Professional Documents

Culture Documents

FIN Money & Banking Chap 9 - Transactions Costs, Asymmetric Information, and The Structure of The Financial System

Uploaded by

Gene'sOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN Money & Banking Chap 9 - Transactions Costs, Asymmetric Information, and The Structure of The Financial System

Uploaded by

Gene'sCopyright:

Available Formats

Why do firms rely more on loans and bonds than on stocks as a source of external finance?

Investors are more willing to buy bonds than stock, which explains why bonds are a more

important source of external finance for firms. Small to medium-sized firms are unable to issue

either bonds or stock and must rely on bank loans as their main source of external finance.

Transactions costs The cost of a trade or a financial transaction; for example, the brokerage

commission charged for buying or selling a financial asset.

Information costs The costs that savers incur to determine the creditworthiness of borrowers

and to monitor how they use the funds acquired.

Economies of scale The reduction in average cost that results from an increase in the volume

of a good or service produced.

Asymmetric information The situation in which one party to an economic transaction has

better information than does the other party.

Adverse selection The problem investors experience in distinguishing low-risk borrowers

from high-risk borrowers before making an investment.

Moral hazard The risk that people will take actions after they have entered into a transaction

that will make the other party worse off.

Economists distinguish between two problems arising from asymmetric information: 1.

Adverse selection

2. Moral hazard

Collateral Assets that a borrower pledges to a lender that the lender may seize if the

borrower defaults on the loan.

Net worth The difference between the value of a firm's assets and the value of its liabilities.

Credit rationing The restriction of credit by lenders such that borrowers cannot obtain the

funds they desire at the given interest rate.

The disclosure of information required by the SEC reduces the information costs of adverse

selection, but it doesn't eliminate them for four key reasons:1. Some good firms may be too

young to have much information for potential investors to evaluate.

2. Lemon firms will try to present the information in the best possible light so that investors will

overvalue their securities.

3. There can be legitimate differences of opinion about how to report some items on income

statements and balance sheets.

4. The interpretation of whether information is material can be tricky.

( see examples page 286)

Relationship banking The ability of banks to assess credit risks on the basis of private

information about borrowers.

Principal-agent problem The moral hazard problem of managers (the agents) pursuing their

own interests rather than those of shareholders (the principals).

Restrictive covenant A clause in a bond contract that places limits on the uses of funds that a

borrower receives.

Relationship banking The ability of banks to assess credit risks on the basis of private

information about borrowers.

Principal-agent problem The moral hazard problem of managers (the agents) pursuing their

own interests rather than those of shareholders (the principals).

Venture capital firm A firm that raises equity capital from investors to invest in startup firms.

Private equity firm (or corporate restructuring firm) A firm that raises equity capital to acquire

shares in other firms to reduce free-rider and moral hazard problems.

You might also like

- Commercial Lending Training GuideDocument82 pagesCommercial Lending Training GuideSURAVARAPU PHANI KUMAR100% (1)

- Chris's AccountsDocument19 pagesChris's AccountsChris Gilliland92% (13)

- Why Are Financial Intermediaries SpecialDocument10 pagesWhy Are Financial Intermediaries SpecialSamra AfzalNo ratings yet

- Private Placement Bonds-A Valuable AlternativeDocument6 pagesPrivate Placement Bonds-A Valuable AlternativeEnergyte BaldonadoNo ratings yet

- BRD - Loan & Loan RepaymentDocument8 pagesBRD - Loan & Loan RepaymentSunisha YadavNo ratings yet

- Good LendingDocument35 pagesGood LendingSirsanath Banerjee100% (7)

- Finance Module 05 - Week 5Document8 pagesFinance Module 05 - Week 5Christian ZebuaNo ratings yet

- Securities Lending Best Practices Mutual Funds 2012Document20 pagesSecurities Lending Best Practices Mutual Funds 2012swinki3No ratings yet

- MCQS ON FOREIGN EXCHANGE CONCEPTSDocument37 pagesMCQS ON FOREIGN EXCHANGE CONCEPTSPadyala Sriram67% (6)

- Mid Term Exam MCQs For 5530Document6 pagesMid Term Exam MCQs For 5530Amy WangNo ratings yet

- Nationwide Title Clearing Cease and Desist ExhibitsDocument33 pagesNationwide Title Clearing Cease and Desist ExhibitsForeclosure Fraud100% (1)

- Lecture 5, Part 2 SecuritisationDocument4 pagesLecture 5, Part 2 SecuritisationZhiyang ZhouNo ratings yet

- How to Increase Your Success Rate of Buying Good Credit Cards from AutoshopsDocument26 pagesHow to Increase Your Success Rate of Buying Good Credit Cards from AutoshopsВиталий Мак100% (1)

- Financial Markets (Chapter 5)Document3 pagesFinancial Markets (Chapter 5)Kyla DayawonNo ratings yet

- Acquirer POS Credit and Debit - Test Cases PDFDocument415 pagesAcquirer POS Credit and Debit - Test Cases PDFTrangNo ratings yet

- Financial Intermediation TheoryDocument38 pagesFinancial Intermediation Theorynira_1100% (1)

- Financial ManagementDocument21 pagesFinancial ManagementsumanNo ratings yet

- General Banking Act PDFDocument69 pagesGeneral Banking Act PDFJerwin TiamsonNo ratings yet

- FIM Anthony CH End Solution PDFDocument287 pagesFIM Anthony CH End Solution PDFMosarraf Rased50% (6)

- Sources and Uses of Short-Term and Long-Term Funds for Debt and Equity FinancingDocument40 pagesSources and Uses of Short-Term and Long-Term Funds for Debt and Equity FinancingKenneth Kim Durban64% (14)

- AUB PayMate Solutions - Conforme Sheet 2020-12-1Document4 pagesAUB PayMate Solutions - Conforme Sheet 2020-12-1Em NueraNo ratings yet

- Sources and Uses of Short-Term and Long-Term FundsDocument7 pagesSources and Uses of Short-Term and Long-Term FundsSyrill Cayetano0% (1)

- Money Banking and The Financial System 2nd Edition Hubbard Solutions ManualDocument10 pagesMoney Banking and The Financial System 2nd Edition Hubbard Solutions Manualkibitkarowdyismqph9100% (22)

- Money and Banking Chapter 8Document3 pagesMoney and Banking Chapter 8Gene'sNo ratings yet

- FIN111 Spring2015 Tutorials Tutorial 5 Week 6 QuestionsDocument3 pagesFIN111 Spring2015 Tutorials Tutorial 5 Week 6 QuestionshaelstoneNo ratings yet

- Understanding the 5Cs of CreditDocument7 pagesUnderstanding the 5Cs of CreditEng Abdikarim WalhadNo ratings yet

- Risks and Risk Management in Financial InstitutionsDocument22 pagesRisks and Risk Management in Financial InstitutionsMikias DegwaleNo ratings yet

- Saunders & Cornnet Solution Chapter 1 Part 1Document5 pagesSaunders & Cornnet Solution Chapter 1 Part 1Mo AlamNo ratings yet

- CFI 321 Lesson 3 June 2023Document3 pagesCFI 321 Lesson 3 June 2023nyambura jacklineNo ratings yet

- Module 1 3 - BofiDocument75 pagesModule 1 3 - BofiJohn Ray AmadorNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter OneDocument14 pagesSolutions For End-of-Chapter Questions and Problems: Chapter Onejl123123No ratings yet

- Chapter 7 Why Do Financial Institutions ExistDocument10 pagesChapter 7 Why Do Financial Institutions ExistJay Ann DomeNo ratings yet

- FM ExamDocument13 pagesFM Examtigist abebeNo ratings yet

- Without Financial InstitutionsDocument2 pagesWithout Financial InstitutionsLevi Emmanuel Veloso BravoNo ratings yet

- Article On Sources of FinanceDocument5 pagesArticle On Sources of FinanceLipon MustafizNo ratings yet

- Selected Tutorial Solutions - Week 2 IntroDocument4 pagesSelected Tutorial Solutions - Week 2 IntroPhuong NguyenNo ratings yet

- Bab 1 FRMDocument11 pagesBab 1 FRMartaninditaNo ratings yet

- Introduction To Business Finance: Anila DeviDocument30 pagesIntroduction To Business Finance: Anila DeviM Hamza SultanNo ratings yet

- Final Credit Ratinggg Repaired)Document52 pagesFinal Credit Ratinggg Repaired)Pratik N. PatelNo ratings yet

- Equity Financing Small Business AdministrationDocument8 pagesEquity Financing Small Business AdministrationrajuNo ratings yet

- Chapter 8Document4 pagesChapter 8John FrandoligNo ratings yet

- Lesson 3 - Overview of The Financial System (Module)Document6 pagesLesson 3 - Overview of The Financial System (Module)Rovelyn SeñoNo ratings yet

- Unit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank ManagementDocument8 pagesUnit 5 Asset-Liability Management Techniques: 5.1. General Principles of Bank Managementመስቀል ኃይላችን ነውNo ratings yet

- Bank Financial Statements & Risk AnalysisDocument8 pagesBank Financial Statements & Risk AnalysisDương PhạmNo ratings yet

- Unit 5 (Loans and Credit)Document4 pagesUnit 5 (Loans and Credit)Dewinta Stefanus67% (3)

- Overview of The Financial System PDFDocument33 pagesOverview of The Financial System PDFFlorence Joy AbkilanNo ratings yet

- Entrepreneurship MGT-3103: BS (Chemistry) - 2 SemesterDocument11 pagesEntrepreneurship MGT-3103: BS (Chemistry) - 2 SemesterLectures On-lineNo ratings yet

- "It Is Not Clear-Cut Whether Firms Choosing To Issue Equity Should Have Higher or LowerDocument2 pages"It Is Not Clear-Cut Whether Firms Choosing To Issue Equity Should Have Higher or LowerG BuenoNo ratings yet

- CH 9 Part 2 Notes EC 113Document6 pagesCH 9 Part 2 Notes EC 113RoselleFayeGarciaTupaNo ratings yet

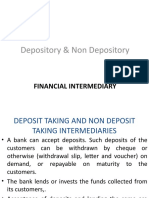

- Depository & Non Depository: Financial IntermediaryDocument136 pagesDepository & Non Depository: Financial IntermediaryMoud KhalfaniNo ratings yet

- Asset Securitization Strategic Questions Your Bank Should Ask Now, Wilson, DonDocument9 pagesAsset Securitization Strategic Questions Your Bank Should Ask Now, Wilson, Donsalah hamoudaNo ratings yet

- Mba Assignment 2Document17 pagesMba Assignment 2Joanne LeoNo ratings yet

- FIM Assignment On Moral HazardDocument6 pagesFIM Assignment On Moral HazardchhonnocharaNo ratings yet

- Current Market ConditionsDocument9 pagesCurrent Market ConditionsNguyễn Thảo MyNo ratings yet

- Week 12: Chapter 17-Banking and Management of Financial InstitutionsDocument4 pagesWeek 12: Chapter 17-Banking and Management of Financial InstitutionsJay Ann DomeNo ratings yet

- Role of Financial Institutions in Facilitating Resource AllocationDocument5 pagesRole of Financial Institutions in Facilitating Resource AllocationAnthony FullertonNo ratings yet

- E8 Business FinanceDocument8 pagesE8 Business FinanceTENGKU ANIS TENGKU YUSMANo ratings yet

- Adverse selection in bond and stock markets prevents effective fundingDocument7 pagesAdverse selection in bond and stock markets prevents effective fundingLê Mai Huyền Linh100% (1)

- Intro to Financial Systems: Stocks, Bonds, Banks & MarketsDocument22 pagesIntro to Financial Systems: Stocks, Bonds, Banks & MarketsTouseef AhmadNo ratings yet

- Chapter 3. Financial IntermediariesDocument30 pagesChapter 3. Financial Intermediariesbr bhandariNo ratings yet

- FIN2339 CH8-An Economic Analysis of Financial StructureDocument9 pagesFIN2339 CH8-An Economic Analysis of Financial StructureJasleen GillNo ratings yet

- Entrepreneurship-CHAPTER SIXDocument9 pagesEntrepreneurship-CHAPTER SIXSyerwe Gkjl GdfNo ratings yet

- Chapter 1Document11 pagesChapter 1Dharmendra PillaiNo ratings yet

- Energy StorageDocument5 pagesEnergy StorageGene'sNo ratings yet

- ACC 200 Chapter 5Document3 pagesACC 200 Chapter 5Gene'sNo ratings yet

- ACCT Midterm 2Document26 pagesACCT Midterm 2Gene'sNo ratings yet

- ACG2021 FSU Paterson Exam 1 Chapter 1Document8 pagesACG2021 FSU Paterson Exam 1 Chapter 1Gene'sNo ratings yet

- Reward Network & Pleasure CycleDocument5 pagesReward Network & Pleasure CycleGene'sNo ratings yet

- Energy ResourcesDocument1 pageEnergy ResourcesGene'sNo ratings yet

- What is a consumer? Income types and consumer rightsDocument2 pagesWhat is a consumer? Income types and consumer rightsGene'sNo ratings yet

- Energy Unit VocabularyDocument2 pagesEnergy Unit VocabularyGene'sNo ratings yet

- ACG2021 FSU Paterson Exam 1 Chapter 2Document9 pagesACG2021 FSU Paterson Exam 1 Chapter 2Gene'sNo ratings yet

- EmotionsDocument2 pagesEmotionsGene'sNo ratings yet

- Transactions Costs, Asymmetric Information, and The Structure of The Financial SystemDocument2 pagesTransactions Costs, Asymmetric Information, and The Structure of The Financial SystemGene'sNo ratings yet

- Energy Science Quiz 1 Study GuideDocument2 pagesEnergy Science Quiz 1 Study GuideGene'sNo ratings yet

- The Distracted Teenage BrainDocument1 pageThe Distracted Teenage BrainGene'sNo ratings yet

- Themantic IB Psych Unit 2, CriminologyDocument2 pagesThemantic IB Psych Unit 2, CriminologyGene'sNo ratings yet

- Things To Understand Before Getting First Credit CardDocument2 pagesThings To Understand Before Getting First Credit CardGene'sNo ratings yet

- Anthropology FinalDocument7 pagesAnthropology FinalGene'sNo ratings yet

- Defining International Business and Globalization TrendsDocument3 pagesDefining International Business and Globalization TrendsGene'sNo ratings yet

- Recruitment strategies and sources for building applicant poolsDocument6 pagesRecruitment strategies and sources for building applicant poolsGene'sNo ratings yet

- AICPA - CPA Reg 2017Document12 pagesAICPA - CPA Reg 2017Gene'sNo ratings yet

- Aggregate Demand and Aggregate SupplyDocument2 pagesAggregate Demand and Aggregate SupplyGene'sNo ratings yet

- Brain Reward CentersDocument2 pagesBrain Reward CentersGene'sNo ratings yet

- International Business - Chapter 12 International StrategiesDocument3 pagesInternational Business - Chapter 12 International StrategiesGene'sNo ratings yet

- Anthropology Test #1Document5 pagesAnthropology Test #1Gene'sNo ratings yet

- IB - International Business Concepts and Globalization TrendsDocument3 pagesIB - International Business Concepts and Globalization TrendsGene'sNo ratings yet

- Tax IncidenceDocument1 pageTax IncidenceGene'sNo ratings yet

- Economic Growth 1Document1 pageEconomic Growth 1Gene'sNo ratings yet

- Anthropology 1 FinaDocument3 pagesAnthropology 1 FinaGene'sNo ratings yet

- International Business - CH 17Document10 pagesInternational Business - CH 17Gene'sNo ratings yet

- Intermediate Finance - Chapter 6Document23 pagesIntermediate Finance - Chapter 6Gene'sNo ratings yet

- Efficiency and TaxationDocument1 pageEfficiency and TaxationGene'sNo ratings yet

- FRMTest 01Document18 pagesFRMTest 01Kamal BhatiaNo ratings yet

- Credit Conversion FactorDocument3 pagesCredit Conversion FactorSachin PandeNo ratings yet

- GMAT2111 General Mathematics Q2 Written Work 1 10 PDFDocument3 pagesGMAT2111 General Mathematics Q2 Written Work 1 10 PDFArnsNo ratings yet

- Exchange Rate SystemsDocument27 pagesExchange Rate SystemsmaurishkaNo ratings yet

- ATM Setup Requirements Guide for Merchants, Owners and ProvidersDocument12 pagesATM Setup Requirements Guide for Merchants, Owners and ProvidersVarun TewariNo ratings yet

- All VouchersDocument23 pagesAll VouchersSunandaNo ratings yet

- Daily Loan Principal & Interest Calculation Spreadsheet: D-H & Associates ConsultingDocument3 pagesDaily Loan Principal & Interest Calculation Spreadsheet: D-H & Associates ConsultingPrabath Madusanka100% (1)

- Montgomery V Etreppid # 1086 - Montgomery DeclarationDocument6 pagesMontgomery V Etreppid # 1086 - Montgomery DeclarationJack RyanNo ratings yet

- MBA 4th Sem A STUDY ON BANKING OPERATIONS IN AN ECONOMYDocument42 pagesMBA 4th Sem A STUDY ON BANKING OPERATIONS IN AN ECONOMYraghav bansalNo ratings yet

- What Is A Bank? How Does A Bank Differ From Most Other Financial-Service Providers?Document4 pagesWhat Is A Bank? How Does A Bank Differ From Most Other Financial-Service Providers?Anh ThưNo ratings yet

- E07h3salary 1Document6 pagesE07h3salary 1api-549665851No ratings yet

- Class 2Document24 pagesClass 2katherine granizoNo ratings yet

- 2023 02 16 17 54 04nov 22 - 600053Document6 pages2023 02 16 17 54 04nov 22 - 600053narendran kNo ratings yet

- Bandhan Bank - WikipediaDocument7 pagesBandhan Bank - WikipediaPuja Devi0% (1)

- Habte AshenafiDocument89 pagesHabte AshenafiBERHANU TAFA0% (1)

- Calculate Simple InterestDocument12 pagesCalculate Simple InterestyonesNo ratings yet

- BBBM 20230929 0604040950013 Statements 1 PDFDocument20 pagesBBBM 20230929 0604040950013 Statements 1 PDFtraviscaines75No ratings yet

- INTL BUS: FX MKT, MONETARY SYSTEMSDocument7 pagesINTL BUS: FX MKT, MONETARY SYSTEMSYomi BrainNo ratings yet

- Ecurrency eSDR White Paper 052019Document7 pagesEcurrency eSDR White Paper 052019Joseph ParkNo ratings yet

- Whitepaper v1.0Document22 pagesWhitepaper v1.0psastrowardoyoNo ratings yet

- Maddys Elect BLLDocument2 pagesMaddys Elect BLLsuzieebillsNo ratings yet

- Electronic Payment Systems GuideDocument10 pagesElectronic Payment Systems GuideRachit SrivastavaNo ratings yet