Professional Documents

Culture Documents

Preparation of Sales Budget

Uploaded by

Renjumul Mofid0 ratings0% found this document useful (0 votes)

21 views3 pagesOriginal Title

course hero

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views3 pagesPreparation of Sales Budget

Uploaded by

Renjumul MofidCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

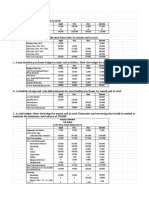

Preparation of sales budget:

January February March

Inventory in units 100,000 2,00,000 3,00,000

Sales @ 10 X 10 X10 X10

BDT 10,00,000 20,00,000 30,00,000

Sales per unit is @BDT. 10. Inventory per quarter are consecutively 1, 00,000 units, 200,000s unit

and 3, 00,000 units

Accounts Receivable balance from last December BDT 10,000. Cash collections from Accounts

Receivable @ 75% in the month of sale, 25% of the following months.

January (Tk) February(tk) March (tk)

Beg balance 10,000

Collection 75% in 7,50,000 2,50,000

January month,

following month

(10,00,000

X75%),25%

(20,00,000 X

Collection 75% in 15,00,000 500,000

month of

February and

following month

(20,00,000 X

75%);25%

Collection 75% in 22,50,000

month of March,

following month

(30,00,000 X

75%),25%

Bdt 7,60,000 17,50,000 27,50,000

Preparation of Cash Budget:

Cash payment on Accounts payable on purchase of purchase raw materials units @.50. Raw material

purchased in January is 11, 00,000 units, February 10, 50, 000, March 12,00,000 units

January February March

Purchase units 11,00,000 10,50,000 12,00,000

@ .50 x.50 X .50 x.50

Bdt 5,50,000 5,25,000 600,000

Due to accounts payable from the month of December BDT 15,000. Payment schedule first month

payment 50% , second month 35% third month 15%

January(tk) February(tk) March(tk)

15,000

Beginning Balance

(Payment of January 5,50,000@ 2,75,000 1,92,500 82,500

50%);35%;15%

(Payment of February 5,25,000@ 2,62,500 183,750

50%);35%;15%

(Payment of March 5,50,000@ 275,000

50%);35%;15%

Total= 2,90,000 4,55,000 5,41,250

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Master Budgeting (Sample Problems With Answers)Document11 pagesMaster Budgeting (Sample Problems With Answers)Jonalyn TaboNo ratings yet

- Cash BudgetsDocument23 pagesCash Budgetsarjun sachdevNo ratings yet

- Proof of Cash: Irene Mae C. Guerra, CPADocument17 pagesProof of Cash: Irene Mae C. Guerra, CPAjeams vidalNo ratings yet

- Exercises Budgeting ACCT2105 3s2010Document7 pagesExercises Budgeting ACCT2105 3s2010Hanh Bui0% (1)

- Cash Budgeting Examples.Document21 pagesCash Budgeting Examples.Muhammad azeem83% (6)

- Quiz 2B - Bank Reconciliation and Proof of CashDocument5 pagesQuiz 2B - Bank Reconciliation and Proof of CashLorence Ibañez100% (2)

- Problems On Cash Budget MBADocument3 pagesProblems On Cash Budget MBAsafwanhossain100% (1)

- Kieso Chapter 10Document6 pagesKieso Chapter 10Dian Permata SariNo ratings yet

- Budgeting - ExamplesDocument2 pagesBudgeting - Examplessunil.ctNo ratings yet

- Questions On Cash Budget-2Document7 pagesQuestions On Cash Budget-2Mpolokeng HlabanaNo ratings yet

- Cash Management QuestionsDocument5 pagesCash Management QuestionsManasi Jamsandekar100% (1)

- Cash BudgetingDocument3 pagesCash Budgetingsunil.ctNo ratings yet

- ACC101Document13 pagesACC101hieuddss170048No ratings yet

- Budgeting - Planning: A325 Discussion - March 19, 2012Document8 pagesBudgeting - Planning: A325 Discussion - March 19, 2012alfaNo ratings yet

- Chapter Two Master Budget and Responsibility Accounting What Is Budget?Document12 pagesChapter Two Master Budget and Responsibility Accounting What Is Budget?kirosNo ratings yet

- PFM 3023 - A231 - Answer CASH BUDGETDocument2 pagesPFM 3023 - A231 - Answer CASH BUDGETbudakmatriks2022No ratings yet

- Scenario Roletter Company Budgets For The Five Months 2007 Particulars Jan Feb Mar Apr MayDocument11 pagesScenario Roletter Company Budgets For The Five Months 2007 Particulars Jan Feb Mar Apr MayajithsubramanianNo ratings yet

- Budget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Document7 pagesBudget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Suraj KumarNo ratings yet

- Chapter Two: Master Budget and Responsibility AccountingDocument25 pagesChapter Two: Master Budget and Responsibility Accountingweyn deguNo ratings yet

- Budgeting Pretest Teachers PDFDocument4 pagesBudgeting Pretest Teachers PDFKatzkie Montemayor GodinezNo ratings yet

- Profit, Planning and ControlDocument14 pagesProfit, Planning and ControlJigoku ShojuNo ratings yet

- CH 14Document6 pagesCH 14Aminul Haque RusselNo ratings yet

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256No ratings yet

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocument8 pagesTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- Acn202 AssignmentDocument5 pagesAcn202 AssignmentAvijit Kumar SahaNo ratings yet

- Case Analysis (1 30)Document3 pagesCase Analysis (1 30)manishadaaNo ratings yet

- Master BudgetDocument12 pagesMaster Budgetshi shiiisshhNo ratings yet

- Question On Budget A LevelDocument3 pagesQuestion On Budget A LevelMUSTHARI KHANNo ratings yet

- Profit. Planning and ControlDocument16 pagesProfit. Planning and ControlNischal LawojuNo ratings yet

- Boomstick CorpDocument14 pagesBoomstick CorpDivya GoyalNo ratings yet

- Ae 15 Intermediate Accounting 1: (Problem 2-1 Ia 1 2019 Edition)Document4 pagesAe 15 Intermediate Accounting 1: (Problem 2-1 Ia 1 2019 Edition)Mae Ann RaquinNo ratings yet

- Ae 15 Bs Acc 1 Home Based ActivityDocument4 pagesAe 15 Bs Acc 1 Home Based ActivityMae Ann RaquinNo ratings yet

- Lecture 11Document26 pagesLecture 11Riaz Baloch Notezai100% (1)

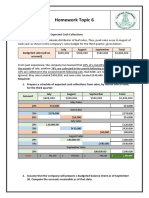

- Homework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionsDocument3 pagesHomework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionskhetamNo ratings yet

- Cash Management: ProblemsDocument4 pagesCash Management: ProblemsPoojitha ReddyNo ratings yet

- ACFrOgAMXLJQ31ib6NhLGI0LJ g6GJ517KX03aMrtqxVEqeGBZVYeNyhJHHN9 NBC Vi fXXpyOSGJRyPbtkRLA5DID6 - WJh7xyy7T4 - lcWF9qvk7GWZbEblGKEapUTdWZQyBqXGaUpCDjeEy - FVDocument6 pagesACFrOgAMXLJQ31ib6NhLGI0LJ g6GJ517KX03aMrtqxVEqeGBZVYeNyhJHHN9 NBC Vi fXXpyOSGJRyPbtkRLA5DID6 - WJh7xyy7T4 - lcWF9qvk7GWZbEblGKEapUTdWZQyBqXGaUpCDjeEy - FVmy VinayNo ratings yet

- Final ProjectDocument24 pagesFinal ProjectMohamed ElabassyNo ratings yet

- Cash Budget TutorialDocument2 pagesCash Budget TutorialThando Majola-MasondoNo ratings yet

- Paper - 1: AccountingDocument18 pagesPaper - 1: AccountingJerry HuffmanNo ratings yet

- CHP 2AnalysisInterpretationofAccountsDocument5 pagesCHP 2AnalysisInterpretationofAccountsalpeshmahto2004No ratings yet

- Business Finance (Quarter 1 - Weeks 3 & 4)Document11 pagesBusiness Finance (Quarter 1 - Weeks 3 & 4)Francine Dominique CollantesNo ratings yet

- Opal ProjectsDocument3 pagesOpal ProjectsMigs CruzNo ratings yet

- Schedule 1: Sales BudgetDocument9 pagesSchedule 1: Sales BudgetAndrea Lyn Salonga CacayNo ratings yet

- Ex of Cash Flow AnalysisDocument7 pagesEx of Cash Flow AnalysisS. Chakrabarty MeconNo ratings yet

- Budgetary ControlDocument5 pagesBudgetary ControlJasdeep Singh DeepuNo ratings yet

- E1049217046 30420 1526459637486Document6 pagesE1049217046 30420 1526459637486Sumit PattanaikNo ratings yet

- Lesson 7.4Document7 pagesLesson 7.4crisjay ramosNo ratings yet

- Budgeting Problems PDFDocument5 pagesBudgeting Problems PDFER Aditya DasNo ratings yet

- Case Study 2022 FallDocument3 pagesCase Study 2022 FallAppleDugarNo ratings yet

- Cash BudgetDocument2 pagesCash BudgetanupsuchakNo ratings yet

- Corp-Bgt#IUP-X#Sept21#Aldira Jasmine R A#12010119190284Document4 pagesCorp-Bgt#IUP-X#Sept21#Aldira Jasmine R A#12010119190284aldira jasmineNo ratings yet

- Cash Budget: Description Jan Feb Mar Sales Purchases Salaries Rent Entertainment Advertising DepreciationDocument1 pageCash Budget: Description Jan Feb Mar Sales Purchases Salaries Rent Entertainment Advertising DepreciationRyan SameerNo ratings yet

- B.SC & Bca Degree Examination: Fourth SemesterDocument11 pagesB.SC & Bca Degree Examination: Fourth SemesterStudents Xerox ChidambaramNo ratings yet

- Exercise 2.1Document9 pagesExercise 2.1Nurul ShazalinaNo ratings yet

- ACCT 10001: Accounting Reports & Analysis - Lecture 9 Illustration: BudgetingDocument4 pagesACCT 10001: Accounting Reports & Analysis - Lecture 9 Illustration: BudgetingBáchHợpNo ratings yet

- Cash Budget: Aizel Joy A. Tampos 12-ABM A February 5, 2017Document3 pagesCash Budget: Aizel Joy A. Tampos 12-ABM A February 5, 2017AJNo ratings yet

- Adjusting Entry1 - AnswerDocument9 pagesAdjusting Entry1 - AnswerReighjon Ashley C. Tolentino100% (1)

- Financial PlanningDocument6 pagesFinancial Planningakimasa raizeNo ratings yet

- Eng 4Document39 pagesEng 4Renjumul MofidNo ratings yet

- This Study Resource Was: Transaction Processing Systems (TPS) Collect, Store, Modify and Retrieve An Organization'sDocument3 pagesThis Study Resource Was: Transaction Processing Systems (TPS) Collect, Store, Modify and Retrieve An Organization'sRenjumul MofidNo ratings yet

- Eng 3Document57 pagesEng 3Renjumul MofidNo ratings yet

- Investigate Social Media Impact On Entrepreneurship Development 5Document1 pageInvestigate Social Media Impact On Entrepreneurship Development 5Renjumul MofidNo ratings yet

- Problem Statement: Creating A Cohesive Brand Image Can Be DifficultDocument5 pagesProblem Statement: Creating A Cohesive Brand Image Can Be DifficultRenjumul MofidNo ratings yet

- Class Test 2 On Chapter 12Document4 pagesClass Test 2 On Chapter 12Renjumul MofidNo ratings yet

- 44 Mohakhali, Dhaka 1212Document4 pages44 Mohakhali, Dhaka 1212Renjumul MofidNo ratings yet

- Sales Agency Agreement - BMSDocument3 pagesSales Agency Agreement - BMSRenjumul MofidNo ratings yet

- Selling and MarketingDocument11 pagesSelling and MarketingRenjumul MofidNo ratings yet

- Southeast University: InstructionsDocument2 pagesSoutheast University: InstructionsRenjumul MofidNo ratings yet

- International MKTDocument11 pagesInternational MKTRenjumul MofidNo ratings yet

- Military of Bangladesh: Army Navy Air ForceDocument3 pagesMilitary of Bangladesh: Army Navy Air ForceRenjumul MofidNo ratings yet

- Murad CVDocument4 pagesMurad CVRenjumul MofidNo ratings yet

- Pricing Strategies: On Completion of This Chapter, You Will Be Able To: 1 2 3 4Document28 pagesPricing Strategies: On Completion of This Chapter, You Will Be Able To: 1 2 3 4Renjumul MofidNo ratings yet