Professional Documents

Culture Documents

HW 3 - ACME Roadrunner

Uploaded by

kartik lakhotiya0 ratings0% found this document useful (0 votes)

147 views7 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

147 views7 pagesHW 3 - ACME Roadrunner

Uploaded by

kartik lakhotiyaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 7

Financial Input-ACME Roadrunner

2009 2010

$

1 Revenue 4,900,000 $ 5,833,250

2 Retained Earnings (at start of year) $ 423,000

$

3 Beginning Inventory 1,500,000 $ 1,000,000

4 Other Short Term Debt (end of year) $ 270,000 $ 50,000

5 Sales & Marketing 10% of Rev 9% of Rev

6 Accumulated Depreciation $ 493,000 $ 557,000

7 Interest $ 50,000

8 Gross Profit

9 Accounts Payable $ 530,000 25% of Purch

10 Total Fixed Assets

11 Raw Materials Purchased $ 2,500,000

12 Total Stockholder Equity

13 Goods Available (beginning inventory+ purchases)

14 Cash $ 207,000

15 Retained Earnings (end of year)

16 Total Long-Term Assets $ 1,176,000

17 Other Current Liabilities $ 32,000

18 Research & Development 12% of Rev 14% of Rev

19 Tax rate 35.00% 40.00%

20 Amortization $ 7,300

21 Dividends $ 25,000 $ 50,000

22 EBITDA

23 Intangibles(gross) $ 100,000 $ 100,000

24 Total Liabilities

25 Marketable Securities $ 162,000 $ 162,000

26 Preferred Stock $ 150,000 $ 250,000

27 Earnings Before Int/Tax

$

28 Earnings Before Tax 1,579,700

29 General & Administrative 5% of Rev

$

30 Property, Plant and Equipment 1,649,000

31 Other liabilities

32 Accumulated Amortization $ 35,000 $ 42,300

33 Accounts Receivable $ 707,000 20% of Rev

34 Total Assets

35 Total Current Liabilities $ 819,000

36 Long Term Debt $ 450,000 $ 250,000 *Assume LTD moved to

37 Common Stock $ 453,195 STD is $200K (amount of

LTD owed with one year

38 Total Liabilities & Equity

period)

$

39 Cost of Goods Sold 1,900,000

40 Depreciation $ 48,000

41 Total Current Assets

42 Net Income

43 Total Operating Expense 30% of Rev

44 Ending Inventory $ 1,250,000

Income Statement-ACME Roadrunner

2009 2010 Notes

Revenue 4,900,000 5,833,250 Given on input sheet

Beginning Inventory 1,500,000 1,000,000 Given on input sheet

Purchases 1,400,000 2,500,000 COGS+ending inventory-beginning inventory

Total Goods Avail Sale 2,900,000 3,500,000 Calculated based on purchases+inventory

2009 is beginning inventory 2010 (which is given);

Ending Inventory 1,000,000 1,250,000 2010 is given on input sheet

Cost of Goods Sold 1,900,000 2,250,000 total goods available - ending inventory

Gross Profit 3,000,000 3,583,250 Revenue - COGS

Operating Expenses

Research & Development 588000 816,655 Given as a % on input sheet

Sales & Marketing 490,000 524,992.5 Given as a % on input sheet

Given as a % on input sheet for 2009, calculated

General & Administrative 245,000 408,317.5 for 2010

Given as a % on input sheet for 2010, calculated

TOTAL OPERATING 1,323,000 1,749,975 for 2009

2009 + 2010: calculated, gross profit-total

EBITDA 1,677,000 1,833,275 operating expense

2009: Given on input sheet, 2010: difference in

Depreciation 48,000 64,000 accumulated depreciation

2009: Given on input sheet, 2010: difference in

Amortization 7,300 7,300 accumulated amortization

Earnings Before Int/Tax 1,621,700 1,761,975 EBITDA-(depreciation and amortization)

2009: Net income - EBITDA, 2010: Given on input

Interest (net) 42,000 50,000 sheet (assuming this is net)

Net Income Before Tax 1,579,700 1,711,975 2009: Given on input sheet, 2010 : EBIT-I

Taxes(35%, 40%) 552,895 684,790 Given as a % on input sheet

Net Income 1,026,805 1,027,185 Calculated as net income before tax- tax

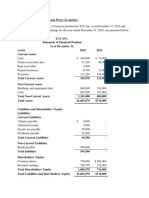

Balance Sheet -ACME Roadrunner

2009 2010 Notes

ASSETS

CURRENT ASSETS

Cash 207,000 507,535 Given

Receivables 707,000 1,166,650 Calculated

Inventory 1,000,000 1,250,000 Given

Marketable Securities 162,000 162,000 Given

TOTAL CURRENT ASSETS 2,076,000 3,086,185 Calculated

LONG-TERM ASSESTS

Property Plant and Equipment 1649000 1,675,300 Given, Calculated

Accumulated Depreciation 493,000 557,000 Given

TOTAL FIXED ASSETS 1,156,000 1,118,300 Calculated

Intangibles 100,000 100,000 Given

Accumulated Amortization 35,000 42,300 Given

NET INTANGIBLES 65,000 57,700 Calculated

TOTAL LONG-TERM ASSETS 1,221,000 1,176,000 Calculated, Given

TOTAL ASSETS 3,297,000 4,262,185 Calculated

LIABILITIES AND EQUITY

CURRENT LIABILITIES

Accounts Payable 530,000 625,000 Given

Short-Term Debt 270000 250,000 Added 200K from LTD

Other Current 19,000 32,000 Given

TOTAL CURRENT 819,000 907,000 Calculated

Long Term Debt 450,000 250,000 Given

TOTAL LIABILITIES 1,269,000 1,157,000 Calculated

Preferred Stock 150,000 250,000 Given

Common Stock 453,195 453,195 Given

Retained Earnings 1,424,805 2,401,990 RE+NI- DIV

TOTAL STOCKHOLDER EQUITY 2,028,000 3,105,185 Calculated

TOTAL LIABILITIES AND EQUITY 3,297,000 4,262,185 Calculated

Balance Sheet -ACME Roadrunner

2009(A) 2010(B) Difference (A-B)

ASSETS

CURRENT ASSETS

Cash 207,000 507,535 (300,535)

Receivables 707,000 1,166,650 (459,650)

Inventory 1,000,000 1,250,000 (250,000)

Marketable Securities 162,000 162,000 0

TOTAL CURRENT ASSETS 2,076,000 3,086,185 (1010185)

LONG-TERM ASSESTS

Property Plant and Equipment 1649000 1,675,300 (26300)

Accumulated Depreciation 493,000 557,000 64000

TOTAL FIXED ASSETS 1,156,000 1,118,300 37,700

Intangibles 100,000 100,000 0

Accumulated Amortization 35,000 42,300 7300

NET INTANGIBLES 65,000 57,700 7300

TOTAL LONG-TERM ASSETS 1,221,000 1,176,000 45000

TOTAL ASSETS 3,297,000 4,262,185 (965,185)

LIABILITIES AND EQUITY B-A

CURRENT LIABILITIES

Accounts Payable 530,000 625,000 95,000

Short-Term Debt 270000 250,000 (20,000)

Other Current 19,000 32,000 13,000

TOTAL CURRENT 819,000 907,000 88,000

Long Term Debt 450,000 250,000 (200,000)

TOTAL LIABILITIES 1,269,000 1,157,000 (112,000)

Preferred Stock 150,000 250,000 100,000

Common Stock 453,195 453,195 0

Retained Earnings 1,424,805 2,401,990 977,185

TOTAL STOCKHOLDER EQUITY 2,028,000 3,105,185 1,077,185

TOTAL LIABILITIES AND EQUITY 3,297,000 4,262,185 965,185

Cash Flow from Operations

Net Income 1,027,185

Depreciation & Amortization 71,300

Working Capital Changes

Changes in Accounts Receivable (459,650)

Changes in Inventory (250,000)

Changes in Accounts Payable 95,000

Changes in Other Current Libalities 13,000

Total Cash Flow from Operations 496,835

Cash Flow from Investments

Changes in PP&E (gross) (26300)

Change in long term intangibles (Gross) 0

Changes in Marketable securities 0

Total Cash Flow from Investments (26300)

Cash Flow from Financing

Changes in STBD (20,000)

Changes in LTBD (200,000)

Payment of Dividends (50,000)

Changes in Preferred stock issues 100,000

Changes in common stock issues 0

Total Cash Flow from Financing (170,000)

Net Cash increase (Decrease) 300,535

Beginning Cash Balance 207,000

Ending Cash Balance 507,535

You might also like

- HW 4 - Wilmot Shirts ProblemDocument5 pagesHW 4 - Wilmot Shirts Problemkartik lakhotiyaNo ratings yet

- Tire City AssignmentDocument6 pagesTire City AssignmentderronsNo ratings yet

- Toy World Case ExhibitsDocument24 pagesToy World Case ExhibitsFrancisco Aguilar PuyolNo ratings yet

- Tire City AssignmentDocument6 pagesTire City AssignmentXRiloXNo ratings yet

- Tire City CaseDocument12 pagesTire City CaseAngela ThorntonNo ratings yet

- FlashMemory SLNDocument6 pagesFlashMemory SLNShubham BhatiaNo ratings yet

- Ch03 P15 Build A ModelDocument2 pagesCh03 P15 Build A Model03020380% (1)

- Pinetree MotelMP 26 Case - N - Group 4Document5 pagesPinetree MotelMP 26 Case - N - Group 4harleeniitrNo ratings yet

- Tire City Spreadsheet SolutionDocument7 pagesTire City Spreadsheet SolutionSyed Ali MurtuzaNo ratings yet

- BCTC Case 2Document10 pagesBCTC Case 2Trâm Nguyễn QuỳnhNo ratings yet

- Chapter 22 HomeworkDocument19 pagesChapter 22 HomeworkashibhallauNo ratings yet

- Case 1 Spreadsheet - EI DuPontDocument6 pagesCase 1 Spreadsheet - EI DuPontSamuel BishopNo ratings yet

- Tire City Case AnalysisDocument10 pagesTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)No ratings yet

- Clarkson Lumber CaseDocument27 pagesClarkson Lumber CaseGovardan SureshNo ratings yet

- Tire City-Spread SheetDocument6 pagesTire City-Spread SheetVibhusha SinghNo ratings yet

- Statement of Profit and Loss: 2012 2011 Net SalesDocument1 pageStatement of Profit and Loss: 2012 2011 Net Salesgaurav SinghNo ratings yet

- 93-Tire-City 22 22Document26 pages93-Tire-City 22 22Daniel InfanteNo ratings yet

- Tire City Inc.Document6 pagesTire City Inc.Samta Singh YadavNo ratings yet

- Profit and Loss Account Expenses IncomeDocument10 pagesProfit and Loss Account Expenses IncomeAnkit AggarwalNo ratings yet

- Clarkson Lumber Case AnalysisDocument7 pagesClarkson Lumber Case Analysispawangadiya1210No ratings yet

- Case 06 Financial Detective 2016 F1763XDocument6 pagesCase 06 Financial Detective 2016 F1763XJosie KomiNo ratings yet

- Tire City SolutionDocument4 pagesTire City SolutionUmeshKumarNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic TreemonemNo ratings yet

- Exhibits and Student TemplateDocument7 pagesExhibits and Student Templatesatish.evNo ratings yet

- Clarkson Lumber CompanyDocument6 pagesClarkson Lumber Companymalishka1025No ratings yet

- Case 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTDocument4 pagesCase 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTkunalNo ratings yet

- Cash Flow Excercise Questions-Set-2Document2 pagesCash Flow Excercise Questions-Set-2AgANo ratings yet

- ButlerDocument1 pageButlerarnab.for.ever9439100% (1)

- Tire City AssignmentDocument7 pagesTire City AssignmentShivam Kanojia100% (1)

- Clarkson Lumber - Cash FlowDocument1 pageClarkson Lumber - Cash FlowSJNo ratings yet

- Saito Solar - Discounted Cash Flow ValuationDocument8 pagesSaito Solar - Discounted Cash Flow ValuationSana BatoolNo ratings yet

- Clarkson Lumber Co Calculations For StudentsDocument27 pagesClarkson Lumber Co Calculations For StudentsQuetzi AguirreNo ratings yet

- Excel Clarkson LumberDocument9 pagesExcel Clarkson LumberCesareo2008No ratings yet

- Tire City Spreadsheet SolutionDocument8 pagesTire City Spreadsheet SolutionsuwimolJNo ratings yet

- Sharing Sheet Hallstead JewelersDocument11 pagesSharing Sheet Hallstead JewelersHarpreet SinghNo ratings yet

- Tire City - WorksheetDocument3 pagesTire City - WorksheetBach CaoNo ratings yet

- Break Even Analysis of Our ProductDocument4 pagesBreak Even Analysis of Our ProductprakashNo ratings yet

- Case 11-2 Alfi Dan Yessy AKT 18-MDocument4 pagesCase 11-2 Alfi Dan Yessy AKT 18-MAna KristianaNo ratings yet

- Total 621 1749 2544 3300Document6 pagesTotal 621 1749 2544 3300Anupam ChaplotNo ratings yet

- CH 14Document41 pagesCH 14Liyana ChuaNo ratings yet

- Marvin CoDocument4 pagesMarvin CoVaibhav KathjuNo ratings yet

- Income StatementDocument3 pagesIncome StatementTahira HassenNo ratings yet

- 6int 2005 Jun QDocument9 pages6int 2005 Jun Qapi-19836745No ratings yet

- Exercises AllDocument9 pagesExercises AllLede Ann Calipus YapNo ratings yet

- Key Answer Financial Statement - TP1Document7 pagesKey Answer Financial Statement - TP1Riza AdiNo ratings yet

- 01 - Exercises Session 1 - EmptyDocument4 pages01 - Exercises Session 1 - EmptyAgustín RosalesNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Key Chapter 1Document4 pagesKey Chapter 1duyanh.vinunihanoiNo ratings yet

- Illustration 1 & 2Document5 pagesIllustration 1 & 2faith olaNo ratings yet

- Ratio Analysis Review QuestionsDocument5 pagesRatio Analysis Review QuestionsPASTORYNo ratings yet

- Federal Public Service CommissionDocument2 pagesFederal Public Service CommissionkarimNo ratings yet

- Kunci Jawaban ICAEW Part 2Document4 pagesKunci Jawaban ICAEW Part 2Dendi RiskiNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- Evidencia 2 ANALISIS E INTERPRETACION DE ESTADOS FINANCIEROSDocument5 pagesEvidencia 2 ANALISIS E INTERPRETACION DE ESTADOS FINANCIEROSRegina De LeónNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- Case Study 2 (Class)Document6 pagesCase Study 2 (Class)ummieulfahNo ratings yet

- C. Net Cash Flow From Operating Activities in 2009: Income Statement 2009Document4 pagesC. Net Cash Flow From Operating Activities in 2009: Income Statement 2009BảoNgọcNo ratings yet

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyDocument10 pagesFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- Week-2-Chapter-3-Financial-Build-A-Mode LDocument7 pagesWeek-2-Chapter-3-Financial-Build-A-Mode LCrusty GirlNo ratings yet

- 4.3. Example Scenario - Pro Forma ProblemsDocument6 pages4.3. Example Scenario - Pro Forma Problemskartik lakhotiyaNo ratings yet

- 3.3b. 7 Scenarios Worksheet and PromptDocument3 pages3.3b. 7 Scenarios Worksheet and Promptkartik lakhotiyaNo ratings yet

- 4.3. Example Scenario - Pro Forma ProblemsDocument6 pages4.3. Example Scenario - Pro Forma Problemskartik lakhotiyaNo ratings yet

- Feedback Planning Sheet - Kartik LakhotiyaDocument2 pagesFeedback Planning Sheet - Kartik Lakhotiyakartik lakhotiyaNo ratings yet

- DNA Damage and Cancer Immunotherapy: A STING in The Tale: ReviewDocument8 pagesDNA Damage and Cancer Immunotherapy: A STING in The Tale: Reviewkartik lakhotiyaNo ratings yet

- (Arabinda Kumar Rath, Narayan Sahoo (Eds.) ) ParticDocument203 pages(Arabinda Kumar Rath, Narayan Sahoo (Eds.) ) Partickartik lakhotiyaNo ratings yet

- Nuaire Ir Autoflow Nu 8700Document56 pagesNuaire Ir Autoflow Nu 8700kartik lakhotiyaNo ratings yet

- LBO (Leveraged Buyout) Model For Private Equity FirmsDocument2 pagesLBO (Leveraged Buyout) Model For Private Equity FirmsDishant KhanejaNo ratings yet

- Chapter 5 New11 - Block Hirt BookDocument14 pagesChapter 5 New11 - Block Hirt BookRamishaNo ratings yet

- Key Technical Questions For Finance InterviewsDocument27 pagesKey Technical Questions For Finance InterviewsSeb SNo ratings yet

- Awasr Chairman Introduction FinalDocument47 pagesAwasr Chairman Introduction Finalabdullahsaleem91No ratings yet

- Vanita Black Book FINALDocument78 pagesVanita Black Book FINALVikas SinghNo ratings yet

- PR - Carrefour Sales Q3 2022Document15 pagesPR - Carrefour Sales Q3 2022FaIIen0nENo ratings yet

- Case Study Part 1 Financial AnalysisDocument4 pagesCase Study Part 1 Financial AnalysisNikola PavlovskaNo ratings yet

- Analysis of BATA - Group 2Document11 pagesAnalysis of BATA - Group 2Rushi AbheeshaiNo ratings yet

- Performance AGlanceDocument1 pagePerformance AGlanceHarshal SawaleNo ratings yet

- CHAPTER 3 Analysis of Financial StatementsDocument37 pagesCHAPTER 3 Analysis of Financial Statementsmuhammadosama100% (1)

- WLCON 2021 17A Annual Report PSEDocument35 pagesWLCON 2021 17A Annual Report PSEEvan TriolNo ratings yet

- Annual Report 2022 TIMDocument498 pagesAnnual Report 2022 TIMDJRNo ratings yet

- North West Company: Analyzing Financial Performance: SolvencyDocument5 pagesNorth West Company: Analyzing Financial Performance: SolvencyAbdullah QureshiNo ratings yet

- TOMY Company LTD.: Fiscal Year 2013 1 Half (6 Months) Results (April 1, 2013 - September 30, 2013)Document24 pagesTOMY Company LTD.: Fiscal Year 2013 1 Half (6 Months) Results (April 1, 2013 - September 30, 2013)Sharingan ShenaniganNo ratings yet

- Class Exercise Fashion Company Three Statements Model - CompletedDocument16 pagesClass Exercise Fashion Company Three Statements Model - CompletedbobNo ratings yet

- Measuring Financial Performance: Book: Leach, J. C., & Melicher, R. W. (2011) - Entrepreneurial FinanceDocument37 pagesMeasuring Financial Performance: Book: Leach, J. C., & Melicher, R. W. (2011) - Entrepreneurial FinanceUmber GullNo ratings yet

- Pizza Asm 2020 ReportDocument130 pagesPizza Asm 2020 ReportJohn Robert ColladoNo ratings yet

- Top 100 Ib InterviewDocument44 pagesTop 100 Ib Interviewxz6ydhrzxcNo ratings yet

- MST Golf - Prospectus (Part 1)Document179 pagesMST Golf - Prospectus (Part 1)Hassan LannaNo ratings yet

- Hotel SWOT Analysis in ChinaDocument17 pagesHotel SWOT Analysis in ChinaMihai PaduraruNo ratings yet

- Batch 74 Contact 0 Raghu Iyer NotesDocument42 pagesBatch 74 Contact 0 Raghu Iyer NotesRajveer SinghNo ratings yet

- Chapter 4 Capital Structure PolicyDocument17 pagesChapter 4 Capital Structure PolicyAndualem ZenebeNo ratings yet

- FIN 615 Fall 2022 Quiz 2 Solution 20221008Document17 pagesFIN 615 Fall 2022 Quiz 2 Solution 20221008sigit luhur pambudiNo ratings yet

- Snapshot Ed General Presentation DisclosuresDocument20 pagesSnapshot Ed General Presentation DisclosuresAsad MuhammadNo ratings yet

- India Pesticides LimitedDocument2 pagesIndia Pesticides LimitedyashNo ratings yet

- Indigo Paints DetailedDocument8 pagesIndigo Paints DetailedMohit RuhalNo ratings yet

- Voltamp Transformers LTD.: Key Share DataDocument5 pagesVoltamp Transformers LTD.: Key Share DataDarwish MammiNo ratings yet

- FI - Reading 44 - Fundamentals of Credit AnalysisDocument42 pagesFI - Reading 44 - Fundamentals of Credit Analysisshaili shahNo ratings yet

- MA 3103 - Valuation Methods (Financial Analysis)Document9 pagesMA 3103 - Valuation Methods (Financial Analysis)Jacinta Fatima ChingNo ratings yet