Professional Documents

Culture Documents

Finacc 334

Finacc 334

Uploaded by

Pogi Kyle Sta. RosaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finacc 334

Finacc 334

Uploaded by

Pogi Kyle Sta. RosaCopyright:

Available Formats

BORROWING COSTS

PROBLEM 1 Jec Company purchased a condominium unit on January 1, 2019 and moved into the building on the

same day for P10,000,000. Jec made a downpayment of P5,000,000 and the balance is payable annually for

P1,000,000 starting on December 31, 2019.

The implicit borrowing rate for this type of loan is 12%.

Required: Compute the capitalizable borrowing costs.

PROBLEM 2 Chum Company started construction of a new office building on January 1, 2019 and moved into the

finished building on July 1, 2020.

Of the P25,000,000 total cost of the building, P20,000,000 was incurred in 2019 evenly throughout the year.

The entity’s incremental borrowing rate was 12% throughout 2019, and the total amount of interest incurred was

P1,020,000.

The entity earned interest of P200,000 for the year on the unexpended portion of the loan.

Required:

1. Provide the relevant entries in 2019.

2. Determine the capitalizable borrowing costs.

3. Determine the carrying amount of the building as of December 31, 2019?

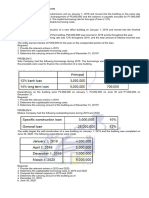

PROBLEM 3 Sulo Company had the following borrowings during 2019. The borrowings were made for general

purposes but the proceeds were used to finance the construction of a new building.

Principal Interest

12% bank loan 3,000,000 360,000

14% long term loan 5,000,000 700,000

The construction began on January 1, 2019 and was completed on December 31, 2019.

Expenditures on the building were P2,000,000 on January 1, P2,000,000 on June 30 and P1,000,000 on December

31.

Required:

1. Provide the relevant entries in 2019.

2. Determine the capitalizable borrowing costs.

3. Determine the carrying amount of the building as of December 31, 2019?

PROBLEM 4 Molave Company had the following outstanding loans during 2019 and 2020.

Specific construction loan 3,000,000 10%

General loan 25,000,000 12%

The entity began the self-construction of a new building on January 1, 2019 and the building was completed on June

30, 2020. The following expenditures were made:

January 1, 2019 4,000,000

April 1, 2019 5,000,000

December 1, 2019 3,000,000

March 1, 2020 6,000,000

Required:

1. Provide the relevant entries in 2019 and 2020.

2. Determine the capitalizable borrowing costs in 2019 and 2020.

3. Compute the interest expense in 2019 and 2020.

4. Determine the carrying amount of the building as of

a. December 31, 2019.

b. June 30, 2020.

You might also like

- Conveyancing Notes 1Document8 pagesConveyancing Notes 1Syarah Syazwan Satury67% (6)

- Lessor Discussion U PDFDocument4 pagesLessor Discussion U PDFadmiral spongebobNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Canada Post Off-Ramp FormDocument2 pagesCanada Post Off-Ramp FormRafia Nisha0% (1)

- Payment Methods - Birbeck CollegeDocument5 pagesPayment Methods - Birbeck CollegeUniDaveNo ratings yet

- Finacc 334Document1 pageFinacc 334Pogi Kyle Sta. RosaNo ratings yet

- Accounting For Borrowing Costs and GG ProblemsDocument2 pagesAccounting For Borrowing Costs and GG ProblemsRenalyn Ps MewagNo ratings yet

- Borrowing Cost DrillDocument2 pagesBorrowing Cost DrillJasmin Rabon0% (1)

- Exercises - Wasting Assets, Borrowing Costs, and Government GrantsDocument3 pagesExercises - Wasting Assets, Borrowing Costs, and Government GrantsMeeka CalimagNo ratings yet

- Borrowing CostsDocument1 pageBorrowing CostsJulliena BakersNo ratings yet

- 07 Loans Receivable - (Problem)Document2 pages07 Loans Receivable - (Problem)kyle mandaresioNo ratings yet

- NonesDocument15 pagesNonesMary Rose Nones100% (3)

- 6978 - Government Grant and Borrowing CostDocument2 pages6978 - Government Grant and Borrowing CostRaquel Villar DayaoNo ratings yet

- Ppe Pas 16 AccountingDocument2 pagesPpe Pas 16 Accountingelsana philipNo ratings yet

- PFA - Borrowing Cost 1Document9 pagesPFA - Borrowing Cost 1Shara Mae SameloNo ratings yet

- QUIZ 1 Part 1Document2 pagesQUIZ 1 Part 1Jerah Marie PepitoNo ratings yet

- SM BorrowingCostDocument2 pagesSM BorrowingCostJoan Rachel CalansinginNo ratings yet

- Borrowing Costs: Assume Instead That The Building W As Completed On September 30, 2022Document2 pagesBorrowing Costs: Assume Instead That The Building W As Completed On September 30, 2022Caila Nicole M. ReyesNo ratings yet

- Assignment 2Document1 pageAssignment 2mallarijhoana21No ratings yet

- Quizzer BridgingDocument94 pagesQuizzer Bridgingglady sanchezNo ratings yet

- Borrowing Cost ProbDocument10 pagesBorrowing Cost ProbYoite MiharuNo ratings yet

- Borrowing CostDocument2 pagesBorrowing CostKyla Mae OrquijoNo ratings yet

- Module # 18 Practical Accounting 1 - Review Borrowing Cost Prof. U.C. ValladolidDocument4 pagesModule # 18 Practical Accounting 1 - Review Borrowing Cost Prof. U.C. ValladolidryanNo ratings yet

- Quiz 10Document1 pageQuiz 10Lalaine BeatrizNo ratings yet

- Government Grant and Borrowing CostDocument2 pagesGovernment Grant and Borrowing CostMaximusNo ratings yet

- Intermediate Accounting 1 - Quiz On Government Grants and Borrowing CostsDocument3 pagesIntermediate Accounting 1 - Quiz On Government Grants and Borrowing CostsGabriela Marie F. PalatulanNo ratings yet

- Module 1 and 3 AssignmentDocument12 pagesModule 1 and 3 AssignmentPrincess Maeca OngNo ratings yet

- LTCC Pas11Document1 pageLTCC Pas11Anna CharlotteNo ratings yet

- LEC03E - BSA 2102 - 012021-Borrowing CostsDocument2 pagesLEC03E - BSA 2102 - 012021-Borrowing CostsKatarame LermanNo ratings yet

- 1st Compre NR and LR PDFDocument3 pages1st Compre NR and LR PDFHelton Jun M. TuralbaNo ratings yet

- Government GrantsDocument1 pageGovernment GrantsJason CNo ratings yet

- Financial Asset at Amortized CostDocument1 pageFinancial Asset at Amortized CostExcelsia Grace A. Parreño25% (12)

- Borrowing Practice TestDocument2 pagesBorrowing Practice TestKiahna Clare ArdaNo ratings yet

- Financial Asset at Amortized CostDocument4 pagesFinancial Asset at Amortized Costramir maglangitNo ratings yet

- Intermediate Accounting 2 Reviewer PDFDocument133 pagesIntermediate Accounting 2 Reviewer PDFCarl CagampzNo ratings yet

- BCDocument2 pagesBCKathrine CruzNo ratings yet

- Problem I.: Borrowing Cost - ExercisesDocument2 pagesProblem I.: Borrowing Cost - Exercisesjingyuu kim100% (1)

- Practice Problems - Notes and Loans Receivable: General InstructionsDocument2 pagesPractice Problems - Notes and Loans Receivable: General Instructionseia aieNo ratings yet

- 3 - Accounting For Loans and ImpairmentDocument1 page3 - Accounting For Loans and ImpairmentReese AyessaNo ratings yet

- Adjusting Entries ProblemsDocument5 pagesAdjusting Entries ProblemsDirck VerraNo ratings yet

- 1912 Derivatives Investment Property and Other InvestmentDocument5 pages1912 Derivatives Investment Property and Other InvestmentCykee Hanna Quizo LumongsodNo ratings yet

- Chapter 7 AssignmentDocument27 pagesChapter 7 Assignmentsanskritishukla2020No ratings yet

- Problem 77Document1 pageProblem 77YukidoNo ratings yet

- Illustrative Examples - Notes and Loans ReceivableDocument4 pagesIllustrative Examples - Notes and Loans ReceivableMelrose Eugenio ErasgaNo ratings yet

- CHAPTER 16: Borrowing Cost: Problem 1Document2 pagesCHAPTER 16: Borrowing Cost: Problem 1Mark IlanoNo ratings yet

- Final Exam W MCQDocument12 pagesFinal Exam W MCQPatrick SalvadorNo ratings yet

- Quiz - QUIZ 01 - Spec 1Document13 pagesQuiz - QUIZ 01 - Spec 1Alliana CunananNo ratings yet

- Assignment - Funds and Other InvestmentsDocument2 pagesAssignment - Funds and Other InvestmentsJane DizonNo ratings yet

- 4 FAR Handout Notes ReceivableDocument2 pages4 FAR Handout Notes Receivablealford sery CammayoNo ratings yet

- Third Exam QuizzerDocument1 pageThird Exam QuizzerKate FernandezNo ratings yet

- Activity in LOAN RECEIVABLEDocument2 pagesActivity in LOAN RECEIVABLEChristopher Mau BambalanNo ratings yet

- Prelims QuizDocument12 pagesPrelims QuizJanine TupasiNo ratings yet

- 2020 Mar - 2020 July - QDocument11 pages2020 Mar - 2020 July - Qnur hazirahNo ratings yet

- Financial Accounting Vol. 2 Example QuestionsDocument8 pagesFinancial Accounting Vol. 2 Example QuestionsMarisolNo ratings yet

- Adjusting EntriesDocument8 pagesAdjusting EntriesYusra PangandamanNo ratings yet

- Financial LiabilitiesDocument4 pagesFinancial LiabilitiesNicah AcojonNo ratings yet

- AnswerQuiz - Module 6Document4 pagesAnswerQuiz - Module 6Alyanna Alcantara100% (1)

- ACCTGREV1 - 002 Notes Payable and RestructuringDocument2 pagesACCTGREV1 - 002 Notes Payable and RestructuringRenz Angel M. RiveraNo ratings yet

- Final Requirment (Case Study)Document2 pagesFinal Requirment (Case Study)Gerry SajolNo ratings yet

- Liabilities - ManuDocument7 pagesLiabilities - ManuClara MacallingNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Week 7 - Review of Control EnvironmentDocument10 pagesWeek 7 - Review of Control EnvironmentMark Angelo Bustos100% (1)

- Review of Internal Control Over Financial ReportingDocument20 pagesReview of Internal Control Over Financial ReportingMark Angelo Bustos100% (1)

- Week 10 Control Self AssessmentDocument24 pagesWeek 10 Control Self AssessmentMark Angelo BustosNo ratings yet

- Disbursements: ACCT 1133 Accounting For Government and Non For Profit OrganizationDocument8 pagesDisbursements: ACCT 1133 Accounting For Government and Non For Profit OrganizationMark Angelo BustosNo ratings yet

- Time Management in E-Learning: January 2009Document6 pagesTime Management in E-Learning: January 2009Mark Angelo BustosNo ratings yet

- Liabilities, Leases Financial Statements: ACCT 1133 Accounting For Governmen T and Non For Profit Organi ZationDocument12 pagesLiabilities, Leases Financial Statements: ACCT 1133 Accounting For Governmen T and Non For Profit Organi ZationMark Angelo BustosNo ratings yet

- Auditing The Finance and Accounting FunctionsDocument19 pagesAuditing The Finance and Accounting FunctionsMark Angelo BustosNo ratings yet

- Revenue and Other ReceiptsDocument17 pagesRevenue and Other ReceiptsMark Angelo BustosNo ratings yet

- Chapter 3 For Qawid Fiqqiyah Article PDFDocument8 pagesChapter 3 For Qawid Fiqqiyah Article PDFkhalidcarabNo ratings yet

- A Summer Internship Report On: Master of Business AdministrationDocument47 pagesA Summer Internship Report On: Master of Business AdministrationLove GumberNo ratings yet

- Abdul Karim Sultanali, Cfa: Professional SummaryDocument5 pagesAbdul Karim Sultanali, Cfa: Professional Summaryfaiza minhasNo ratings yet

- 1.0 Background To The StudyDocument31 pages1.0 Background To The StudyNeethu Maria JoseNo ratings yet

- 1.1.1 - FS00 - GL Account Master Record Maintenance Centrally - VHDocument5 pages1.1.1 - FS00 - GL Account Master Record Maintenance Centrally - VHHa Trang PhamNo ratings yet

- CS Daily 14 MarDocument45 pagesCS Daily 14 Marph.alvinNo ratings yet

- Sales Promotion and Customer Awareness of The Services, Standerd Charterd Finance Ltd. by Shiv Gautam - MarketingDocument67 pagesSales Promotion and Customer Awareness of The Services, Standerd Charterd Finance Ltd. by Shiv Gautam - MarketingRishav Ch100% (1)

- Journal EntriesDocument63 pagesJournal EntriesTwinkle Kashyap50% (2)

- Stephen Poser - Elliott Wave Theory For Short Term and Intraday TradingDocument16 pagesStephen Poser - Elliott Wave Theory For Short Term and Intraday Tradingchetuzz2100% (1)

- DLP 7es TemplateDocument4 pagesDLP 7es TemplateANNALYN CABATINGANNo ratings yet

- Synopsis Icici & Customer SatisfactionDocument17 pagesSynopsis Icici & Customer SatisfactionbhatiaharryjassiNo ratings yet

- M.P. State Consumer Disputes Redressal Commission, 76 Arera Hills Bhopal (M.P.)Document7 pagesM.P. State Consumer Disputes Redressal Commission, 76 Arera Hills Bhopal (M.P.)Nikhilesh MallickNo ratings yet

- Atm HardwareDocument32 pagesAtm HardwareMalar100% (1)

- Jain Computers and EverfreshDocument19 pagesJain Computers and EverfreshGaurav SharmaNo ratings yet

- Legal Aspects: Canara Bank Officers' AssociationDocument20 pagesLegal Aspects: Canara Bank Officers' Associationmail2me.preet1801No ratings yet

- 2024 5 2+DOA+250M SBLC - Docx - 053130Document25 pages2024 5 2+DOA+250M SBLC - Docx - 053130azeem khanNo ratings yet

- RWPL BrochureDocument10 pagesRWPL BrochurerukshanwNo ratings yet

- 080 - Cavite Development Bank v. LimDocument2 pages080 - Cavite Development Bank v. Limalexis_beaNo ratings yet

- MATHEMATICS Form 1 PercentagesDocument18 pagesMATHEMATICS Form 1 PercentagesG Nathan JdNo ratings yet

- Clearing Code and Branch Code (21 Jan 2015) With Tel NoDocument318 pagesClearing Code and Branch Code (21 Jan 2015) With Tel NoArdisonNo ratings yet

- Analysis of Notes Receivable and Related AccountsqDocument5 pagesAnalysis of Notes Receivable and Related AccountsqCJ alandyNo ratings yet

- Reagan RodriguezDocument1 pageReagan Rodriguez5th Avenue Acquisitions & Venture CapitalistsNo ratings yet

- "A Study of Financial Performnace of Cipla And: SynopsisDocument10 pages"A Study of Financial Performnace of Cipla And: SynopsisAnonymous g7uPednINo ratings yet

- Principles of Islamic Financial SystemDocument30 pagesPrinciples of Islamic Financial Systematiqa tanveerNo ratings yet

- GST CHALLAN Delta April 21Document1 pageGST CHALLAN Delta April 21pawan kanojiaNo ratings yet

- Documents-1 Click Transaction AgreementDocument2 pagesDocuments-1 Click Transaction AgreementjonatanNo ratings yet

- Perfecto Jabalde, Plaintiff-Appellant, PHILIPPINE NATIONAL BANK, Defendant-AppelleeDocument7 pagesPerfecto Jabalde, Plaintiff-Appellant, PHILIPPINE NATIONAL BANK, Defendant-AppelleeMirzi Olga Breech SilangNo ratings yet