Professional Documents

Culture Documents

Activity For Sep 21 Sep 26

Uploaded by

Nick ivan AlvaresOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity For Sep 21 Sep 26

Uploaded by

Nick ivan AlvaresCopyright:

Available Formats

DIT and OC

P1

Information in relation to BIR Co.’s bank reconciliation for September:

Deposit made by BIR Co. in September 2,300,000

Deposit recorded by the bank in September 1,700,000

Credit Memo – loan proceeds in September 120,000

Credit Memo – loan proceeds in August 160,000

Deposit in Transit, August 31 400,000

Requirements: The amount of deposit in transit on September 30 is:

P2

Included in the bank reconciliation for DOC Co. for November:

Checks paid by the bank in November 480,000

Check issued by DOC Co. in November 350,000

Debit memo in October 14,500

Debit memo in November 17,000

Outstanding checks October 31 185,000

Requirements: The amount of outstanding check on November 30 is:

P3

Included in the bank reconciliation for BD Co. for December:

Debits by BD Co. in December 1,400,000

Credits by the bank in December 1,700,000

Credit Memo – loan proceeds in December 200,000

Credit Memo – loan proceeds in November 100,000

Deposit in Transit, November 30 300,000

Debits by the bank in December 950,000

Credits by BD Co. in December 850,000

Debit memo in November 350,000

Debit memo in December 150,000

Outstanding checks November 30 250,000

Requirements:

1. The amount of outstanding check on November 30 is:

2. The amount of deposit in transit on September 30 is:

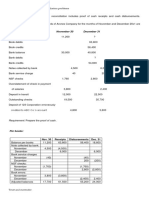

Proof of cash

The following information was taken from the records of DEF Co.:

February 28 March 31

Book balance

Book debits 116,000

Book credits 104,000

Bank balance 30,000 45,000

Bank debits 90,000

Bank credits

Deposits in transit 20,000 30,000

Outstanding checks 10,000 20,000

Deposit of DEF Co. erroneously credited to ABE Co. account

(Note: not yet corrected on the end of March 31) 0 5,000

Note collected by the bank 15,000 25,000

Bank service charges 2,000 4,000

Erroneously debited by the book

(Note: already corrected on the current month) 6,000

Requirements: Compute for the following by preparing proof of cash:

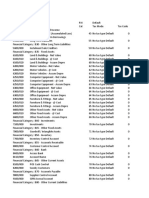

Accounts Receivable

P1

On December 31, 2019, subsidiary details revealed the following:

a. Trade accounts receivable (net of credit balance) – 700,000

b. Trade notes receivable (due in 14 months) – 250,000

c. Customers’ accounts reporting credit balances arising from advances – (50,000)

d. Advance payments for purchases of merchandise – 150,000

e. Cash advances to officers (due in 15 months) – 100,000

f. Claims from insurance company (due in 2 years) – 500,000

g. Subscription receivable – 300,000

h. Accrued interest receivable – 50,000

Requirements:

1. Total trade receivables

2. Trade and other receivables line item in financial statement.

P2

The following data relating to the receivable to be recognized by the company at the end of the year:

Cost of goods sold FOB shipping point, shipment date December 25, 2018, the customer received the goods

January 3, 2019 – 200,000

Cost of goods sold FOB destination, shipment date January 2, 2019, the customer received the goods January

10, 2019 – 500,000

Cost of goods sold FOB destination, freight collect (5,000 shipment cost), shipment date December 27, 2018,

the customer receive the goods January 2, 2019 – 400,000

Requirements: How much is the total receivable of the company in given the data?

P3

An entity sells inventory with a list price of 125,000 on account under credit terms of 20%, 5/10, n/30. The

entity estimates that only 70% of the cash discount will be taken and concludes that is highly probable that a

significant reversal in the cumulative amount of revenue recognized will not occur as the uncertainty is

resolved. Estimate does not coincide with actual result only 90% of the discount was actually taken.

Requirements: Using PFRS 15 how much is the adjustment to make due to the difference between the

estimate and actual result of the customers taking the discounts?

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- ProblemsDocument28 pagesProblemsYou Knock On My DoorNo ratings yet

- MOD 03 - Bank ReconDocument3 pagesMOD 03 - Bank ReconIrish VargasNo ratings yet

- Cash AssignmentDocument2 pagesCash Assignmentyjkq4byrj6No ratings yet

- Auditing 1 AssessmentDocument15 pagesAuditing 1 AssessmentEmilou AustriacoNo ratings yet

- FINANCIAL ACCOUNTING - Cash To Receivables Problems and SolutionsDocument8 pagesFINANCIAL ACCOUNTING - Cash To Receivables Problems and Solutionsstan iKONNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsJessica JamonNo ratings yet

- 001 Cash Cash Equi Bank Recon and PocDocument5 pages001 Cash Cash Equi Bank Recon and PocArsenio N. RojoNo ratings yet

- SPDocument28 pagesSPkrizzmaaaayNo ratings yet

- Bank ReconciliationDocument4 pagesBank ReconciliationAmerisha Faura Meldegard PunzalanNo ratings yet

- Cash and Cash Equivalents ReviewDocument3 pagesCash and Cash Equivalents ReviewashlyNo ratings yet

- 1.1 Cce To Proof of Cash Discussion ProblemsDocument3 pages1.1 Cce To Proof of Cash Discussion ProblemsGiyah UsiNo ratings yet

- SolutionDocument5 pagesSolutionClariz Angelika EscocioNo ratings yet

- Bank ReconciliationDocument12 pagesBank ReconciliationJieniel ShanielNo ratings yet

- HO 1 - Cash and Cash EquivalentsDocument8 pagesHO 1 - Cash and Cash EquivalentsCharmain ReganitNo ratings yet

- 100% Key Answers For The 2 First Quizzes - ACT1104Document34 pages100% Key Answers For The 2 First Quizzes - ACT1104moncarla lagonNo ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash Equivalentsattiva jadeNo ratings yet

- P01. Cash and Cash Equivalents AnswersDocument8 pagesP01. Cash and Cash Equivalents AnswersIosif DzhugasviliNo ratings yet

- Practice Set: Page 5 of 7Document3 pagesPractice Set: Page 5 of 7darren sanchezNo ratings yet

- CASH QuestionsDocument9 pagesCASH QuestionsKenncyNo ratings yet

- AACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Document4 pagesAACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Dawson Dela CruzNo ratings yet

- Aud Rev ProblemsDocument12 pagesAud Rev ProblemsPrankyJellyNo ratings yet

- 1 Review CceDocument10 pages1 Review CceJobelle Candace Flores AbreraNo ratings yet

- Proof of Cash and Bank Recon StatementDocument7 pagesProof of Cash and Bank Recon StatementJean BritoNo ratings yet

- Financial Accounting and Reporting With AnswersDocument11 pagesFinancial Accounting and Reporting With AnswersHades MercadejasNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- Inacc 1 Chap 3 Act PDFDocument12 pagesInacc 1 Chap 3 Act PDFSharmin Reula50% (2)

- FAR Practical Exercises Proof of CashDocument3 pagesFAR Practical Exercises Proof of CashAB CloydNo ratings yet

- Problem 1Document8 pagesProblem 1Mikaela JeanNo ratings yet

- 3.3 - Bank Reconciliation and Proof of CashDocument5 pages3.3 - Bank Reconciliation and Proof of CashxxxNo ratings yet

- Audit of Cash and Cash Equivalents - Set ADocument7 pagesAudit of Cash and Cash Equivalents - Set AZyrah Mae SaezNo ratings yet

- Assignment 3 ACFAR 1231 Proof of CashDocument2 pagesAssignment 3 ACFAR 1231 Proof of CashkakaoNo ratings yet

- AC 1201 Homework 1Document4 pagesAC 1201 Homework 1nericuevas1030No ratings yet

- Audit of Cash Problems (Seatwork)Document5 pagesAudit of Cash Problems (Seatwork)LorraineMartinNo ratings yet

- Cce Board WorkDocument3 pagesCce Board WorkNicole VinaraoNo ratings yet

- Audit of Cash - SeatworkDocument4 pagesAudit of Cash - SeatworkTEOPE, EMERLIZA DE CASTRONo ratings yet

- On January 1Document6 pagesOn January 1Warren Nahial ValerioNo ratings yet

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- Handout +Cash+and+Cash+EquivalentsDocument7 pagesHandout +Cash+and+Cash+Equivalentsbenedictmoses.koe.acctNo ratings yet

- Illustrative Examples - Bank Recon & PCFDocument3 pagesIllustrative Examples - Bank Recon & PCFjames patrick LaysonNo ratings yet

- Cce Bankrecon 223Document4 pagesCce Bankrecon 223Maliha KansiNo ratings yet

- Cash and Cash Equivalents-StudentDocument2 pagesCash and Cash Equivalents-StudentJerome_JadeNo ratings yet

- Bank Reconciliation & Proof of CashDocument25 pagesBank Reconciliation & Proof of CashTanya MaxNo ratings yet

- Cash and Cash Equivalents C5 Valix 2006Document5 pagesCash and Cash Equivalents C5 Valix 2006Ghaill CruzNo ratings yet

- FAR Cash and Cash EquivalentsDocument2 pagesFAR Cash and Cash EquivalentsXander AquinoNo ratings yet

- FAR Rev Cash To POCDocument6 pagesFAR Rev Cash To POCCattyyy Delos ReyesNo ratings yet

- Bulacan State University: College of Business AdministrationDocument13 pagesBulacan State University: College of Business AdministrationLiana100% (1)

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- Cash and Cash EquivalentsDocument8 pagesCash and Cash EquivalentsNMCartNo ratings yet

- Exercises No1 CCash Equiv and Bank ReconDocument3 pagesExercises No1 CCash Equiv and Bank Recondelrosario.kenneth996No ratings yet

- Assessment Task 1-1Document10 pagesAssessment Task 1-1hahahahaNo ratings yet

- Problem 1 - 1 (IAA) : RequiredDocument11 pagesProblem 1 - 1 (IAA) : RequiredMareah Evanne Bahan50% (2)

- Bank Reconciliation (IA)Document7 pagesBank Reconciliation (IA)rufamaegarcia07No ratings yet

- Profel1 AC Activity Assets Part1Document2 pagesProfel1 AC Activity Assets Part1Dizon Ropalito P.No ratings yet

- Cash Cash Equivalent Bank ReconDocument4 pagesCash Cash Equivalent Bank Reconmavie arellanoNo ratings yet

- Audprob Cash2 Bsa4 2Document5 pagesAudprob Cash2 Bsa4 2Mark Gelo WinchesterNo ratings yet

- 5 6248879817396060958Document6 pages5 6248879817396060958Jeff GonzalesNo ratings yet

- FAR 0 Drill Problem CCEDocument4 pagesFAR 0 Drill Problem CCEyeeaahh56No ratings yet

- PRACTICAL ACCOUNTING 1 - ReviewDocument21 pagesPRACTICAL ACCOUNTING 1 - ReviewMaria BeatriceNo ratings yet

- Agricultural Building and StructureDocument5 pagesAgricultural Building and StructureNick ivan Alvares100% (1)

- Building and Structure Q and ADocument5 pagesBuilding and Structure Q and ANick ivan AlvaresNo ratings yet

- Activity - Accounting For Overhead: Problem 1Document2 pagesActivity - Accounting For Overhead: Problem 1Nick ivan AlvaresNo ratings yet

- Agricultural Engineering Law, Professional Ethics, Engineering Contracts and SpecificationsDocument43 pagesAgricultural Engineering Law, Professional Ethics, Engineering Contracts and SpecificationsNick ivan AlvaresNo ratings yet

- Problems Partnership Dissolution and LiquidationDocument5 pagesProblems Partnership Dissolution and LiquidationNick ivan AlvaresNo ratings yet

- P1 - Percentage of Credit Sales: Requirements: Compute For The FollowingDocument2 pagesP1 - Percentage of Credit Sales: Requirements: Compute For The FollowingNick ivan AlvaresNo ratings yet

- Agricultural Engineerning Law Q and ADocument5 pagesAgricultural Engineerning Law Q and ANick ivan AlvaresNo ratings yet

- Rural Electrification GeneralDocument6 pagesRural Electrification GeneralNick ivan AlvaresNo ratings yet

- Activity - Allocation of Service Department Problem 1: Total Cost For FOH Rate ComputationDocument2 pagesActivity - Allocation of Service Department Problem 1: Total Cost For FOH Rate ComputationNick ivan AlvaresNo ratings yet

- ACAE 22 Activity - Job Order With Spoilage/Defective Units: Problem 1Document2 pagesACAE 22 Activity - Job Order With Spoilage/Defective Units: Problem 1Nick ivan AlvaresNo ratings yet

- ACAE 15 Activity - Investment in Bonds: Problem 1Document5 pagesACAE 15 Activity - Investment in Bonds: Problem 1Nick ivan AlvaresNo ratings yet

- ACAE 14 Activity - Partnership Dissolution: P1 Partners AdmissionDocument3 pagesACAE 14 Activity - Partnership Dissolution: P1 Partners AdmissionNick ivan AlvaresNo ratings yet

- ACAE 15 Activity Receivable FinancingDocument3 pagesACAE 15 Activity Receivable FinancingNick ivan AlvaresNo ratings yet

- Spreadsheet UsesDocument31 pagesSpreadsheet UsesNick ivan AlvaresNo ratings yet

- ACAE 14 Activity - Partnership Formation: RequirementsDocument2 pagesACAE 14 Activity - Partnership Formation: RequirementsNick ivan AlvaresNo ratings yet

- World Wide WebDocument3 pagesWorld Wide WebNick ivan AlvaresNo ratings yet

- Rural Electrification: Overview of TopicsDocument4 pagesRural Electrification: Overview of TopicsNick ivan AlvaresNo ratings yet

- Rural Electrification: 3 Technology OverviewsDocument8 pagesRural Electrification: 3 Technology OverviewsNick ivan AlvaresNo ratings yet

- Network Protocol: ProtocolsDocument3 pagesNetwork Protocol: ProtocolsNick ivan AlvaresNo ratings yet

- WEEK 8 Purposive CommunicationDocument8 pagesWEEK 8 Purposive CommunicationNick ivan AlvaresNo ratings yet

- Module 2 ActivityDocument1 pageModule 2 ActivityNick ivan AlvaresNo ratings yet

- Three Elements of An OSDocument2 pagesThree Elements of An OSNick ivan AlvaresNo ratings yet

- Waste Management Q and ADocument6 pagesWaste Management Q and ANick ivan AlvaresNo ratings yet

- Questions and Answer EconomicsDocument5 pagesQuestions and Answer EconomicsNick ivan Alvares100% (3)

- Arias, Kyla Kim B. - Midterm Project October 8,2021Document6 pagesArias, Kyla Kim B. - Midterm Project October 8,2021Kyla Kim AriasNo ratings yet

- Uneb Uace Entrepreneurship Education 2018Document5 pagesUneb Uace Entrepreneurship Education 2018Barasa marvin33% (3)

- Intacc 3 Cash Flow QuizDocument13 pagesIntacc 3 Cash Flow QuizRica RegorisNo ratings yet

- Assignment 4 Job Order Costing - ACTG321 - Cost Accounting and Cost ManagementDocument3 pagesAssignment 4 Job Order Costing - ACTG321 - Cost Accounting and Cost ManagementGenithon PanisalesNo ratings yet

- Department of Education: Sablayan National Comprehensive High SchoolDocument1 pageDepartment of Education: Sablayan National Comprehensive High SchoolRia Dela CruzNo ratings yet

- Chapter 8 Problem 9Document2 pagesChapter 8 Problem 9Erica CastroNo ratings yet

- MSQ-02 - Variable & Absorption Costing (Final)Document11 pagesMSQ-02 - Variable & Absorption Costing (Final)Kevin James Sedurifa OledanNo ratings yet

- ABC and FifoDocument4 pagesABC and FifosninaricaNo ratings yet

- Chapter 21Document6 pagesChapter 21Meii ZhangNo ratings yet

- Process Costing CompleteDocument85 pagesProcess Costing CompleteGian Carlo RamonesNo ratings yet

- ACCT5013 M5 LectureDocument40 pagesACCT5013 M5 LecturegregNo ratings yet

- StudyDocument10 pagesStudyirahQNo ratings yet

- Print Chapter 2 Mcqs BankDocument7 pagesPrint Chapter 2 Mcqs BankMohammedAlmohammedNo ratings yet

- Chapter 8 - InventoryDocument26 pagesChapter 8 - Inventorychandel08No ratings yet

- Soal Akuntansi Manajemen 2019Document15 pagesSoal Akuntansi Manajemen 2019Hasna RosyidaNo ratings yet

- MOD 07 Inventory BasicsDocument17 pagesMOD 07 Inventory BasicsKhen HannaNo ratings yet

- Group 9 Budgeting Manac 2Document7 pagesGroup 9 Budgeting Manac 2amartyadasNo ratings yet

- Exam 1Document19 pagesExam 1김현중No ratings yet

- Cost Sheet Prepation-NotesDocument12 pagesCost Sheet Prepation-NotesSunita BasakNo ratings yet

- Mahesh 5 SemDocument56 pagesMahesh 5 SemManjunath HagedalNo ratings yet

- Accounting IAS Model Answers Series 3 2006 Old SyllabusDocument20 pagesAccounting IAS Model Answers Series 3 2006 Old SyllabusAung Zaw HtweNo ratings yet

- DM Various SceneriousDocument15 pagesDM Various SceneriousSyed FaizanNo ratings yet

- RR No. 13-94Document13 pagesRR No. 13-94Jerwin DaveNo ratings yet

- Accounts MozDocument6 pagesAccounts MozzulecaNo ratings yet

- A - Mock PSPM Set 2Document6 pagesA - Mock PSPM Set 2IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- CH 19Document12 pagesCH 19Felicia Carissa0% (1)

- B Com Core Cost AccountingDocument116 pagesB Com Core Cost AccountingPRIYANKA H MEHTA100% (1)

- QE - Cost & FMDocument10 pagesQE - Cost & FMJykx SiaoNo ratings yet

- Bva 3Document7 pagesBva 3najaneNo ratings yet

- Activity 12.3 Sales Transactions A. Transactions Perpetual SystemDocument2 pagesActivity 12.3 Sales Transactions A. Transactions Perpetual SystemDonna Lyn BoncodinNo ratings yet