Professional Documents

Culture Documents

Problem Set 2 With Solution - Cost Concept & Design Process

Uploaded by

Noel So jrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem Set 2 With Solution - Cost Concept & Design Process

Uploaded by

Noel So jrCopyright:

Available Formats

ENEECO30 -Engineering Economy

PROBLEM SET # 2

COST CONCEPT AND DESIGN PROCESS

PROBLEM #1: COST, VOLUME, BREAK-EVEN RELATIONSHIP

To maintain constant pressure on engine valves, and improve efficiency in automotive

engine, lash adjuster is used. Equation below shows the link between the lash adjuster price (p)

and monthly demand (D).

3000 − 𝑝

𝐷=

0.15

To maximize total revenue, what demand should be considered? What important dat

needed if maximum profit is desired?

Given:

𝐷=

.

Solution:

Get number of demands to maximize revenue

𝐷=

.

𝑝 = 3000 − 0.15𝐷

Take note that 𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 (𝑇𝑅) = 𝑝𝐷

𝑇𝑅 = 𝑝 ∗ 𝐷 = 3000𝐷 − 0.15𝐷

Get the first derivate of TR with respect to D

( ) ( )

= 3,000 − 0.3𝐷 To get maximum value of D, set =0

0 = 3,000 − 0.3𝐷

0.3𝐷 = 3000

𝐷 = 10,000

Answer:

𝑫 = 𝟏𝟎, 𝟎𝟎𝟎 𝒖𝒏𝒊𝒕𝒔 𝒑𝒆𝒓 𝒎𝒐𝒏𝒕𝒉

Instructor: Engr. Michael Benjamin M. Diaz

ENEECO30 -Engineering Economy

PROBLEM #2: COST, VOLUME, BREAK-EVEN RELATIONSHIP

Engr. Roque owner of the HarRoq’s Ice Plant is monitoring the cashflow of the plant.

Based on the following information, how many ice blocks must produce and able to sell per month

in order to break even?

Ice block price Php 50.00/ice block

Cost of electricity Php 30.00/ice block

Tax to be paid Php 3.00/ice block

Real estate Tax Php 4,500.00/month

Salaries and wages Php 30,000.00/month

Others Php 15,000.00/month

Given:

Ice block price Php 50.00/ice block

Cost of electricity Php 30.00/ice block

Tax to be paid Php 3.00/ice block

Real estate Tax Php 4,500.00/month

Salaries and wages Php 30,000.00/month

Others Php 15,000.00/month

Solution:

Let 𝐷 = 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑖𝑐𝑒 𝑏𝑙𝑜𝑐𝑘 𝑡𝑜 𝑏𝑒 𝑠𝑜𝑙𝑑 𝑝𝑒𝑟 𝑚𝑜𝑛𝑡ℎ

𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 = 𝑇𝑜𝑡𝑎𝑙 𝐶𝑜𝑠𝑡

𝐼𝑐𝑒 𝐵𝑙𝑜𝑐𝑘 𝑃𝑟𝑖𝑐𝑒 = 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐸𝑙𝑒𝑐𝑡𝑟𝑖𝑐𝑖𝑡𝑦 + 𝑇𝑎𝑥 𝑡𝑜 𝑏𝑒 𝑝𝑎𝑖𝑑 + 𝑅𝑒𝑎𝑙 𝑠𝑡𝑎𝑡𝑒 𝑇𝑎𝑥 +

𝑆𝑎𝑙𝑎𝑟𝑖𝑒𝑠 𝑎𝑛𝑑 𝑤𝑎𝑔𝑒𝑠 + 𝑂𝑡ℎ𝑒𝑟𝑠

(Php 50.00)𝐷 = (Php 30.00)𝐷 + (Php 3.00)𝐷 + 𝑃ℎ𝑝 4,500.00 +

𝑃ℎ𝑝 30,000.00 + 𝑃ℎ𝑝 15,000.00

𝐷 = 2,911.76 𝑖𝑐𝑒 𝑏𝑙𝑜𝑐𝑘𝑠 𝑜𝑟 2,912 𝑖𝑐𝑒 𝑏𝑙𝑜𝑐𝑘𝑠

Answer:

𝑫𝒊𝒄𝒆 = 𝟐, 𝟗𝟏𝟐 𝒊𝒄𝒆 𝒃𝒍𝒐𝒄𝒌𝒔

Instructor: Engr. Michael Benjamin M. Diaz

ENEECO30 -Engineering Economy

PROBLEM #3: COST, VOLUME, BREAK-EVEN RELATIONSHIP

A part is being considered for manufacture on two currently owned machines. The capital

investment in the machines is roughly the same and can be overlooked. The production capabilities

and reject rates of the machines are the most significant distinctions between them. Consider the

table below.

Machine A Machine B

Production hours 7 hours/day 6 hours/day

Rejected parts 5% 12%

Rate of production 100 parts/hour 130 parts/hour

The material cost is Php 300.00 per part, and all defect-free parts can be sold for Php 600.00 each.

For either machine, the operator cost is Php 750.00 per hour and the variable overhead costs is Php

250 per hour.

a. Assume that the daily demand for this part is large enough that all defect-free parts can be

sold. Which machine should be selected?

b. What would the percent of parts rejected have to be for the other machine to be as profitable

as the chosen machine?

Given:

Operating Cost (𝐶 ) = 𝑃ℎ𝑝 250 𝑝𝑒𝑟 ℎ𝑜𝑢𝑟

Material Cost (𝑐 ) = 𝑃ℎ𝑝 300.00 𝑝𝑒𝑟 𝑝𝑎𝑟𝑡

Parts price (𝑝) = 𝑃ℎ𝑝 600.00 𝑝𝑒𝑟 𝑝𝑎𝑟𝑡

Machine A

Production hours (𝑡) = 7 ℎ𝑜𝑢𝑟𝑠/𝑑𝑎𝑦

Rejected parts rate (𝑥) = 5%

Rate of production (𝐷) = 100 parts/hour

Instructor: Engr. Michael Benjamin M. Diaz

ENEECO30 -Engineering Economy

Machine B

Production hours (𝑡) = 6 ℎ𝑜𝑢𝑟𝑠/𝑑𝑎𝑦

Rejected parts rate (𝑥) = 12%

Rate of production (𝐷) = 130 parts/hour

Solution:

A. Assume that the daily demand for this part is large enough that all defect-free parts

can be sold. Which machine should be selected?

𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 – 𝑇𝑜𝑡𝑎𝑙 𝐶𝑜𝑠𝑡

Note: Cost should be accumulated daily

For Total Revenue

𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 = 𝑅𝑎𝑡𝑒 𝑜𝑓 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 ∗ 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 ℎ𝑜𝑢𝑟𝑠 ∗ 𝑃𝑎𝑟𝑡 𝑃𝑟𝑖𝑐𝑒 ∗

𝐸𝑓𝑓𝑖𝑐𝑖𝑒𝑛𝑐𝑦

𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 = 𝑡𝑝𝐷𝜂

Where 𝐸𝑓𝑓𝑖𝑐𝑖𝑒𝑛𝑐𝑦 (𝜂) = 1.00 − 𝑥

For Total Cost

𝑇𝑜𝑡𝑎𝑙 𝐶𝑜𝑠𝑡 = 𝐹𝑖𝑥𝑒𝑑 𝐶𝑜𝑠𝑡 + 𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝐶𝑜𝑠𝑡

𝑇𝑜𝑡𝑎𝑙 𝐶𝑜𝑠𝑡 = 𝑡𝐶 + 𝑡𝑐 𝐷

Solve for the Total Profit of Machine A

𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 – 𝑇𝑜𝑡𝑎𝑙 𝐶𝑜𝑠𝑡

𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 = (𝑝𝐷𝜂) – (𝑡𝐶 + 𝑡𝑐 𝐷)

𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 = (𝑃ℎ𝑝 600.00 𝑝𝑒𝑟 𝑝𝑎𝑟𝑡) 100 7 (1 −

0.05) – 7 (𝑃ℎ𝑝 250 𝑝𝑒𝑟 ℎ𝑜𝑢𝑟) +

7 100 (𝑃ℎ𝑝 300 𝑝𝑒𝑟 𝑝𝑎𝑟𝑡𝑠)

𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 = 𝑃ℎ𝑝 187,250.00/𝑑𝑎𝑦

Solve for the Total Profit of Machine B

𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 – 𝑇𝑜𝑡𝑎𝑙 𝐶𝑜𝑠𝑡

𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 = (𝑝𝐷𝜂) – (𝑡𝐶 + 𝑡𝑐 𝐷)

Instructor: Engr. Michael Benjamin M. Diaz

ENEECO30 -Engineering Economy

𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 = (𝑃ℎ𝑝 600.00 𝑝𝑒𝑟 𝑝𝑎𝑟𝑡) 130 6 (1 −

0.12) – 6 (𝑃ℎ𝑝 250 𝑝𝑒𝑟 ℎ𝑜𝑢𝑟) +

6 130 (𝑃ℎ𝑝 300 𝑝𝑒𝑟 𝑝𝑎𝑟𝑡𝑠)

𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 = 𝑃ℎ𝑝 176,340.00/𝑑𝑎𝑦

Answer:

𝑴𝒂𝒄𝒉𝒊𝒏𝒆 𝑨 𝒔𝒉𝒐𝒖𝒍𝒅 𝒃𝒆 𝒔𝒆𝒍𝒆𝒄𝒕𝒆𝒅 𝒘𝒊𝒕𝒉 𝒂 𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 𝑜𝑓𝑃ℎ𝑝 187,250.00/𝑑𝑎𝑦

B. What would the percent of parts rejected have to be for the other machine to be as

profitable as the chosen machine?

Consider the following:

1. Total Profit for Machine B equal to Total Profit of Machine A

(𝑃ℎ𝑝 187,250.00/𝑑𝑎𝑦)

2. Rejection rate is unknown

𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 – 𝑇𝑜𝑡𝑎𝑙 𝐶𝑜𝑠𝑡

𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡 = (𝑝𝐷𝜂) – (𝑡𝐶 + 𝑡𝑐 𝐷)

𝑃ℎ𝑝 187, 250/𝑑𝑎𝑦 = (𝑃ℎ𝑝 600.00 𝑝𝑒𝑟 𝑝𝑎𝑟𝑡) 130 6 (1 −

𝑥) – 6 (𝑃ℎ𝑝 250 𝑝𝑒𝑟 ℎ𝑜𝑢𝑟) +

6 130 (𝑃ℎ𝑝 300 𝑝𝑒𝑟 𝑝𝑎𝑟𝑡𝑠)

(𝑥) = 0.09668

Answer:

𝒙 = 9.67%

Instructor: Engr. Michael Benjamin M. Diaz

You might also like

- Time To Get SeriousDocument354 pagesTime To Get SeriousEdmond Blair100% (1)

- 94209674Document10 pages94209674Anjo VasquezNo ratings yet

- Problem Set 3 With Solution - Cashflow, Interest, Discount, InflationDocument8 pagesProblem Set 3 With Solution - Cashflow, Interest, Discount, InflationNoel So jrNo ratings yet

- Lesson 10 - Replacement StudiesDocument3 pagesLesson 10 - Replacement StudiesRVNo ratings yet

- MODULE 04 - Engineering Economy - DepreciationDocument22 pagesMODULE 04 - Engineering Economy - DepreciationNoel So jr100% (2)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Other Annuity TypesDocument7 pagesOther Annuity TypesLevi John Corpin AmadorNo ratings yet

- Engineering Economy Problem Set 5Document7 pagesEngineering Economy Problem Set 5Noel So jrNo ratings yet

- MODULE 05 - Engineering Economy - Present EconomyDocument12 pagesMODULE 05 - Engineering Economy - Present EconomyNoel So jr100% (1)

- Lesson 4Document22 pagesLesson 4Armil Senope Monsura20% (5)

- Module 4Document17 pagesModule 4Noel S. De Juan Jr.100% (1)

- MODULE 03 - Engineering Economy - Principles of Money-Time RelationshipsDocument54 pagesMODULE 03 - Engineering Economy - Principles of Money-Time RelationshipsNoel So jrNo ratings yet

- Engineering Economics QuizDocument10 pagesEngineering Economics QuizLarah PiencenavesNo ratings yet

- Engineering EconomyDocument5 pagesEngineering EconomyDayLe Ferrer AbapoNo ratings yet

- Problem Set 4 With Solution - AnnuityDocument14 pagesProblem Set 4 With Solution - AnnuityNoel So jrNo ratings yet

- IE 307 Engineering Economy Gradient Series and Amortization ScheduleDocument8 pagesIE 307 Engineering Economy Gradient Series and Amortization ScheduleJayrMenes100% (1)

- GCT CIVIL ENGINEERING REVIEW CLASS NOTESDocument2 pagesGCT CIVIL ENGINEERING REVIEW CLASS NOTESUnknown Engr.No ratings yet

- Smith Bell v. Sotello MattiDocument3 pagesSmith Bell v. Sotello MattijrvyeeNo ratings yet

- Additional Problems Engineering EconomyDocument4 pagesAdditional Problems Engineering EconomyMark James0% (1)

- Seatwork7 Withanswer Final PDFDocument3 pagesSeatwork7 Withanswer Final PDFLester John PrecillasNo ratings yet

- Lab Exercise No. 7:: Closed Compass TraverseDocument5 pagesLab Exercise No. 7:: Closed Compass TraverseLoki PagcorNo ratings yet

- Problem Set 6 With Solution - Gradient SeriesDocument8 pagesProblem Set 6 With Solution - Gradient SeriesNoel So jr100% (4)

- Evosys Fixed Scope Offering For Oracle Fusion Procurement Cloud ServiceDocument12 pagesEvosys Fixed Scope Offering For Oracle Fusion Procurement Cloud ServiceMunir AhmedNo ratings yet

- New Monasticism: An Interspiritual Manifesto For Contemplative Life in The 21st CenturyDocument32 pagesNew Monasticism: An Interspiritual Manifesto For Contemplative Life in The 21st CenturyWorking With Oneness100% (8)

- Fco Gar 6500-6300 Abmm-Musa Q 50.000 MTDocument2 pagesFco Gar 6500-6300 Abmm-Musa Q 50.000 MTEnergi Alam BorneoNo ratings yet

- Prepared By: Engr. Jeffrey P. LandichoDocument10 pagesPrepared By: Engr. Jeffrey P. LandichoNoel So jrNo ratings yet

- Lesson 1Document7 pagesLesson 1Ma Aaron Gwyneth BalisacanNo ratings yet

- Cee 109 - First ExamDocument43 pagesCee 109 - First ExamRonald Renon QuiranteNo ratings yet

- TrigonometryDocument4 pagesTrigonometryKim Kelley AngNo ratings yet

- Simple Interest Compound InterestDocument6 pagesSimple Interest Compound InterestKaye OleaNo ratings yet

- Solution 1-5 1Document4 pagesSolution 1-5 1Dan Edison RamosNo ratings yet

- Exercise No. 7 in ECON 11 Capitalized CostDocument3 pagesExercise No. 7 in ECON 11 Capitalized CostMarlon BautistaNo ratings yet

- NUt 6 SA9 SSN 65Document38 pagesNUt 6 SA9 SSN 65Don RomantikoNo ratings yet

- Hue HueDocument26 pagesHue HueWex Senin Alcantara100% (1)

- Surveying Elem HigherDocument14 pagesSurveying Elem HigherNeilCyrus RamirezNo ratings yet

- Problem Set 1 With Solution - Introduction To Engineering EconomyDocument6 pagesProblem Set 1 With Solution - Introduction To Engineering EconomyNoel So jrNo ratings yet

- Regine Mae Yaniza - 2 Year BsceDocument11 pagesRegine Mae Yaniza - 2 Year BsceRegine Mae Lustica YanizaNo ratings yet

- 08 26 21 Ulo 1b Let's AnalyzeDocument6 pages08 26 21 Ulo 1b Let's AnalyzeAlexis Mikael EjercitoNo ratings yet

- Module 4 - FOSDocument21 pagesModule 4 - FOSHades Vesarius RiegoNo ratings yet

- Cost comparison of task completion methodsDocument3 pagesCost comparison of task completion methodsJohnjacob GerardoNo ratings yet

- Engineering Economy Part 3Document13 pagesEngineering Economy Part 3Josiah FloresNo ratings yet

- Eeco HWDocument19 pagesEeco HWRejed VillanuevaNo ratings yet

- Orca Share Media1533208944176Document90 pagesOrca Share Media1533208944176Christian Jimenez Reyes0% (1)

- PROBABILITYDocument8 pagesPROBABILITYalmiraNo ratings yet

- Equation of Value For Ceit-04-501aDocument9 pagesEquation of Value For Ceit-04-501aAngeli Mae SantosNo ratings yet

- Engineering Economic HandoutsDocument4 pagesEngineering Economic HandoutsAngelo Luigi YasayNo ratings yet

- Economics AnnuityDocument2 pagesEconomics AnnuityGeodetic Engineering FilesNo ratings yet

- Engineering Economy ReviewerDocument5 pagesEngineering Economy ReviewerBea Abesamis100% (1)

- ENGECODocument3 pagesENGECOmgoldiieeee20% (5)

- Calculate investment earnings and loan payments over timeDocument1 pageCalculate investment earnings and loan payments over timeYss CastañedaNo ratings yet

- Deflection Angle TraverseDocument5 pagesDeflection Angle TraverseJustine BotillaNo ratings yet

- Surveying and Transportation EngineeringDocument34 pagesSurveying and Transportation EngineeringRimar LiguanNo ratings yet

- Econ c3Document51 pagesEcon c3larra100% (1)

- ES 33 - Plate No. 1Document10 pagesES 33 - Plate No. 1Maybelline DipasupilNo ratings yet

- Lecture 1 Part 2 - Present EconomyDocument9 pagesLecture 1 Part 2 - Present EconomyIvan Dave TorrecampoNo ratings yet

- Nova Assignment 1 - Surveying Finals (Autosaved) (Autosaved) Nova Assignment 1 - Surveying FinalsDocument10 pagesNova Assignment 1 - Surveying Finals (Autosaved) (Autosaved) Nova Assignment 1 - Surveying FinalsKenNo ratings yet

- Mec2213 Chapter 1 II v2Document15 pagesMec2213 Chapter 1 II v2Alex CheeNo ratings yet

- Negative secant and tangent between 90 and 180 degreesDocument7 pagesNegative secant and tangent between 90 and 180 degreesKevin Christian Plata100% (1)

- Depreciation ConceptDocument22 pagesDepreciation ConceptJulie Ann ZafraNo ratings yet

- Problemset EconceDocument10 pagesProblemset EconceGerly Joy MaquilingNo ratings yet

- Polytechnic University of the Philippines College of Engineering Final ExaminationDocument5 pagesPolytechnic University of the Philippines College of Engineering Final ExaminationAndrian ReyesNo ratings yet

- Eng'g Economics (Fsi 2018) PDFDocument70 pagesEng'g Economics (Fsi 2018) PDFKettlecorn KarlisNo ratings yet

- The Time Value of Money ExercisesDocument4 pagesThe Time Value of Money ExercisesCesia MontelloNo ratings yet

- EE40 Simple and Compound Interest Rates Solved ProblemsDocument9 pagesEE40 Simple and Compound Interest Rates Solved ProblemsJm T. Despabeladero100% (1)

- ProblemsDocument10 pagesProblemsJune CostalesNo ratings yet

- IEMECON - HandoutsDocument64 pagesIEMECON - HandoutsEzekiel BernardoNo ratings yet

- PRESENT ECONOMY Sample Problems Part 2Document4 pagesPRESENT ECONOMY Sample Problems Part 2Ellen Mae OlaguerNo ratings yet

- Engineering Economy Problems SolvedDocument14 pagesEngineering Economy Problems SolvedMohamedNo ratings yet

- EEE - Assignment 2 Sanjeev 16001174 PDFDocument7 pagesEEE - Assignment 2 Sanjeev 16001174 PDFSanjeev Nehru100% (1)

- Operationmanagementproblems 131216134550 Phpapp02Document86 pagesOperationmanagementproblems 131216134550 Phpapp02Mai LinhNo ratings yet

- Review QuestionsDocument22 pagesReview QuestionsJustus MusilaNo ratings yet

- ME40 Assignment 6Document3 pagesME40 Assignment 6Benmar N. OcolNo ratings yet

- Prepared By: Engr. Jeffrey P. LandichoDocument16 pagesPrepared By: Engr. Jeffrey P. LandichoNoel So jrNo ratings yet

- Problem Set 9Document11 pagesProblem Set 9Noel So jrNo ratings yet

- Engineering EconomyDocument16 pagesEngineering EconomyNoel So jrNo ratings yet

- Flow of Fluid and Bernouoli'S Equation: Problem Set 6Document8 pagesFlow of Fluid and Bernouoli'S Equation: Problem Set 6Noel So jrNo ratings yet

- Centroid and Moment of Inertia: Problem Set 7Document4 pagesCentroid and Moment of Inertia: Problem Set 7Noel So jrNo ratings yet

- Problem Set 7Document7 pagesProblem Set 7Noel So jrNo ratings yet

- Force Due To Static Fluid: Problem Set 6Document4 pagesForce Due To Static Fluid: Problem Set 6Noel So jrNo ratings yet

- Problem Set 10Document11 pagesProblem Set 10Noel So jrNo ratings yet

- MODULE 02 - Engineering Economy - Cost Concept and Design EconomicsDocument28 pagesMODULE 02 - Engineering Economy - Cost Concept and Design EconomicsNoel So jrNo ratings yet

- Flow of Fluid and Bernouoli'S Equation: Problem Set 9Document3 pagesFlow of Fluid and Bernouoli'S Equation: Problem Set 9Noel So jrNo ratings yet

- Problem Set 8Document10 pagesProblem Set 8Noel So jrNo ratings yet

- Centroid and Moment of Inertia: Problem Set 7Document4 pagesCentroid and Moment of Inertia: Problem Set 7Noel So jrNo ratings yet

- Force Due To Static Fluid: Problem Set 6Document6 pagesForce Due To Static Fluid: Problem Set 6Noel So jrNo ratings yet

- Force Due To Static Fluid: Problem Set 6Document4 pagesForce Due To Static Fluid: Problem Set 6Noel So jrNo ratings yet

- Prepared By: Engr. Jeffrey P. LandichoDocument17 pagesPrepared By: Engr. Jeffrey P. LandichoLenNo ratings yet

- Homework No. 5: National University ManilaDocument3 pagesHomework No. 5: National University ManilaNoel So jrNo ratings yet

- Prepared By: Engr. Jeffrey P. LandichoDocument16 pagesPrepared By: Engr. Jeffrey P. LandichoLenNo ratings yet

- Force Due To Static Fluid: Problem Set 6Document4 pagesForce Due To Static Fluid: Problem Set 6Noel So jrNo ratings yet

- Differential CalculusDocument12 pagesDifferential CalculusLenNo ratings yet

- Homework No. 5: National University ManilaDocument3 pagesHomework No. 5: National University ManilaNoel So jrNo ratings yet

- Centroid and Moment of Inertia: Problem Set 7Document4 pagesCentroid and Moment of Inertia: Problem Set 7Noel So jrNo ratings yet

- UNIT 2 Ielts Speaking Part 1 Questions Sample Answers IELTS FighterDocument15 pagesUNIT 2 Ielts Speaking Part 1 Questions Sample Answers IELTS FighterVi HoangNo ratings yet

- CLASS 7B Result Software 2023-24Document266 pagesCLASS 7B Result Software 2023-24JNVG XIB BOYSNo ratings yet

- Module IV StaffingDocument3 pagesModule IV Staffingyang_19250% (1)

- IN SUNNY SPAIN, 1882-85: "My Country, My Love, My People, I Leave You Now, You Disappear, I Lose Sight of You"Document4 pagesIN SUNNY SPAIN, 1882-85: "My Country, My Love, My People, I Leave You Now, You Disappear, I Lose Sight of You"Mary Claire ComalaNo ratings yet

- Learning, Perception, Attitudes, Values, and Ethics: Fundamentals of Organizational Behavior 2eDocument21 pagesLearning, Perception, Attitudes, Values, and Ethics: Fundamentals of Organizational Behavior 2eJp AlvarezNo ratings yet

- EasyGreen ManualDocument33 pagesEasyGreen ManualpitoupitouNo ratings yet

- Spreadsheet and Presentation Skills SyllabusDocument4 pagesSpreadsheet and Presentation Skills SyllabusGbox CTCNo ratings yet

- 1967 Painting Israeli VallejoDocument1 page1967 Painting Israeli VallejoMiloš CiniburkNo ratings yet

- Skills Test Unit 1 Test A EmailDocument4 pagesSkills Test Unit 1 Test A EmailЛиза ОмельченкоNo ratings yet

- PH.D Scholars UGCDocument25 pagesPH.D Scholars UGCUsha MurthyNo ratings yet

- IELTS2 Video ScriptsDocument5 pagesIELTS2 Video ScriptskanNo ratings yet

- India-An Underdeveloped Economy: (Contd )Document6 pagesIndia-An Underdeveloped Economy: (Contd )Amrita Prashant IyerNo ratings yet

- SoalDocument4 pagesSoalkurikulum man2wonosoboNo ratings yet

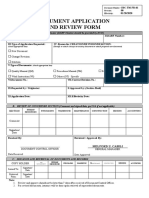

- Document Application and Review FormDocument1 pageDocument Application and Review FormJonnel CatadmanNo ratings yet

- Marine Clastic Reservoir Examples and Analogues (Cant 1993) PDFDocument321 pagesMarine Clastic Reservoir Examples and Analogues (Cant 1993) PDFAlberto MysterioNo ratings yet

- Literature 1 Study GuideDocument7 pagesLiterature 1 Study GuideEs EsNo ratings yet

- Thesis Chapter 123Document15 pagesThesis Chapter 123Chesca Mae PenalosaNo ratings yet

- Lesson Plan-MethodsDocument6 pagesLesson Plan-Methodsapi-272643370No ratings yet

- Soil Penetrometer ManualDocument4 pagesSoil Penetrometer Manualtag_jNo ratings yet

- Fishblade RPGDocument1 pageFishblade RPGthe_doom_dudeNo ratings yet

- Ap Finance Go PDFDocument3 pagesAp Finance Go PDFSuresh Babu ChinthalaNo ratings yet

- BATCH Bat Matrix OriginalDocument5 pagesBATCH Bat Matrix OriginalBarangay NandacanNo ratings yet

- PassportDocument4 pagesPassportVijai Abraham100% (1)

- Lesson 5 Classifications of CommunicationDocument48 pagesLesson 5 Classifications of CommunicationRovenick SinggaNo ratings yet

- Group Assgnmt 8 Rev080515Document9 pagesGroup Assgnmt 8 Rev080515Suhaila NamakuNo ratings yet