Professional Documents

Culture Documents

Chapter 03

Uploaded by

Crayon Shin-ChanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 03

Uploaded by

Crayon Shin-ChanCopyright:

Available Formats

Chapter 3: Interest Rate and Economic Equivalence

Types of Interest

3.1

$10,000 = $5,000(1 + 0.08 N )

• Simple interest: (1 + 0.08 N ) = 2

1

N= = 12.5 years

0.08

$10,000 = $5,000(1 + 0.07) N

• Compound interest: (1 + 0.07) N = 2

N = 10.2 years

3.2

• Simple interest:

I = iPN = (0.08)($1,000)(5) = $400

• Compound interest:

I = P[(1 + i ) N − 1] = $1,000(1.4693 − 1) = $469

3.3

• Option 1: Compound interest with 8%:

F = $3,000(1 + 0.08) 5 = $3,000(1.4693) = $4,408

• Option 2: Simple interest with 9%

$3,000(1 + 0.09 × 5) = $3,000(1.45) = $4,350

• Option 1 is better

3.4

End of Year Principal Interest Remaining

Repayment payment Balance

0 $10,000

1 $1,671 $900 $8,329

2 $1,821 $750 $6,508

3 $1,985 $586 $4,523

4 $2,164 $407 $2,359

5 $2,359 $212 $0

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

2

Equivalence Concept

3.5

P = $12,000( P / F , 5%, 5) = $12,000(0.7835) = $9,402

3.6

F = $20,000( F / P, 8%, 2) = $20,000(1.1664) = $23,328

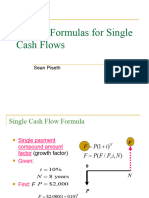

Single Payments (Use of F/P or P/F Factors)

3.7

(a) F = $5,000( F / P, 5%, 8) = $7,388

(b) F = $2,250( F / P, 3%,12) = $3,208

(c) F = $8,000( F / P, 7%, 31) = $65,161

(d) F = $25,000( F / P, 9%, 7) = $45,700

3.8

(a) P = $5,500( P / F ,10%, 6) = $3,105

(b) P = $8,000( P / F , 6%,15) = $3,338

(c) P = $30,000( P / F , 8%, 5) = $20,418

(d) P = $15,000( P / F ,12%, 8) = $3,851

3.9

(a) P = $10,000( P / F ,13%, 5) = $5,428

(b) F = $25,000( F / P,13%, 4) = $40,763

3.10

F = 3P = P (1 + 0.12) N

log 3 = N log(1.12)

N = 9.69 years

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

3

3.11

F = 2 P = P(1 + 0.15) N

• log 2 = N log(1.15)

N = 4.96 years

• Rule of 72: 72 /15 = 4.80 years

Uneven Payment Series

3.12

(a) Single-payment compound amount ( F / P, i, N ) factors for

n 9% 10%

35 20.4140 28.1024

40 31.4094 45.2593

To find ( F / P, 9.5%, 38) , first, interpolate for n = 38

n 9% 10%

38 27.0112 38.3965

Then, interpolate for i = 9.5%

( F / P, 9.5%, 38) = 32.7039

As compared to formula determination

( F / P, 9.5%, 38) = 31.4584

(b) Single-payment compound amount ( P / F , i, N ) factors for

n 45 50

0.0313 0.0213

Then, interpolate for n = 47

( P / F , 8%, 47) = 0.0273

As compared with the result from formula

( P / F , 8%, 47) = 0.0269

3.13

$32,000 $43,000 $46,000 $28,000

P= + + + = $114,437

1.08 2 1.08 3 1.08 4 1.08 5

3.14

F = $1,500( F / P, 6%,15) + $1,800( F / P, 6%,13) + $2,000( F / P,6%,11) = $11,231

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

4

3.15

P = $3, 000, 000 + $2, 400, 000( P / F ,8%,1) +

+$3, 000, 000( P / F ,8%,10)

= $20, 734, 618

Or,

P = $3, 000, 000 + $2, 400, 000( P / A,8%,5)

+$3, 000, 000( P / A,8%,5)( P / F ,8%,5)

= $20, 734, 618

3.16

P = $7,500( P / F , 6%, 2) + $6,000( P / F , 6%, 5) + $5,000( P / F ,6%,7) = $14,484

Equal Payment Series

3.17

(a) With deposits made at the end of each year

F = $1,000( F / A, 7%,10) = $13,816

(b) With deposits made at the beginning of each year

F = $1,000( F / A, 7%,10)(1.07) = $14,783

3.18

(a) F = $3,000( F / A, 7%, 5) = $16,713

(b) F = $4,000( F / A, 8.25%,12) = $77,043

(c) F = $5,000( F / A, 9.4%, 20) = $267,575

(d) F = $6,000( F / A,10.75%,12) = $134,236

3.19

(a) A = $22,000( A / F , 6%,13) = $1,166

(b) A = $45,000( A / F , 7%, 8) = $4,388

(c) A = $35,000( A / F , 8%, 25) = $479.5

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

5

(d) A = $18,000( A / F ,14%, 8) = $1,361

3.20

$30, 000 = $1,500( F / A, 7%, N )

( F / A, 7%, N ) = 20

N = 12.94 ≈ 13 years

3.21

$15, 000 = A( F / A, 11%, 5)

A = $2, 408.56

3.22

(a) A = $10,000( A / P, 5%, 5) = $2,310

(b) A = $5,500( A / P, 9.7%, 4) = $1,723.70

(c) A = $8,500( A / P, 2.5%, 3) = $2,975.85

(d) A = $30,000( A / P, 8.5%, 20) = $3,171

3.23

• Equal annual payment:

A = $25,000( A / P,16%, 3) = $11,132.5

• Interest payment for the second year:

End of Year Principal Interest Remaining

Repayment payment Balance

0 $25,000

1 $7,132.5 $4,000 $17,867.5

2 $8,273.7 $2,858.8 $9,593.8

3 $9,593.8 $1,535 -

3.24

(a) P = $800( P / A, 5.8%,12) = $6,781.2

(b) P = $2,500( P / A, 8.5%,10) = $16,403.25

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

6

(c) P = $900( P / A, 7.25%, 5) = $3,665.61

(d) P = $5,500( P / A, 8.75%, 8) = $30,726.3

3.25

(a) The capital recovery factor ( A / P, i, N ) for

n 6% 7%

35 0.0690 0.0772

40 0.0665 0.0750

To find ( A / P, 6.25%, 38) , first, interpolate for n = 38

n 6% 7%

38 0.0675 0.0759

Then, interpolate for i = 6.25% ; ( F / P, 6.25%, 38) = 0.0696

As compared with the result from formula

( F / P, 6.25%, 38) = 0.0694

(b) The equal payment series present-worth factor (P / A, i, 85) for

i 9% 10%

11.1038 9.9970

Then, interpolate for i = 9.25%

( P / A, 9.25%, 85) = 10.8271

As compared with the result from formula

( P / A, 9.25%, 85) = 10.8049

Linear Gradient Series

3.26

F = F1 + F2

= $5,000( F / A, 8%, 5) + $2,000( F / G, 8%,5)

= $5,000( F / A,8%,5) + $2,000( A / G, 8%, 5)( F / A,8%,5)

= $50,988.35

3.27

F = $3,000( F / A, 7%, 5) − $500( F / G, 7%,5)

= $3,000( F / A,7%,5) − $500( P / G, 7%, 5)( F / P,7%,5)

= $11,889.47

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

7

3.28

P = $100 + [$100( F / A, 9%,7) + $50( F / A, 9%, 6) + $50( F / A, 9%,4)

+ $50( F / A, 9%, 2)]( P / F ,9%, 7)

= $991.26

3.29

A = $15,000 − $1,000( A / G,8%,12)

= $10,404.3

3.30

(a) P = $6,000,000( P / A1 ,−10%,12%,7) = $21,372,076

(b) Note that the oil price increases at the annual rate of 5% while the oil

production decreases at the annual rate of 10%. Therefore, the annual

revenue can be expressed as follows:

An = $60(1 + 0.05) n −11000,000(1 − 0.1) n −1

= $6,000,000(0.945) n −1

= $6,000,000(1 − 0.055) n −1

This revenue series is equivalent to a decreasing geometric gradient series

with g = -5.5%.

So, P = $6,000,000( P / A1 ,−5.5%,12%,7) = $23,847,896

(c) Computing the present worth of the remaining series ( A4 , A5 , A6 , A7 ) at the end

of period 3 gives

P = $5,063,460( P / A1 ,−5.5%,12%,7) = $14,269,652

3.31

20

P = ∑ An (1 + i ) − n

n =1

20

= ∑ (2, 000, 000)n(1.06) n −1 (1.06) − n

n =1

20

1.06 n

= (2, 000, 000 /1.06)∑ n( )

n =1 1.06

= $396, 226, 415

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

8

Note: if i ≠ g ,

N

x[1 − ( N + 1) x N + Nx N +1

∑ nx n =

n =1 (1 − x) 2

When g = 6% and i = 8%,

1+ g

x= = 0.9815

1+ i

$2, 000, 000 ⎡ 0.9815[1 − (21)(0.6881) + 20(0.6756)] ⎤

P= ⎢⎣ ⎥⎦

1.06 0.0003

= $334,935,843

3.32

(a) The withdrawal series would be

Period Withdrawal

11 $5,000

12 $5,000(1.08)

13 $5,000(1.08)(1.08)

14 $5,000(1.08)(1.08)(1.08)

15 $5,000(1.08)(1.08)(1.08)(1.08)

P10 = $5,000( P / A1 ,8%,9%,5) = $22,518.78

Assuming that each deposit is made at the end of each year, then;

$22,518.78 = A( F / A, 9%, 10) = 15.1929 A

A = $1482.19

(b) P10 = $5,000( P / A1 ,8%,6%,5) = $24,491.85

$24, 491.85 = A( F / A, 6%, 10) = 13.1808 A

A = $1858.15

Various Interest Factor Relationships

3.33

(a) ( P / F , 8%, 67) = ( P / F , 8%,50)( P / F ,8%,17) = (0.0213)(0.2703) = 0.0058

( P / F , 8%, 67) = (1 + 0.08) 67 = 0.0058

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

9

i

(b) ( A / P, i, N ) =

1 − ( P / F , i, N )

( P / F , 8%, 42) = ( P / F , 8%,40)( P / F ,8%,2) = 0.0394

0.08

( A / P, 8%, 42) = = 0.0833

1 − 0.0394

0.08(1.08) 42

( A / P, 8%, 42) = = 0.0833

(1.08) 42 − 1

1 − ( P / F , i, N ) 1 − ( P / F ,8%,100)( P / F ,8%,35)

(c) ( P / A, i, N ) = = = 12.4996

i 0.08

(1.08)135 − 1

( A / P, 8%,135) = = 12.4996

0.08(1.08)135

3.34

(a)

( F / P, i, N ) = i ( F / A, i, N ) + 1

(1 + i ) N − 1

(1 + i ) N = i +1

i

= (1 + i ) N − 1 + 1

= (1 + i ) N

(b)

( P / F , i, N ) = 1 − ( P / A, i, N )i

(1 + i ) N − 1

(1 + i ) − N = 1 − i

i (1 + i ) N

(1 + i ) N (1 + i ) N − 1

= −

(1 + i ) N (1 + i ) N

= (1 + i ) − N

(c)

( A / F , i, N ) = ( A / P, i, N ) − i

i i (1 + i ) N i (1 + i ) N i[(1 + i ) N − 1]

= −i = −

(1 + i ) N − 1 (1 + i ) N − 1 (1 + i ) N − 1 (1 + i ) N − 1

i

=

(1 + i ) N − 1

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

10

(d)

i

( A / P, i, N ) =

[1 − ( P / F , i, N )]

i (1 + i ) N i

=

(1 + i ) − 1 (1 + i )

N N

1

−

(1 + i ) N

(1 + i ) N

i (1 + i ) N

=

(1 + i ) N − 1

(e) (f) & (g) Divide the numerator and denominator by (1 + i) N and take the

limit N → ∞ .

Equivalence Calculations

3.35

P = [$100( F / A,12%,9) + $50( F / A,12%, 7) + $50( F / A,12%,5)]( P / F ,12%,10)

= $740.49

3.36

P(1.08) + $200 = $200( P / F , 8%,1) + $120( P / F , 8%, 2) + $120( P / F , 8%,3)

+ $300( P / F ,8%,4)

P = $373.92

3.37 Selecting the base period at n = 0, we find

$100( P / A,13%,5) + $20( P / A,13%,3)( P / F ,13%, 2) = A( P / A,13%,5)

$351.72 + $36.98 = (3.5172) A

A = $110.51

3.38 Selecting the base period at n =0, we find

P1 = $200 + $100( P / A,6%,5) + $50( P / F ,6%,1) + $50( P / F ,6%,4) + $100( P / F ,6%,5)

= $782.75

P2 = X ( P / A,6%,5) = $782.75

X = $185.82

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

11

3.39

P = $20( P / G,10%,5) − $20( P / A,10%,12)

= $0.96

$80

$60

$40

$20

0 1 2 3 4 5 6 7 8 9 10 11 12

$20

3.40 Establish economic equivalent at n = 8 :

C ( F / A,8%,8) − C ( F / A,8%,2)( F / P,8%,3) = $6,000( P / A,8%,2)

10.6366C − (2.08)(1.2597)C = $6,000(1.7833)

8.0164C = $10,699.80

C = $1,334.73

3.41 The original cash flow series is

n An n An

0 0 6 $900

1 $800 7 $920

2 $820 8 $300

3 $840 9 $300

4 $860 10 $300 − $500

5 $880

3.42 Establishing equivalence at n = 8, we find

$300( F / A,10%,8) + $200( F / A,10%,3) = 2C ( F / P,10%,8) + C ( F / A,10%,7)

$4,092.77 = 2C (2.1436) + C (9.4872)

C = $297.13

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

12

3.43 Establishing equivalence at n = 5

$200( F / A,8%,5) − $50( F / P,8%,1)

= X ( F / A,8%,5) − ($200 + X )[( F / P,8%, 2) + ( F / P,8%,1)]

$1,119.32 = X (5.8666) − ($200 + X )(2.2464)

X = $185.09

3.44 Computing equivalence at n = 5

X = $3,000( F / A,9%,5) + $3,000( P / A,9%,5) = $29,623.2

3.45 (2), (4), and (6)

3.46 (2), (4), and (5)

3.47

A1 = ($50 + $50( A / G,10%,5) − [$50 + $50( P / F ,10%,1)]( A / P,10%,5) = $115.32

A2 = A + A( A / P,10%,5) = 1.2638 A

A = $91.25

3.48 (a)

3.49 (b)

3.50 (b)

$25,000 + $30,000( P / F ,10%,6)

= C ( P / A,10%,12) + $1,000( P / A,10%,6)( P / F ,10%,6)]

$41,935 = 6.8137C + $2,458.60

C = $5,793

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

13

Solving for an Unknown Interest Rate of Unknown Interest Periods

3.51

2 P = P(1 + i )5

log 2 = 5 log (1 + i )

i = 14.87%

3.52 Establishing equivalence at n = 0

$2,000( P / A, i,6) = $2,500( P / A1 ,−25%, i,6)

Solving for I with Excel, we obtain i = 92.35%

3.53

$35, 000 = $10, 000( F / P, i,5) = $10, 000(1 + i )5

i = 28.47%

3.54

$1, 000, 000 = $2, 000( F / A, 6%, N )

(1 + 0.06) N − 1

500 =

0.06

31 = (1 + 0.06) N

log 30 = N log1.06

N = 58.37 years

Short Case Studies

ST 3.1 Assuming that they are paid at the beginning of each year

(a)

$15.96 + $15.96( P / A,6%,3) = $58.62

It is better to take the offer because of lower cost to renew.

(b)

$57.12 = $15.96 + $15.96( P / A, i,3)

i = 7.96%

ST 3.2 The equivalent future worth of the prize payment series at the end of

Year 20 (or beginning of Year 21) is

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

14

F1 = $1,952,381( F / A, 6%, 20)

= $71,819, 490

The equivalent future worth of the lottery receipts is

F2 = ($36,100, 000 − $1,952,381)( F / P, 6%, 20)

= $109,516, 040

The resulting surplus at the end of Year 20 is

F2 − F1 = $109,516, 040 − $71,819, 490

= $37, 696,550

ST 3.3

(a) Compute the equivalent present worth (in 2006) for each option at i = 6% .

PDeferred = $2, 000, 000 + $566, 000( P / F , 6%,1) + $920, 000( P / F , 6%, 2) +

+$1, 260, 000( P / F , 6%,11)

= $8,574, 490

PNon-Deferred = $2, 000, 000 + $900, 000( P / F , 6%,1) + $1, 000, 000( P / F , 6%, 2) +

+$1,950, 000( P / F , 6%,5)

= $7, 431,560

∴ At i = 6% , the deferred plan is a better choice.

(b) Using either Excel or Cash Flow Analyzer, both plans would be

economically equivalent at i = 15.72%

ST 3.4 The maximum amount to invest in the prevention program is

P = $14,000( P / A,12%,5) = $50,467

ST 3.5 Using the geometric gradient series present worth factor, we can establish

the equivalence between the loan amount $120,000 and the balloon payment

series as

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

15

$120, 000 = A1 ( P / A1 ,10%,9%,5) = 4.6721A1

1)

A1 = $25, 684.38

2) Payment series

n Payment

1 $25,684.38

2 $28,252.82

3 $31,078.10

4 $34,185.91

5 $37,604.50

ST 3.6

1) Compute the required annual net cash profit to pay off the investment

and interest.

$70, 000, 000 = A( P / A,10%,5) = 3.7908 A

A = $18, 465, 759

2) Decide the number of shoes, X

$18, 465, 759 = X ($100)

X = 184, 657

ST 3.7

$1, 000( P / F ,9.4%,5) + $500( F / A,9.4%,5) = $4,583.36

$4,583.36( F / P,9.4%, 60) = $1, 005,132

The main question is whether or not the U.S. government will be able to

invest the social security deposits at 9.4% interest over 60 years.

ST 3.8

(a)

PContract = $3,875, 000 + $3,125, 000( P / F , 6%,1)

+$5,525, 000( P / F , 6%, 2) + …

+$8,875, 000( P / F , 6%, 7)

= $39,547, 242

(b)

PBonus = $1,375, 000 + $1,375, 000( P / A, 6%, 7)

= $9, 050, 775 > $8, 000, 000

Stay with the original deferred plan.

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

16

ST 3.9

Basically we are establishing an economic equivalence between two

payment options. Selecting n = 0 as the base period, we can calculate the

equivalent present worth for each option as follows:

Option 1: P = $140, 000

Option 2: P = $32, 639( P / A, i %,9)

Or,

$140, 000 = $32, 639( P / A, i%,9)

i = 18.10%

If Mrs. Setchfield can invest her money at a rate higher than 18.10%, it is

better to go with Option 1. However, it may be difficult for her to find an

investment opportunity that provides a return exceeding 18%.

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

© 2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

You might also like

- Park - Fundamentals of Engineering Economics - 2nd Edition - Solution Manual - ch2Document15 pagesPark - Fundamentals of Engineering Economics - 2nd Edition - Solution Manual - ch2Mobin Akhand50% (6)

- Chapter 04Document29 pagesChapter 04arfat_ahmad_khan67% (3)

- Chapter 06Document27 pagesChapter 06mazin903No ratings yet

- Chapter 12 PDFDocument41 pagesChapter 12 PDFaaaNo ratings yet

- Chapter 10 PDFDocument47 pagesChapter 10 PDFaaaNo ratings yet

- Chapter 5 Present-Worth Analysis: Identifying Cash Inflows and OutflowsDocument23 pagesChapter 5 Present-Worth Analysis: Identifying Cash Inflows and Outflowsahjhnlol50% (2)

- Engineering Economics Lecture 10 PDFDocument29 pagesEngineering Economics Lecture 10 PDFNavinPaudelNo ratings yet

- FEE ISM Ch08 3e OKDocument15 pagesFEE ISM Ch08 3e OKonlydlonlyNo ratings yet

- Park - Fundamentals of Engineering Economics, 2nd Edition - Solution Manual - ch0Document4 pagesPark - Fundamentals of Engineering Economics, 2nd Edition - Solution Manual - ch0Martin Van Nostrand0% (11)

- Engineering Economics Lecture 3 PDFDocument44 pagesEngineering Economics Lecture 3 PDFNavinPaudelNo ratings yet

- Chapter 05Document26 pagesChapter 05slee11829% (7)

- CNC Part ProgrammingDocument17 pagesCNC Part ProgrammingGptc ChekkanuraniNo ratings yet

- Minggu 2 - Interest and EquivalenceDocument32 pagesMinggu 2 - Interest and EquivalencekasmitaNo ratings yet

- 2 Cost Concepts and Design EconomicsDocument16 pages2 Cost Concepts and Design EconomicsAlex XleaNo ratings yet

- Money Time Relationships and EquivalenceDocument34 pagesMoney Time Relationships and EquivalenceRyan Jay EscoriaNo ratings yet

- MSG 00002 Solution ManualDocument5 pagesMSG 00002 Solution ManualGo Turpin0% (1)

- Engineering Economy Chapter 5Document102 pagesEngineering Economy Chapter 5Jason Gabriel JonathanNo ratings yet

- Fundamentals of Engineering ExamDocument3 pagesFundamentals of Engineering Examkarlcruz_ibNo ratings yet

- C09Document84 pagesC09Farah Fazlin JamilNo ratings yet

- Chapter #19 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument15 pagesChapter #19 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'bNo ratings yet

- S-Curve Exam QuestionsDocument3 pagesS-Curve Exam QuestionsSanjith SadanandanNo ratings yet

- Statistics and Probability - Solved Assignments - Semester Spring 2010Document33 pagesStatistics and Probability - Solved Assignments - Semester Spring 2010Muhammad UmairNo ratings yet

- EIT PE BrochureDocument8 pagesEIT PE BrochureSamer HouzaynNo ratings yet

- Performance Appraisal: Meaning:: DefinitionDocument14 pagesPerformance Appraisal: Meaning:: DefinitionAisha BarbieNo ratings yet

- Pp01aDocument32 pagesPp01aAlexandra NeacsuNo ratings yet

- Cold Formed Steel Construction Connectors Catalog - Download PDFsDocument3 pagesCold Formed Steel Construction Connectors Catalog - Download PDFssmartcad60No ratings yet

- CH 08Document41 pagesCH 08Saied Aly SalamahNo ratings yet

- Rate of ReturnDocument38 pagesRate of ReturnPraz AarashNo ratings yet

- 7-Engineering Economics 2014Document42 pages7-Engineering Economics 2014hiva_p_23716778No ratings yet

- Group 3 - Presentation PDFDocument20 pagesGroup 3 - Presentation PDFSofina HumagainNo ratings yet

- ASSIGNMENT 3 - Evaluating A Single Project - SolutionsDocument5 pagesASSIGNMENT 3 - Evaluating A Single Project - SolutionsMinh Tuyền100% (1)

- Engineering Economics - SyllabusDocument6 pagesEngineering Economics - Syllabuscharmaine fos100% (1)

- Reading and Presenting GraphsDocument11 pagesReading and Presenting GraphsJemma MilitonyanNo ratings yet

- Performance Management Chapter 3 EvaDocument27 pagesPerformance Management Chapter 3 EvaYasichalew sefinehNo ratings yet

- FE Exam TipsDocument17 pagesFE Exam TipsAshraf Badr100% (1)

- Dwnload Full Contemporary Engineering Economics 5th Edition Park Solutions Manual PDFDocument35 pagesDwnload Full Contemporary Engineering Economics 5th Edition Park Solutions Manual PDFnenupharflashilysp5c100% (16)

- Contemporary Engineering Economics 5th Edition Park Solutions ManualDocument35 pagesContemporary Engineering Economics 5th Edition Park Solutions Manualbyronrogersd1nw8100% (17)

- 03 Park ISM ch03 PDFDocument15 pages03 Park ISM ch03 PDFBenn DoucetNo ratings yet

- Gemmw: Mathematics in The Modern World Module 4: Consumer Math Learning OutcomesDocument24 pagesGemmw: Mathematics in The Modern World Module 4: Consumer Math Learning OutcomesMary Grace Angeles50% (2)

- Lecture 3Document13 pagesLecture 3saher.khkefat12No ratings yet

- GENERAL MATHEMATICS Quarter 2 - Module 6: Simple and Compound InterestsDocument3 pagesGENERAL MATHEMATICS Quarter 2 - Module 6: Simple and Compound InterestsAngeline TumananNo ratings yet

- Assignment ExcelDocument3 pagesAssignment ExcelTarek KamelNo ratings yet

- Business Mathematics Midterm ExamDocument10 pagesBusiness Mathematics Midterm ExamYasmin BeltranNo ratings yet

- Part 1Document10 pagesPart 1DantesNo ratings yet

- Lecture5-Equal Payment SeriesDocument25 pagesLecture5-Equal Payment SeriesGanda GandaNo ratings yet

- Business Mathematics Chapter 8&9Document89 pagesBusiness Mathematics Chapter 8&9WiilsoonvegaNo ratings yet

- Module 4 - Consumer MathDocument23 pagesModule 4 - Consumer MathCIELICA BURCANo ratings yet

- Chapter 5 Interest Formulas For Single Cash FlowsDocument10 pagesChapter 5 Interest Formulas For Single Cash FlowsORK BUNSOKRAKMUNYNo ratings yet

- Activity Sheets Obj. 3Document7 pagesActivity Sheets Obj. 3BOBBY BRAIN ANGOSNo ratings yet

- Chapter 9 Simple Interest PDFDocument7 pagesChapter 9 Simple Interest PDFAhmed AymanNo ratings yet

- Learning Outcomes:: SolutionDocument4 pagesLearning Outcomes:: Solutiondreamfever0323No ratings yet

- Assignment 1+2 SolutionsDocument4 pagesAssignment 1+2 SolutionsMinh TuyềnNo ratings yet

- ISE431 L3 3rDocument23 pagesISE431 L3 3rjohnNo ratings yet

- General Mathematics InterestDocument29 pagesGeneral Mathematics InterestDenmark SantosNo ratings yet

- 04 Park ISM ch04 PDFDocument28 pages04 Park ISM ch04 PDFBenn DoucetNo ratings yet

- Chapter3 SolutionsDocument6 pagesChapter3 SolutionsjamalcrawfordNo ratings yet

- Mathematics of InvestmentsDocument9 pagesMathematics of InvestmentsJohndee Mozart Dela CruzNo ratings yet

- Tutorial 2 SolutionsDocument4 pagesTutorial 2 SolutionsSadia R ChowdhuryNo ratings yet

- Surigao Del Sur State University: Mathematics in The Modern World Module Number 5Document8 pagesSurigao Del Sur State University: Mathematics in The Modern World Module Number 5TOP ERNo ratings yet

- Simple CompoundDocument46 pagesSimple CompoundJanelle Ghia RamosNo ratings yet

- SLVR White Paper FinalDocument16 pagesSLVR White Paper FinalTorVikNo ratings yet

- 2006111512164611635642060Document60 pages2006111512164611635642060Awsaf Amanat Khan AuzzieNo ratings yet

- Syllabus FMGT3531 Fall 2010Document4 pagesSyllabus FMGT3531 Fall 2010Tony KiyoshiNo ratings yet

- Candlestick by SanstocktraderDocument33 pagesCandlestick by SanstocktraderSakthi VelNo ratings yet

- Daftar DisporaDocument10 pagesDaftar DisporaElena RosintaNo ratings yet

- Capital Market of BangladeshDocument14 pagesCapital Market of BangladeshMD. Azharul IslamNo ratings yet

- 'ContribDocument756 pages'ContribMatt DixonNo ratings yet

- Case 45 Jetblue ValuationDocument12 pagesCase 45 Jetblue Valuationshawnybiha100% (1)

- GP Bhiya: & (+27) (Admin@Princevix75)Document4 pagesGP Bhiya: & (+27) (Admin@Princevix75)herrlich adefoulouNo ratings yet

- The Economist (Intelligence Unit) PDFDocument115 pagesThe Economist (Intelligence Unit) PDFfra100% (1)

- Candlestick PatternsDocument17 pagesCandlestick PatternsaaryinfoNo ratings yet

- SAPM Portfolio EvaluationDocument6 pagesSAPM Portfolio EvaluationsarahrahulNo ratings yet

- BFMS Course OutlineDocument5 pagesBFMS Course OutlineSaksham GoyalNo ratings yet

- Nism X B Caselet 1Document9 pagesNism X B Caselet 1Harish MadanNo ratings yet

- McKinley V Board of Governors AIG Production 4 January 2013 Heavily Redacted (Lawsuit #3a)Document908 pagesMcKinley V Board of Governors AIG Production 4 January 2013 Heavily Redacted (Lawsuit #3a)Vern McKinleyNo ratings yet

- Nigerian Stock Exchange and Economic DevelopmentDocument14 pagesNigerian Stock Exchange and Economic DevelopmentAbdulhameed BabalolaNo ratings yet

- Cheyne Real Estate Debt Fund Wins Credit & Distressed Category at EuroHedge AwardsDocument1 pageCheyne Real Estate Debt Fund Wins Credit & Distressed Category at EuroHedge AwardsCheyne CapitalNo ratings yet

- Float Charts SimplifiedDocument26 pagesFloat Charts Simplifiednguyenvanlanh0725No ratings yet

- PWT 90Document1,315 pagesPWT 90burcakkaplanNo ratings yet

- PartnershipDocument11 pagesPartnership555angelNo ratings yet

- LimclmdDocument120 pagesLimclmdSakshi DubeyNo ratings yet

- Summer Internship Project ReportDocument86 pagesSummer Internship Project ReportShalini Chatterjee100% (2)

- The World's Greatest Investors: Related ArticlesDocument1 pageThe World's Greatest Investors: Related ArticlesDidiette BilemboNo ratings yet

- How To Really Be A MillionaireDocument6 pagesHow To Really Be A MillionaireLolitaBarronsNo ratings yet

- Rich Dad Poor DAD: Interpretation by Monil NisarDocument20 pagesRich Dad Poor DAD: Interpretation by Monil Nisarshethiren8832No ratings yet

- Bajaj Auto Pvt. Ltd. Market Returns and Stock PriceDocument4 pagesBajaj Auto Pvt. Ltd. Market Returns and Stock PriceArron CarterNo ratings yet

- 16 Investors and Their NeedsDocument22 pages16 Investors and Their NeedsSAHIL GUPTANo ratings yet

- A Project Report On Derivatives (Futures & Options) : FOR Kotak Securities Pvt. LTDDocument78 pagesA Project Report On Derivatives (Futures & Options) : FOR Kotak Securities Pvt. LTDSandesh GadeNo ratings yet

- A Project Report On Indian Capital MarkeDocument85 pagesA Project Report On Indian Capital MarkeZeeshan KhanNo ratings yet