL CASH FLOW INCREASE/ (DECREASE) (16,550)

CASH BALANCE, DEC. 31, 2019 83,250

CASH BALANCE, DEC. 31, 2018 66,700

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Course Description and Course Intended Learning Outcomes (Cd-Cilos/ Outcomes)Document12 pagesCourse Description and Course Intended Learning Outcomes (Cd-Cilos/ Outcomes)Hazel L. ansulaNo ratings yet

- Easy Shop Plus Kick Off Tour - Werner - PH - Basic VersionDocument90 pagesEasy Shop Plus Kick Off Tour - Werner - PH - Basic VersionHazel L. ansulaNo ratings yet

- ReligionDocument2 pagesReligionHazel L. ansulaNo ratings yet

- Chords 2Document17 pagesChords 2Hazel L. ansulaNo ratings yet

- Philippine Lit (Syllabus)Document11 pagesPhilippine Lit (Syllabus)Hazel L. ansulaNo ratings yet

- © 2018 - Do Not Reproduce or Amend Without Authority.: Plexus Services Pty LTDDocument4 pages© 2018 - Do Not Reproduce or Amend Without Authority.: Plexus Services Pty LTDHazel L. ansulaNo ratings yet

- Philippine: LiteratureDocument25 pagesPhilippine: LiteratureHazel L. ansulaNo ratings yet

- Office of The Director, Quality Assurance Management CenterDocument2 pagesOffice of The Director, Quality Assurance Management CenterHazel L. ansulaNo ratings yet

- Demo PrintDocument18 pagesDemo PrintHazel L. ansulaNo ratings yet

- Instructional Plan (Iplan) : Motivation/Introductor Y ActivityDocument3 pagesInstructional Plan (Iplan) : Motivation/Introductor Y ActivityHazel L. ansulaNo ratings yet

- English and American Literature - : RealistDocument39 pagesEnglish and American Literature - : RealistHazel L. ansulaNo ratings yet

- Language Teaching Materials Production: Graphic OrganizersDocument15 pagesLanguage Teaching Materials Production: Graphic OrganizersHazel L. ansulaNo ratings yet

- CourseOutline GE 5Document3 pagesCourseOutline GE 5Hazel L. ansulaNo ratings yet

- CharactersketchDocument16 pagesCharactersketchHazel L. ansulaNo ratings yet

- RRLDocument1 pageRRLHazel L. ansulaNo ratings yet

- Approval Form (1B) : 1. To Be Completed by Student and ParentDocument1 pageApproval Form (1B) : 1. To Be Completed by Student and ParentHazel L. ansulaNo ratings yet

- Approval Form (1B) : 1. To Be Completed by Student and ParentDocument1 pageApproval Form (1B) : 1. To Be Completed by Student and ParentHazel L. ansulaNo ratings yet

- The Period of EnlightenmentDocument21 pagesThe Period of EnlightenmentHazel L. ansulaNo ratings yet

- Claire Dayne Noela L. Ansula Grade 10 - Archimedes Mapeh: A. Avant-GardeDocument3 pagesClaire Dayne Noela L. Ansula Grade 10 - Archimedes Mapeh: A. Avant-GardeHazel L. ansulaNo ratings yet

- Mapeh WHLP Week 2Document2 pagesMapeh WHLP Week 2Hazel L. ansulaNo ratings yet

- Activity 1.1: I Fill in Love With Music!: Name of Composer Year Noted AccomplishmentDocument2 pagesActivity 1.1: I Fill in Love With Music!: Name of Composer Year Noted AccomplishmentHazel L. ansulaNo ratings yet

- What English Words Are Stop Words For Google?Document3 pagesWhat English Words Are Stop Words For Google?Hazel L. ansulaNo ratings yet

- Chem Week 4Document8 pagesChem Week 4Hazel L. ansulaNo ratings yet

- WHLP Week 1: Quiz: MusicDocument3 pagesWHLP Week 1: Quiz: MusicHazel L. ansulaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- INDUSTRIAL ENGINEERING Assignment 1Document21 pagesINDUSTRIAL ENGINEERING Assignment 1AmanNo ratings yet

- Separate and Consolidated Dayag Part 3Document4 pagesSeparate and Consolidated Dayag Part 3Edi wow WowNo ratings yet

- T Mobile Usa.2023Document1 pageT Mobile Usa.2023applelog100% (2)

- Marketing Channel DesignDocument35 pagesMarketing Channel DesignMuskan ManchandaNo ratings yet

- Final Assessment: NAME: Sumama Syed Reg No.: 1811339 Class: BBA Open Course: Cost AccountingDocument7 pagesFinal Assessment: NAME: Sumama Syed Reg No.: 1811339 Class: BBA Open Course: Cost AccountingSyed SumamaNo ratings yet

- Microeconomics II.Document90 pagesMicroeconomics II.Andualem Begashaw100% (1)

- Jurnal JohnsonDocument51 pagesJurnal JohnsonJennifer WijayaNo ratings yet

- Tugas 3 - Teori Pengambilan Keputusan - Yusriani Syam - A021181033Document5 pagesTugas 3 - Teori Pengambilan Keputusan - Yusriani Syam - A021181033Yusriani SyamNo ratings yet

- ABC, Transfer, DifferentialDocument3 pagesABC, Transfer, DifferentialLeoreyn Faye MedinaNo ratings yet

- Mba Project 2023-24 NewDocument79 pagesMba Project 2023-24 NewRupali PatilNo ratings yet

- Hospital ProcurementDocument16 pagesHospital ProcurementAbir UpadhyayNo ratings yet

- Digital Banking: by Navdeep KaurDocument7 pagesDigital Banking: by Navdeep KaurNavdeep Kaur XII-ENo ratings yet

- The Great Taking (David R. Webb) (Z-Library)Document130 pagesThe Great Taking (David R. Webb) (Z-Library)Gustavo Benaderet100% (1)

- Chapter 4 Statement of Cash Flows Part ADocument23 pagesChapter 4 Statement of Cash Flows Part AKwan Kwok AsNo ratings yet

- Ellipse Vs SapDocument3 pagesEllipse Vs Sapnbasanez8No ratings yet

- Imp Question Cost Accounting 3rd YearDocument4 pagesImp Question Cost Accounting 3rd YearNancy JainNo ratings yet

- How To Be A Successful Scalper Using OI PulseDocument205 pagesHow To Be A Successful Scalper Using OI Pulsevvpvarun100% (7)

- Factors Influencing Global Marketing Policy of ColgateDocument8 pagesFactors Influencing Global Marketing Policy of Colgatesayam siddiquegmail.comNo ratings yet

- Jumbo Water Curtain Nozzle: HD Fire Protect Pvt. Ltd. Technical DataDocument2 pagesJumbo Water Curtain Nozzle: HD Fire Protect Pvt. Ltd. Technical DataTony Bou GhariosNo ratings yet

- Strategies To Achieve Competitive Advantage in Industrial Revolution 4.0Document8 pagesStrategies To Achieve Competitive Advantage in Industrial Revolution 4.0NealNo ratings yet

- Projek Kajian KesDocument11 pagesProjek Kajian KesSyafiqah AbdullahNo ratings yet

- Events Management Fine Food AustraliaDocument20 pagesEvents Management Fine Food AustraliaHannah Van GeeresteinNo ratings yet

- The Statement of Financial Position of Ninety LTD For The Last Two Years AreDocument2 pagesThe Statement of Financial Position of Ninety LTD For The Last Two Years Arenjoroge mwangiNo ratings yet

- Learning Task For Module 1Document6 pagesLearning Task For Module 1Alfredo III SantianesNo ratings yet

- What Does A Billionaire Mind EntailsDocument2 pagesWhat Does A Billionaire Mind EntailsAyesha ButtNo ratings yet

- Myra Condovfqbp PDFDocument2 pagesMyra Condovfqbp PDFOdgaardOgle5No ratings yet

- Bài tập trên lớp buổi 5Document4 pagesBài tập trên lớp buổi 5Thu TrangNo ratings yet

- KPMG Whitepaper Model Risk Management 2016Document9 pagesKPMG Whitepaper Model Risk Management 2016Vova KulykNo ratings yet

- Chilime Annual Report 2078-79Document92 pagesChilime Annual Report 2078-79Arun LuitelNo ratings yet

- Supply Chain Operations: Making and DeliveringDocument13 pagesSupply Chain Operations: Making and Deliveringm. rubi setiawan100% (1)