Professional Documents

Culture Documents

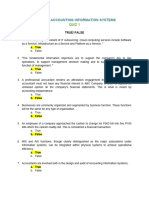

Samplepractice Exam 18 April 2017 Questions and Answers

Uploaded by

MAG MAGCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Samplepractice Exam 18 April 2017 Questions and Answers

Uploaded by

MAG MAGCopyright:

Available Formats

lOMoARcPSD|8422790

Sample/practice exam 18 April 2017, questions and answers

Accounting (Far Eastern University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

AFAR - SET A Forward Rate

Spot Rate (for March 12,2017)

Use the following information for question 1 and 2: November 20, 2016……………… P .87 P .89

CC admits DD as a partner business. Accounts in the ledger for CC on November December 12, 2016………………. .88 .90

30,20x4, just before the admission of DD, show the following balances: December 31, 2016………………. .92 .93

It is

Cash………………………………………………………………………………… P 6,800 3. Imp entered into the first forward contract to hedge a purchase of inventory in

Accounts receivable………………………………………………………… 14,200 November 2016, payable in March 2017. At December 31, 2010, what amount of

Merchandise inventory…………………………………………………… 20,000 foreign currency transaction gain from this forward contract should Imp include in

Accounts payable……………………………………………………………. 8,000 net income?

CC, capital……………………………………………………………………….. 33,000 a. P 0 c. P 5,000

agreed that purposes of establishing CC’s interest the following adjustment shall be b. P 3,000 d. P 10,000

made:

a. An allowance for doubtful accounts of 3% of accounts receivable is to be 4. At December 31,2016, what amount of foreign currency transaction loss should

established. Imp include in income from the revaluation of the Accounts Payable of 100,000

b. The merchandise inventory is to be valued at P23,000. foreign currencies incurred as a result of the purchase of inventory at November

c. Prepaid salary expenses of P600 and accrued rent expense of P800 are to 30, 2016 payable in March 2017?

recognized. a. P 0 c. P 4,000

b. P 3,000 d. P 5,000

1. DD is to invest sufficient cash to obtain a 1/3 interest in the partnership. CC’s

adjusted capital before the admission of CC: 5. Imp entered into the second forward contract to hedge a commitment to

a. P28,174 c. P35,374 purchase equipment being manufactured to Imp’s specification. The expected

b. P35,347 d. P36,374 delivery date is March 2017 at which time settlement is due to the manufacturer.

2. The amount of cash investment by DD: The hedge qualities as a fair vale hedge. At December 31, 2016, what amount of

a. P11,971 c. P17,687 foreign currency transaction gain from this forward contract should Imp include in

b. P14,087 d. P18,487 net income?

Items 3 to 6 are based on the following information: a. P 0 c. P 5,000

On December 12, 2010, Imp Company entered into three forward exchange b. P 3,000 d. P 10,000

contract to purchase 100,000 FC (foreign currency) in 90 days. The relevant

exchange rates are as follows: 6. Imp entered into the third forward contract for speculation. At December 31,

2016, what amount of foreign currency transaction gain from this forward contract

should Imp include in net income?

a. P 0 c. P 5,000

b. P 3,000 d. P 10,000

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

Use the following information for quesrtions 7 and 8: (2) Assuming the functional currency of the subsidiary is the local currency,

Cleary, Wasser and Nolan formed a partnership on January 1, 20x4, with what total should be included in Parker’s consolidated balance sheet at

investments of P100,000, P150,000 and P200,000, respectively. For division of December 31, 20x4, for the above items?

income, they agreed to (1) interest of 10% of the beginning capital balance each a. (1) P407,500; (2) P418,000 c. (1) P407,500; (2) P407,500

year, (2) annual compensation of P10,000 to Wasser and (3) sharing the remainder b. (1) P418,000; (2) P407,500 d. (1) P418,000; (2) P418,000

of the income or loss in a ration of 20% for Cleary and 40% each for Wasser and 10. A local partnership was considering the possibility of liquidation since one of

Nolan. Net income was P150,000 in 20x4 and 20x5. the partners (Ding) was insolvent. Capital balances at that time were as follows.

7. What was Wasser’s share of income for 20x4? Profits and losses were divided on a 4:2:2:2 basis, respectively.

a. P 63,000 d. P 29,000 Ding, capital…………………………………………. P 60,000

b. P 53,000 e. P 51,000 Laurel, capital………………………………………. P 67,000

c. P 58,000 Ezzard, capital……………………………………… P 17,000

Tillman, capital…………………………………….. P 96,000

8. What was Wasser’s capital balance at the end of 20x5? Ding’s creditors filed a P25,000claim against the partnership’s assets. At that time,

a. P 201,000 d. P 304,040 the partnership held assets reported at P360,000 and liabilities of P120,000. If the

b. P 263,520 e. P 313,780 assets could be sold for P228,000, what is the minimum amount that Ding’s

c. P 264,540 creditors would have received?

a. P -0- c. P 36,000

9. Certain balance sheet accounts of a foreign subsidiary of Parker Company at b. P 2,500 d. P 38,250

December 31, 20x4 have been restated into pesos as follows: 11. Finley Company sells office equipment. On January 1, 20x3, Finley entered into

Restated at an installment sale contract with Miller Company for a six-year period expiring

Current Rates Historical Rates January 1, 20x9. Equal annual payments under the installment sale are P936,000

Cash…………………………………………………… P 47,500 P 45,000 and are due on January 1. The first payment was made on January 1, 20x3.

Accounts receivable…………………………… 95,000 90,000 Additional information is as follows:

Inventory at market…………………………… 76,000 72,000 The cash selling price of the equipment, i.e., the amount that would be

Land…………………………………………………… 57,000 54,000 realized on an outright sale, is P4,584,000.

Equipment (net)…………………………………. 142,500 135,000 The cost of sales relating to the equipment is P3,825,000.

Total…………………………………………………… P418,000 P396,000 The finance charges relating to the installment period are P1,032,000 based

on a stated interest rate of 9% which is appropriate. For tax purposes, Finley

(1) Assuming the functional currency of the subsidiary is the peso, what total appropriately uses the accrual basis for recording finance charges.

should be included in Parker’s consolidated balance sheet at December Circumstances are such that the collection of the installment sale is

31, 20z4, for the above items? reasonably assured.

The installment sale qualified for the installment method of reporting for tax

purposes

Assume that the income tax rate is 30%.

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

What income (loss) before income taxes should Finley appropriately record as a a. P 410,000 and P270,000 c. P 140,000 and P189,000

result of this transaction for the year ended December 31, 20x3? b. P 140,000 and P270,000 d. P 410,000 and P189,000

a. P 154,979 c. P 759,000

b. P 483,299 d. P 1,087,320 14. The after-closing balances of Carter Corporation’s home office and its branch at

January 1, 20x4 were as follows:

12. Lark Corp.has a contract to construct a P5,000,000 cruise ship at an estimated Home Office Branch

cost of P4,000,000. The company will begin construction of the cruise ship in early Cash…………………………………………………………….. P 7,000 P 2,000

January 20x4 and expects to complete the project sometime in late 20x7. Lark Accounts receivable-net………………………………. 10,000 3,500

Corp. has never constructed a cruise ship before and the customer has never Inventory…………………………………………………….. 15,000 5,500

operated a cruise ship. Due to this and other circumstances, Lark Corp. believes Plant assets-net…………………………………………… 45,000 20,000

there are inherent hazards in the contract beyond the normal, recurring business Branch……………………………………………………….. 28,000 -0-

risks. Lark Corp. expects to recover all its costs under the contract. During 20x4 and Total Assets………………………………………………….. P105,000 P 31,000

20x5, the company has the following activity:

20x4 20x5 Accounts payable………………………………………… P 4,500 P 2,500

Costs to date P 980,000 P2,040,000 Other liabilities…………………………………………… 3,000 500

Estimated costs to complete 3,020,000 1,960,000 Unrealized profit-branch inventory……………. 500 -0-

Progress billings during the year 1,000,000 1,000,000 Home office………………………………………………… -0- 28,000

Cash collected during the year 648,000 1,280,000 Capital stock………………………………………………. 80,000 -0-

On its statement of financial position at December 31, 20x5, what amount will be Retaining earnings……………………………………… 17,000 -0-

reported related to the Construction in Process account? Total Assets………………………………………………… P105,000 P 31,000

a. P40,000 costs in excess of billings.

b. P1,020,000 costs in excess billings. A summary of the operations of the home office and branch for 20x4 follows:

c. P40,000 billings in excess of costs. 1. Home office sales: P100,000, including P33,000 to the branch. A standard

d. P20,000 billings in excess of costs. 10% markup on cost applies to all sales to the branch. Branch sales to its

customers totaled P50,000.

13. A partnership has the following capital balances: 2. Purchases from outside entities: home office, P50,000; branch P7,000.

Partners Capital Balance 3. Collections from sales: home office P98,000 (including P30,000 from

William (40% of gains and losses)……………………. P 220,000 branch); branch collections, P51,000.

Jennings (40%)………………………………………………… 160,000 4. Payments on account; home office, P51,500; branch; P4,000.

Bryan (20%)…………………………………………………….. 110,000 5. Operating expenses paid: home office, P20,000; branch, P6,000.

Darrow invest P270,000 in cash for a 30 percent ownership interest. The money 6. Depreciation on plant assets: home office, P4,000; branch P1,000.

goes to the original partner. Goodwill is to be recorded. How much goodwill should 7. Home office operating expenses allocated to the branch, P2,000.

be recognized, and what is Darrow’s beginning capital balance?

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

8. At December 31, 20x8, the home office inventory is P11,000 and the 17. Assume at March 15, 20x4, the time of signing the contact, collectability of the

branch inventory is P6,000 of which P1,050 was acquired from outside receivable was reasonably assured and there were no significant continuing

suppliers. obligations. The journal entry at signing would include a:

The combined net income amounted to: a. Credit to franchise fee revenue for P36,000.

a. P -0- c. P21,000 b. Credit to franchise fee revenue for P9,000.

b. P 4,550 d. P25,550 c. Credit to unearned franchise fee revenue for P36,000.

d. Credit to unearned franchise fee revenue for P27,000

Use the following information for questions 15 to 17:

Flapper Jack’s Inc. sells franchises for an initial fee of P36,000 plus operating fees of Use the following information for questions 18 to 19:

P500 per month. The initial fee covers site selection, training, computer and Duck Corporation acquired a 70% interest in Whistle Corporation on January 1,

accounting software, and on0site consulting and troubleshooting, as needed, over 20x5, when Whistle’s book values were equal to their fair values. During 20x5, Duck

the first five years. On march 15 20x4, Anton signed a franchise contract, paying sold merchandise that cost P75,000 to Whistle for P110,000. On December 31,

the standard P6,000 down with the balance due over 5 years with interest. 20x5, three-fourths of the merchandise acquired from Duck remained in Whistle’s

inventory. Separate incomes (investment income not included) of Duck and Whistle

15. Assume that at the time of signing contract, collection of the receivable was are as follows:

assured and that service obligations were substantial. However, by October 20 Duck Whistle

20x4, substantially all continuing obligations had been met. The journal entry Sales Revenue………………………………….. P 150,000 P 200,000

required at October 20, 20x4 would include a: Cost of Goods Sold…………………………… 90,000 70,000

a. Credit to franchise fee receivable for P27,000. Operation Expenses…………………………. 12,000 15,000

b. Debit to unearned franchise fee revenue for P36,000. Separate incomes…………………………….. P 48,000 P 115,000

c. Credit to franchise fee revenue for P9,000.

d. Debit to unearned franchise fee revenue for P27,000. 18. The consolidated income statement for Duck Corporation and subsidiary for the

16. Assume at March 15, 20x4, the time of signing contract, collectability of the year ended December 31, 20x5 will show consolidated cost of sales of?

receivable was reasonably assured and there were no significant continuing a. P50,000 c. P133,750

obligations. The journal entry at signing would include a: b. P76,250 d. P160,000

a. Credit to franchise fee revenue for P36,000.

b. Credit to franchise fee revenue for P9,000. 19. Duck’s investment income for 20x5, assuming dividends paid by Whistle

c. Credit to unearned franchise fee revenue for P36,000. amounted to P40,000.

d. Credit to unearned franchise fee revenue for P27,000. Cost Method Equity Method

a. P 13,750 P 54,250

b. P 28,000 P 80,500

c. P 54,250 P 28,000

d. P 28,000 P 54,250

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

20. The balance sheet of Venner and Wigstaff Partnership immediately before the On December 27, 20x5, the branch returned P15,000 of seasonal

partnership was Incorporated as Venwig Corporation follows: merchandise to the home office for the January clearance sale. The

merchandise was not received by the home office until January 6, 20x6.

Cash…………………………………………………………………. P 10,500 The home office allocated general expenses ofP28,000 to the branch. The

Trade accounts payable……………………………………. 16,400 branch had not entered the allocation at the year-end.

Trade accounts receivable……………………………….. 15,900 Branch store insurance premiums of P900 were paid by the home office. The

Venner, capital…………………………………………………. 60,000 branch recorded the amount at P600.

Inventories………………………………………………………. 42,000 The correct balance of the reciprocal account amounted to:

Wigstaff, capital………………………………………………. 52,000 a. P575,000 c. P534,700

Equipment (net of P18,000 Depreciation)………… 60,000 b. P535,000 d. P507,000

Net assets………………………………………………………… P128,400 Use the following information to answer questions 22 to 24:

The following adjustments to the balance sheet of the partnership were The balance sheet of Salt Company, along with market values of its assets and

recommended by a CPA before accounting records for Venwig Corporation were to liabilities, is as follows:

be established: Salt company

An allowance for doubtful accounts was to be established in the amount of Book value debit Market value

P1,200. (credit) debit (credit)

Short-term prepayments of P800 were to be recognized. Current assets P 2,000,000 P 1,500,000

The current fair value of inventories, P48,000, and the current fair value of Plant & equipment (net) 30,000,000 35,000,000

equipment, P72,000, were to be recognized. Patents 100,000 2,000,000

Accrued liabilities of P750 were to be recognized. Completed technology 0 10,000,000

Immediately following incorporation, the additional paid-in capital in excess of par Broader customer base 0 16,000,000

should be credited for: Technically skilled workforce 3,000,000

a. P128,850 c. P78,850 Potentially profitable future contracts 2,000,000

b. P96,000 d. No additional paid-in capital

Licensing agreements 0 4,000,000

21. At December 31, 20x5, the following information has been collected by

Potential contract with new customers 1,500,000

Maxwell Company’s office and branch for reconciling the branch and home office

Advertising jingles 1,000,000

accounts.

Future cost savings 1,800,000

The home office’s branch account balance at December 31, 20x5 is P590,000.

The branch’s home office account balance is P506,700. Goodwill 200,000 700,000

On December 30, 20x5, the branch sent a check for P40,000 to the home Liabilities (28,000,000) (30,000,000)

office to settle its account. The check was not delivered to the home office Common stock, P10 par (1,000,000)

until January 3, 20x6. Additional paid-in capital (5,000,000)

Retained earnings 1,700,000

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

22. Now assume Pail Company pays P10,000,000 in cash to acquire the assets and 26. Rizzalyn Corporation, a capital goods aufacturing business that taed on January

liabilities of Salt Company. Pail records a bargain purchase gain on acquisition of: 4, 20x3, and operates on a calendar-year basis. The following data were taken from

a. Zero c. P 17,500,000 the records of 20x3 and 20x4:

b. P 12,500,000 d. P 28,500,000 20x3 20x4

Installment Sales P 480,000 P 620,000

23. Pail paid P100,000,000 in cash for Salt. Three months later, Salt;s patents are Gross profit as a percent of costs 25% 28%

determined to have been worthless as of the date of acquisition. The entry to Cash collections on sales of 20x3 P 140,000 P 240,000

record this information includes Cash collections on sales of 20x4 P -0- P180,000

a. a debit to loss of P2,000,000. Compute the realized gross profit to be reported in the 20x4 income statement:

b. a debit to patents of P2,000,000. Installment Sales Method Cost Recovery Method

c. A debit to goodwill of P2,000,000. a. P 87,375 P -0-

d. A debit to retained earnings of P2,000,000. b. P 87,375 180,000

c. 39,375 -0-

24. Pail paid P 10,000,000 in cash for Seattle. Three months later, it is determined d. 48,000 240,000

that Seattle’s acquisition-date liabilities omitted a pending lawsuit valued at

P2,000,000. The entry to record this information includes 27. Falcon Corporation sold equipment to its 80%-owned subsidiary, Rodent Corp.,

a. a debit to bargain purchase gain on acquisition of P2,000,000. on January 1, 20x4. Falcon sold the equipment for p110,000 when its book value

b. a debit to liabilities of P2,000,000. was P85,000 and it had a 5-year remaining useful life with no expected salvage

c. A debit to goodwill of P2,000,000. value. Separate balance sheets for Falcon and Rodent included the following

d. A debit to retained earnings of P2,000,000. equipment and accumulated depreciation amounts on December 31, 20x4:

25. Equipment with a book values of P120,000 is sold in a liquidation process for Falcon Rodent

cash of P110,000. This equipment was security for a P150,000 bank loan. Any Equipment………………………………………. P750,000 P 300,000

remainder is consider unsecured. How would this transaction be reported on the Less: Accumulated depreciation……… (200,000) (50,000)

Statement of Realization and Liquidation? Equipment-net………………………………… P550,000 P 250,000

a. A reduction in non-cash assets of P120,000 Consolidated amounts for equipment and accumulated depreciation at December

b. A loss reported to owner’s equity of P10,000 31, 20x4 were respectively,

c. A disbursement of cash to the bank of P110,000, a reduction in partially a. P 1,025,000 and P245,000. c. P 1,025,000 and P245,000.

secured liability of P150,000, and an increase in unsecured without priority b. P 1,025,000 and P250,000. d. P 1,050,000 and P250,000.

liability of P 40,000

d. all of the above would occur

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

28. On January 1, 20x4, RR Corporation acquire 80 percent of SS Corporation’s P10 30. A company has identified the following overhead costs and cot divers for the

par common stock for P956,000. On this date, the fair value of the non-controlling coming year:

interest was P239,000, and the carrying amount of SS’s net assets was P1,000,000. Overhead Item Cost Driver Budgeted Cost Budgeted Activity

The fair values of SS’s identifiable assets and liabilities were the same s their Level

carrying amounts except for plant assets (net) with a remaining life of 20 years, Machine Setup Number of setups P 20,000 200

which were P100,000 in excess of the carrying amount. For the year ended Inspection Number of inspections P 130,000 6,500

December 31, 20x4, SS had net income of P190,000 and paid cash dividends Material handling Number of Material P 80,000 8,000

totaling P125,000. In the December 31, 20x4, consolidated balance sheet, the moves

amount of non-controlling interest reported should be: Engineering Engineering Hours P 50,000 1000

a. P200,000 c. P251,000 P 280,000

b. P239,000 d. P252,000 The following information was allocated on three jobs that were completed during

the year:

29. Gianne Co., sold a computer on installment basis on October 1, 20x4. The unit Job 101 Job 102 Job 103

cost to the company was P86,400, but the installment selling price was set at Direct materials P 5,000 P 12,000 P 8,000

P122,400. Terms of payment included the accpetance of a used computer with a Direct labor P 2,000 P 2,000 P 4,000

trade-in allowance of P43,200. Cash of P7,200 was paid in addition to the traded-in

Units competed 100 50 200

computer with the balance to be paid in ten monthly installments due at the end of

Number of setups 1 2 4

each month commencing the month of sale.

Number of inspections 20 10 30

Number of material moves 30 10 50

It would require P1,800 to recondition the used computer si that it could be resold

for P36,000. A 15% gross profit was usual from the sale of used compter. The Engineering hours 10 50 10

realized gross profit from the 20x4 collections amounted to: Budgeted direct labor cost was P100,000 and budgeted direct material cost was

a. P5,760 c. P11,520 P280,000.

b. P14,100 d. P48,960 Compute the cost of each unit of Job 102 using Activity-Based Costing:

a. P340 c. P440

b. P392 d. P520

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

31. Some units of output failed to pass final inspection at the end of the Use the following information for questions 33 and 34:

manufacturing process. The production and inspection supervisors determined Fetzler Company’s branch in Virginia began operations om January 1. 20x4.

that the incremental revenue from reworking the units exceeded the cost of During the first year of operations, the home office shipped merchandise to

rework. The rework of the defective units was authorizes, and the following costs the Virginia branch that cost P250,000 at a billed price of P300,000. One-

were incurred in reworking the units: fourth of the merchandise remained unsold at the end o 20x4. The home

Materials requisitioned from stores: office records the shipments to the branch at the P300,000 billed price at the

Direct materials………………………………………………. P 5,000 time shipments are made.

Miscellaneous supplies……………………………………. 300 33. The home office should make:

Direct labor……………………………………………………………… 14,000 a. A year-end adjusting entry or entries to establish an unrealized profit

The manufacturing overhead budget includes an allowance for rework. The (loading) account of P75,000.

predetermined manufacturing overhead rate is 150% of direct labor cost. The b. A year-end adjusting entry or entries to establish an unrealized profit

account(s) to be charged and the appropriate charges for the rework cost would (loading) account of P62,500.

be: c. A year-end adjusting entry or entries to establish an unrealized profit

a. Work-in-process inventory control for P19,300. (loading) account of P12,500.

b. Work-in-process inventory control for P5,000 and factory overhead control d. No year-end adjusting entry because the shipments to branch (home office

for P35,000. books) and shipments from home office (branch books) are reciprocal.

c. Factory overhead control for P19,300.

d. Factory overhead control for P40,300. 34. Freight-in of P2,000 on the shipments from the office was paid by the branch.

The home office should make:

32. Hartwell Company distributes the service department overhead costs to a. A year-end adjusting entry debiting the branch account for P500

producing departments and the following information for the month of January is b. A year-end adjusting entry debiting the branch account for P2,000

presented as follows: c. A year-end adjusting entry crediting the branch account for P500

Maintenance Utilities d. No year-end adjusting entry for the freight charges

Overhead costs incurred P 18,700 P 9,000

Services provided to: 35. On December 20, 2006, Leigh Museum, not-for-profit organization received a P

Maintenance department - 10% 7,000,000 donation of Day Company shares with donor-stipulated requirements as

Utilities department 20% - follows:

Producing department A 40% 30% Shares valued at P 5,000,000 are to be sold, with the proceeds used to erect a

Producing department B 40% 60% public viewing building.

The company distributes service department costs based on the reciprocal method, Shares valued at P 2,000,000 are to be retained with the dividends used to

what would be the formula to determine the total maintenance costs? support current operations.

a. M = P18,700 + .10U c. M = P18,700 + .30U + .40A + .40B As a consequence of the receipt of the Day shares, how much should Leigh report

b. M = P9,000 + .20U d. M = P27,700 + .40A + .40B as temporarily restricted net assets on its 2006 statement of financial position

(balance sheet) ?

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

a. P 0 c. P 5,000,000 39. Pistahan Corporation is a manufacturing company engaged in the production

b. P2,000,000 d. P 7,000,000 of a single special product known as “Marvel”. Production costs are

accumulated with the use of a job-order-cost system.

Items 36 and 37 are based on the following data: The following information is available as of June 1, 2016:

A chemical company manufactures joint products Pep and Vim, and a by- Work-in process……………………………………………….. P 10,710

product. Zest. Costs are assigned to the joint products by the market value Direct materials inventory………………………………… 48,600

method, which considers further processing costs in subsequent operations. In analyzing the job-order cost sheets, the records disclosed that the

For allocating joint costs to the by-product, the market value or reversal cost compositions of the work-in process inventory on June 1, 2016 were as

method is used. follows:

The total manufacturing costs for 10,000 units were P172,000 during the Direct materials used……………………………………….. P 3,960

quarter. Production and cost data follow: Direct labor (900 hours)…………………………………… 4,500

Pep Vim Zest Factory overhead applied…………………………………. 2,250

Units produced 5,000 4,000 1,000 P10,710

Sales price per unit P50 P40 P5 The following manufacturing activity occurred during the month of June 2016:

Further processing cost per unit 10 5 - Purchased direct materials costing P 60,000

Selling and administrative expense per unit 2 Direct labor worked 9,900 hours at P 5 per hour

Operating profit per unit 1 Factory overhead of P 2.50 per direct labor hour was applied to production.

At the end of June 2016, the following information was gathered in connection

36. The value of Zest to be deducted from the joint costs is: with the inventories:

a. P5,000 c. P 2,000 Inventory of work-in-process:

b. P3,000 d. Zero Direct materials used……………………………………… P 12,960

Direct labor (1,500 hours)………………………………. 7,500

37. The gross profit for Pep amounted to: Factory overhead applied………………………………. 3,750

a. P100,000 c. P70,000 P24,210

b. P 90,000 d. Zero Inventory of direct materials…………………………………… P51,000

Compute the cost of goods manufactured:

38. The Unused National Clearing Account “Cash-Modified Disbursement System” a. P 142,560 c. P 131,850

should be credited against: b. P 118,350 d. P 108,600

a. Income and Expense Summary c. Retained Operating Surplus

b. Accumulated Surplus/Deficitd. Subsidy from National Government

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

Items 40 and 41 are based on the following information: 2005 , what total amount should be reported for “net assets released from

40. The following information summarizes the standard cost for producing one restrictions?”

metal tennis racket frame. In addition, the variances for one month’s production a. P 0 c. P250,000

are given. Assume that all inventory accounts have zero balances at the beginning b. P 50,000 d. P300,000

of the month:

Standard Cost Standard Monthly Items 43 and 44 are based on the following information:

Per unit Costs Kuchen Manufacturing uses backflush costing to account for an electronic meter it

Materials P 4.00 P 8,400 makes. During August 2016, the firm produced 16,000 meters of which it sold

Direct labor 2 hrs @P2.60 5.20 10,920 15,800. The standard cost for each meter is:

Factory overhead: Direct material P 20

Variable 1.80 3,780 Conversation costs 44

Fixed 5.00 10,500 Total P 64

Variances: Assume that the company had no inventory on August 1. The following event

Material price, P244.75 unfavorable took place in August:

Materials quantity, P500.00 unfavorable 1. Purchased P320,000 of direct materials.

Labor rate, P520.00 unfavorable 2. Incurred P708,000 of conversion costs.

Labor efficiency, P2,080.00 unfavorable 3. Applied P704,000 of conversion costs to Raw and in Process Inventory.

What were the actual direct labor hours worked during the month? 4. Finished 16,000 meters.

a. 5,000 c. 4,000 5. Sold 15,800 meters for P100 each.

b. 4,800 d. 3,400

43. The amount of ending finished goods:

41. What were the actual quantities of materials used during the month? a. Nil or zero c. P 12,800

a. 2,156 c. 2,225 b. P 12,775 d. P 12,850

b. 2,100 d. 1,975

44. The amount of cost of goods sold after the adjustments of over-under applied

42. Saint Paul Hospital, a nonprofit hospital affiliated with Saint Paul University, conversion cost amounted to:

received the following cash contributions from donors during the year ended a. P 1,011,200 c. P 1,022,000

December 31, 2004: b. P 1,015,200 d. P 1,024,000

Contributions restricted by donors or research……………………….P 50,000

Contributions restricted by donor for capital acquisitions………. 250,000

Neither of the contributions was spent during 2004, however, during 2005, the

hospital spent the entire P 50,000 contribution on research and the entire

P250,000 contribution on a capital asset which was placed into service during the

year. On the hospital’s statement of operations for the year ended December 31,

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

45. Three joint operators are involved in a joint operation that manufactures ships 49. If consolidated statements are presented for the first time instead of

chandlery. At the beginning of the year the joint operation held P50,000 in cash. statements of several individual companies, this change should be accounted for?

During the year the joint operation incurred the following expenses: Wages paid a. retrospectively

P20,000, Overheads accrued P10,000. Additionally, creditors amounting to P40,000 b. prospectively

were paid and the joint operators contributed P15,000 cash each to the joint c. by cumulative effect adjustment

operation. The balance of cash held by the joint operation at the end of the year is: d. by footnote disclosure only

a. P 5,000 c. P 35,000

b. P 25,000 d. P 75,000 50. An inconsistency in accounting theory can occur because

a. Internally developed goodwill is expensed, while purchased goodwill is

Items 46 and 47 are based on the following information: capitalized

The standard cost per unit of component part K-45 is p4. During the month 6,000 b. Both internally developed goodwill and purchased goodwill are expensed

units of K-45 were purchased at a total cost of P25,200. In addition, 7,100 units of c. Internally developed goodwill is capitalized, while purchased goodwill is

K-45 were used during the month; however, the standard quantity allowed for expensed

actual production is 6,900 units. d. Both internally developed goodwill and purchased goodwill are capitalized

46. The price variance, if materials are recorded at standard cost (price): 51. Which models are allowed to be used by the private operator for build-operate-

a. P1,200 unfavorable c. P1,200 unfavorable transfer (BOT) schemes under IFRIC 12?

b. P1,420 unfavorable d. P1,420 unfavorable I - Financial Asset model III - Property, Plant & Equipment model

II - Intangible Asset model

47. The price variance, if materials are recorded at actual cost (price): a. I and II

a. P1,200 unfavorable c. P1,200 unfavorable b. I and III

b. P1,420 unfavorable d. P1,420 unfavorable c. II and III

d. I, II and III

48. The modified accrual basis under the New Government Accounting System

(NGAS) prescribes that 52. The application of factory overhead costs under job order costing would be

a. Expenses are recognized as paid reflected in the general ledger as an increase in

b. Expenses are recognized as paid except when a specific law requires a. Factory overhead control

otherwise b. Cost of goods sold

c. Expenses are recognized as incurred c. Work in process

d. Expenses are recognized as incurred except when a specific law requires d. Finished goods

otherwise

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

53. A Philippine importer that purchases merchandises from a foreign firm’s foreign 57. What are two major classification of government income under NGAS?

current unit (FCU) would be exposed to a net exchange gain on the unpaid balance a) National and local income

if the b) General and specific income

a. Peso weakened relative to the FCU and the FCU was the denominated c) Regular and specific income

currency d) Internal and external income

b. Peso weakened relative to the FCU and the peso was the denominated 58. Which of the following is among those listed under Pas 29 as indicators of

currency hyperinflation according to PAS 29?

c. Peso strengthened relative to the FCU and the FCU was the denominated a) People prefer to keep their wealth in monetary assets

currency b) People prefer to keep their wealth in relatively stable foreign currency

d. Peso strengthened relative to the FCU and the peso was the denominated c) Interest rates, wages and pries are not linked to a price index

currency d) The cumulative inflation rate over five years exceeds or is approaching

100%

54. For which type of hedge are changes in fair value deferred and amortized as an 59. Under PAS 11, when it is probable that total contract costs on a fixed price

equity adjustment? construction contract will exceed total contract revenue, the expected loss should

a) Cash flow hedge be

b) Operating hedge a) Set off against profit of other construction contract where available

c) Fair value hedge b) Recognized as an expense immediately, unless revenue to date exceeds

d) Notional value hedge costs to date

55. For nonprofit organization, contributions are reported in the Statement of c) Apportioned to the years of the contract according to the percentage of

Activities using all of the following categories, EXCEPT: completion method

a) Unrestricted d) Recognized as an expense immediately

b) Board-restricted 60. In partnership

c) Temporarily restricted a) Management consists of the board of directors

d) Permanently restricted b) Profits are always divided equally among partners

56. The consideration transferred in a business combination is measured as the fair c) Dissolution results when a partner leaves the partnership

value of the: d) No partner is liable for more than a proportion of the company’s debts

a) Net assets acquired 61. Under PFRS 4, it refers to a party that has a right to compensation under an

b) Cost directly attribute to the combination insurance contract if an insured event occurs.

c) Consideration given only a) Cedant

d) Consideration given plus directly attribute costs b) Insurer

c) Reinsurer

d) Policyholder

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

62. Under PFRS 10, when a parent loss control o a subsidiary, it must recognize any 67. Given a hyperinflationary economy under PAS 29, which of the following

investment retained in the former subsidiary at elements of the statement of financial position is not restated using the general

a) Carrying amount price index?

b) Fair value, with any gain or loss recognized in profit or loss a) Monetary and nonmonetary assets

c) Fair value, with any gain or loss recognized in other comprehensive b) Monetary assets and liabilities

income c) Nonmonetary assets and liabilities

d) Original acquisition cost, adjusted for any dividend received from d) Nonmonetary assets and liabilities

subsidiary 68. When accounting for a business combination a contingent liability is recognized

63. Under PAS 21, gains and losses from both foreign currency transactions and if:

translation of foreign operations can be presented in the a. It is a present obligation that gas failed to meet the recognition criteria

a) Balance sheet b. Its fair value can be measure reliably

b) Income statement c. It is a possible obligation and it Is probable that it will occur

c) Statement of changes in equity d. It is probable that an outlaw of resources may occur in order to the settle

d) Statement of comprehensive income the obligation

64. In process costing, units receievd by a department from another department is 69. In standard costing, an unfavorable price variance occurs because of

treated by receiving department as a) Price increases on raw materials

a) Raw materials b) Price decreases on raw materials

b) Work in process c) Less than anticipated levels of waste in the manufacturing process

c) Finished goods d) More than anticipated levels of waste in the manufacturing process

d) Equivalent units 70. Which is NOT a major classification of government expenses?

65. A “statement of functional expenses” is required for which of the following a) Personal services c) Selling and administrative expenses

nonprofit organizations? b) Financial expenses d) Maintenance & other operating expenses

a) College

b) Hospital

c) Performing arts organizations

d) Voluntary health and welfare organization

66. What is the CORRECT accounting for Joint Arrangements?

a) All joint arrangements are accounted for under PAS 28.

b) Joint arrangements classified as joint ventures are accounted for under

PFRS 11.

c) Joint arrangements classified as joint ventures are accounted for under

PAS 28.

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

AFAR (solution to Final Preboard - 31st batch) FER, 12/12/x4 P.90

FER, 12/31/x4 P.93

1. C - P35,374 - refer to No.2 AJE:

2. C - P17,687 Forward Contact receivable 3,000

Unadjusted capital of CC…………………………………………………………….. P 33,000 Foreign Exchange Gain 3,000

Add (deduct): adjustments- Revalue forward contract:

Allowance for doubtful accounts (3% x P14,200)………………… ( 426) P3,000 = 100,000 FCU x (P.93 - P.90) change in forward rates

Increase in merchandise inventory (P23,000 - P20,000)……… 3,000

Prepaid salary…………………………………………………………………….. 600 Foreign Exchange Loss 10,000

Accrued rent expense…………………………………………………………. ( 800) Account Payable 10,000

Adjusted capital balance of CC……………………………………………………. P 35,374 Revalue foreign currency payable:

Divided by: Capital interest of CC……………………………………………….. 2/3 P10,000 = 100,000 FCU x (P.98 - P.88) change in spot rates

Total capital of the partnership…………………………………………………… P 55,061

Less: Adjusted capital balance of CC……………………………………………. 35,374 4. D - (P.87 - P.92) x 100,000 = P5,000 loss

Capital balance of DD…………………………………………………………………. P 17,687 5. B

Hedge of a Firm Commitment:

3. B Value FEC based on changes in forward rate.

Manage an exposed position: AJE:

Value the forward exchange contract (FEC) at its fair value, measured by Forward Contract Receivable 3,000

changes in the forward exchange rate (FER). Note that the question asks only Foreign Exchange Gain 3,000

for the effect on income from the forward contract transaction: thus, any Revalue forward contract, using the forward rates.

effect on income from the foreign currency denominated account payable is

not included in the answer. Foreign Exchange Loss 3,000

Firm Commitment 3,000

Recognize loss on firm commitment.

Again, note that the question asks only about the effect on income from the

forward contract, not the underlying firm commitment portion of the transaction

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

6. B 8. C - refer to No. 7

Speculation: 9. A

Value forward exchange contract at fair value based on changes in the (1) The peso is the functional currency, so a remeasurement (or temporal

forward rate method) is appropriate. Cash and accounts receivable are monetary assets

AJE: remeasured at current exchange rate of P47,500 and P95,000, respectively.

Forward Contract Receivable 3,000 Inventory is a nonmonetary asset (carried at market value) are remeasured

Foreign Exchange Gain 3,000 at the current exchange rate of P76,000. Land and equipment, both

7. A nonmonetary assets (carried at cost) are remeasured at the historical

C W N Total exchange rate of P54,000 and P135,000, respectively.

Capital, 1/1/x4 100,000 150,000 200,000 450,000 (2) Because the functional currency is the local currency, a translation (or

Net Income - 20x4 29,000 63,000 58,000 150,000 current rate method is required. All assets accounts are translated at current

Withdrawal - personal (12,000) (12,000) (12,000) (36,000) rates.

Capital, 12/31/x4 117,000 20,100 24,600 564,000 10. B

Ding Laurel Ezzard Tillman Total

Net Income - 20x4 C W N Total Capital before realization 60,000 67,000 17,000 96,000 240,000

10% interest on 10,000 15,000 20,000 45,000 Loss on sale (4:2:2:2) (52,300) (26,400) (26,400) (26,400) (132,000)

beginning capital 7,200 40,600 (9,400) 69,600 108,000

Salary - 10,000 - 10,000 Possible insolvency loss (4:2:2) (4,700) (2,350) (9,400) (2,350) -0-

Safe payments 2,500 38,250 0 67,250 103,000

20% : 40% : 40% 19,000 33,000 38,000 95,000

29,000 63,000 58,000 150,000

11. D

(Note: For financial accounting purposes, the installment sales method is not

Capital, 1/1/x5 117,000 201,000 246,000 564,000

used, and the full gross profit is recognized in the year of sale, because

Net Income 34,420 75,540 70,040 180,000

collection of the receivable is reasonable assured.)

Withdrawal - personal (12,000) (12,000) (12,000) (36,000) Finley Company

Capital, 12/31/x5 139,420 264,540 304,040 708,000 Computation of Income Before Income Taxes

On Installment Sale Contract

Net Income - 20x5 117,000 201,000 246,000 564,000 For the Year Ended December 31, 20x3

10% interest a beginning 34,420 75,540 70,040 180,000 Sales P 4,584,000

capital Cost of Sales 3,825,000

Salary (12,000) (12,000) (12,000) (36,000) Gross Profit 759,000

20% : 40% : 40% 139,420 264,540 304,040 708,000 Interest Revenue (Schedule I) 328,320

Income before Income Taxes P 1,087,320

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

Schedule I 15. B

Computation of Interest Revenue on Unearned franchise fee 36,000

Installment Sale Contract Franchise fee revenue 36,000

Cash selling price (sales) P 4,584,000 16. A

Payment made on January 1, 20x3 936,000 Cash 6,000

Balance outstanding at 12/31/x3 3,648,000 Notes receivable 30,000

Interest rate 9% Franchise fee revenue 36,000

Interest Revenue P 328,320

17. A - same with No. 16

12. A - P2,040,000 - (P 1,000,000 + P 1,000,000) = P40,000. 18. B Combined cost of sales P 160,000

13. A - Admission by purchase, The implied value of the company is P900,000 Less: Intercompany sales revenue 110,000

(P270,000/30%). Since the money is going to the partners rather than into the Add: Unrealized profit taken out of inventory

business, the capital total is P490,000, before realigning the balances. Hence, (75%) x (35,000) = 26,250

goodwill of P410,000 must be recognized based on the implied value (P900,000 - Consolidated cost of sales P 76,250

P490,000). This goodwill is assumed to represent unrealized business gains and is

attributed to the original partners according to their profit and loss ratio. They will 19. D

then each convey 30 percent ownership of the P900,000 partnership to Darrow for Cost method: P40,000 x 70% = P28,000,dividend income

a capital balance of P270,000. Equity Method: (P115,000 x 70%) - P26,250 = P54,250, equity in subsidiary income

14. D 20. D

Sales (P100,000 - P33,000 + P50,000)……………………………………….. P117,000 If 10,000 shares were issued with a P5 par value, then the APIC would P78,850 (c)

Less: Cost of goods sold: (c)

Inventory, beg. [P15,000 + (P5,500/110%) or (P5,500 - P500)] P20,000 Unadjusted assets (P10,500 + P15,900 + P42,000 + P60,000)…….. P 128,400

Add: Purchases (P50,000 + P7,000)…………………………………… 57,000 Add (deduct): adjustments:

COGAS……………………………………………………………………………… P77,000 Allowances for doubtful accounts………………………………………. ( 1,200)

Less: Inventory, end [P11,000 + P1,050 + Short-term prepayments……………………………………………………. 800

(P6,000 - P1,050)/110%]…………………………………………. 16,550 60,450 Revaluation of inventory (P48,000 - P42,000)…………………….. 6,000

Gross profit…………………………………………………………………………….. P 56,550 Revaluation of equipment (P72,000 - P60,000)…………………… 12,000

Less: Expenses (P20,000 + P6,000 + P5,000)…………………………….. 31,000 Adjusted asset balance………………………………………………………………..P146,000

Combined Net income…………………………………………………………… .. P 25,550 Less: Liabilities (P16,400 + P750)…………………………………………………. 17,150

Adjusted net assets………………………………………………………………………P128,850

Less: Common stock, P5 par x 10,000 shares……………………………….. 50,000

Additional paid-in capital……………………………………………………………… P 78,850

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

21. B 26. A

Home Office Books Branch Books Installment Sales Method:

(Branch Current- (Home Office Current- 20x3 Sales: P240,000 x 25/125 P 48,000

Dr. balance) Cr. balance) 20x4 Sales: P180,000 x 28/128 39,375

Unadjusted balance P590,000 P506,700 Realized Gross Profit on Installment Sales P 87,375

Add (deduct) adjustments: Cost Recovery Method:

Remittance (40,000) 20x3 Cost: P480,000/ 1.25 P 384,000

Returns (15,000) Less: Collections in 20x3 140,000

Error by the branch 300 Collections in 20x4 240,000

Expenses - branch 28,000 Unrecovered Cost, 12/31/20x4 P 4,000

Adjusted balance P535,000 P535,000

Under the cost recovery method, no income is recognized on a sale until the cost

22. B of the item sold is recovered through cash receipts. All cash receipts, both interest

P(12,500,000) = P10,000,000 - (P1,500,000 + P35,000,000 + P2,000,000 + and principal portions are applied first to the cost of the items sold. Then, all

P10,000,000 + P4,000,000 - P30,000,000). subsequent receipts are reported as revenue. Because all costs have been

recovered, the recognized revenue after the cost recovery represents income

23. C (interest and realized gross profit). This method is used only when the

The correcting entry, within the measurement period is: circumstances surrounding a sale are so uncertain that earlier recognition is

Goodwill 2,000,000 impossible.

Patents 2,000,000

27. a or c

24. A Combined equipment amounts P 1,050,000

The correcting entry, is: Less: Gain on sale 25,000

Gain on acquisition 2,000,000 Consolidated equipment balance P 1,025,000

Liabilities 2,000,000

Combined Accumulated Depreciation P 250,000

25. D Less: Depreciation on gain 5,000

Consolidated Accumulated Depreciation P 245,000

28. C - P251,000 = .20[(P956,000 + P239,000) + (P190,000 - P5,000 - P125,000)]

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

29. C 31. D

Trade-in allowance P43,200 Materials: P 5,000 + P 300…………………………………………………. P 5,300

Less: MV of trade-in allowance: Direct labor……………………………………………………………………….. 14,000

Estimated resale price after reconditioning costs P36,000 Applied factory overhead (150% x P14,000)……………………… 21,000

Less: Reconditioning costs 1,800 P40,300

Normal profit (15% x P36,000) 5,400 28,800 Since, the allowance for rework was included in the manufacturing overhead

Over-allowance P14,400 budget, therefore, the rework cost should be charged to factory overhead

control.

Installment sales P122,400

Less: Over-allowance 14,400 32. A - the total maintenance cost is determined by adding overhead costs

Adjusted Installment Sales P108,000 incurred in the Maintenance Department plus any share in the Utilities

Less: Cost of Installment Sales 86,400 Department because of services provided to the Utilities Department. Note:

Gross profit P 21,600 Service provided to (not “by”).

Gross profit rate: P21,600/P108,000 20%

Realized gross profit: 33. C - (P300,000 x ¼ = P75,000, ending inventory x (P300,000 -

Down payment P 7,200 P250,000)/P300,000 = P12,500.

Trade-in (at market value) 28,800

Installment collections: 34. D

(P108,000 - P28,800 - P7,200) / 10mos. X 3mos. 21,600 35. C

Total collections in 2008 P 57,600 The P5,000,000 are considered temporary restricted since it has a purpose

x: Gross profit rate 20% which have not yet been fulfilled.

Realized gross profit P 11,520

30. A The P2,000,000 principal which had to be retained (meaning to be held in

Job 102: perpetuity - permanent) is classified as permanently restricted, while the

Direct materials……………………………………………….. P 12,000 dividends is classified as temporary restricted because of purpose restriction

Direct labor…………………………………………………….. 2,000 but to no avail, amount is not given.

Overhead:

Machine Setup: P20,000/200 = P100 x 2……….. P 200 36. C

Inspection: P130,000/6,500 = P20 x 10…………. 200 MV of By-product Zest……………………………………………… P 5

Material Moves: P80,000/8,000 = P10 x 10…… 100 Less: Selling and administrative expense………………….. 2

Engineering: P50,000/1,000 = P50 x 50…………. 2,500 3,000 Operating profit……………………………………………….. 1

Production/Manufacturing Costs………………………….. P 17,000 Share in Joint Cost per unit……………………………………….. P 2

Divided by: Units completed………………………………… 50 x: Units produced………………………………………………………. 1,000

Cost per unit under ABC……………………………………….. P 340 Share in joint cost……………………………………………………… P 2,000

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

37. A 41. C

Hyp. MV Jt. Costs P4.00 x AQ) - (2,100 x P4.00) = P500 U

Pep: 5,000 x (P 50-P 10)= P 200,000 x 50% = P 100,000 AQ = 2,225

Vim: 4,000 x (P 40-P 5) = 140,000

P 340,000 P 170,000* 42. D

Joint Costs…………………………………………………………………. P172,000 Since both contributions can be utilized (purpose can be fulfilled) within the

Less: Joint costs allocated to By-product……………………. 2,000 current year (before the cut off date, 12/31/2005), then, both of them should

Joint costs to joint products………………………………………. P170,000 also be reclassified as Unrestricted Net Assets.

43. C

Sales of Pep: (P50 x 5,000)…………………………………………. P250,000

Less: Cost of Sales: Raw-and-In-Process Finished Goods Cost of Goods Sold

Joint costs……………………………………P 100,000 320,000 320,000 320,000 1,011,200 1,011,200

Further processing cost………………. 50,000 150,000 704,000 4,000

Gross profit………………………………………………………………… P100,000

Conversion Cost 1,024,000 1,011,200 1,015,200

38. D 708,000 704,000 12,800*

39. B *P1,024,000/16,000 = P64 x (16,000-15,800) = P12,800.

Direct materials inventory, June 1, 2016……………… P 48,600 4,000 4,000

Add: Purchases……………………… 60,000

Direct materials available for use……………… P 108,600 44. B - refer to No. 43

Less: Direct materials inventory, June 30, 2016………. 51,000 45. C - [P50,000 - (P20,000 + P40,000) + P45,000] = P35,000

Direct materials used………………….. P 57,600 46. A - MPPV: (P25,200/6,000 - P4.20-P4 = P.20 unf) x 6,000 units = P1,200

Direct labor (9,900 hours x P5/hour)……………… 49,500 unfavorable

Applied factory overhead (9,900 hours x P2.5/hour)…… 24,750 47. B - MPuV: P.20 unfavorable x 7,100 units = P 1,420 unfavorable

Manufacturing cost……………………………. P 131,850 48. D

Add: Work-in-process, June 1, 2016…………………. 10,710 49. A

Total work placed in process………………. P 142,560 50. A

Less: Work-in-process, June 30, 2016……………………… 24,210 51. A

Cost of goods manufactured……………………………. P 118,350 52. C

53. C

40. A 54. A

Number of units = P33,600/16.00 = 2,100 55. B

[AH - (2,100 x 2)] x P2.60 = P2,080 U; AH = 5,000 56. C

57. B

Downloaded by MAG MAG (rga22412@gmail.com)

lOMoARcPSD|8422790

58. B

59. D

60. C

61. D

62. B

63. D

64. A

65. D

66. C

67. B

68. B

69. A

70. c

Downloaded by MAG MAG (rga22412@gmail.com)

You might also like

- ABC Co Adjusted Working CapitalDocument2 pagesABC Co Adjusted Working CapitalRio De LeonNo ratings yet

- Ap 01 Overview of The Audit ProcessDocument6 pagesAp 01 Overview of The Audit ProcessYoung MetroNo ratings yet

- CA51019 Departmentals Quiz 1 and 2Document16 pagesCA51019 Departmentals Quiz 1 and 2artemisNo ratings yet

- Chapter 4, AccountingDocument13 pagesChapter 4, AccountingIyadAitHou100% (1)

- Solution Chapter 17 PDFDocument87 pagesSolution Chapter 17 PDFnashNo ratings yet

- Petty Cash, Part 3 - Kuya Joseph's BlogDocument5 pagesPetty Cash, Part 3 - Kuya Joseph's BlogCM LanceNo ratings yet

- United Coconut Planters Bank v. Planters Produts, Inc.Document3 pagesUnited Coconut Planters Bank v. Planters Produts, Inc.Jay jogsNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC) policies on insured depositsDocument5 pagesPhilippine Deposit Insurance Corporation (PDIC) policies on insured depositsAngelo Raphael B. DelmundoNo ratings yet

- Practice Problems With Answers - Process Costing Average MethodDocument3 pagesPractice Problems With Answers - Process Costing Average MethodAndrea ValdezNo ratings yet

- Mutuum CommodatumDocument12 pagesMutuum CommodatumArceli MarallagNo ratings yet

- Practical Accounting QuizzesDocument3 pagesPractical Accounting QuizzesMichelle ValeNo ratings yet

- Auditing Theory Reviewer-BobadillaDocument483 pagesAuditing Theory Reviewer-BobadillaJanelle Ricci MariposqueNo ratings yet

- Long Quiz 2Document8 pagesLong Quiz 2KathleenNo ratings yet

- FAR: KEY ASPECTS OF PROPERTY, PLANT AND EQUIPMENT ACCOUNTINGDocument13 pagesFAR: KEY ASPECTS OF PROPERTY, PLANT AND EQUIPMENT ACCOUNTINGAl ChuaNo ratings yet

- FAR Derivatives BasicsDocument9 pagesFAR Derivatives BasicsAl ChuaNo ratings yet

- Psa 500 NoteDocument21 pagesPsa 500 NoteMark Kyle P. AndresNo ratings yet

- Saviour Exam 1Document1 pageSaviour Exam 1BLACKPINKLisaRoseJisooJennieNo ratings yet

- CASE STUDY 1 - Demetillo, Emnace, NepomucenoDocument15 pagesCASE STUDY 1 - Demetillo, Emnace, NepomucenoCheveem Grace Emnace100% (1)

- NegoDocument6 pagesNegoIvhy Cruz EstrellaNo ratings yet

- Law003 Ease of Doing Business Act QuestionsDocument5 pagesLaw003 Ease of Doing Business Act Questionskgandamarket.jeasselNo ratings yet

- FAR Problem Quiz 1Document6 pagesFAR Problem Quiz 1Ednalyn CruzNo ratings yet

- Intermediate Accounting Exam QuestionsDocument2 pagesIntermediate Accounting Exam QuestionsBLACKPINKLisaRoseJisooJennieNo ratings yet

- ICARE Preweek APDocument15 pagesICARE Preweek APjohn paulNo ratings yet

- Urdaneta City University College of Business Management and Accountancy San Vicente West, Urdaneta City 2428 Pangasinan, PhilippinesDocument13 pagesUrdaneta City University College of Business Management and Accountancy San Vicente West, Urdaneta City 2428 Pangasinan, Philippinesthalia alfaroNo ratings yet

- Prelims - AuditDocument15 pagesPrelims - AuditJayson CerradoNo ratings yet

- CPA Review Philippines Financial Accounting Preweek LectureDocument6 pagesCPA Review Philippines Financial Accounting Preweek LecturepompomNo ratings yet

- Acquire To Retire Discussion DocumentDocument11 pagesAcquire To Retire Discussion DocumentShrasti VarshneyNo ratings yet

- Partnership LiquidationDocument2 pagesPartnership LiquidationJapsNo ratings yet

- CPA Review - Partnership Formation OperationsDocument7 pagesCPA Review - Partnership Formation OperationsMikael James VillanuevaNo ratings yet

- Exercise No.4 Bus. Co.Document56 pagesExercise No.4 Bus. Co.Jeane Mae BooNo ratings yet

- AFAR-07 (Home-Office & Branch Accounting)Document7 pagesAFAR-07 (Home-Office & Branch Accounting)mysweet surrenderNo ratings yet

- Auditing Theory Comprehensive ReviewerDocument37 pagesAuditing Theory Comprehensive ReviewerElaine ALdovinoNo ratings yet

- Quiz 1 Inventory and InvestmentsDocument7 pagesQuiz 1 Inventory and InvestmentsMark Lawrence YusiNo ratings yet

- CH 2 (WWW - Jamaa Bzu - Com)Document6 pagesCH 2 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (1)

- App 03 ADocument43 pagesApp 03 Adoyeonkim21No ratings yet

- 2021 2022 1st Sem Prelim ExamDocument2 pages2021 2022 1st Sem Prelim ExamPHILLIT CLASSNo ratings yet

- 01 Gen Prov & Proc OrgDocument63 pages01 Gen Prov & Proc OrgPatrick Maguyon VillafuerteNo ratings yet

- AudithaccDocument3 pagesAudithaccTk KimNo ratings yet

- At.3213 - Application of Audit Process To Transaction Cycles Part 1Document9 pagesAt.3213 - Application of Audit Process To Transaction Cycles Part 1Denny June CraususNo ratings yet

- This Study Resource Was: Miscellaneous TopicsDocument2 pagesThis Study Resource Was: Miscellaneous Topicsbbrightvc 一ไบร์ทNo ratings yet

- General Partnership Characteristics & FormationDocument6 pagesGeneral Partnership Characteristics & FormationAIENNA GABRIELLE FABRONo ratings yet

- Obligations and Contracts HWDocument22 pagesObligations and Contracts HWJessamyn DimalibotNo ratings yet

- A7 Quiz 3Document26 pagesA7 Quiz 3Garcia Alizsandra L.No ratings yet

- Aud2 CashDocument6 pagesAud2 CashMaryJoyBernalesNo ratings yet

- Quiz2 ParCorDocument8 pagesQuiz2 ParCorStephanie gasparNo ratings yet

- Audprob 9Document2 pagesAudprob 9lovely abinalNo ratings yet

- CamScanner Scans PDFs QuicklyDocument4 pagesCamScanner Scans PDFs QuicklyMarvic CabangunayNo ratings yet

- Bouncing Checks Law: Batas Pambansa Bilang No. 22Document8 pagesBouncing Checks Law: Batas Pambansa Bilang No. 22Chara etangNo ratings yet

- ABC Co Acquisition of XYZ Inc ConsolidationDocument3 pagesABC Co Acquisition of XYZ Inc ConsolidationLabLab ChattoNo ratings yet

- MCQ practice test on accounting conceptsDocument12 pagesMCQ practice test on accounting conceptsGuinevereNo ratings yet

- Financial Accounting and Reporting Finals ReviewerDocument12 pagesFinancial Accounting and Reporting Finals ReviewerNiccoRobDeCastroNo ratings yet

- Qualifying Exam - FAR - 1st YearDocument11 pagesQualifying Exam - FAR - 1st YearKristina Angelina ReyesNo ratings yet

- Junior Philippine Institute of Accountants BA 99.1 First Long Exam ReviewDocument6 pagesJunior Philippine Institute of Accountants BA 99.1 First Long Exam ReviewMelissa FelicianoNo ratings yet

- PREFINAL EXAMINATIONS MANAGEMENT CONSULTANCYDocument3 pagesPREFINAL EXAMINATIONS MANAGEMENT CONSULTANCYAbraham Jr. ManansalaNo ratings yet

- Chapter 4-Differential Analysis (Q)Document10 pagesChapter 4-Differential Analysis (Q)Vanessa HaliliNo ratings yet

- Financial Accounting Part 1Document11 pagesFinancial Accounting Part 1christineNo ratings yet

- Auditing Theory: Quiz 2Document4 pagesAuditing Theory: Quiz 2KIM RAGANo ratings yet

- Accounting for Business Combinations MidtermDocument8 pagesAccounting for Business Combinations MidtermNanya BisnestNo ratings yet

- ApaDocument2 pagesApaPaula Villarubia100% (1)

- ReSA B46 AFAR Final PB Exam Questions Answers SolutionsDocument24 pagesReSA B46 AFAR Final PB Exam Questions Answers SolutionsJohair BilaoNo ratings yet

- Objectives: Measures of Correlation and Regression AnalysisDocument16 pagesObjectives: Measures of Correlation and Regression AnalysisMAG MAGNo ratings yet

- Chapter 2 - Pre1Document21 pagesChapter 2 - Pre1MAG MAGNo ratings yet

- Chap 13Document78 pagesChap 13MAG MAG100% (1)

- Module 7 - Internal ControlDocument22 pagesModule 7 - Internal ControlMAG MAGNo ratings yet

- Module 7 - Internal ControlDocument22 pagesModule 7 - Internal ControlMAG MAGNo ratings yet

- MCQ - Intro To AuditDocument13 pagesMCQ - Intro To Auditemc2_mcv74% (27)

- Home Office & Branch AccountingDocument13 pagesHome Office & Branch AccountingGround ZeroNo ratings yet

- Independe NT T-Test: - The Independent T-Test Compares Two Means Have Come From Different GroupsDocument23 pagesIndepende NT T-Test: - The Independent T-Test Compares Two Means Have Come From Different GroupsMAG MAGNo ratings yet

- MCQ - Assurance ServicesDocument13 pagesMCQ - Assurance Servicesemc2_mcv67% (30)

- Consideration of Internal ControlDocument10 pagesConsideration of Internal ControlMAG MAGNo ratings yet

- Consideration of Internal ControlDocument10 pagesConsideration of Internal ControlMAG MAGNo ratings yet

- Midterm Exam Review: Property, Plant and Equipment CalculationsDocument11 pagesMidterm Exam Review: Property, Plant and Equipment CalculationsMAG MAGNo ratings yet

- Auditing Theory: A-433 and F432 Fundamentals of Assurance EngagementsDocument9 pagesAuditing Theory: A-433 and F432 Fundamentals of Assurance EngagementsJane Michelle EmanNo ratings yet

- Audit Sampling TechniquesDocument17 pagesAudit Sampling TechniquesMAG MAGNo ratings yet

- MCQ - Assurance ServicesDocument13 pagesMCQ - Assurance Servicesemc2_mcv67% (30)

- 11 Home Office and BranchDocument3 pages11 Home Office and BranchabcdefgNo ratings yet

- Auditing Theory: A-433 and F432 Fundamentals of Assurance EngagementsDocument9 pagesAuditing Theory: A-433 and F432 Fundamentals of Assurance EngagementsJane Michelle EmanNo ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument133 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFLote Marcellano71% (14)

- Questionnaire PRACTICAL ACCOUNTINGDocument8 pagesQuestionnaire PRACTICAL ACCOUNTINGJusthine RofuliNo ratings yet

- Quiz 2 AnswersDocument7 pagesQuiz 2 AnswersLayla MainNo ratings yet

- Lesson 3Document7 pagesLesson 3Shane Audrey MercadoNo ratings yet

- Business LawDocument51 pagesBusiness LawjacobpulikodenNo ratings yet

- PAS 23 - Borrowing Cost PDFDocument16 pagesPAS 23 - Borrowing Cost PDFGeoff MacarateNo ratings yet

- Test Bank Aa Part 2 2015 EdDocument143 pagesTest Bank Aa Part 2 2015 EdNyang Santos72% (25)

- Property, Plant and Equipment: Problem 28-1 (AICPA Adapted)Document21 pagesProperty, Plant and Equipment: Problem 28-1 (AICPA Adapted)Jay-B Angelo67% (3)

- Business Ethics Lesson on Principles, Morality and Social ResponsibilityDocument5 pagesBusiness Ethics Lesson on Principles, Morality and Social ResponsibilityMAG MAGNo ratings yet

- Chapter 9 - Interim Financial ReportingDocument8 pagesChapter 9 - Interim Financial ReportingXiena0% (1)

- Prevent Fraud at ABC Inc1. L2. B 3. G4. G5. I 6. B7. D8. I9. C10. O11. K 12. P13. P14. O15. MDocument2 pagesPrevent Fraud at ABC Inc1. L2. B 3. G4. G5. I 6. B7. D8. I9. C10. O11. K 12. P13. P14. O15. MMAG MAGNo ratings yet

- Basic Principles of TaxationDocument45 pagesBasic Principles of TaxationHyviBaculiSaynoNo ratings yet

- Chapter - 2Document5 pagesChapter - 2MAG MAGNo ratings yet

- Applications Invited For Stratup Agri-Business IncubationDocument11 pagesApplications Invited For Stratup Agri-Business IncubationAjey Kulkarni100% (1)

- RASCI Qualifications Pack 0101 - Retail Store Ops AssistantDocument52 pagesRASCI Qualifications Pack 0101 - Retail Store Ops AssistantAbhijit DasNo ratings yet

- Chapter 9 Investments QuizDocument5 pagesChapter 9 Investments QuizMs Vampire100% (1)

- Attachment Report ContinuousDocument11 pagesAttachment Report ContinuousMaina100% (1)

- Microeconomics (Applied Managerial Economics) :: Petersen, Lewis and Jain Chapter 01Document7 pagesMicroeconomics (Applied Managerial Economics) :: Petersen, Lewis and Jain Chapter 01Aditya ZananeNo ratings yet

- Chapter 7 E-Business SystemsDocument33 pagesChapter 7 E-Business SystemsParvez AliNo ratings yet

- 12th Economics Question Papers 2023Document8 pages12th Economics Question Papers 2023Renuka ManeNo ratings yet

- Transportation Modeling - NWM & LCMDocument16 pagesTransportation Modeling - NWM & LCMkashi nath DebNo ratings yet

- Introduction To Multicultural DiversityDocument4 pagesIntroduction To Multicultural DiversityChandria SimbulanNo ratings yet

- African Nations Cup ProjectDocument15 pagesAfrican Nations Cup ProjectAgbor AyukNo ratings yet

- REQUIREMENTS FOR ITR - 2019 CorporationDocument3 pagesREQUIREMENTS FOR ITR - 2019 CorporationSally SiaotongNo ratings yet

- How To Load Credit CardsDocument20 pagesHow To Load Credit Cardsleninadebra10100% (1)

- Cost Sheet Format To CustomersDocument32 pagesCost Sheet Format To Customersthetrilight2023No ratings yet

- SHALINI CV PDFDocument2 pagesSHALINI CV PDFSanjay JindalNo ratings yet

- Jobdescription-Comsense Consulting: About The CompanyDocument2 pagesJobdescription-Comsense Consulting: About The CompanyMayank PatelNo ratings yet

- 537-2 DiffDocument43 pages537-2 DiffMohammad HassanNo ratings yet

- Computer Training InstituteDocument10 pagesComputer Training InstituteaefewNo ratings yet

- ResumeDocument2 pagesResumechantellrambergNo ratings yet

- WIDGB2 Utest Skills 7B PDFDocument2 pagesWIDGB2 Utest Skills 7B PDFАнастасияNo ratings yet

- Lean Manufacturing Key BenefitsDocument12 pagesLean Manufacturing Key BenefitsSundaravignesh 1809No ratings yet

- De Leon - F-Quiz - 6.7.2023GCDocument7 pagesDe Leon - F-Quiz - 6.7.2023GCSir AlexNo ratings yet

- CHECK - Chapter 12 TCD Answers PDFDocument4 pagesCHECK - Chapter 12 TCD Answers PDFIbrahim Khan Arif MehmoodNo ratings yet

- CBSE Class 11 Economics Sample Paper 1 1Document18 pagesCBSE Class 11 Economics Sample Paper 1 1Smart shopNo ratings yet

- Database AdminDocument118 pagesDatabase Adminvivekpandey99No ratings yet

- Proposal KaiaDocument18 pagesProposal KaiaWahyu AdezzoneNo ratings yet

- Human Resource Management Research Paper PDFDocument5 pagesHuman Resource Management Research Paper PDFqqcxbtbndNo ratings yet

- Hazardous Spill PlanDocument8 pagesHazardous Spill PlanChandan ChamanNo ratings yet

- CVP AnalysisDocument2 pagesCVP Analysissakura harunoNo ratings yet

- OSD Systems Engineering GuidebookDocument240 pagesOSD Systems Engineering GuidebookJeff GardnerNo ratings yet

- Bid-Ask Spread and Its EffectsDocument32 pagesBid-Ask Spread and Its EffectsTom WongNo ratings yet