Professional Documents

Culture Documents

Indian Income Tax Return Verification Form: Form Itr-V Assessment Year

Uploaded by

account patnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Income Tax Return Verification Form: Form Itr-V Assessment Year

Uploaded by

account patnaCopyright:

Available Formats

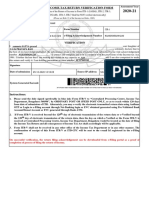

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment

FORM Year

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-V ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically] 2021-22

(Please see Rule 12 of the Income-tax Rules, 1962)

Name SANGITA KUMARI

PAN CCFPK1088M Form Number ITR-1

139(1) Return filed on or before due date e-Filing Acknowledgement

Filed u/s 584657010260921

Number

VERIFICATION

I, SANGITA KUMARI son/ daughter of AWADESH KUMAR SINGH , solemnly declare that to the best of my knowledge and

belief, the information given in the return which has been submitted by me vide acknowledgement number 584657010260921

is correct and complete and is in accordance with the provisions of the Income-tax Act, 1961. I further declare that I am

making this return in my capacity as Self and I am also competent to make this return and verify it. I am holding permanent

account number CCFPK1088M

Signature >

Date of

submission 26-Sep-2021 Source IP address 10.1.82.69

System Generated

Barcode/QR Code CCFPK1088M01584657010260921F34EE2918C21D52DFD3F365B8307B79664F33DD1

Instructions:

1. Please send the duly signed (preferably in blue ink) Form ITR-V to "Centralized Processing Centre, Income Tax

Department, Bengaluru 560500", by ORDINARY POST OR SPEED POST ONLY, so as to reach within 120 days from

date of submission of ITR. Alternatively, you may e-verify the electronically transmitted return data using Aadhaar OTP or

Login to e-Filing account through Net-Banking login or EVC generated using Pre-Validated Bank Account/Demat Account

or EVC generated through Bank ATM.

2. If Form ITR-V is received beyond the 120th day of electronic transmission of the return data or e-Verified beyond the 120th

day of electronic transmission of the return data, then the day on which the return is e-Verified or the Form ITR-V is

received at Centralized Processing Centre, Income Tax Department, Bengaluru would be treated as the date of filing the

Income Tax Return and all consequences of Income Tax Act, 1961, shall accordingly will be applicable.

3. Form ITR-V shall not be received in any other office of the Income Tax Department or in any other manner. The

confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail Id registered in the e-Filing account.

On successful verification, the return filing acknowledgement can be downloaded from e-Filing portal as a proof of

completion of process of filing the return of Income.

You might also like

- PC Terminale D Top Chrono-1-1Document448 pagesPC Terminale D Top Chrono-1-1SARRO Wawa100% (6)

- Welcome To: Online SabongDocument24 pagesWelcome To: Online SabongWazap Madlang100% (1)

- Requirements of Good Manufacturing Practice: Get All Pharmaceutical Guidelines OnDocument230 pagesRequirements of Good Manufacturing Practice: Get All Pharmaceutical Guidelines OnMichael JacksonNo ratings yet

- Connection Manager 0.73 Apk DownloadDocument3 pagesConnection Manager 0.73 Apk DownloadAshok Kumar100% (3)

- Ccsa r80 Lab Setup GuideDocument15 pagesCcsa r80 Lab Setup GuideNguyễn Gia ĐạtNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearBilalNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearkeval limbasiyaNo ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearGoutham Kumar'sNo ratings yet

- Indian Income Tax Return Verification FormDocument1 pageIndian Income Tax Return Verification FormRahul BhanNo ratings yet

- PDF 919198870310723Document1 pagePDF 919198870310723sunil jadhavNo ratings yet

- Form Itr-V Indian Income Tax Return Verification Form 2021-22Document1 pageForm Itr-V Indian Income Tax Return Verification Form 2021-22Chetanya VigNo ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- Sunita RanaDocument1 pageSunita RanaVIKASH KUMARNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearAnil kadamNo ratings yet

- PDF 147397690310723Document1 pagePDF 147397690310723Rashi SrivastavaNo ratings yet

- Income Tax ReturnDocument1 pageIncome Tax ReturnalharamislamicfoundationNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearL ROMANANDA SINGHNo ratings yet

- Indian Income Tax Return Verification Form 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Verification Form 2021-22: Assessment YearHarsha vardhan ReddyNo ratings yet

- PDF 994551360250722Document1 pagePDF 994551360250722ca.bhagirathbariNo ratings yet

- Itr-V Aygpk1992d 2023-24 206400380070623Document1 pageItr-V Aygpk1992d 2023-24 206400380070623muraliswayambuNo ratings yet

- PDF 579203040271223Document1 pagePDF 579203040271223Manivannan VNo ratings yet

- PDF 334657210280923Document1 pagePDF 334657210280923Manish NirwanNo ratings yet

- Mohit ShuklaDocument1 pageMohit ShuklaVaibhav PandeyNo ratings yet

- PDF 895015630200722Document1 pagePDF 895015630200722sukanta mitraNo ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearTechwiser services and engineeringNo ratings yet

- J Itr 2022-23Document1 pageJ Itr 2022-23prabhjeet singh antalNo ratings yet

- PDF 297442290260623Document1 pagePDF 297442290260623TAX INDIANo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearShraddha JagadNo ratings yet

- PDF 676646680170622Document1 pagePDF 676646680170622CE30 Sanket BadadeNo ratings yet

- Itr-V Asnpp1028l 2023-24 448120190130723Document1 pageItr-V Asnpp1028l 2023-24 448120190130723harsh sethiNo ratings yet

- Itr-V Amypm5266g 2023-24 151362850310723Document1 pageItr-V Amypm5266g 2023-24 151362850310723sunil jadhavNo ratings yet

- PDF 994808580250722Document1 pagePDF 994808580250722ca.bhagirathbariNo ratings yet

- Form Itr-V Indian Income Tax Return Verification Form 2021-22Document1 pageForm Itr-V Indian Income Tax Return Verification Form 2021-22Arihant SatpathyNo ratings yet

- Itr-V MXFPK0148F 2023-24 454963440281023Document1 pageItr-V MXFPK0148F 2023-24 454963440281023prakashdebleyNo ratings yet

- 2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2Document1 page2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2sunny.likescatNo ratings yet

- Itrv EnglishDocument1 pageItrv Englishniko belicNo ratings yet

- PDF 523510460230922Document1 pagePDF 523510460230922Vikash KumarNo ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearVikas CheedellaNo ratings yet

- PDF 878054160291222Document1 pagePDF 878054160291222Barun DasNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVivek BajajNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMurari AgarwalNo ratings yet

- B4 VerifyDocument1 pageB4 VerifyJasmin NirmalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormShyamala SubramanianNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNikhil SinghNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormDevesh Singh SenwalNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearsandhya dollyekkaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formjyothi venkat sainathNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formjyothi venkat sainathNo ratings yet

- Adobe Scan Oct 07, 2021Document4 pagesAdobe Scan Oct 07, 2021Dherminder sethiNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormRohit SharmaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormRaghu TNo ratings yet

- Itr-V Acwps3168b 2023-24 129905930310723Document1 pageItr-V Acwps3168b 2023-24 129905930310723aruncaoffice1979No ratings yet

- Itr-V Adyps7344c 2023-24 149225400310723Document1 pageItr-V Adyps7344c 2023-24 149225400310723taxindia610No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formvarghese philip kottaramNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormArun VeeraniNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- 2020 07 15 21 11 18 480 - 1594827678480 - XXXPJ9614X - ItrvDocument1 page2020 07 15 21 11 18 480 - 1594827678480 - XXXPJ9614X - Itrvishasalex03No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMahendra PatilNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Backup & RecoveryDocument12 pagesBackup & RecoverymuzzamilfaizNo ratings yet

- Crypto CurrencyDocument32 pagesCrypto CurrencyY Udaya ChandarNo ratings yet

- TNPSC Assistant System Engineer and Analyst SyllabusDocument10 pagesTNPSC Assistant System Engineer and Analyst SyllabussoundaryaNo ratings yet

- SMT Ipmi ManualDocument109 pagesSMT Ipmi ManualiamssjNo ratings yet

- Cytofast Elite: Cytotoxic Safety CabinetsDocument8 pagesCytofast Elite: Cytotoxic Safety CabinetsalexanderNo ratings yet

- EMDS Security Matrix - FrontOffice - 02aug2011Document2 pagesEMDS Security Matrix - FrontOffice - 02aug2011Anob EhijNo ratings yet

- Rob Romero: CEO at Sector 8 Research LabsDocument5 pagesRob Romero: CEO at Sector 8 Research LabsR T RomeroNo ratings yet

- SafeNet MobilePASS+ Setup Guide For AndroidDocument12 pagesSafeNet MobilePASS+ Setup Guide For Android4jawwy markme026No ratings yet

- Food Card Application Form - ICICI Bank PDFDocument1 pageFood Card Application Form - ICICI Bank PDFshawn1mathias8055No ratings yet

- Computer Crime and EthicsDocument20 pagesComputer Crime and EthicsArmand Bardhi100% (1)

- 1SDC200006D0209 - Emax enDocument276 pages1SDC200006D0209 - Emax enArun KumarNo ratings yet

- Cyber - Unit 3 QPDocument1 pageCyber - Unit 3 QPAnonymous sbicuzHNo ratings yet

- Circular: REF. NO.: S&P/TRG/109/2023 DATE: 24/04/2023Document2 pagesCircular: REF. NO.: S&P/TRG/109/2023 DATE: 24/04/2023Atul NayakNo ratings yet

- Driving License Procedure - KuwaitDocument2 pagesDriving License Procedure - KuwaitArunChandraBabuNo ratings yet

- General Knowledge Multiple Choice QuestionsDocument12 pagesGeneral Knowledge Multiple Choice QuestionsAmy 786No ratings yet

- Trying Out HTTP (Client Side) For Yourself: 1. Telnet To Your Favorite Web ServerDocument21 pagesTrying Out HTTP (Client Side) For Yourself: 1. Telnet To Your Favorite Web ServerRochmad G. SaputraNo ratings yet

- Click Here To Download Admit CardDocument3 pagesClick Here To Download Admit CardpavanNo ratings yet

- DKFJDDocument8 pagesDKFJDbabud zombyaNo ratings yet

- Challenges in Network ForensicsDocument5 pagesChallenges in Network ForensicsRennyYuLiyantiNo ratings yet

- QSG0009 PS Selection Guide For AC BackupDocument8 pagesQSG0009 PS Selection Guide For AC BackupRoberto MontoyaNo ratings yet

- XMission Spam LawsuitDocument11 pagesXMission Spam LawsuitBen WinslowNo ratings yet

- Unit - 3 Cloud Platform ArchitectureDocument21 pagesUnit - 3 Cloud Platform ArchitectureDurgesh KollaNo ratings yet

- Bizgram Simlim Square #05-50 PricelistDocument4 pagesBizgram Simlim Square #05-50 PricelistBizgram AsiaNo ratings yet

- 2020-12-28 PDFDocument67 pages2020-12-28 PDFShan LinNo ratings yet

- Uclfire TN 013Document41 pagesUclfire TN 013herikNo ratings yet