Professional Documents

Culture Documents

Enrichment Activity 3

Uploaded by

Roxanne GenerozaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

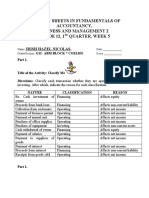

Enrichment Activity 3

Uploaded by

Roxanne GenerozaCopyright:

Available Formats

A.

Classify the given transactions as either (1) Operating, (2) Investing, (3)

Financing, or (4) No Effect in Cash

1. Opening an account under the business name and depositing cash from initial

capital contribution of the owner. (Financing)

2. Paying barangay, municipal, and other related taxes for the creation of the

business entity. (Operating)

3. Contributing land to the business. (No Effect in Cash)

4. Purchasing buildings. (Investing)

5. Purchasing computers and printers for office use. (Investing)

6. Borrowing cash from a bank for additional working capital. (Financing)

7. Purchasing office tables and chairs. (Investing)

8. Selling and distributing merchandise sold. (Operating)

9. Advertising for public exposure of goods for sale. (Operating)

10. Paid electricity and water consumption. (Operating)

11. Rendered services to customers. (Operating)

12. Paid internet subscription. (Operating)

13. Mortgaged business property to acquire a loan from the bank. (Financing)

14. Owner withdrew cash for personal use. (Financing)

15. Paid salaries of employees. (Operating)

16. Acquisition of machinery (Investing)

17. Decrease in Accounts Receivable (Operating)

18. Gain on sale - Investment (Operating)

19. Share of treasury shares (Financing)

20. Payment of dividends (Financing)

B. Write the letter corresponding to the correct answer

A OPERATING ACTIVITY - INFLOW

B OPERATING ACTIVITY - OUTFLOW

C INVESTING ACTIVITY - INFLOW

D INVESTING ACTIVITY - OUTFLOW

E FINANCING ACTIVITY - INFLOW

F FINANCING ACTIVITY - OUTFLOW

21. Purchase of various office supplies. (Operating-Outflow) B

22. Purchase of computers for office use. (Investing-Outflow) D

23. Collection from customers for services rendered. (Operating-Inflow) A

24. Withdrawal of cash by the owner. (Financing-Outflow) F

25. Paid liabilities to suppliers of office supplies. (Operating-Outflow) B

26. Interest earned on cash deposited in the bank. (Operating-Inflow) A

27. Sale of old furniture used in the office. (Investing-Inflow) C

28. Payment of employees’ salaries and wages. (Operating-Outflow) B

29. Payment of interest on the loan from the bank. (Operating-Outflow) B

30. Dividend earned on stocks of PLDT Company. (Operating-Inflow) A

31. Payment of the principal amount of bank loan. (Financing-Outflow) F

32. Payment of barangay and municipal taxes. (Operating-Outflow) B

33. Payment of electricity and water consumption. (Operating-Outflow) B

34. Additional cash investment of the owner. (Financing - Inflow) E

35. Cash donation was given to Red Cross. (Financing - Outflow) F

36. Payment of dividends (Financing - Outflow) F

37. Increase in inventory (Operating - Outflow) B

38. Cash Payment for other expenses (Operating - Outflow) B

39. Sale of machinery (Investing - Inflow) C

40. Income tax paid (Operating - Outflow) B

You might also like

- FABM2-MODULE 5 - With ActivitiesDocument5 pagesFABM2-MODULE 5 - With ActivitiesROWENA MARAMBANo ratings yet

- Activity in Fabm 2 Cash FlowDocument3 pagesActivity in Fabm 2 Cash Flowje-ann montejoNo ratings yet

- Fabm-2 2Document33 pagesFabm-2 2KIRSTEN HENRYK CHINGNo ratings yet

- Cash Flow StatementsDocument15 pagesCash Flow StatementsMaryjoy CuyosNo ratings yet

- Statement of Cash FlowsDocument9 pagesStatement of Cash FlowsNini yaludNo ratings yet

- Assignment QuestionsDocument13 pagesAssignment QuestionsAiman KhanNo ratings yet

- Topic 9 Additional Revision ExerciseDocument5 pagesTopic 9 Additional Revision ExerciseDương LêNo ratings yet

- Group Work. DR and CRDocument2 pagesGroup Work. DR and CRShiela Ruben LanadoNo ratings yet

- Assignment of Fundamental of Accounting IDocument12 pagesAssignment of Fundamental of Accounting IibsaashekaNo ratings yet

- Philippine High School Exam on Accounting and FinanceDocument5 pagesPhilippine High School Exam on Accounting and FinanceRaul CabantingNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsIan VinoyaNo ratings yet

- Statement of Cash FlowsDocument3 pagesStatement of Cash FlowsEricka DelgadoNo ratings yet

- Excercises For Transaction AnalysisDocument4 pagesExcercises For Transaction AnalysisAhmed Muhamed AkrawiNo ratings yet

- Activity Sheets in Fundamentals of Accountanc5Document7 pagesActivity Sheets in Fundamentals of Accountanc5Irish NicolasNo ratings yet

- Exercise 1 Accounting EquationDocument3 pagesExercise 1 Accounting EquationkoyinNo ratings yet

- FABM 2 - Module 5Document9 pagesFABM 2 - Module 5Joshua Acosta100% (4)

- Learning Exercise 1: Supplementary Exercises On Preparation of Statement of Cash FlowDocument4 pagesLearning Exercise 1: Supplementary Exercises On Preparation of Statement of Cash FlowHarold KianNo ratings yet

- FInal Quiz 1 Finman 2aDocument6 pagesFInal Quiz 1 Finman 2aella alfonsoNo ratings yet

- Chapter 6 Activity Sheet 2Document2 pagesChapter 6 Activity Sheet 2Flordeliza HalogNo ratings yet

- MT Principles of Accounting Fall 2023 UGDocument5 pagesMT Principles of Accounting Fall 2023 UGwww.kazimarzanjsbmsc570No ratings yet

- CH 14Document59 pagesCH 14Gaurav KarkiNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow Statementashishj2053No ratings yet

- Chapter 12 ExercisesDocument3 pagesChapter 12 ExercisesAreeba QureshiNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementsushikoolNo ratings yet

- UntitledDocument7 pagesUntitledKit BalagapoNo ratings yet

- Performance TasksDocument3 pagesPerformance TasksJebEscuetaAriolaNo ratings yet

- Accounting 2 - Debits & Credits, T Accounts, Trial BalanceDocument20 pagesAccounting 2 - Debits & Credits, T Accounts, Trial BalanceOanh NguyenNo ratings yet

- Fema f2Document2 pagesFema f2Yashdeep GuptaNo ratings yet

- Exercise 1. Classification of Cash Flow 2Document8 pagesExercise 1. Classification of Cash Flow 2Linh LinhNo ratings yet

- Statement of Cash FlowsDocument28 pagesStatement of Cash FlowsseanakkigNo ratings yet

- Financial Accounting I: Classify Items & Analyze TransactionsDocument3 pagesFinancial Accounting I: Classify Items & Analyze TransactionsJane Carla BorromeoNo ratings yet

- Acc 255 Final Exam Review Packet (New Material)Document6 pagesAcc 255 Final Exam Review Packet (New Material)Tajalli FatimaNo ratings yet

- Intermediate Accounting Cash Flow StatementDocument19 pagesIntermediate Accounting Cash Flow StatementAG VenturesNo ratings yet

- SCF ReportDocument13 pagesSCF ReportKenshin Zaide GutierrezNo ratings yet

- Cash Flow Statement: Position of A Firm. Cash and Relevant Terms As Per AS-3 (Revised)Document17 pagesCash Flow Statement: Position of A Firm. Cash and Relevant Terms As Per AS-3 (Revised)Jebby VargheseNo ratings yet

- 23 CH 23 Textbook Quizzes (Student)Document7 pages23 CH 23 Textbook Quizzes (Student)Naveen Rênârd100% (1)

- Lesson 6 - The Major Accounts - NotesDocument18 pagesLesson 6 - The Major Accounts - NotesJoanNo ratings yet

- 506200404-Statement-of-Cash-Flows-Final-Term_240325_221434Document20 pages506200404-Statement-of-Cash-Flows-Final-Term_240325_221434Kawaii SevennNo ratings yet

- Reviewer 4Document2 pagesReviewer 4Zamantha TiangcoNo ratings yet

- Tax II Chapter IDocument49 pagesTax II Chapter IsejalNo ratings yet

- Erica Lamsen - Modified Module 5Document13 pagesErica Lamsen - Modified Module 5erica lamsenNo ratings yet

- SEMIFINAL-EXAM-IN-IA3Document16 pagesSEMIFINAL-EXAM-IN-IA3Oly VieenaNo ratings yet

- 1 Financial Statements Exercises 2022Document9 pages1 Financial Statements Exercises 2022Alyssa TolcidasNo ratings yet

- Accounting EquationDocument8 pagesAccounting EquationIanah AlvaradoNo ratings yet

- Form A2 PDFDocument2 pagesForm A2 PDFkiran_nyusNo ratings yet

- Crafting a Successful Financial PlanDocument41 pagesCrafting a Successful Financial PlanMohan RajNo ratings yet

- LUYONG - 3rd Periodical - FABM1Document4 pagesLUYONG - 3rd Periodical - FABM1Jonavi Luyong100% (2)

- Accounting Practice Paper InsightsDocument3 pagesAccounting Practice Paper InsightsSameer Hussain100% (1)

- MIDTERM LESSON 1 Accounting EquationDocument2 pagesMIDTERM LESSON 1 Accounting EquationJomar Villena100% (3)

- Accounting Volume 2 Canadian 9th Edition Horngren Solutions Manual 1Document76 pagesAccounting Volume 2 Canadian 9th Edition Horngren Solutions Manual 1edna100% (31)

- CH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Document71 pagesCH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Lina SakhiNo ratings yet

- Accounting EquationDocument4 pagesAccounting EquationSid Tushaar SiddharthNo ratings yet

- Worktext Fabm1 Q4 W1-WokDocument19 pagesWorktext Fabm1 Q4 W1-WokQuincy Lawrence DimaanoNo ratings yet

- Accounting EquationDocument4 pagesAccounting EquationSid Tushaar SiddharthNo ratings yet

- Abm 11 Fabm2 2ND Semester Midterm Module 5 MertadoDocument8 pagesAbm 11 Fabm2 2ND Semester Midterm Module 5 Mertadojian.ryccNo ratings yet

- Statement of Cash Flows Quiz Set ADocument5 pagesStatement of Cash Flows Quiz Set AImelda lee0% (1)

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Prelim Reviewer UCSPDocument5 pagesPrelim Reviewer UCSPRoxanne GenerozaNo ratings yet

- Enrichment Activity 3Document2 pagesEnrichment Activity 3Roxanne GenerozaNo ratings yet

- Equities SharesDocument76 pagesEquities SharesRoxanne GenerozaNo ratings yet

- Translation and Philippine Poetry in English: J. Neil C. GarciaDocument19 pagesTranslation and Philippine Poetry in English: J. Neil C. GarciaRoxanne GenerozaNo ratings yet

- Bloomberg BrochureDocument20 pagesBloomberg BrochureRoxanne GenerozaNo ratings yet

- Equities SharesDocument76 pagesEquities SharesRoxanne GenerozaNo ratings yet

- Bloomberg BrochureDocument20 pagesBloomberg BrochureRoxanne GenerozaNo ratings yet

- National Income MCQDocument23 pagesNational Income MCQishaanrox64No ratings yet

- 2-2 Stock Options Elliott StephanieDocument4 pages2-2 Stock Options Elliott StephanieStephanie ElliottNo ratings yet

- ELP-Exclusive Analysis Budget 2017Document66 pagesELP-Exclusive Analysis Budget 2017Panache ZNo ratings yet

- Residential Status of HUFDocument2 pagesResidential Status of HUFyash agNo ratings yet

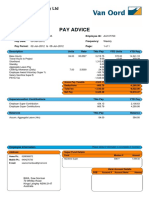

- Van Oord Australia Pty Ltd pays its employeesDocument1 pageVan Oord Australia Pty Ltd pays its employeesNorman BwaNo ratings yet

- Tax ScriptDocument4 pagesTax Scriptpierre-benoit.alaisNo ratings yet

- Nishat Cash FlowDocument2 pagesNishat Cash FlowomairNo ratings yet

- Shree Ganesh Jewellery HouseDocument17 pagesShree Ganesh Jewellery HousePrakash SharmaNo ratings yet

- II Mcom - CTLP - Mcq's - II MidDocument7 pagesII Mcom - CTLP - Mcq's - II MidChakravarti ChakriNo ratings yet

- Capital Market Development in UgandaDocument83 pagesCapital Market Development in UgandaThach Bunroeun100% (1)

- Taxation ReviewerDocument4 pagesTaxation ReviewerAesha Tamar PastranaNo ratings yet

- Josefa Mercado V Alfredo RizalDocument1 pageJosefa Mercado V Alfredo RizalSj EclipseNo ratings yet

- SIP 123 AsmaDocument20 pagesSIP 123 AsmaAsma KhanNo ratings yet

- Sbe Gen Ed March 2023 QuestionnaireDocument14 pagesSbe Gen Ed March 2023 QuestionnaireMary Mel GarciaNo ratings yet

- GST Taxmann Com2Document35 pagesGST Taxmann Com2Kamna AgrwalNo ratings yet

- Year 12 Presentation - Unit 2 - MicroeconomicsDocument279 pagesYear 12 Presentation - Unit 2 - Microeconomicsakash4690No ratings yet

- "From Home To Home, and Heart To Heart, From One Place To Another. The Warmth and Joy of Christmas, Brings Us Closer To Each Other." - Emily MatthewsDocument4 pages"From Home To Home, and Heart To Heart, From One Place To Another. The Warmth and Joy of Christmas, Brings Us Closer To Each Other." - Emily MatthewsColleen M. RyanNo ratings yet

- Ishikawajma-Harima Heavy Industries Ltd. Director of Income-TaxDocument6 pagesIshikawajma-Harima Heavy Industries Ltd. Director of Income-TaxpriyaNo ratings yet

- Tiu vs. CADocument2 pagesTiu vs. CABryce KingNo ratings yet

- RR No. 11-2018 SummaryDocument6 pagesRR No. 11-2018 SummaryCaliNo ratings yet

- Tax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainDocument52 pagesTax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainVrind JainNo ratings yet

- All Propaty Tax ApplicationsDocument51 pagesAll Propaty Tax Applicationskantipudi rakeshNo ratings yet

- App IDocument13 pagesApp I김민성No ratings yet

- Bishop of Nueva Segovia V Provincial Board PDFDocument2 pagesBishop of Nueva Segovia V Provincial Board PDFMarianneNo ratings yet

- SunLink Brochure CimbDocument29 pagesSunLink Brochure CimbIzzah FarouqNo ratings yet

- El Muebles Company Trial Balance As of September 30, 2020: Total 691,245.00 691,245.00Document6 pagesEl Muebles Company Trial Balance As of September 30, 2020: Total 691,245.00 691,245.00PaupauNo ratings yet

- Chapter 3 Income TaxDocument50 pagesChapter 3 Income TaxGirlie Kaye Onongen PagtamaNo ratings yet

- Audit Case - Audit of Noncurrent LiabilitiesDocument6 pagesAudit Case - Audit of Noncurrent LiabilitiesKristine Lirose BordeosNo ratings yet

- Expenditure StatementDocument100 pagesExpenditure StatementTaghral FarhanNo ratings yet

- Presentation On Manappuram Gold Finance by Indu & Sheena of GRGSMS, Cbe.Document26 pagesPresentation On Manappuram Gold Finance by Indu & Sheena of GRGSMS, Cbe.indukanna143100% (1)