Professional Documents

Culture Documents

PDF 878054160291222

Uploaded by

Barun DasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF 878054160291222

Uploaded by

Barun DasCopyright:

Available Formats

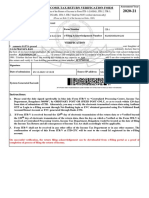

Acknowledgement Number:878054160291222 Date of filing:29-Dec-2022

INDIAN INCOME TAX RETURN VERIFICATION FORM

Assessment

FORM [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, Year

ITR-V ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically] 2022-23

(Please see Rule 12 of the Income-tax Rules, 1962)

Name BARUN DAS

PAN ANJPD2950Q Form Number ITR-1

139(4) Belated- Return filed after due date e-Filing Acknowledgement

Filed u/s 878054160291222

Number

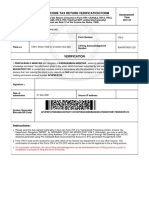

VERIFICATION

I, BARUN DAS son/ daughter of LILA DAS, solemnly declare that to the best of my knowledge and belief, the information

given in the return which has been submitted by me vide acknowledgement numer 878054160291222 is correct and complete

and is in accordance with the provisions of the Income-tax Act, 1961. I further declare that I am making this return in my

capacity as Self and I am also competent to make this return and verify it. I am holding permanent account number

ANJPD2950Q

Signature >

Date of

submission 29-Dec-2022 Source IP address 10.128.2.1

System Generated

Barcode/QR Code

ANJPD2950Q0187805416029122255BC286CB67FAAE2DBD79292D3A5EB507F8E2FEA

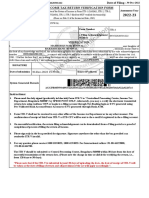

Instructions:

1. Please send the duly signed (preferably in blue ink) Form ITR-V to "Centralized Processing Centre, Income Tax

Department, Bengaluru 560500", by SPEED POST ONLY. Alternately, you may e-verify the electronic transmitted return

data using Aadhaar OTP or Login to e-Filing account through Net-Banking login or EVC generated using Pre-Validated

Bank Account/Demat Account or EVC generated through Bank ATM.

2. Form ITR-V shall not be received in any other office of the Income Tax Department or in any other manner. The

confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail Id registered in the e-Filing account.

3. On successful verification, the return filing acknowledgement can be downloaded from e-Filing portal as a proof of

completion of process of filing the return of Income.

4. Please sign only in the box provided for signature. Signature anywhere else other than the box provided can render the

ITR V invalid.

5. For any queries, please contact 1800 103 0025, 1800 419 0025. For International callers +91-80-46122000, +91-80-

61464700.

The ITR V should be received at Central Processing Centre, Bengaluru - 560500 within 30 days from the date of successful

transmission of the return data. (Please note the change in time available for verifying the return, i.e from 120 days to 30

days).

"Please note that if the ITR-V is received beyond 30 days of uploading the data, the date of receipt of ITR-V will be

taken as the date of filing of return and all provisions of the act will apply accordingly."

1 of 1

You might also like

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Sunita RanaDocument1 pageSunita RanaVIKASH KUMARNo ratings yet

- PDF 895015630200722Document1 pagePDF 895015630200722sukanta mitraNo ratings yet

- PDF 523510460230922Document1 pagePDF 523510460230922Vikash KumarNo ratings yet

- PDF 994551360250722Document1 pagePDF 994551360250722ca.bhagirathbariNo ratings yet

- Mohit ShuklaDocument1 pageMohit ShuklaVaibhav PandeyNo ratings yet

- J Itr 2022-23Document1 pageJ Itr 2022-23prabhjeet singh antalNo ratings yet

- PDF 994808580250722Document1 pagePDF 994808580250722ca.bhagirathbariNo ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearGoutham Kumar'sNo ratings yet

- PDF 579203040271223Document1 pagePDF 579203040271223Manivannan VNo ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearTechwiser services and engineeringNo ratings yet

- Form Itr-V Assessment YearDocument1 pageForm Itr-V Assessment YearVikas CheedellaNo ratings yet

- PDF 297442290260623Document1 pagePDF 297442290260623TAX INDIANo ratings yet

- Itr-V Amypm5266g 2023-24 151362850310723Document1 pageItr-V Amypm5266g 2023-24 151362850310723sunil jadhavNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearaccount patnaNo ratings yet

- Indian Income Tax Return Verification FormDocument1 pageIndian Income Tax Return Verification FormRahul BhanNo ratings yet

- PDF 919198870310723Document1 pagePDF 919198870310723sunil jadhavNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearkeval limbasiyaNo ratings yet

- Sanjay Sarju ITR-V APKPG2803C 2021-22 580822850301221Document1 pageSanjay Sarju ITR-V APKPG2803C 2021-22 580822850301221vijay mishraNo ratings yet

- PDF 334657210280923Document1 pagePDF 334657210280923Manish NirwanNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearAnil kadamNo ratings yet

- Itr-V MXFPK0148F 2023-24 454963440281023Document1 pageItr-V MXFPK0148F 2023-24 454963440281023prakashdebleyNo ratings yet

- Itr-V Asnpp1028l 2023-24 448120190130723Document1 pageItr-V Asnpp1028l 2023-24 448120190130723harsh sethiNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearL ROMANANDA SINGHNo ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- Form Itr-V Indian Income Tax Return Verification Form 2021-22Document1 pageForm Itr-V Indian Income Tax Return Verification Form 2021-22Chetanya VigNo ratings yet

- Indian Income Tax Return Verification Form 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Verification Form 2021-22: Assessment YearHarsha vardhan ReddyNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearBilalNo ratings yet

- PDF 147397690310723Document1 pagePDF 147397690310723Rashi SrivastavaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormBaby MazumdarNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNikhil SinghNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormDevesh Singh SenwalNo ratings yet

- Income Tax ReturnDocument1 pageIncome Tax ReturnalharamislamicfoundationNo ratings yet

- B4 VerifyDocument1 pageB4 VerifyJasmin NirmalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMahendra PatilNo ratings yet

- Itr-V Aygpk1992d 2023-24 206400380070623Document1 pageItr-V Aygpk1992d 2023-24 206400380070623muraliswayambuNo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Yearsandhya dollyekkaNo ratings yet

- PDF 676646680170622Document1 pagePDF 676646680170622CE30 Sanket BadadeNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVivek BajajNo ratings yet

- Form Itr-V Indian Income Tax Return Verification Form 2021-22Document1 pageForm Itr-V Indian Income Tax Return Verification Form 2021-22Arihant SatpathyNo ratings yet

- Itr-V Acwps3168b 2023-24 129905930310723Document1 pageItr-V Acwps3168b 2023-24 129905930310723aruncaoffice1979No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormMurari AgarwalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSAMMETA SATYANo ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment YearDocument1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment YearShraddha JagadNo ratings yet

- Itr-V Adyps7344c 2023-24 149225400310723Document1 pageItr-V Adyps7344c 2023-24 149225400310723taxindia610No ratings yet

- 2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvDocument1 page2020 12 05 18 48 54 934 - 1607174334934 - XXXPK6024X - ItrvRohan KapurNo ratings yet

- Itr-V Elkpd1794p 2024-25 188420870250424Document1 pageItr-V Elkpd1794p 2024-25 188420870250424taxindia610No ratings yet

- Indian Income Tax Return Verification Form: Form Itr-V Assessment Year 2021-22Document1 pageIndian Income Tax Return Verification Form: Form Itr-V Assessment Year 2021-22Mayank JoshiNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- 2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2Document1 page2020-06-23-14-08-00-089 - 1592901480089 - XXXPK1844X - Itrv 2sunny.likescatNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVijay Sai RoyalsNo ratings yet

- 2021 02 13 18 38 02 527 - 1613221682527 - XXXPS3184X - Itrv PDFDocument1 page2021 02 13 18 38 02 527 - 1613221682527 - XXXPS3184X - Itrv PDFtavenderpal singhNo ratings yet

- Ack Aggpr0859n 2022-23 893522620301222Document1 pageAck Aggpr0859n 2022-23 893522620301222CMA RAJESH RunwalNo ratings yet

- 2021 05 31 11 01 39 957 - 1622439099957 - Xxxpy5228x - ItrvDocument1 page2021 05 31 11 01 39 957 - 1622439099957 - Xxxpy5228x - Itrvjohnyadav.ryNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSujan SamantaNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementrushikeshlohe01No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbhavya gowdaNo ratings yet

- Design and Implementation of A Turbo Code System On FPGA: November 2011Document6 pagesDesign and Implementation of A Turbo Code System On FPGA: November 2011Ankit GuptaNo ratings yet

- Iot Based Home Automation Using NodemcuDocument52 pagesIot Based Home Automation Using NodemcuSyed ArefinNo ratings yet

- Outsourcing-Insourcing CriteriaDocument8 pagesOutsourcing-Insourcing CriteriaGuadagustinNo ratings yet

- Test 1 AbsenteesDocument6 pagesTest 1 AbsenteesHamza AhmedNo ratings yet

- S-Block Elements: Earth Metals. These Are So Called Because Their Oxides and Hydroxides Are Alkaline in NatureDocument8 pagesS-Block Elements: Earth Metals. These Are So Called Because Their Oxides and Hydroxides Are Alkaline in NatureAgamGoelNo ratings yet

- 1993 Book Non ThermalPlasmaTechniquesFor 2Document422 pages1993 Book Non ThermalPlasmaTechniquesFor 2denizinak100% (1)

- Philippine Urban TreesDocument83 pagesPhilippine Urban TreesKit LorenzNo ratings yet

- 211 ThermoDynamics ThermoDynamicsDocument5 pages211 ThermoDynamics ThermoDynamicsmozam haqNo ratings yet

- Constitutions and ConstitutionalismDocument10 pagesConstitutions and ConstitutionalismmylovebhuNo ratings yet

- Aakash ADV Full Tests MERGEDDocument486 pagesAakash ADV Full Tests MERGEDAnirudh100% (1)

- Antiphon - Caritas - Habundat - in - Omnia - Hildegard Von BingenDocument3 pagesAntiphon - Caritas - Habundat - in - Omnia - Hildegard Von BingenGStarkNo ratings yet

- GP150 PDFDocument125 pagesGP150 PDFBf Ipanema100% (1)

- Il Ruolo Delle Esperienze Religiose Nella Cultura Della LegalitàDocument42 pagesIl Ruolo Delle Esperienze Religiose Nella Cultura Della LegalitàMarisa La BarberaNo ratings yet

- 7 PolymersDocument25 pages7 PolymersPrasad YarraNo ratings yet

- RFEupdatingTrack BasicTutorial 2.4Document9 pagesRFEupdatingTrack BasicTutorial 2.4TurugayuNo ratings yet

- Academic Retention Policy - 1625568420Document3 pagesAcademic Retention Policy - 1625568420Kim WaNo ratings yet

- Syllabuses MSC (Eng) 2014-15Document78 pagesSyllabuses MSC (Eng) 2014-15kelvinaaaNo ratings yet

- LDK8000Document110 pagesLDK8000asjoben1002No ratings yet

- Prevalencia Geofagia - 2014Document108 pagesPrevalencia Geofagia - 2014Farmaceutico RaulNo ratings yet

- A Review of The Book That Made Your World. by Vishal MangalwadiDocument6 pagesA Review of The Book That Made Your World. by Vishal Mangalwadigaylerob100% (1)

- Chapter II Sample ThesisDocument13 pagesChapter II Sample ThesisAllen Bradley OngNo ratings yet

- Behavior Intervention PlanDocument22 pagesBehavior Intervention Planapi-343163369100% (1)

- Johnson Power Pumping CatalogDocument24 pagesJohnson Power Pumping CatalogAlvaro Patricio Etcheverry TroncosoNo ratings yet

- Spacex PDFDocument69 pagesSpacex PDFEmerovsky ReyesNo ratings yet

- Class TestDocument15 pagesClass TestMitul KaziNo ratings yet

- Understanding Advertising and Consumer Behaviour: Pankaj KumarDocument7 pagesUnderstanding Advertising and Consumer Behaviour: Pankaj KumarAlfredo ValeraNo ratings yet

- Proposed USG Boral Ceiling System For Tropicana MiyuDocument5 pagesProposed USG Boral Ceiling System For Tropicana MiyuLorraineNo ratings yet

- SiteDocument6 pagesSiteMikeNo ratings yet

- IOM Gram HC CompressorsDocument46 pagesIOM Gram HC CompressorsBenito Antonio Formoso LouroNo ratings yet

- Designation Order SicDocument3 pagesDesignation Order SicMerafe Ebreo AluanNo ratings yet