Professional Documents

Culture Documents

Answer Key - Problem Sets - Adjusting Entries

Uploaded by

Alexa Abary0 ratings0% found this document useful (0 votes)

100 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

100 views2 pagesAnswer Key - Problem Sets - Adjusting Entries

Uploaded by

Alexa AbaryCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

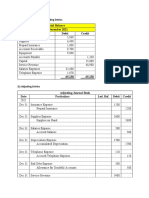

PROBLEM I

Page 1

Date Description P.R. Debit Credit

2019

Dec 31 Prepaid Insurance 100,000

Insurance Expense 100,000

To record unexpired portion of the insurance

(120,000 * 20/24)

Dec 31 Rent Income 42,000

Unearned Rent Income 42,000

To record unearned portion of the rent income received

(63,000 * 6/9)

Dec 31 Depreciation Expense - Machinery 95,625

Accumulated Depreciation - Machinery 95,625

To record depreciation of machinery for the year

[(300,000 * 25%) + (110,000 * 25% * 9/12)]

Dec 31 Commissions Receivable 50,000

Commissions Income 50,000

To record commissions earned but uncollected

Dec 31 Supplies Expense 23,000

Supplies 23,000

To record supplies consumed during the period

Dec 31 Unearned Subscriptions Revenue 41,250

Subscriptions Revenue 41,250

To record subscriptions revenue earned during the period

(75,000 * 55%)

Dec 31 Interest Expense 2,200

Interest Payable 2,200

To record accrued interest on notes issued

(240,000 * 11% * 30/360)

Dec 31 Fees Collected in Advance 175,000

Fees Earned 175,000

To record fees already earned during the period

(250,000 * 70%)

Dec 31 Interest Receivable 1,800

Interest Income 1,800

To record interest earned on notes received fom customers

[180,000 * 8% * (45/360)]

Dec 31 Insurance Expense 195,000

Prepaid Insurance 195,000

To record expired portion of the insurance

[(300,000 * 10/24) + (210,000 * 4/12)]

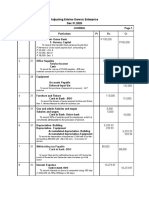

PROBLEM II

Page 1

Date Description Debit Credit

2019

Dec 31 Salaries Expense 8,400

Salaries Payable 8,400

To record salaries incurred but unpaid as of yearend

(650 * 4) + (700 * 4) + (750 * 4)

Dec 31 Unearned Interest Income 25,000

Interest Income 25,000

To record interest income already earned

Dec 31 Prepaid Interest 5,500

Interest Expense 5,500

To record interest paid in advance

Dec 31 Supplies Expense 15,300

Supplies 15,300

To record supplies used during the period

(25,000 - 9,700)

Dec 31 Interest Expense 2,400

Interest Payable 2,400

To record accrued interest on notes issued

(160,000 * 12% * 45/360)

Dec 31 Interest Receivable 6,250

Interest Income 6,250

To record interest earned on notes received fom customers

[250,000 * 15% * (60/360)]

Dec 31 Depreciation Expense - Office Equipment 11,250

Accumulated Depreciation - Office Equipment 11,250

To record depreciation of office equipment

(80,000-5,000)/5 = 15,000

15,000 * 9/12 = 11,250

Dec 31 Advertising Expense 48,000

Prepaid Advertising 48,000

To record expired portion of the prepaid advertisement

(80,000 * 60%)

Dec 31 Depreciation Expense - Furniture 25,000

Accumulated Depreciation - Furniture 25,000

To record depreciation of furniture

(75,000 /3)

Dec 31 Taxes and Licenses 17,000

Salaries Expenses 30,000

Accrued Expenses - Taxes and Licenses 17,000

Salaries Payable 30,000

To record unpaid taxes and salaries as of yearend

You might also like

- Tutorial On AdjustmentsDocument8 pagesTutorial On AdjustmentsPushpa ValliNo ratings yet

- 77 FDocument3 pages77 FJohn CalvinNo ratings yet

- 4 1aDocument1 page4 1aWaritsa KupraditNo ratings yet

- Fabm Unit 8: Assignment: Mark Kenneth V Adonis Grade 11-GalatiansDocument2 pagesFabm Unit 8: Assignment: Mark Kenneth V Adonis Grade 11-GalatiansKenCy CUTENo ratings yet

- Acctg Assginment 4 Adjusting EntriesDocument3 pagesAcctg Assginment 4 Adjusting EntriesDaisy Marie A. RoselNo ratings yet

- FDNACCT Unit 3 - Financial Statements - ExampleDocument2 pagesFDNACCT Unit 3 - Financial Statements - ExampleerinlomioNo ratings yet

- Financial Accounting Major Assignment1Document7 pagesFinancial Accounting Major Assignment1Elham JabarkhailNo ratings yet

- Ques 1Document2 pagesQues 1Sorowar SalauddinNo ratings yet

- Poa Week 8 LectureDocument14 pagesPoa Week 8 LectureTabsheer KamranNo ratings yet

- Final Finals PDFDocument4 pagesFinal Finals PDFD PNo ratings yet

- Susquehanna Equipment Rentals General Journal (Adjusting Entries)Document1 pageSusquehanna Equipment Rentals General Journal (Adjusting Entries)Miles LinNo ratings yet

- Agbanlog Ae121 Fa2 MidtermsDocument28 pagesAgbanlog Ae121 Fa2 MidtermsMariette Alex AgbanlogNo ratings yet

- Acctg Lab 4Document3 pagesAcctg Lab 4AngieNo ratings yet

- Investment in Associate ExercisesDocument7 pagesInvestment in Associate ExercisesJo KeNo ratings yet

- Perilla Geriqjoeden Quiz Prob11Document1 pagePerilla Geriqjoeden Quiz Prob11Geriq Joeden PerillaNo ratings yet

- Assignment#5Document2 pagesAssignment#5Hope Trinity EnriquezNo ratings yet

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- 2019 Vol 1 CH 5 AnswersDocument23 pages2019 Vol 1 CH 5 AnswersDummy Number 2No ratings yet

- Homework P4 4ADocument8 pagesHomework P4 4AFrizky Triputra CahyahanaNo ratings yet

- ReviewDocument38 pagesReviewFiana DolinogNo ratings yet

- Casos de Ajuste.Document9 pagesCasos de Ajuste.Alguien algunoNo ratings yet

- Is and BS For FinalsDocument5 pagesIs and BS For FinalsRehan FarhatNo ratings yet

- Acc CDocument7 pagesAcc CYaseen MawlaniNo ratings yet

- Assignment 3 - Financial Accounting - February 4Document7 pagesAssignment 3 - Financial Accounting - February 4Ednalyn PascualNo ratings yet

- 2019 Vol 1 CH 5 AnswersDocument21 pages2019 Vol 1 CH 5 AnswersArkhie Davocol80% (5)

- Assignment #1 BADM 1050 Emily KiaraDocument5 pagesAssignment #1 BADM 1050 Emily Kiaraemilynelson1429No ratings yet

- Tutorial Test 3Document2 pagesTutorial Test 3Hải NhưNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Chapter 24 Answer KeyDocument3 pagesChapter 24 Answer KeyShane TabunggaoNo ratings yet

- Final Ass. 2 Malinao Kathleen S. BSBAHRM 2 3DDocument4 pagesFinal Ass. 2 Malinao Kathleen S. BSBAHRM 2 3DHanna Ruth FloreceNo ratings yet

- PracticeSet BondsPayableDocument5 pagesPracticeSet BondsPayablearabelle contrerasNo ratings yet

- Item (A) Type of Adjustment (B) Accounts Before AdjustmentDocument11 pagesItem (A) Type of Adjustment (B) Accounts Before Adjustmentsuci monalia putriNo ratings yet

- Accounting Adjusting EntriesDocument12 pagesAccounting Adjusting EntriesChin-Chin SantiagoNo ratings yet

- Topic 4 Tutorial QuestionsDocument5 pagesTopic 4 Tutorial QuestionsAbigailNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- FA Assignment # 1Document8 pagesFA Assignment # 1Saad AhmedNo ratings yet

- Tampoa Ae211 Unit 1 Assessment ProblemsDocument12 pagesTampoa Ae211 Unit 1 Assessment ProblemsJahna Kay TampoaNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- AJP RM MUBARAK-dikonversiDocument1 pageAJP RM MUBARAK-dikonversiBulan julpi suwellyNo ratings yet

- Adjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsDocument31 pagesAdjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsFlorenz AmbasNo ratings yet

- Problem 5Document3 pagesProblem 5Rudy LugasNo ratings yet

- Chapter 5 - Selected SolutionsDocument13 pagesChapter 5 - Selected SolutionsNouh Al-SayyedNo ratings yet

- Powerjob Inc CaseDocument6 pagesPowerjob Inc CaseGloryNo ratings yet

- Accounting ExerciseDocument40 pagesAccounting ExerciseAsri Marwa UmniatiNo ratings yet

- Completion of Accounting CycleDocument12 pagesCompletion of Accounting Cycleeater PeopleNo ratings yet

- Comprehensive Problem Excel SpreadsheetDocument23 pagesComprehensive Problem Excel Spreadsheetapi-237864722100% (3)

- Adjusting Entries-Owwsic EnterpriseDocument2 pagesAdjusting Entries-Owwsic EnterpriseLianna RoNo ratings yet

- WK 4 More Practice Adjusting EntriesDocument8 pagesWK 4 More Practice Adjusting EntriesOsman Bin SaifNo ratings yet

- SBR Practice Questions 2019 - ADocument305 pagesSBR Practice Questions 2019 - AALEX TRANNo ratings yet

- Mishal Mustafa BTA111 Prof. WuDocument2 pagesMishal Mustafa BTA111 Prof. WuMishalm96No ratings yet

- (ASSIGNMENT 3) Eslam Mahmoud MohamedDocument4 pages(ASSIGNMENT 3) Eslam Mahmoud MohamedAmira OkashaNo ratings yet

- Exercise 2ADocument3 pagesExercise 2A31231020764No ratings yet

- Chapter 14 AnswersDocument6 pagesChapter 14 AnswersjoshualendiotamayoNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Assignment 3Document2 pagesAssignment 3Ahmed AwedNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Chapter 2 PDFDocument32 pagesChapter 2 PDFPrajwal BhattNo ratings yet

- ABM Society: English For Academic and Professional Purposes Preliminary Exam ReviewerDocument9 pagesABM Society: English For Academic and Professional Purposes Preliminary Exam ReviewerAlexa AbaryNo ratings yet

- Entrep-Finals (DE)Document5 pagesEntrep-Finals (DE)Alexa AbaryNo ratings yet

- 4 Remaining Characteristics of Academic TextsDocument1 page4 Remaining Characteristics of Academic TextsAlexa AbaryNo ratings yet

- Economics 3rdquarter 2ndsem 1920Document14 pagesEconomics 3rdquarter 2ndsem 1920Alexa AbaryNo ratings yet

- Answer Key - Exercises - Adjusting EntriesDocument4 pagesAnswer Key - Exercises - Adjusting EntriesAlexa AbaryNo ratings yet

- Academics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerDocument5 pagesAcademics Committee: Fundamentals of Accountancy, Business & Management 1 Preliminary Exam ReviewerAlexa Abary100% (1)

- Answer Key - Problem Sets - Adjusting EntriesDocument2 pagesAnswer Key - Problem Sets - Adjusting EntriesAlexa AbaryNo ratings yet

- Fabm1-Additional Reading MaterialsDocument31 pagesFabm1-Additional Reading MaterialsAlexa AbaryNo ratings yet

- Answer Key - Problem Sets - Adjusting EntriesDocument2 pagesAnswer Key - Problem Sets - Adjusting EntriesAlexa AbaryNo ratings yet

- Alto 5 - Depreciation - Answer KeyDocument4 pagesAlto 5 - Depreciation - Answer KeyAlexa AbaryNo ratings yet

- Process CostingDocument108 pagesProcess CostingAnjali rajbharNo ratings yet

- Final JV Sheet For Accruals Mar 16Document64 pagesFinal JV Sheet For Accruals Mar 16qasmi576No ratings yet

- SUBSIDIARY BOOKS Purchases JournalDocument5 pagesSUBSIDIARY BOOKS Purchases JournalRichard TshumahNo ratings yet

- ch05 Accounting For Merchandising OperationDocument59 pagesch05 Accounting For Merchandising OperationJawad Arko100% (1)

- Accounting II - Final AssignmentDocument5 pagesAccounting II - Final AssignmentMarwan AminNo ratings yet

- AssignmentDocument8 pagesAssignmentSameer SawantNo ratings yet

- Lesson 15 Home Office, Branch and Agency AccountingDocument11 pagesLesson 15 Home Office, Branch and Agency AccountingMark TaysonNo ratings yet

- DAL Revised For Proprietor 6.25Document5 pagesDAL Revised For Proprietor 6.25Sakshi SinghNo ratings yet

- Quiz Adjusting Entries Multiple Choice WithoutDocument5 pagesQuiz Adjusting Entries Multiple Choice WithoutRakzMagaleNo ratings yet

- 1st Sem Accounting PDFDocument5 pages1st Sem Accounting PDFJeevan karkiNo ratings yet

- 2551QDocument3 pages2551QnelsonNo ratings yet

- Conceptual Framework MidtermsDocument6 pagesConceptual Framework MidtermsRyzeNo ratings yet

- Nutty Company Problem 23 - 5 (INTACCS Problem)Document2 pagesNutty Company Problem 23 - 5 (INTACCS Problem)Ya Na100% (1)

- Account NumberDocument1 pageAccount NumberBinom SkuyNo ratings yet

- Format Description SWIFT MT940 Structured Tcm79-183712Document20 pagesFormat Description SWIFT MT940 Structured Tcm79-183712Pambudi SatriaNo ratings yet

- Beams Aa13e TB 15Document29 pagesBeams Aa13e TB 15Feby SinagaNo ratings yet

- Introduction To AccountingDocument13 pagesIntroduction To AccountingShivam MutkuleNo ratings yet

- Giới thiệu giải pháp Core Banking của PolarisDocument18 pagesGiới thiệu giải pháp Core Banking của Polarisdownloadvn10No ratings yet

- Account Assignment and Revenue RecognitionDocument8 pagesAccount Assignment and Revenue RecognitionPraveen KumarNo ratings yet

- Test 2 Acc117 Q Sem Mar 2022 Am1103bDocument6 pagesTest 2 Acc117 Q Sem Mar 2022 Am1103bHUMAIRA LIYANA FARISHA JAFRINo ratings yet

- Schwab MoneyLink Electronic Funds Transfer FormDocument5 pagesSchwab MoneyLink Electronic Funds Transfer FormcadeadmanNo ratings yet

- Annisa Putri Ariyanto - Lembar Kerja Buku Besar - PT AC NOL DERAJATDocument12 pagesAnnisa Putri Ariyanto - Lembar Kerja Buku Besar - PT AC NOL DERAJATannisa putriNo ratings yet

- Chapter 35Document30 pagesChapter 35Mike SerafinoNo ratings yet

- India-GST-Documentation 1709 ConfigDocument9 pagesIndia-GST-Documentation 1709 ConfigShagun JainNo ratings yet

- Accounting Information Systems: Moscove, Simkin & BagranoffDocument26 pagesAccounting Information Systems: Moscove, Simkin & BagranoffJessa WongNo ratings yet

- GST 7th Edition PDFDocument366 pagesGST 7th Edition PDFUtkarshNo ratings yet

- Soal AKLDocument3 pagesSoal AKLErica Lesmana100% (1)

- CIS Midterm ReviewerDocument16 pagesCIS Midterm ReviewerAbygail PaulinoNo ratings yet

- Job Costing: I. Learning ObjectivesDocument8 pagesJob Costing: I. Learning ObjectivesKerby Gail RulonaNo ratings yet