Professional Documents

Culture Documents

Ingersol Rand

Uploaded by

Bitan RoyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ingersol Rand

Uploaded by

Bitan RoyCopyright:

Available Formats

Introduction

Ingersoll-Rand (I-R), is a leading firm in the stationary air compressor industry.I-R had a

30% market share of the estimated $660 Million US market in 1985 . I-R marketed 3

types of compressors: Reciprocating, Rotary Screw and Centrifugal ranging in size from

¾ to 6000 horsepower (hp) through various networks of Direct Sales force,

Independent distributors, Company owned Air Centers and Manufacturers’ Reps. IR has

grown from a single distribution channel in the 1960’s to managing 4 channels in 1985

for a better reach. In 1985, after the launch of their new product, a decision had to be

made regarding its distribution via the 4 available channels.

Ingersoll Rand’s Management of Distribution Policy

Ingersoll Rand had different channels of connection to the market and the demands of

each channel were different hence there seemed to be some difficulty in managing the

distribution network.

● The compressor had 3 different sizes of large, medium and small, which required

different consumer bases and had led to multiple consumer bases and the

strategy for each channel needed to change.

● The large compressor required frequent repairs and spare parts and also there

was delay in the delivery of spare parts which distrurbed the customer service

quality.

● To avoid clashes the company introduced the full partner program, where if a

sales rep referred a lead to a distributor then he got a commission of 1 - 2% and

if the distributor referred to the sales rep they got 2 - 5% .

● There is collusion between the sales rep and the distributor which led the

company having to pay higher money whereas the work was being done by only

one of them and passed off as 2.

● Insider information, unfair and biased policies in terms of sales turnover, supply

and more. Hence, they need to improve their distribution policy to bring down the

disparity between the centres further to reduce the infighting and improve sales.

● We will rate their distribution policy as ‘Good’.

Recommended Distribution Strategy for CENTAC - 200

The advantage of selling through CENTAC-200's direct sales team is that they have

well-established service capabilities, and it would be an excellent addition to the

diminishing direct sales product range. Furthermore, because the Centac 200 operates

at high speeds, improper maintenance could result in significant damage. The service

department for direct sales is well qualified to manage this, but Clabough is unsure

about distributors. Furthermore, the annual spare part demand is as low as 2% to 3% of

the initial cost, and because distributors thrive on spare parts and maintenance

services, such a low amount is unlikely to appeal to them. So even though the hp

assignment for CENTAC 200 falls within the purview of the distributors, it would take

their attention away from the smaller compressors and would require intensive

distributor training plus it would leave the company dependent on a channel they cannot

completely control. Due to all these reasons we believe Ingersoll Rand should distribute

CENTAC 200 through direct salesforce.

How would distributors benefit from Centac-200?

Centac-200 was a 200 hp centrifugal air compressor which falls in the medium range

25-250 HP category.This would also help increase Distributors long term relations with

the company. It would be one of the most lucrative products for the Distributors as

currently no distributor were selling Centrifugal air compressors and also it would help

Distributors expand their product portfolio. The independent distributors drew 50% of

their revenues and profit from Ingersoll Rand lines. The distributors were charged 20%

off the listing price,they set their own resale price and earned a gross margin of 10-15%

on compressors and 30-35% on spare parts and services and it would also help

increase the distributors further increase revenue and profits from the Ingersoll-Rand

product line as Centec - 200 was considered to be a direct competitor to the Atlas-

Copco’s Z series Oil Free rotary compressor.The Full Partner Program would also help

the distributor earn commissions for referring enquiries to the direct sales rep and on

conversion they could earn a 2% commission on a lead and 5% in case of active

involvement in sales.

Below is the Cost of Centac-200

Cost of Centrifugal Compressor per HP $225

Cost of Centac-200 $45000

Installation Cost @ 12% $5400

Spare parts & Maintenance @ 2% $900

4. How would the salesforce benefit from CENTAC-200?

The Direct Sales Force Sales Index has been declining from 100 in 1980 to 75 in 1985,

indicating that the Direct Sales Force isn't performing to expectations.

It's also clear from exhibit 4 that the problem of underperformance isn't limited to any

product category, since across all product versions, sales through this channel are

declining.

In these conditions, a new product like centac-200, which has a high entry barrier but no

competition, might tip the scales in Salesforce's favor.

The Sales force will have the following advantages from Centac-200:

● It can be deduced that only the sales force has prior selling experience of the

centrifugal air compressor.Centac-200, which is a centrifugal air compressor,

belongs to the same category. Only a direct sales force can provide the greatest

service.

● Since of the aspects that go into the performance of the Centac-200, such as

working at fast speeds, technical support is necessary (50000 r.p.m.). As a

result, the individual in charge of sales must have a high level of technical

expertise to deliver superior customer care. Direct sales reps have previously

received technical training. When compared to training the distributors, this will

save time, money, and give faster results.

● As the Centac-200 will be Ingersoll-first Rand's oil-free machine, it makes more

sense to use the sales force channel to provide better service to this new

segment, as it is preferred by industries such as food processing, electronic

assembly, and pharmaceuticals where other channels will be ineffective.

You might also like

- WorkingGroup - A1 - Ingersoll Rand (A)Document5 pagesWorkingGroup - A1 - Ingersoll Rand (A)Apoorva SharmaNo ratings yet

- Analyse The Case Facts in Terms of Customer, Company, Competitor, Context and CollaboratorsDocument9 pagesAnalyse The Case Facts in Terms of Customer, Company, Competitor, Context and Collaboratorsshweta singh100% (1)

- Ingersoll CaseDocument5 pagesIngersoll CaseUrooj AnsariNo ratings yet

- Ingersoll Rand Sec B Group 1Document8 pagesIngersoll Rand Sec B Group 1biakNo ratings yet

- Ingersoll Rand Case AnalysisDocument7 pagesIngersoll Rand Case AnalysisSrikanth Kumar Konduri0% (2)

- Good Morning Cereal - Dimensioning Challenge Case 010621Document12 pagesGood Morning Cereal - Dimensioning Challenge Case 010621Tushar SoniNo ratings yet

- Project On Ingersoll RandDocument16 pagesProject On Ingersoll RandVikram MandalNo ratings yet

- Group 5 Culinarian-CookwareDocument10 pagesGroup 5 Culinarian-CookwareNupur AnandNo ratings yet

- BM Kurlon CaseDocument6 pagesBM Kurlon CaseArun A RNo ratings yet

- Body Power CaseDocument7 pagesBody Power Casekewlkewl123No ratings yet

- Problem Set 6 - Mixed SetDocument3 pagesProblem Set 6 - Mixed SetRitabhari Banik RoyNo ratings yet

- How Hindalco Industries can improve its working capital managementDocument15 pagesHow Hindalco Industries can improve its working capital managementBikramdevPadhiNo ratings yet

- Presented By: Azeem Rahman K.MDocument32 pagesPresented By: Azeem Rahman K.Mpratyush05010% (1)

- Dominion Motors and Controls Ltd. - Case AnalysisDocument7 pagesDominion Motors and Controls Ltd. - Case Analysisdhiraj agarwalNo ratings yet

- PRICING EXERCISES ANALYSISDocument14 pagesPRICING EXERCISES ANALYSISvineel kumarNo ratings yet

- Global Logistics AssignmentDocument3 pagesGlobal Logistics AssignmentSara KiranNo ratings yet

- Bajaj Electricals LimitedDocument9 pagesBajaj Electricals LimitedSivaraman P. S.No ratings yet

- ME15 - Unit 3Document59 pagesME15 - Unit 3Bharathi RajuNo ratings yet

- Wipro Consumer Care: Merchandising For Success: Submitted By: Group 9Document6 pagesWipro Consumer Care: Merchandising For Success: Submitted By: Group 9TryNo ratings yet

- Soren Chemical: Why Is The New Swimming Pool Product Sinking?Document2 pagesSoren Chemical: Why Is The New Swimming Pool Product Sinking?Kushagra VarmaNo ratings yet

- Group 3 WhirlpoolDocument8 pagesGroup 3 WhirlpoolSumit VakhariaNo ratings yet

- Industrial Chemical Inc - Pigment DivisionDocument8 pagesIndustrial Chemical Inc - Pigment DivisionRahul NiranwalNo ratings yet

- Mehta SoyacaseDocument9 pagesMehta Soyacaseshehbaz_khanna28No ratings yet

- Managing Business Markets - Case Analysis of IndiaMART's GoalsDocument2 pagesManaging Business Markets - Case Analysis of IndiaMART's GoalsCH NAIRNo ratings yet

- Northboro Machine Tools CorporationDocument9 pagesNorthboro Machine Tools Corporationsheersha kkNo ratings yet

- WAC-P16052 Dhruvkumar-West Lake Case AnalysisDocument7 pagesWAC-P16052 Dhruvkumar-West Lake Case AnalysisDHRUV SONAGARANo ratings yet

- Wipro Consulting Services - Building An Effective Global Configuration in Business and IT Consulting IndustryDocument2 pagesWipro Consulting Services - Building An Effective Global Configuration in Business and IT Consulting IndustryRam Ayodhya SinghNo ratings yet

- Assignment 2 Group 4BDocument5 pagesAssignment 2 Group 4BBhumika VishnoiNo ratings yet

- Group 9 - SDMDocument50 pagesGroup 9 - SDMPRASHANT KUMARNo ratings yet

- Dell & Eureka Forbes' Channel StrategyDocument17 pagesDell & Eureka Forbes' Channel StrategySaHil GuptaNo ratings yet

- Venky 3Document39 pagesVenky 3Uday GowdaNo ratings yet

- Wrightline Inc. Case Study: Group-6Document6 pagesWrightline Inc. Case Study: Group-6sili coreNo ratings yet

- Asian PaintsDocument13 pagesAsian PaintsGOPS000No ratings yet

- Parkin LabsDocument3 pagesParkin LabsMayur DadiaNo ratings yet

- Gillette'S Energy Drain (A) : The Acquisition of DuracellDocument3 pagesGillette'S Energy Drain (A) : The Acquisition of DuracellNANo ratings yet

- Group 7 Assignment 2 Wilkins - A Zurn CompanyDocument15 pagesGroup 7 Assignment 2 Wilkins - A Zurn CompanyVanshika Chhabra 27No ratings yet

- Prithvi Electricals B2B Motor StrategyDocument4 pagesPrithvi Electricals B2B Motor StrategyOishik BanerjiNo ratings yet

- Hunter Business GroupDocument2 pagesHunter Business GroupPratyushGarewalNo ratings yet

- Group 10 - Sec BDocument10 pagesGroup 10 - Sec BAshishKushwahaNo ratings yet

- Case-A: Aditi Agro ChemicalsDocument1 pageCase-A: Aditi Agro ChemicalsDivya Punjabi50% (2)

- Akash (Marketing Management)Document23 pagesAkash (Marketing Management)MY COMPUTERNo ratings yet

- Case Analysis: Group No. 1, Section B, PGP-2, IIM IndoreDocument7 pagesCase Analysis: Group No. 1, Section B, PGP-2, IIM IndorePappu JoshiNo ratings yet

- Capturing The Value of Supplementary ServicesDocument4 pagesCapturing The Value of Supplementary ServicesnikhilkabadiNo ratings yet

- Marketing - Product Line of V Guard IndustriesDocument5 pagesMarketing - Product Line of V Guard IndustriesDhanya Paul100% (1)

- Advanced C1 - Mobonik-CaseDocument7 pagesAdvanced C1 - Mobonik-CaseKshitij chaudharyNo ratings yet

- Hari Krishna Exports - Case Study SolutionDocument2 pagesHari Krishna Exports - Case Study SolutionTitiksha GuhaNo ratings yet

- Kingfisher Vs Fosters With Porters Five ForcesDocument32 pagesKingfisher Vs Fosters With Porters Five Forcesvenkataswamynath channa100% (5)

- Official Finocontrol Brochure 2020Document23 pagesOfficial Finocontrol Brochure 2020pavan kalyan50% (2)

- Mid-Term Question Paper Set - 1Document17 pagesMid-Term Question Paper Set - 1Archisha Srivastava0% (1)

- Mahindra Trucks & Bus Division: Building A Marketing PlanDocument1 pageMahindra Trucks & Bus Division: Building A Marketing PlanAyyappa ChakilamNo ratings yet

- "The New Science of Salesforce Productivity": Reading SummaryDocument2 pages"The New Science of Salesforce Productivity": Reading SummarypratyakshmalviNo ratings yet

- SDM Cases HighlightedDocument33 pagesSDM Cases HighlightedRoshan HmNo ratings yet

- CancerScreeninginJapanCaseAnalysis 061415Document11 pagesCancerScreeninginJapanCaseAnalysis 061415Yu Nathaniel KangNo ratings yet

- Group 2Document54 pagesGroup 2Vikas Sharma100% (2)

- Case Questions WilkinsDocument1 pageCase Questions Wilkinsvimal_prajapatiNo ratings yet

- Ingersoll Case Studies Aman Raja DCM-GR2 - Pgsf2005Document3 pagesIngersoll Case Studies Aman Raja DCM-GR2 - Pgsf2005aman KumarNo ratings yet

- IngersollDocument8 pagesIngersolldev_90No ratings yet

- Ingersoll Rand - FAS - D2Document7 pagesIngersoll Rand - FAS - D2Sunil PatelNo ratings yet

- Ingersoll Rand Case AnalysisDocument3 pagesIngersoll Rand Case AnalysisKrutarthVashi75% (4)

- Ingersoll Rand's Distribution Strategy for Centac-200Document13 pagesIngersoll Rand's Distribution Strategy for Centac-200Nitesh RajNo ratings yet

- CHAPTER THREE - Operations ManagementDocument1 pageCHAPTER THREE - Operations ManagementPattraniteNo ratings yet

- How Israel Helped To Spawn HamasDocument7 pagesHow Israel Helped To Spawn HamasChrysthian ChrisleyNo ratings yet

- Strategic Marketing Plan of NagadDocument26 pagesStrategic Marketing Plan of Nagadhojega100% (1)

- Chap 007 Business PlanDocument31 pagesChap 007 Business PlanAliAdnan AliAdnanNo ratings yet

- Plaint in The Court of Civil Judge Senior Division Nasik Summary Suit No. 1987Document3 pagesPlaint in The Court of Civil Judge Senior Division Nasik Summary Suit No. 1987AaradhyNo ratings yet

- The Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceDocument21 pagesThe Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceFarwa KhalidNo ratings yet

- Chapter 9 Caselette Audit of SheDocument26 pagesChapter 9 Caselette Audit of SheBusiness MatterNo ratings yet

- Csec Poa June 2010 p2Document12 pagesCsec Poa June 2010 p2Renelle RampersadNo ratings yet

- Deed of Conditional SaleDocument2 pagesDeed of Conditional SaleJustin Mikhael Abraham100% (1)

- Understanding Business Cycles Through IndicatorsDocument2 pagesUnderstanding Business Cycles Through Indicatorsawais mehmoodNo ratings yet

- ODLIČNO Marsden - Et - Al-2000-Sociologia - Ruralis PDFDocument15 pagesODLIČNO Marsden - Et - Al-2000-Sociologia - Ruralis PDFIzabela MugosaNo ratings yet

- Contract of AgencyDocument2 pagesContract of Agencyjonel sembranaNo ratings yet

- Assurance Certificate LevelDocument76 pagesAssurance Certificate Levelrubel khan100% (4)

- Promotion, Transfer and DemotionDocument33 pagesPromotion, Transfer and DemotionShalini WahalNo ratings yet

- Entrepreneurship: - New Venture CreationDocument33 pagesEntrepreneurship: - New Venture CreationSudip KarNo ratings yet

- Pay Slip Details for Siddharth in September 2022Document1 pagePay Slip Details for Siddharth in September 2022SiddharthNo ratings yet

- Dragon Fruit Greek Yogurt Feasibility StudyDocument16 pagesDragon Fruit Greek Yogurt Feasibility StudyJamie HaravataNo ratings yet

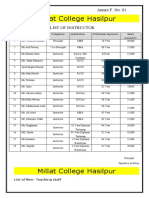

- Millat College Hasilpur: Annex F. No. 01Document3 pagesMillat College Hasilpur: Annex F. No. 01Hashim IjazNo ratings yet

- PUMBA - DSE A - 506 - LDIM - 1.1 Nature and Scope of International Trade Law - PPTDocument34 pagesPUMBA - DSE A - 506 - LDIM - 1.1 Nature and Scope of International Trade Law - PPTTô Mì HakkaNo ratings yet

- FAR 1 - Journal EntriesDocument3 pagesFAR 1 - Journal EntriesAnime LoverNo ratings yet

- E-Commerce in Afghanistan: Department of Management SciencesDocument12 pagesE-Commerce in Afghanistan: Department of Management SciencesEnamNo ratings yet

- Position Paper - Milo Olivay Mabasa Vs Orbiter-MeyersDocument12 pagesPosition Paper - Milo Olivay Mabasa Vs Orbiter-MeyersGigi De LeonNo ratings yet

- Specialized Expertise: Established Knowledge, Guiding You ThroughDocument6 pagesSpecialized Expertise: Established Knowledge, Guiding You ThroughOmar GuillenNo ratings yet

- MIS604 RE-Group Work-DevangiDocument6 pagesMIS604 RE-Group Work-DevangiAbhilasha DahiyaNo ratings yet

- Annual Report Laporan Tahunan: PT Gudang Garam TBKDocument132 pagesAnnual Report Laporan Tahunan: PT Gudang Garam TBKAnnisa Rosie NirmalaNo ratings yet

- Fundamentals Strategic Management Navas & Guerras 2013Document18 pagesFundamentals Strategic Management Navas & Guerras 2013Pedro AlmeidaNo ratings yet

- Updated Blaw Past Papers by RNK-1Document90 pagesUpdated Blaw Past Papers by RNK-1muzamil azizNo ratings yet

- FTMRDocument77 pagesFTMRSarang RokadeNo ratings yet

- Full AssignmentDocument46 pagesFull AssignmentCassandra LimNo ratings yet

- SREA TrainingDocument59 pagesSREA TrainingYoohyun LeeNo ratings yet