Professional Documents

Culture Documents

Indian Income Tax Return Verification Form: Form Itr-V Assessment Year

Uploaded by

L ROMANANDA SINGHOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Income Tax Return Verification Form: Form Itr-V Assessment Year

Uploaded by

L ROMANANDA SINGHCopyright:

Available Formats

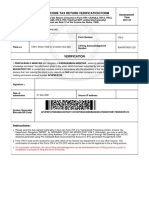

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment

FORM Year

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-V ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically] 2021-22

(Please see Rule 12 of the Income-tax Rules, 1962)

Name KSHETRIMAYUM OPEN SINGH

PAN EYKPS0856N Form Number ITR-1

139(5) Revised- Return revised after filing e-Filing Acknowledgement

Filed u/s 522626860160921

original return Number

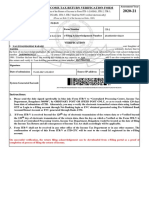

VERIFICATION

I, KSHETRIMAYUM OPEN SINGH son/ daughter of KSHETRIMAYUM ACHOU SINGH , solemnly declare that to the best of

my knowledge and belief, the information given in the return which has been submitted by me vide acknowledgement number

522626860160921 is correct and complete and is in accordance with the provisions of the Income-tax Act, 1961. I further

declare that I am making this return in my capacity as Self and I am also competent to make this return and verify it. I am

holding permanent account number EYKPS0856N

Signature >

Date of

submission 16-Sep-2021 Source IP address 10.1.82.126

System Generated

Barcode/QR Code EYKPS0856N015226268601609214D7C1BE87C6B47326521E5A2BC498EA04FBDDD64

Instructions:

1. Please send the duly signed (preferably in blue ink) Form ITR-V to "Centralized Processing Centre, Income Tax

Department, Bengaluru 560500", by ORDINARY POST OR SPEED POST ONLY. Alternately, you may e-verify the

electronic transmitted return data using Aadhaar OTP or Login to e-Filing account through Net-Banking login or EVC

obtained generated using Pre-Validated Bank Account/Demat Account or EVC generated through Bank ATM.

2. Form ITR-V shall not be received in any other office of the Income-tax Department or in any other manner. The

confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail Id registered in the e-Filing account.

3. On successful verification, the return filing acknowledgement can be downloaded from e-Filing portal as a proof of

completion of process of filing the return of Income.

You might also like

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearsandhya dollyekkaNo ratings yet

- Form Itr-V Indian Income Tax Return Verification Form 2021-22Document1 pageForm Itr-V Indian Income Tax Return Verification Form 2021-22Chetanya VigNo ratings yet

- Indian Income Tax Return Verification Form 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Verification Form 2021-22: Assessment YearHarsha vardhan ReddyNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearShraddha JagadNo ratings yet

- Form Itr-V Indian Income Tax Return Verification Form 2021-22Document1 pageForm Itr-V Indian Income Tax Return Verification Form 2021-22Arihant SatpathyNo ratings yet

- Indian Income Tax Return Verification FormDocument1 pageIndian Income Tax Return Verification FormRahul BhanNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment Year 2021-22Document1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Year 2021-22Mayank JoshiNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearAnil kadamNo ratings yet

- Income Tax ReturnDocument1 pageIncome Tax ReturnalharamislamicfoundationNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearkeval limbasiyaNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearaccount patnaNo ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearVikas CheedellaNo ratings yet

- PDF 676646680170622Document1 pagePDF 676646680170622CE30 Sanket BadadeNo ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearGoutham Kumar'sNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNikhil SinghNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMurari AgarwalNo ratings yet

- Itrv EnglishDocument1 pageItrv Englishniko belicNo ratings yet

- Mohit ShuklaDocument1 pageMohit ShuklaVaibhav PandeyNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearBilalNo ratings yet

- PDF 579203040271223Document1 pagePDF 579203040271223Manivannan VNo ratings yet

- Nagji Badhabhai Rabari Itrv Ay 2020-21Document1 pageNagji Badhabhai Rabari Itrv Ay 2020-21B N MishraNo ratings yet

- Sunita RanaDocument1 pageSunita RanaVIKASH KUMARNo ratings yet

- PDF 334657210280923Document1 pagePDF 334657210280923Manish NirwanNo ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbhavya gowdaNo ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearTechwiser services and engineeringNo ratings yet

- Itr-V Adyps7344c 2023-24 149225400310723Document1 pageItr-V Adyps7344c 2023-24 149225400310723taxindia610No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormShyamala SubramanianNo ratings yet

- PDF 297442290260623Document1 pagePDF 297442290260623TAX INDIANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormDevesh Singh SenwalNo ratings yet

- PDF 994808580250722Document1 pagePDF 994808580250722ca.bhagirathbariNo ratings yet

- PDF 994551360250722Document1 pagePDF 994551360250722ca.bhagirathbariNo ratings yet

- PDF 523510460230922Document1 pagePDF 523510460230922Vikash KumarNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- Itr-V Amypm5266g 2023-24 151362850310723Document1 pageItr-V Amypm5266g 2023-24 151362850310723sunil jadhavNo ratings yet

- PDF 147397690310723Document1 pagePDF 147397690310723Rashi SrivastavaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVivek BajajNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormArun VeeraniNo ratings yet

- PDF 878054160291222Document1 pagePDF 878054160291222Barun DasNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormInderdeepNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormRaghu TNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formravi rajaNo ratings yet

- 2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvDocument1 page2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvRohan KapurNo ratings yet

- 2021 01 16 13 47 21 871 - 1610785041871 - XXXPC3129X - ItrvDocument1 page2021 01 16 13 47 21 871 - 1610785041871 - XXXPC3129X - ItrvDibyo ChatterjeeNo ratings yet

- PDF 919198870310723Document1 pagePDF 919198870310723sunil jadhavNo ratings yet

- Itr-V Elkpd1794p 2024-25 188420870250424Document1 pageItr-V Elkpd1794p 2024-25 188420870250424taxindia610No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormHarishNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument2 pagesItr-V: Indian Income Tax Return Verification FormMemories2022No ratings yet

- KiranDocument3 pagesKiransuneetbansalNo ratings yet

- 2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2Document1 page2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2sunny.likescatNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMahendra PatilNo ratings yet

- 2021 05 31 11 01 39 957 - 1622439099957 - Xxxpy5228x - ItrvDocument1 page2021 05 31 11 01 39 957 - 1622439099957 - Xxxpy5228x - Itrvjohnyadav.ryNo ratings yet

- J Itr 2022-23Document1 pageJ Itr 2022-23prabhjeet singh antalNo ratings yet

- 2021 01 08 20 23 43 556 - 1610117623556 - XXXPV9294X - ItrvDocument1 page2021 01 08 20 23 43 556 - 1610117623556 - XXXPV9294X - Itrvanusha.veldandiNo ratings yet

- 2021 02 13 18 38 02 527 - 1613221682527 - XXXPS3184X - Itrv PDFDocument1 page2021 02 13 18 38 02 527 - 1613221682527 - XXXPS3184X - Itrv PDFtavenderpal singhNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormBaby MazumdarNo ratings yet

- Sps. Carpo v. ChuamDocument13 pagesSps. Carpo v. ChuamEmma Ruby Aguilar-ApradoNo ratings yet

- People's Bank and Trust Co. v. Odom - Gab: Banking: Week 5 - 1Document41 pagesPeople's Bank and Trust Co. v. Odom - Gab: Banking: Week 5 - 1vmanalo16No ratings yet

- Incontinence Medical Supplies 1Document10 pagesIncontinence Medical Supplies 1sury koNo ratings yet

- Working Capital ManagementDocument65 pagesWorking Capital ManagementPranav PasteNo ratings yet

- The Interaction of Contract Law and Tort and Property Law in Europe A Comparative StudyDocument574 pagesThe Interaction of Contract Law and Tort and Property Law in Europe A Comparative StudyIrma Rahmanisa75% (4)

- Employee Master File Creation FormDocument4 pagesEmployee Master File Creation Formmuhammad younasNo ratings yet

- Unit - 2 IllustrationsDocument2 pagesUnit - 2 IllustrationsRakesh SriNo ratings yet

- A Critique of The Anglo-American Model of Corporate GovernanceDocument3 pagesA Critique of The Anglo-American Model of Corporate GovernanceSabrina MilaNo ratings yet

- Philippine Society of Mechanical Engineers: To: Ferdinand B. Sales, DirectorDocument2 pagesPhilippine Society of Mechanical Engineers: To: Ferdinand B. Sales, DirectorJImlan Sahipa IsmaelNo ratings yet

- Account Management & Client Services: Ashita Gupta 13PGDM136Document71 pagesAccount Management & Client Services: Ashita Gupta 13PGDM136Karan GuptaNo ratings yet

- chp03 CevapDocument3 pageschp03 CevapSundus AshrafNo ratings yet

- Brand ManagementDocument46 pagesBrand ManagementPayal AroraNo ratings yet

- Industry Analysis - Automobile (Group 4)Document16 pagesIndustry Analysis - Automobile (Group 4)Suyash RastogiNo ratings yet

- Tom Corley Rich Habits REPORT Goal SettingDocument7 pagesTom Corley Rich Habits REPORT Goal SettinggabrijelNo ratings yet

- Project Economy Group 5 Section 7 BFC 44602 Economy EngineeringDocument37 pagesProject Economy Group 5 Section 7 BFC 44602 Economy EngineeringfuadNo ratings yet

- Axis Offer Latter For SalariedDocument4 pagesAxis Offer Latter For Salariedyoursmanish8312No ratings yet

- Stock Price (EUR) Exchange RateDocument2 pagesStock Price (EUR) Exchange RateHoàng NhưNo ratings yet

- Guidelines For Corporate Strategic Audit ProjectDocument7 pagesGuidelines For Corporate Strategic Audit ProjectMay Cris BondocNo ratings yet

- Narvre Unit 19 Newsletter of March 2015Document2 pagesNarvre Unit 19 Newsletter of March 2015api-167123914No ratings yet

- Accounting MCQDocument15 pagesAccounting MCQFahad RazaNo ratings yet

- Letter To U.S. Department of Justice Regarding Tennessee State Sen. Brian KelseyDocument57 pagesLetter To U.S. Department of Justice Regarding Tennessee State Sen. Brian KelseyUSA TODAY NetworkNo ratings yet

- Mas 10Document8 pagesMas 10CGNo ratings yet

- Module 1 - Canvas SlidesDocument40 pagesModule 1 - Canvas SlidesAniKelbakianiNo ratings yet

- Project Report ON: Investment IN EquitiesDocument63 pagesProject Report ON: Investment IN Equitiesvaishu7896541384No ratings yet

- Statement of Account For Month Ending: 04/2022 PAO: 62 SUS NO.: 1941041 TASK: 21Document2 pagesStatement of Account For Month Ending: 04/2022 PAO: 62 SUS NO.: 1941041 TASK: 21The Aaryan MATHURNo ratings yet

- 1 Horngren Harrison Oliver Accounting 9th Edition PrenticeDocument5 pages1 Horngren Harrison Oliver Accounting 9th Edition PrenticeAyesha IqbalNo ratings yet

- Confidential: Dear Mr. Chaitanya SonawaneDocument2 pagesConfidential: Dear Mr. Chaitanya SonawaneColab ITNo ratings yet

- Financial Accounting Past Present and FutureDocument10 pagesFinancial Accounting Past Present and Futuresudarjanto100% (1)

- Acctg For Special TransactionsDocument2 pagesAcctg For Special TransactionsLea EndayaNo ratings yet

- P&L Assumption BS Assumptions P&L Output BS FCFF Wacc DCF ValueDocument66 pagesP&L Assumption BS Assumptions P&L Output BS FCFF Wacc DCF ValuePrabhdeep DadyalNo ratings yet