Professional Documents

Culture Documents

Soal Akuntansi

Uploaded by

nidya eka putri0 ratings0% found this document useful (0 votes)

25 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views1 pageSoal Akuntansi

Uploaded by

nidya eka putriCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

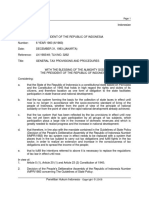

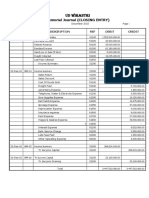

1.

Create journal entrie under perpetual method for transactions as below:

1.1. Purchase of inventories. The inventories price was Rp 1,000,000,000. The company got

20% discount and this purchase was subject to 10% VAT. The term of payment was 30

days after invoice date.

1.2. Payment of payable. Thirty days later, the Company paid their payable for the purchase

above.

1.3. Sales of inventories. The company sold all of the inventories purchased above. Their

selling price was Rp 1,300,000,000 in total. The company gave 15% discount for the

customers and this sale was subject to 10% VAT. The term of payment was 1 week after

invoice date.

1.4. Service purchase. The company hired a technician to fix the broken electrical

installation. This service was subject to Income Tax art 23. The term of payment was

cash upon service delivery. The service fee was Rp 1,000,000.

1.5. Prepayment of warehouse rental. The company paid Rp 3,000,000,000 warehouse rental

fee for 12 months period.

1.6. Prepare journal entries which shall be recorded each month regarding warehouse rental

above.

2. Mention at least 3 pairs of eleminiation journal entries in consolidation process in the space

provided below.

3. At December 30, 2020, PT A paid dividend to their two shareholders: PT B dan PT C. PT B

owes 95% of PT A’s shares and PT C owes the rest of it. Total dividend paid by PT A was Rp

2,000,000,000. Prepare journal entries which shall be recorded by PT A, PT B, dan PT C.

4. Briefly explain the definition on fixed asset capitalization and mention at least 3 cost

components which are allowed to be capitalized under PSAK 16.

You might also like

- The Size of Government: Measurement, Methodology and Official StatisticsFrom EverandThe Size of Government: Measurement, Methodology and Official StatisticsNo ratings yet

- Soal Pengantar AkuntansiDocument10 pagesSoal Pengantar Akuntansiakid windrayaNo ratings yet

- Soal Akuntansi Perusahaan JasaDocument2 pagesSoal Akuntansi Perusahaan JasasaharaoaoaNo ratings yet

- Contoh Soal Pajak Dan PembahasannyaDocument24 pagesContoh Soal Pajak Dan PembahasannyaMerita Chen0% (1)

- Soal Siklus AkuntansiDocument10 pagesSoal Siklus AkuntansiAlfin Dwi SaptaNo ratings yet

- Soal Surya Catering Multi Currency PDFDocument9 pagesSoal Surya Catering Multi Currency PDFDestiNo ratings yet

- Penyelesaian Soal PRE-TEST BASIC LEVEL PDFDocument55 pagesPenyelesaian Soal PRE-TEST BASIC LEVEL PDFFriza Noor An NisaNo ratings yet

- Uts Bahasa Inggris Stie1Document2 pagesUts Bahasa Inggris Stie1Tia MitraNo ratings yet

- SOAL AKUNTANSI KEUANGANDocument4 pagesSOAL AKUNTANSI KEUANGANekaeva03No ratings yet

- Rangkuman Bisnis OwnershipDocument8 pagesRangkuman Bisnis OwnershipYeni MulyaniNo ratings yet

- Lapran Keuangan Kso Per November 2021Document13 pagesLapran Keuangan Kso Per November 2021BekNo ratings yet

- Financial Statements SummaryDocument27 pagesFinancial Statements SummaryRina KusumaNo ratings yet

- Intermediate Debt and Leasing: Debagus SubagjaDocument12 pagesIntermediate Debt and Leasing: Debagus SubagjaDebagus SubagjaNo ratings yet

- CH 11Document50 pagesCH 11Mareta Vina ChristineNo ratings yet

- Accounting Equation Practice ProblemsDocument119 pagesAccounting Equation Practice ProblemsLita NataliaNo ratings yet

- ALDO LKT Des 2014 PDFDocument66 pagesALDO LKT Des 2014 PDFMiftahNo ratings yet

- Laporan Perubahan Arus Kas (Indirect)Document2 pagesLaporan Perubahan Arus Kas (Indirect)Amelia SembiringNo ratings yet

- CHAPTER 12 Liquidation Partnership (Depreciation)Document6 pagesCHAPTER 12 Liquidation Partnership (Depreciation)nashNo ratings yet

- Persamaan Dasar AkuntansiDocument10 pagesPersamaan Dasar Akuntansiapelina teresia100% (1)

- Elizar Sinambela (Hal 484-495) - 0Document12 pagesElizar Sinambela (Hal 484-495) - 0banu wicakNo ratings yet

- The Respective Normal Account Balances of Sales RevenueDocument12 pagesThe Respective Normal Account Balances of Sales RevenueRBNo ratings yet

- 4 PBDocument9 pages4 PBHarisanti PhewNo ratings yet

- Kode FaskesDocument426 pagesKode FaskesIrvan Ediya AkbarNo ratings yet

- FORMAT-Jurnal JAEMB UpdateDocument2 pagesFORMAT-Jurnal JAEMB UpdateevasariNo ratings yet

- Investasi&Aset Lain 28032016Document27 pagesInvestasi&Aset Lain 28032016AjengPutriKarismaNo ratings yet

- Neraca SaldoDocument6 pagesNeraca SaldoNorhalimah TustaiyahNo ratings yet

- Law No. 6 of 1983 On General Tax Provisions and Procedures (English)Document41 pagesLaw No. 6 of 1983 On General Tax Provisions and Procedures (English)Ranny Hadrianto100% (2)

- Closing entry journalDocument1 pageClosing entry journalDaulat mugiNo ratings yet

- P7Document2 pagesP7Andreas Brown0% (1)

- Pengantar Akuntansi S1Document4 pagesPengantar Akuntansi S1Ela SelaNo ratings yet

- Lecture 8 - Exercises - QuestionDocument3 pagesLecture 8 - Exercises - QuestionIsyraf Hatim Mohd TamizamNo ratings yet

- MYOB Accounting Module PracticumDocument121 pagesMYOB Accounting Module PracticumVISTANo ratings yet

- ANALISIS MANAJEMEN STRATEGIK PADA APPLE INCDocument53 pagesANALISIS MANAJEMEN STRATEGIK PADA APPLE INCAnastacia TakashiNo ratings yet

- Kieso CH 10 Aset Tetap Versi IFRS LilikDocument44 pagesKieso CH 10 Aset Tetap Versi IFRS LilikSri Apriyanti Husain100% (1)

- Health CommunicationDocument17 pagesHealth CommunicationshuvoNo ratings yet

- Iwan Pratama: IDR 2,418,071.32 IDR 2,575,789.00Document2 pagesIwan Pratama: IDR 2,418,071.32 IDR 2,575,789.00iwan pratamaNo ratings yet

- FIN604 - HW03 - Farhan Zubair - 18164052Document9 pagesFIN604 - HW03 - Farhan Zubair - 18164052ZNo ratings yet

- Chapter 3Document6 pagesChapter 3Pauline Keith Paz ManuelNo ratings yet

- Chaplin Co Likuidasi Aset dan KewajibanDocument16 pagesChaplin Co Likuidasi Aset dan KewajibanJunjung PrabawaNo ratings yet

- The Influence of Auditors' Ethics on Detecting Creative Accounting PracticesDocument14 pagesThe Influence of Auditors' Ethics on Detecting Creative Accounting PracticesMarlim JayantaraNo ratings yet

- Perlakuan PPN Atas Penyerahan BKP Oleh Perusahaan Real Estate Dan Kegiatan Membangun Sendiri PPN Atas Sewa Guna UsahaDocument8 pagesPerlakuan PPN Atas Penyerahan BKP Oleh Perusahaan Real Estate Dan Kegiatan Membangun Sendiri PPN Atas Sewa Guna UsahaMuhammad Ainul YakinNo ratings yet

- CH5 Accounting QuizDocument7 pagesCH5 Accounting QuizTarun ImandiNo ratings yet

- Soal ProblemDocument2 pagesSoal ProblemZulan IlmadaNo ratings yet

- Contoh Soal AkuntansiDocument16 pagesContoh Soal AkuntansiNabilah UsmanNo ratings yet

- Exercise AKM Chapter 3 Kelompok 2Document34 pagesExercise AKM Chapter 3 Kelompok 2RizalMawardiNo ratings yet

- Resume Cost Accounting #Meeting4Document4 pagesResume Cost Accounting #Meeting4DoniNo ratings yet

- Chapter 17 Investasi IFRS MhsDocument49 pagesChapter 17 Investasi IFRS MhsNindy PutriNo ratings yet

- Stie Malangkuçeçwara Malang Program Pasca Sarjana Ujian Tengah SemesterDocument13 pagesStie Malangkuçeçwara Malang Program Pasca Sarjana Ujian Tengah SemesterDwi Merry WijayantiNo ratings yet

- Tugas Sesi 7Document5 pagesTugas Sesi 7mutmainnahNo ratings yet

- Nama: Estherlina Putri Cahyati Belgin Kelas: C Prodi: S1 Akuntansi Lyre Co Trial Balance Per 1 Agustus 2006 No Akun Nama Akun Debit KreditDocument15 pagesNama: Estherlina Putri Cahyati Belgin Kelas: C Prodi: S1 Akuntansi Lyre Co Trial Balance Per 1 Agustus 2006 No Akun Nama Akun Debit KreditEun SaraNo ratings yet

- Synonyms and workplace roles matching exerciseDocument2 pagesSynonyms and workplace roles matching exerciseŞtefan AlinNo ratings yet

- Ud. Cakra ManggilinganDocument36 pagesUd. Cakra ManggilinganWahyudinNo ratings yet

- Jawaban Forum Diskusi Experiment and SampleDocument1 pageJawaban Forum Diskusi Experiment and SampleReyhan Julianto PribadiNo ratings yet

- Corporate FinanceDocument5 pagesCorporate FinancejahidkhanNo ratings yet

- PR 14-4A Accounting QuestionsDocument2 pagesPR 14-4A Accounting QuestionsLegnaNo ratings yet

- Concept of Installment SystemDocument5 pagesConcept of Installment Systemshambhuling ShettyNo ratings yet

- AaaDocument4 pagesAaaMaritesParceroMagcalasNo ratings yet

- Exercise 1Document2 pagesExercise 1Charice Anne VillamarinNo ratings yet

- Quiz-Bee Pa1-Toa DifficultDocument4 pagesQuiz-Bee Pa1-Toa DifficultCPANo ratings yet

- Ventura, Mary Mickaella R - Revenue From Contracts - p.209 - Group3Document5 pagesVentura, Mary Mickaella R - Revenue From Contracts - p.209 - Group3Mary VenturaNo ratings yet

- PT Wbi Stock Value Average Ws Cikande Monthly 1-Jul-21Document12 pagesPT Wbi Stock Value Average Ws Cikande Monthly 1-Jul-21nidya eka putriNo ratings yet

- 20092021-Project Receivable ControlDocument4 pages20092021-Project Receivable Controlnidya eka putriNo ratings yet

- Soal AkuntansiDocument1 pageSoal Akuntansinidya eka putriNo ratings yet

- Indonesia Cyclotron PET-CT Business Model Rev IDR (2) - NidyaDocument5 pagesIndonesia Cyclotron PET-CT Business Model Rev IDR (2) - Nidyanidya eka putriNo ratings yet

- Soal AkuntansiDocument1 pageSoal Akuntansinidya eka putriNo ratings yet