Professional Documents

Culture Documents

June 25 Payslip

Uploaded by

Bry GutierrezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

June 25 Payslip

Uploaded by

Bry GutierrezCopyright:

Available Formats

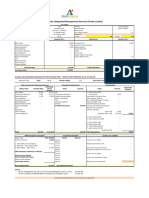

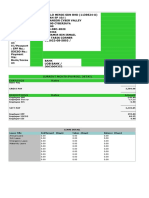

Unit 5E, 1607 Cityland Herrera Tower

Valero St. Salcedo Village, Makati City

Contact Number: (0998) 593 1596

EMPLOYEE'S ID # : 2772

EMPLOYEE'S NAME : Bryan T. Gutierrez

POSITION : IT Service Desk Analyst

PAYROLL PERIOD : June 1 - June 15, 2021

PAYROLL RELEASE DATE: June 25, 2021

MONTHLY BASIC SALARY : 20,000.00

MONTHLY DEMINIMIS BENEFITS : 3,000.00

TAX IDENTIFICATION NUMBER : 259-729-706

SOCIAL SECURITY SYSTEM NUMBER : 34-2933864-8

PHILHEALTH NUMBER : 01-051442148-5

HOME DEVELOPMENT MUTUAL FUND NUMBER : 1210-4138-1160

SIL BALANCE AVAILABLE FOR USE ( IN HOURS ) -

PARTICULAR HOURS AMOUNT

Basic Pay 10,000.00

Absences / Late / Undertime 4.00 (459.77)

Missing Hours on Timecard - -

Overtime ( Regular Day ) - 125% 0.50 71.84

Overtime ( Rest Day ) - 169% - -

Overtime ( Special Holiday ) - 169% - -

Overtime ( Rest Day & Special Holiday ) - 195% - -

Overtime ( Legal Holiday ) - 260% - -

Overtime ( Rest Day & Legal Holiday ) - 338% - -

Overtime ( Double Holiday ) - 390% - -

Overtime ( Rest Day & Double Holiday ) - 507% - -

Premium Pay ( Rest Day ) - 130% - -

Premium Pay ( Special Holiday ) - 30% - -

Premium Pay ( Rest Day & Special Holiday ) - 150% - -

Premium Pay ( Legal Holiday ) - 100% - -

Premium Pay ( Rest Day & Legal Holiday ) - 260% - -

Premium Pay ( Double Holiday ) - 200% - -

Premium Pay ( Rest Day & Double Holiday ) - 390% - -

Total Night Shift Differential Pay 714.08

BASIC PAY & OVERTIME & PREMIUMS ( NET OF LOST HRS ) 10,326.15

Excess Attendance - -

Taxable Adjustment - Missing Timecards Regular Hrs 16.00 1,839.08

Taxable Adjustment - Missing Timecards Night Diff Hrs 11.00 126.44

Taxable Adjustment - Missing Timecards Overtime Hrs - -

Taxable Adjustment - Others -

TAXABLE INCOME 12,291.67

Loyalty Incentives -

Referral Bonus -

Deminimis Benefits 1,500.00

Transportation & Meal Allowance -

Transportation & Meal Allowance -

Transportation & Meal Allowance -

Others -

Internet Reimbursement -

Non Taxable Adjustment 1,500.00

NON TAXABLE INCOME 3,000.00

GROSS SALARY / COMPENSATION 15,291.67

Less : Employee SSS Contribution 697.50

Less : Employee Philhealth Contribution 300.00

Less : Employee HDMF Contribution 100.00

Less : SSS Loan -

Less : HDMF Loan -

Less : Financial Assistance -

Less : HMO -

Less : Withholding Tax 155.50

TOTAL DEDUCTIONS 1,253.00

NET PAY 14,038.67

Employer SSS Contribution 1,317.50

Employer SSS Contribution 30.00

Employer Philhealth Contribution 300.00

Employer HDMF Contribution 100.00

TOTAL COMPANY'S CONTRIBUTION 1,747.50

*** PEOPLEPLUSTECH CONFIDENTIAL ***

You might also like

- Hotel Manager ContractDocument5 pagesHotel Manager ContractDoni June Almio86% (7)

- Annel Rice Mill: For The Period October 1-31, 2018 PayslipDocument3 pagesAnnel Rice Mill: For The Period October 1-31, 2018 PayslipGregory CamacamNo ratings yet

- Certificate of Clearance for Ciano Glitz Clarence AdiwangDocument2 pagesCertificate of Clearance for Ciano Glitz Clarence Adiwangkorean languageNo ratings yet

- PayslipDocument2 pagesPayslipWelson TeNo ratings yet

- Sample PDFDocument2 pagesSample PDFkorean languageNo ratings yet

- Certificate of Clearance: Cherrlyne Daez Hris ManagerDocument2 pagesCertificate of Clearance: Cherrlyne Daez Hris ManagerFernan MacusiNo ratings yet

- PRCL 03 Cumulating and Storing Time Wage Types in RTDocument4 pagesPRCL 03 Cumulating and Storing Time Wage Types in RTeurofighterNo ratings yet

- Saudi Labor Law (ENGLISH Version)Document62 pagesSaudi Labor Law (ENGLISH Version)Wally Perez0% (1)

- Aug 10 PayslipDocument1 pageAug 10 PayslipBry GutierrezNo ratings yet

- Peopleplustech ConfidentialDocument1 pagePeopleplustech ConfidentialBry GutierrezNo ratings yet

- Dela CruzDocument1 pageDela CruzdelacruzjoeuieNo ratings yet

- Payslip John Adriane PagunsanDocument1 pagePayslip John Adriane Pagunsangenovitasolo05No ratings yet

- (Worked) (Worked) : Total 5,333.61 Total 7,427.38Document13 pages(Worked) (Worked) : Total 5,333.61 Total 7,427.38Nicole N. BeldinezaNo ratings yet

- Abong, Arnold, TDocument1 pageAbong, Arnold, TROGER APOSTOLNo ratings yet

- Employee Information Allowances (Non-Taxable) : Earnings Total EarningsDocument2 pagesEmployee Information Allowances (Non-Taxable) : Earnings Total Earningsdon ryan cabreraNo ratings yet

- Payslip - Dec 16-31, 2020 - RLCDocument15 pagesPayslip - Dec 16-31, 2020 - RLCKassandra faith jewel alabatNo ratings yet

- Homecrew payroll records May 2016Document1 pageHomecrew payroll records May 2016Vic CumpasNo ratings yet

- Abarquez, Roland, PDocument1 pageAbarquez, Roland, PROGER APOSTOLNo ratings yet

- PAYSLIP - Oppo April 25 May 10 June 25 April 10Document2 pagesPAYSLIP - Oppo April 25 May 10 June 25 April 10bktsuna0201No ratings yet

- Payslip NovDocument7 pagesPayslip Novthiwankaashi531No ratings yet

- Payslip OctDocument7 pagesPayslip Octthiwankaashi531No ratings yet

- Payslip SepDocument7 pagesPayslip Septhiwankaashi531No ratings yet

- Your Paycheck Statement At-a-Glance: SampleDocument1 pageYour Paycheck Statement At-a-Glance: SampleGeorge J AlexNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- F3ltd-Payroll With Payslip FormatDocument6 pagesF3ltd-Payroll With Payslip FormatSonu PathakNo ratings yet

- MH003-Md. Mofazzal Hossain Pramanik-Payslip - May 2020 PDFDocument1 pageMH003-Md. Mofazzal Hossain Pramanik-Payslip - May 2020 PDFFarzana AktherNo ratings yet

- Payslip - VillaHermosa RosemarieDocument4 pagesPayslip - VillaHermosa Rosemarieronelle casunuranNo ratings yet

- Aux Foods - Salary Slip - Okt 2023 - KothanayakeDocument1 pageAux Foods - Salary Slip - Okt 2023 - Kothanayakearrimon584No ratings yet

- Cash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerDocument17 pagesCash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerJoebert ReginoNo ratings yet

- Cash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerDocument17 pagesCash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerJoebert ReginoNo ratings yet

- Cash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerDocument17 pagesCash Flow Analysis: Noted By: M. Escobal G.Valeriano Account Officer FMCM/Branch ManagerJoebert ReginoNo ratings yet

- Saaob DetailedDocument3 pagesSaaob DetailedzcacctgauditNo ratings yet

- Estrope, Ana MarielleDocument2 pagesEstrope, Ana Mariellejepoy palaruanNo ratings yet

- 5 May PS 2022Document4 pages5 May PS 2022Almira CaranogNo ratings yet

- Fy 2022 Appropriation ProgramDocument162 pagesFy 2022 Appropriation ProgramElbert O BaetaNo ratings yet

- It 23-24Document5 pagesIt 23-24Alok G ShindeNo ratings yet

- Company Info - Print Financials 1Document2 pagesCompany Info - Print Financials 1rjaman9981No ratings yet

- Constantino, Rowena Constantino, Rowena: Strictly Confidential Strictly ConfidentialDocument4 pagesConstantino, Rowena Constantino, Rowena: Strictly Confidential Strictly ConfidentialRowena Dimla SantiagoNo ratings yet

- 2 February Ps 2022Document5 pages2 February Ps 2022Almira CaranogNo ratings yet

- Crystal Tube Ice Corporation Employee Payroll DetailsDocument1 pageCrystal Tube Ice Corporation Employee Payroll DetailsAlbert ObadoNo ratings yet

- Sofia PaystubsDocument3 pagesSofia PaystubsSuiNo ratings yet

- Payslip 833Document1 pagePayslip 833Md Ahsanul MoyeenNo ratings yet

- 2023 05 07.santiago AgudeloDocument1 page2023 05 07.santiago Agudelothiago040103No ratings yet

- 1402 (1)Document1 page1402 (1)Vishal BawaneNo ratings yet

- Final SettlementDocument1 pageFinal SettlementFARAZ KHANNo ratings yet

- Payslip TemplateDocument7 pagesPayslip TemplateAlyani MineNo ratings yet

- P&a GT Payroll Philippines 2Document1 pageP&a GT Payroll Philippines 2Allyzza DimaapiNo ratings yet

- BNPPDocument16 pagesBNPPramilreyesNo ratings yet

- PayslipDocument1 pagePayslipWilmer Gallan ComighodNo ratings yet

- SalaryDocument2 pagesSalaryGlaiza CuencaNo ratings yet

- 01 - Blue Residences - 08152021 - 5TH&20THDocument8 pages01 - Blue Residences - 08152021 - 5TH&20THYT ChannelNo ratings yet

- MM0366.2020-12-End Month - PayslipDocument1 pageMM0366.2020-12-End Month - PayslipMuzamir IsmailNo ratings yet

- Pay Slip TemplateDocument1 pagePay Slip TemplateRudy QuismorioNo ratings yet

- Mahatharsnedevi 202009Document1 pageMahatharsnedevi 202009Mahatharsnedevi RavindranNo ratings yet

- Wall Street Courier Services Inc. Payslip: Earnings AdjustmentDocument1 pageWall Street Courier Services Inc. Payslip: Earnings AdjustmentFerdinand Salvador SrNo ratings yet

- Provincial Veterinary Office - Statement of Appropriations - June 30, 2023Document2 pagesProvincial Veterinary Office - Statement of Appropriations - June 30, 2023kessejunsan16No ratings yet

- Xiao Enterprise Payslip Mar15Document5 pagesXiao Enterprise Payslip Mar15D Jay ApostelloNo ratings yet

- LADERAS JIM - 4november 30 2023Document1 pageLADERAS JIM - 4november 30 2023jimladerasNo ratings yet

- CABUGNASONDocument1 pageCABUGNASONLief Ryan CabugnasonNo ratings yet

- Income Tax CalculatorDocument4 pagesIncome Tax CalculatorAchin AgarwalNo ratings yet

- Yajuvendra ThakurDocument6 pagesYajuvendra ThakurthakuryaNo ratings yet

- Pro-Forma Income Statement: RevenueDocument6 pagesPro-Forma Income Statement: Revenuemas kapcaiNo ratings yet

- PAL Dispute Over Wage Computation FormulaDocument138 pagesPAL Dispute Over Wage Computation FormulaCherryNo ratings yet

- 4471242v6 1rq National Collective Agreement 2007-2009 Wage Attachment 2016Document15 pages4471242v6 1rq National Collective Agreement 2007-2009 Wage Attachment 2016AdityaNo ratings yet

- JurisprudenceDocument28 pagesJurisprudenceReynalyn BanggowoyNo ratings yet

- Noosa Boathouse - Employee Handbook 2021Document42 pagesNoosa Boathouse - Employee Handbook 2021Raj GaneshNo ratings yet

- Labour Tutorial QuestionsDocument4 pagesLabour Tutorial QuestionsCristian Renatus100% (1)

- U.S. Attorney's Office Charges William KreissDocument9 pagesU.S. Attorney's Office Charges William KreissThe TrentonianNo ratings yet

- Myanmar Labour Law Booklet July 2023Document44 pagesMyanmar Labour Law Booklet July 2023Shwe Yi Shin ThantNo ratings yet

- St. Anthhony'S College: San Jose de Buenavista, AntiqueDocument5 pagesSt. Anthhony'S College: San Jose de Buenavista, AntiqueLorenz Joy Ogatis BertoNo ratings yet

- National Development Co V CIRDocument5 pagesNational Development Co V CIRtheresagriggsNo ratings yet

- Book Three Conditions of Employment Title I Working Conditions and Rest Periods Hours of WorkDocument3 pagesBook Three Conditions of Employment Title I Working Conditions and Rest Periods Hours of WorkPaula BitorNo ratings yet

- Union of Filipro Vs VivarDocument7 pagesUnion of Filipro Vs VivarXryn MortelNo ratings yet

- IELTS Complete WorkbookDocument74 pagesIELTS Complete WorkbookAjinkya PatilNo ratings yet

- Labour Cost L4Document40 pagesLabour Cost L4Yopie WishnugrahaNo ratings yet

- Educational Services Post Secondary Education Award Ma000075 Pay GuideDocument34 pagesEducational Services Post Secondary Education Award Ma000075 Pay Guiderabi1973No ratings yet

- Labor Law 1 ReviewerDocument156 pagesLabor Law 1 ReviewersovxxxNo ratings yet

- Online license application for contractorsDocument5 pagesOnline license application for contractorsPalani KumarNo ratings yet

- The Labour Laws (Exemption From Furnishing Returns and Maintaining Registers by Certain Establishments) Amendment Bill, 2011Document16 pagesThe Labour Laws (Exemption From Furnishing Returns and Maintaining Registers by Certain Establishments) Amendment Bill, 2011MD IMRAN RAJMOHMADNo ratings yet

- Revised Project Background Mission Vision and Core Values by Sir ODocument112 pagesRevised Project Background Mission Vision and Core Values by Sir OIvann BustalinioNo ratings yet

- Caltex Union v. CaltexDocument2 pagesCaltex Union v. CaltexKim Michael de JesusNo ratings yet

- Nate Casket Maker V ArangoDocument26 pagesNate Casket Maker V ArangoyousirneighmNo ratings yet

- Labour CostDocument3 pagesLabour CostQuestionscastle FriendNo ratings yet

- Labor DoctrinesDocument30 pagesLabor DoctrinesVince Abucejo100% (1)

- Employee ManualDocument26 pagesEmployee ManualRocketLawyer89% (45)

- Lession 2Document44 pagesLession 2Yi WeiNo ratings yet

- Quotaion DriverDocument2 pagesQuotaion DriverTripilar InvestamaNo ratings yet

- Basic Labor Law Affecting Employer Employee RelationshipsDocument38 pagesBasic Labor Law Affecting Employer Employee RelationshipsCharity SolatorioNo ratings yet

- Public Service Regulations ExplainedDocument80 pagesPublic Service Regulations ExplainedMfaneloNo ratings yet