Professional Documents

Culture Documents

Ox 5

Uploaded by

Görkem ErcanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ox 5

Uploaded by

Görkem ErcanCopyright:

Available Formats

5

Roxxon affiliate in Iran was prepared to supply and amount of crude up to

100,000 B/D at the cost of 2.00$/B at Abadan, the crude terminal on the Persian

Gulf (See Figure 1 for a map of the area).

Late in July, Ray Jackson returned from his field assignment to Aussi Petroleums,

Ltd., (APL) in Australia, where he had been working with local operating people

in determining the various characteristics and constraint in their operations,

which except for crude oil production, are fully integrated. APL’s refinery, located

in Sydney, is designed for a 50,000 B/D throughput. Process equipment includes

a catalytic cracking unit and sufficient auxiliary equipment to produce a

specification quality product from the crude normally available for its use. A large

part of Jackson’s time had been spent on familiarizing himself with the linear

programming model that APL uses for solving day-to-day operating plans at the

refinery. This model totals 110 rows and 250 columns which define the operating

characteristics of all the refinery’s equipment using various modes of possible

operation and the different crudes normally available.

Although the model had been designed to provide APL with the ability to solve

operational problems, Jackson believed that he could use it to derive cost

parameters and refining coefficients for planning purpose. With this goal in mind

and working with the local stuff to assure himself that the results were realistic.

Jackson used the refinery model to establish the yields and costs for the crudes

available in 2005. To accomplish this, he assumed that the quality specifications

for the three principal and products would remain constant during the planning

period. In addition, although the refinery had processing flexibility that permitted

a wide range of yields, he decided for planning purposes that the use of the

values at the highest and lowest conversion (process intensity) for the crudes

available would suffice. The yields so derived are as follows:

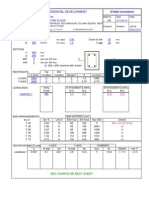

APL Refinery Yields

Brunei crude Iranian crude

process intensity process

Product Low High Low High

Motor Gasoline (Mogas) .259 .365 .186 .312

Distillate (Dist.) .371 .379 .229 .230

Fuel Oil (Fuel) .317 .194 .503 .378

Total .947 .938 .918 .920

6

In using this data he realized that a certain amount of nonlinearity existed in the

refining yields of products going from low process intensity to high process

intensity, however, he felt that the error introduced by assuming a linear

relationship would not be significant in the planning model he hoped to

construct, and the linearity assumption would certainly reduce the size of matrix.

Jackson planned to test the significance of nonlinearity in the refining coefficients

on the planning model’s results after it was formulated by the Head Office

planning staff.

Using the high and low conversion limits as the refinery’s operating modes,

Jackson was able to determine incremental costs for those manufacturing

activities vary as a function of the type of crude being processed and the level of

process intensity being employed. These costs include special chemicals and

catalysts used, utilities required, the tetraethyl lead (TEL) used to bring the

product up to octane specification, and so on. Fixed charges (those not varying

with changes in processing modes) are excluded. Deducted from the sum of the

variable, or incremental manufacturing costs is the value of the byproduct

produced by the particular process mode using the particular type crude. These

so called by products are defined as minor products as contrasted to the three

main products manufactured for Far Eastern Area consumption (namely, motor

gasoline, distillate, and fuel oil), and consist of small quantities of specialty

products and such things as coke, tar, and fuel gas. The net incremental costs

Jackson found appropriate were

Incremental Manufacturing Costs ($/B)

Brunei Iranian

Intensity Level

Crude Crude

Low .12 .15

High .28 .30

APL management forecasted that fixed operating expenses at the refinery would

total $10,038,000 during 2005.

Besides the refinery study, Jackson collected data on shipping costs to the

Australian refinery. Normally, in this area crude is transported in tankers owned

by a subsidiary of the Roxxon Company, however, in cases where refinery

shipping demands exceed the fleet capacity, spot charters of independent

You might also like

- Total04 Digital Version PDFDocument52 pagesTotal04 Digital Version PDFbeatriz matos67% (3)

- VAM Must Sumitomo 1209 PDFDocument4 pagesVAM Must Sumitomo 1209 PDFnwohapeterNo ratings yet

- UOP Improving Diesel Yields and Cloud PointDocument12 pagesUOP Improving Diesel Yields and Cloud PointSachin ChavanNo ratings yet

- Modelling and Optimization of Fluid Catalytic Cracking Unit (FCCU) Using HysysDocument9 pagesModelling and Optimization of Fluid Catalytic Cracking Unit (FCCU) Using HysysYahaya Danjuma BabaNo ratings yet

- Techno Economic Evaluation of Waste Lube Oil Re-Refining in Saudi ArabiaDocument7 pagesTechno Economic Evaluation of Waste Lube Oil Re-Refining in Saudi ArabiaArifNo ratings yet

- Draft STATCOM Maintenance Schedule (FINAL)Document36 pagesDraft STATCOM Maintenance Schedule (FINAL)Sukanta Parida100% (2)

- Refinery ConfigurationsDocument10 pagesRefinery Configurationsedgardiaz5519No ratings yet

- IGCC For RefineryDocument20 pagesIGCC For RefinerydensandsNo ratings yet

- Under Pass Wing Wall (4.1m)Document12 pagesUnder Pass Wing Wall (4.1m)Naveed NazNo ratings yet

- Simulation of Bitumen Upgrading ProcessesDocument6 pagesSimulation of Bitumen Upgrading ProcessesDonato MontroneNo ratings yet

- Ibp1325 12Document7 pagesIbp1325 12Marcelo Varejão CasarinNo ratings yet

- Refinery Configuration (With Figures)Document9 pagesRefinery Configuration (With Figures)phantanthanhNo ratings yet

- Modeling, Control, and Optimization of Natural Gas Processing PlantsFrom EverandModeling, Control, and Optimization of Natural Gas Processing PlantsRating: 5 out of 5 stars5/5 (1)

- Guide To Greyhawk PDFDocument108 pagesGuide To Greyhawk PDFAnonymous PtMxUHm9RoNo ratings yet

- Simulation of Crude Distillation Unit of Eastern Refinery Limited (ERL) Using Aspen PlusDocument6 pagesSimulation of Crude Distillation Unit of Eastern Refinery Limited (ERL) Using Aspen PlusAndre BasantesNo ratings yet

- Hydrocracking: P A R T 7Document22 pagesHydrocracking: P A R T 7Bharavi K SNo ratings yet

- Mercedez-Benz: The Best or NothingDocument7 pagesMercedez-Benz: The Best or NothingEstefania RenzaNo ratings yet

- Refinery ConfigurationDocument11 pagesRefinery ConfigurationIoana Popescu100% (2)

- Optimum Transportation Method For Development of Extra Heavy Crude OilDocument21 pagesOptimum Transportation Method For Development of Extra Heavy Crude OilYudi SuwandaNo ratings yet

- Cost Analysis For Biodiesel Production From Waste Cooking Oil Plant in EgyptDocument7 pagesCost Analysis For Biodiesel Production From Waste Cooking Oil Plant in EgyptRoneet JenaNo ratings yet

- Refinery Analytical Techniques Optimize Unit PerformanceDocument8 pagesRefinery Analytical Techniques Optimize Unit PerformanceAlberto Fonseca Uribe100% (1)

- Convert Bottom-Of-The-Barrel Into Diesel and Light OlefinsDocument5 pagesConvert Bottom-Of-The-Barrel Into Diesel and Light OlefinsAmjad HaniNo ratings yet

- Aspen Hysys Based Simulation and Analysis of Crude Distillation UnitDocument5 pagesAspen Hysys Based Simulation and Analysis of Crude Distillation UnitSata Ajjam100% (1)

- Refinery Operations Planning Final ReportDocument31 pagesRefinery Operations Planning Final ReportMohamed AlaaNo ratings yet

- 1170 2034 1 SMDocument10 pages1170 2034 1 SMMohammed HeshamNo ratings yet

- Real-Time Optimization of A Gasoline Run-Down Header Blending OperationDocument18 pagesReal-Time Optimization of A Gasoline Run-Down Header Blending Operationkirandevi1981No ratings yet

- 112-Answers To The 2012 AFPM QA QuestionsDocument5 pages112-Answers To The 2012 AFPM QA QuestionselglockNo ratings yet

- On Line Optmiz of Crude Distillation Unit W Constraints On Product Prperties OJODocument12 pagesOn Line Optmiz of Crude Distillation Unit W Constraints On Product Prperties OJOccnew3000No ratings yet

- Refinery Configurations - Designs For Heavy Oil - Hydrocarbon Processing - October 2011Document12 pagesRefinery Configurations - Designs For Heavy Oil - Hydrocarbon Processing - October 2011SumitAggarwalNo ratings yet

- Predicting Hydrotreater Performance While Co-Processing Vegetable OilDocument4 pagesPredicting Hydrotreater Performance While Co-Processing Vegetable OilJeffrey Ryan LindmarkNo ratings yet

- Age10506 PDFDocument29 pagesAge10506 PDFrichard nagilusNo ratings yet

- Valero Emerson BlendingDocument3 pagesValero Emerson BlendingGerrard ArchuletaNo ratings yet

- The Story of ULSD Optimisation at The Chevron Pembroke RefineryDocument11 pagesThe Story of ULSD Optimisation at The Chevron Pembroke RefineryLindsey BondNo ratings yet

- 1 s2.0 S0016236122033749 MainDocument15 pages1 s2.0 S0016236122033749 MaincemilNo ratings yet

- Screw CompressorsDocument4 pagesScrew CompressorsGeorge J AlukkalNo ratings yet

- Simulation of Crude Distillation Unit ofDocument6 pagesSimulation of Crude Distillation Unit ofSiddharth SharmaNo ratings yet

- The Rose Process: Tayseer Abdel-Halim and Raymond FloydDocument14 pagesThe Rose Process: Tayseer Abdel-Halim and Raymond FloydBharavi K SNo ratings yet

- Iraq ESP1Document6 pagesIraq ESP1juliocanel2009No ratings yet

- Seminar Report On Bio-Diesel: (In Partial Fulfilment To B.Tech Degree From MMEC, Mullana.)Document9 pagesSeminar Report On Bio-Diesel: (In Partial Fulfilment To B.Tech Degree From MMEC, Mullana.)Karan TandonNo ratings yet

- Low-Cost Hydrogen Distributed Production System Development, Frank Lomax, H2GenDocument3 pagesLow-Cost Hydrogen Distributed Production System Development, Frank Lomax, H2GenbooshscrbdNo ratings yet

- GD A 001.sgDocument2 pagesGD A 001.sgLarva MusicaNo ratings yet

- Steady State Simulation of Basrah Crude Oil Refinery Distillation Unit Using Aspen HysysDocument11 pagesSteady State Simulation of Basrah Crude Oil Refinery Distillation Unit Using Aspen HysysStive BrackNo ratings yet

- CV - Nainish Sahare Oil and GasDocument5 pagesCV - Nainish Sahare Oil and GasNitai DuraisamiNo ratings yet

- Unisim Based Simulation and Analysis of Crude Oil DistillationDocument8 pagesUnisim Based Simulation and Analysis of Crude Oil DistillationHoàng NhânNo ratings yet

- Portin 2010-Wartsila Dual Fuel (DF) Engines For Offshore Applications and Mechanical DriveDocument6 pagesPortin 2010-Wartsila Dual Fuel (DF) Engines For Offshore Applications and Mechanical DrivesestoubosNo ratings yet

- Steady State Simulation of Basrah Crude Oil Refinery Distillation Unit Using ASPEN HYSYSDocument12 pagesSteady State Simulation of Basrah Crude Oil Refinery Distillation Unit Using ASPEN HYSYSAli AlmajedNo ratings yet

- CBE Attachment 6 3 2 12 UCS 2011Document20 pagesCBE Attachment 6 3 2 12 UCS 2011MohammedNo ratings yet

- Software Approach On Crude Oil Yields Prediction: A Case Study of Tema Oil RefineryDocument19 pagesSoftware Approach On Crude Oil Yields Prediction: A Case Study of Tema Oil RefineryKen OtooNo ratings yet

- Micellar/Polymer Flooding - An Overview: SPE-AIME, Marathon Oil CoDocument13 pagesMicellar/Polymer Flooding - An Overview: SPE-AIME, Marathon Oil Coorenji nimong crossNo ratings yet

- PETSOC 2008 127 EA - UnpwDocument3 pagesPETSOC 2008 127 EA - Unpwoppai.gaijinNo ratings yet

- Simulation of Eastern Refinery Process PDFDocument3 pagesSimulation of Eastern Refinery Process PDFMorgan SidesoNo ratings yet

- Choosing A Hydroprocessing SchemeDocument7 pagesChoosing A Hydroprocessing SchemeJignesh DodiyaNo ratings yet

- Petsoc 2005 161Document15 pagesPetsoc 2005 161hcycNo ratings yet

- Multiobjective Optimisation of Fluid Catalytic Cracker Unit Using Genetic AlgorithmsDocument6 pagesMultiobjective Optimisation of Fluid Catalytic Cracker Unit Using Genetic AlgorithmsShaik RuksanaNo ratings yet

- Processes: Optimization Study On Increasing Yield and Capacity of Fluid Catalytic Cracking (FCC) UnitsDocument9 pagesProcesses: Optimization Study On Increasing Yield and Capacity of Fluid Catalytic Cracking (FCC) UnitsDika CodNo ratings yet

- 1 s2.0 S1875510015300251 MainDocument7 pages1 s2.0 S1875510015300251 MainMuhammad Aizuddin Zainal AbidinNo ratings yet

- Inner CleanlinessDocument8 pagesInner CleanlinessGustavo FelipeNo ratings yet

- Appendix F Exhaust Temperature Data Analysis For Portable Diesel-Fueled EnginesDocument4 pagesAppendix F Exhaust Temperature Data Analysis For Portable Diesel-Fueled Enginesmarwan senussiNo ratings yet

- Allyl3 LECHO FLUIDocument9 pagesAllyl3 LECHO FLUIJoha BetancurNo ratings yet

- Case Study Reliance Refinery Uses Emerson S Fiscal Metering System To Monitor Oil Gas Valued at Us 20b Annually Daniel en 44098Document3 pagesCase Study Reliance Refinery Uses Emerson S Fiscal Metering System To Monitor Oil Gas Valued at Us 20b Annually Daniel en 44098ghooestiepNo ratings yet

- Processes 11 02264 - 3Document14 pagesProcesses 11 02264 - 3salim salimNo ratings yet

- SPE-189139-MS Integrating Modular Refining and Marginal Field Operations Under Proposed Fiscal Terms - Is Value Possible?Document12 pagesSPE-189139-MS Integrating Modular Refining and Marginal Field Operations Under Proposed Fiscal Terms - Is Value Possible?Thuunder ThunderNo ratings yet

- Production of Diesel Fuel From Used Engine OilDocument6 pagesProduction of Diesel Fuel From Used Engine OilNorBertoChavezNo ratings yet

- Engineeringpractice September2023Document47 pagesEngineeringpractice September2023shashankNo ratings yet

- BPCL K Model Product Brochure 2020Document12 pagesBPCL K Model Product Brochure 2020Naresh SamalaNo ratings yet

- Bringing Decarbonization To Life September 2023Document4 pagesBringing Decarbonization To Life September 2023Balaji VaithyanathanNo ratings yet

- MATH164 Lecture Notes 10Document3 pagesMATH164 Lecture Notes 10Görkem ErcanNo ratings yet

- MATH164 Essay 6Document4 pagesMATH164 Essay 6Görkem ErcanNo ratings yet

- MATH164 Module 2Document5 pagesMATH164 Module 2Görkem ErcanNo ratings yet

- MATH164 Chapter 10Document5 pagesMATH164 Chapter 10Görkem ErcanNo ratings yet

- MATH164 Lab 7Document4 pagesMATH164 Lab 7Görkem ErcanNo ratings yet

- Case Study: Roxxon Company Production and Distribution Problem (Part I)Document14 pagesCase Study: Roxxon Company Production and Distribution Problem (Part I)Görkem ErcanNo ratings yet

- Ox 2Document2 pagesOx 2Görkem ErcanNo ratings yet

- Case Study: Roxxon Company Production and Distribution Problem (Part I)Document14 pagesCase Study: Roxxon Company Production and Distribution Problem (Part I)Görkem ErcanNo ratings yet

- Ox 3Document2 pagesOx 3Görkem ErcanNo ratings yet

- Ox 4Document2 pagesOx 4Görkem ErcanNo ratings yet

- Ox 2Document2 pagesOx 2Görkem ErcanNo ratings yet

- Ox 5Document2 pagesOx 5Görkem ErcanNo ratings yet

- Ox 3Document2 pagesOx 3Görkem ErcanNo ratings yet

- Ox 4Document2 pagesOx 4Görkem ErcanNo ratings yet

- Ox 4Document2 pagesOx 4Görkem ErcanNo ratings yet

- Case Study: Roxxon Company Production and Distribution Problem (Part I)Document14 pagesCase Study: Roxxon Company Production and Distribution Problem (Part I)Görkem ErcanNo ratings yet

- Ox 3Document2 pagesOx 3Görkem ErcanNo ratings yet

- Ox 5Document2 pagesOx 5Görkem ErcanNo ratings yet

- Ox 2Document2 pagesOx 2Görkem ErcanNo ratings yet

- Subject: Digital System Design Faculty: Mr. P.Jayakrishna Unit-5 Assignment 5 Set 1Document2 pagesSubject: Digital System Design Faculty: Mr. P.Jayakrishna Unit-5 Assignment 5 Set 1Jayakrishna CharyNo ratings yet

- Web+Presentation+12+July+2016 EA+-+Eric+LumeDocument57 pagesWeb+Presentation+12+July+2016 EA+-+Eric+LumetranthabinNo ratings yet

- Homophones WorksheetDocument3 pagesHomophones WorksheetAmes100% (1)

- Caption Sheet 4-Kailynn BDocument4 pagesCaption Sheet 4-Kailynn Bapi-549116310No ratings yet

- Novel Image Enhancement Technique Using CLAHE and Wavelet TransformsDocument5 pagesNovel Image Enhancement Technique Using CLAHE and Wavelet TransformsInnovative Research PublicationsNo ratings yet

- NURS1108 Lecture 10 - Nervous System ENHANCEDDocument40 pagesNURS1108 Lecture 10 - Nervous System ENHANCEDJacia’s SpaceshipNo ratings yet

- 1 Name of Work:-Improvement of Epum Road (Northern Side) Connecting With Imphal-Saikul Road I/c Pucca DrainDocument1 page1 Name of Work:-Improvement of Epum Road (Northern Side) Connecting With Imphal-Saikul Road I/c Pucca DrainHemam PrasantaNo ratings yet

- En LF Drivers 10nw76 8Document3 pagesEn LF Drivers 10nw76 8ChrisNo ratings yet

- Technical Methods and Requirements For Gas Meter CalibrationDocument8 pagesTechnical Methods and Requirements For Gas Meter CalibrationIrfan RazaNo ratings yet

- Company Profile: Only Milling Since 1967Document16 pagesCompany Profile: Only Milling Since 1967PavelNo ratings yet

- Daoyin Physical Calisthenics in The Internal Arts by Sifu Bob Robert Downey Lavericia CopelandDocument100 pagesDaoyin Physical Calisthenics in The Internal Arts by Sifu Bob Robert Downey Lavericia CopelandDragonfly HeilungNo ratings yet

- Tutorial 2Document2 pagesTutorial 2Adam HakimiNo ratings yet

- Ge Druck PTX 7535Document2 pagesGe Druck PTX 7535ICSSNo ratings yet

- NARS Fall 2011 Press File PDFDocument19 pagesNARS Fall 2011 Press File PDFheather_dillowNo ratings yet

- Column c4 From 3rd FloorDocument1 pageColumn c4 From 3rd Floor1man1bookNo ratings yet

- CFD - Basement Car ParkDocument43 pagesCFD - Basement Car ParkTanveer HasanNo ratings yet

- Adminstration of Intramusclar InjectionDocument3 pagesAdminstration of Intramusclar InjectionDenise CastroNo ratings yet

- An Experimental Investigation On Abrasive Jet Machining by Erosion Abrasive GrainDocument3 pagesAn Experimental Investigation On Abrasive Jet Machining by Erosion Abrasive GrainPkNo ratings yet

- Zetor Crystal 150 170 Tractor Operator Manual PDFDocument234 pagesZetor Crystal 150 170 Tractor Operator Manual PDFAntonNo ratings yet

- Metageographies of Coastal Management: Negotiating Spaces of Nature and Culture at The Wadden SeaDocument8 pagesMetageographies of Coastal Management: Negotiating Spaces of Nature and Culture at The Wadden Seadwi kurniawatiNo ratings yet

- PECI 405 ECPP 7th Sem CivilDocument96 pagesPECI 405 ECPP 7th Sem CivilYasaswi AkkirajuNo ratings yet

- CADS Revit Scia Engineer Link Best PracticesDocument32 pagesCADS Revit Scia Engineer Link Best PracticestrevorNo ratings yet

- Wic ReflectionDocument3 pagesWic Reflectionapi-307029735No ratings yet

- IsdettaDocument2 pagesIsdettaHa Phuoc HoaNo ratings yet